Lockdown cloud begins to lift

The success of the vaccine rollout in the UK and the implementation of a roadmap out of lockdown saw the share prices of listed property companies – most of which had been decimated during the last year – make somewhat of a recovery.

The economy is on firmer footing and optimism for a strong second half of the year is growing. Property companies focused on the most COVID-affected sectors – retail, leisure and hospitality – are set to benefit most, as the economy gradually reopens. Investors took advantage of the apparent good value of these stocks during the quarter.

There is still much uncertainty in the sector, however, which is reflected in the wide discounts to net asset values (NAV) some property companies’ shares are still trading on.

The shining beacon of the property sector that is logistics continues to dominate, with several specialists reporting significant uplifts in portfolio valuations and NAVs during the quarter.

Performance data

The successful vaccine rollout and the resultant positive sentiment that it has brought to the real estate sector is reflected in the share price performance of property companies in the first quarter of 2021.

Best performing property companies

Leading the way was Drum Income Plus REIT, which saw its share price rally 69.4% in the quarter following the announcement that its board was considering the future of the company. The trust has traded at a significant discount to net asset value (NAV) since it launched in 2015 and, despite the uplift in its share price, is still trading at a 31% discount.

Perennial 2020 underperformer U and I Group, saw its share price rise more than 50% in the first quarter of 2021. This followed news in January that it had replaced its chief executive and was undertaking a review of the business that will likely see it focus on fewer, more valuable development schemes.

Shopping centre owner Hammerson also saw a jump in its share price, albeit from a low base. The company’s share price has been decimated over recent years as its exposure to the struggling retail sector hit the valuation of its portfolio. It is working through plans, under a new chief executive, to fix its balance sheet.

RDI REIT was the subject of a cash offer from its largest shareholder Starwood Capital in February, valuing the company at £467.9m. The bid price was a 33% premium to its previous day’s closing price.

Long income specialist Secure Income REIT staged a bit of a share price recovery in the quarter, rising almost 20%. The group’s portfolio includes hotels and leisure attractions – two of the hardest hit sectors during the pandemic – and despite the rally its share price is still 22% down on its pre-pandemic high.

Worst performing property companies

Despite reporting a positive trading update, in which occupancy and income was up, AIM-listed self-storage operator Lok’n Store was the leading share price faller in the quarter, closely followed by BMO Commercial Property Trust. That company, which owns a diverse property portfolio weighted towards offices, reported a rent collection rate for the quarter of 75% in a trading update.

Last year’s leading property company in share price terms, Triple Point Social Housing REIT – which gained 24.2% in 2020 – saw its share price fall in the first quarter of 2021, perhaps on profit taking.

Uncertainty around the future of the office sector after restrictions are eased may be behind a 4.4% fall in Regional REIT’s share price in the quarter. The group is very positive on the future of the office and has nailed its colours to the mast with a portfolio overhaul to focus solely on the sector.

Significant rating changes

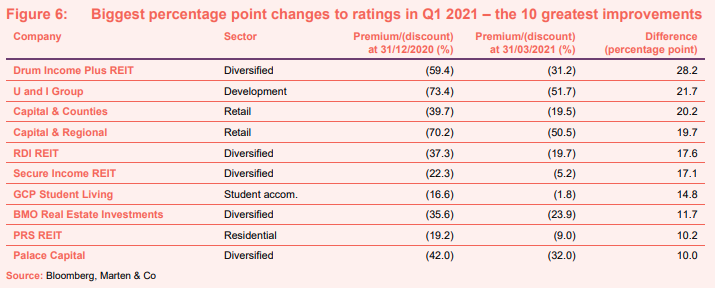

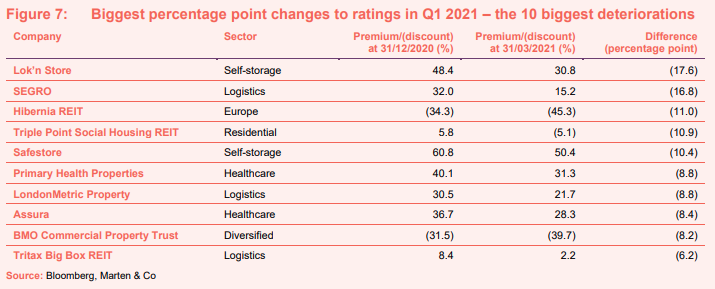

Figures 6 and 7 show how premiums and discounts have moved over the course of the quarter.

Many of the constituents of the greatest rating improvements feature in the share price performance table above. Capital & Counties, which owns a huge swathe of Covent Garden in central London, saw its discount cut in half after momentum in its shares gathered pace in anticipation of non-essential retail and hospitality re-opening following lockdown.

Shopping centre owner Capital & Regional’s discount came in by almost 20 percentage points in the quarter, due to both share price gains (of 8.6%) and a significant fall in its NAV (of 33%). It still trades at a substantial 50% discount.

GCP Student Living, the student accommodation owner, saw its discount narrow to just 1.8% during the quarter due to a combination of a healthy 8.6% share price rise and an 8.1% NAV fall.

The property generalist BMO Real Estate Investment had a strong quarter in share price terms, perhaps due to its significant portfolio weighting to the favourable industrial and logistics sector.

Again, most of the companies to feature in Figure 7 have been covered off earlier in the worst performing companies’ section. Additional entrants include industrial and logistics giant SEGRO, which saw its premium rating narrow mainly due to a huge uplift in its NAV as the value of its logistics assets were marked up.

It was the same story for fellow logistics heavyweight Tritax Big Box REIT. Its premium shrank in the quarter following a big increase in its NAV, despite a 6.9% rise in its share price.

Primary healthcare specialists Assura and Primary Health Properties both saw their discounts narrow following share price falls in the quarter.

Major corporate activity

Fundraises

Just north of £600m was raised by property companies in the first quarter of 2021. Not surprisingly, all were by companies focused on favoured property sectors, with the majority of the capital raises oversubscribed, reflecting investor appetite for exposure to these budding sectors.

Tritax EuroBox raised the largest amount, with an oversubscribed issue of €230m (£198.4m). The proceeds will be used to acquire a near-term pipeline of assets worth €416m.

Supermarket Income REIT raised £153m from an oversubscribed issue. The group has identified immediate investment opportunities worth £230m across four deals and has a further nine assets in the pipeline worth £184m.

LXI REIT raised £125m from a significantly oversubscribed share issue. The group, which targeted a £75m issue, has identified an acquisition pipeline worth £140m in sectors including foodstores, industrial, drive-thru coffee and garden centres.

Target Healthcare REIT raised £60m in an oversubscribed issue, exceeding its target of £50m. It will deploy the proceeds into an investment pipeline that consists of three care homes and one forward funding development project.

Warehouse REIT raised gross proceeds of £45.9m in an issue and has spent the capital on the acquisition of warehouses in Harlow, Liverpool and Glasgow.

Aberdeen Standard European Logistics Income raised £19.4m after issuing 18.45 million new shares, representing the total remaining authority granted by shareholders at its AGM.

Mergers and acquisitions

RDI REIT agreed terms on a £467.9m cash offer for the company from its largest shareholder Starwood Capital. Starwood made a cash offer for the 70% of shares it didn’t own of 121.35p, representing a discount of 19.9% to the group’s most recent EPRA NAV but a 38.2% premium to its six-month average share price.

The board of Drum Income Plus REIT announced a strategic review into the company that it said could result in the company being sold.

Major appointments

Tritax Big Box REIT chairman Sir Richard Jewson announced his intention to retire at the next AGM in May 2021. Aubrey Adams OBE, the current senior independent director, will take his place.

London office developer Derwent London appointed former JP Morgan vice chairman of mergers and acquisitions Mark Breuer as its new chairman. He will initially join the board as a non-executive director before taking over from John Burns as chairman following the conclusion of the company’s 2021 AGM.

LondonMetric appointed Kitty Patmore as an independent non-executive director. Patmore is current chief financial officer at Harworth Group and has 15 years of finance, banking and real estate lending experience.

St Modwen Properties appointed Dame Alison Nimmo DBE as a non-executive director. The former Crown Estate chief executive joined the board on 1 February 2021.

British Land appointed Bhavesh Mistry as chief financial officer. Mistry is currently deputy chief financial officer at Tesco and was previously finance director at Whitbread’s hotels & restaurants division. He will become an executive director and join the main board at British Land when he makes the move no later than 1 August 2021.

Hammerson chief financial officer James Lenton resigned from the role after just over a year in the job. He will stay in the role until a successor is appointed.

Other major corporate activity

LondonMetric priced a £380m private debt placement with institutional investors in North America and the UK, upsized from an initial £150m. The debt has a blended maturity of 11.1 years and a weighted average coupon of 2.27%. £50m has been designated as ‘Green notes’, which have to be secured against buildings that have high sustainability standards. This is the first time a UK REIT has issued these and the debt is 2 basis points (or 0.02%) cheaper than non-green debt. The money will be used to replace existing debt facilities.

Ceiba Investments raised €25m in a convertible bond issue. The unsecured, 10%, five-year bond was priced at the unaudited NAV of 104.3p. It will use the capital to finance the construction of the Melia Trinidad hotel.

Civitas Social Housing secured investment grade credit rating with Fitch, which will allow it to grow its debt funding strategy and gives it access the broader bond market.

Tritax EuroBox was also assigned investment grade credit rating by Fitch, which immediately reduces the cost of its current debt by 30 basis points and gives it access to a wider pool of financing strategies.

Major news stories

- Home REIT fully invested the proceeds of its £240m initial public offering after the acquisition of 11 portfolios for £48.1m. The group, which launched in October 2020, now has a portfolio of 572 homeless accommodation properties.

- Helical let the 88,500 sq ft Kaleidoscope office in Farringdon to TikTok on a 15-year term at an annual rent of £7.6m.

- LXI REIT acquired seven grocery stores for £85m, in the first step in deploying capital from its £125m raise. The acquisitions comprise both pre-let forward fundings and built investments and have an average net initial yield of 5.25%.

- Urban Logistics REIT forward funded on a speculative basis the development of five assets in the East Midlands for £23m. It also sold five assets for £30m at a 35.4% uplift to book value.

- Regeneration specialist U and I Group replaced chief executive Matthew Weiner with chief development officer Richard Upton after a prolonged period of underperformance. Upton will undertake a review of the group’s investment strategy.

- Supermarket Income REIT acquired a Tesco Superstore, which forms part of Prestatyn Shopping Park, from Ediston Property Investment Company for £26.5m, which is equivalent to a net initial yield of 5.3%.

- Assura completed the acquisition of primary care developer Apollo Capital Projects Development. The deal will increase Assura’s immediate and extended development pipeline by an initial eight schemes with capital expenditure of £50m.

- CLS exchanged contracts to acquire three offices in Germany – in Dusseldorf, Berlin and Hamburg – for a combined €89.7m, reflecting a net initial yield of 4.8%.

- Unite Students, the student accommodation owner, sold a portfolio of eight properties, comprising 2,284 beds, for £133m as part of its strategy to exit “subscale” markets.

- NewRiver REIT and joint venture partner BRAVO Strategies III exchanged contracts to acquire The Moor, a 28-acre retail and leisure estate in Sheffield, for £41m (NewRiver share: £4.1m). NewRiver will be appointed asset and development manager, in return for a management fee.

Selected QuotedData views

- Will Rishi’s call for return to office impact sector?

- Property one year on from lockdown

- Student digs top of the class for COVID rebound?

- Property tinkermen worth their weight in gold

- Can Upton regenerate U and I Group’s future?

Publications

Standard Life Investments Property Income Trust – Focus on tomorrow’s world

Grit Real Estate Income Group – On the path to recovery

Aberdeen Standard European Logistics Income – Expansion on the radar

Tritax EuroBox – Boxing clever

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.