Real Estate Roundup

Kindly sponsored by abrdn

Performance data

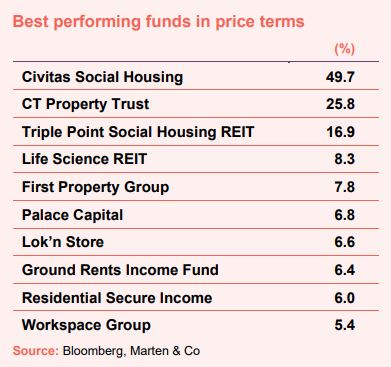

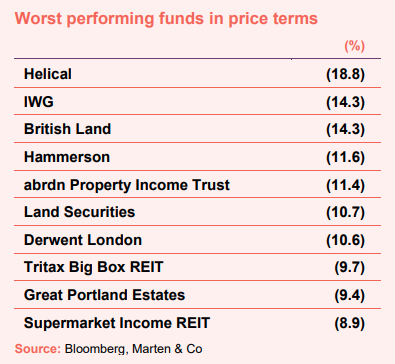

May’s biggest movers in price terms are shown in the charts below.

The property sector is a hotbed of merger and acquisition (M&A) activity as investors look to take advantage of the unloved sector and wide discounts to net asset values (NAVs). Higher than expected inflation and another interest rate rise meant that the median average share price fell across the sector once again, this time by 2.1%. A bid to take Civitas Social Housing private (see page 3) saw it top the list of movers in May, and was behind the double-digit rise in the share price of its peer Triple Point Social Housing REIT. The bid was a 26.7% discount to Civitas’s NAV, reflecting the sector’s wide discounts. CT Property Trust was the subject of an all-share bid from LondonMetric, at a decent premium, which resulted in its share price jumping 25.8%. Of the rest, Life Science REIT continued its decent share price performance this year as it makes headway with its letting strategy. Flexible office provider Workspace completes the top 10 after it announced favourable annual results compared to the rest of the market (see page 2) and continues to dispose of non-core assets (see page 4). Workspace was an oddity within the sector, as almost all of the other office focused property companies suffered share price falls in May.

Topping the worst-performing list was Helical after it published a double-digit fall in the value of its London office portfolio in annual results (see page 2). Investors are still cautious on the potential future performance of offices as a number of headwinds exist, including potential demand erosion from new ways of working and impending refinancing events that could potentially force firesales across the market and impact further on valuations. Serviced office provider IWG (which is behind the Regus and Spaces brands), Derwent London, and Great Portland Estates all featured in the list of largest share price fallers in May. British Land, which also owns a large office portfolio in London, saw its share price fall 14.3% after reporting another write down in the value of its portfolio in annual results. The recent share price performance, down 34.7% over 12 months, will see it drop out of the FTSE 100 for the first time in 20 years. Fellow property titan Land Securities, which is also substantially invested in offices, also reported a significant NAV fall as high interest rates continue to play havoc with the commercial real estate sector.

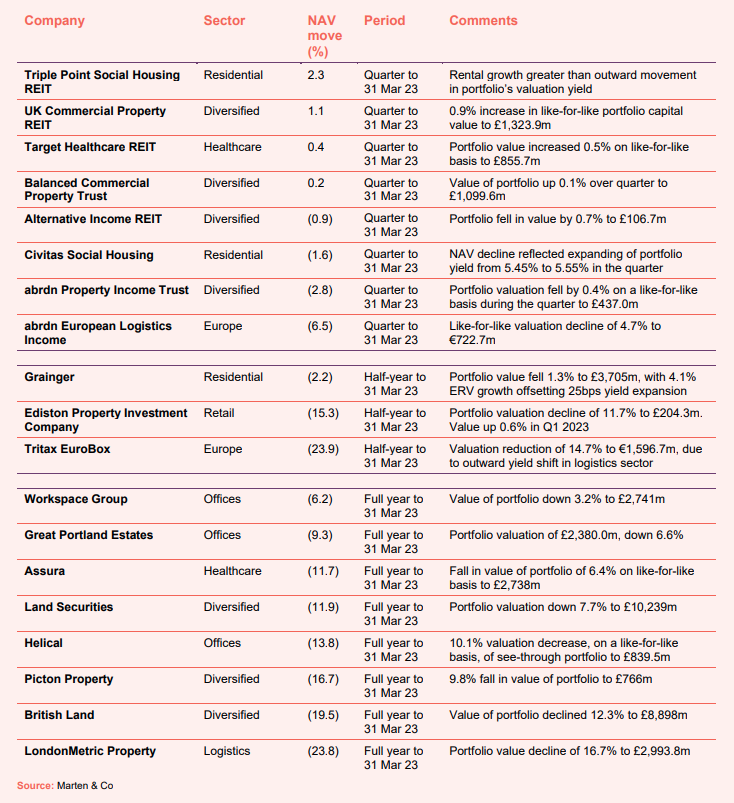

Valuation moves

Corporate activity

LondonMetric and CT Property Trust reached agreement on the terms of a recommended all-share offer that will see LondonMetric acquire the entire share capital of CTPT. CTPT shareholders will receive 0.455 new LondonMetric shares per share, valuing the company at £198.6m. This represents a premium of 34.3% to the closing price of CTPT on 23 May and a discount of 6.3% on a NAV basis.

Industrials REIT shareholders voted overwhelmingly in favour of the £511m cash offer for the company made by US private equity giant Blackstone. Under the terms of the offer, each shareholder would receive 168p per share, a hefty premium to its prevailing share price.

Shareholders in Civitas Social Housing have until 21 July to vote on the £485m sale of the company to Wellness Unity Limited, a subsidiary of CK Assets. Although the bid price of 80p per share was a 44.4% premium to the prevailing price, it was a 26.7% discount to the unaudited NAV at 31 March 2023.

Embattled Home REIT appointed AEW UK Investment Management LLP as its new manager. The manager will prioritise rent collection, which fell to 13% for the five months to the end of April, and will also market a portfolio of properties for sale.

Home REIT also announced an update on its internal investigation into allegations of wrongdoing finding that former investment adviser Alvarium used numerous tactics, without the board’s knowledge, to inflate its rent collection figures. Amongst other things, the investigation also found that inaccurate information was given to the Good Economy (an ESG research consultancy) by the investment adviser to improve its social impact rating, the results of which were referenced in its 2021 annual report.

Sirius Real Estate completed the early refinancing of its next major debt expiry, a €58.3m facility with Deutsche Pfandbriefbank. A new seven-year, €58.3m facility with an all-in fixed interest rate of 4.25% will replace and redeem the existing facility upon its expiry on 31 December 2023 and will run until December 2030. The refinancing extends the group’s total weighted average debt expiry from 3.3 years to 5.0 years, while the weighted average cost of debt will increase from 1.4% to 2.1%. The group has a total of €975.1m of outstanding debt, €735.0m of which is unsecured.

Major news stories

- UK Commercial Property REIT sells warehouse to Mormons… at book value

UK Commercial Property REIT sold its 186,455 sq ft Wembley180 logistics asset in London for £74m, reflecting a net initial yield of 3.49%, to The Church of Jesus Christ of Latter-day Saints. It will use the proceeds to enhance earnings by paying down a substantial amount of its £93m floating rate Revolving Credit Facility (RCF), currently costing 6.3% per annum in interest.

- Workspace works out of McKay industrial portfolio

Workspace Group sold five non-core warehouse properties in the South East of England for a total of £82m. These disposals were from the portfolio of assets acquired as part of the McKay acquisition, which completed in May 2022.

- Tritax Big Box REIT ventures into urban logistics

Tritax Big Box REIT acquired an urban logistics park in Birmingham for £58.5m, at a 4.5% net initial yield and a reversionary yield of 6.7%. The group bought Junction 6 Industrial Park, one of the UK’s leading urban logistics estates of scale totalling 384,000 sq ft across 12 assets.

- Great Portland Estates fills development hopper with London buys

Great Portland Estates acquired two central London offices for redevelopment for a total of £53m. It bought 141 Wardour Street, in Soho (which has planning consent for a comprehensive refurbishment), for £39m and Bramah House, 65/71 Bermondsey Street, for £14m.

- Tritax EuroBox lets German development

Tritax EuroBox let its recently completed development in Dormagen, Germany, to a leading logistics company on a 10-year green lease. The 36,000 sqm letting was 17.8% ahead of the rental guarantee it was receiving and benefits from 100% CPI annual indexation. The ‘green lease clause’ ensures the occupier uses the building in a sustainable way.

- abrdn European Logistics Income sells in Spain

abrdn European Logistics Income completed the sale of a 32,645 sqm warehouse, in Leon, Northern Spain, to SCPI Iroko Zen, for €18.5m. The disposal price reflects a 3% premium to the 31 December 2022 valuation and crystalises 20% profit.

- LondonMetric sells DHL warehouse

LondonMetric Property exchanged on the sale of a DHL logistics warehouse in Solihull for £20.5m, reflecting a net initial yield of 4.15%. The sale was at a small premium to the 31 March 2023 book value.

- abrdn Property Income Trust lets up vacant office space

abrdn Property Income Trust completed a trio of lettings within its office portfolio. A lease to The Birmingham Chamber of Commerce and Industry and an agreement for lease to FCN Group have completed at 54 Hagley Road in Birmingham, whilst a letting to OneStream Software has completed at 15 Basinghall Street in London. 54 Hagley Road is now over 90% let, while 15 Basinghall Street is now fully-let. Overall fund occupancy rate now exceeds 95%.

- Palace Capital continues sell down of assets with £34m industrial disposal

Palace Capital exchanged contracts for the sale of six industrial properties for £34.0m, as it continues to sell down its assets. The sales price was 3.0% ahead of 31 March 2023 book value.

- Urban Logistics REIT lettings point to strong occupier market

Urban Logistics REIT made 15 new lettings in the first quarter of the year, covering 490,188 sq ft of space and generating £1.6m of additional rental income. The like-for-like rental uplift was 24% for new lettings and 5% for regears.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Offices

Toby Courtauld, chief executive:

It is clear from our recent leasing experience that high quality offices remain in high demand. With hybrid working here to stay, and customers having more choices about where they work, our spaces need to provide compelling reasons to come into the office. With average office rents only c.5% – 10% of a typical London business’ salary cost, and the office environment a key tool in attracting and retaining talent, we anticipate that competition for the very best spaces will remain healthy.

So, with office demand robust, we expect that the uncertain economic outlook in the near term will exacerbate the shortage of new deliveries in central London, further restricting supply. As a result, we anticipate supportive rental conditions for the best spaces with rents for prime office space likely to rise over the next 12 months by 3.0% to 6.0%.

Gerald Kaye, chief executive:

While previous valuation falls have been caused by recessions following periods of economic exuberance leading to an oversupply of new office space, the current decline in values reflects a number of differing cyclical and structural factors.

The economy has been affected by multiple geopolitical and economic events which have generated high levels of inflation and a steep rise in interest rates. We have had ultra-low interest rates since 2009 and with the base rate rising from 0.10% in December 2021 to the current 4.50%, the financing of real estate has become significantly more expensive. The rise in interest rates has also led to a repricing of government bonds across the market. Consequently, valuation yields have risen.

In addition, structural changes are impacting the office market, with the latest sustainability criteria challenging the suitability of older office buildings.

Around 75% of buildings in the central London office market do not meet the MEES (Minimum Energy Efficiency Standards) rating of EPC A or B rating required by 2030 and these buildings will need significant capex to bring them up to the necessary standard when leases end and tenants vacate. Previously, these less sustainable buildings could have remained in the market with a low cost refurbishment and a reletting at a significantly lower rent than for the better buildings. For buildings below an EPC rating of B this will no longer be an option. The additional costs of bringing these older buildings up to the required standard is exacerbated by the significant build cost inflation we have seen in the last year.

The impact of all these factors has accelerated the bifurcation in the market. With best-in-class property valuations adjusting to reflect the movement in bond yields, it is the older, poorer quality buildings that are facing what is likely to be a deeper correction, with downward price discovery potentially not reaching an endpoint until a lease ends and the rent stops, or from refinancing events.

Tenant demand for the best, newly developed or refurbished buildings at the forefront of sustainability with top quality amenities is strong, and seeing rising rental values.

Logistics

Andrew Jones, chief executive:

Interest rates remain the yardstick by which all investments are assessed, and so the material shift in monetary policy has had a profound impact on real estate valuations. Whilst the full impact is continuing to play out, we expect some of the short term reactions to be superseded by longer term trajectories.

Lower yielding and high growth sectors certainly took the brunt of the initial repricing in the latter part of 2022, whilst higher yielding ex-growth sectors remained largely unscathed. This seems largely irrational and we would expect some of these initial movements to unwind, with other movements accelerating as market data becomes more evident and reliable.

For a while now, the logistics sector has been the only property asset class transacting, which helps to explain why valuations in March 2023 are stronger than the market had been expecting at the end of 2022. Whilst liquidity is much improved from the days of the mini budget, it is still likely to remain far from optimum until five year swap rates fall back below 300bps. We still have some way to go as, whilst it is down materially from its highs of 540bps immediately following the mini budget last Autumn, it remains elevated at around 400bps, reflecting stubbornly high inflation.

For those sectors that have not seen material re-pricing, when more liquidity returns, they will surely print at yields materially softer than those currently suggested by valuers’ yield sheets. We expect the greatest fallout to be in those troubled sectors facing structural headwinds and a perfect storm of falling rental values, weaker valuations and higher borrowing costs.

When interest rates are low and debt readily available, many of the structural cracks in these asset classes can be papered over. However, we are now in a new paradigm and if the property market won’t offer price discovery, then the debt market inevitably will. One of the fallouts from the recent banking crisis in the USA is that debt availability will be more restricted. Whilst many will point to this being a localised issue, it would be naive to think that there will not be implications on debt availability and/or credit margins closer to home.

Troubled sectors including certain parts of retail as well as offices seem the most exposed. Here, debt refinancing will bring some serious pain as owners discover that some of their troubled assets presently yielding a positive carry and attractive cash on cash metrics, will no longer be so productive.

The good news is that the UK listed sector is in a much better position than the private sector or indeed many of the European REITs, where leverage is already higher. Many of the lessons from the Global Financial Crisis were missed, but, in the UK, lower leverage was not one of them and so we do not expect a repeat of 2008/09. Asset quality is also much higher and, either by choice or market forces, very few UK REITs are now owning structurally obsolete shopping centres and ageing regional offices.

The times are truly changing and today’s debt and equity markets offer no hiding places. Outdated strategies have been unmasked and sub-scale offerings are out of favour, and this will become more apparent as pockets of the market rerate in response to an improved economic outlook.

Diversified

Simon Carter, chief executive:

The past 12 months have been volatile in terms of the economic and political landscape. Although more recently the outlook for the UK economy is improving, sentiment remains fragile. Higher interest rates have had an impact on property yields. Whilst we remain mindful of ongoing macro-economic challenges, the upward yield pressure appears to be easing and there are early signs of compression for retail parks.

Ultimately, value in real estate is created over the medium to long term. We like to invest in supply constrained segments with pricing power, where we can be market leaders and leverage our competitive strengths to generate attractive returns. We already lead in campuses, where we continue to see strong demand for best in class space and are increasing our focus on life sciences and innovation sectors. We are consolidating our position as the largest owner operator of retail parks where scale is an advantage and we are building a unique portfolio of centrally located and highly sustainable urban logistics schemes in London.

Mark Allan, chief executive:

Despite the recent disruption from transport strikes, London continues to get busier and office utilisation continues to gradually increase. We continue to see a growing bifurcation in demand, with customers focussing on flexibility, the best quality space in areas with the right amenities to attract key talent, and sustainability. Across the London market, office take-up slowed in the second half, ending the year at 11.8m sq ft – up 7% vs last year and just 4% below the 10-year average. Space under offer reduced to 3.2m sq ft vs a 10-year average of 3.4m sq ft and vacancy in the City remains high at 11.7%. Conversely, vacancy in the West End, where c. 70% of our assets are located is just 3.6% and down 70bps YoY. Overall, 67% of available space is second-hand, as Grade A vacancy remains low at 1.7%.

Looking forward, we have been clear in our expectation that more flexible ways of working would reduce overall demand for office space in the UK. However, we have also consistently said that the impact of this will not be evenly spread, with large HQ type space and areas which lack the amenities that offer people a reason to want to spend time there expected to see a much bigger impact. This has started to play out and we expect this will continue. Across London space marketed for subletting increased to 5.1m sq ft over the year, but 75% of this is in the City, City Fringe and Docklands. In the West End and Southwark, where assets are smaller and occupiers more diversified, demand remains strong and Grade A supply is low. This continues to drive ERV growth for the best assets, which continues to benefit our portfolio.

Customer demand for retail space in the best locations continues to grow. Consumer behaviour continues to gradually revert back to pre-Covid trends, with online sales down and in-store sales up over the past year. For most leading brands, online and physical channels are now firmly interconnected, and a number of key brands such as Next and Inditex indicated recently that online is no longer expected to grow as quickly as previously anticipated. The increase in cost of capital and cost of doing business online has also led many online pure-play retail models to shift their focus from growing market share to growing profitability, increasing the cost for consumers to buy online.

Whilst we expect brands continue to rationalise their overall store footprints, their focus on ‘fewer, bigger, better’ stores continues to drive growth in demand for space in our assets, as they upsize existing stores or open new stores as they move from nearby locations to benefit from higher footfall in a ‘flight to prime’.

Jason Baggaley, manager:

Despite a weak start to the year, UK real estate performance was broadly flat in Q1 2023 according to the MSCI monthly index, with all property recording a total return of 0.2%. This was helped by the first month of positive performance in March 2023 since June 2022, with monthly performance increasing from -0.3% in February to 0.7% in March. This demonstrated a continued recovery in UK real estate performance.

Offices continued to be the worst performing sector over Q1 2023 with a total return of -1.8%, while the residential sector produced the best performance at 2.9%. Other areas of the market which demonstrated robust performance and outperformed the market average were retail warehousing, hotels and south east industrial.

Capital value declines also showed signs of slowing, with capital values rising 0.2% in March 2023, resulting in capital value declines over Q1 2023 of -1.2%. Whilst remaining negative, this was a significant improvement on a fall of -15.6% recorded in Q4 2022 (the largest quarterly fall in the history of the MSCI monthly index).

That being said, improved performance is set to be largely derived from the direction of the Bank of England’s monetary policy, and the speed at which any rate cutting cycle is implemented. At present, the BoE is expected to begin a cutting cycle in late 2023 although markets remain turbulent, and uncertainty persists on the timing.

Any recovery in performance is likely to be asymmetric, with those sectors which benefit from positive underlying fundamentals – and which experienced the largest correction in capital values in late 2022 – likely to see a more pronounced recovery. As a result, our outlook and forecasts for the industrial and logistics, supermarket and retail warehouse sectors have improved.

We anticipate further capital value declines in those sectors which are yet to experience significant outward yield movements, and which remain under structural pressure, with the office sector likely at greatest risk of further pricing declines. Best in class offices are expected to remain more resilient, particularly in supply constrained locations, whereas the outlook for secondary office assets is poor. Anecdotal evidence suggests that secondary office assets are now beginning to see material discounts to pricing, but a wide gap remains between buyer/seller pricing aspirations.

Michael Morris, chief executive:

Due to the sharp rise in the risk-free rate and cost of debt, the MSCI UK Quarterly Property Index All Property equivalent yield moved out by 85 basis points in the three months to December 2022. MSCI reported capital growth of -12.6% for this period, the fastest quarterly correction since December 2008 at the height of the Global Financial Crisis. The situation appears to now be stabilising and the three months to March 2023 saw capital growth of -1.0%.

Despite the tribulations of the investment market, the occupier market saw a more encouraging performance, and All Property ERV growth for the year to March 2023 was 3.5%. This compares to 3.1% ERV growth for the year to March 2022.

Following an extraordinarily strong year of capital growth to March 2022, the low yielding industrial sector was disproportionately affected by the recent market correction. The MSCI All Industrial total return for the year to March 2023 was -20.4%, comprising capital growth of -23.2% and income return of 3.6%. Capital growth ranged from -18.7% to -27.1% between sub-sectors.

On a more positive note, due to ongoing supply constraints and healthy occupier demand, the industrial sector achieved strong rental growth for the year to March 2023 of 8.6%, ranging from 10.0% to 7.2% between sub-sectors.

Residential

Helen Gordon, chief executive:

The UK private rented sector and build-to-rent sector in particular are highly resilient through cycles. Rental growth is underpinned by inflation, specifically wage inflation, offsetting the downward pressure on valuations from a higher interest rate environment. Demand for renting equally remains resilient. It demonstrates defensive qualities, as more people choose to rent for longer as borrowing costs rise and economic uncertainty remains. Rental demand is expected to continue to grow over the long term as modern living patterns change with more fluid labour markets. More and more people are choosing to rent for longer as it provides the flexibility they require, offers good value, and a place to put down roots and call home, something Grainger and the wider build-to-rent sector is committed to.

The opportunity in front of us is large. There are 5m households in the UK renting privately, representing 25% of all households. Yet only c.1.5% of these households live in purpose built, build-to-rent properties owned by large scale institutional landlords such as ourselves. The vast majority of the rental market is made up of small individual private landlords whose overall exit from the market is accelerating. This presents a significant opportunity for Grainger to increase market share.

The investment case for the UK build-to-rent sector is underpinned by the severe housing shortage which characterises the UK housing market. Centre for Cities, a think tank, estimate that the UK requires 4.3m additional homes to plug the current gap, while official figures show supply of new homes continuing to reduce.

Europe

Robert Orr, chairman:

The weaker economic backdrop is likely to cause take-up levels to moderate from the exceptional levels recently experienced, but overall occupier demand remains robust and derived from a diverse range of business sectors. Supply continues to be limited and development pipelines constrained by the higher cost and lower availability of debt finance. Against this external context, we expect vacancy rates to remain low which will continue to support positive rental growth, albeit potentially at levels below the very high rates recently recorded.

The sharp increase in interest rates experienced over the second half of 2022 has led to a consequent adjustment of property yields and asset values. For those markets where significant declines in values have already been seen, investment volumes appear to be stabilising, with investors responding to the adjusted pricing levels and the strong underlying fundamentals of the logistics sector.

Looking beyond this financial year, prospects for the sector and the company remain positive. As greater visibility emerges in terms of the uncertain macroeconomic backdrop, we believe the combination of strong underlying market fundamentals and positive structural drivers will continue to attract capital to the European logistics sector and support rental growth.

Retail

Ediston Property Investment Company

William Hill, chairman:

The property market has seen a considerable re-pricing due to the rapid rise in interest rates and fears of a recession in H2 2022. The stabilising of real estate markets in Q1 2023 was aided by the fear of a recession receding, inflationary prospects improving, and belief that interest rate rises might be close to reaching their peak. Hopefully this will not prove to be an overly optimistic view and, that, subsequently there is a case to say that the market correction may have been overdone.

Although the retail warehousing market declined over the period, in common with the direction of the overall market, the sector is performing well at tenant level. This is especially the case at the essential/value end of the retail market where much of the company’s portfolio is focused.

Retail warehousing works well with the digital economy and the EPRA Vacancy Rate, at 6.7%, remains low. The efficiency and flexibility of space remains a strong attribute and relocations from in town to out of town remain a feature. Poorer schemes continue to be taken out of the market as they are repurposed for other more valuable uses.

Healthcare

Jonathan Murphy, chief executive:

The critical need for investment in infrastructure to support the services delivered by the NHS is as pronounced as it has ever been. We have an ageing population, and it is cheaper for the NHS to deliver health services in a primary care setting. Waiting lists are longer than they have been for decades because hospitals are overburdened, and appropriate space doesn’t exist in a community setting to deliver care where it is needed.

The existing NHS estate is not fit for purpose and requires significant investment to meet this demand. Healthcare professionals openly admit that the premises they work in are constraining the services they can provide, hindering recruitment of staff and holding back progress on tackling the care backlog. The recent restructuring of the NHS into Integrated Care Partnerships should provide a greater opportunity for stronger collaboration across health professionals, services and the property estate.

Assura has a vital role as a partner to health providers to ease the pressures faced by the system. By investing in our capabilities, we are strategically placing ourselves as the partner of choice for the long-term. We are best placed to provide high-quality, sustainable new premises for delivery of health services, to retrofit existing buildings to meet the net zero carbon challenge, partnering with our supply chain to maximise the social value that we create for the communities we operate in and continually evolving our offering through adopting the latest technologies.

Real estate research notes

Urban Logistics REIT – Fundamentals strong as market stabilises

Lar España Real Estate – Dominant assets make a resilient business

Civitas Social Housing – Time to buy?

abrdn European Logistics Income – Negotiating choppy waters

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.