Building for a new normal

As with the wider REIT sector, Standard Life Investments Property Income Trust’s (SLI) share price has been hit hard during the COVID-19 pandemic. Unlike its peers however, a 52.7% weighting to the buoyant industrial sector gives it scope for enhanced rental growth. Given that its nimble, sector-agnostic approach has seen it grab investment opportunities at cut-price deals during the crisis, a 30%-plus discount is undeserving of a trust that we think is in good shape for future growth.

Commercial UK property exposure

SLI aims to generate an attractive level of income, along with the prospect of both income and capital growth, by investing in a diversified portfolio of UK commercial property assets, primarily in three principal commercial property sectors: industrial, office and retail. SLI uses gearing with the aim of enhancing returns, with the current loan-to-value (LTV) ratio at 26.2%.

Fund profile

Standard Life Investments Property Income Trust (SLI) launched on 19 December 2003. It is domiciled in Guernsey, has a premium main market listing on the London Stock Exchange and, to maintain a tax-efficient structure, migrated its tax residence to the UK on 1 January 2015, when it also became a UK Real Estate Investment Trust (REIT).

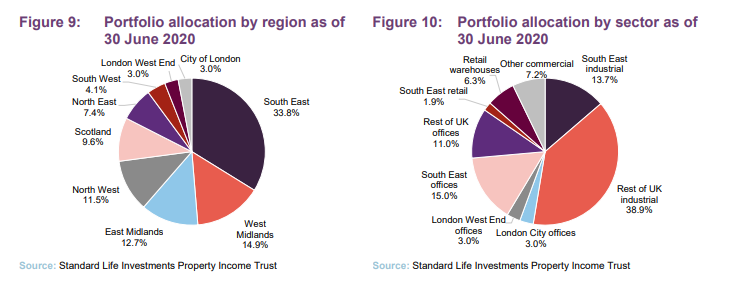

SLI aims to provide investors with an attractive level of income, together with the prospect of income and capital growth. It aims to achieve this by investing in a diversified portfolio of UK commercial property. These are principally direct holdings within the three main commercial property sectors: office, industrial and retail although it can also hold assets in the alternatives sector, with 7.2% of the portfolio currently in this sector. The company has a large exposure to the favoured industrial sector of 52.7%.

The board’s and manager’s preference is towards properties that are in good, but not necessarily prime-locations, where it is perceived that there will be good continuing tenant demand. The manager also looks for properties where it can add value using asset management initiatives. There is a focus on tenant quality and, as part of SLI’s strategy, tenants are treated as key stakeholders and the manager works closely to understand their needs. The aim is to achieve greater tenant satisfaction and retention, and hence lower voids, higher rental values and stronger returns.

SLI has full use of the wider Aberdeen Standard Investments (ASI) team, which has 270 people globally working on property. This provides access to specialist transactions, ESG, debt and research teams, as well as providing a risk management framework.

Manager

SLI’s portfolio has been managed by Jason Baggaley since September 2006. Jason has 30 years of property management experience. He has previously worked for Legal & General as a portfolio manager and joined Standard Life Investments in 1996. He gained his degree in real estate from the University of Portsmouth in 1990. He is a member of the Royal Institution of Chartered Surveyors (RICS).

Benchmark index

SLI uses the quarterly version of the IPD Balanced Monthly Funds Index to assess the performance of its property portfolio. The trust also uses the FTSE All-Share REIT Index and, to a lesser extent, the FTSE All-Share Index as means of comparison in its own literature. For the purpose of this report, we have used the Morningstar UK REIT Index and the MSCI UK Index as comparators. However, we have also included comparisons against peer group averages as well as a range of cash measures.

Market outlook – COVID weighs heavy on property

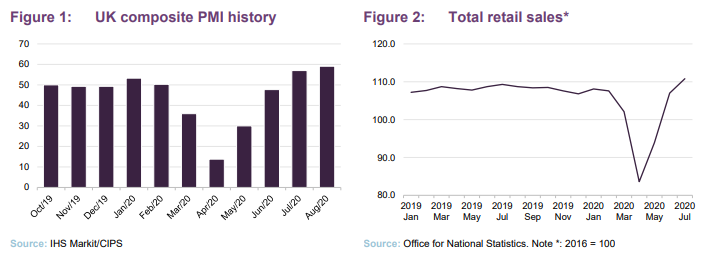

Signs of a pickup in economic activity in the UK, following the worst quarterly fall in GDP since records began in the second quarter, are promising for the wider real estate sector. The country is still in the grips of the coronavirus, however, and an increase in recent cases has seen a return to tighter restrictions.

Second quarter UK GDP fell 20.4%, but once lockdown restrictions were eased in June, activity came bounced back. The recovery began in June with monthly growth of 8.7% and continued into July with a 6.6% monthly growth in GDP. There are encouraging signs of economic recovery, with the UK composite Purchasing Managers Index (PMI) – historically a good predictor of GDP – reaching 59.1 in August, well above the 50 level which indicates an expansion in activity. Moreover, retail sales volumes (excluding fuels) were 3% higher in July than they were in February before the UK economy went into lockdown.

As the world battles to control and contain the coronavirus pandemic, the economic fallout has been felt across the UK commercial property sector and will continue to do so for months and years to come. The initial national lockdown, which started on 23 March 2020 in the UK and saw all but essential retail closed down, was lifted in June. The ability of retailers to pay their rent was massively impacted and negotiations for rent deferrals and waivers have been prevalent across the country, while some retailers have fallen into administration or conducted company voluntary arrangements (CVAs).

The hospitality sector has been equally hard hit during the crisis, with pubs and cinemas shut until 4 July and theatres still closed. Substantially reduced foreign visitor numbers have seen tourist hotspots, especially in London, suffer.

The outlook for the office sector is particularly blurred, with the enforced prolonged working-from-home period highlighting the benefits of agile working, a trend that manager Jason Baggaley says has been around for a while but is now likely to be accelerated. A hybrid style of working, involving working days being split between the office and home, is predicted to be adopted by many companies, with the net effect being a smaller office footprint in the future. Although the many unknowns make it difficult to forecast the future of offices, change is almost certainly coming.

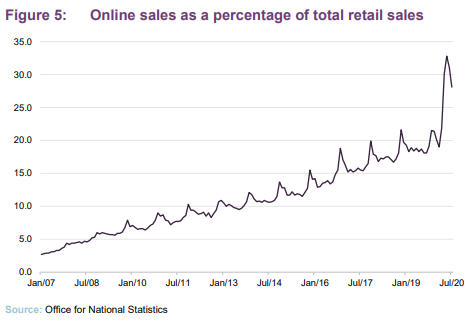

One of only a very few property sectors to come out of the pandemic in a position of strength is the industrial and logistics sector. Lockdown forced many more people to adopt online retailing – a trend that was growing way before the pandemic – and the upsurge in demand for products online saw an uptick in demand from retailers and parcel delivery companies for extra logistics space. Some caution should be attached to the fact that we are in a recession and that demand in some industries could dry up.

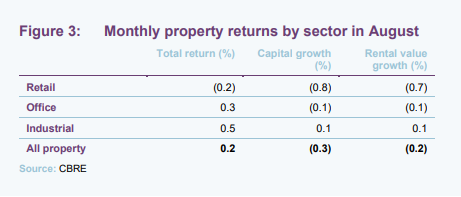

Industrial sector outperforming

It is important to note that every sector, and even sub-sector, has very wide performance differentials within them, but the polarisation in the core property sectors is clearly evident in Figure 3.

Across UK commercial property, capital values fell -0.3% in August as rental values dipped -0.2%. Total returns remained positive at 0.2%. The retail sector reported a -0.8% decline in capital values in August. This was pulled down considerably by shopping centres where capital values decreased -1.9%. Retail rental values declined -0.7% and total returns were -0.2%. The office sector posted a decrease in capital values of -0.1% over the month. A sub-sector analysis showed that the only office sub-sector to post an increase in capital values was the outer London/M25 offices, of 0.2%. Rental values fell -0.1 in August and total returns were 0.3%.

The industrial sector continued to be the only sector to report positive capital value growth at 0.1%. Sector average rental values increased 0.1%, while total returns were 0.5% in August.

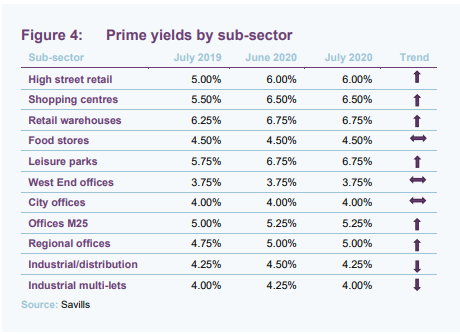

The Savills prime yields chart in Figure 4 confirms the divergence between property sectors. The yield goes up (softens) when values fall and goes down (hardens) when values rise.

The acceleration in e-commerce penetration rates is expected to prevail into the future (around 20% of retail was conducted online before the pandemic with that figure increasing to 32.8% in May and dropping slightly to 28.1% in July), resulting in sustained demand for space. A significant proportion of those online sales are expected to stick.

Other drivers for demand growth in the industrial and logistics sector that have prevailed from the pandemic are companies increasing stock levels and a re-shoring of supply chains. Before the crisis, most logistics operators across all sectors, including manufacturing, adopted a ‘just-in-time’ supply chain model where goods would arrive in warehouses at optimal times. After a surge in demand for goods and a cut-off in supply, many companies found they could not meet demand. This has resulted in a reassessment of inventory levels and a supply chain closer to home.

Subdued investment and occupier markets

Unsurprisingly, take-up figures for commercial property have been subdued this year. In the central London office sector, take-up of space in the first half of the year stood at 3.8m sq ft, according to Colliers, down 35% on the corresponding 2019 figure. Despite the slowdown in deals, vacancy across London only rose modestly in the past three months. The second quarter rate stood at 5.3%, which compares to the 10-year quarterly average of 5.7%.

Occupier activity in central business districts (CBDs) in regional markets across the UK remains strong, with a number of larger lettings completed in July including Baillie Gifford signing for 280,000 sq ft in Edinburgh. Supply in London and regional markets remains at historic lows, so the prospects of oversupply are low. The industrial and logistics sector recorded occupier take-up for Q2 2020 of 8.8m sq ft (in deals above 100,000 sq ft). This brings the H1 2020 figure to 17.7m sq ft, 20% ahead of the same period last year.

As already mentioned, the retail sector has been heavily hit. This year a total of 4,158 retail and leisure units have been through an insolvency procedure (a company voluntary arrangement (CVA), administration or liquidation) up to the beginning of August, spread across 71 brands and 39 holding companies. This compares to 4,283 units across the whole of 2019. With a quarter of the year remaining, it is likely the overall volume of insolvency activity will eclipse 2019.

As the fallout from the pandemic takes its toll on the property sector, £1.5bn of March 2020 rent payment remains unpaid in UK commercial property. As a consequence, it is inevitable that retail rents will fall in some over-rented sub-sectors like shopping centres.

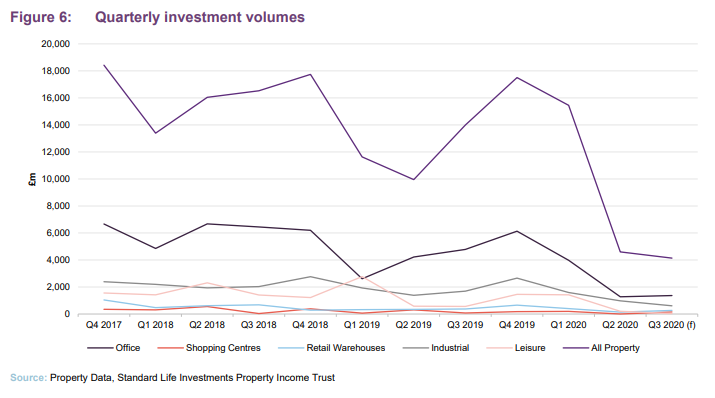

Again unsurprisingly, investment activity in the UK commercial property market remains well below typical levels, with preliminary data from Colliers suggesting that around £2bn was transacted during July, in line with the June figure. This is around 60% down on the corresponding 2019 figure of £5.6bn. Investment volumes in the first seven months of the year are down 20% on the same period in 2019.

Investment activity has picked up sufficiently across all sectors for the Royal Institution of Chartered Surveyors (RICS) to remove guidance on the “material uncertainty clause” for valuers of property, including retail, stating there was “sufficient evidence of market activity to warrant recommending this general lifting”.

However, it emphasised that this should exclude “some assets valued with reference to trading potential”, in particular where leisure and hospitality are concerned. RICS has recommended these may be applied on a case-by-case basis by an individual valuer, until the property’s trading potential “can be seen more clearly”.

Due to a lack of observable market activity, which provides the empirical data for an adequate level of certainty in the valuation, the “material uncertainty clause” was introduced on all property valuations by the RICS at the start of the pandemic and meant a higher degree of caution should be attached to valuations than would normally be the case.

Returns forecast

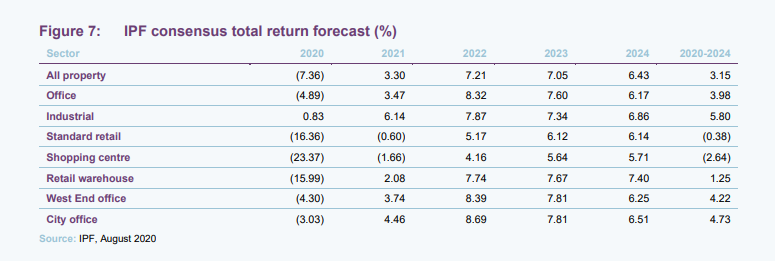

Whilst we would always caution about placing too much emphasis on forecasts, they do give a good indication of the current mood of the market. The Investment Property Forum (IPF) surveys a wide variety of market participants (20 contributors to this forecast comprising agents and institutions) to form a view of the health of the UK property sector. Figure 7 shows current IPF forecast for total returns across the property sectors.

The contrasts in the industrial sector and all other property sectors are clear, with industrial the only sector forecast to grow this year and over the five-year period forecast to return 5.8%. All property is forecast to return -7.36% this year.

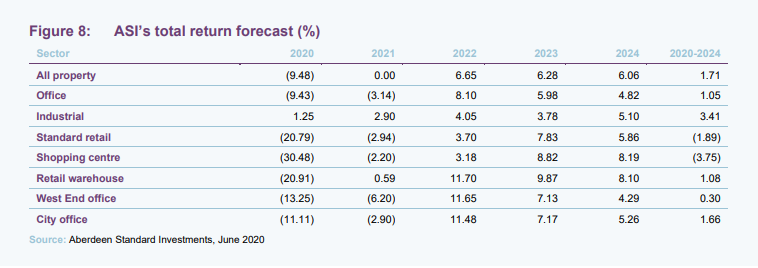

In comparison, Aberdeen Standard Investments’ own sector total returns forecast is shown in Figure 8. It forecasts negative returns for a number of sectors into 2021, including offices and retail.

Manager’s view

The manager, Jason Baggaley, is staunch in his philosophy that sustainability and durability of income is most important and that is equally applied across the different property sectors. He has a “bottom-up” approach to asset selection and is not sector-led. Not all retail is bad and, conversely, not all industrial is good.

Offices

Jason believes the COVID-19 pandemic has accelerated trends that were already at play in the office sector – namely, a shift to agile working. The trend has been driving SLI’s decision-making process on its office assets over the past few years.

The way the office is used by companies is changing. People will spend some time at home or at a local co-working place and remain committed to going into the office some of the time, he says. Time in the office will be about interacting, learning, sharing and collaborating, not isolating in desk pens. The upshot, he says, will be more break-out space and meeting rooms and staff facilities like showers and studios for classes. The office will become a best-in-class, central hub where the workforce goes to learn and develop.

Jason predicts a net reduction in office demand – in the short term due to the economy and longer term due to agile working.

Retail

Jason remains cautious about investing in the retail sector, where pricing has been depressed across the sub-sectors due to the prolonged negative sentiment towards the sector. Jason would not consider investing in shopping centre or high street retail, but some retail parks, let on reasonable and sustainable levels of rent, are a good investment opportunity. SLI acquired a B&Q-let retail warehouse in September 2020 that matched these characteristics.

Retail parks have seen a good level of demand from retailers (especially from grocers and discounter retailers) due to their prime locations, large format stores and low all-in costs (rent, service charge and rates). They also offer free parking.

Their location also makes them perfect for click-and-collect, something many retailers – like Next – are pushing onto online consumers. The assets are also underpinned by alternative use values (residential or logistics) due to their location.

Jason believes more opportunities will present themselves as landlords with high exposure to retail struggle to service their debt and have to sell their crown jewels. He was more comfortable with the recent purchase to take the retail weighting up to 12%, than he would have been to take the office weighting above the current 35%.

Logistics

The real strength in the industrial and logistics market is in the lower size band of 30,000 sq ft to 50,000 sq ft, Jason says. There is positive pressure on rents in the short and long-term driven by a combination of growing internet sales, nearshoring and greater supply chain management.

Urban logistics assets are in huge demand, especially by retailers and parcel delivery companies, exacerbated by the huge spike in online orders during the pandemic. As demand has increased, supply of these properties has not kept up and in many areas, including London, has shrunk, with existing estates turned into residential schemes. Where supply and demand imbalances exist, pressure on rents will follow.

Investment process

The majority of the portfolio is invested in direct holdings within the three main commercial property sectors of retail, office, and industrial, although SLI may also invest in other commercial property such as hotels, nursing homes and student housing. Investment in property development and in co-investment vehicles where there is more than one investor is permitted up to a maximum of 10% of the property portfolio.

Risks limits and controls

SLI must abide by the following restrictions to the portfolio in normal market conditions:

• No property will be greater by value than 15% of total assets;

• No tenant (with the exception of the government) shall be responsible for more than 20% rent roll; and

• Gearing, calculated as borrowings as a percentage of the group’s gross assets, may not exceed 65%. The board’s current intention is that the company’s LTV will not exceed 45%. The current LTV is 26.2%, well within the manager’s intended range at this point in the cycle of 25-30%.

Research-based approach to investments

A research-based approach is taken to buying and selling property, looking at where markets are likely to change in the short term, with changes in infrastructure seen as a key driver of market developments.

The manager has been carrying out SLI’s strategy by being agnostic to location and lot size. When it comes to sourcing deals, SLI’s size and reputation sees it receive numerous leads from the market; these are then passed through a centralised acquisitions team.

SLI typically targets a different profile of property to most other closed-end funds, which reduces deal competition and the likelihood of overpaying. SLI has often waited for the market cycle to shift prices in its favour.

SLI minimises the use of agents when dealing with its tenants, preferring a principal-to-principal approach to reduce fees, improve outcomes and increase its understanding of tenant needs. This is possible because of SLI’s existing relationships and the ASI network.

The manager considers no property to be “sacrosanct” and makes the point that SLI’s asset base has been turned over three times since he took over in 2006. Realising profit at key times has been just as important as making new investments.

SLI cannot complete investment deals without prior consent of ASI’s ESG team.

Asset allocation

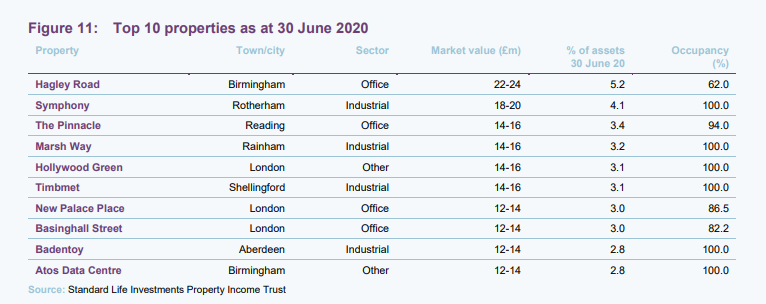

SLI’s portfolio was valued at £447.3m on 30 June 2020 (March 2020: £458.6m) and is primarily allocated across three sectors: industrials 52.7%, offices 31.9% and retail 8.2%. The three largest properties are covered in more detail below.

Top 10 holdings

Hagley Road

The acquisition of 54 Hagley, Birmingham, in late 2018 was SLI’s largest to date. It paid £23.75m for this multi-let office complex, comprising 141,436 sq ft. The manager says the building is located in an area where rents are generally cheaper than in other parts of Birmingham, at £12–18 per sq ft compared with £25 per sq ft in much of the city. The building is equipped with amenities that include a yoga studio and parking docks for cyclists.

Five floors in the building, including the reception area, will undergo a £2m refurbishment following the administration of a tenant. A new conference facility will also double up as a fitness studio with bike storage, lockers and changing facilities.

The tenant had been paying a rent of around £10 per sq ft across six floors. SLI agreed terms on one of the floors in the high-teens per sq ft and the manager is optimistic for further rental growth following the refurbishment works, which are expected to complete in November 2020.

A new tram stop is due to be built right outside the building, increasing connectivity. Meanwhile, the city of Birmingham is proposing a congestion charge, which the manager says 54 Hagley would sit outside of.

Why does the manager like it? The manager believes the building to be well-situated and to offer good prospects for rental growth. Demand for office space in the area will grow as the launch of the tram station approaches.

Symphony

The Symphony acquisition in October 2014, for £14.6m, included three storage units in Rotherham, covering 360,000 sq ft. The units were acquired with a 20-year letting agreement in place with Symphony Group, a kitchenware and bathroom furniture manufacturer. The passing rent is £1.225m per annum, making Symphony the second-largest tenant, behind BAE Systems (£1.26m).

Symphony Group is the UK’s largest privately-owned manufacturer in the sector, turning over more than £220m per annum, with a headcount of over 1,500 staff. It supplies private developers, social housing providers, retailers and hotel operators across the UK and internationally. The 20-year lease includes a tenant break clause after 15 years, as well as a provision for fixed uplifts every five years.

Why does the manager like it? The three units are located in an established manufacturing region and were acquired with a long-term lease in place with a leading firm in its sector. The lease contract also includes an inflation adjustment.

The Pinnacle

SLI bought The Pinnacle, a multi-let office building in central Reading, for £13.45m in August 2017. The six-storey, 41,721 sq ft property is located within 150 meters of Reading’s central train station. The purchase price reflected a yield of 6.75%. At 30 June 2020, the property was 94% occupied by area. Office demand in the Berkshire town of Reading is expected to be boosted with the arrival of a Crossrail station in 2022.

Why does the manager like it? The manager saw this as a well-located property in an area that was seeing rental growth. SLI used its active management approach to enhance the property by building out amenities and working on the fit-out.

New acquisition – B&Q, Halesowen

SLI completed the purchase of a B&Q retail warehouse in Halesowen, West Midlands, for £19.5m in September 2020. The purchase, at a net initial yield of 7.5%, was financed through its revolving credit facility.

The property is let to B&Q for a further 11 years. The site is a top quartile trader for B&Q and is let on a reasonably low rent in the mid-teens per square foot.

Why does the manager like it? The manager says the asset fits its strategy exceptionally well, providing secure long-term income on an asset that not only works for the existing tenant, but also has future potential for urban logistics.

Asset management initiatives

SLI completed one new letting in the second quarter of the year, securing £110,000 per annum in rent. The letting was in the industrial sector and to an existing tenant expanding their business. The business also extended their original lease.

SLI also completed a lease renewal and lease restructure securing £491,788 per annum, a 19.5% increase on previous rents. The company also completed a new lease at its office in Epsom at one of its fully fitted suites. SLI says it has seen increased demand for fully fitted suites, where businesses can turn up and go, and not have to spend time and money on fitting the space out. SLI had already rolled out fitted suites across its estate.

A number of deals that were in the offing were put on hold during lockdown. Since lockdown restrictions were eased, the company says it has seen a strong recovery in viewings across its portfolio.

Solar

In June, SLI completed the installation of a major Photo Voltaic (PV) scheme on one of its assets, the largest undertaken by Aberdeen Standard Investments in the UK. The power will be sold to the tenant and SLI will receive a yield of around 7% from the £500,000 investment. The scheme is expected to produce, and therefore save, the equivalent of 229 tonnes of operational CO2 in the first year of operation, and the power output is the equivalent of the yearly electricity usage of 230 homes.

SLI will look to roll out solar panel installations across its industrial portfolio due to better technology, improved efficiency and cheaper costs

Rent collection figures

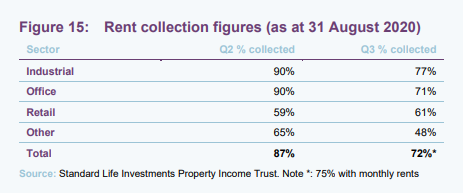

As mentioned earlier, the onset of the COVID-19 pandemic and the resultant lockdown had meant some tenants’ cash flow was turned off almost overnight. SLI has supported its tenants that are struggling through rent deferrals or rent-free periods, in exchange for amended lease terms (generally extensions) and, in a small number of cases, rental write-offs. Some of SLI’s tenants have abused government restrictions on landlords being able to enforce lease covenants, and chosen not to pay and not to engage with SLI. SLI has said it will chase those tenants with vigour as and when government restrictions allow (current restrictions have been extended to the end of the year). Figure 15 is a sectoral breakdown of SLI’s most current rent collection figures for the second and third quarters of 2020.

Where SLI has granted rent-free periods to tenants, it has negotiated favourable lease extensions that have off-set the fall in valuation due to the hit on income. It agreed to a small rent-free period with one of its retail tenants and increased the lease to 15 years from an expiry in 2022. In its office portfolio, SLI agreed a 12-month rent-free period for a tenant in exchange for the removal of a break clause in the lease next year. There is now seven years to expiry on the lease.

Valuations

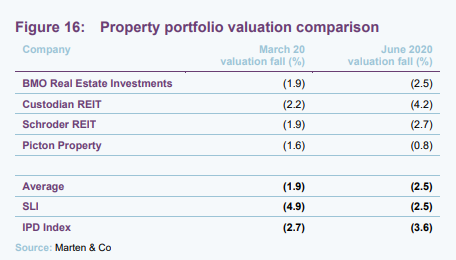

SLI’s portfolio valuation has been one of the hardest-hit among its diversified property peers, which is surprising given the large exposure to the industrial sector. Figure 16 shows the substantially different portfolio valuation falls reported by a select number of its peers that have similar diverse property portfolios.

The valuation approach used by SLI’s valuer, Knight Frank, was to put a higher degree of weight to sentiment and assumptions on lease events than the valuers of other companies’ portfolios. There was general acceptance by most of the other companies’ valuers that a lack of transactional evidence should justify only marginal falls in value.

The March 2020 valuation saw SLI’s portfolio fall 4.9% in the quarter, far greater than the market with the IPD Index at 2.7% and the average of the peer group in Figure 16 at 1.9%. This movement is in our view wholly reasonable, given that at the end of December 2019 there was a lot of optimism in the property sector following the general election earlier that month. At the end of March 2020, with the lockdown in place, it seems to us wholly appropriate that property was worth less than it was at the end of December 2019.

QuotedData believes valuations will sort themselves out over the course of a year in one of two ways. Either the market recovers and SLI’s values will move up more than others, as it went down further – or other property companies’ values will fall further than SLI’s if the market does not recover as they did not move early.

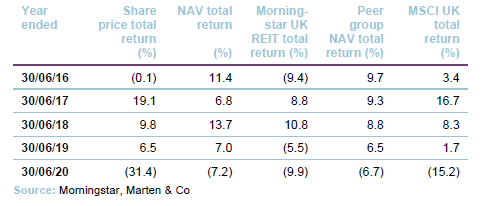

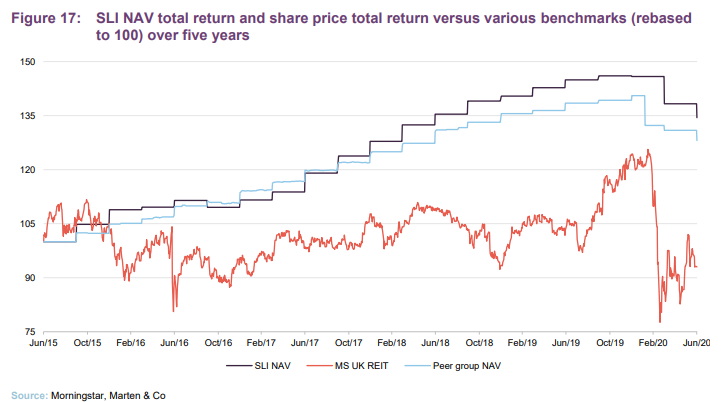

Performance

SLI’s NAV total return has, for all periods of three years and above, beaten that of the Property – UK Commercial peer group average, as illustrated in Figures 17 and 18. For a strategy such as SLI’s, where assets tend to be held for the long term, we consider that the longer-term periods are the most relevant when assessing the effectiveness of the strategy. In this regard, SLI has markedly outperformed the peer group averages.

We have used the Morningstar UK REIT Index and the MSCI UK Index as comparators to SLI’s short- and long-term performance and it has significantly outperformed both over a six-month, one-year, three-year, five-year and 10-year period, in NAV terms. In share price total return terms, SLI has been markedly below that of the peer group over all time periods.

From an inflation comparison, SLI’s NAV total return has been markedly ahead of inflation (as measured by both RPI and CPI) over five and 10 year periods. In Figure 18, we have used RPI, RPI + 2%, CPI + 3% and Libor + 5%.

NAV and portfolio valuations

SLI publishes NAVs on a quarterly basis, based on portfolio valuations, which are approved by the board prior to publication.

Independent international real estate consulting firm Knight Frank performs the valuation, in accordance with the then-current RICS guidance. The fair value of properties is determined using the income capitalisation method, which begins by capitalising a property’s net income over its lease period; the valuer then assumes the property will be re-let at a pre-determined estimated open market rental value; allowances for voids are made where applicable. The yield used by the valuer to capitalise a property’s income stream reflects views on factors that include (not an exhaustive list): a property’s location, its perceived quality, the credit quality of its tenants and its lease term profile.

SLI’s manager meets with the valuers on a quarterly basis to ensure the valuers are aware of all relevant information for the valuation and any change in the investment over the quarter. The manager then reviews and discusses the draft valuations with the valuers to ensure correct factual assumptions are made. The valuers report a final valuation that is then reported to the board.

In March 2020, in accordance with the RICS’ global valuation standards, all commercial property in the UK was subject to “material valuation uncertainty” due to the outbreak of COVID-19. Consequently, less certainty – and a higher degree of caution – was attached to the valuation of property than would normally be the case. The inclusion of the “material valuation uncertainty” declaration does not mean that the valuation cannot be relied upon. Rather, the declaration has been included to ensure transparency of the fact that – in the extraordinary circumstances – less certainty can be attached to the valuation than would otherwise be the case.

In September, the RICS recommended that with the exception of hospitality and leisure properties, “material valuation uncertainty” need no longer apply when assessing all types of UK real estate.

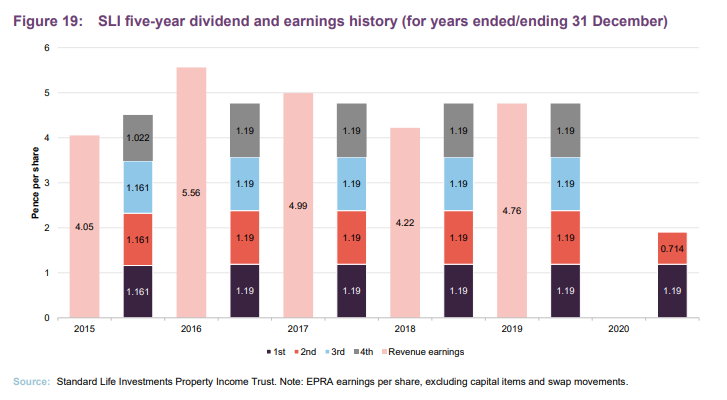

Dividend

SLI declared a dividend of 1.19p per share for the first quarter of 2020, in line with the quarterly dividend payments of the previous four years. This reflected the fact that a significant proportion of rent for this period was paid in advance, prior to the impact from the COVID-19 pandemic. It deployed a small part of the financial resources it has available to cover the shortfall in income for this period. SLI put its dividend policy for the remainder of 2020 under review following the outbreak of COVID-19 due to depressed rent collection levels.

The board declared a dividend for the second quarter at a reduced rate of 60% of the historic level, equating to 0.714p per share. The board has kept the dividend policy under review and will monitor rent receipts and recurring earnings ahead of future declarations.

SLI’s EPRA earnings per share were less than its total dividend payment for two of the last five financial years (2015 and 2018). In these instances, SLI is able to draw on its retained earnings to fund any deficit. As at 31 December 2019, SLI had retained earnings of £6.17m (equivalent to 1.51p per share).

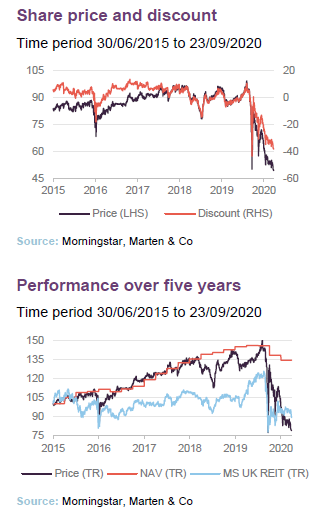

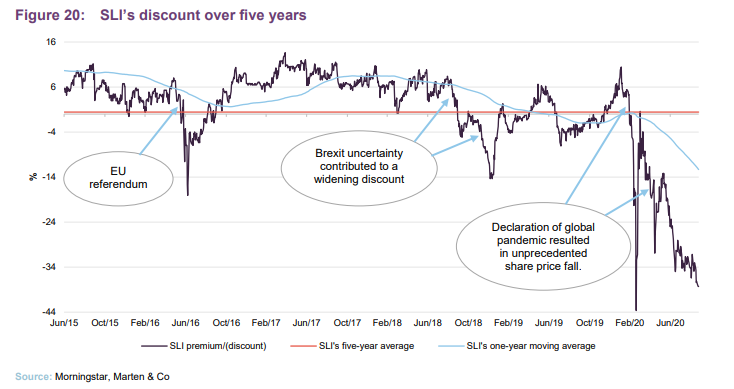

Premium/(discount)

Having traded at a premium for much of the last five years, SLI is currently trading at a significant discount of 38.3% (as at 23 September 2020). The outbreak of COVID-19 saw SLI’s rating fall from a 9.8% premium to a 43.6% discount in a matter of days, with a mass stock market sell-off.

SLI is authorised to repurchase up to 14.99% and issue up to 10% of its issued share capital (renewal of these authorities is sought annually at the company’s AGM). Purchase of shares will only be made at prices below the prevailing net asset value to enhance shareholder value.

Fees and costs

SLI’s management fees are charged according to the following structure: 0.7% of total asset up to £500m and 0.6% of total assets above £500m. SLI does not pay a performance fee. The investment management agreement can be terminated at one year’s notice by either side.

Administrative, secretarial and registrar services

Administrative, company secretarial and registrar services are provided by Northern Trust International Fund Administration Services (Guernsey) Limited. For these services, Northern Trust is entitled to a fee of £65,000 per annum, payable quarterly in arrears. Northern Trust is also entitled to reimbursement of reasonable out-of-pocket expenses. Total fees and expenses charged for the year ended 31 December 2019 amounted to £81,250 (2018: £81,250).

Portfolio valuation services

Portfolio valuation services are provided by Knight Frank LLP, which values SLI’s property portfolio on a quarterly basis. For these services, Knight Frank is entitled to an annual fee that is equal to 0.017% of the aggregate value of property portfolio paid quarterly.

The total valuation fees charged for the year ended 31 December 2019 were £97,668 (2018: £91,396). Knight Frank charges a minimum fee of £2,500 per property for new properties that are added to SLI’s portfolio.

Allocation of fees and costs

In SLI’s accounts, investment management fees, administrative expenses, finance costs and all other revenue expenses are charged to the revenue account. The costs of property purchases and disposal are allocated to the capital reserve as are capital expenditure on properties and the capital expenditure that results in a movement in the capital value of a property (e.g. refurbishing an asset).

Capital structure and life

SLI has a simple capital structure with a single class of ordinary shares in issue and trades on the main market of the London Stock Exchange. As at 23 September 2020, there were 406,865,419 ordinary shares in issue and no shares in treasury. SLI does not have a fixed winding-up date and there is no specific measure, such as a regular continuation vote, to wind up the company.

Gearing

SLI is permitted to borrow and its articles of association mandate that its gearing, defined as total borrowing divided by gross assets, cannot exceed 65%. The board’s current intention is that SLI’s loan-to-value ratio (total borrowings less cash divided by portfolio value) shall not exceed 45%. At 30 June 2020, SLI’s loan-to-value (LTV) ratio was 26.2%.

SLI has a term loan in place for £110m and a £55m revolving credit facility, of which £35m has been drawn, both of which expire in 2023. The blended rate of interest at the year-end was 2.59%, comfortably below the net initial yield of 5.2% and indicative of the relatively attractive spread that persists between the rental yield and financing costs.

Loan covenants for the quarter ended 30 June 2020 were comfortably met. SLI’s interest cover of 437% was significantly greater than the limit of 175% and its LTV of 27.3% (loan value less cash held in RBS accounts only divided by pledged portfolio) is well below the 55% covenant limit.

SLI entered into an interest rate swap when the term loan was taken out. As at 30 June 2020, the interest rate swap had a liability of £4.05m (December 2019 – £2.2m). This liability will reduce to zero on maturity.

Financial calendar

The trust’s year-end is 31 December. The annual results are usually released in April (interims in September) and its AGMs are usually held in June of each year. SLI pays quarterly dividends in May, August, November and March.

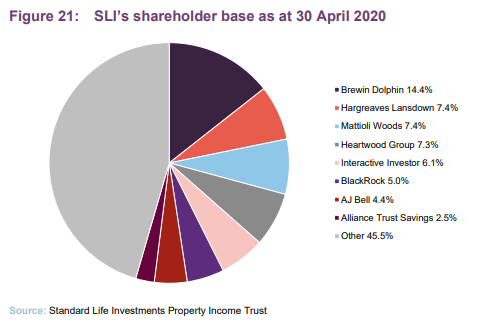

Major shareholders

Board

SLI’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. All directors stand for re-election on an annual basis.

Former chairman Robert Peto, who had been a member of the board since May 2014, retired from the board on 25 August 2020. He has been succeeded as chairman by James Clifton-Brown.

James Clifton-Brown (chairman)

James Clifton-Brown heads the board as non-executive chairman. James has extensive experience in the real estate sector. He joined CBRE Global Investors in 1984 as a fund manager on the Courtaulds Pension Scheme Account (now Akzo Nobel Pension Scheme) and became the firm’s UK chief investment officer in 1996, where he had responsibility for the firm’s UK house strategy and risk management as well as client and investor relationship management. Since 2004, he has been a director on a number of boards relating to CBRE Global Investors Limited. James is a voting member on the USA and European Investment Committees of CBRE Global Investors.

Hugh Evans (senior independent director)

Huw Evans assumed the role of senior independent director on 13 June 2019. He is based in Guernsey and qualified as a chartered accountant with KPMG before building a career in financial advisory, focused on mergers and acquisitions and more general corporate strategy. Huw advised a wide range of companies in financial services and other industries. He is currently also a director of Third Point Offshore International Limited and of VinaCapital Vietnam Opportunity Fund Limited.

Mike Balfour (director)

A chartered accountant by training, Mike Balfour has more than 30 years of experience in investment management. He has held a number of executive leadership roles, including seven years as the chief executive of Thomas Miller Investment, before which he was the chief executive at Glasgow Investment Managers. He has also held the role of chief investment officer at Edinburgh Fund Managers. Mike was appointed to SLI’s board in March 2017. He also holds non-executive directorships with Perpetual Income and Growth Investment Trust, Fidelity China Special Situations and chairs the Investment Committee of TPT Retirement Solutions.

Jill May (director)

Jill May assumed her role as non-executive director with effect from 12 March 2019. She has spent most of her career in investment banking, where she held roles with SG Warburg & Co for 13 years (in mergers and acquisitions) and UBS for 12 years. Jill is currently an external member of the Prudential regulation committee of the Bank of England. She is also a non-executive director of Sirius Real Estate, JPMorgan Claverhouse Investment Trust, Ruffer Investment Company, and the Institute of Chartered Accountants in England & Wales (ICAEW).

Sarah Slater (director)

Sarah Slater joined the board on 27 November 2019. She is the chief executive of The Eyre Estate, a private family trust, a trustee of Dulwich Estate and was a board member of GRIP REIT Plc, one of the UK’s largest residential REITs. During her career, Sarah held senior positions at The Canada Pension Plan Investment Board (CPPIB), ING Real Estate Investment Management (now CBRE GI) and Henderson Global Investors (now Nuveen) with responsibility for the delivery of major real estate programmes.

The legal bit

This marketing communication has been prepared for Standard Life Investments Property Income Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.