Second quarter of 2023

Investment Companies | Quarterly roundup | July 2023

Kindly sponsored by abrdn

Calm like a bomb

As we wave goodbye to the first half of 2023, we can reflect on what may well go down as one of the most bizarre periods in recent market history. The dominant assumption to begin the year was that the perennially resilient consumer would finally give up the ghost, driving corporate earnings into the ground and sending developed markets around the world into recession. With any luck, the slow down would finally nip that pesky inflation in the bud and central banks could get back to what they do best, cutting rates; all would be well.

Unfortunately, this reality did not quite play out as expected, with rates still touching cycle highs as they exited June. Investors refused to let that get in the way of a good story however, with global markets clawing back the bulk of their 2021 losses over the first six months of the year.

It was not all smooth sailing as the collapse of US bank SVB threatened to precipitate the beginning of the interest rate easing cycle. However coordinated intervention averted contagion, and bond yields resumed their merry jaunt up towards 5% and beyond. All the while, US tech led global markets higher as investors piled into the AI trade, forgetting the sector’s perceived correlation with higher discount rates.

This resilience has left many wrong footed, particularly for those who thought the 2021 rally and subsequent collapse was the death knell for the long duration, growth trade which has now comfortably outperformed its value counterpart so far this year. With valuations approaching extremes and markets faced with a raft of deteriorating leading indicators it is easy to assume that the 2023 vintage of the bull market has run its course, however if this year has shown us anything it is that things rarely turn out as expected.

New research

So far in Q2, we have published notes on: Temple Bar, Montanaro UK Smaller Companies, abrdn European Logistics Income, Vietnam Holding, Aquila European Renewables, Polar Capital Technology, Polar Capital Global Financials, Urban Logistics REIT, Edinburgh Worldwide, HydrogenOne Capital, JPMorgan Multi-Asset Growth & Income, Rights and Issues, Gulf Investment Fund, RIT Capital Partners.

At a glance

Winners and losers

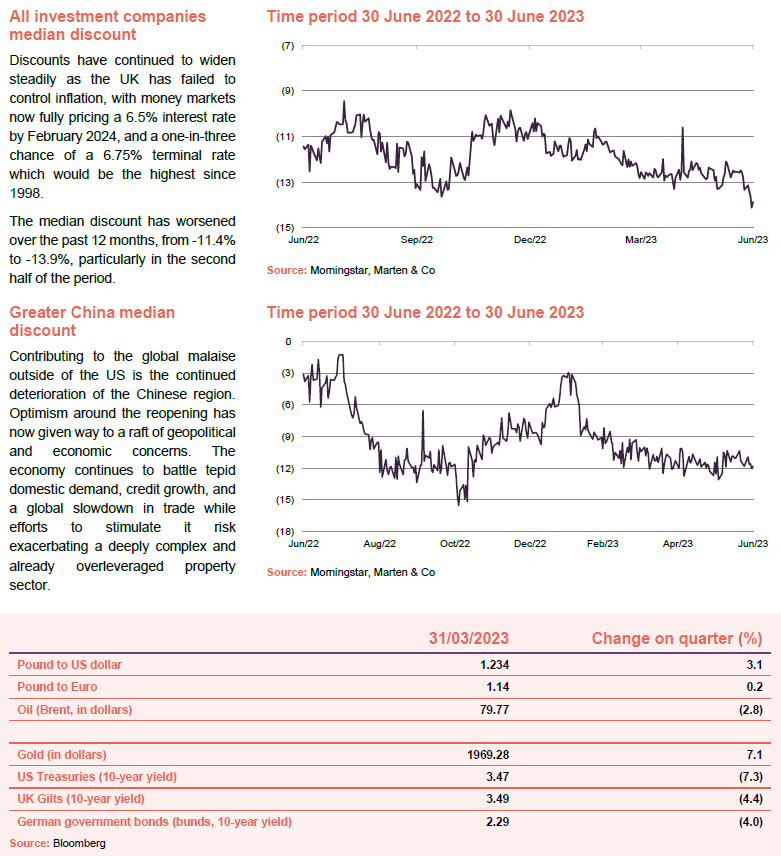

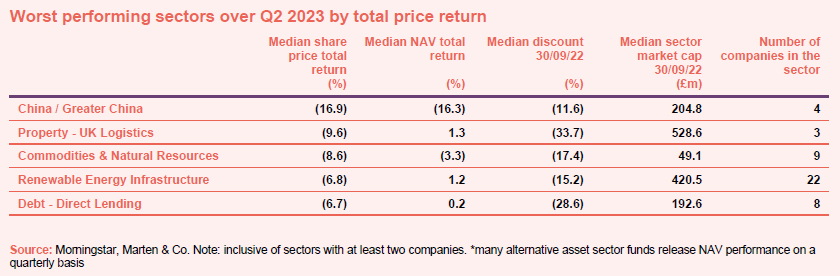

Median NAV for the quarter fell 0.08% while discounts continued to widen, falling from 12.5% at the end of Q1 to 13.8% in Q2 as the median share price fell -1.3%.

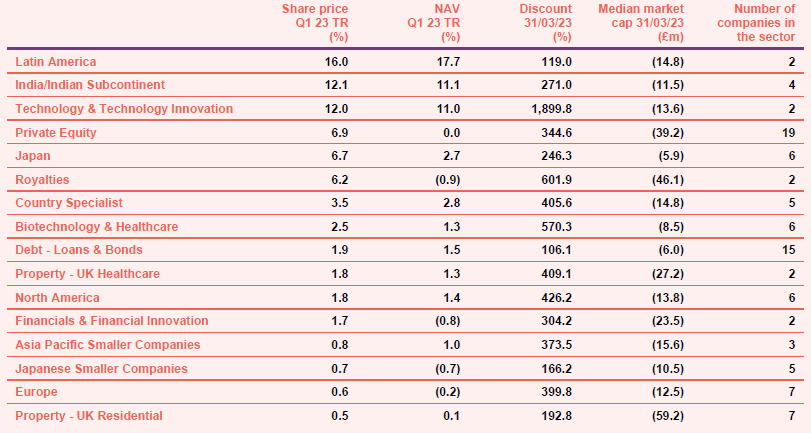

By sector

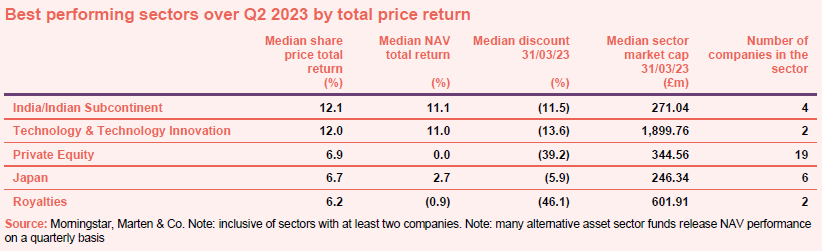

Much of the focus over the last quarter has been directed at the resilience of developed markets in the face of a seemingly never-ending list of potential negative catalysts. During that time however, a number of emerging economies have outperformed, leaning on macro stability and supportive fiscal spending made possible by moderating inflation. India leads the way, with the sector up over 12% for the quarter. Over the past year, its benchmark NIFTY500 index is up 21%. With a pro-growth budget and an increasing focus on industrial policy and domestic consumption, the economy appears to be on steady footing, with risk assets tracking its world leading growth rates.

Latin American is another emerging economy that has rebounded strongly – up 8.9% – although the sector has been left off the best performers list by virtue of BlackRock Latin America Trust being the last fund standing following the wind up of the abrdn Latin America trust earlier this year – our sector results are screened with a requirement of having a minimum of at least two funds. Within the Country specialist sector, the Vietnam Enterprise and Vietnam Holding funds were also up strongly, boosted by relatively low inflation in the region, improved consumer spending, and increasing tourist activity. The Country Specialist sector, made up predominantly of trusts from Vietnam, was also up strongly coming in just outside the list as the sixth best performing sector for the quarter.

The outperformance of the Technology & Technology Innovation sector follows on from its market beating performance in Q1. Its growth has been well documented, particularly regarding the concentration in US markets with the top seven companies on the tech dominated NASDAQ, adding one entire Germany’s worth of market cap over the first six months of the year. Along with the AI binge, large cap tech has benefited from the relative safety provided by established, secular cashflows and unparalleled balance sheet strength which appears to have insulated the sector from continually rising discount rates.

After a challenging 12 months, Private Equity has begun to claw back performance as the appetite for deal making picks up and dry powder starts to find its way back into the system. Apax Global Alpha led the way for the sector, up 19.1%. While it is not yet clear what drove the returns, over 50% of the fund is invested in the tech, digital, and internet sectors which have tended to follow their listed equivalent assets higher over the past few months. The Royalties sector performance was generated entirely through Round Hill Music, with shares up 12% for the quarter, benefiting from several stock specific factors including the use of its music in a number of successful advertising campaigns.

Continuing the theme of expectations leading into 2023, investors were bullish on the outlook for China, and by extension, global commodity demand, anticipating a surge of spending stemming from the end of China’s zero covid policy. As it has turned out, the two sectors are among the worst performing asset classes on the planet.

The UK Property Logistics sector has suffered as inflation continues to run unabated in the UK, while concerns around demand for logistics space and commercial real estate have added to the misery. Both Direct lending and Renewable Energy Infrastructure have struggled with higher risk-free rates and capital flows out of more risky sectors of the market.

Top 10 performers by fund

As discussed on page four, the two emerging market funds lead Q2 performance with BlackRock Latin America and India Capital Growth growing NAV by 18% and 16% respectively while Ashoka India and Gulf Investments followed closely behind. Investors have piled into Latin American funds attracted by high real yields and an unexpectedly resilient economy, with the region now supporting five of the world’s top eight performing currencies.

The Technology & Technology Innovation sector is also well represented as expected with a number of funds holding substantial positions in market leading tech including NVDA, APPL, MSFT and FB. The performance of chip designer NVDA highlights the strength of the rally with the stock up 54% for the quarter and 196% year to date as investors piled into the AI trade, bookended by an overnight market cap gain of $150bn, one of the largest one day moves in history.

RTW Biotech benefited from the sale of portfolio company Prometheus Biosciences to Merck for $11bn. The sale resulted in total proceeds for RTW of $99.1m on total invested capital of $8.4m, representing a 11.8x multiple.

While the share prices of the Renewable Infrastructure sector have suffered from the flow of risk capital, the underlying fundamentals of the funds have remained robust. Greencoat Renewables in particular has benefited from a number of recent acquisitions with the latest a NAV accretive purchase of Dalquhandy wind farm in Scotland from BayWa’s renewables division for a total consideration of approximately £50m.

In terms of share price movement, Civitas Social Housing REIT rose on the announcement of a take private offer from Hong Kong-based investor CK Asset Holdings. The 80p per share cash offer represented a 44.4% premium to Civitas’ closing share price on 5 May. During the company’s annual results which were released on 29 June, the board revealed the sale was now unconditional, with one commentator noting the price was ‘extremely disappointing’ for shareholders. The initial announcement had a knock-on effect for the sector, with Triple Point Social Housing also rallying 17%.

The impressive return for HydrogenOne of almost 35% comes after a challenging period for the company which at one point had fallen almost 50% from its peak, suffering from the rotation away from more risky sectors of the market. The stock bounced back strongly off its lows, perhaps boosted by a more risk-on mood precipitated by the AI trade. The company also announced a trading update which highlighted a positive industry outlook and continued NAV growth and this may have added to the positive sentiment. Unfortunately for investors, shares have turned over once again, down more than 20% from their recent peak.

Despite investing in very different stocks, returns for Chrysalis have tended to track closely to those of HydrogenOne, adding weight to the risk on narrative given it is also exposed to assets at the higher growth end of the spectrum. In addition, the company also announced its annual results, highlighting solid operational performance. As with HydrogenOne, the stock has fallen since the end of the quarter.

Bucking the trend we have seen in property trusts, which have generally performed poorly during the quarter, CT Property rallied on the news that LondonMetric had reached an agreement on the terms of an all-share offer that will see the company acquire the entire share capital of CT Property.

The returns of abrdn Japan reflect the continued momentum in the Japanese stock market which is now up almost 30% year to date. However, it was the merger plan with Nippon Active Value that drove the share price higher over the second quarter.

Bottom 10 performers by fund

Things have gone from bad to worse in Chinese markets, as optimism around the reopening gave way to a raft of geopolitical and economic concerns. The economy continues to battle tepid domestic demand, credit growth, and a global slowdown in trade with efforts to stimulate risk exacerbating a deeply complex and already overleveraged property sector. The outlook remains just as uncertain with the yuan in constant decline, and the ever-present threat of escalating trade restrictions weighing further on confidence.

Outside of China, Schroder Capital Global Innovation’s struggles continued with the fund’s persistent discount refusing to budge from around 50%. A continuation vote for the fund is planned for 2025. Elsewhere, Baker Steel resources has suffered from the general malaise in commodity prices which have been trending down as global growth expectations fall.

In terms of share price movement, the property sector, particularly in the UK, suffered as inflation continues to run unabated with money markets fully pricing a 6.5% interest rate by February 2024, and a one-in-three chance of a 6.75% terminal rate which would be the highest since 1998.

While we did see a recovery in the appetite for risk during the AI surge, generally speaking the worst performers for the quarter reflect the rotation away from riskier sectors of the market, including small caps, growth capital, biotech, and nascent renewable infrastructure – companies perceived as having large capital requirements and relatively weak balance sheets which are reliant on external funding for growth.

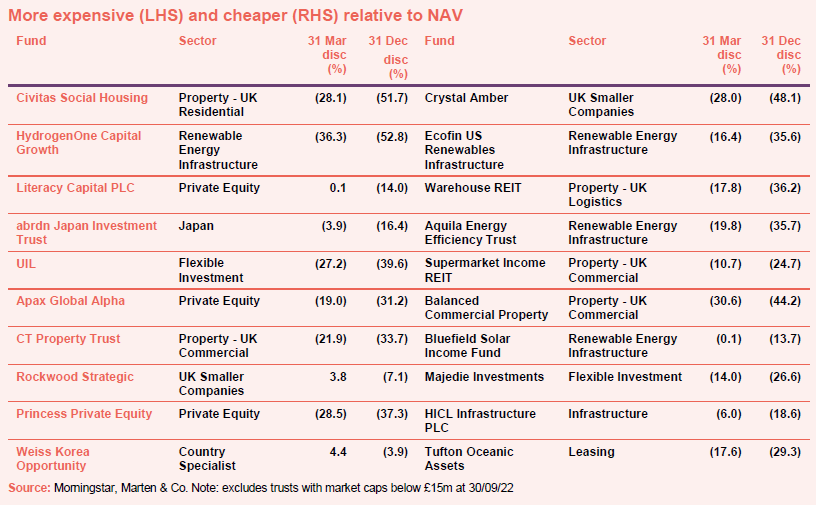

Getting more expensive

Of the funds not mentioned above, Literacy Capital benefited from the sale of its fourth largest asset for a 48.9% premium to carrying value while UIL staged a modest recovery, bouncing around on the fortunes of its largest asset, Somers Ltd, which makes up almost 40% of the fund. It is not immediately clear what drove the returns of the two private equity funds, Apax, and Princess, however both are recovering after a challenging 12 months. Rockwood continues to benefit from impressive portfolio execution. Over the most recent financial year, the company completed the most active period in its history, with 13 new investments, which contributed to outperformance of more than 35%. This momentum has continued and the fund now trades on a premium of 3%, one of only two companies in the UK smaller companies sector to do so.

Getting cheaper

For those funds whose discounts continued to widen, the dominant themes already discussed were on display with the Property and Renewable Energy Infrastructure sectors dominating the list. Elsewhere, Crystal Amber continues to trade down following its continuation vote failure last year.

Money raised and returned

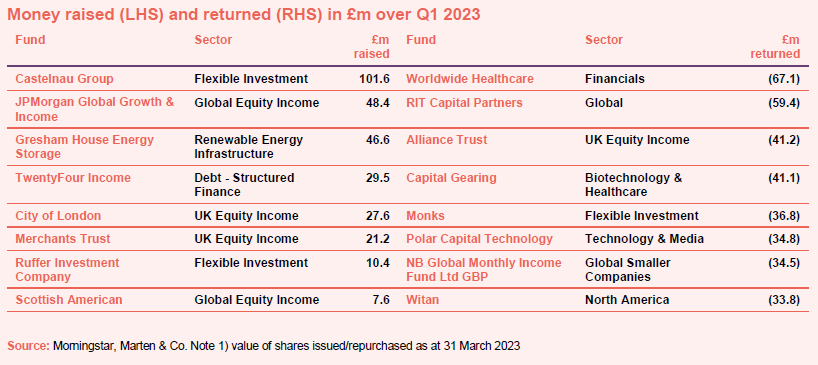

Money coming in

Castelnau Group led the way for the quarter raising funds for its share of the consortium takeover of Dignity, the UK funeral service provider. Since its shares returned to a premium at the end of 2022, JPMorgan Global Growth and Income has been aggressively raising capital along with usual suspects TwentyFour income, City of London, Merchants, and Ruffer. Gresham House Energy Storage successfully raised £50m to fund the first closing of Project Iliad, a battery storage project in California. Scottish American shares also reached a premium at the beginning of the quarter, with management taking the opportunity to issue equity.

Money going out

In terms of money going out it was a case of the usual suspects as a number of larger trusts continued to operate their respective buy back policies.

Major news stories over Q2 2023

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled.

| · HICL Infrastructure AGM – 19 July

· Artemis Alpha manger presentation – 19 July · CT UK High Income AGM – 20 July · Fidelity China Special Situations AGM – 20 July · Biotech Growth AGM – 27 July · Cordiant Digital Infrastructure AGM – 28 July |

· Syncona AGM – 1 August

· Triple Point Energy Transition – 31 August · abrdn New India online presentation – 14 September · STS Global Income & Growth AGM – 20 September · Schroder British Opportunities AGM – 27 September · abrdn New India AGM – 27 September |

Interviews

Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest discussing a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 14 April | GABI, MLI | Stephen Inglis | Regional REIT |

| 21 April | CSH, HGEN, RTW, SOHO | Jean Roche | Schroder UK Mid Cap Fund |

| 28 April | NESF, RHM, TLEI | Craig Baker | Alliance Trust |

| 5 May | AEET/ AEEE, CHRY | Nicholas Weindling | JP Morgan Japanese Investment Trust |

| 12 May | BSIF, CSH, HOME, HGEN, NESF, ORIT, USF | Kamal Warraich | Canaccord Genuity Wealth Management |

| 19 May | BPCR, GRID, AJIT | Michael Anderson | Aquila Capital European Renewables |

| 26 May | CTPT, HOME, LMP, MAVT, RMII | Andy Ho & Khanh Vu | VinaCapital Vietnam Opportunity Fund |

| 2 June | AERI | Iain McCombie | Baillie Gifford UK Growth |

| 9 June | CSH, INV, TLEI | James Thom | abrdn New Dawn |

| 16 June | CREI, HAN, PNL | Matthias Siller | Barings Emerging EMEA Opportunities |

| 23 June | CSH, MNKS, ADIG | Jonathan Hick | Triple Point Energy Transition |

| 30 June | BGLF / BGLP, RNEW / RNEP, MWY | Gervais Williams | Milton UK Microcap |

Research notes published over Q2 2023

Oakley Capital Investments – The best-performing UK-listed private equity fund

Oakley Capital Investments (OCI) invests in private equity funds managed by Oakley Capital Limited (Oakley). OCI is, as we show on page 22, the best-performing fund in its peer group over five years. As evidenced by its latest full-year results, this has been achieved in spite of a difficult macroeconomic backdrop.

RIT Capital Partners – A rare opportunity to buy a unique trust

Last year was a turbulent one for markets and, unusually, there were few places for investors to hide, with nearly all asset classes recording large declines. RIT’s net asset value (NAV) also fell in 2022, and this appears to have unnerved some investors who, after 10 years of consecutive NAV uplifts, may have come to believe that RIT‘s portfolio would never decline in value. This has led to RIT Capital Partners (RIT) coming in for some criticism recently, with some investors claiming that RIT has ‘changed its stripes’. As a result, the shares have come under short-term pressure and have been selling at a rec discount to NAV against recent history of around 23%. We believe this is unjustified and presents a rare opportunity to buy a unique trust with an impressive long-term track rec.

The team behind the Gulf Investment Fund (GIF) has more than proven its worth as an active manager, having negotiated the turbulent markets of 2022 to deliver truly impressive outperformance of both GIF’s peers and its benchmark. In particular, in recent trading activity, it has eschewed some of the more highly-valued regions, and the globally exposed petrochemical sector (as at 31 December 2022, GIF had no direct exposure and limited indirect exposure), in favour of more-attractively-valued opportunities focused on the domestic economies of the Gulf. This includes a substantial investment into local companies in Saudi Arabia. GIF continues to offer significant diversification benefits for global portfolios, thanks to the Gulf’s idiosyncratic markets.

Rights and Issues Investment Trust – Under new management, same high conviction approach

Following the retirement of Simon Knott, who managed Rights and Issues (RIII) for 39 years, RIII’s portfolio is now the responsibility of Dan Nickols and Matt Cable, part of the UK small and mid-cap team at Jupiter Asset Management. The Jupiter team aims to ensure that RIII continues to offer access to a focused portfolio of handpicked UK small and mid-cap companies, though the trust will be bolstered by a significant increase in the investment management resource dedicated to the portfolio.

JPMorgan Multi-Asset Growth & Income – Caution in the face of volatile markets

In a world of volatile equity markets and uncertain futures, MATE offers investors a refreshingly straightforward target of achieving an average of 6% compound annual returns over a rolling five-year period and paying an inflation-linked dividend. MATE has now passed its five-year anniversary, and its life has been marked by two of the worst bear markets in recent memory. Given that we are in the grip of a painful downturn, it is unsurprising that MATE has fallen short of its target return. Commendably, the team has not taken on more risk in an attempt to catch up. As evidence of this, the standard deviation of MATE’s net asset value (NAV) returns over the past five years is half that of the global equity market.

HydrogenOne Capital Growth (HGEN) is the only pure play green (renewables-powered, no carbon dioxide produced) hydrogen fund available on the London listed market. It offers diverse exposure to nine exciting private hydrogen investments and a hydrogen production facility that is being developed in Germany.

Edinburgh Worldwide – The output of innovation is alive and well

As interest rates have risen in response to rising inflation, Edinburgh Worldwide (EWI) – with its focus on small cap global growth stocks – has given up a significant portion of its previous outperformance (see page 17). The trust finds itself in a somewhat unusual position in that it has moved to a significant discount to NAV, about a 20% discount versus a five-year average of 2.5%. This comes at a time when global small cap stocks are trading at a modest discount to global equities, rather than their usual significant premium (see page 6).

Urban Logistics REIT – Fundamentals strong as market stabilises

The industrial and logistics sector suffered its largest fall in value on rec in the second half of 2022, even eclipsing that of the global financial crisis, as investment yields moved out rapidly to keep pace with interest rates. The fall in Urban Logistics REIT’s (SHED’s) share price was even faster, putting it on a wide discount to net asset value (NAV). However, evidence that values have bottomed out is building, with MSCI’s quarterly UK property index reporting uplifts in March for the first time in months. Whilst SHED has yet to announce its end of March NAV (due in June), its current discount to NAV of 27.6% seems very attractive.

After years of squeezed margins thanks to ultra-low interest rates, banks’ profitability is increasing (in part, as the spread between the interest rates that they pay on deposits and the rates that they charge borrowers widens). However, higher rates have brought increased recession risk and, as we discuss from page 4 onwards, have exposed inept risk management within some US regional banks, with some high-profile bank failures.

An inflection point in artificial intelligence (AI) – which combines computer science and datasets to enable problem-solving – is close to being reached. Major improvements in output and rapid adoption make the likelihood that it will become a general purpose technology – one that can affect an entire economy, like the computer and internet before it – and impact on all parts of everyday life an inevitability. Polar Capital Technology’s (PCT’s) manager, Ben Rogoff, has a steadfast conviction in the all-encompassing potential of AI and has been positioning the portfolio towards AI winners, with the majority of PCT exposure now in companies that he believes will be AI beneficiaries.

Aquila European Renewables (AERI) is about four years old. Since launch, it has built up a 464MW portfolio of operational solar, wind and hydropower projects, spread across six European power markets. It has also generated returns in line with the target that it set at launch, returning an average of 7.2% per year against a target of 6.0–7.5%. For 2023, AERI is targeting a dividend of 5.51 cents per share (that is euro cents – given that it invests in Europe, it presents its figures in euros), 5% ahead of the target it had for 2022. Importantly, the board reckons that this will be covered 1.8x.

Vietnam Holding (VNH) has put in a compelling performance in net asset value (NAV) total return terms versus competing funds investing in emerging Asia (see page 25), but this is not being reflected in its share price. Presently, its share price is at a 13.5% discount to its NAV. This is despite Vietnam’s long-term structural growth drivers remaining intact (see page 7) and a strong outlook for GDP growth over the next five years (the forecast is for an average of 6.7% a year through to 2028).

abrdn European Logistics Income (ASLI) is riding out the storm of market valuation declines, with a focus on managing its portfolio and securing income. It has recently completed a number of letting renewals across its portfolio (see page 9) and uncapped, annual inflation-linked rental uplifts on two-thirds of its leases offer further promise. Evidence that valuations in the European logistics real estate sector are stabilising is growing, not least through the sale of an asset from ASLI’s portfolio at a small premium to book value, which should serve to support its net asset value (NAV).

After a tough year for investment strategies focused on quality and growth of all kinds, Montanaro UK Smaller Companies (MTU) may finally be seeing the light at the end of the tunnel, thanks to the possible plateauing of interest rates. Manager Charles Montanaro remains focused on picking high-quality stocks with long-term growth potential, sticking with the approach despite the headwinds of early 2022. In fact, the sell off in UK small caps has meant that MTU has become even more attractive on a fundamental basis, with many of its holdings trading on attractive valuation multiples, despite demonstrating the same growth potential.

We are quickly approaching year three of Temple Bar’s rehabilitation under the new management of Redwheel, who took over the fund in November 2020. While sticking to its value-seeking roots, managers Ian Lance and Nick Purves favour a more balanced approach than the deep value model employed by the fund’s previous manager, which had been a drag on performance through the growth dominated decade that followed the global financial crisis (GFC). So far, the change has paid off handsomely, with the shares up 76% since the handover, compared 35 percentage points ahead of the benchmark UK index. Although it might be disingenuous to attribute the recent outperformance purely to the change in management, considering the dramatic swings we have seen in equity markets since the pandemic, the team certainly appears to have established a foundation for ongoing success.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

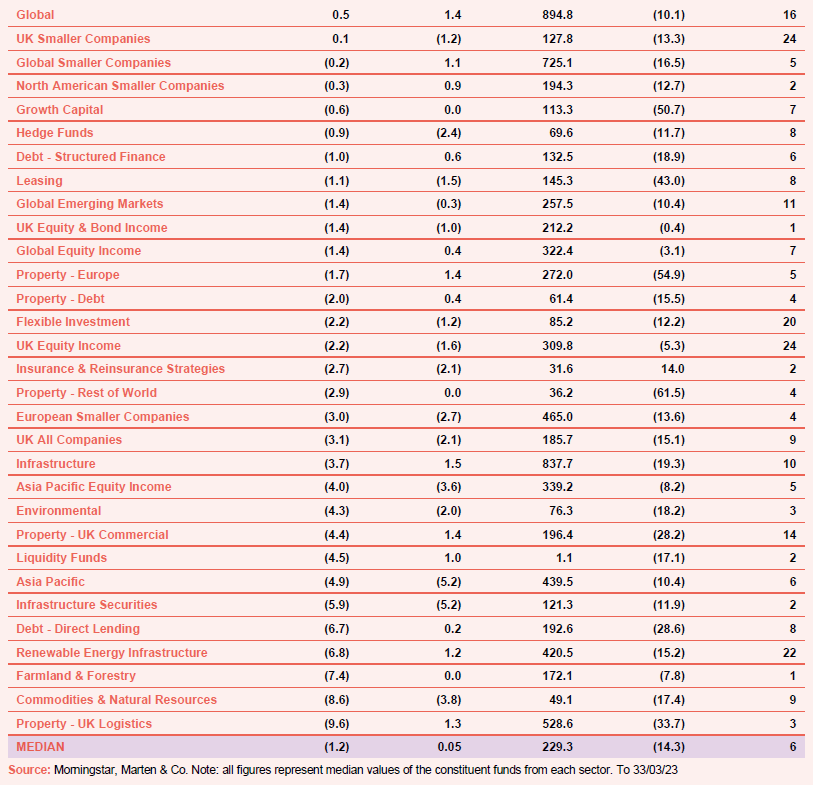

Appendix 1 – median performance by share price return over Q2 2023

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.