Real Estate Roundup

Performance data

Performance data

December’s biggest movers in price terms are shown in the chart below.

December was a good month for listed property companies, with the sector experiencing a bounce following the convincing majority the Conservative party won at the general election. For the second month in a row, estate agency group Countrywide topped the charts for the biggest share price gains. This follows news that it had agreed a deal to sell its commercial property arm Lambert Smith Hampton. Prior to this, the company had suffered big falls in its share price, down 19.3% in 2019.

It was a good month for regeneration specialists, with Harworth Group, Henry Boot and U and I Group all experiencing a rise in their share price. For U and I Group, it is the second month in a row it has featured in the top 10 risers. Conygar Investment Company saw a 16.7% rise in its share price over the month having reported its full year results at the end of November. Countryside Properties ended a fine 2019 with another strong month, making the top 10 for the fourth month running. In all, the housebuilder’s share price rose a whopping 49.5% in 2019. Stenprop’s share price was up 14% having made progress on its transition to a fully focused UK multi-let industrial landlord with the sale of its largest non-core asset.

Not all real estate companies benefitted from a general election bounce, however. Shopping centre landlord Capital & Regional suffered December’s biggest share price fall, down 9.9%. The company had seen its share price grow over September and October after South African REIT Growthpoint acquired a majority stake in the company.

Schroder European REIT saw its share price fall 6.4% despite reporting strong full year results during the month. Ceiba Investments, which invests in real estate in Cuba, and Macau Property Opportunities, which invests in the Chinese gaming city of Macau, both witnessed share price falls, of 4.1% and 3.5% respectively. Reflecting investor sentiment towards retail, shopping centre owner Intu Properties capped off a dreadful year with another appearance in the bottom 10 and ended 2019 as the worst performing real estate company with a 70% fall in its share price. Both of BMO’s real estate funds featured in the bottom 10 in December, with BMO Commercial Property Trust suffering a 2.5% fall and BMO Real Estate Investments’ share price falling 1.9%. Phoenix Spree Deutschland, which invests in residential property in Berlin, has suffered for much of 2019 as a result of proposed Berlin State rent controls.

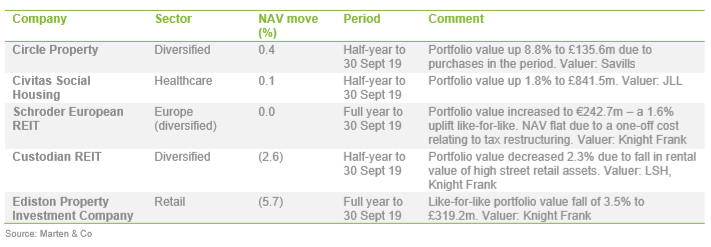

Valuation moves

Valuation moves

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Diversified

Custodian REIT

Richard Shepherd-Cross, investment manager:

We do not expect to see a meaningful change in investor demand for UK real estate over the next few months. We anticipate the conundrum of Brexit will continue to occupy investors’ thoughts and we anticipate a period of continued relative inaction while investors wait to see what happens next. However, we believe the outcome of the general election could produce an upsurge in confidence and activity and we remain ready with available undrawn debt facilities to exploit any opportunities which may arise. Meanwhile, the occupational market in the regions remains short of supply which continues to support rental growth in office and industrial markets.

While Custodian REIT is not immune from falling values in retail, as witnessed in the NAV decrease during the period, this is a cloud with a silver lining. Market conditions through late 2018 and 2019 have made it very difficult to source investment property with the appropriate risk profile. Properties that are modern, fit for purpose; capable of delivering long-term secure income; not in need of significant capital expenditure and likely to show limited voids have been scarce. A downward adjustment in market values could create the sort of opportunities that will allow Custodian REIT’s strategy to continue to thrive. We remain confident that the company’s strategy of targeting income with conservative net gearing in a well-diversified regional property portfolio will continue to deliver the stable long-term returns demanded by our shareholders.

Circle Property

John Arnold, chief executive:

Circle’s strategic focus on regional commercial property resulted in strong rental income being achieved in the period. During the past six months, the Circle Property team have been investing in the pipeline, increasing rental growth and we are on track to deliver expectations for the full year. In the first half, the pace of lettings has quickened, with over £950,000 of newly-contracted rents being completed to date since the start of the year. This bodes well for a positive uplift in valuation at the year end and we look forward to continuing our momentum.

Retail

Retail

Ediston Property Investment Company

William Hill, chairman:

The advantages of real estate as an asset class remain compelling both as a source of income and as a diversifier. In addition, pricing does not appear stretched relative to bonds. From an international perspective, yields are competitive against the European markets. Supply levels are in check and development activity subdued. Demand for property investment companies to access the market should rise as the liquidity issues in the daily traded property unit trusts continues to be a concern. This should be a positive for the closed-ended investment company sector and its ability to manage illiquid asset classes.

Notwithstanding the positive medium term ‘big picture’, the company’s rating has been hit hard in the last six months due to investor concerns about retail. The sector has been changing for a long time in how it is carried out as an activity, and in terms of what consumers want to buy and from where. Investors and retailers on the wrong side of this substantial shift are paying a big price. However, retail is not dying, it is changing. The extent of the letting activity in the company’s retail warehouse portfolio during the last 12 months shows that a market clearly exists for the right accommodation which suits retailers with good business propositions.

The board believes the company is on the right side of the retail change given its assets are largely in convenience led retail warehousing, and this will increasingly be evident going forward. The board is as positive as it can be on the medium-term outlook and our belief that our share rating in the future will reflect better the prospects of the ‘retail winners and retail losers’.

Healthcare

Healthcare

Civitas Social Housing

Civitas Housing Advisors, investment manager:

The past six months have been both challenging and rewarding. The comments from the Regulator of Social Housing (RSH) in April 2019, and subsequently in October 2019, clearly unsettled some in the investment community and Civitas is still recovering from that in terms of share price performance and discount to net asset value. We are at the same time working actively to address the risks identified by the RSH.

The company’s portfolio has over the past three years delivered both in terms of economic and social returns and we work on a daily basis to ensure this can continue to be the case in the future. We have taken a very hands-on approach to bringing about improvements in the sector and we know that this has been noted by the RSH and other important sector participants.

Working closely with local authorities and care providers on a daily basis we see the levels of unsatisfied demand within the system and we appreciate the quality of the enhanced housing service that is being delivered by the staff of our Housing Association partners and the quality of primary care that is being delivered by the staff of the care providers. Both are highly dedicated to helping all the residents achieve better outcome for lives that face daily challenges. For our part we intend to continue to bring forward the very best accommodation possible to assist in meeting these challenges and enabling people to achieve the very best outcomes possible.

Europe (diversified)

Europe (diversified)

Schroder European REIT

Schroder Real Estate Investment Management, investment manager:

The eurozone is currently a two-speed economy. The slowdown in world trade and investment has hit manufacturers and output has fallen by 1% since late 2018. Conversely, the services sector continues to grow, supported by solid labour markets, rising consumption and government spending. The risk is that the downturn in manufacturing deepens, possibly because of a disruptive Brexit or a further escalation of the trade dispute and then spreads to the services sector. The ECB has begun to loosen policy, but its room to manoeuvre is limited, given that the main financing rate is already at zero. However, low borrowing costs for governments provide some room for government stimulus. Schroders forecasts that eurozone GDP will grow by 1% per annum through 2019/20. Sweden, France and Spain will probably see faster growth, while Germany, which has a relatively large manufacturing sector, is likely to lag behind.

The company’s portfolio is 100% allocated to ‘Winning Cities’, those cities that will grow faster than their domestic economies from a GDP, employment and population perspective. This has been the central theme to constructing the portfolio and is expected to position the company well for the future. This will be particularly important if risks around the economic and political backdrop increase.

We continue to focus on asset management as a means to grow shareholder returns. The Paris refurbishment initiative is a good case in point. Successful completion will not only strengthen portfolio real estate fundamentals but also provide opportunity to deliver profits. Other asset management initiatives, such as leasing vacant accommodation in Hamburg and Seville will also be important in supporting the income profile of the company.

New research

New research

We have also published the first two editions in a series of research notes on the different real estate sectors, starting with the retail market and the industrial market. Read them by clicking on the link or by visiting www.quoteddata.com.

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.