Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Performance

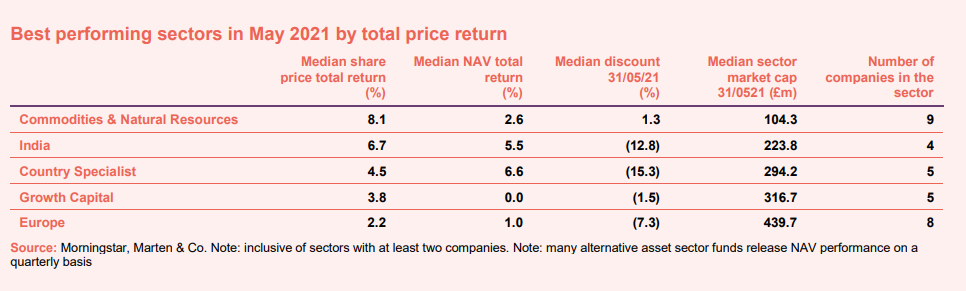

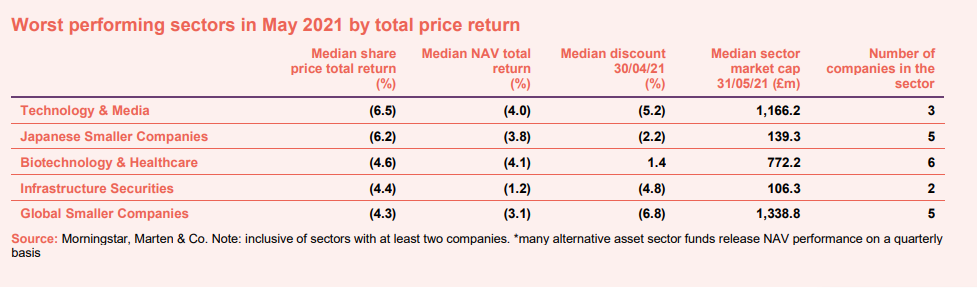

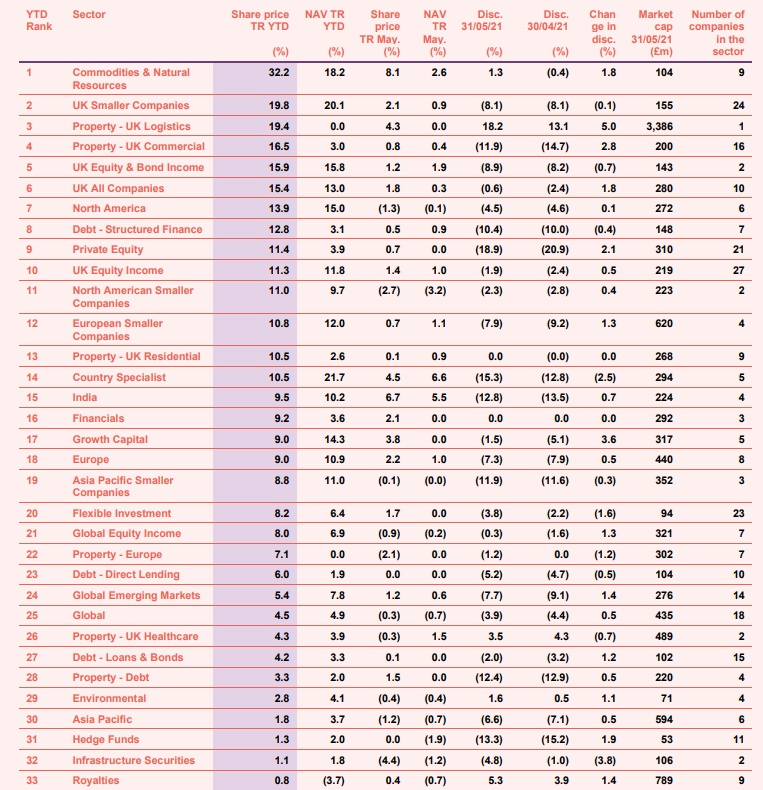

The question that many an investor has been thinking about for the past decade or so – whether/when the tech bubble is going to burst again – is probably being voiced louder than ever now. The sector and trusts exposed to it continued to take a hit throughout May. Inflation and rising interest rates are growing concerns, and this only makes matters worse for the sector. Commodities and natural resources trusts on the other hand did very well, with gold, uranium and crude oil all benefiting from increasing demand. Gold may well be proving its status as a safe-haven asset. Despite Indian funds losing significant capital and being one of the worst-performing sectors in April, as the country suffered at the hands of a particularly deadly second coronavirus wave, India bounced back in May (see Appendix 1 for a breakdown of how all the sectors have performed this year).

May’s median total share price return across our universe was 0.5% (the average was 0.9%) which compares with 4.4% in April.

Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over May

Worst performing sectors over May

On the positive side

Vietnam trusts dominated the list of best-performing funds in May, as the Vietnamese market shrugged off concerns over rising Covid-19 cases. VietNam Holding was the best-performing investment company in NAV terms, and second-best performing in price terms. Vietnam Enterprise and VinaCapital Vietnam Opportunities also did well. Domestic investors are driving the market higher, encouraged by good earnings data for the first quarter of 2021. Electra Private Equity continues to climb after a strong showing in April. The trust’s two remaining assets will be listed as the company approaches the final stage of its winding up.

The rally in commodities appears to have gained momentum with Golden Prospect Precious Metal and CQS Natural Resources in the top ten NAV performers for a second consecutive month as the gold price continued to climb, and this time joined by Geiger Counter, which invests in uranium (its price is benefiting from constrained supply) and BlackRock World Mining. The rally in value stocks is benefitting Scottish Investment Trust. Symphony International’s share price rose after AVI, managers of AVI Global Trust, called for a shake-up of its board in a bid to narrow its discount.

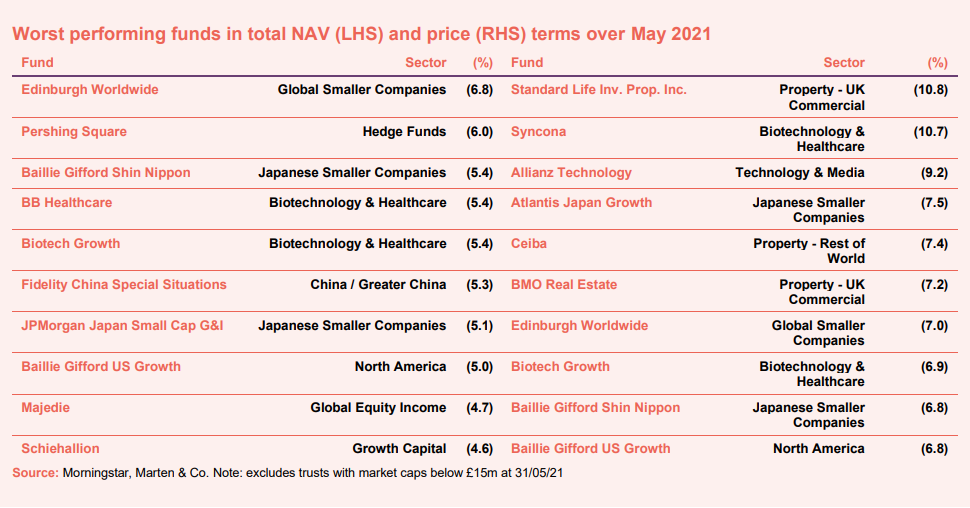

On the negative side

There was a mix of mandates among the worst performers for the month, though a fairly common theme is a sell-off in growth stocks such as biotech and technology. Biotech Growth and BB Healthcare were one of the 10 worst performing funds in NAV terms and Syncona and Allianz Technology, among the worst performers in share price terms. Growth stocks are the first to suffer when there are concerns around rising inflation and higher interest rates which make future cash flows less attractive.

Japanese smaller companies names including Baillie Gifford Shin Nippon, JPMorgan Japan Small Cap Growth & Income and Atlantis Japan Growth featured prominently. While the country managed to avoid a coronavirus death toll as seen in other developed countries, the vaccine rollout is progressing slowly, suggesting that it may take some time before economic activity can return to normal.

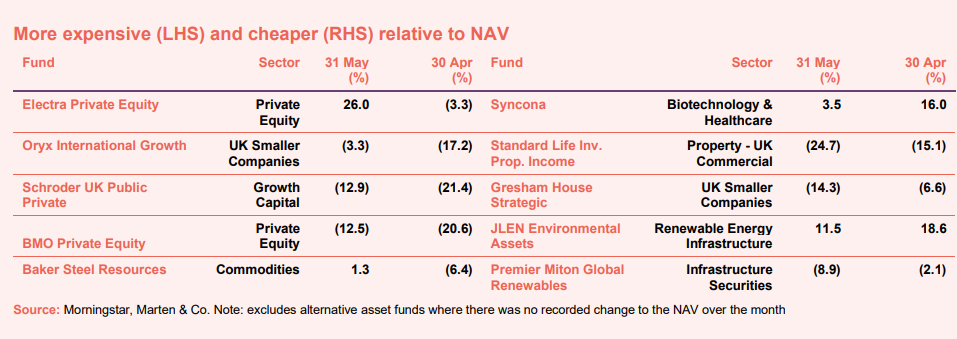

Discounts and premiums

More expensive and cheaper relative to NAV

We discussed Electra Private Equity above. Oryx only publishes its NAV monthly and this distorts its short-term discount moves. Schroder UK Public Private clawed back some of the discount widening it experienced In April. It announced a $6.75m investment into cybersecurity company, Tessian, as part of its $65m Series C funding round. This is the first new investment the manager has made since taking over the trust, formerly known as Woodford Patient Capital, in December 2019.

Syncona has been a casualty of the sell-off in growth stocks. There seems little rationale for Standard Life Investment Property Income’s share price move. Gresham House Strategic‘s discount swung out towards the end of May, following the announcement of a strategic review alongside a call for its chairman to retire which was met just a day later with the dramatic resignation of one of its managers, Richard Stavely. JLEN Environmental Assets’ premium moderated after it issued more shares.

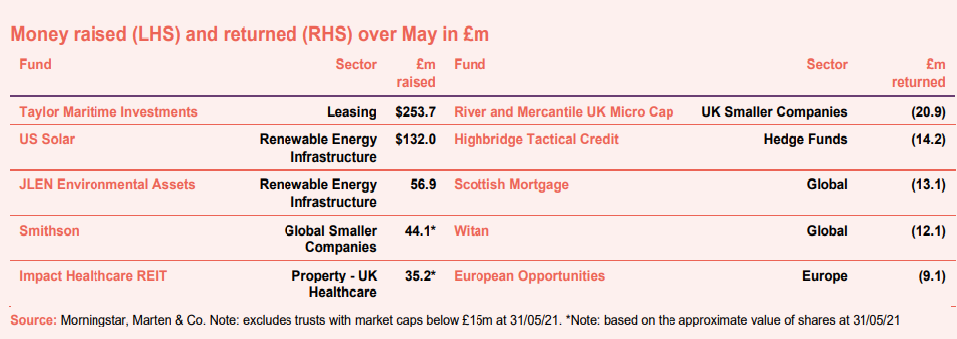

Money in and out

Money coming in and going out

Approximately £545.4m of net new money was raised in May. Taylor Maritime Investments hit its IPO target – 160m shares were issued following the fund raise and the 93.7m balance came from issuing shares in exchange for a portfolio of ships. US Solar completed its first raise since its launch in 2019. The proceeds will be used to reduce financing attributable to its Heelstone Portfolio, as well as its overall gearing. The balance will be put towards its pipeline. May’s other major placing came from JLEN Environmental Assets, which, in addition to paying down its revolving credit facility, will provide headroom for further investment into the likes of bio-energy and battery storage assets.

Share buybacks were led by River and Mercantile UK Micro Cap, which has a policy of handing back cash once its net assets exceed £100m, Highbridge Tactical Credit, Scottish Mortgage, Witan, and European Opportunities.

We also note that City Merchants High Yield is now Invesco Bond Income Plus, following a merger with Invesco Enhanced Income.

Research published over May

Jupiter Emerging & Frontier Income – Out in front

“In both total net asset value (NAV) and share price return terms, Jupiter Emerging & Frontier Income (JEFI) has been the pacesetter within its peer group since the November 2020 vaccine announcements. Manager Ross Teverson and the team’s long-held view that stocks were priced more attractively outside of China has been paying off, led by its Taiwan-based holdings in particular.”

Tritax EuroBox – Full throttle

“Tritax EuroBox (EBOX) has been firing on all cylinders as it looks to cement its place as the leading logistics investor in continental Europe. It has checked off several key milestones in the past six months, as it looks to take advantage of favourable demand-supply dynamics in the sector (which should result in rental and capital value growth). In March 2021, it raised €230m in a bumper equity issue and attained an investment-grade credit rating, which will give it access to alternative and cheaper debt.”

JPMorgan Japanese Investment Trust – Medium-term outlook undimmed

“JPMorgan Japanese Investment Trust (JFJ) performed exceptionally well last year. However, as our last update note warned, in periods of market exuberance, JFJ’s performance may lag its benchmark. Over the past couple of quarters, investors have become more excited about the prospects of post-COVID economic recovery in Japan and globally. As lower quality stocks have bounced, JFJ has given up some of its considerable outperformance relative to its benchmark, TOPIX, in recent months.”

Civitas Social Housing – On firm footing

“The leading UK social housing investor, Civitas Social Housing (CSH), is on a firm footing as it steps up its growth plans. It has secured new debt facilities that will allow it to grow the portfolio in the near-term. Significantly, it has also attained an investment grade credit rating that not only gives it access to the bond market and cheaper debt, but provides a big vote of confidence for the lease-based model in the social housing sector. Strong operational performance, including a rent collection rate that was unaffected by the pandemic, coupled with the planned growth of the portfolio, has given the board the confidence to raise its dividend target for the year to March 2022 above inflation forecasts.”

Ecofin US Renewables Infrastructure Trust – Sunny outlook

“Ecofin US Renewables Infrastructure Trust (RNEW) is just a few months old, but has already deployed well over half of its IPO proceeds and declared its maiden dividend two months ahead of target, putting it well on the way to achieving its 7.0-7.5% total return and 5.25%-5.75% dividend yield target (based on the $1 IPO price). s we explain on page 6, RNEW’s US focus comes with much longer-term contracts for sales of the power it generates (power purchase agreements) than are typically available in the UK. This much reduces RNEW’s sensitivity to short-term power prices relative to its UK- and European-focused peers.”

Major news stories over May

Portfolio developments

- HarbourVest Global Private Equity posted its largest annual NAV increase since launch

- VH Global Sustainable Energy Opportunities bought Brazilian solar

- Downing Renewables & Infrastructure announced plans to acquire Elektra

- Renewables Infrastructure Group bought Swedish wind farms

- RTW Venture backed NiKang Therapeutics Series C

- Schroder UK Public Private made its first new investment since the new manager’s December 2019 appointment

- US Solar refinanced legacy loans in its Heelstone Portfolio

- Schroder British Opportunities bought a stake in Waterlogic

- JLEN invested in an Italian waste-to-energy plant

- Apax Global Alpha gained ‘ultra-premium’ pet food exposure

- Gore Street Energy Storage acquired a new project in Milton Keynes

Corporate news

- Ashoka India Equity announced a fundraising

- JZ Capital Partners called an EGM to issue loan notes to managers

- Strategic Equity Capital took action on its discount

- AVI asked Third Point Investors to tackle its discount

- JLEN implemented an ESG-linked credit facility

- New shipping trust Taylor Maritime achieved its IPO target

- Gresham House Strategic announced a strategic review

- City Merchants High Yield announced plans to acquire £130m from Invesco Enhanced Income

- RM Secured Direct Lending planned for a name change as its social and environmental focus intensified

- Aquila Energy Efficiency targeted an £150m IPO

- Liontrust ESG Trust issued an intention to float for a £150m IPO

- US Solar raised US$132m in first fundraise since IPO

Managers and fees

- Richard Staveley left Gresham House Strategic

- Acorn Income announced plans to appoint BMO following strategic review

Property news

- Civitas Social Housing acquired 10 supported living properties

- TR Property beat its benchmark despite earnings dip

- Sharp falls in retail property hit British Land

- LondonMetric upped its urban logistics weighting

- Tritax EuroBox hiked its dividend after positive performance

- Warehouse REIT bought a Cambridge industrial estate

- St Modwen Properties was subject of a £1.2bn cash offer

- UK Commercial Property REIT upped its dividend by 40%

- Alternative Income REIT increased its dividend

QuotedData views

- Got gas? – 28 May

- Warm fuzzy feelings? – 21 May

- Property funds to fall like dominoes? – 21 May

- Efficiency matters – 14 May

- Timid start for real estate stock exchange – 14 May

- Spotlight on logistics development – 7 May

- How the top 10 trusts have changed – 7 May

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Honeycomb AGM 2021, 8 June

- Martin Currie Portfolio AGM 2021, 9 June

- Aquila European Renewables AGM 2021, 9 June

- Dunedin Income Growth AGM 2021, 10 June

- Aberdeen New Thai AGM 2021, 17 June

- ICG Enterprise AGM 2021, 21 June

- ICG Longbow AGM 2021, 28 June

- Aurora AGM 2021, 30 June

- JPMorgan Multi-Asset Growth & Income AGM 2021, 6 July

- JPMorgan European AGM 2021, 8 July

- Worldwide Healthcare AGM 2021, 8 July

- 3i Infrastructure AGM 2021, 8 July

- India Capital Growth AGM 2021, 14 July

- Axiom European Financial Debt AGM 2021, 19 July

- Blackstone Loan Financing AGM 2021, 23 July

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – May median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.