Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

May’s biggest movers in price terms are shown in the chart below.

Unsurprisingly, St Modwen Properties saw a big rise in its share price in May having received a cash offer for the business (logistics developments and a housebuilding arm) from Blackstone, valuing it at a big premium to net asset value (NAV). Its share price was up 26.5% in the month. BMO Commercial Property Trust continued its share price resurgence over the past three months, with another double-digit monthly gain. Its share price was up 24.9% in three months to the end of May, which saw its discount narrow to 25.8%.

Flexible office space provider Workspace witnessed a 10.5% share price gain after reporting enquiry levels and lettings picked up measurably as lockdown restrictions started to ease in the UK. The three listed self-storage specialists – Big Yellow Group, Safestore and Lok’n Store – made it into the top 10 best performing property companies in May as each reported significant revenue gains. Warehouse REIT reported a big NAV increase in full-year results during the month, as values continue to rise in the industrial sector.

While generalist real estate investment trusts (REITs) have mostly seen share price gains this year as the country emerges from the depths of the pandemic, several featured in the worst performing property companies in May. Bottom of the list was Standard Life Investments Property Income Trust with an 11.9% share price fall.

BMO Real Estate Investments, Picton Property and Custodian REIT also saw their share price come off. Despite this, all four are up in 2021 (by 7.0%, 18.7%, 14.2% and 10.5% respectively). Cuban real estate company CEIBA Investments reported a slide in its NAV in the year to the end of 2020 of 6%, mainly driven by a fall in the value of its hotel assets, which have been severely impacted by the pandemic. Tritax EuroBox’s share price fell 7.0% in May despite reporting strong half-year results and swiftly deploying the proceeds of its €230m equity raise. West End of London landlord Capital & Counties also suffered a slight drop in its share price in May, although the group is up 19.2% in the year-to-date as it gears up for a full reopening of retail and leisure assets.

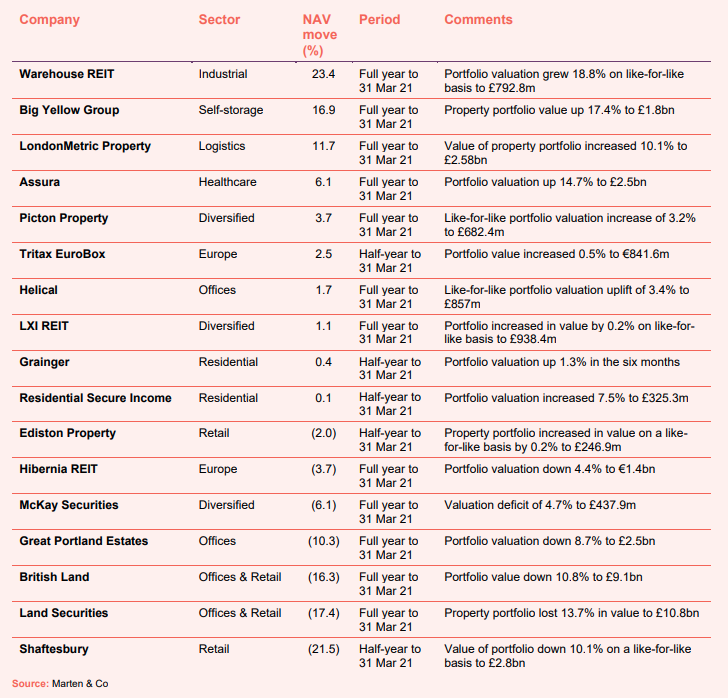

Valuation moves

Corporate activity

The directors of St Modwen Properties have agreed terms on an all-cash offer for the business by Blackstone valuing the company at £1.237bn. The directors said they intend to recommend unanimously that St Modwen shareholders vote in favour of the bid, which is at a price of 542p per share (21.1% premium to the closing price on 6 May and a 23.8% premium to its most recent NAV).

Tritax EuroBox announced the pricing of €500m of senior unsecured green bonds maturing on 2 June 2026. The notes will have a tenor of five years and an annual coupon of 0.95%. It will significantly reduce the trust’s cost of debt and will be used to finance and/or refinance, in whole or in part, a portfolio of eligible assets.

LondonMetric completed a £380m private debt placement, which has a blended maturity of 11.1 years and a blended coupon of 2.27%. Simultaneously with the completion of the placement, the company has also secured two new revolving credit facilities (RCFs) totalling £400m. They comprise a £175m, five-year facility with Wells Fargo and a £225m facility for a three-year term with NatWest, Barclays, HSBC and Santander. The placement and the new debt facilities will replace existing debt facilities. Overall, the refinancings increase the company’s loan maturity by four years to 8.2 years and reduces the average cost of debt to 2.6%.

Hibernia REIT has issued €125m of new unsecured US private placement notes. The issue comprises equal amounts of 10- and 12-year notes with an average fixed coupon of 1.9%. The notes have been placed with five institutional investors, all new lenders to Hibernia.

Sirius Real Estate attained an investment grade credit rating from Fitch Ratings of BBB, with a stable outlook.

Major news stories

LondonMetric acquired an urban logistics warehouse in London for £43.8m in a sale-and-leaseback deal with foodservice business Reynolds. The 115,000 sq ft warehouse in Waltham Cross is let on a new 23-year index-linked lease.

Grainger agreed a deal to forward fund a 259-home build to rent development in Derby for £37.4m. Grainger said it expects the investment to generate a yield on cost of 7%.

BMO Commercial Property Trust sold a B&Q retail warehouse located in East Kilbride, Scotland, for £19m, reflecting a 7.2% premium to the 31 March 2021 valuation. The proceeds will be used to buy back shares.

UK Commercial Property REIT has increased its dividend by 40% due to the improved economic outlook for the UK. This is still 30% down on its pre-COVID quarterly dividend level.

LXI REIT forward-funded a portfolio of nine Costa Coffee drive-thrus and an industrial asset for £36m. The nine drive-thru units will be built in the car park of Morrisons supermarkets, while the industrial facility is located in the Midlands.

Mailbox REIT, which owns the Mailbox office block in Birmingham, began trading on the International Property Securities Exchange (IPSX), the debut listing on the world’s first real estate stock exchange.

Warehouse REIT completed the acquisition of Cambridge South Industrial Estate for £20.15m, reflecting a yield of 4.15%.

Yew Grove REIT acquired an industrial building in Dundalk and two adjoining offices in Citywest Dublin – all let to multinational tenants – for a combine €19m.

Civitas Social Housing completed the acquisition of 10 supported living properties across Hertfordshire, Essex, Suffolk and Wales for £8.6m. The portfolio provides adapted homes for 41 individuals with complex mental health care needs.

Great Portland Estates completed the letting of 18 Hanover Square with a 16,500 sq ft letting to a financial services company. The nine-storey building produces an annual rent of £14.8m and has a WAULT of 15.7 years.

QuotedData views

- Property funds to fall like dominoes? – 21 May 2021

- Timid start for real estate stock exchange – 14 May 2021

- Spotlight on logistics development – 7 May 2021

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Offices

Simon Carter, chief executive:

With a roadmap out of lockdown, confidence has strengthened and UK economic forecasts for calendar 2021 are being revised upwards. In offices, we expect demand for modern, high quality and sustainable space which helps businesses to perform at their best, to be firm but across the market, our central case is for rents to fall by up to 5% before recovering. We anticipate downward pressure on prime office yields as confidence improves and investors target the yield differential with other European cities. Retail occupational markets remain tough and we expect rents to decline further. However, we are seeing signs of stabilisation on retail parks and our central case is an additional rental decline of around 5%, with the potential for some yield compression given the increased capital targeting this space. Shopping centres, which have been more impacted by COVID-19, are likely to take a little longer to stabilise. We are encouraged by the strong rebound we are seeing on footfall and sales particularly on our retail parks, which are now in line with pre pandemic levels. Urban logistics in London should continue to see strong rental growth of 4% to 5% per annum benefitting from compelling underlying fundamentals.

Gerald Kaye, chief executive:

The office sector is on the cusp of considerable change and we believe there are four key trends that will shape the use of offices going forward and provide a clear differentiation across the sector.

First, sustainability is at the top of corporate agendas. This is exemplified by the 2021 annual letter to CEOs from Larry Fink, the CEO of BlackRock. He wrote of a tectonic shift in the reallocation of capital to sustainable assets. Tenants will want to occupy the most sustainable and environmentally favourable buildings to achieve both their own net zero carbon targets and those of their stakeholders. For the same reasons, investors will actively seek to acquire these buildings. We believe there will be a “green” rental and yield premium for the most sustainable assets.

The second trend is wellness. In a post-COVID environment, tenants will require the most efficient and up to date air conditioning systems to minimise the risk from airborne viruses. Sensors showing air quality in a building will be essential and office density per worker will decrease so employees will benefit from a more comfortable environment.

Third, buildings will see greater use of technology to optimise their environment and the workplace experience. Sensors that record occupation levels will improve energy efficiency and the management of buildings.

The fourth and final trend is enhanced amenity. There will be greater demand for secure bike parking and high-quality “club style” changing facilities. Buildings should provide an attractive working environment with food and beverage facilities close at hand. As part of this enhanced amenity, we will see an increasing “hotelification” of office buildings, with five-star management a necessity. Assets are moving from passive, low risk, long lease investments to intensively managed shorter leased buildings where maximising tenant retention, rental growth and building performance will be the priorities.

There will be bifurcation in the office sector as the “real” Grade A buildings, which incorporate these facilities and amenities, diverge from the rest in both capital value and rental growth. I would expect this pattern to accelerate as tenants seek working environments that match the expectations of their employees.

Toby Courtauld, chief executive:

Looking ahead, the ongoing vaccination programme and the government roadmap to easing lockdown restrictions is now supporting renewed optimism. Moreover, the last year has reaffirmed to many businesses the importance of their office space for collaboration, creativity and learning, with the best offices acting as magnets for their workforce, providing services and amenity that employees cannot get at home. As a result, prime offices and best-in-class flexible spaces in central London continue to be highly sought after and in relatively short supply, both trends which we expect to persist. As a result, barring further lockdowns, we look forward to rents for the best office space rising over the next 12 months, although we expect further falls for retail. Longer term, we believe the prospects for London remain positive given its status as one of only a handful of truly global cities and the world’s top ranked city for innovation.

Logistics

Andrew Jones, chief executive:

Technology and changing consumer behaviour were already having a profound impact, but COVID-19 has accelerated these shifts with trends that were expected to take years, occurring in just months and in some cases weeks. The behavioural changes that surged during lockdown have been well-mapped; working from home, online retailing, gaming, video on demand, online banking etc. These shifts were only possible due to an exponential increase in technological capability.

At long last, society has reopened and lives are returning to near normality. However, whilst humans need real interaction with each other to thrive, the world continues to evolve and digitise at a rapid rate and COVID-19 has added to the seismic shift in the tectonic plates. The scale of these changes can be discussed, but certain conclusions are uncontroversial.

Firstly, online retailing took a quantum and permanent leap. Previously high barriers of entry were toppled in a matter of weeks and consumers quickly realised the convenience, safety and security of online shopping. Consequently, online retail sales grew by over 40% in 2020, accounting for 28% of total sales and peaking at 36% during the start of 2021, a level higher than the first lockdown. The change in online grocery has been most apparent, accounting for over 15% of food shopping at its peak after doubling from pre-pandemic levels.

Secondly, an unusually large number of retailers have failed or are seriously wounded. Many will blame the pandemic, but the truth is that too many failed to embrace change with an excessive physical estate and they failed to pivot. The pandemic has exacerbated their difficulties and accelerated their demise. Supporting business models that work and starving those that do not is how economies adapt and evolve.

Thirdly, COVID-19 has materially changed the way we work and has accelerated ongoing trends towards home working. Each day, it is becoming more apparent that a substantially higher percentage of office workers will spend some of their week working from home. The pandemic has certainly not generated any new demand for offices.

Unsurprisingly, real estate performances have polarised further. Logistics, healthcare and grocery remain the standout performers, enjoying an ever-wider margin of victory. Conversely, the acceleration of secular declines in physical retail has seen downward repricing of high streets and shopping centres to levels that may now start to encourage alternative use or demolition. For offices, less space is needed and this new reality is yet to be reflected in their yields.

After years of denial, many companies are now experiencing the full force of these structural changes. They are realising that it’s not just cyclical, it’s permanent, and they aren’t quite what they were and are now worrying what they might become.

Diversified

Lena Wilson, chairman:

The UK’s vaccination programme has been one of the most well-executed globally. We are close to restrictions being fully lifted and there is a much-anticipated economic recovery starting to emerge. During the year the UK left the European Union, however there remain several matters to be resolved, such as financial passporting rights. Pending any major Brexit-related disruption or problematic new coronavirus variants, the outlook for the UK economy looks considerably brighter than it did this time last year.

To mitigate the impact of the pandemic and stimulate the economy, there has been a large response both in terms of UK Government policy and measures introduced by the Bank of England, including the furlough scheme, business rates relief, a ban on commercial evictions, record ultra-low interest rates (0.1% since March 2020) and Quantitative Easing. In stark contrast to previous periods of recession, average house prices in the UK rose 7.7% during 2020, largely thanks to the stamp duty holiday, which has been extended in part until September 2021.

In March 2021 retail sales rose higher than pre-pandemic levels, even before non-essential shops reopened. Online retail reached a record proportion of total retail sales in January 2021 of 36.4%, as consumers were restricted from using physical stores. Of course, whilst some retail sectors have struggled, others have thrived. As people were confined to their local area, businesses still able to trade benefitted from this additional footfall at the expense of retailers situated at transport hubs or in central business districts. Many companies with an established online offering had a strong year.

Many households were fortunate to see income levels maintained and outgoings reduced, contributing to a record increase in the household savings ratio, which reached a peak of 25.9% in the second quarter of 2020. As restrictions are eased and retail and leisure businesses reopen, it is expected that this elevated savings ratio will contribute to an economic recovery.

The recovery has begun to gather pace. It is anticipated that healthy consumer spending and interest rates staying lower for longer will contribute to a rapid rebound in the second half of 2021. The Office for Budget Responsibility has forecast GDP growth of 4.0% for 2021 and a recovery to pre-pandemic levels by mid-2022.

Retail

Brian Bickell, chief executive:

Following the start of the government’s roadmap to recovery in March, we have seen an encouraging increase in demand for space and lettings and, since the start of re-opening on 12 April, there has been a welcome return of footfall and spending across our locations, heralding the beginning of the revival in the West End’s broad-based economy. Most of our hospitality, leisure and retail businesses have now reopened and will benefit from the footfall generated by the reopening of the West End’s world-renowned theatres, cinemas and cultural attractions, hotels and nightlife. There has already been a gradual return of the important local working population, which we anticipate will gather pace once the final stage of lifting of legal social distancing measures is reached, on or after 21 June.

Currently, a material recovery in international travel is not expected to begin until later next year. However, whilst there will be fewer inbound visitors to London, we expect a significant rise in UK domestic tourists and locals coming to the West End for day visits or longer stays. Services are now expected to commence on the central section of the Elizabeth Line in the first half of 2022, bringing a significant improvement in capacity and quality of travel to the West End.

The realistic prospect of a sustained recovery in footfall and trading through the summer and autumn, and particularly in the busy period leading up to Christmas and the New Year, is helping to restore the confidence and stability of businesses which have suffered as a result of the pandemic. As the global pandemic recedes, we are confident that the unique appeal and features of London and the West End will continue to attract businesses and visitors on a scale matched by few other cities.

William Hill, chairman, and Calum Bruce, investment manager:

The progress made within the UK to re-open the economy is encouraging, and it is certainly feasible for a strong bounce in the rate of growth to take place. Real estate investment markets are relatively buoyant and have the capacity to respond further when travel restrictions are lifted, and more international capital is unlocked. However, there is much to ponder for investors including the fiscal response to repairing the nation’s balance sheet, the potential for inflation and its impact on interest rates, the effect of the pandemic on how we live, work, shop and play and regulatory interventions guiding our journey to net zero carbon.

The success of the vaccination programme and the easing of lockdown restrictions across the UK are reasons to be optimistic. The pathway out of the COVID-19 pandemic is now clearer, but there will still be obstacles to navigate. There is nervousness around new strains of the virus emerging, and until the economy is fully open and restrictions are eased further, a degree of caution should be exercised.

That said, demand for UK real estate remains robust and there is an increased appetite for retail warehouse assets. Retail warehousing has proved to be more resilient than other parts of the retail market, and its attributes are now being more widely understood.

Healthcare

Jonathan Murphy, chief executive:

As we head into a summer which we all hope will bring an end to many of the pandemic’s restrictions, attention must turn to the NHS’s future needs and to how the response to COVID-19 should change the sorts of spaces we need for healthcare in local communities. Demographics remain the same, with a growing, ageing population in the UK requiring care. But this is one of the groups with the greatest reliance on primary care, and research by Age UK suggests that many older people with long-term conditions have been struggling to manage given the more limited access to services during the pandemic, with worsening symptoms, reduced ability to complete day-to-day activities and an increase in pain. While remote consulting is here to stay, it does not work for all patients or every clinical scenario. Healthwatch has warned about the dangers of older people being left behind, so the primary care spaces of the future must be fit for a sophisticated marriage of remote and face-to-face care.

Waiting times for non-urgent procedures grew exponentially last year as the system pivoted to cope with the pandemic, and will take years to clear. The wider health, social and economic impacts of this, such as the mental health challenges of living with long-term pain, are lurking. But it is clear that local access to diagnostic services will be crucial in reducing waiting lists and their ripple effects for wider health and society. The government remains committed to the expansion of access to primary care and to a broader range of professionals there; as Integrated Care Systems become formally part of the landscape in the coming year, the role of primary care as the gateway to wider health services is at their heart.

All of those changes notwithstanding, the primary care and community health estate remains doggedly unfit for purpose. Many of these gateway buildings to the NHS are too old, too small, don’t meet accessibility requirements and – as our YouGov research with healthcare professionals found this year – have not provided the flexibility needed during the pandemic and beyond to a future with hybrid care routes. A recovery built on new housing and infrastructure must include the healthcare provision to care for new communities, and equality of access to healthcare is as much about the NHS’s places, spaces and technology as it is the design of local systems and pathways. The NHS’s net zero ambition – to become the world’s first healthcare system to achieve this – will require a shift like we have never seen before across its vast estate.

Residential

Helen Gordon, chief executive:

COVID-19 does not change the long-term market fundamentals nor does it change the highly compelling investment case for the professional, large-scale private rented sector and build-to-rent. More and more people will continue to choose to rent for longer periods of their lives and they will become increasingly discerning, looking for quality and service, which plays to Grainger’s core strengths. If anything, COVID-19 is accelerating these rental trends.

In the shorter term, we have been closely monitoring live economic data to fully understand the shape and velocity of the UK’s newly emerging economic recovery, and how this will flow through to the rental market and, in particular, lettings activity. Comparing this to international examples where vaccine programmes and economic reopening’s are more advanced than ours, gives us confidence that the chances of the UK keeping to its roadmap of easing restrictions is looking increasingly likely. Green shoots seem to be appearing, with increased city centre footfall, increased leisure spending and a gradual return to more normal levels of economic activity. This analysis has led us to our positive market outlook.

Europe

Kevin Nowlan, chief executive:

Against the backdrop of the COVID-19 pandemic and a 3.4% decline in global GDP in 2020 (source: the OECD), the Irish economy has performed very strongly, recording GDP growth of 3.3% in 2020, the fastest in the developed world. Much of this was due to the contribution of the multinational-dominated sectors, such as technology and pharmaceuticals. Irish output, as measured by Gross Value Added, in the foreign-owned sector increased by 18% in 2020, while other domestic industries declined by 9.5% (source: Goodbody).

The Irish government continues to offer significant support to the labour market through pandemic payments and wage subsidy schemes: the standard measure of monthly unemployment was 5.8% in April 2021 (compared with 5.1% in January 2020), while the COVID-19 adjusted measure of unemployment was 22.4% if all claimants of the Pandemic Unemployment Payment were classified as unemployed (source: the CSO). Much of this emergency support is going to the hospitality and retail sectors, with office-based employment less impacted, particularly given the strong performance of many multinationals in Ireland. The labour market is expected to recover gradually as restrictions ease, in-line with the vaccine rollout. Current government expectations are that all adults in Ireland will be vaccinated by late summer 2021 and the unemployment rate is projected to average 16.3% in 2021, 8.2% in 2022 and 6.0% in 2024, still above the pre-pandemic level of 5.1% (source: the DoF).

While global progress on vaccines and the new EU-UK Trade and Cooperation Agreement (TCA), which came into force on 1 January 2021 and averted the threat of a no-deal Brexit, have been positive developments for the Irish economic outlook, nonetheless risks remain over the pace of recovery from the pandemic and there is additional friction to trade between Ireland and the UK as a result of the TCA. International tax reforms could negatively affect Ireland’s attractiveness for foreign direct investment: while a lot remains uncertain at present, changes to the way multinationals are taxed have been discussed for some time by the OECD under the base erosion and profit shifting process and the US is also discussing corporate tax reform.

As we have noted before, the structural changes that have occurred in Ireland’s property market since 2007, namely greater levels of institutional ownership and less debt, have given it greater resilience than existed historically. Furthermore, the Dublin office market entered the pandemic with much healthier fundamentals than it had prior to the Global Financial Crisis in 2008, due in part to the limited speculative development funding available this cycle. While prime headline quoting rents in March 2020 and March 2008 were both in excess of €60 per square foot, the Dublin office vacancy rate in March 2020 was 6.5% versus 12.3% in March 2008 and the unlet office space under construction totalled 3.0m square foot (6.9% of existing stock) in March 2020 versus 4.6m square foot (14.9% of existing stock) in March 2008 (source: Knight Frank, Property Market Analysis).

Research notes

Tritax EuroBox – Full throttle

Civitas Social Housing – On firm footing

Standard Life Investments Property Income Trust – Focus on tomorrow’s world

Grit Real Estate – On the pathway to recovery

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.