Real Estate Roundup

Kindly sponsored by abrdn

Performance data

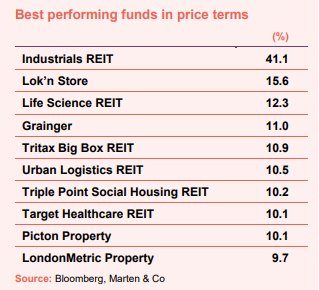

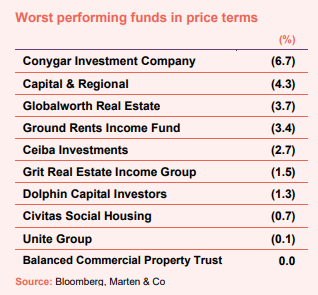

April’s biggest movers in price terms are shown in the charts below.

Property stocks returned to positive territory in April after months of losses due to the impact of higher interest rates on valuations. The first signs of values stabilising are starting to feed through with company’s NAV updates for the end of March (see next section). Reflecting this, the median average share price rose across the sector by 4.3%. Industrials REIT was the subject of a take-private bid at a whopping 42% premium to its share price (see corporate activity). Its share price reacted in kind and may have been the catalyst for a re-rating of other industrial and logistics-focused companies. Tritax Big Box REIT, Urban Logistics REIT and LondonMetric Property all made the top 10 price movers in the month. We would have expected to see more of a positive reaction to the bid price for Industrials REIT across the property sector, however investor caution continues to be displayed towards the sector. Other positive price movers included Life Science REIT, whose share price is recovering from an all-time low in March, and Triple Point Social Housing REIT, which launched a share buyback programme to tackle its large discount.

An eclectic mix of companies made up the worst performing funds in April, topped by small-cap owner and developer Conygar Investment Company. The topsy-turvy performance of secondary shopping centre owner Capital & Regional continued, having seen a double-digit gain in March. Cuban real estate specialist Ceiba Investments saw its share price fall following the announcement of a drop in NAV in annual results, reflecting the difficulties in the Cuban economy. The company will internalise its management, saving costs (see corporate activity). Mediterranean hotel developer Dolphin Capital Investors, which is in the process of selling down its assets and returning capital to shareholders, saw its share price fall after getting caught up in a legal row following the firing of its manager over an “undeclared” property deal (see last month’s quarterly roundup). Post month end, Civitas Social Housing was the subject of a £485m bid for the company (see corporate activity section for details). Although at a significant premium to its share price, the bid was a 26.7% discount to its March 2023 NAV, substantially undervaluing the company in our view.

Valuation moves

Corporate activity

Post month end, Civitas Social Housing agreed the terms of a sale of the company to Wellness Unity Limited, a subsidiary of CK Assets, for £485m. Although the bid price of 80p per share is a 44.4% premium to the closing price on 5 May 2023, it is a 26.7% discount to the unaudited NAV at 31 March 2023 of 109.16 pence (readers interested in more information may wish to read our most recent note on Civitas, published in February, where we commented that the hefty discount it was trading at was unjustified – click here to read). Civitas’ board admitted that the offer undervalues the long-term prospects of the company but “recognises that Civitas and the sector in which it operates faces a number of challenges in light of the current macro environment and outlook” and has recommended shareholders vote in favour of the bid.

Industrials REIT has agreed terms on a £511m cash offer for the company by US private equity giant Blackstone. Under the offer, each shareholder would receive 168p per share, which represents a premium of 42.4% to the closing price on 31 March 2023 (the last day before the initial announcement about a possible bid was made) and a “material” premium to the group’s expected EPRA NTA for 31 March 2023, which has yet to be published. The Industrials REIT directors intend to recommend unanimously that shareholders vote in favour of the bid, while it already has the support of shareholders representing 22.4% of the ordinary share capital. Shareholders will vote on the bid at a general meeting in May.

Regional REIT’s manager, London and Scottish Property Investment Management (LSPIM), completed the sale of a majority stake in the company to ARA Asset Management Limited. Stephen Inglis, chief executive of LSPIM, retained a significant minority interest. The board says that there will be no disruption to the services provided to Regional REIT and adds that it believes the transaction will enhance the overall strength and capabilities of the asset manager.

Triple Point Social Housing REIT announced a share buyback programme to address its wide share price discount to NAV, which has been around the 60% mark for a number of weeks. It will initially buyback £5m worth of shares, which it says will be accretive to NAV and increase dividend cover. The company is also in the process of selling a portfolio of assets, with some of the proceeds being used to return capital to shareholders through an extension of the share buyback programme.

Shaftesbury Capital redeemed the Chinatown and Carnaby bonds, after the bondholders exercised a change of control put option. The redemption of the bonds was funded in full by the group’s £576m loan facility with Barclays Bank, BNP Paribas SA and HSBC Bank, which was secured on 16 June 2022.

LXI REIT has a new £565m secured, interest-only debt facility with a syndicate of banks, comprising a £200m five-year revolving credit facility, a £115m five-year term loan and a £250m three-year term loan. The blended margin on the facility is 2.23% per annum over SONIA. The company has purchased interest rate caps representing £400m to cap the SONIA cost of the facility at a rate of 2.0%, resulting in an all-in rate of 4.23% per annum for the first three-years of the facility.

Urban Logistics REIT has proposed a change in its management agreement that will see Logistics Asset Management LLP, which currently undertakes the day-to-day running of the company through asset management services, take over from PCP2 (which is part of the Pacific Investments Group) as investment adviser. Pacific will transfer its interests in the investment adviser to Richard Moffitt and Christopher Turner – part of the existing management team. The investment adviser’s appointment is to be extended for a further three years from 12 May 2024 and may be terminated on one year’s notice from 12 May 2026 onwards. Under the terms of the proposal (which will be voted on by shareholders on 11 May 2023), the annual advisory fee will also be reduced from May 2024.

Ceiba Investments agreed to internalise the investment management contract away from abrdn plc. Sebastiaan Berger, the lead fund manager of Ceiba and a current employee of abrdn, will move to Ceiba as chief executive together with the existing management team. 4K Keys Limited, a company owned by the management team that currently provides consulting services to abrdn in connection with the management of Ceiba, will be appointed to provide strategic consulting services focused on generating cash flows from the real estate assets of the company’s subsidiaries. There will be no change to the board of directors of the company as a result of the internalisation. Subject to contract, the internalisation is expected to become effective on 30 June 2023.

Major news stories

- Hammerson sells Paris shopping centre in €164m deal

Hammerson completed the disposal of its 25% stake in Italie Deux, a 62,000 sqm shopping centre in central Paris, and 100% of the 6,500 sqm Italik extension, for €164m to Ingka Centres. This represents a 4% discount to 31 December 2022 book value and a net equivalent yield of 5.0%. The sale proceeds will be used to reduce the company’s net debt.

- Record year for lettings at Great Portland Estates

Great Portland Estates recorded a record year for leasing, signing 105 new leases and renewals covering 861,200 sq ft and generating annual rent of £55.5m in the year to 31 March 2023. These were at an average 3.3% above the March 2022 estimated rental value (ERV).

- Supermarket Income REIT bags Tesco store for £38.3m

Supermarket Income REIT acquired a Tesco omnichannel supermarket in Worcester, for £38.3m, reflecting a net initial yield of 6.0%. The store is being acquired from British Steel Pension Fund, with an unexpired lease term of 12 years, with annual upwards only RPI-linked rent reviews (subject to a 4.0% cap and 0.0% floor).

- UK Commercial Property REIT secures 40% rental uplift in trio of deals

UK Commercial Property REIT secured a trio of new leases at an average premium of 40% to the previous passing rent. It signed Webcon, a supplier of car parts, to a five-year lease renewal for Unit 1 at Dolphin Industrial Estate in Sunbury-on-Thames, Surrey; South West Ambulance Service to a new 10-year lease for Unit 111 at Emerald Park, Bristol; and KFC to a 20-year lease renewal on Unit 4 at Trafford Retail Park in Manchester.

- abrdn Property Income Trust shops Morrison’s store

abrdn Property Income Trust completed the purchase of a Morrison’s supermarket in Welwyn Garden City for £18.3m, through a sale and leaseback deal, with Morrison’s entering into a new 25-year lease with rent reviews linked to CPI.

- Industrials REIT completes multi-let industrial transition

Industrials REIT sold its interest in a German care home joint venture for £15.6m, completing its five-year transition to become a 100% UK multi-let industrial business.

- Sirius Real Estate makes €12.2m disposals

Sirius Real Estate completed the disposals of two assets for a combined total of €12.2m, representing an average net initial yield of 4.1%. It sold a 15,000 sqm mixed-use business park in Wuppertal, in North Rhine Westphalia, Germany, and a vacant office building in Ipswich, UK.

- Value and Indexed Property strikes deal in Coventry

Value and Indexed Property Income Trust acquired a leisure asset at Coventry Crosspoint Business Park that comprises a bowling alley and two small restaurant units for £7.8m, reflecting a net initial yield of 7.4%.

- Town Centre Securities sells residential scheme in Leeds

Town Centre Securities sold the residential element of its development site at Whitehall Riverside, Leeds, to the build-to-rent residential developer Glenbrook for £13.0m, ahead of its book value of £10m as at 31 December 2022.

- abrdn Property Income Trust lets four floors at 54 Hagley

abrdn Property Income Trust leased 21,500 sq ft of office space across four floors of 54 Hagley Road in Birmingham. The letting to the UK Curriculum and Accreditation Body will be for a period of 10 years at an initial rent of £429,750 per annum and accounts for 14% of the group’s overall portfolio vacancy.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Europe

abrdn European Logistics Income

Tony Roper, chairman:

Rising construction and financing costs and an uncertain economic landscape will likely exacerbate an already delayed construction pipeline as we expect construction activity to continue to weaken this year, with inflationary pressures being felt throughout the supply chain.

This lack of new development, which is typically more sustainable, energy-efficient buildings, and the delay in refurbishment projects transforming older stock will put further pressure on occupiers who are increasingly seeking best-in-class space, especially as corporate ESG strategies increasingly restrict the leasing of buildings that are not green certified.

If the indicators suggesting inflation is nearing its peak across the eurozone are borne out, there is likely to be a recovery in values in 2024, especially if interest rates follow consensus forecasts in heading back down towards 2%. Certainly there is evidence that investors are already looking at opportunities once again in the market, and this should offer more positive momentum later in the year. Whilst we will continue to screen for new acquisitions, our core focus for the coming year will be on optimising the current portfolio in terms of both occupancy and earnings growth. We retain a strong conviction in our investment strategy and during this period of inflationary pressure, the company’s indexation characteristics should provide a level of inflation protection alongside our attractive dividend yield.

Diversified

CT Property Trust

Matthew Howard, fund manager:

Following the rapid repricing of real estate in the second half of 2022, the early part of 2023 has shown a stabilisation in yields for some property sub sectors. Industrial/logistics property and retail warehousing in particular is attracting renewed investor interest. There were early signs in December that the market was emerging from a period of ‘pricing discovery’ with an uptick in investment activity following the relative market paralysis between September to November. These cautious steps have continued into the first quarter with investment activity gathering pace as we head into the spring. Increasing confidence in real estate pricing has been supported by the stability in 10-year UK government bonds, which over the past five months have trended around the 3.5% level (having peaked at 4.6% in September) meaning the pricing margin to UK real estate is closer to the generally accepted long term risk premia.

As such, yields for resilient assets and sectors have seen some marginal appreciation since the start of the year suggesting that the worst is behind us for ‘relevant’ real estate. This is reflected in the capital return of our industrial and retail warehouses (representing 77.9% by value of the portfolio), which were +0.8% and +2.5% respectively. We also saw a small rebound of +0.7% in our high street assets, a sector that has been largely repriced in recent years and offers an attractive income return for the portfolio. As always, the markets remain nuanced. Prime offices, of high quality, strong amenity and ESG credentials have seen some value stabilisation, but we expect values for offices of a quality below the best-in-class to remain under pressure owing to the ongoing uncertainties and structural risk repricing for this property segment. Our offices saw capital loss of -1.6% over the period.

The MSCI monthly data indicates that All-Property capital values moved -1.2% at a market level for Q1 2023. This may reflect a degree of overhang from Q4, with March showing positive capital movements on a monthly basis for the first time since June 2022. The quarterly data, which reflects a larger pool of funds, will be released in a few weeks.

In context of the recent economic backdrop, we have spoken much of the continued positive news within the occupational markets. At a market level, we saw rental growth within the logistics market in excess of 10% over 2022, with vacancy rates remaining at near record lows nationally. Trading within retail warehouses now exceeds that of pre-pandemic levels and, as a format, is attractive to retailers as part of omni channel sales strategies, a trend which has caused a headache for shopping centres and high street assets.

Our investment strategy to focus on resilient locations, smaller assets and active management will be key to our performance as markets continue to adopt a cautious view of the year ahead. Occupiers, although proving resilient, are still navigating inflationary pressures and the full effects of consumer credit squeeze are perhaps yet to be completely felt. Against this backdrop, we remain confident in our conviction position to industrial and retail warehousing and the prospects for portfolio income and capital growth in the near term.

abrdn Property Income Trust

Jason Baggaley, investment manager:

Given the magnitude and speed of correction we have seen in sectors including supermarkets, industrial and logistics, and long duration income more generally, we believe that the market pricing for these areas of UK real estate will find a floor much quicker than we have seen in previous cycles. As such, our outlook, and forecasts for these areas of the market have improved materially, given the size of the corrections experienced.

Following the poor reception to the mini budget in September 2022 longer term yields may have peaked in early 2023 and could reduce by year end if inflation falls as predicted. Lower yields, and in particular forward swap rates, will make utilising debt more accretive again and will likely increase investment volumes as debt backed buyers re-enter the market.

It is never easy to call the bottom of a market cycle, however it appears that the industrial sector may be bottoming out about now, with offices and retail values having further to fall. The rapid repricing of the UK market means that the prospective returns from today’s levels look more attractive, along with the likely improvement of the yield premium of growth assets over gilts as the year develops. abrdn forecasts a market return of 4.3% over the 3 years from April 2023.

The outlook is positive for the industrial sector and particularly for better quality assets in strong locations, as both occupiers and investors narrow their focus on best-in-class assets. The size and speed of value correction in 2022 means the sector now looks better value relative to other real estate sectors and indeed, other asset classes. The sector continues to benefit from structural tailwinds and a positive supply/demand dynamic, with the UK wide vacancy rate remaining near historic lows and new supply levels likely to remain muted due to higher development costs. Whilst we anticipate the industrial vacancy rate to move higher this year, largely as a result of a weaker economic backdrop, we expect occupational demand to remain robust as the advent of ‘onshoring’ and continued demand for e-commerce supports demand for good quality accommodation. As a result, further rental value growth is expected and is likely to drive performance in the medium term. There is the prospect for capital value growth for best-in-class assets, as investors once again compete for good quality industrial accommodation with strong occupational fundamentals.

The office sector continues to face real structural headwinds as working habits remain altered following the COVID-19 pandemic. Indeed, the bifurcation between best-in-class and secondary office space is acutely evident, becoming even more entrenched during 2022. Secondary office accommodation is at risk of obsolescence and asset stranding, while the capital requirements to ensure assets meet minimum ESG standards is unlikely to lead to positive returns.

The office sector did not reprice as much as many other UK property sectors in 2022, predominantly due to limited transactional evidence. However, we expect further pricing discovery to emerge over the course of 2023 and for secondary accommodation, this is likely to result in large downward revisions to valuations. Supply of truly best-in-class office space remains extremely limited across the UK which will provide more support for pricing and tenant demand.

Performance within the retail sector is expected to remain polarised in 2023. Consumer spending habits will be driven by consumer cost considerations and as such, non-discretionary led retailing is expected to be best placed.

Following a period of repricing in 2022, the retail warehouse sector is garnering more interest from investors, particularly for food anchored schemes with a discount orientated line-up which will be more insulated from any slowdown in consumer spending. Equally, the supermarket sector now looks attractive following a broad re-pricing last year, but the sector will not be immune to increasingly price sensitive consumers, with supermarket operators adapting to changes in consumer behaviour. A divergence in performance between the supermarket operators is already evident and as such, a focus on the quality of the underlying real estate will remain crucial.

The outlook for 2023 feels a lot more positive than it did at the end of 2022. Tenant demand remains resilient for good quality accommodation, and the impact of high interest rates and gilt yields seems to be easing, although recent turmoil in the banking sector is a timely reminder that risks still remain. If the UK can experience some political stability and a soft landing, then it feels as though real estate is well placed to benefit following the short sharp correction of 2022.

Balanced Commercial Property Trust

Richard Kirby, fund manager:

Inflationary pressures and the cost of debt are easing, gilt and swap markets have settled, and the Bank of England has signalled that their forecast for growth for 2023 is less negative than previously feared. There is therefore an expectation that the real estate market will move to a recovery phase in the second half of 2023 although the impact of credit tightening from the recent banking market volatility has created further uncertainty.

As capital growth returns, the diversification of the Company’s portfolio offers both a steady footing alongside growth potential. We expect continued recovery at St Christopher’s Place to be a bedrock of returns. The industrial and retail warehousing sectors – which account for over 40 per cent of the portfolio – have been oversold but retain a strong performance outlook founded on their critical role in UK business and consumer infrastructure. Much has been made of the uncertain outlook for the offices sector, but the portfolio is aligned towards prime assets that continue to deliver occupier demand. The portfolio is therefore aligned to continue to deliver capital outperformance, founded on the portfolio’s prime nature that will benefit from a flight to quality.

Income is the driver of real estate returns in the long run. Across the sectors, the occupational markets have been relatively resilient. The Company’s portfolio is generating an attractive yield premium at a time when income will dominate totals returns. The portfolio offers strong reversionary rental potential alongside ample opportunity for delivery of this income upside. Maintaining a low vacancy and exploiting lease events to crystallise rental uplifts will be of paramount importance in generating a stable and growing income stream, alongside capital appreciation.

UK Commercial Property REIT

Ken McCullagh, chairman:

2022 was a year dominated by inflationary pressures. The monetary policy tightening phase, which began in earnest to tame inflation, saw interest rates increasing across all major economies. Whilst it appears that we are now past peak inflation globally, 2023 is likely to be another year dominated by inflation and more importantly for real estate, by the interest rate policy of central banks.

Looking forward, and despite the poor performance in 2022, the outlook is more positive for the industrial sector where the Company has a weighting of 59.1%. The size and speed of capital value correction in 2022 means the sector now looks better value relative to other real estate sectors. The sector continues to benefit from structural tailwinds and a positive supply/demand dynamic, with the UK-wide vacancy rate at 3.3%, (according to CoStar), a near historic low.

Overall, we expect a recovery in UK real estate performance in 2023. The pace of repricing for UK real estate in 2022 means opportunities will arise over the course of 2023, particularly as the path of monetary policy turns more accommodative. Those sectors that benefit from longer-term growth drivers, such as the industrial and living sectors, will see greater demand return, attracted by re-based yields and rental value growth prospects. We believe that market pricing for these areas of UK real estate is finding a floor more quickly than we have seen in previous cycles. As such, our outlook, and forecasts for these areas of the market, have improved materially. Inflationary pressures are expected to moderate as we move through 2023, with the BoE likely to commence its base rate cutting cycle in the latter part of the year which will provide a more supportive backdrop for real estate pricing.

Real estate research notes

Lar España Real Estate – Dominant assets make a resilient business

Civitas Social Housing – Time to buy?

abrdn European Logistics Income – Negotiating choppy waters

Grit Real Estate Income Group – Going for growth

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.