March 2023

Monthly roundup | Investment companies

Winners and losers in February 2023

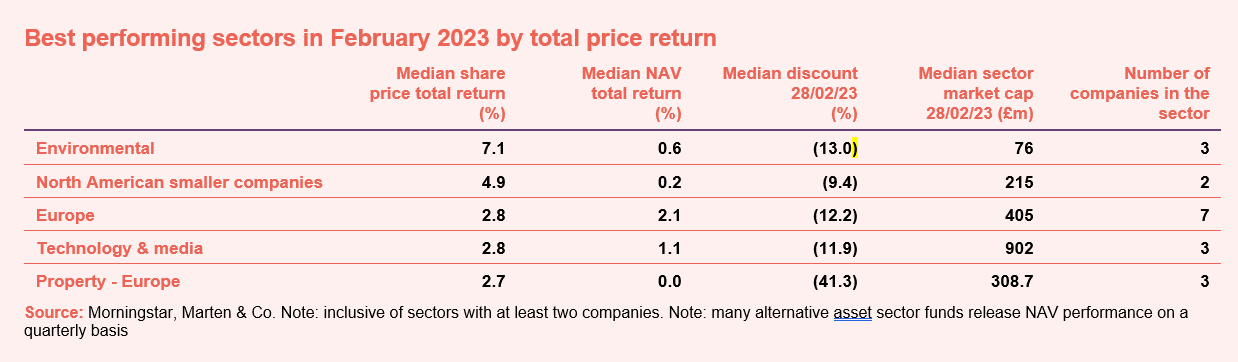

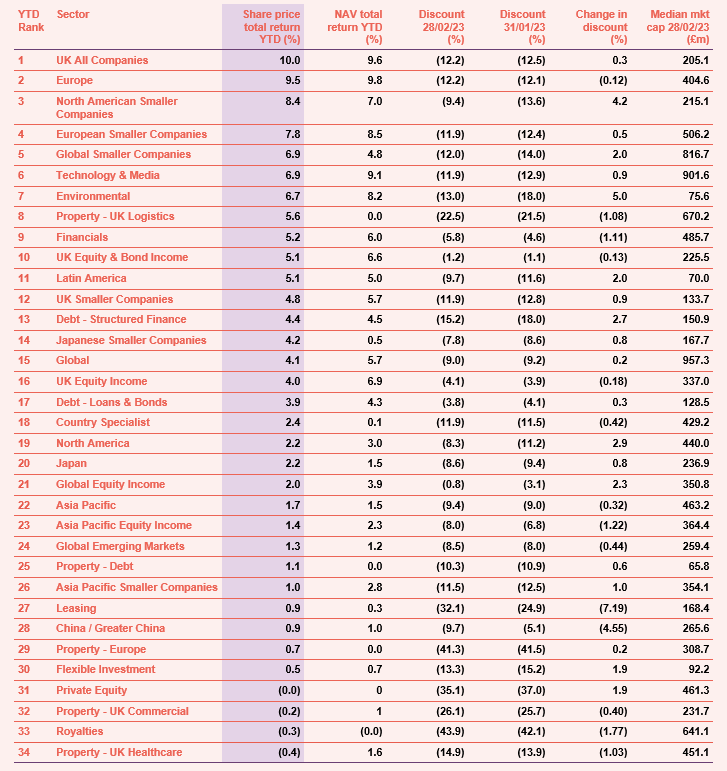

The environmental sector had a strong month, although noting that this is a relatively small category with only three funds, and its positive returns are more a factor of mean reversion following a period of underperformance. The North American Smaller Companies sector also outperformed, following the Russell 2000 index higher, boosted by a positive read on US growth and labour market strength. The sector was also helped by a rebound in the US dollar, which is relatively beneficial for small caps as these companies derive more of their business locally. European markets were generally solid with a slew of positive data during the month including a GDP release which showed a surprise expansion for Q4 2022, something that would have been considered a minor miracle six months ago. It was a bit of a surprise to see Technology & Media show up given the sector’s exposure to large cap US tech. The result was largely down to Polar Capital Technology which was boosted by a solid month for the USD and overweights in Apple and Nvidia.

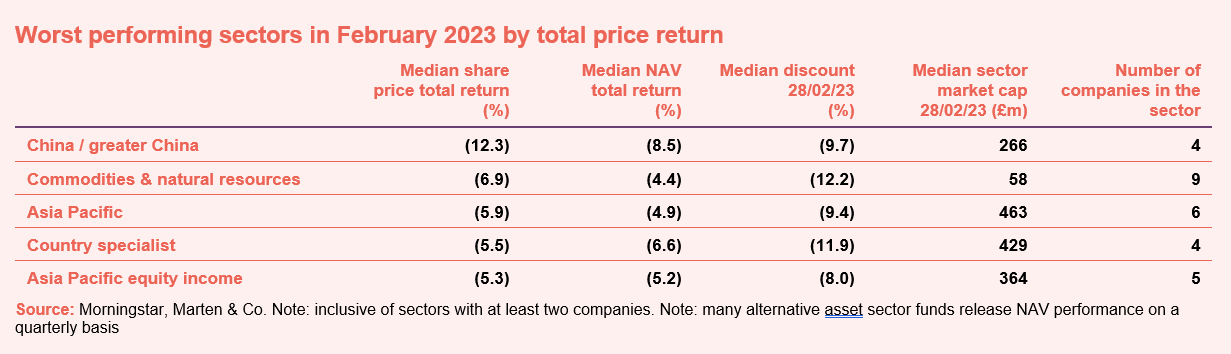

The worst performing sectors are almost entirely a story of Chinese volatility. Asian markets have been outperforming since November, with the rally culminating in a 15% surge in Hong Kong’s Hang Seng Index over just 20 trading days in January. February captured the downside of this rally almost to the day, with the index dropping 13% from its peak.

For the most part Chinese reopening optimism remains, March’s soft GDP target notwithstanding, however investors in the region should expect this elevated volatility to continue for the foreseeable future. Weaker sentiment towards China often translates to weaker sentiment towards commodities and wider Asian funds, as the numbers demonstrate.

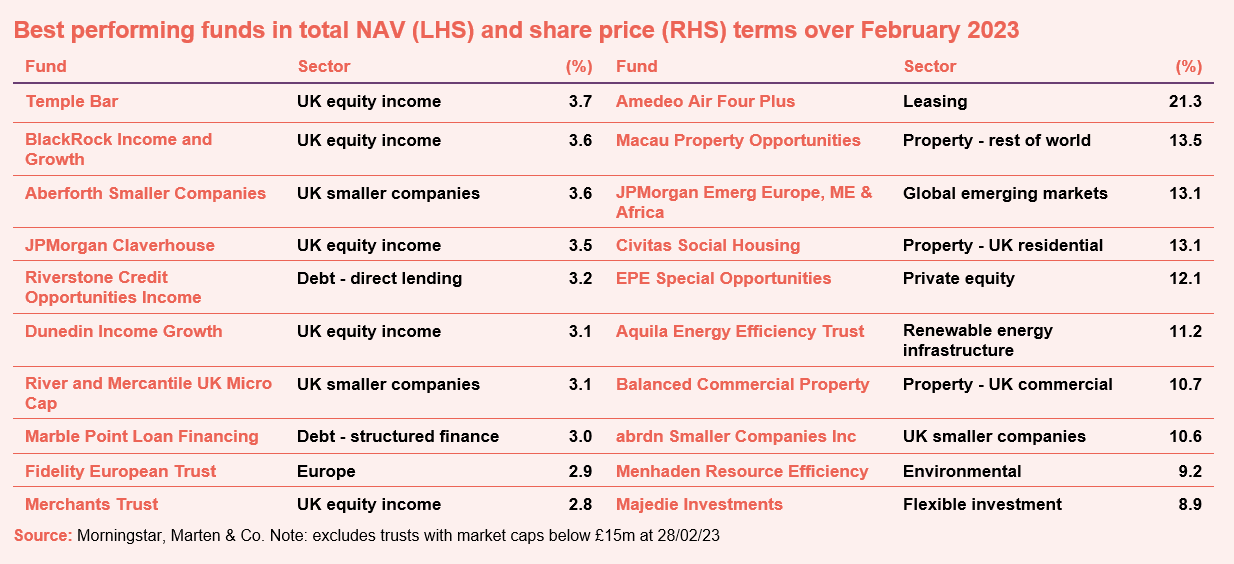

NAV movements were modest compared to recent months in a sign of markets tempering optimism after a period of solid growth, although a strong UK representation underscores their relative resilience. Temple Bar continued its recent momentum, helped by considerable overweights to oil and gas producers BP and Shell, who are benefiting from resilience in the growth outlook and the subsequent uptick in crude oil prices. BP stock also popped on an announcement that it will slow its transition away from oil and gas which investors view as positive for its returns in the short term (though maybe not for the planet). The fund also has considerable exposure to interest rate sensitive financials which have benefited from rising interest rate expectations. Other equity income funds including Blackrock, JP Morgan, and Dunedin benefited from similar tailwinds.

Share price movements were more company specific; Amedeo Air Four Plus saw its stock rise after announcing plans to increase its dividend, while both Macau Property and JPM emerging funds continue to rally off their lows on the back of an improving market outlook, although these moves should be taken in the context of huge capital losses over the past few years. Aquila Energy failed its continuation vote while abrdn Smaller Companies announced a strategic review that could possibly lead the fund into a merger. Both stocks bounced on the news.

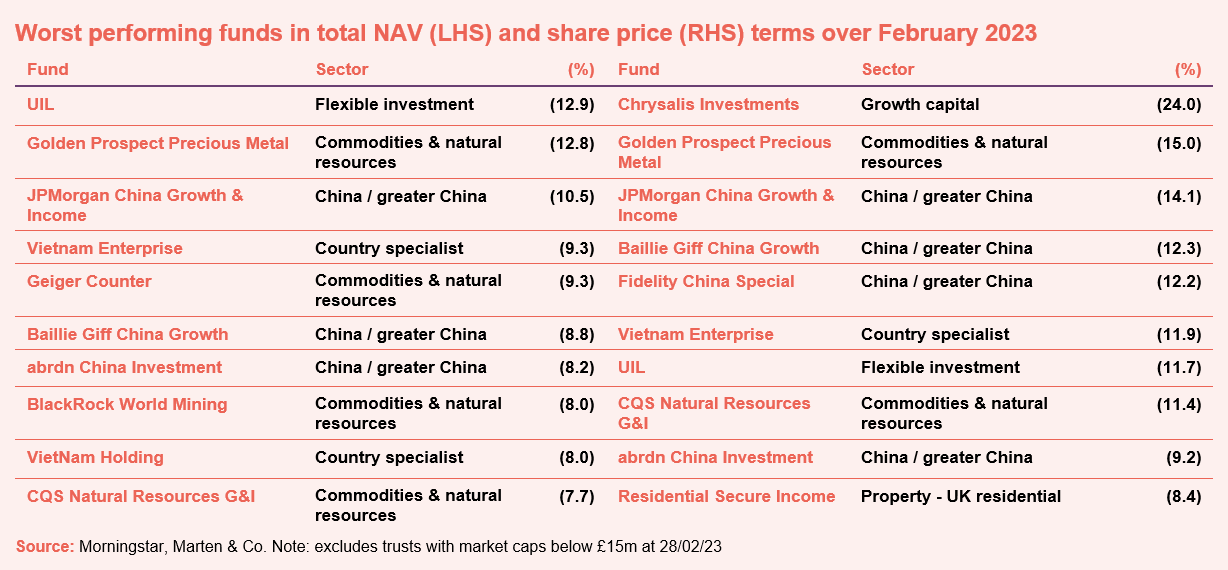

Worst-performing

As with sector level returns, the worst performing funds remain predominantly a story of Chinese exposure, with the market cooling after a rapid ascent over the past six months. Still, headline data released in February was mostly positive, particularly the read-on manufacturing which smashed expectations, showing activity expanding at its fastest pace in a decade.

While the selloff in February was broad based, some sectors have been harder hit than others with commodity funds, including Golden Prospect, impacted by the falling price of precious metals which was made worse by slowing Chinese EV sales. US interest rates also rose strongly driving down the price of gold and hurting the two emerging market funds, Vietnam Enterprise, and Vietnam Holding.

UIL’s poor month was down to a lack of diversity within the fund. Its main holding, Somers Limited, which contributes 37.5% of gross assets, fell 11.1% due to the poor performance of one of its subsidiaries. Chrysalis Investments saw the largest share price decline for the month, continuing a rough period for the shares. The selloff was put down to a poor reaction to its £20m equity purchase of Starling Bank and was compounded further by the possibility of higher discount rates following US inflation data.

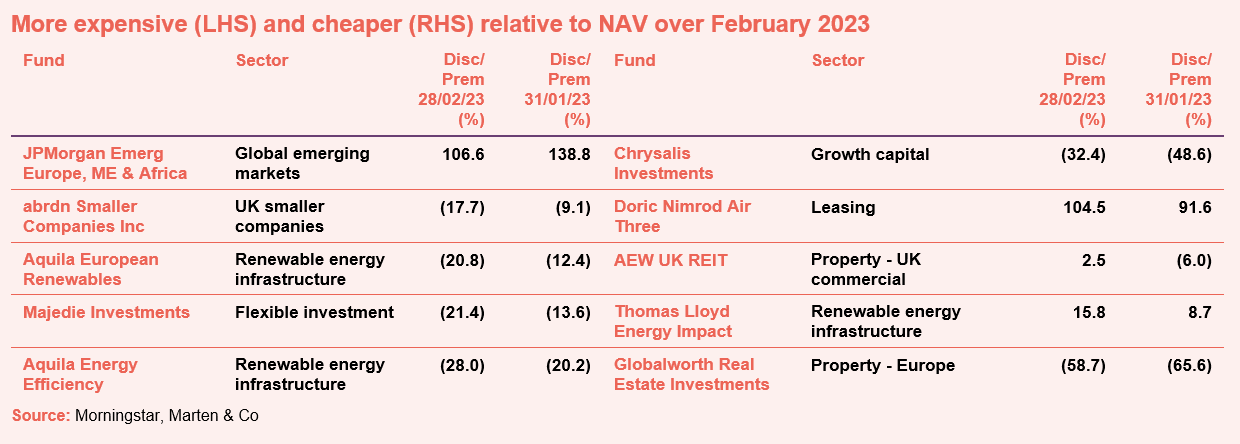

Moves in discounts and premiums

Of the funds not discussed above, Majedie Investments saw its discount tightening in February. This was a continuation of momentum from the appointment of Marylebone Partners as its investment manager, first announced back in November. In terms of widening discounts, aircraft lease company Doric Nimrod Air Three became more expensive, however it would pay not to read much into month on month fluctuations in its discount with the company still struggling to recover from the pandemic selloff. Globalworth Real Estate Investments sits in a similar basket with the discount steadily trending downward over the past few years to now sit at 65%. The fortunes of AEW UK REIT, the commercial property investor, are closely tied to interest rates and recent weakness stems from the rising outlook in the UK which has been particularly noticeable at the prime end of the industrial and warehousing sector. There does not appear to be any company specific news affecting Thomas Lloyd Energy Impact, however the entire renewables infrastructure sector has undergone a derating over the last month or so, possibly reflecting rising concerns around grid access for these companies, however the long-term thesis for the sector should remain intact.

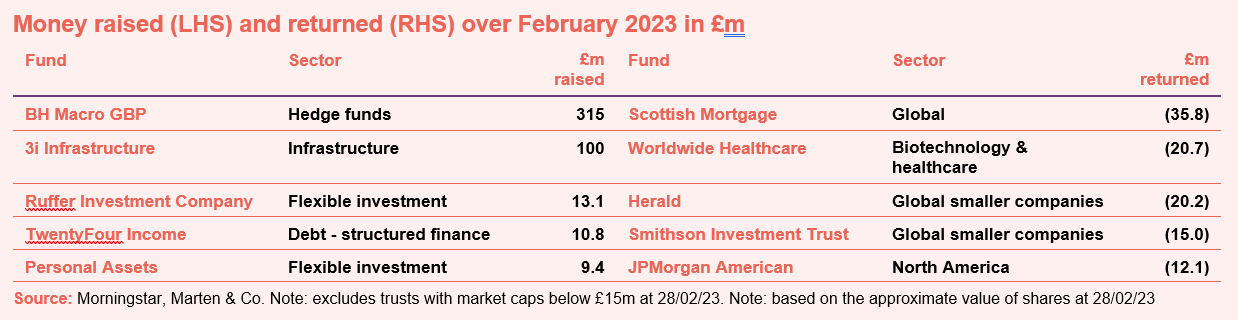

Money raised and returned

There were two big fundraises this month, with BH Macro and 3i Infrastructure raising £315m and £100m respectively, the former taking advantage of impressive performance thanks to considerable market volatility over the past three years. Following the raise, management suggested they could have taken in more but decided to scale back investors’ applications, favouring existing shareholders in the allocation process. 3i Infrastructure’s discount has been flirting with both sides of its NAV over the past six months, with the issue coming at a slight discount of 3.4% on release (that is dilutive for shareholders, and we think that there would have been an outcry if investors thought it was deliberate). Management plan on using funds to pay down drawings on its revolving credit facility. Elsewhere, debt funds continue to benefit from higher bond yields with TwentyFour Income also appearing on January’s list of highest raisers. We also said goodbye to Blue Planet and Doric Nimrod Air One in February. For those funds returning cash, it was more or less the usual suspects.

Major news stories and QuotedData views over February 2023

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 2 December | CHRY, SYNC | Rhys Davies | Invesco Bond Income Plus |

| 9 December | VSL, RTW, SYNC | Stuart Widdowson | Odyssean |

| 16 December | HOME, API, FSF | Richard Aston | CC Japan Income and Growth |

| 6 January | 2022 review | Andrew McHattie | Review of 2022 |

| 13 January | DGI9, AT85 | Thao Ngo | Vietnam Enterprise |

| 20 January | RICA, ORIT | Stephanie Sirota | RTW Venture Fund |

| 27 January | JLEN, HGEN, USF, HNE | Eileen Fargis | Ecofin US Renewables |

| 3 February | SOHO, AERI | Will Fulton | UK Commercial Property REIT |

| 10 February | 3IN, CCJI, CHRI | Colm Walsh | ICG Enterprise |

| 17 February | IBT, ASCI | James Dow | The Scottish American Investment Company |

| 24 February | HEIT, NESF | Jean Hugues de Lamaze | Ecofin Global Utilities and Infrastructure |

| 03 March | AEET/AEEE, PEY/PEYS, SOHO | David Bird | Octopus Renewables Infrastructure Trust |

| Coming up | |||

| 10 March | Anthony Catachanas | VH Global Sustainable Energy Opportunities | |

| 17 March | James Hart | Witan Investment Trust | |

| 24 March | Richard Staveley | Rockwood Strategic | |

| 3 March | Jean Roche | Schroder UK Mid Cap Fund | |

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

Research

GCP Infrastructure (GCP) has seen a dramatic improvement in the tailwinds supporting its investment approach. The rise in UK inflation and power prices has driven a substantial, positive uplift in its net asset value (NAV). This uplift has more than made up for the negative impact of the UK government’s new levy (windfall tax) on energy producers. GCP has also made major strides in the quality of its ESG disclosures.

However, the company’s shares have moved to trade on a historically wide discount to NAV, currently 14.7%. As we explain in this note, this may be a reflection of the wider pressure on bond yields that has been felt globally, although as a result, GCP now offers an attractive dividend yield of 7.2%, one of the highest yields of its peer group.

North American Income Trust (NAIT) adopted its income strategy in May 2012 and, for most of the nearly 11 years that this has been in place, there has been a headwind to value investing in the form of easy money policies (where interest rates and borrowing costs are low, which tends to favour growth-style investing). However, a marked uplift in inflation, bringing with it rises in interest rates, has seen the market re-embrace value stocks. This has been to NAIT’s benefit, pushing it up its peer group rankings over the last year, as most funds in the North America sector now have a growth bias.

abrdn New Dawn (ABD) ended 2022 with the peculiar, if compelling, combination of the second-best 12-month performance within its peer group, and its shares trading at the widest discount to net asset value (NAV), at 11.5%. Manager James Thom has highlighted the ongoing complexity of navigating the Asia Pacific region which is made up of a diverse range of countries, all with varying outlooks.

Whilst ABD has underperformed its benchmark (the MSCI All Countries Asia Pacific ex Japan index) over the last 12 months, as more speculative sections of the market have bounced back from recent lows, it remains ahead of its peers, with James’s process generating sector-leading consistency in its outperformance over the longer-term.

Civitas Social Housing (CSH) has suffered a sustained fall in its share price which sees it now trade on a discount of 44.4%. This seems wholly unjustified given the strong market fundamentals in the social housing sector and the group’s proven, secure government-backed income.

CSH’s inflation-linked leases (which benefit from annual rental uplifts in line with inflation as measured by the consumer price index (CPI) or CPI+1%) more than compensated for a higher discount rate used to value its portfolio on a discounted cash flow method (following market volatility caused by higher interest rates) and resulted in CSH reporting a healthy uplift in net asset value (NAV) in September 2022 – one of the only real estate investment trusts (REITs) to do so in the period. Its NAV fell by 3.4% in the quarter to December 2022, which compares favourably with the REIT sector.

AVI Global Trust (AGT) offers investors a unique opportunity to access a distinctive portfolio of good-quality investments that are selected because the managers believe that they are trading at a discount to their intrinsic value.

Thanks to recent market movements, AGT’s ‘double discount’ – its own share price discount to NAV plus the discount on the underlying portfolio – now sits on an abnormally wide level. The management team has been tactically increasing AGT’s market exposure to tap into these discount-opportunities. This gives AGT’s shareholders the potential to benefit from a powerful combination of NAV gains and discount closing.

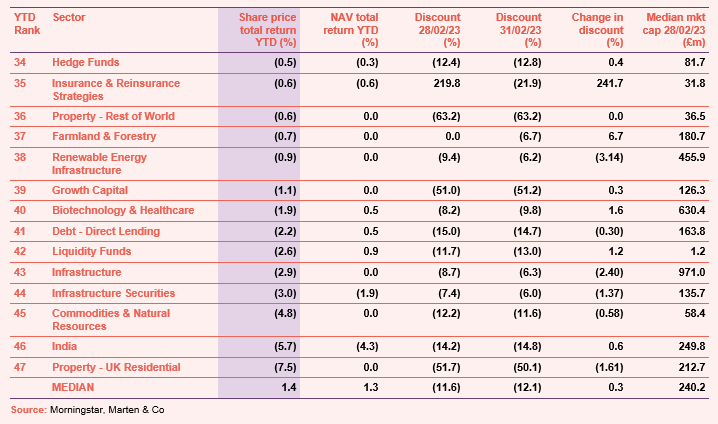

Appendix 1 – median performance by sector, ranked by 2022 year to date price total return

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.