Resilient to covid-19

Resilient to covid-19

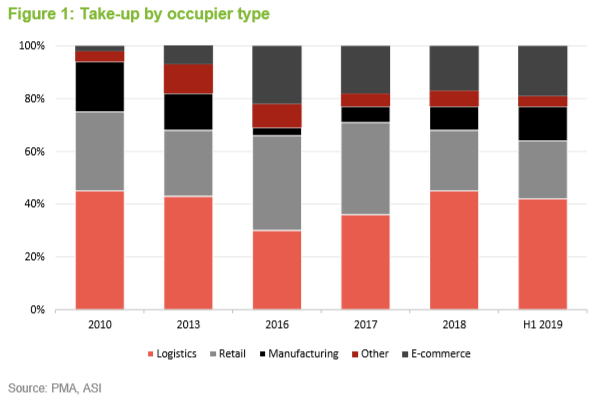

The logistics sector, in which Aberdeen Standard European Logistics Income (ASLI) invests, would appear to be one of the few property sectors that could see occupier demand increase in the long term as a result of the coronavirus pandemic. With some form of a lockdown enforced in most European countries, there has been a spike in ecommerce orders. A whole new group of people have been introduced to online retailing, which is expected to speed up penetration rates across Europe and reinforce long-term systemic changes in the logistics sector.

ASLI has built a portfolio of 14 assets since it launched in December 2017. These are focused on a mix of ‘big box’ and urban logistics warehouses in established logistics locations in five different European countries. As ecommerce and logistics companies look to drive efficiencies across their supply chains, demand for logistics assets in locations close to major cities is forecast to grow.

Big box and urban logistics in Europe

Big box and urban logistics in Europe

ASLI invests in a diversified portfolio of ‘big box’ logistics and ‘last mile’ urban warehouse assets in Europe with the aim of providing its shareholders with a regular and attractive level of income return (achieving a 5% yield on its IPO price in 2019) together with the potential for long-term income and capital growth (target total return of 7.5% a year in euros).

Fund profile

Fund profile

ASLI invests in a portfolio of European logistics assets, diversified by both geography and tenant, with a focus on well-located assets at established distribution hubs and within population centres. ASLI’s aim is to provide its shareholders with a regular and attractive level of income return, together with the potential for long-term income and capital growth (it has targeted a total return of 7.5% a year in euros). ASLI benefits from inflation-linked leases across its portfolio.

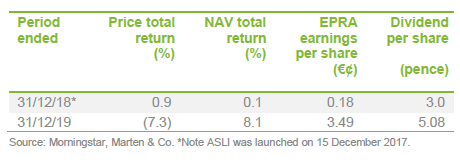

ASLI paid a dividend of 5.08p per share for the year ended 31 December 2019, in line with its target for the year of 5% of the IPO price (100p), and has declared a dividend for the first quarter of 2020 of 1.24p. Dividends are paid in sterling, but the assets and the income derived from them are predominantly in euros. The manager may use currency hedging to help reduce the volatility of the income, but there is no current intention to hedge the capital value of the portfolio.

ASLI’s portfolio management services are undertaken by Aberdeen Standard Investments Ireland Limited, part of the Aberdeen Standard Investments group of companies, and is led by Evert Castelein. Aberdeen Standard Investments Real Estate is the second-largest European real estate investment manager and has an extensive regional presence, with 25 offices in 14 countries across Europe.

Market outlook

Market outlook

Coronavirus

Coronavirus

The deep decline in economic activity across the world created by covid-19 has been unprecedented. Some property sectors have been hit harder than others. Retail stores, for example, have all but shut down in some European countries, aside from grocery and other essential goods, while manufacturing has ground to a halt. The long-term implications for the property sector are still unclear and a lot will depend on the policy response from governments.

For logistics, the pandemic presents both significant short-term risks and long-term positives. The lockdown has forced a whole new cohort of the population into adopting online retailing and may result in a speeding up of penetration rates in many European countries. Specific risks exist around certain types of tenants – for example, fashion retailers – and certain industries, such as manufacturing.

It appears that the supply of new logistics facilities could well dry up over the next two or three years as developers turn the tap off, with business confidence dropping and development financing costs increasing. On the demand side, there are many factors that could influence both short-term and long-term demand.

Impact on short-term demand for European logistics space

Trade volumes between Europe and the rest of the world had been growing at 2% per annum prior to the pandemic. However, the flow of goods from China all but ceased as production shut down. Whilst factories are starting to re-open in China, lower demand for goods in the West, as it now fights the pandemic, is expected to restrict a swift recovery of the movement of goods across the world. It is too early to say whether the demand base will return. Industries such as commodities, automotive, aerospace, construction and discretionary goods have been hit hard and face an uncertain future.

For those industries that emerge relatively unscathed, such as pharmaceuticals, perishables and non-discretionary goods, a period of inventory building and back-filling orders could lead to a strong bounce-back in demand. Indeed, this could manifest itself in strong warehouse demand as companies tilt their supply chains back to towards ensuring sufficient stock over efficient stock handling and just in time fulfilment.

Some retailers will perish as a result of the pandemic and this will inevitably have a negative impact on the sector as logistics facilities become vacant. Whilst most retailers have suffered a sharp fall in demand for their products, pure-play ecommerce retailers have seen a huge spike in demand during the pandemic. Amazon, for example, has said it needs 100,000 new staff and is increasing wages across North America and Europe by $2 per hour (or the equivalent) to attract staff. Grocery retail, both online and traditional, has also seen a sharp increase in demand and many supermarkets are looking for short-term warehouse space to meet demand.

Impact on long-term demand for European logistics space

Even before the pandemic, a re-shoring of manufacturing had started to take place, with companies reducing the length of supply chains and bringing operations closer to their customers. The pandemic could speed up this process, as the reliance on manufacturing in Far East Asia was exposed. Add to this political pressure, rising labour costs in Asia, growing supply chain risks and an increase in automation (namely robotics and 3D printing) and the re-shoring trend looks set to continue. ASLI’s manager expects this to increase the share of global manufacturing taking place in Europe and increase the demand for related supply chain activity, particularly in the medium-size regional distribution centre category, as the infrastructure is not yet in place to support these moves.

Although some retailers may not survive the pandemic, many others will be scrambling to improve their online retail offer in order to defend against the tide of sales moving to purchases online and via smart phones. The manager believes that one of the major impacts of the pandemic will be the acceleration in shift in purchasing habits of existing and new demographic groups to online shopping. As we explain later, on page 6, it is estimated that the tipping point when online retail sales creates a notable structural increase in ecommerce logistics demand is around 10.7%. More European countries should be hitting that mark in the next few years. This will be particularly prevalent in urban logistics and mid-sized distribution centres, the manager says, as ecommerce companies adapt to increased demand and move to holding more inventory to avoid future shortfalls during risk events.

Covid-19 impact on ASLI

The manager says the impact of covid-19 on European logistics property is hard to quantify, but that a recession means overall weaker demand and an increased risk in tenant default.

It is not necessarily all negative for the sector, however. Some types of demand – including food retailers, ecommerce companies and pharmaceutical companies – are likely to see stronger demand in the short term. This reinforces the parts of the supply chain focused on supporting consumers – often in urban fringe and mid-box locations.

In the medium term, the manager says, the market could see quite a strong period of inventory rebuilding which generally contributes to larger space requirements. In the longer term, the pandemic is likely to accelerate the pace of growth in ecommerce sales, leading to increased demand in logistics property to support these businesses.

This positive sentiment around the resilience of the logistics sector was reflected in ASLI’s net asset value (NAV) announcement for 31 March 2020. Its NAV per share increased 6.1% (1.5% in euros) over Q1, off the back of a 0.7% rise in the value of its portfolio.

As at 22 May 2020, ASLI had collected 75% of rents for the quarter to the end of June 2020. It said it expected this to increase to 82% following the conclusion of tenant discussions. Of the remaining 18%, representing around €1m, €720,000 is expected to be deferred and due for payment by December 2020 and €100,000 deferred and due for payment by June 2022.

Rent free periods were requested on the remaining €180,000, which ASLI says it would agree to (along with an additional €210,000 for the remainder of 2020 and €130,000 in respect of 2021/22) in exchange for lease extensions of up to five years.

The manager says the outlook for European logistics real estate remains compelling, and perhaps even more so following the impact the covid-19 crisis will likely have on consumer behaviour and supply chain logistics.

Ecommerce to continue to drive demand

The fundamental shift in consumer spending habits to online retailing that saw ecommerce take off five years ago is still evolving. Consumer spending online is predicted to continue to grow as a percentage of overall sales globally, the pace of which is likely to grow following covid-19. Before coronavirus, demand for logistics space from ecommerce businesses was already growing.

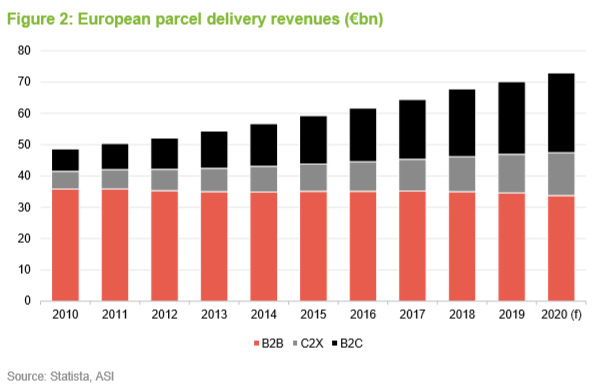

The evolution of consumer spending habits saw the invention of same-day – and even one-hour – deliveries. Figure 2 illustrates the growth in business-to-consumer (B2C) parcel delivery revenues in Europe. This has intensified the need for more logistics space located as close to urban populations as possible.

Logistics facilities are effectively parcel hubs located on the outskirts of towns and cities, which predominantly service ecommerce deliveries to people’s homes and offices. They come in a wide range of sizes, with the big logistics facilities being between 20,000 sqm and 35,000 sqm.

Urban logistics is a fast-growing part of the sub-sector and, as the name suggests, are logistics facilities located very close to town and city centres and are in the 2,000 sqm to 20,000 sqm size bracket. With the growth of ecommerce, they have become more and more popular with ecommerce companies and third-party logistics operators, which service retailer contracts, as they try to streamline their supply chains.

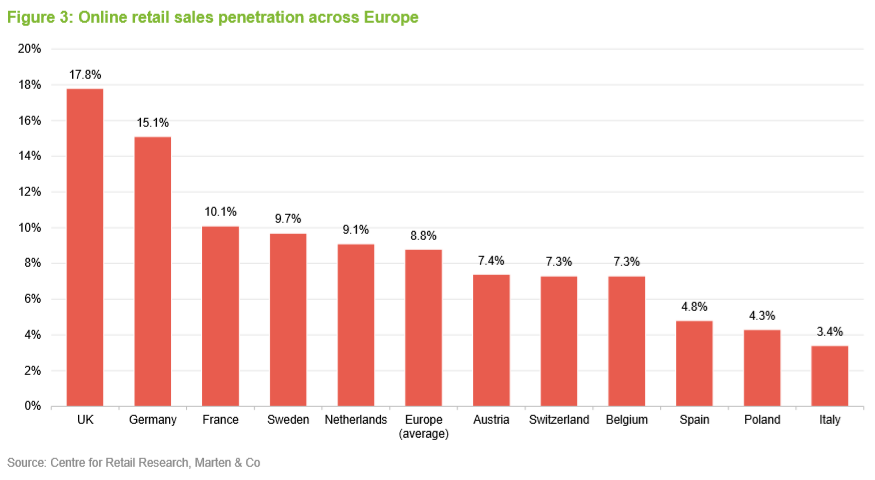

The penetration of online sales in the UK is far greater than most western countries, as Figure 3 shows, but the proportion of purchases being made online is rising almost everywhere. Although behind the UK, the European market is on a similar growth trajectory to that witnessed in the UK over the past five years.

In the UK, Savills identified a tipping point of 10.7% of total retail sales being online, which created rapid growth in occupational demand for warehouse space. Several countries, including France, Sweden and the Netherlands, have online penetration rates approaching 10.7% and it is expected that these countries will follow a similar trajectory in take-up volumes to that of the UK.

With less than 5% of total retail sales currently made online in Spain and Italy, these two markets are forecast to see the strongest online retail sales growth of all Western European markets over the next five years, according to Savills, at 17% per annum and 21% per annum respectively. Likewise, Poland is predicted to witness an average growth of 17.5% per annum.

As Europe plays catch-up with the UK, ASLI expects to benefit from significant rental and capital growth going forward.

Lack of supply has driven rental growth

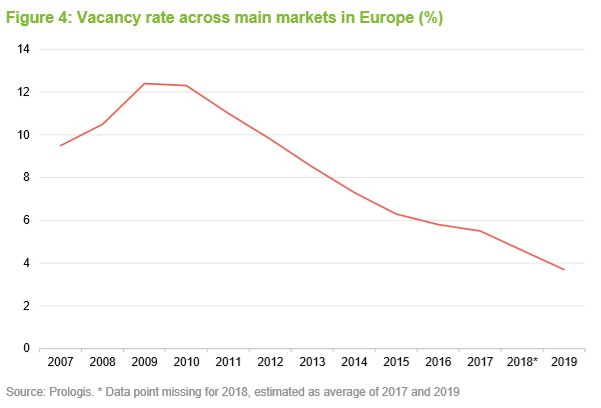

The high level of demand for logistics space has been coupled with a severe lack of supply of buildings in good, suitable locations across Europe – putting an upward pressure on rents. According to commercial property consultancy Cushman & Wakefield, key European logistics markets located close to cities saw huge rental growth over a 12-month period to the end of September 2019. For example, Hamburg witnessed rental growth of 7.1% in the year, Antwerp 6.7%, Warsaw 5.6%, Stockholm 4.3% and Frankfurt 3.3%.

Vacancy rates (the percentage of space that is vacant) across Europe have hit record lows. Figure 4 shows that European logistics vacancy rates have been steadily falling from a peak in 2009 (following the financial crash) of over 12% to sub-4% in 2019. The supply of efficient modern stock is even lower, with some parts of the market with no supply at all.

Although demand is likely to drop off in some areas following the coronavirus pandemic, supply of new, purpose-built facilities looks likely to stop as development is halted.

Supply of new stock was already sparse given the scarcity of land around most major European cities and logistics developers competing with other property developers – such as residential developers – for sites.

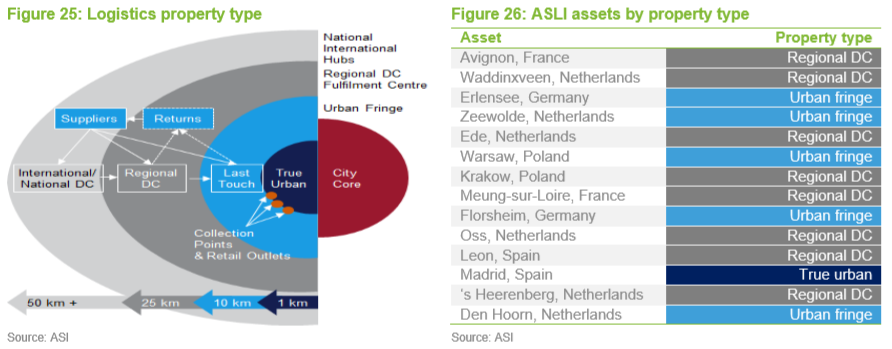

Logistics property types

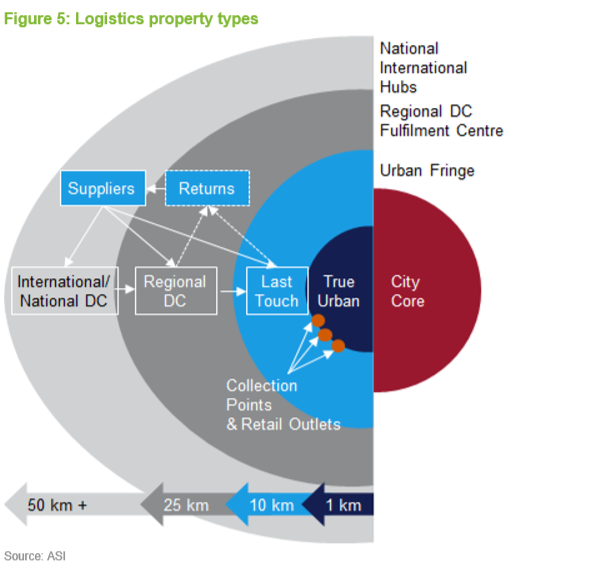

The logistics supply chain is typically made up of four different property types – each playing their own unique role.

• First is the national or international distribution centre (DC). These are the biggest of the logistics property types, often more than 30,000 sqm and sometimes up to 200,000 sqm in size. They are strategically located in a geographically central location and is the first step of a product’s journey from supplier to consumer.

• The national or international DC supplies a series of regional DCs or fulfilment centres that are located closer to large conurbation areas. These can be between 10,000 and 30,000 sqm in size and supply stores in the region and/or feed urban logistics properties.

• Urban logistics properties can be split into two different types, based on their location:

– Urban fringe, as the name suggests, are facilities located on the edge of major cities and services consumer deliveries. They are smaller in size, between 2,000 and 10,000 sqm, and are cross-docked – meaning that it has loading doors on both sides of the building for incoming and outgoing goods. This is where items are sorted ahead of their end delivery.

– True urban properties are located in the heart of the city. They are rare, due to land constraints in most major cities across Europe, but are increasingly in demand from ecommerce and parcel delivery companies.

European logistics: the investment case

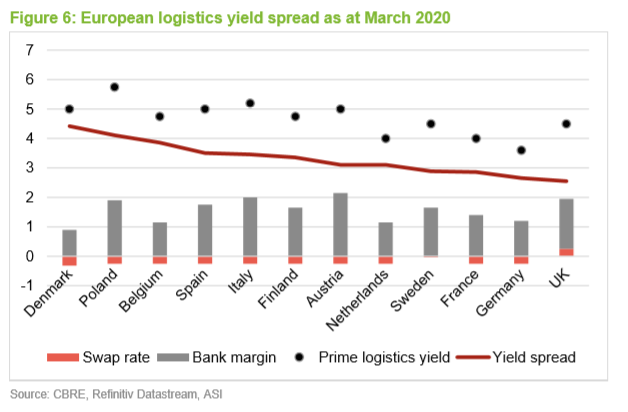

The manager believes that the investment case for European logistics is strong. The yield spread (investment yield minus total financing cost) is comparatively wider in European markets versus the UK. Figure 6 shows the yield spread of different countries across Europe and is based on property yields recorded by commercial property consultant CBRE, and average financing costs across ASI’s wider property portfolio.

Logistics properties in Europe come with a more palatable yield than in the UK and, furthermore, benefit from significantly better financing costs. Financing costs are around 100 basis points lower in Europe, compared with the UK.

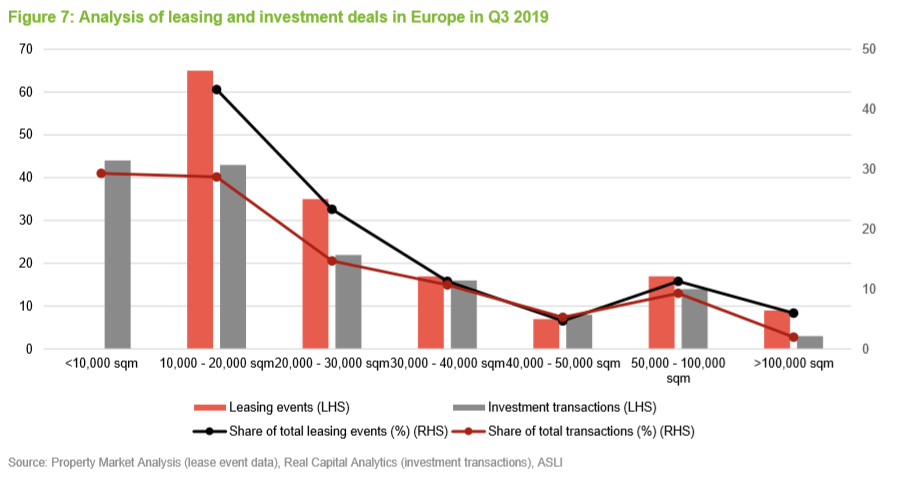

Logistics assets in the 10,000 sqm to 40,000 sqm size bracket are more liquid in terms of leasing and investment deals. The pool of investors looking to buy assets in that size bracket, which usually trade for around €30m, is very deep. Tenant demand in that size bracket is also highest, due to the fact that they are typically located closer to urban areas. Figure 7 shows that 77% of leasing deals and 83% of investments deals across European logistics, in a sample period, occurred in that size bracket.

Figure 7 provides a breakdown of the last 150 recorded leasing deals and 150 recorded investment transactions in European logistics assets, excluding the UK, as of the end of August 2019, by building size. (Note: leasing activity in the smaller size band (<10,000 sqm) is not tracked due to the difficulty in capturing a representative sample. ASLI assumes there is a lot of leasing activity in this size band, but the properties may be industrial rather than logistics.)

Logistics assets in the higher size range are less liquid on an occupier and investment front. There are not many occupiers that can take such a big unit, which is often very bespoke and equipped with multi-level mezzanine floors. There is also a limited pool of investors for these facilities, which can often be priced at €100m-plus, making it more difficult to dispose of such an asset.

Continental leases tend to be shorter than UK equivalents, but lessors seem increasingly prepared to sign longer leases, even up to 20 years without a break option in the lease. However, the structure of leasing contracts on commercial real estate in Europe includes annual indexation as standard, unlike in the UK. This gives property owners protection against inflation. The indexation is sometimes agreed with a cap and collar in place – an upper and lower limit on the rental uplift.

Investment process

Investment process

The properties will predominantly be located at established distribution hubs and within population centres. Typically, these will come with long-term, index-linked leases. The manager may also target properties that could benefit from structural change. When selecting investments, the manager will look at aspects such as:

• location, building quality, scale, transportation links, workforce availability and operational efficiencies;

• the terms of the lease (focusing on duration, inflation-linked terms, the basis for rent reviews and the potential for growth in rental income); and

• the strength of the tenant’s finances (financial covenant) and the way they are using the building.

The team looks at potential acquisitions on a bottom-up basis, ensuring that the locations are suited to the lessor’s target markets. Local market dynamics are more important than macroeconomic considerations.

In addition to buying operational assets, the company may forward fund new developments (purchase the asset before its development has been completed) or commit to buying an asset once building is complete. The manager will do this when it thinks this would lead to better returns for shareholders. It may also be a good way of securing an asset at an attractive yield. These assets will be predominantly pre-let when ASLI commits to the investment.

Forward funding new developments

Forward funding new developments

ASLI does not undertake speculative development, but has forward funded a selection of developments on the basis that these are at least 50% pre-let. There are good reasons for this: these deals tend to be agreed off-market and so are not as exposed to competitive pressures; new developments do not attract stamp duty; you can be sure that the tenant is committed to the location; and the buildings are high-quality and because they are new, have low maintenance costs.

Deals are usually structured so that ASLI makes an upfront payment for the purchase of the land (typically 20%) and then makes monthly instalments dependent on progress. The developer pays a coupon to ASLI during the development. ASI has a strong reputation within the European property market and is therefore a favoured partner for developers and lenders.

Risk limits and controls

Risk limits and controls

The following limits apply at the time ASLI makes an investment:

• ASLI will only invest in assets located in Europe;

• Maximum of 50% of gross assets in any one country;

• Maximum of 20% of gross assets in any one investment;

• Forward funded commitments will be wholly or predominantly pre-let;

• Maximum 20% of gross assets in forward funded commitments;

• Maximum 20% of gross assets exposed to any single developer;

• No investment in other closed-ended investment companies;

• Tenants must have strong financial covenants (in the manager’s view); and

• No single tenant to provide more than 20% of ASLI’s annual gross income.

Making full use of Aberdeen Standard’s resource

Making full use of Aberdeen Standard’s resource

When it comes to sourcing deals, ASI has 25 offices across Europe, 14 of which host real estate professionals. Evert Castelein, who is based in Amsterdam, says that it is important that he has access to local knowledge and a local network, which makes it easier to source off-market deals. Ideas are shared across ASI’s property teams through weekly deal allocation calls. All prospective investments are listed and reviewed on an internal portal and first right to deals cycles between the teams to ensure that all clients have fair access to prospective investments.

For the most part, the manager finds itself competing against local investors. However, there are quite a few pan-European investors looking at the largest investment grade properties. The manager will check the strength of covenants with external sources such as Dun & Bradstreet but it also cross-correlates this with information drawn from ASI’s equity and credit teams.

Asset allocation

Asset allocation

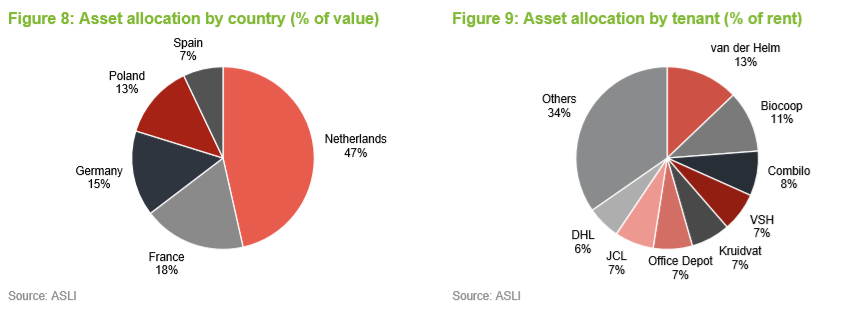

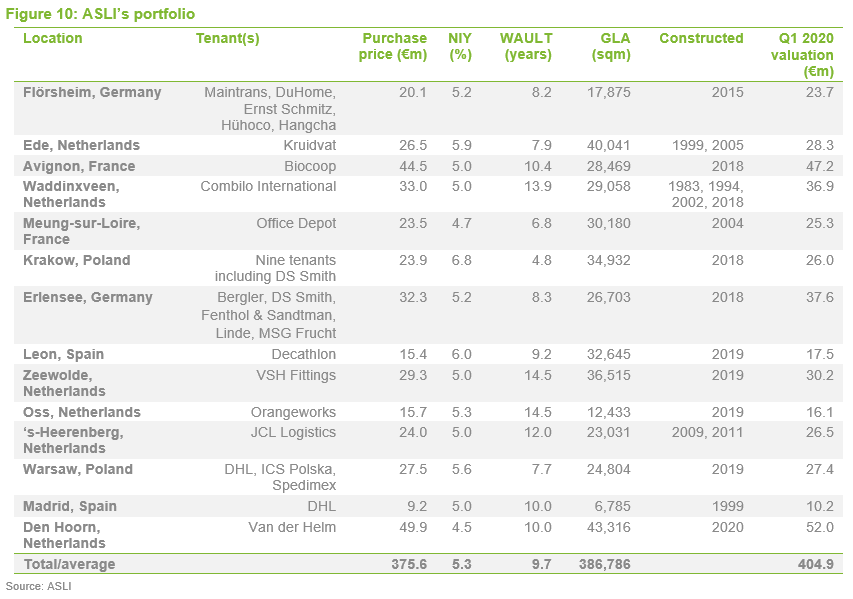

ASLI has a portfolio of 14 assets located across five European countries. Nine of the 14 purchases it has made to date have been conducted off-market, which means that there wasn’t a formal sales process or a potential bidding war. Since launch, ASLI has evaluated over 170 potential investment opportunities worth around €9bn in total. It has bid for assets in 11 European countries. There is a limit of 50% exposure to any one country.

ASLI’s portfolio is made up of 33 tenants, diversifying its income. More information on the underlying tenants is given below. The portfolio has a weighted average unexpired lease term (WAULT) of just under 10 years.

Den Hoorn

Den Hoorn

Acquired in January 2020 for €49.9m, the 43,316 sqm logistics facility is the fund’s largest purchase to date. The newly built warehouse was bought on a perpetual leasehold basis with the option to purchase the freehold from the local municipality. It is fully let to logistics operator A.G. Van der Helm Vastgoed Moerdijk B.V. on a 10-year lease that is indexed against CPI (the consumer price index).

The warehouse is located within the Randstad region, the most densely populated area in Europe, close to both the Hague and Rotterdam and with access to the A4 connecting Den Hoorn with the port of Rotterdam and Schiphol airport.

Why does the manager like it? Its urban location is highly sought after by tenants giving the asset upside potential on rent. It is a new building with low maintenance costs and ASLI has the upside potential to add solar panels on the roof, generating €75,000 of additional income.

Madrid

Madrid

This 6,785 sqm logistics facility, which was acquired in December 2019 for €9.2m, is the first ‘last-mile’ asset in ASLI’s portfolio. It is located in Coslada – a 16-minute drive to Madrid city centre and 1km away from Madrid Barajas International Airport, making it the ideal location for last-mile deliveries.

It is a cross-docked facility, making it ideal for city distribution with lorries bringing in goods at the front end of the building and smaller delivery vans on the opposite side being loaded for onward transmission. It is let to DHL, one of the largest logistics operators in the world, on a 10-year lease linked to CPI.

Why does the manager like it? Its location in the highly supply constrained Coslada submarket, which connects Madrid with the airport and routes through to the east of the country, supports the long-term relevance of this asset in the supply chain and rental growth prospects.

Warsaw

Warsaw

ASLI acquired the new logistics scheme, which was built in 2019, for €27.5m. It comprises two warehouses totalling 24,626 sqm with one of the buildings containing cross-docking facilities.

The scheme’s main tenant is one of the world’s largest logistics companies, DHL. Other tenants include ICS Polska, which specialises in industrial cleaning products, and Spedimex, a logistics company. Advanced negotiations are underway to let a small amount of space that is vacant but covered by a five-year rental guarantee.

Why does the manager like it? The warehouse is located in an established logistics location in Poland, on the A2 motorway, and benefits from close proximity to the city of Warsaw. It is also close to two international airports, which the manager says makes it the ideal location for urban logistics and ecommerce related delivery.

‘s-Heerenberg

‘s-Heerenberg

The property, which was acquired in July 2019 for €24m, is fully let to logistics operator JCL Logistics Benelux for a further 12 years, linked to CPI. Like the Madrid property, it is cross-docked and located in a strong logistics area – on the border between the Netherlands and Germany. The 23,031 sqm building has a low site coverage, providing expansion/development opportunity.

Why does the manager like it? The manager says the tenant has a strong covenant, generating a durable income stream. The expansion potential, of around 4,500 sqm, is another positive and there is also the option to add solar panels to the roof.

Oss

Oss

ASLI bought the 12,534 sqm asset, which was completed in July 2019, while the building was in construction, paying €15.7m. The asset is located between the port of Rotterdam and the industrial region of the Ruhr – a logistics hotspot with vacancy rates around 2%.

The tenant, Orangeworks (a Dutch food-processing and handling machinery business), signed a new 15-year triple net lease with no break and rents 100% linked to CPI when the building was completed in July 2019. The building spec includes a 5 tonne/sqm floor loading capacity and five loading doors. There is an option to extend the building by an additional 3,000 sqm.

Why does the manager like it? The manager likes the location’s strong fundamentals, the triple net lease (in a market where landlords are typically responsible for repairs and maintenance), the length of the lease and the 100% inflation-linkage.

Zeewolde

Zeewolde

ASLI paid €30.0m for this asset during its construction and was paid a coupon until it was completed in July 2019. It comprises 36,250 sqm of space located in the heart of the Netherlands, near the fast-growing town of Almere. Inditex/Zara has recently built a 100,000 sqm facility here, underlining the area’s desirability as a logistics hotspot. In addition, nearby Lelystad airport is being expanded.

The building is let to VSH Fittings (a Dutch pipes and fittings business, and a subsidiary of Aalberts Industries) on a triple net lease with 14.5-years to expiry, 100% linked to CPI (but capped at 2.4%).

Why does the manager like it? The manager says that the €41/sqm rent is low, given the building’s central location and ample labour supply. The triple net lease is welcome in a market where landlords are usually responsible for repairs and maintenance. The inflation-linkage is also good news. The manager is looking into the potential installation of solar panels.

Leon

Leon

Located in the north-west of Spain, ASLI paid €15.3m for this asset, which was completed in Q1 2019 and fully let to sportswear retailer Decathlon. It comprises three buildings with a total floor area of 32,637 sqm (which could suit a multi-let format in the future, if necessary).

Decathlon, which services 40 shops from the facility as part of its ecommerce business, has an unexpired lease term of 9.2 years, with no breaks, with rent 100% linked to CPI. It also has an option to extend the building by 10,000 sqm.

Why does the manager like it? The manager says the low rent (€32/sqm) is very competitive and index-linked. The extension option creates an opportunity to add value.

Erlensee

Erlensee

ASLI bought the asset, which comprises two multi-let buildings of 10,919 sqm and 15,431 sqm, for €32.3m. Built in 2018 to modern specifications, including a 5 tonne/sqm floor loading capacity and 50 loading doors, the asset is 26km north-east of Frankfurt.

The buildings have a WAULT of 8.3 years, with between 80% and 100% of rents linked to CPI. The tenants are:

• Bergler (a third-party logistics operator);

• DS Smith (a packaging company and FTSE100 Index constituent);

• Fenthol & Sandtman (a third-party logistics operator);

• Linde (a chemicals company with revenues in 2017 in excess of €17bn); and

• MSG Frucht (a German fruit and vegetable supplier, and a subsidiary of Compass Group).

Why does the manager like it? The manager says the property is in a prime logistics location in an area with a strong economy. The tenant base is diversified (the largest accounts for no more than 30% of the rent). Rents are rising in the area and the rents for this asset are largely linked to inflation.

Krakow

Krakow

Built in 2018, ASLI paid €24.5m for this asset, equivalent to a net initial yield of 6.8% (the highest in the portfolio). The 34,932 sqm building is located in an established logistics area alongside the A4 motorway, giving access to Germany, Wroclaw and Silesia and also benefits from proximity to Krakow and Katowice international airports.

It is a true multi-let asset, with nine tenants, including DS Smith (a tenant at Erlensee) and Lynka (a provider of textile printing services). The asset has a WAULT of 4.8 years and all leases are 100% linked to CPI.

Why does the manager like it? The flexible structure allows for future reconfiguration if required. In addition, Evert says: “Growing demand for logistics space in one of the most affluent urbanised areas of Poland, together with the diversified income stream make this a very attractive asset.”

Meung-sur-Loire

Meung-sur-Loire

The 30,180 sqm building is let to Office Depot and was acquired by ASLI for €23.5m. It is located 27km south-west of Orleans and is suited to serving Paris as well as central and southern France. A number of major logistics firms operate from this area, including DHL.

The asset has a low site coverage of just 29%, giving ASLI scope for extension/development. The asset has a WAULT of 6.8 years with no break and rents are 100% inflation linked against ILAT.

Why does the manager like it? The manager likes the location’s suitability as a national distribution centre. The low site cover offers the prospect of asset management opportunities and the tenant has announced it will consolidate its business on the location. The existing asset is built to modern specifications and benefits from indexlinked rents. ASLI is also looking into installing solar panels.

Waddinxveene

Waddinxveene

Acquired for €33.0m, this asset, which was constructed in 1983 and part refurbished to modern specifications in 2018, totals 28,131 sqm in size. The tenant, Combilo International, is a fruit and vegetable import/export business and has 13.9 years left on the CPI-linked lease (with no breaks).

The asset, which has 51 loading doors in a cross-dock formation, is located within the Randstad conurbation of the Netherlands (8m consumers live within one hour’s driving distance). The tenant has an option to extend the facility by 5,000 sqm.

Why does the manager like it? The manager says that the low vacancy rate in the Randstad area, of around 2%, supports future rental growth but, in the meantime, the long index-linked lease with a strong covenant provides an attractive income stream. The tenant is covering maintenance costs. Upside potential exists in the form of an extension, if the tenant requires additional space.

Avignon

Avignon

ASLI paid €44.5m for this asset, which comprises 28,571 sqm arranged as four cells, two of which (1/3 of floor space) are cold storage. It is located in the Noves suburb of Avignon with good road links to Marseille, Lyon and Montpellier.

The buildings have a WAULT of 10.4 years and rents are 100% linked to ILAT. The tenant is Biocoop, the leading organic supermarket in France with over 500 stores located across the country. It migrated its south-east distribution centre (one of four centres) to Noves from Sorgues, where it had an 18,000 sqm facility constructed in 1984.

Why does the manager like it? The manager says that the building design should attract low maintenance costs. Land supply in the area is constrained and the building comes with a tenant with a strong covenant and index-linked rent.

Ede

Ede

The 39,840 sqm building, which ASLI paid €26.5m for, was originally constructed in 1999 but half of the building was fully refurbished in 2018.

The asset, which is centrally located within the Netherlands in an area of just 3.9% vacancy for logistics assets, has a WAULT of 7.9 years with no break and the rental income is 100% linked to CPI. The tenant is Kruidvat, a leading drugstore in the Netherlands and part of the AS Watson Group, that is using the facility for ecommerce related activities due to its central location in the Netherlands.

Why does the manager like it? The manager likes the location, close to the main transport corridors towards Germany, the strong tenant covenant and the attractive 5.9% yield (especially given the inflation-linkage and WAULT).

Flörsheim

Flörsheim

Flörsheim was ASLI’s first acquisition, in February 2018. It paid €20.1m for the asset, which comprises two multi-let buildings of 10,762 sqm and 7,047 sqm and is located 15km from Frankfurt Airport.

The buildings have a WAULT of 8.2 years and rents are 100% linked to CPI. The tenants are:

• Maintrans (a third-party logistics firm);

• DuHome (an ecommerce retailer);

• Ernst Schmitz (a third-party logistics firm);

• Hühoco (a global coatings and materials business); and

• Hangcha Europe (a forklift and material handling business).

Why does the manager like it? The manager says that there is limited logistics capacity in the Rhine-Main region, with less than a 5% vacancy rate. The local economy is strong and the building is of good quality. The diversified tenant base and the CPI-linked rents are a further source of comfort.

Asset by classification

Asset by classification

ASLI’s assets are not only diverse in terms of size and location, but also logistics property type. The logistics market is made up of a network of property types that have different functions in the supply chain – starting from national/international hubs and flowing down into true urban ‘last mile’ delivery hubs. As illustrated in Figure 23 and 24, ASLI’s assets are classified as predominantly regional distribution centres and urban fringe property types, with its recent Madrid purchase being the only true urban facility in the portfolio. The manager has indicated that it wants to buy more true urban assets.

Asset management initiatives

Asset management initiatives

ASLI plans to carry out a number of asset management initiatives across its portfolio that will drive rental income and capital values. These projects comprise of building extensions and solar panel installations.

At ‘s-Heerenberg, ASLI is in discussions with the tenant, JCL Logistics, over a potential extension of the building by 4,200 sqm. It is estimated it will cost ASLI €2.5m and increase the value of the asset by €3.5m, with an extra €210,000 of annual rental income.

ASLI is also pursuing expansion opportunities at its asset in Meung-sur-Loire, France. The building, which is let to Office Depot, has a site coverage of just 29%, providing ASLI with ample space for future development. It is in discussions with Office Depot, which is considering consolidating its French business to the site, about a 10,000 sqm extension at an estimated cost of €3.4m. The extra space is expected to generate an annual rental income of €267,000 and add €5.4m to the value of the asset.

ASLI is also rolling out a programme of solar panel installations on its Dutch portfolio. It already leases out the roof of its Avignon building for around €160,000 a year. At Den Hoorn, ASLI is installing solar panels on the roof at a cost of €500,000 and will lease the space for €75,000 a year. As well as the income, the initiative will increase the value of the asset by an estimated €1m. At Ede and Zeewolde, ASLI is looking to install roof solar panels through subsidies from the Dutch government that will produce a combined €115,000 a year. It hopes the projects will be producing green energy by the end of 2020.

Longer-term asset management initiatives also exist across the portfolio. A number of assets have low site coverage, presenting it with the opportunity to extend the size of the buildings or build new facilities on the plots of land.

At its asset in Leon, Spain, the tenant – sports goods retailer Decathlon – has a fiveyear option to expand the building by an additional 10,000 sqm, which the manager believes is a key attraction for Decathlon. ASLI estimates that this would cost €3.8m and increase the value of the property by €5m.

In the Netherlands, at both its Oss and Waddinxveen assets, the potential to expand also exists. In Oss, the low site coverage of the existing buildings gives ASLI the opportunity to extend the facility by 3,000 sqm. In Waddinxveen, the opportunity exists to extend the building by 5,000 sqm.

Overall, the three potential asset management initiatives – in Leon, Oss and Waddinxveen – have an estimated cost of €8.3m, will increase the value of the properties by an estimated €13.1m and bring in an estimated €768,000 of rental income.

Performance

Performance

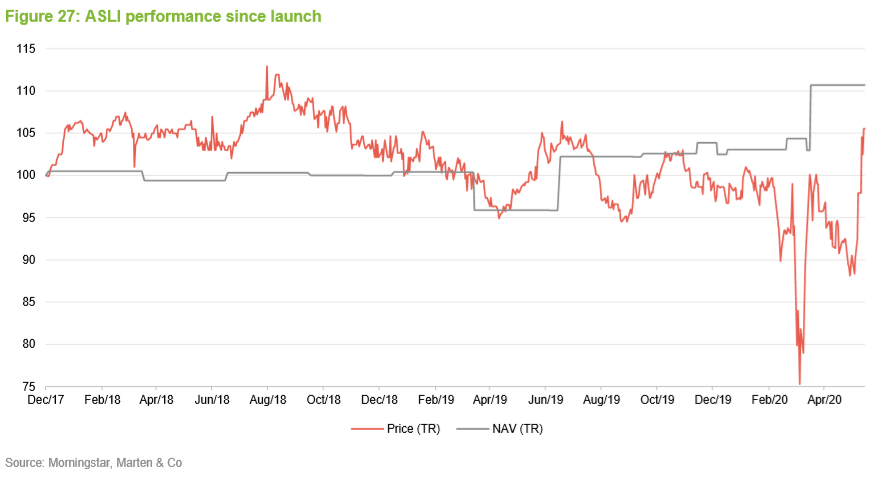

ASLI’s NAV initially made modest progress from launch, with rising property values offset by expenses incurred in establishing the portfolio. The NAV is reported in both euro and sterling. The NAV in Figure 25 is in sterling and the dip in March 2019 was due to a stronger sterling exchange rate against the euro. Sterling weakened in June 2019 and, coupled with a portfolio valuation increase, ASLI’s NAV total return increased. Due to a favourable exchange rate and a rise in portfolio valuation, ASLI’s NAV increased again in March 2020.

Peer group

Peer group

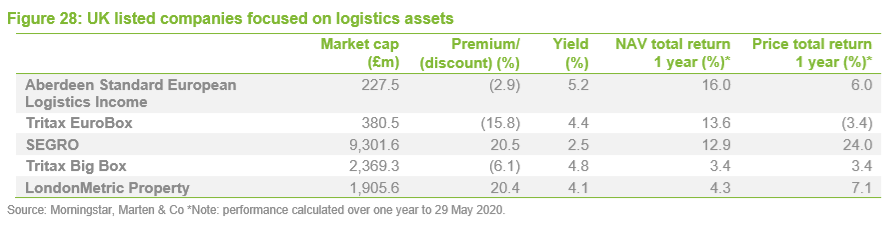

Most of those investing in European logistics are unlisted funds or subsidiaries of larger groups. The listed peer group we have assembled consists of: Tritax EuroBox, ASLI’s closest competitor; SEGRO, which owns a mixture of ‘big box’, urban and industrial space, about a third of which is located in continental Europe; Tritax Big Box; and LondonMetric Property. The latter two are UK-focused and provide a comparison to ASLI’s UK peers.

ASLI is at the smaller end of this peer group, for the moment, as it continues to grow its portfolio. The yield is superior relative to peers and over the last 12 months has produced the largest NAV return.

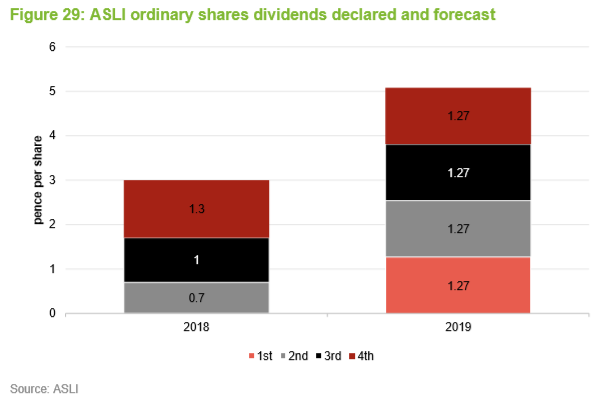

Dividend

Dividend

ASLI paid 3p per share in the period from launch to 31 December 2018. The company paid 5.08p per share in dividends in respect of the year to 31 December 2019, achieving its target of 5% of the IPO price. ASLI has said it intends to pay a quarterly interim dividend, in line with its dividend policy, during the covid-19 pandemic dependant on the ability of its tenants to maintain rental payments. It has declared an interim dividend for the first quarter of 2020 of 1.41 euro cents (equivalent to 1.24p) per share.

References to ‘dividends’ in this note cover both dividend income, and income which is designated as an interest distribution for UK tax purposes and therefore subject to the interest-streaming regime applicable to investment trusts.

Premium/(discount)

Premium/(discount)

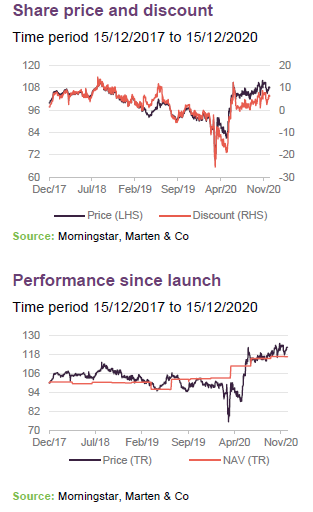

ASLI almost exclusively traded at a premium following its launch, peaking at just under 15% in August 2018. Its premium narrowed over the next seven months before spiking again in early July 2019. Following a capital raise on 26 July 2019, it lost its premium rating and fluctuated between a 2.5% premium and a 5% discount until the coronavirus pandemic took hold across Europe. After initially seeing its discount widen to 26%, it has since narrowed considerably, reflecting the resilient nature of its portfolio, and on 29 May 2020, it was trading at a 2.9% discount.

In the event that the ordinary shares trade at a premium, ASLI has the authority to issue new shares that could be used to satisfy any excess market demand.

Similarly, should the shares trade at a discount, ASLI has authority to repurchase up to 14.99% of its issued share capital. ASLI says that the directors will consider repurchasing ordinary shares in the market if they believe it to be in shareholders’ interests and as a means of correcting any imbalance between the supply of and demand for the ordinary shares.

Fees and costs

Fees and costs

The Alternative Investment Fund Manager (AIFM) is a subsidiary of ASI sub-delegating investment management to a subsidiary based in Dublin. Under the terms of the management agreement, as amended in December 2018, the AIFM is entitled to receive a tiered annual management fee as follows:

• 0.75% of net assets up to €1.25bn

• 0.60% of any net assets in excess of €1.25bn.

No annual management fee was charged on uninvested funds until 75% of the net proceeds of the initial issue had been invested. The annual management fee is calculated and paid quarterly in arrears and there is no performance fee. The management agreement can be terminated on 12 months’ notice, by either side.

The AIFM provides services in respect of company secretarial services, day-to-day administration, accounts preparation and NAV publication. The accounting and administrative functions are delegated to State Street Bank and Trust Company (London).

Capital structure and life

Capital structure and life

ASLI has 234,500,001 ordinary shares in issue and no other classes of share capital.

The fund’s year end is 31 December. It published its annual report in May 2020 and will hold its AGM in June 2020.

Borrowing

Borrowing

ASLI uses gearing with the aim of enhancing shareholder returns. All financing decisions are organised by the manager’s in-house treasury team (located in Frankfurt, London and Edinburgh) and must be approved by the investment committee.

ASLI’s loan to value (LTV – debt relative to gross assets) is around 35%, in line with its long-term target. The debt is typically held at the asset level, rather than the company level. Borrowings are secured against individual assets or groups of assets with crosscollateralisation. Debt at asset level may increase temporarily from 35% where the manager seeks to undertake asset management initiatives or purchases, in advance of a cash raise, through the use of a revolving credit facility (RCF).

The loans are fixed with an average all-in cost of 1.36% and maturity of 6.5 years. The manager aims to avoid taking on debt that amortises.

Aggregate borrowings will always be subject to an absolute maximum, calculated at the time of drawdown, of 50% of gross assets. Furthermore, where borrowings are secured against a group of assets, any such group of assets shall not exceed 25% of ASLI’s gross assets so as to ensure that investment risk remains suitably spread.

ASLI is in negotiations to secure a new £40m RCF, that would increase its LTV by 5% if fully drawn. The manager had planned to use the RCF to buy new properties ahead of a capital raise to pay down the debt, thus reducing cash drag. However, in light of covid-19, the project has been put on hold to avoid any extra costs.

Continuation vote at sixth AGM, three-yearly votes thereafter

Continuation vote at sixth AGM, three-yearly votes thereafter

ASLI has an unlimited life, but shareholders will be offered a continuation vote at the company’s sixth AGM following admission. Thereafter, shareholders are to be offered continuation votes at three-yearly intervals. In the event that a continuation resolution fails to pass, the directors will cease further investment, the properties in the portfolio will be sold in an orderly fashion and the net funds available for distribution will be returned to shareholders.

The investment team

The investment team

ASLI’s investment team is made up of Evert Castelein (fund manager), Attila Molnár (fund manager) andJames Wythe (deputy fund manager). The team has over 20 years’ combined experience of investing in European logistics, and Aberdeen Standard Investments is currently managing €4.0bn of logistics warehouses in Europe. This comprises 160 logistics properties, across 11 countries.

Evert Castelein – fund manager (Amsterdam)

Evert has worked as a fund manager for the Aberdeen European Balanced Property Fund. He joined Aberdeen in 2008 as a senior analyst within the property research and strategy team. Besides research and portfolio analysis, Evert has been responsible for the asset management of a small German fund, and he has previously worked for FGH Bank as a research analyst. Evert graduated with a Masters degree in Economic Geography from the University of Groningen and has a Masters of Science in Real Estate (MSRE). He speaks English, Dutch, German and French.

Attila Molnár –fund manager (Frankfurt)

Attila is fund manager at Aberdeen Immobilien KAG, based in Frankfurt, Germany. Attila joined Dresdner Bank’s property fund management business (DEGI) in 2006, shortly before the business was acquired by Aberdeen. He has been involved from the beginning in the planning and establishment of a new product line for institutional clients and joined the fund management teams of those funds. Now he is responsible for two institutional funds. Prior to this, Attila worked for PricewaterhouseCoopers where he was responsible for diverse audit and due diligence projects in the property fund business.

Attila graduated with a MSc in Accounting and Finance from Budapest University of Economics. He speaks German, Hungarian and English.

James Wythe – deputy fund manager (Amsterdam)

James is deputy fund manager of ASLI and is based in Amsterdam. He joined what was Standard Life Investments in 2016, just before the merger, to assist with the management of a balanced Dutch and Swedish portfolio. He took over responsibility for managing that portfolio during 2018 before joining the ASLI team in 2019.

James graduated with a BSc in Biology from The University of Nottingham and has an MSc in Real Estate from the University of Reading. He is also a member of the RICS.

Second largest European real estate investment manager

Second largest European real estate investment manager

Aberdeen Standard Investments Real Estate is the second-largest European real estate investment manager. It has an extensive regional presence with 25 offices across Europe, 11 of which have real estate professionals. The team says that this ‘boots on the ground’ presence provides for strong local insight and deal flow.

Aberdeen Standard Investments manages more than 50 real estate portfolios in Europe, with total direct real estate assets under management of €43.5bn. The broader real estate team includes more than 250 investment professionals.

Board

Board

The ASLI board has four members, after former chairman Pascal Duval retired from the board in June 2019. Tony Roper was appointed chairman following the company’s AGM in June 2019. All directors are independent of the manager and do not sit together on other boards.

Tony Roper started his career as a structural engineer with Ove Arup and Partners in 1983. In 1994 he joined John Laing Plc to review and make equity investments in infrastructure projects both in the UK and abroad. In 2006, Tony joined HSBC Specialist Investments (part of the HSBC Holdings group) to be the fund manager for HICL Infrastructure Company Limited. Tony continued in this role until May 2017, during which time HICL grew from £250 million to circa £2.8 billion. In 2011, Tony was part of the senior management team that bought HSBC Specialist Investments from HSBC, renaming it InfraRed Capital Partners. Tony is a Managing Partner and a senior member of the infrastructure management team at InfraRed Capital Partners. He holds a MA in Engineering from Cambridge University and is an ACMA-CGMA.

Caroline Gulliver is a chartered accountant with over 25 years’ experience at Ernst & Young LLP, latterly as an executive director before leaving in 2012. During that time, she specialised in the asset management sector and developed an extensive experience of investment trusts. She was a member of The Association of Investment Companies’ Technical Committee and also the AIC SORP working party for the revision to the 2009 investment trust SORP. Caroline is also a non-executive director and audit committee chair for JP Morgan Global Emerging Markets Income Trust Plc, International Biotechnology Trust Plc and Civitas Social Housing Plc.

John Heawood has 40 years’ experience as a Chartered Surveyor advising a broad range of investors, developers and occupiers. In 1987 he became a partner, and subsequently a director, of DTZ responsible for the London-based team dealing with industrial, logistics and business park projects across the UK. John was appointed to the board of SEGRO plc in 1996 and was responsible for its UK business for the next 12 years. From 2009-2013 he was managing director of the Ashtenne Industrial Fund, a £500 million multi-let industrial and logistics portfolio managed by Aviva on behalf of 13 institutional investors. John is currently a non-executive director of Place Partnership Limited, a member of council and the finance and general purposes committee of the Royal Veterinary College and a trustee of Marshalls Charity, a Southwark-based charity established in 1631. John holds a BSc in Estate Management and a MSc in Rural Planning Studies from the University of Reading.

Diane Wilde has over 30 years’ experience of managing equity, balanced and multiasset funds in both the asset management and wealth management sectors. She was managing director at Gartmore Scotland Ltd, managing investment trust assets on behalf of the company from 1993 to 2000. Following a period of managing similar assets at Aberdeen Asset Managers between 2000 and 2003, she joined Barclays Wealth as Head of Endowment Funds in Scotland. A former member of the Pension Fund Advisory Committee to the Barclays Bank UK Retirement Fund, Diane was a senior adviser at Allenbridge, an investment consulting firm, until May 2018. She is also a board member of the Social Growth Fund, managed by Social Investment Scotland (SIS), a leading social enterprise and impact investor in Scotland and the United Kingdom. Diane holds a BA in Economics and Social Administration from the University of Strathclyde.

Previous publications

Previous publications

Readers may be interested in our initiation note, Poised to expand?, published in March 2019 and our update note, On the crest of a wave, published in October 2019. Please click the links above.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Aberdeen Standard European Logistics Income.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.