Real Estate Roundup

Kindly sponsored by abrdn

Performance data

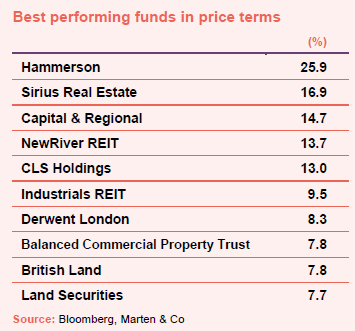

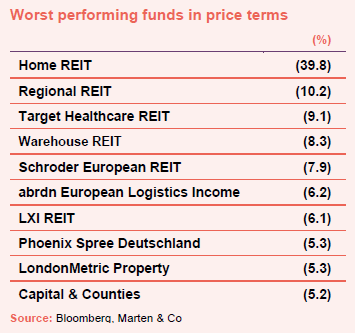

November’s biggest movers in price terms are shown in the charts below.

Valuation declines in the property sector are starting to feed through in NAV announcements and interim results (see page 2) as higher cost of debt continues to put pressure on pricing. Having seen dramatic falls over the past few months, several REITs have rebounded as their share prices are looking cheap. Top of the positive movers in November was retail landlord Hammerson after it reported a positive trading update showing positive leasing momentum feeding through to earnings growth. It also indicated that third quarter valuations were stable, with retail-focused companies less prone to the impact of rising interest rates after many years of yield expansion on their assets. That was perhaps behind the share price gains for secondary shopping centre owner Capital & Regional and retail parks specialist NewRiver REIT, the share prices of both having been hammered in recent years. Decent lettings progress on Derwent London’s central London office portfolio and a healthy balance sheet (with 100% fixed debt and long-term maturity) may have been behind its share price rise of 8.3% in the month. The two traditional property heavyweights – British Land and Land Securities – both saw share price uplifts in the month after reporting half-year results.

Home REIT, the provider of homeless accommodation, saw its share price fall almost 40% in the month after coming under attack from a short seller, which made several allegations against the company (see page 4). These were rebutted by the company, but question marks remain over the financial strength of its charity tenants. Elsewhere, office landlord Regional REIT continued its share price decline as sentiment towards that sector remains challenging. The company has now seen its share price fall 36.1% over the year and is now trading at a discount to NAV of 41%. Industrial and logistics specialists have also come under sustained negative share price pressure with three companies – Warehouse REIT, abrdn European Logistics Income and LondonMetric – making the bottom 10 price performers in November. Conversely to the retail-focused companies, investment yields on logistics assets have compressed markedly over the past few years and therefore are most vulnerable to a higher cost of debt. This was borne out in half year results of both Warehouse REIT and LondonMetric (see page 2). Long-income specialist LXI REIT saw its share price fall 6.1% after it announced a fall in NAV in its interims results.

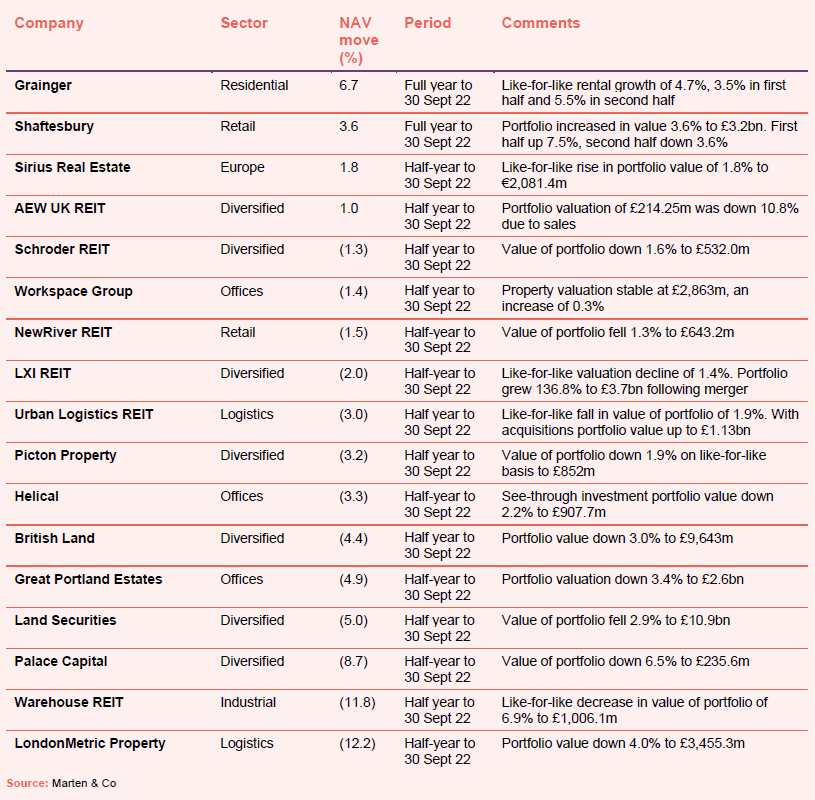

Valuation moves

Corporate activity in November

SEGRO launched a £350m bond, priced at 175 basis points above gilts, with an annual coupon of 5.125%. The 19-year senior unsecured bond issue was almost six times oversubscribed. The group’s cost of debt increases to 2.2% (from 2.1%) and the average debt maturity increases to 9.1 years (from 8.2 years). The bond also increases the fixed element of its interest rate exposure to 78%.

Impact Healthcare REIT secured an extension of £25m to its existing revolving credit facility (RCF) with HSBC UK Bank. The extension is on the same terms as the existing RCF and takes the total facility with HSBC to £75m. The group simultaneously cancelled the £15m RCF element of its available facility with Metro Bank.

CT Property Trust appointed Davina Walter as its new chairman following the retirement of Vikram Lall. Walter is also chairman of Aberdeen Diversified Income and Growth Trust and a director of Miton UK MicroCap Trust. The company has also appointed James Thornton as a director.

Life Science REIT announced its intention to be admitted to the premium segment of the main market of London Stock Exchange and delist from AIM. It is expected that admission will occur by early December 2022.

Town Centre Securities commenced a share buyback programme to help tackle its share price discount to NAV. It has the authority to repurchase up to 7.7m shares.

Hammerson announced that it will exercise the early redemption option on its €500m bonds that were due to mature in 2023. The aggregate amount of bonds outstanding was €235.5m and will be settled using existing cash.

November’s major news stories – from our website

- Home REIT hit by short-seller attack

Home REIT was the subject of a short-seller attack that alleged that many of its tenants were struggling financially and malpractice within the company. Home REIT strongly rebuffed the claims as baseless and misleading.

- Great Portland Estates secures its largest ever office letting…

Great Portland Estates secured its largest ever letting – the 321,100 sq ft pre-let of its office development, 2 Aldermanbury Square, EC2, to international law firm Clifford Chance LLP.

- … and nets Oxford Street retail letting

Great Portland Estates signed up fashion retailer Reserved for 19,645 sq ft of retail space at its 70/88 Oxford Street development. Reserved will occupy the ground and first floors and is set to open later in 2023.

- Helical secures tenant at Farringdon scheme

Helical leased the sixth and seventh floors at The JJ Mack Building, 33 Charterhouse Street, Farringdon (comprising 37,880 sq ft of offices) to Partners Group, a leading global private markets firm.

- LondonMetric makes £28.2m in double sale

LondonMetric Property sold two assets for £28.2m at a blended net initial yield of 4.6%. It disposed of a 61,000 sq ft retail park in Tonbridge, for £22.0m and a 30,000 sq ft urban warehouse in Digbeth, Birmingham, for £6.2m.

- abrdn Property Income Trust continues office sales

abrdn Property Income Trust completed the sale of The Kirkgate office in Epsom for £7.725m, reflecting a 7.25% net initial yield, as it continues to reduce exposure to the office sector.

- Circle Property sells office for £15.2 as it continues sell down

Circle Property sold Somerset House, Temple Street, Birmingham for £15.18m, in line with its disposal strategy. The board expects that a minimum of two returns of capital will be made to shareholders, the first by March 2023.

- NewRiver REIT to manage 16-strong retail portfolio

NewRiver REIT struck a deal to manage a retail portfolio of 16 retail parks and a shopping centre on behalf of a leading real estate investor. It will be paid a fee calculated with reference to the rental income of the portfolio.

- CLS Holdings secures trio of lettings

CLS Holdings signed three new office leases in Germany, amounting to 3,566 sqm (38,384 sq ft). At “Flexion”, in Berlin-Mitte, it secured two new corporate tenants – Hologic Deutschland GmbH and Tower Productions. The third lease was at Office Connect, Cologne for 753 sqm (8,105 sq ft) to Ecowo. Combined, the three leases were 4.9% above ERV.

- Custodian REIT books profit on industrial unit

Custodian REIT sold an industrial unit in Kilmarnock at auction for £1.4m at a 12% premium to its 30 June 2022 valuation. recently increased the lease term by 10 years it was considered the right time to crystallise a valuation uplift on the 18,424 sq ft warehouse and distribution unit.

Manager’s views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Simon Carter, chief executive:

We are now operating in a significantly different environment to the one we reported on in May 2022. Rapid inflation has led the Bank of England to initiate an interest rate hike cycle and 10-year gilt rates are significantly ahead of the level six months ago, albeit below recent highs. This has directly impacted property yields with the effect most pronounced in lower yielding assets. Looking forward, yields will be heavily influenced by where medium-term interest rates settle, which is difficult to forecast, but we currently expect to see yield expansion across our business in the second half. However, this impact will likely be cushioned by rental growth across our key markets.

We go into the second half with a strong leasing pipeline focused on markets where we have pricing power, but we are mindful of the weaker macro environment we are operating in. The disposal of stakes in Paddington Central and Canada Water strengthened our balance sheet and combined with the quality of our platform and our continued commitment to capital recycling, mean we are well placed to exploit our attractive development pipeline and the opportunities now emerging in the market.

Mark Allan, chief executive:

Looking ahead, we anticipate global economic uncertainty to remain elevated. Decades of globalisation, fuelling growth and depressing inflation, have started to go into reverse, with rising geopolitical tensions adding to risks around energy reliance and supply chains. Positively, the turbulence in UK politics in late summer has started to normalise, although political stability remains fragile.

Still, it is clear that London remains a top global city which continues to attract new businesses and talent; that the future of major retail destinations is more positive than most, including many retailers themselves, thought two years ago; and that there remains a structural need to remodel city centres in a sustainable way. It is difficult to say where interest rates will settle.

Cyrus Ardalan, chairman:

The wider effects of the economic measures taken by the Government and Bank of England to bring inflation under control, and the expectation of poor economic growth in the near term have begun to impact property values in the UK. The most impacted sectors so far are those that had the tightest spread to the risk-free rate, such as industrial and logistics, and yield prints from transactional evidence show some further decline in values since September this year.

What is clear from the data available relating to long income property valuations over multiple cycles, is that correlation between property yields and debt rates is limited. Prime index property yields over the past 40 years have intersected the 10-year gilt rate at various times and the long lease sector has tended to be the most defensive sector of all, benefiting from a flight to safety as well as the income growth provided by index-linked rent reviews.

It is clear that the current economic climate will begin to separate those real estate companies whose business model has been driven by arbitraging a low interest rate environment and passively benefiting from a tightening of long income yields, from those that generate value for shareholders through a strategy of active management of their underlying assets, quality and experience of their management team, scale and availability of capital.

Rising interest rates will put pressure on income returns over the medium to long term for all leveraged property investment companies, but the environment also provides buying opportunities. We are already seeing significant buying opportunities in the market from open-ended funds suffering net outflows and are finding tenants more amenable to value-add opportunities that we identify through our asset management strategies.

Mark Burton, chairman:

The company is as defensively positioned as possible against the current challenging backdrop. Whilst further near-term value decline is expected, the company’s fixed cost of debt and book values which are closer to long term value fundamentals, such as alternative use values and replacement cost, provide a robust outlook for the portfolio over the long term. The portfolio’s current high weighting to cash and value investment style leave it well placed to benefit from upcoming investment opportunities. The strategy’s approach, being unconstrained by sector, and its active management style of the portfolio provide a strong basis for counter-cyclical performance. In addition, we are seeing resilience in occupational demand from the company’s tenants.

Lena Wilson, chairman:

We are in an unusual position of record-low unemployment, whilst at the same time households are struggling with a cost-of-living crisis. The outlook is dependent on stability returning to the financial markets and the severity of any recession.

The marked change in gilt yields and financing costs recently means a repricing in the commercial property market has commenced. Despite this, the fundamental supply/demand balance has not altered, and we are still continuing to see occupational demand and rising rental values in many of the areas where we operate.

Whilst there are many events currently outside of our control, we will continue to do what we do well: proactively manage our portfolio, work with our occupiers and enhance income and value. Although the leasing markets are likely to be more challenging in the short-term, we believe that we can further enhance our income profile from our high-quality portfolio.

During the past few years, we have witnessed periods of instability and the property sector has been more resilient than many had anticipated.

Retail

Brian Bickell, chief executive:

The exceptional features of London and the West End have enabled their economies to largely recover from the disruption caused by the pandemic. The actions we took in 2020 and 2021 to support our occupiers and protect our portfolio have been rewarded with a rapid return to normal operating conditions in our locations over the last 12 months, and a much-improved financial performance.

From the early months of 2022, many countries have been faced with common challenges arising from the after-effects of the pandemic and the consequences of Russia’s illegal invasion of Ukraine. Together, they have led to supply chain disruption, labour shortages, rising inflation and higher interest rates, resulting in declining consumer confidence and a deteriorating medium-term global economic outlook. Whilst inflation is expected to start to decline in 2023, in common with all businesses it will continue to impact our operating and capital expenditure costs in the near term.

We have already seen an impact on investment market sentiment, with our valuers reporting an outward yield shift in the second half. The future direction of yields will be heavily influenced by macro factors and the medium-term outlook for UK interest rates. However, the prospect of continuing to deliver a robust operational performance from our portfolio will be important in tempering the impact on investor sentiment of adverse conditions in the wider real estate market.

Although London and the West End cannot be immune from the unprecedented range of challenges which are now dominating the national outlook, their long-term prospects remain bright, thanks to their enduring appeal to global, domestic and local visitors, businesses and investors, their dynamic economies and ability to attract talent and creativity from across the world.

Allan Lockhart, chief executive:

Geopolitical tensions, elevated market volatility and the fastest pace of monetary tightening by the Bank of England in decades are meaningful economic headwinds contributing to an unusually uncertain environment. In their recent report the OBR stated that the UK economy is now in a recession that they expect to last a year and will result in a 2% fall in GDP and an increase in the unemployment rate.

Therefore, the outlook for consumers and retailers suggests that 2023 will be a challenging year and for retail real estate owners the key to minimising the impact from this challenging operating environment will depend upon portfolio positioning and underlying rental affordability. In this regard, the scenario testing that we have undertaken on our rental affordability and probability of tenant failure indicates that we are well positioned and are unlikely to suffer any material income disruption. Furthermore, we believe that having one of the highest yield spreads with the risk free rate should mean that our valuations should be more insulated.

We said at our full year results that in the near-term it is in our shareholders’ interest to maintain headroom to our LTV guidance given the increasingly uncertain macro-economic outlook and we still believe that is the correct position to continue with as we move into the second half of FY23. That said, we believe there will be attractive opportunities which will arise in the market and with the capital resources we have at hand we are well positioned to take advantage of them and stay within our LTV guidance.

With a portfolio predominately focused on essential goods and services, a flexible and strong balance sheet and our market leading asset management platform, we remain confident of our ability to manage the financial impact of a more challenging economic outlook.

Logistics

Andrew Jones, chief executive:

As we continue to live in a period of increased uncertainty across the world, we believe that real estate can continue to deliver reliable, repetitive and growing income streams. We are also conscious that when we allocate capital, it is wise to determine what is structural and what is cyclical.

We have a high conviction that this thesis is more dependable within structurally supported sectors that are located in the strongest geographies. The fundamentals in our core sectors remain strong and so we will continue to pivot our portfolio to take advantage of the strongest demand/supply dynamics to deliver the most attractive income and rental growth. We have strengthened our portfolio, selling our weaker assets and replacing them with better assets that are more fit for purpose through our acquisitions and developments.

Over the next 12 months we expect market volatility and dislocation to offer up even more opportunities which will allow us, once again, to improve our financial and portfolio metrics. We believe that this is best achieved by investing in the winning sectors, owning the best buildings and focusing on the biggest cities where there is a falling land supply to meet the rapidly changing behaviour and growing expectations of the UK consumer. This will allow us to efficiently and effectively collect, grow and compound our rental income. After all, when you invest in quality, time will create wealth.

Richard Moffitt, chief executive:

To weather the current macroeconomic storm commercial property owners need tenants who can continue to pay the rent, an ability to capture inflationary uplift through active asset management, low gearing and a low and secure cost of debt. At Urban Logistics we believe our base of larger tenants selling essential goods, our team’s decades of experience in asset management, and our 97% hedged debt with no refinancings required until 2025 mean we face the future in the best possible shape.

Our focus on the one hand is how to best equip Urban Logistics to deal with the macro-economic challenges, and on the other, how best to take advantage of the opportunities presented to us in our market.

We have capital to deploy in the short-term. We will deploy this cautiously, into assets we believe we can add value to via our asset management skills. Given the make up of our portfolio, with an even split between Core Assets and Asset Management, there is an opportunity for us to realise some of the value created by our lettings activity by selling Core Assets and recycle the capital into properties with more asset management potential.

Offices

Gerald Kaye, chief executive:

The bifurcation that has been evident for a few years in the leasing market, between the best-in-class most sustainable buildings and the rest, has now appeared in the investment market, accentuated by rising bond yields and interest rates. We anticipate this will accelerate, with yields stabilising and rents continuing to grow for the best-in-class most sustainable buildings, such as those that comprise the Helical portfolio, and yields moving outwards and rents falling for the rest.

Price discovery will continue for the poorer quality less sustainable second-hand buildings as they decouple from the rest of the market. In time, these assets will provide Helical with the opportunity to turn these tired office buildings into market leading and highly sustainable new spaces providing amenity rich and technologically enabled offices which will appeal to discerning tenants seeking the best environment for their staff. This will enable us to continue to provide strong returns from our developments over the medium term.

Toby Courtauld, chief executive:

Our markets are cyclical, as a result, we actively monitor numerous lead indicators to help identify key trends in our marketplace. Over the last six months, given the increased economic uncertainty, our property capital value indicators have deteriorated from those we reported in May. In the short term, we expect investment activity in the central London commercial property market to remain muted, as higher interest rates reduce prospective returns, and prime yields to come under further upward pressure. In the occupational market, given a strong leasing and rental performance of the portfolio in the first half of the year, we have marginally moderated our rental value growth range for the financial year to 31 March 2023 to between 0% and +2.5%, predominantly driven by the positive performance of our office portfolio.

Residential

Helen Gordon, chief executive:

Our market benefits from continuing positive tailwinds, with demand for renting rising, constrained supply and a resilient customer base. The inflation-linked characteristics of our asset class, coupled with our high-quality properties, scalable operating platform and unrivalled data, insight and analytics gives me the confidence for our continued strong performance.

Despite the macro environment, we have locked-in and de-risked our medium-term growth, enabling us to continue our growth trajectory and deliver into a strong occupational market.

Real estate research notes

An update on Tritax EuroBox (EBOX). The company’s share price discount to NAV has widened along with the rest of the sector as interest rate rises hit valuations. The occupier fundamentals in the sector remain strong, however.

An annual overview on Urban Logistics REIT (SHED). The company has seen its discount to NAV widen considerably on weakened investor sentiment towards the logistics sector. The long-term market dynamics driving growth in the sector remain, however.

An update note on Grit Real Estate Income Group (GR1T). After its capital raise, the company has cleared a path for an increased, sustainable dividend and NAV growth following the acquisition of a developer.

An update note on Civitas Social Housing (CSH). The fundamentals of the social housing sector remain strong and the wide discount that the group’s share price trades may make it attractive.

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.