Investment Companies Quarterly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

From COVID to conflict

23 March 2022 marked two years since the UK’s nationwide lockdown was implemented in response to the outbreak of COVID-19. While cases and lockdowns are still occurring across the globe to varying degrees, it appears we are over the worst of it. However, it was out of the frying pan and into the fire for the first quarter of 2022 as Russia launched an attack on Ukraine at the end of February and the war sadly remains ongoing. In addition to uncertainty and volatility in markets, this has had a significant impact on energy, metals, and wheat prices, Meanwhile, interest rate rises have been the flavour of the month since the turn of the year and fears of rising inflation have been compounded, keeping everyone firmly on their toes.

In this issue

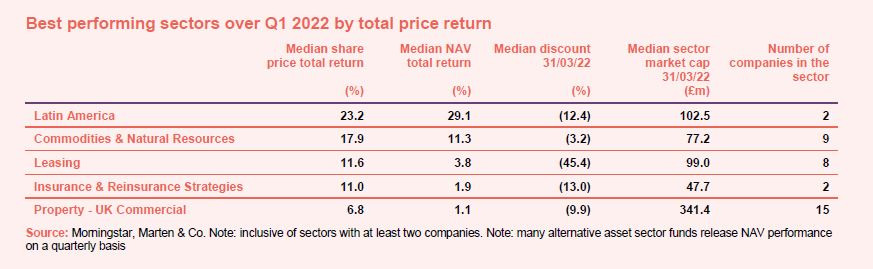

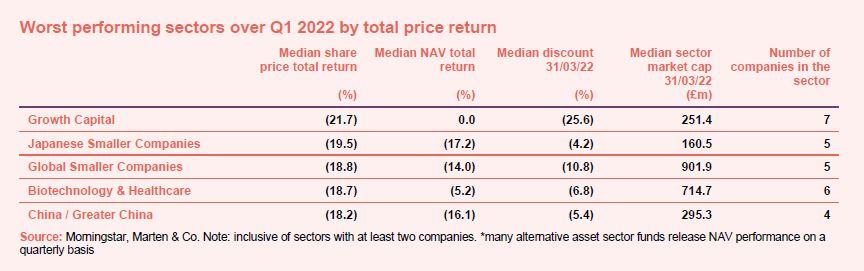

Performance data – In response to the Russo-Ukrainian conflict, Latin America and commodities & natural resources have been the best-performing sector over Q1 2022. Meanwhile, growth capital trusts have suffered as the direction of inflation and interest rates caused a sharp rotation from growth-style investing.

Major news stories – Strategic Equity Capital shared a corporate update as it declined Odyssean’s combination offer, JPMorgan Russian Securities and Barings Emerging EMEA Opportunities suffered from sanctions and Jupiter Emerging & Frontier Income announced the end.

Money in and out – Just over £1.2bn of net new capital was raised over the first quarter of 2022, led by fundraises from the Renewables Infrastructure Group, LXi REIT and Cordiant Digital Infrastructure.

Research published over Q1 2022

Over the quarter, we published notes on JLEN Environmental Assets, Ecofin US Renewables Infrastructure, Montanaro European Smaller Companies, Strategic Equity Capital, Henderson Diversified Income, abrdn European Logistics Income, Tritax EuroBox, AVI Japan Opportunity, NextEnergy Solar, Herald, Urban Logistics REIT, GCP Infrastructure and Edinburgh Worldwide. You can read all of these notes by clicking on the links above or by visiting our website.

Winners and losers

Out of a total of 353 investment companies that we follow, the median total NAV return over the first quarter of 2022 was -0.4% (the median total share price return was -3.8%).

By sector

Latin America was the best-performing sector over Q1 2022, a reversal from being one of the worst over the previous two years. The commodity exporting region has benefited from the Russo-Ukrainian conflict, which has driven up prices. As expected, commodities & natural resources also made the top performers list, with many of its members among the best performing trusts every month since January. The UK commercial property sector also fared well. In its annual UK Real Estate Outlook, CBRE said 2022 could be a year of recovery for the commercial property market with a renewed sense of optimism and growing economy.

In another reversal of fortune, growth stocks took a beating at the start of the year as the direction of inflation and interest rates caused a sharp rotation from growth-style investing. Accordingly, the growth capital sector was the worst performing for the quarter, and the biotech sector took another hit. Meanwhile, Russia’s invasion of Ukraine has not helped sentiment on a global basis. Investors sought the perceived relative safety of larger companies. China/Greater China was the worst performing sector in March as coronavirus cases remain high in parts of the country and restrictions are still well in place. Meanwhile, President Xi Jinping set China’s growth target for 2022 at 5.5% – the lowest in three decades.

By fund

There were some pretty clear winners over the first quarter of 2022, with Latin American and commodities & natural resources funds monopolising the top of the best-performing tables in both NAV and share price return terms, for reasons already discussed. BlackRock Latin American received the quarter’s crown, with an NAV return of 31% and share price return of 32%. Other winners in NAV terms included abrdn Latin American Income and the uranium-focused Geiger Counter, which was one of the best performing trusts over 2021. This success looks likely to continue as investors have reasoned that in Europe, nuclear power would be favoured over natural gas.

Fellow commodities & natural resources names BlackRock World Mining, CQS Natural Resources Growth & Income and BlackRock Energy & Resources Income all had strong quarters while a higher oil price was also good news for oil producers outside Russia, benefiting Gulf Investment and Middlefield Canadian. Meanwhile, Livermore Investments announced a hefty dividend while UK Commercial Property REIT featured in the list as the sector appears to be bouncing back.

On the negative side, JPMorgan Russian Securities and Barings Emerging EMEA Opportunities have – unsurprisingly – suffered in the face of the current conflict. The former, which is purely invested in Russia, is down by a huge 94% in NAV and 80% in share price terms, as sanctions have been placed on the country. Investments listed on the Moscow Exchange have been valued at zero, until such a time as the market begins to function in a way deemed appropriate. All four members of the China / Greater China sector suffered in March but JPMorgan China Growth & Income saw the worst of it, down by 23% over the quarter.

Schiehallion (2021’s top performer), Scottish Mortgage, Baillie Gifford US Growth, and Baillie Gifford European Growth – all of which are managed by famously growth-style investors Baillie Gifford, also suffered as the prospect of rising interest rates continued to dent valuations of high growth companies. Similarly affected were quality growth small cap funds Montanaro European Smaller, Montanaro UK Smaller and BlackRock Throgmorton, growth capital and private equity names such as Chrysalis, Schroder UK Public Private and EPE Special Opportunities, and Fidelity Japan (Japan also suffers from being a big importer of oil and coal).

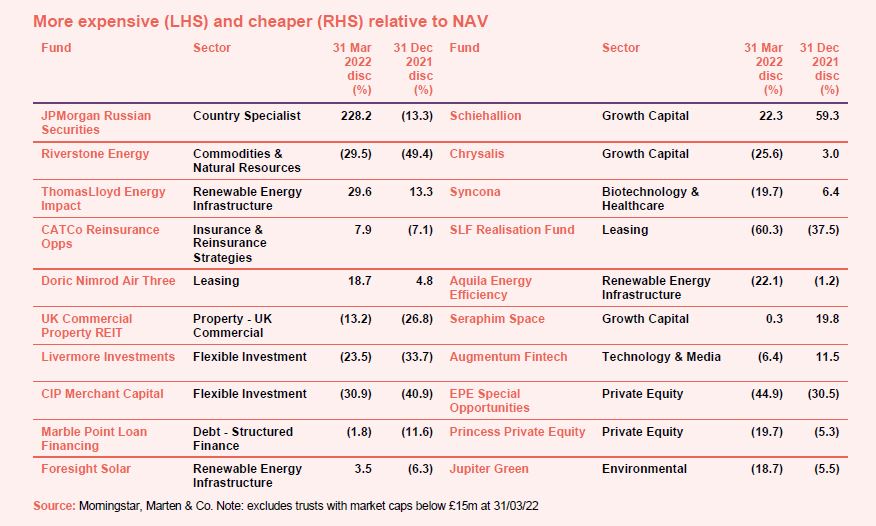

Significant rating changes by fund

Getting more expensive

JPMorgan Russian Securities’ premium soared to a ridiculous 228% by the end of March as, rather distastefully, some investors try to profit from the war in Ukraine, by betting that sanctions will be lifted. Riverstone Energy is a beneficiary of a rising oil price, though remains on a wide discount of 29.5%. Meanwhile UK Commercial Property REIT has also become more expensive having acquired a COVID-19 lab in a £94m deal at the tail-end of December. Renewable energy infrastructure names ThomasLloyd Energy Impact and Foresight Solar also feature on the list perhaps as the importance of renewable energy alternatives is growing stronger. A lack of liquidity in the ThomasLloyd vehicle has pushed its premium to precariously high levels. CIP Merchant Capital was bid for and CatCo Reinsurance made progress with its wind-up.

Getting cheaper

Schiehallion’s premium appears to be coming back down to reality after trading on a 59.3% premium by the end of 2021, though it remains fairly high. Fellow growth capital peers, Seraphim Space and Chrysalis which have enjoyed premiums for some time are now trading at or close to a discount as the sector took a hit during the first quarter of 2022. Biotech name Syncona also saw its premium rerate to a discount. Leasing fund in wind-up mode SLF Realisation Fund saw its discount widen following a capital distribution. Aquila Energy Efficiency has disappointed on the pace of the deployment of its IPO proceeds – two directors resigned in protest. Jupiter Green’s savage de-rating has reversed a little since the quarter-end.

Money raised and returned

Out of the 353 investment companies we follow, just over £1.2bn of net new capital was raised over the first quarter of 2022.

Though there were no IPOs (GCP Co-Living REIT and Cordiant Global Agricultural Income had to pause theirs in light of recent events) there was a good amount of fundraising from a number of trusts, with some more on the way following recent placing announcements.

Money coming in

The biggest fundraising came from Renewables Infrastructure Group, which raised over £270m in March. The trust issued shares to professional investors via a bookbuild – where investors bid to buy shares through the company’s brokers at a strike price (in this case no less than 130p). The proceeds were raised to acquire a 7.8% equity interest in the Hornsea One offshore wind farm in the UK from Global Infrastructure Partners. Fellow renewable energy infrastructure peer group member SDCL Energy Efficiency raised £100m in an oversubscribed placing to fund new investment opportunities identified in its wider pipeline worth over £250m. LXi REIT raised £250m in an oversubscribed fundraise, having initially targeted £125m as announced in January while JLEN Environmental Assets also enjoyed an oversubscribed issue of £60m through a placing and offer for subscription.

Having only launched in 2021 and still manged to raise more funds since then, infrastructure names Cordiant Digital Infrastructure and Digital 9 Infrastructure were the gifts that keep on giving. Meanwhile Polar Capital Global Financials also completed a fundraise shortly after it reported strong outperformance and an increase in demand for financials. You can read more about why in our latest research note on the trust. Ruffer, Capital Gering and JLEN Environmental Assets also issued new shares.

Money going out

Share buybacks were also led by F&C, Alliance Trust and Polar Capital Technology.

Major news stories over Q1 2022

Portfolio developments:

- Chrysalis reported a strong year as it doubled in size

- Record results achieved by Standard Life Private Equity

- RTW Venture Fund backed Kyverna

- Apax Global Alpha made a double acquisition

- Brunner reached 50 years of dividend increases

- RTW made two new investments

- Mobius enjoyed strong performance despite EM volatility

- CQS New City High Yield’s manager warned on inflation

- Temple Bar set up a share split after a good 2021

- International Public Partnerships said COVID woes were receding

- Aquila European Renewables Income acquired a 100MW solar project in Andalucía

- Barings Emerging EMEA Opportunities updated on Russia

- Fondul to benefit from Hidroelectrica IPO

Corporate news:

- Cordiant Digital Infrastructure invested the last of its C share proceeds and announced a new placing

- Infrastructure India got two more months

- HydrogenOne was looking for more money

- CIP Merchant Capital got a new bid approach

- Strategic Equity Capital shared a corporate update as it declined Odyssean’s combination offer

- Alternative Liquidity announced plans to target £50m

- Circle Property announced plans to return sales proceeds to shareholders to counter its persistent discount

- GCP Co-Living REIT paused its IPO process

- New conditional tender for Aberdeen New India

- Fidelity Japan wanted to seek shareholder approval to invest in more unlisted companies

- JPMorgan Russian lost another director

- Henderson Opportunities wanted to amend its policy

Managers and fees:

- There was a management shake-up at JPMorgan Japan Small Cap Growth & Income as lead manager Saito departed

- Invesco Asia hired Fiona Yang as a new co-manager

- Macau Property Opportunities agreed a new investment management agreement

- Allianz Technology’s Walter Price announced his retirement

- New US investment and revised management agreement for Gore Street

- F&C cut fees and upped dividend

- Ross Teverson departs Jupiter as fund edges towards oblivion

Property news:

- Tritax EuroBox acquired a third Swedish asset

- BMO Commercial Property increased its logistics exposure

- Great Portland Estate broke its leasing record

- LXI REIT splashed £87m on nine assets

- Empiric Student Property bought a £19m asset in Bristol

- British Land bought a £157m urban logistics business

- Developments paid dividends for Tritax Big Box REIT

- Hammerson cut its losses

- Unite sold its digs portfolio for £306m

QuotedData views:

- Feeling the pinch? – 7 January

- Ecofin Global Utilities and Infrastructure – better value than you might think – 14 January

- Private companies dominate in 2021 – 21 January

- Every cloud – 28 January

- Co-living la vida loca – 4 February

- CQS New City High Yield – inflation premium – 11 February

- The real dividend heroes – 18 February

- Russia and Ukraine – can we really continue to turn the other cheek? – 24 February

- Feeling resourceful? – 4 March

- Cushion the inflation blow – 11 March

- Why AVI Japan is blooming – 18 March

- Two years since the world changed – 24 March

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Herald AGM 2022, 19 April

- Murray International AGM 2022, 22 April

- JPMorgan US Smaller Companies AGM 2022, 25 April

- Rockwood Realisation EGM, 25 April

- ShareSoc Webinar – BlackRock Latin American, 26 April

- Annual Investment Fund Conference 2022, 26 April

- VH Global Sustainable Energy Opportunities AGM 2022, 27 April

- EP Global Opportunities AGM 2022, 27 April

- Premier Miton Global Renewables AGM 2022, 28 April

- HICL EGM 2022, 28 April

- Greencoat UK Wind AGM 2022, 28 April

- JPMorgan Claverhouse AGM 2022, 29 April

- AVI Japan Opportunity AGM 2022, 3 May

- Smithson AGM 2022, 3 May

- RIT Capital AGM 2022, 4 May

- Apax Global Alpha AGM 2022, 5 May

- Pershing Square Holdings AGM 2022, 5 May

- abrdn Smaller Companies Income AGM 2022, 5 May

- Witan AGM 2022, 5 May

- BlackRock World Mining AGM 2022, 6 May

- Temple Bar AGM 2022, 10 May

- abrdn Asian Income AGM 2022, 11 May

- Schroder Asian Total Return AGM 2022, 11 May

- Baillie Gifford Shin Nippon AGM 2022, 12 May

- Schiehallion AGM 2022, 12 May

- Dunedin Income Growth online presentation, 16 May

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

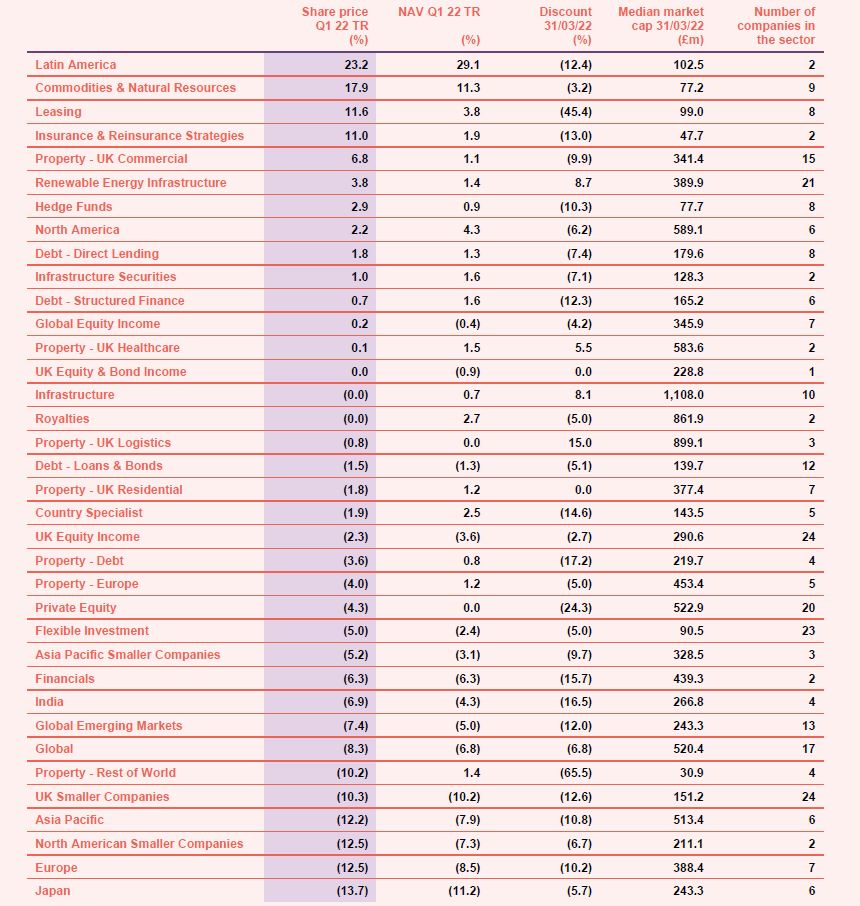

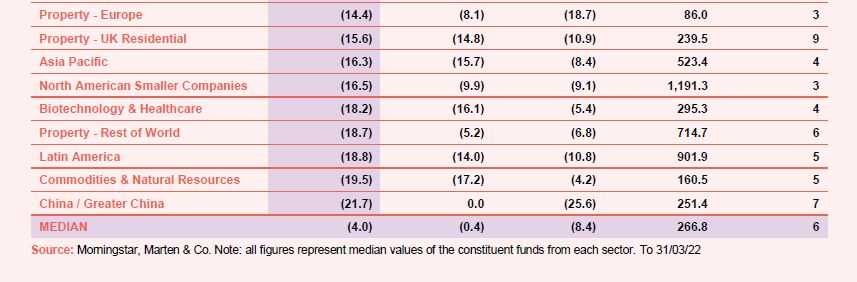

Appendix – Q1 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in any of the securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.