Real Estate Roundup

Kindly sponsored by abrdn

Performance data

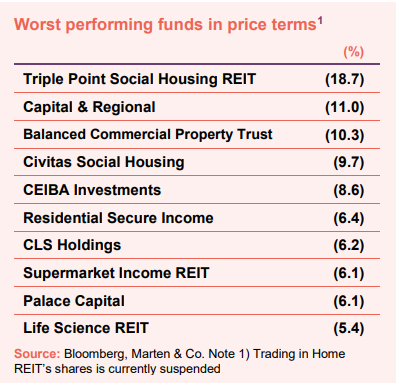

January’s biggest movers in price terms are shown in the charts below.

2023 started positively for the property sector, with a median average share price uplift of 1.3%. A gloomy economic outlook at the end of 2022 saw many property companies’ share prices fall to substantial discounts to NAV, which now look attractive. Leading the way was London office developer and landlord Great Portland Estates, which announced that the final quarter of 2022 was a record for lettings activity as best-in-class offices continue to demonstrate occupier resilience. The property titans – Land Securities and British Land – both saw decent share price performance as investors look for value, while flexible, serviced office providers Workspace Group and IWG continued a run that has seen their share prices rise 23.4% and 40.6% over three months respectively. Retail heavyweight Hammerson and retail park owner NewRiver REIT also continued a resurgence in their share prices, with Hammerson up 40.3% and NewRiver up 25.1% over three months. Logistics specialist Tritax Big Box REIT bounced back in January, having seen its share price fall 44.3% in 2022 as valuations in the logistics sub-sector plummeted following a rise in interest rates.

The share prices of both social housing specialists Triple Point Social Housing REIT and Civitas Social Housing were hit after an enforcement notice was served on one of their tenants – My Space (which makes up 7.9% of Triple Point’s annual rent and just 1.3% of Civitas’s). Both companies, which are looking to re-assign the leases to other housing associations, may also have been impacted by the ongoing troubles of Home REIT (details of which can be found on page 3). However, the properties held by both social housing players deliver mid- and high-acuity care in a highly regulated sector (which is not the same as with homeless accommodation). Other property companies to suffer a share price fall in January include secondary shopping centre landlord Capital & Regional, which ended a run of share price gains at the end of 2022. Supermarket Income REIT suffered a 6.1% share price decline despite announcing it had taken a majority stake in a Sainsbury’s-let portfolio (more details on page 4). Life Science REIT’s share price continues to disappoint despite positive fundamentals in the nascent sub-sector and leasing momentum at the company (further information on page 4).

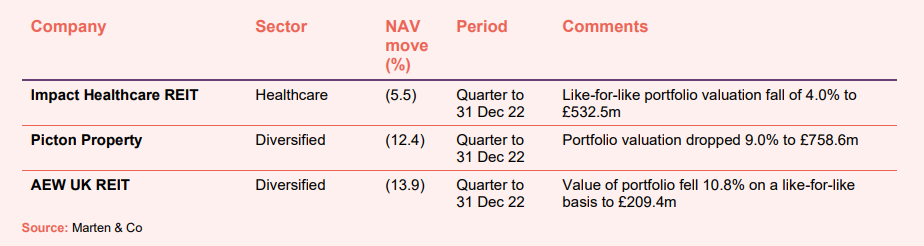

Valuation moves

Corporate activity

Home REIT’s troubles continued in January. Trading in its shares were suspended at the start of the month after it missed the statutory deadline for publishing its annual results due to an need for an enhanced audit following allegations made by a short seller. Later in the month the company confirmed reports that some of its largest tenants were withholding rent and the month ended with further worrying news that allegations of bribery at the company were being investigated by the National Crime Agency. The company is due to hold its AGM on 20 February where it will update shareholders on its plan to move forward.

Circle Property proposed a return of capital to shareholders by way of the issue of B Shares. This will allow the company to make successive bonus issues of redeemable B Shares to shareholders and to redeem them shortly thereafter. Subject to the passing of the resolution at an Extraordinary General Meeting, the board expects that the first return of capital of at least £30m, being £1.03 per share will take place in March 2023. The company has suffered limited liquidity in its shares and a persistent discount to NAV since it listed in 2016. In February last year it announced a strategy to sell its assets and return money to shareholders.

Land Securities appointed Sir Ian Cheshire as an independent non-executive director and chair designate. Sir Ian will join the board on 23 March 2023 and will succeed Cressida Hogg as chair on 16 May 2023, when she retires after almost five years as chair and over nine years on the board. Sir Ian is currently chair of Channel 4, Spire Healthcare Group Plc, UK investment trust Menhaden Resource Efficiency Plc and serves as non-executive director at BT Group Plc. He will step down as chair (but remain as non-executive director) at Menhaden Resource Efficiency Plc on 16 May 2023 and retire from BT Group Plc at their AGM in July 2023 to ensure he has sufficient capacity to act as chair of Land Securities.

Great Portland Estates announced that non-executive director Charles Philipps will retire from the board on 30 March 2023 after nine years of service. He will be succeeded as senior independent director by Nick Hampton, who joined the board in October 2016.

Major news stories

- Land Securities sells City office for £350m

Land Securities sold One New Street Square, EC4 to Chinachem Group for £349.5m. The sale price compares to a September 2022 valuation of £362.8m, but crystallises a total return on capital averaging 10% per annum since its acquisition of the site in June 2005 and subsequent redevelopment in 2016. One New Street Square is fully let to Deloitte, with a 14-year unexpired lease term remaining and a current annual net rent of £16.8m.

- Supermarket Income REIT increases Sainsbury’s JV stake

Supermarket Income REIT acquired a further 25.5% stake in a portfolio of 26 Sainsbury’s supermarkets for £196m, resulting in its ownership of the joint venture increasing to 51% (the remaining 49% interest is held by Sainsbury’s Plc). The ownership structure of the portfolio will contractually unwind in 2023, when Sainsbury’s will acquire 21 of the stores for £1.04bn. Supermarket Income REIT will receive a minimum of £380m in cash from Sainsbury’s in two tranches for the sale of the 21 stores, £264m in March 2023 and £116m in July 2023.

- Urban Logistics REIT buys five assets for £48m

Urban Logistics REIT acquired five new assets for a total of £48m at a net initial yield of 6.0%. It bought a portfolio of four assets for £39.5m and a separate asset for £8.7m. All of the assets are income producing but with short- or medium-term asset management opportunities.

- Derwent London makes £54m City sale

Derwent London sold 19 Charterhouse Street, in the City of London, for £54.0m. The 63,170 sq ft building, which was purchased in 2013 for £41.3m, is occupied by the London College of Accountancy at a rent of £2.6m a year on a lease expiring in August 2025. The sale price represents a 4.6% net initial yield and a small discount to June 2022 book value.

- Impact Healthcare REIT bags portfolio for £56m

Impact Healthcare REIT acquired a portfolio of six care homes for £56m, which will partly be paid in cash and partly with an issue of new shares to the vendor Morris Care. The portfolio has 438 beds, with five in Shropshire and one in Cheshire.

- LondonMetric report strong logistics demand

LondonMetric completed 62 lettings, lease regears and rent reviews in the four months since 30 September 2022, adding £2.4m of annualised rent, delivering an average uplift of 21% against previous passing.

- Primary Health Properties grows in Ireland

Primary Health Properties acquired Irish property management business Axis Technical Services Limited and signed a long-term development pipeline agreement providing access to a €50m pipeline of future primary care projects in Ireland.

- Life Science REIT completes two lettings

Life Science REIT announced two lettings across its portfolio. It has let 4,887 sq ft of the ground floor of Building One at Oxford Technology Park to Oxford Ionics Limited, an Oxford University spin, and 7,322 sq ft at its Rolling Stock Yard asset in London to a life science company backed by Syncona.

- Circle Property continues disposal programme

Circle Property sold Victory House, 400 Pavilion Drive, Northampton for £2.75m, as it continues to sell down its assets and return capital to shareholders. The 22,300 sq ft office building was acquired by the Group in 2011 for £1.7m and valued at £3.2m at 31 March 2022.

- Custodian Property Income REIT puts retail asset under the hammer

Custodian Property Income REIT sold a high street retail unit in Bury St Edmunds at auction for £0.54m, 35% ahead of valuation. It had recently increased the lease term by five years.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Laura Elkin, manager:

Following interest rate rises and the unfolding UK macro-economic backdrop, real estate valuations across all market sectors, in particular at the prime end of the industrial and warehousing sector, fell significantly during the quarter. The value of the Company’s assets has not been immune from this trend with like-for-like value loss of 10.82% during the quarter ending 31 December. Nevertheless, this compares favourably to wider market declines with the CBRE monthly index showing capital value falls of 6.8%, 5.5% and 3% for all UK property in October, November and December respectively. This indicates total value loss in the index of 14.57% during the quarter.

Volatile markets can present significant opportunities for an actively managed value strategy such as our own and, following a number of timely disposals which helped to maximise the values of key assets during the summer of 2022, we purchased two high-quality retail assets over the period. During the quarter, vendor requirements for sale led to valuations moving materially in favour of purchasers and this has allowed AEWU to access quality locations at more favourable pricing. This opportunity is also demonstrated in our investment pipeline where attractive assets in a number of sectors can currently be bought at income levels that are accretive to the Company’s earnings and at capital values in line with their long-term fundamentals. Looking forward, we are confident that the supply of value opportunities will continue during the first half of 2023 and are excited to progress with some of these using our available cash resources and capital if it can be efficiently recycled.

The Company’s diversified exposure and active asset management style help provide investors with counter-cyclical performance from some assets, with the values of several properties bucking wider market trends – either gaining or holding value during the quarter as a result of accretive business plans. The Odeon Cinema in Southend on Sea increased in value by 37 per cent. during the period as a result of a completed lease renewal. In addition, four new leases or agreement for leases were completed at the Central Six Retail Park in Coventry and the value of the asset remained the same during the quarter. Further capital and income growth is expected in future periods as a result of our focus on active asset management.

Lena Wilson, chairman:

During the quarter we have seen the impact of market volatility on our property portfolio valuation. Our modest gearing level, predominately fixed rate loan facilities and strong dividend cover have helped to mitigate the impact on net assets. Encouragingly, looking at the MSCI Monthly Index at an All Property level, rental growth remains positive and the rate of capital decline reduced in December relative to October and November.

Real estate research notes

abrdn European Logistics Income – Negotiating choppy waters

Grit Real Estate Income Group – Going for growth

abrdn Property Income Trust – Laser focus on the basics

Tritax EuroBox – Opportunity knocks

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.