Lessons learnt

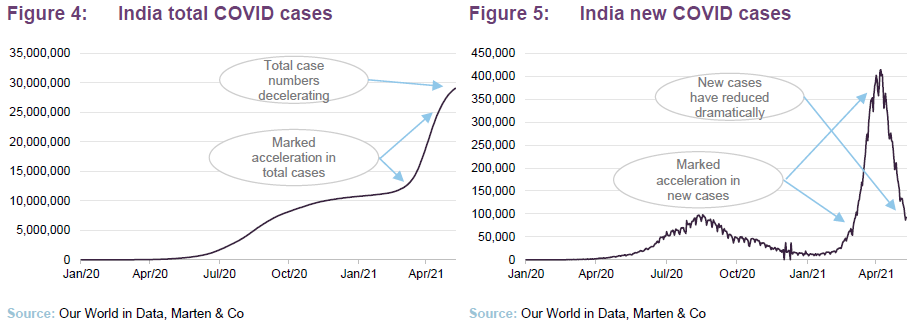

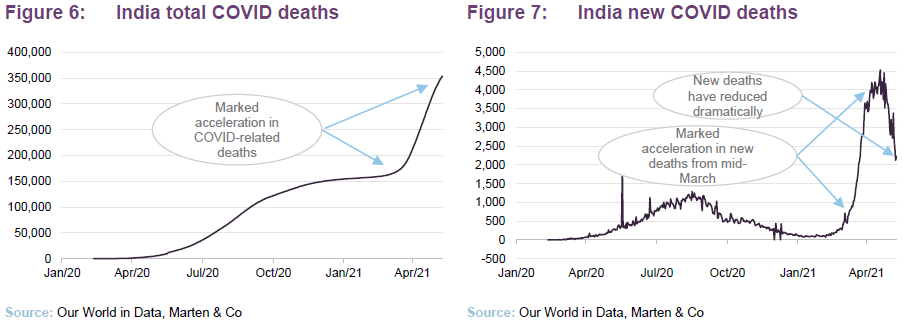

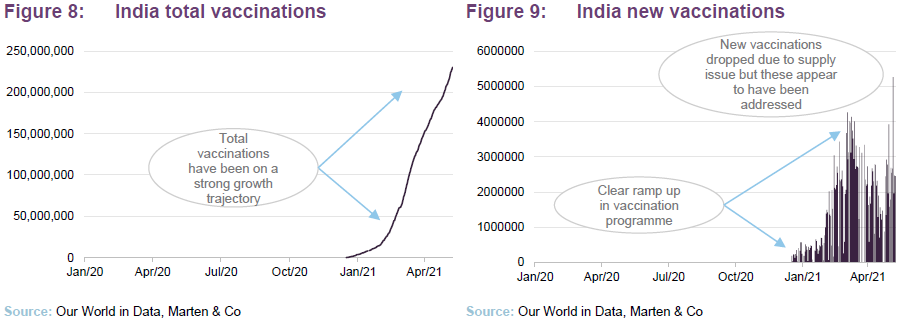

Though India’s second coronavirus wave – which started in March 2021 and saw as many as 414,000 recorded daily cases as recently as 6 May – has been described as one of the worst in the world, Gaurav Narain, India Capital Growth’s (IGC’s) investment adviser, believes the peak has now passed. Daily cases appear to be falling and the country’s vaccine rollout is ramping up after a temporary slowdown following production constraints.

Gaurav also believes India’s government learnt its lesson from the first outbreak and its decision to allow businesses to continue to operate this time around has helped the economy to recover faster and emerge stronger.

Mid- and small-cap listed investments in India

IGC’s investment objective is to provide long-term capital appreciation by investing (directly or indirectly) in companies based in India. The investment policy permits the company to make investments in a range of Indian equity securities and Indian equity-linked securities. The company’s investments are predominantly in listed mid- and-small-cap Indian companies.

Market outlook

India was one of the better performing markets during 2020, with the MSCI India Index returning 11.99%, only slightly behind the total return for the MSCI World Index at 12.32%. By way of comparison, the UK market was down 13.23% over the year. Year-to-date, India is up 10.08%, versus 8.24% for MSCI World but still behind an 11.73% return for the UK, which has so far achieved a successful ongoing vaccination programme and easing of lockdown.

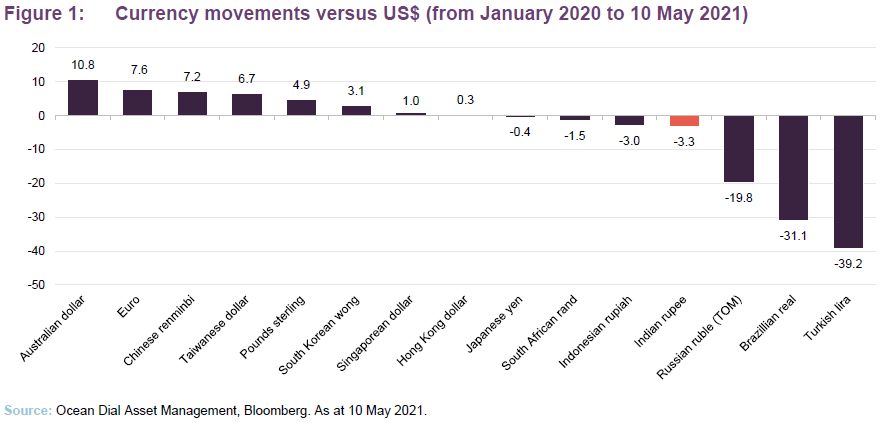

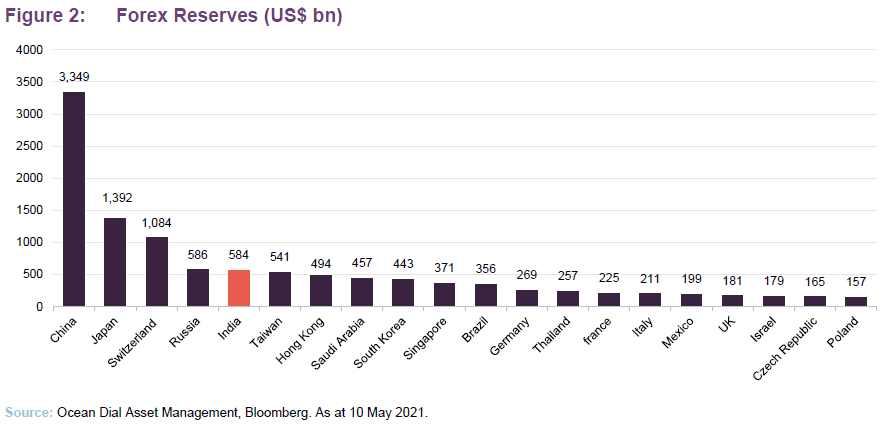

As illustrated in Figure 1, the Indian Rupee appears to have held up relatively well over the pandemic, having fallen by just 3.3% against the US dollar since January 2020, which differentiates it from some other emerging markets. IGC’s managers think that this is a reflection of the macroeconomic stability that Prime Minister Narendra Modi and his government have brought about. As illustrated in Figure 2, India has strong FX reserves and IGC’s managers say that this, as well as increased foreign direct investment, is supporting low currency volatility.

Though the Association of Investment Companies (AIC)’s India sector was the worst performing for April in share price terms (down by 3.7%), it appears to have bounced back in May, as the second-best performer, with a median share price total return of 6.7% and median NAV total return of 5.5%. The median discount, however, is still wide at 12.8% as at 31 May 2021.

Valuations and recovery potential

IGC’s portfolio currently trades at 16x historic earnings, and 12.9x one-year forward earnings, with earnings per share growth of 35% and 24% respectively. In comparison, the Nifty 50 Index is more expensive, trading at 20.3x historic earnings and 17.6x one-year forward earnings, with comparable historic earnings growth of 36% and 15.4% earnings growth over the next twelve months.

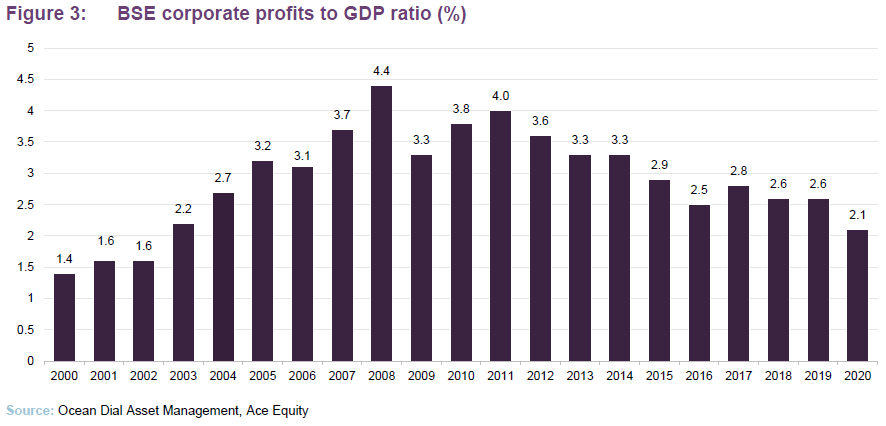

As illustrated in Figure 3, the ratio of corporate profits to GDP is at a multi-year low (it is now at its lowest since 2003) suggesting strong recovery potential. The managers think there is the potential for a longer-term upward revision cycle if this ratio returns to its mean level of 3.5 to 4%.

The big – COVID – picture in India

Over the past week, national capital, Delhi and financial hub, Mumbai, are among the regions across the country that have started to reopen, albeit partially. This is a big development considering that less than two months ago, the crushing second wave saw hospital beds, medicine and oxygen supplies run short. India has administered more than 230m jabs so far – but less than four percent of its

1.4bn-strong population have been fully vaccinated.

A botched initial roll-out of the vaccination programme also saw demand outstrip supply and so the country struggled. Most recent figures show India saw 67,208 new reported infections on 16 June, and more than 2,330 deaths. Though still problematic, this is far lower than the nearly 400,000 daily cases it recorded in May. 29.7m cases and 382,000 deaths have been recorded so far, though experts believe the actual toll is much higher.

Rise of the SMID cap

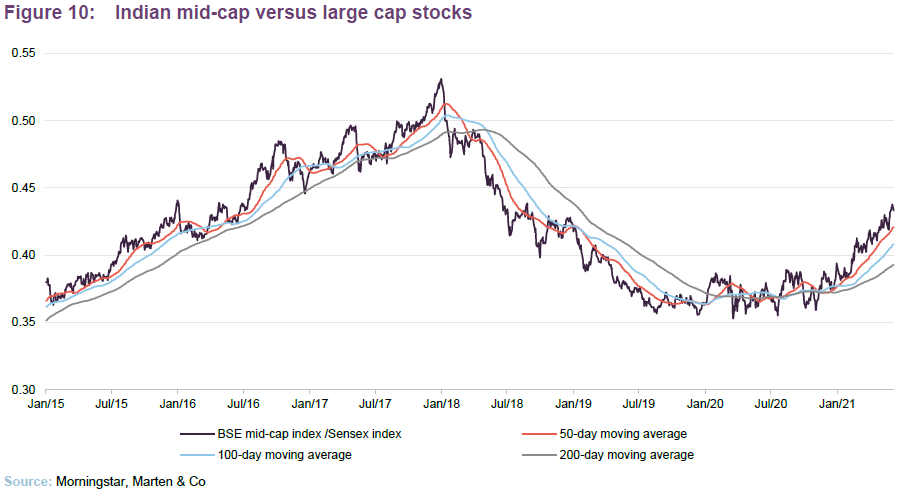

IGC says that there has been an important shift in market sentiment towards small- and medium-sized companies in India, as the reformation has encouraged greater transparency, less corruption and a genuine strive for better businesses. Figure 10 illustrates this graphically, showing that mid-caps have recently been outperforming the large caps. The managers believe that market is looking through recent upheavals towards a sustained domestic economic recovery, with the small- and mid-caps the engine room of growth. The small- and mid-caps have been laggards since late 2017 and are now catching up.

Manager’s view – Not as bad as it looks

IGC’s adviser, Gaurav Narain, believes that while India remains one of the hardest hit countries with regards to the coronavirus pandemic, the recent data suggests the severity of the virus has peaked and the worst may well be over. Though absolute numbers for infections remain high relative to other parts of the world, active cases are falling and those states that were the worst-affected (such as Maharashtra and Delhi) have all seen a prominent decline.

Furthermore, Gaurav says that the government learnt its lesson from the first outbreak in 2020, which saw a strict lockdown implemented across the country lasting two months. This time, businesses were given the freedom to continue operating, which has given the economy a much better standing to get through the crisis.

Gaurav is also reassured by the vaccine rollout which appears back on track after a slowdown caused by production issues. As many as four million doses were given in just one day in early April, but this has since declined to around two million per day. Gaurav agrees this needs to be faster but is not as concerned as perhaps some observers – and investors – from overseas may be.

To that regard, he feels India has been unfairly portrayed by the media – both nationally and globally – and that while the situation has certainly been dire, the Indian government’s handling of the pandemic has nonetheless been

over-criticised. He said the scaremongering has been led by the bulk of the Indian media, which is then picked up internationally, painting a somewhat bleaker picture than what is really going on.

He feels that the negative story surrounding India used to be focused on disappointment around Prime Minister Modi’s reforms but since these have been proven to ‘clean up the system’, the media has simply looked for something else to critique.

Playing for economic recovery

On that note, Gaurav is confident that the challenges that have threatened India over the past decade have finally been addressed by many of Modi’s reforms. In his view, some may have been met with an initial backlash and caused a period of disruption, but they have now created an economy for India that helps small businesses that want to grow and punishes those that thrive on corruption.

Regulatory changes and the increasing use of technology and artificial intelligence have helped this to become possible. Companies on the verge of defaulting can no longer move from bank to bank and the digitalisation of transactions means the methods by which others evaded taxes have been addressed. These changes did initially hurt the economy, but have since proven to be necessary, while stronger balance sheets and a cleaned-up banking system have allowed a better handling of the pandemic.

Meanwhile, the economic bounce back after the first COVID outbreak was much sharper than Gaurav and the IGC team expected, and certain areas were even booming. While big cities came to a grinding halt, rural areas enjoyed the rewards from two good monsoon seasons, a rise in agriculture prices and hardly any impact from the virus. The team downgraded their prospective earnings yet found themselves putting them back up again as new data came out and they soon realised they needed to be more aggressive.

Despite these quantifiable changes and a clear pathway to an improving economy, the wider – and negative – view of India is taking longer than Gaurav was expecting to shift, though when it does, IGC’s portfolio is well positioned to play the economic recovery that will follow. He says when it eventually swings from a narrative of disappointing earnings, disruptive institutional reform and COVID, to one with a government set on a growth-driven agenda, a successful vaccination rollout and being the fastest growing economy, investors need to be ready to take advantage. He says India’s story is still backward-looking but when it starts to turn, mid-and-small cap companies will be the biggest beneficiaries.

Push for growth

On 1 February 2021, the Union Budget of India for 2021-2022 was presented by minister of finance, Nirmala Sitharaman. Due to low demand in the Indian market and a high unemployment rate, these were the areas of focus along with a huge push for better healthcare and infrastructure growth.

The healthcare strategy included a new programme and scheme sponsored by Central Government called PM Aatmanirbhar Swasth Bharat Yojana, which would focus on establishing new institutions that would work in the field of detection and cure from new diseases, including the National Institution for One Health. Meanwhile the infrastructure strategy listed more than 7,000 projects, mainly around the development of the country’s rail and road networks. The National Rail Plan aims to develop adequate rail infrastructure across India by 2030 to cater for the projected traffic requirements up to 2050. Gaurav says this is what will provide momentum in India and has helped change the mindset of those running out of patience with the government’s lack of plans for growth. He expects high GDP growth going forward, which should be sustained for at least the next four to five years.

Prior to the budget announcement, there was mass speculation that the government would increase tax rates to decrease its fiscal deficit, causing a dip in the BSE Sensex. However, the market welcomed the budget, causing the index (BSE Sensex) to close with a 5% gain, the highest since the ‘dream budget’ of 1997.

Asset allocation

As was highlighted in our December 2020 annual overview for IGC, Gaurav made a lot of changes throughout the year as the crisis continued. He reduced his exposure to financials but since February’s Budget, has been building his weighting back to the usual 19-20% level, though this has been purely in the banking space. He continues to avoid stocks which are B2C export orientated as their future remains uncertain in the light of the pandemic and its long-term impact.

Money has instead been deployed into more stable businesses such as those in the electronics manufacturing space. Gaurav says the backlog of reforms has also started finally having an impact on the languishing real estate sector, and there has been increasing demand and registrations of property.

IGC’s cash level has been at its lowest since June 2020, ranging between 1-2.2%, compared to a typical holding of between 3-5%. As at 31 May 2021, the net cash level stands at 2.2%.

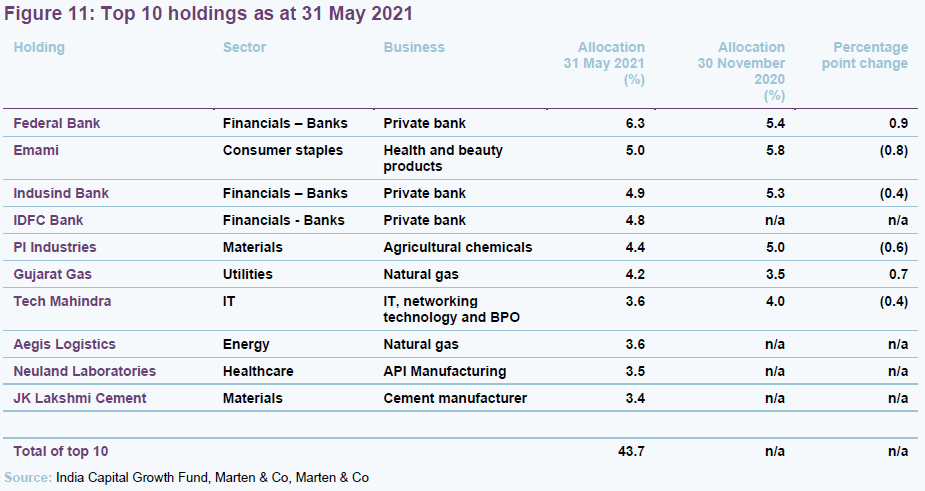

Top 10 holdings

Figure 11 shows IGC’s top 10 holdings as at 31 May 2021 and how these have changed since 30 November 2020 (the most recently-available data when we last published). New entrants to the top 10 since then are IDFC Bank, Neuland Laboratories, Aegis Logistics and JK Lakshmi Cement. Names that have moved out of the top 10 since then are Divi’s Laboratories, City Union Bank and Jyothi Laboratories. We discuss some of the more interesting changes in the following pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been previously discussed (see end of this note).

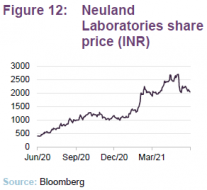

Neuland Laboratories

Neuland Laboratories (www.neulandlabs.com) is a leader in the pharmaceutical space in India and moved up into IGC’s top ten holdings in April, with an allocation of 4.5%, though this now stands at 3.5% as the manager has trimmed into the rally. It performed well after the first coronavirus outbreak in 2020 as well as more recently, and has delivered more than 500% over the past 12 months, as illustrated in Figure 12. It has suffered over the past three to four years but has consistently come out stronger each time. The healthcare sector in general has also done well as of late and is set to grow in line with the government’s plans for the sector as outlined in February’s Budget.

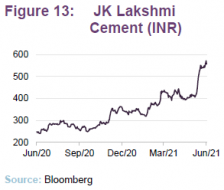

JK Lakshmi Cement

Another one of IGC’s May top 10 new additions, JK Lakshmi Cement (www.jklakshmicement.com) is a part of the 132 years old JK group and has a 3% market share in India with 13.3m tonnes per annum (MTPA) cement capacity. Its primary operations are based out of northern and western India and it has three cement plants and four grinding units. Gaurav says the company plans to undertake a brownfield capacity expansion of 2.5MTPA in the north-western state of Rajasthan once the pandemic wanes, further strengthening its position in this region.

It has also enjoyed a reduction in debt, with leverage falling from 1.1x to 0.4x and has achieved this strong operating performance despite COVID-led demand headwinds and raw material cost inflation. With the expectation of strong robust demand led by increased infrastructure spending in northern and eastern India, Gaurav believes JK Lakshmi Cement will benefit from its strong presence in these regions. Meanwhile, a recent change in management will bring fresh perspective and renewed focus on key performance parameters which, coupled with robust demand outlook, will help the company maximise performance to its full potential.

Kajaria Ceramics

Though Kajaria Ceramics (www.kajariaceramics.com) fell out of IGC’s top 10 holdings in May (it is now the 11th largest holding, representing 3.4% of the portfolio), it is still worth mentioning as one of the company’s longer-term investments. Kajaria is the largest tile manufacturer in India and eighth largest in the world. Gaurav says the business is of ‘gold standard’ in its sector and is the name that competition look to benchmark themselves against. Through each economic cycle the company emerges stronger, reducing the volatility of its earnings profile, and allowing it to command a higher and more constant valuation multiple for the future. As India’s prosperity takes-off, the manager is confident that shareholders will watch it climb the global rankings, whilst as minority business owners, benefitting from strong returns of an exceptionally well-managed company.

Performance

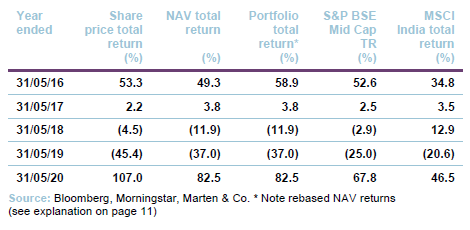

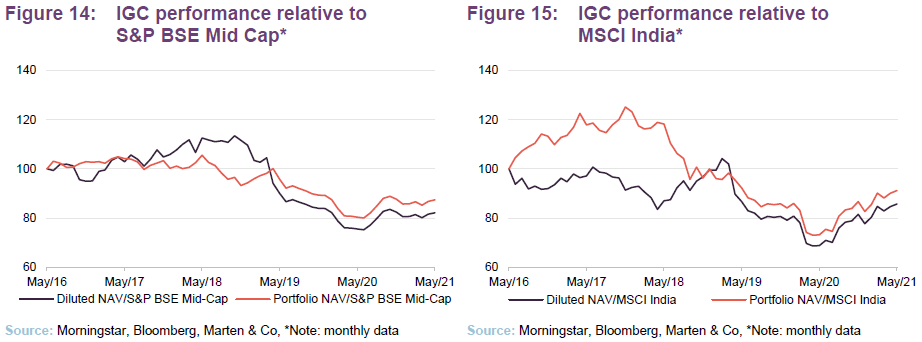

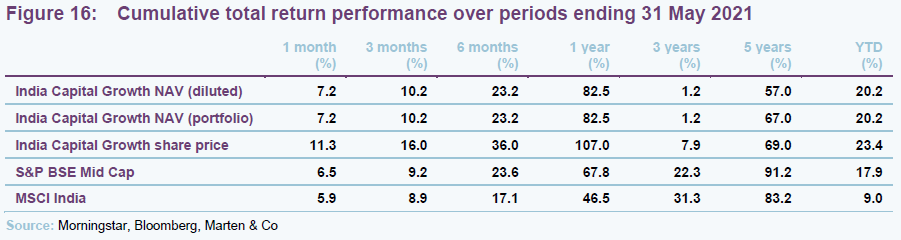

The data in Figures 14, 15 and 16 show returns for both IGC’s published NAV and for an adjusted, ‘portfolio’ NAV. The portfolio NAV removes the dilutive effects of IGC’s subscription shares (which were exercised in full in August 2016) and represents the performance generated by the manager and adviser.

Small- and medium-sized Indian companies have generally underperformed larger ones, for much of the last three years, and this has impacted on IGC’s performance relative to the MSCI India Index.

Stock selection decisions have also weighed on IGC’s performance in the past, relative to the S&P BSE Mid Cap Index. However, last year the team was vocal about its mistakes and made public statements declaring the changes it would make to turn performance around. As we discussed in our May 2020 note, the changes put in place to give more rigour to the investment process were showing early signs of improving the stock selection performance, and this has continued. The improvement is particularly evident over the past year.

Attribution

Aarti Industries

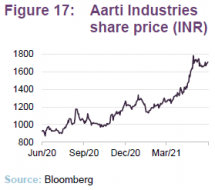

Aarti Industries (www.aarti-industries.com) is the 17th largest holding and represents 2.9% of IGC’s portfolio. It is a leading manufacturer of speciality chemicals and pharmaceuticals and a global leader in the benzene chemistry chain supplying to the likes of Pfizer, Bayer, BASF, 3M, Dow and Unilever, as well as a whole host of Indian blue chips. Customers are looking to de-risk their sourcing from China, whose chemicals manufacturing base is ten times the size of India’s. Gaurav says that Aarti boasts a strong order book and has an excellent track record in executing on its product pipeline. The company has high visibility of its earnings and along with other IGC holdings in the chemicals space, Gaurav predicts a conservative 20% growth trajectory for the coming years.

Emami

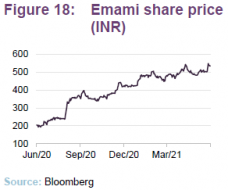

Emami (www.emamiltd.in) is a long-time holding of IGC, having been in the portfolio for almost seven years. It is also the second biggest holding, representing 5% of the portfolio. As discussed earlier, it is one of the trust’s holdings that is highly geared to rural consumers in India and has seven manufacturing units across the country. It is a part of the increasingly popular Ayurvedic segment (Ayurveda is a traditional Indian system of medicine) and though it fell around 60% in 2020, it has participated in the sharpest end of the recovery in sales, largely thanks to strong cash flow. Gaurav thinks Emami remains very attractively valued relative to both its own history and its peers.

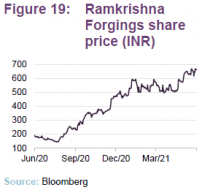

Ramkrishna Forgings

Ramkrishna Forgings (www.ramkrishnaforgings.com) was promoted to IGC’s top ten in April but fell just outside of it again in May, in 12th position. It now represents 3.3% of the trust. A manufacturer of large forgings for trucks, initially for heavy commercial vehicles in India, the company now gets 60% of its business from overseas, mainly North America and Europe. Gaurav says it has taken on new clients which it has gained from the China Plus One strategy – India’s business strategy designed to encourage businesses to diversify their supply chains away from China. More recently it has started receiving more enquiries from South America and though it is a small cap business, is home to one of the largest automated presses in India. When COVID first hit in 2020, the stock fell but Gaurav topped up IGC’s holding. He bought shares in the company at different times for between 160 to 240 rupees. They are now worth 630 rupees each. Gaurav said Ramkrishna Forgings is an example of a company he has nothing but conviction in and knows well enough to double his exposure to in times of distress.

Other portfolio developments

Towards the end of last year, Gaurav added Dixon Technologies to the portfolio. This company has expanded its base to be an outsourced manufacturer for the likes of Xiaomi, Panasonic, Phillips and Samsung for items including televisions, mobile phones, and medical equipment. The manager believes the company is in the right place at the right time, as companies look to broaden their geographic production locations and while the Indian government is providing significant incentives to reduce its electronics import bill of over $40bn (mainly from China). Gaurav says Dixon has spent the first half of 2021 rapidly adding brands to its portfolio, across various segments, and is now set to grow at a ‘staggering’ pace over the next few years.

As mentioned earlier, Gaurav reduced financials exposure during the first wave of the pandemic but started building that back up again towards the end of 2020 and this year so far, though this has been exclusively in the banking space. IDFC Bank, which is a more retail focused bank, was promoted to the top 10 in April. Gaurav says it is well-capitalised and has used the Reserve Bank of India’s moratorium on recognising defaults to boost provision coverage ratios in anticipation of higher non-performing loans. Along with other private bank holdings (City Union, Federal Bank and IndusInd Bank) Gaurav believes IDFC First Bank will emerge amongst a pack of stronger survivors.

Other areas of interest include the tech start-up space, which is now home to more than 100 ‘unicorns’. While IGC does not invest in unlisted companies, Gaurav says he keeps a close eye on many of them and meets directly with their management teams. He believes there are many opportunities to be found as and when these names go public.

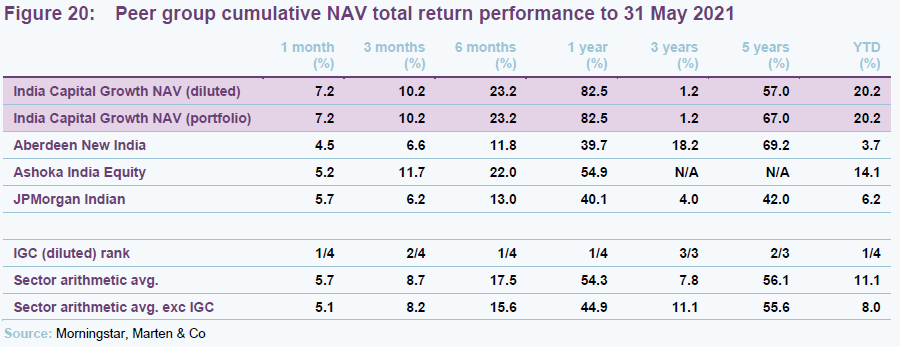

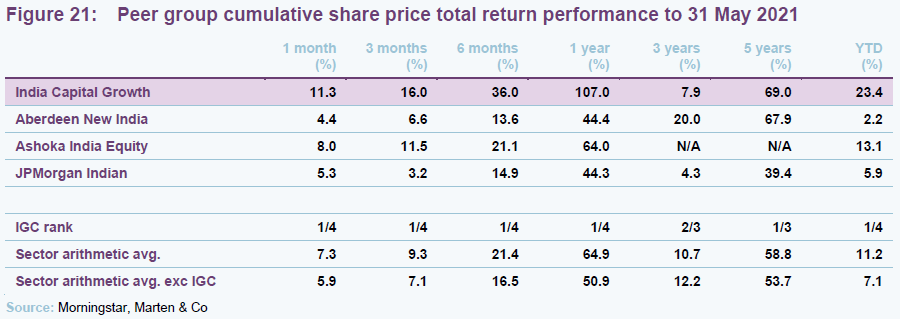

Peer group – marked improvement in IGC’s near term relative performance

Since the end of March, IGC has been a member of the AIC’s India sector, having previously been a member of the AIC’s Country Specialist: Asia Pacific-ex Japan sector. This change has had no effect on our peer group analysis as, reflecting the diverse range of funds in its previous sector (there were 12 different funds with a range of remits) we have previously focused our peer group analysis on the four pure Indian equity funds, which are listed in Figures 20, 21 and 22. Within this peer group, IGC is the most-focused on small and medium-sized companies.

As illustrated in Figure 20, there has been a marked improvement in IGC’s cumulative NAV total return performance relative to peers during the last 12 months, following the change in investment process. Performance over this period has been so strong that it has pulled up IGC’s performance over the longer-term periods. As illustrated in Figure 20, IGC’s diluted NAV now ranks second over the five-year period, with a performance that is marginally ahead of the sector average. Otherwise, IGC ranks first over one-month, six-months, one year and YTD. The continued strong performance since we last published in December 2020 reinforces the manager’s statement, at that time, that the changes to the investment process were bearing significant fruit, according to its own internal analysis. As we have said previously, if the adviser’s changes continue to drive outperformance, IGC will continue to move up the rankings over the longer-term periods as well.

Looking at Figure 21, a similar picture can be seen for IGC’s share price performance (in fact, the only period for which it doesn’t rank first is the three-year period, where it ranks second). We think that IGC is yet to feel the full benefit from its improved performance but, if it continues to outperform it peers, this should lead to additional interest from investors closing the discount and driving superior share price returns. Nonetheless, as illustrated in Figure 22, IGC’s discount is not out of line with those of the two largest funds in the sector. It is worth noting that, for a strategy such as this, longer-term time frames are generally considered to be more relevant to assessing performance, and we believe that the market may still be waiting to see if the recent strong performance is maintained.

As illustrated in Figure 22, IGC is the smallest of the four funds focused on India and listed in London and this is a significant reason why it has the highest ongoing charges ratio of this peer group. Ashoka India Equity (the next smallest fund) has a particularly low ongoing charges ratio, because it does not charge a base management fee, but unlike the rest of the peers charges a performance fee of 30% of outperformance (capped), measured over three years, to compensate. Consequently, in years where the performance fee falls due, its ongoing charges ratio will increase accordingly, pushing it up the rankings.

IGC is operating with the largest net cash position (unlike its peers, it does not utilise gearing). Volatility of NAV returns, as measured by the standard deviation of daily NAV returns over five years, are broadly comparable across the four peers, although IGC’s volatility is broadly in line with the sector average.

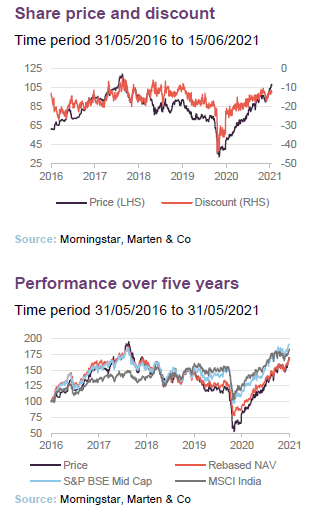

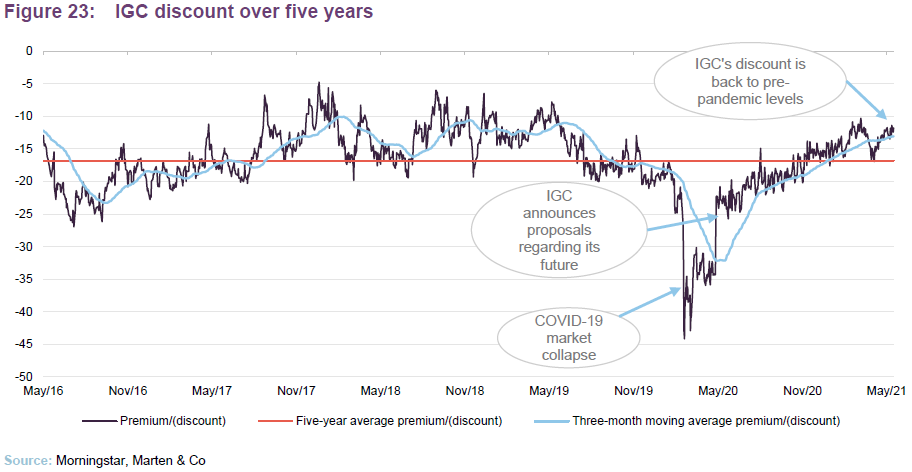

Premium/(discount)

Over the year ended 31 May 2021, IGC’s shares have traded consistently on a discount, ranging from 35.9% to 10.2%, with an average discount of 18.5%.

At 15 June 2021, IGC’s shares were trading at a discount of 11.8%, which, as illustrated in Figure 23, is more akin to its levels prior to the onset of the pandemic.

Like many other funds, IGC’s discount was impacted by the onset of the pandemic. As discussed in our notes of May 2020 and December 2020, IGC published a series of proposals regarding its future on 26 May 2020, which led to a dramatic narrowing of its discount. Following the announcement of these proposals, shareholders voted to approve IGC’s continuation on 12 June 2020. Readers interested in more details of the proposals should see our May 2020 note, which covered them in more detail. However, to recap, a summary of the proposals is provided as follows:

As we said in our December 2020 note, IGC has until December 2021 to prove itself but, as discussed in the performance section, it is clear that it has made an excellent start, with the fruits of the change in investment process clearly visible. As illustrated in Figure 23, reflecting both better than expected economic data, and welcome news on the development of a vaccine, IGC’s discount has continued to narrow as markets recovered.

However, in our opinion, IGC does not appear to have reaped the full benefits of its improved performance (in our December 2020 note, we highlighted that both an improvement in IGC’s relative performance and an improvement in sentiment towards mid-cap Indian stocks would be key catalysts for a narrowing of IGC’s discount).

We continue to think that if India is able to improve its vaccination rate as planned and is visibly able to get a better handle on controlling the virus, this might suggest that the trust would respond well to any improvement in India’s economy. We think that if there is the narrative change that the adviser expects, and IGC’s portfolio companies continue to see a marked uplift in performance, this is likely to provide momentum for the discount to continue to narrow, particularly as markets turn their focus towards India’s attractive valuations and its long-term opportunity to widen its manufacturing base.

Fund profile

IGC is an investment company listed on the Main Market of the London Stock Exchange. It invests in India, predominantly in listed mid- and small-cap Indian companies. The fund is aiming to generate capital growth for shareholders. IGC has not paid dividends in the past and the manager says it is unlikely to do so in the near future.

While IGC’s main focus is on Indian mid- and small-cap companies, the fund can and does hold large-cap stocks as well. The board and the manager use the S&P BSE Mid Cap Index (total return) for performance evaluation purposes, although the portfolio is not constructed with reference to this index. The other funds in IGC’s peer group benchmark themselves against the MSCI Index and therefore we have included this index within the report as well.

Exit opportunity

The introduction of a redemption facility last year gave shareholders the right to request the redemption of part or all of their shareholding on 31 December 2021 and every second year thereafter at an exit discount equal to a maximum of a 6% discount to NAV per redemption share.

Management arrangements

IGC has been managed since 2010 by David Cornell of Ocean Dial, a company owned by Avendus Capital Private Limited, which in turn is backed by KKR. He has been assisted in this since November 2011 by Gaurav Narain of Ocean Dial Asset Management India Private Limited, which is based in Mumbai. Gaurav has over 25 years of experience in Indian capital markets, having started his career as vice president of research for SG Asia. The seven-strong investment team is split between London and Mumbai. Each of the analysts is assigned responsibility for several industry sectors. The manager is responsible for monitoring portfolio risk and all dealing is done from London.

Ocean Dial manages two funds investing in India: IGC and an open-ended fund, Gateway to India fund. Ocean Dial had AUM of US$250 as at the end of

May 2021.

Recent developments

Earlier this year, Ocean Dial appointed two equity analysts to its Mumbai office, bringing the total number to six, including co-heads of equity Gaurav Narain and Tridib Pathak.

London-based Shahil Shah was also appointed as a dedicated ESG analyst and is now responsible for integrating ESG into the investment process across the trust’s investible universe of 135 companies, known as the ‘House of Ocean Dial’. Shahil was part of the original Ocean Dial investment team which was set up in 2005. He works with Gaurav Narain in conducting investment research for IGC and specialises in telecommunications, consumer, healthcare, and media. Shahil holds a Masters in Commerce and Finance from Mumbai University.

On 1 April 2021, Ocean Dial became a signatory to the United Nations Principles of Responsible Investment.

Lynne Duquemin was appointed as a non-executive director of IGC with effect from 1 June 2021. She has taken over from Peter Niven, who will step down from the board at the end of 2021. Lynne has over thirty years’ experience in financial markets, initially in London, before being seconded by Credit Suisse to Guernsey, Channel Islands, where she is still based. Lynne is a member of the CFA Society of the UK and holds the ASIP qualification. She is also a member of the CFA Institute, Fellow of the Chartered Institute for Securities and Investment, Chartered Director and Chartered Wealth Manager. Lynne was previously a non-executive director of Aberdeen Frontier Markets Investment Company Limited.

The next annual general meeting for India Capital Growth will take place on 14 July 2021.

Alignment of interest

Employees of Ocean Dial collectively hold 373,972 shares in IGC, while members of IGC’s board collectively own 112,500 shares between them. Combined, Ocean Dial employees and the three directors hold 0.4% of IGC’s issued share capital.

Previous publications

Readers interested in further information about IGC may wish to read our previous notes. You can read the notes by clicking on the links below:

| Compounding machine | Initiation | 23 March 2016 |

| Indian powerhouse | Update | 8 July 2016 |

| India at a significant discount | Update | 21 October 2016 |

| Full steam ahead | Annual overview | 29 March 2017 |

| Moving to the main board | Update | 30 January 2018 |

| A return to earnings growth | Annual overview | 26 June 2018 |

| Shakeout uncovers value | Update | 29 November 2018 |

| Discounted value | Annual overview | 1 October 2019 |

| Needs more time | Update | 26 May 2020 |

| A win-win scenario | Annual overview | 15 December 2020 |

The legal bit

This marketing communication has been prepared for India Capital Growth Fund Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.