Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

October’s biggest movers in price terms are shown in the chart below.

October finished with the threat of a second lockdown looming over the UK as COVID-19 cases continued to rise. However, this did not dampen demand for shares in some of the companies that have already been battered during the pandemic, even before news of a potential vaccine breakthrough broke in early November. Successful sales of retail assets by NewRiver REIT saw its share price bounce 28.7% in the month to top the table.

Schroder European REIT also saw a big increase in its share price after announcing it had forward sold an office development in Paris that would increase its NAV by 15%. London office developer Helical posted positive rent collection figures during the month, while serviced office provider Workspace Group saw a double-digit gain in its share price. Alternative Income REIT’s share price rose 12.2% following a tender offer for 25% of its shares by Glenstone Property. Meanwhile, CEIBA Investments, which owns real estate in Cuba, saw its share price grow 9.3% in the month in anticipation of a Joe Biden victory in the US election. A Biden administration is expected to reverse stringent economic sanctions imposed on Cuba by Donald Trump.

The heaviest share price faller in October – Panther Securities – is very illiquid so its share price can be distorted with one big transaction. Of the rest, Grit Real Estate Income saw a double-digit fall in its share price after reporting a big drop in NAV. Student accommodation specialists Empiric Student Property and GCP Student Living both continue to be impacted by COVID-19, with occupancy and income down. The companies have seen a 44.6% and 43.4% fall in their share price in the year to date, respectively.

Ground Rents Income Fund continues to be dogged by a cladding dispute at Beetham Tower in Manchester. The High Court has ordered it to carry out remedial work at a cost of £8.9m. The legal dispute has so far cost the company £2.1m. Meanwhile, Secure Income REIT announced it was sticking with Travelodge despite a CVA that would see its rental income slashed, after failing to secure a buyer or new tenant for the portfolio of 123 hotels. Private rented residential development specialist Sigma Capital Group saw its share price come off slightly after a huge rise last month following its launch of a £1bn joint venture to deliver 3,000 homes in London.

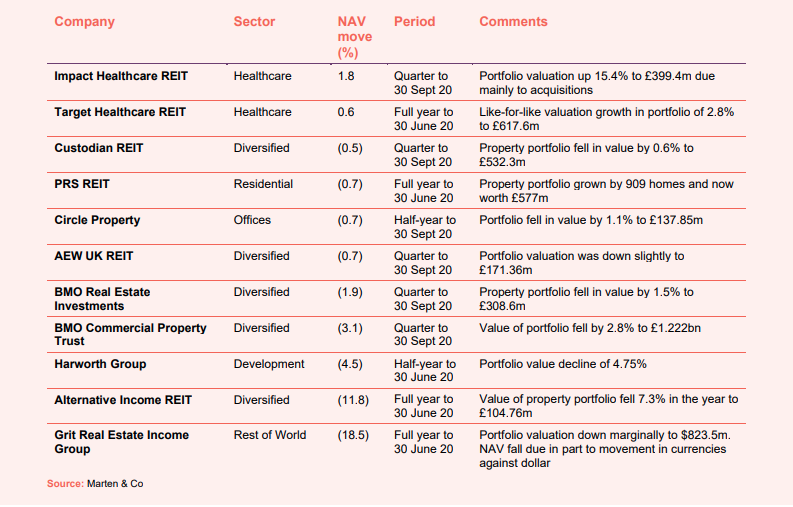

Valuation moves

Corporate activity in October

A new real estate investment trust (REIT) that will invest in a portfolio of homeless accommodation, Home REIT, launched in October raising £240.5m in an initial public offering.

Supermarket Income REIT raised £200m in an oversubscribed issue, beating its £150m target. It has an investment pipeline worth £400m, including target assets worth £135m.

Triple Point Social Housing REIT raised £55m in a placing, below its £70m target. It has identified a pipeline of investment opportunities in excess of £150m.

West End landlord Shaftesbury announced its intention to raise £297m through a placing to firm up its balance sheet. The issue price of 400p is a 54% discount to its last reported NAV. Rival West End landlord Capital & Counties has committed to subscribe for £65m new shares, taking its stake in Shaftesbury to 25%.

Real Estate Investors and Conygar Investment Company both commenced share buyback programmes. Real Estate Investors said it will repurchase £2m worth of its ordinary shares.

Aberdeen Standard European Logistics Income entered into a new uncommitted four year €40m master facility loan agreement with Investec Bank. Under the facility, the company can make drawdowns at selected short-term periods as and when needed to fund acquisitions.

Unite Group, the student accommodation specialist, announced Richard Huntingford as its new chairman. Huntingford, who is chairman of Future Plc, will take over from Phil White on 1 April 2021.

October’s major news stories

• Supermarket Income REIT buys Sainsbury’s store for £53.1m

Supermarket Income REIT acquired a Sainsbury’s supermarket in Heaton, Newcastle upon Tyne, for £53.1m, reflecting a net initial yield of 4.1%.

• Glenstone looks to acquire 25% stake in Alternative Income REIT

Glenstone Property announced its intention to acquire 25% of Alternative Income REIT at a 12.9% premium to its share price but a 29% discount to its NAV.

• CEIBA Investments buys stake in Cuban logistics development

Cuban real estate investor CEIBA Investments acquired a 50% stake in a mixed-use industrial park development project in Mariel. The deal diversifies its portfolio with a new asset class.

• Secure Income REIT sticks with Travelodge

Secure Income REIT decided to stick with Travelodge at its 123 sites (it could have evicted them as part of the hotel group’s CVA) after sales and re-letting exercises came up short.

• CLS Holdings sells German office for €22.5m

CLS Holdings exchanged contracts to sell Bismarckallee 18-20 in Freiburg for €22.5m, reflecting a 12.3% premium to the June 2020 valuation.

• SEGRO buys London logistics scheme at 2.3% yield

SEGRO acquired Electra Park, in Canning Town, for £133m, reflecting a record low net initial yield for the sector of 2.3%.

• LXI REIT shuffles portfolio with series of transactions

LXI REIT sold three assets (an office, a small social housing portfolio and development land) for £17m and recycled the proceeds into the acquisition of two foodstores (Aldi and Lidl) for £15m.

• Home REIT makes first acquisitions

Home REIT made its first purchases since launching, buying a portfolio of five properties for £9m.

• NewRiver REIT makes £34.7m retail park sale

NewRiver REIT sold a 90% stake in Sprucefield Retail Park, in Lisburn, for £34.7m, reflecting a net initial yield of 9.0%.

• Schroder European REIT sells Paris office for €104m

Schroder European REIT forward sold Boulogne-Billancourt office in Paris for €104m. The deal delivered a net profit of 35% and increased the company’s NAV by 15%.

QuotedData views

• Up in the AIRE – 30 October 2020

• Will Landsecs return to former glory? – 23 October 2020

• Rent collection nuggets – 16 October 2020

• International investors back for London offices – 9 October 2020

• IPSX has watershed moment – 2 October 2020

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Alternative Income REIT

Steve Smith, chairman:

Despite continuing political uncertainty and the potential for global economic dislocation, the fundamentals for UK property remain strong, even though there will inevitably be a good deal of disruption in the short term.

The performance at shareholder level has been unsatisfactory but the group has a solid portfolio which has suffered modest impairment in the past year and should perform well moving forwards. The proposed amendments to the investment policy will enhance the company’s capacity to pay a progressive dividend without impacting the underlying security of income and the board is encouraged by the relatively limited valuation reduction. This resilience together with the recent cost savings leaves the group well positioned to pursue an enhanced strategy, supported by an accomplished investment adviser in market conditions suited to a more active and responsive approach. The board believes that with additional investment it can deliver to its shareholders both strong performance and a secure and progressive dividend.

Although the board acknowledges that for certain shareholders the changes may represent a departure from the original strategy and a reduction of the commitment to a very long WAULT, we must all recognise that the world is going through a major upheaval which is having a huge impact on the physical environment and it would be wrong for the board to ignore the changes. Investments subject to very long leases of 20 years or more have become very expensive and the board and the investment adviser are convinced that the proposed target WAULT of 12 years is a more realistic objective and will deliver superior shareholder returns.

BMO Real Estate Investments

Peter Lowe, fund manager:

The property market had started to show some tentative signs of improvement as government restrictions eased. Investment activity saw a partial recovery, helped by overseas buying, with rent collection rates generally improving. Any improvement was however from a very low base with underlying performance polarised. A widespread or lengthy return to restrictions could compound existing structural challenges for parts of the economy.

There was further downward pressure on valuations in the retail sector remaining troubled, while there has been much debate around the future shape of the office market combined with a recent increase in available space and this sector has delivered a muted performance over the period. Industrial, logistics and distribution continue to offer relative resilience, reflected in increased investment demand and strong take-up.

Custodian REIT

Richard Shepherd-Cross, investment manager:

Investment activity had been increasing and appeared to have been tracking the emerging picture of forecast occupier demand. There is confidence in the industrial and logistics market where record investment volumes have been matched by record occupational demand for warehouse space. This occupational demand, driven by the continued growth of e-commerce and onshoring of supply chains, combined with low vacancy rates has led to the continuation of rental growth. Much of the investment capital that might have been focused on the office or retail sectors has been redirected to industrial and logistics. We see continued opportunity in this sector as the UK has yet to build a sufficient logistics network to support the continued growth in e-commerce.

Despite widespread remote working and the resulting low utilisation of offices across the country we expect recognition from occupiers of the social and well-being impact of returning to offices in some meaningful way, post the COVID-19 pandemic. Office owners must invest in their existing buildings to create flexible working spaces which may result in greater space requirements per head but perhaps for fewer workers. Offices allow space for organisational productivity, rather than individual productivity which may prove better when delivered working remotely either from home or smaller satellite offices. The lettings market has already seen an increase in enquiries in satellite office locations reflecting this trend which could be positive for Custodian REIT’s portfolio of small regional offices, acknowledging that forecasting office demand is currently subject to significant uncertainty.

The retail market has borne the brunt of the impact of lockdown with a huge reduction in footfall and consumers switching to online retailing instead. The COVID-19 pandemic disruption has accelerated trends that were already embedded in retailing when online retail already made up almost 20% of all UK retail sales, namely an oversupply of shops, downward pressure on rents and a rise in the number of retailers failing.

Healthcare

Target Healthcare REIT

Malcolm Naish, chairman:

The uncertainty and disruption [caused by COVID-19] look like continuing for quite some time in the absence of effective treatment or a vaccine. In the same manner in which many anticipate further profound changes to our way of life, particularly with regard to places of work, commuting and travel, government policy may also have to respond radically. The shape of recovery, with the prospects for a quick “V” shape rapidly waning, will impact borrowing, taxation levels and the need for further stimulus initiatives. Brexit concerns and trade wars have not vanished, and the counter-intuitive recent stock market highs have been “tech-dependent” and feel fragile.

Against this backdrop, two fundamentals stand out for me – both of which give me great confidence about the group’s prospects. Firstly, our business model is designed to allow us to pay a regular, stable and attractive dividend in what may well be an entrenched “lower-for-longer” interest rate environment. Secondly, our portfolio has performed well during the year, and has thus far demonstrated a satisfying resilience during COVID-19. We have seen rental and valuation growth. Falls in occupancy levels as a result of lockdown are being substantially matched by new enquiry levels. Whilst the timeframe for our homes to fully recover occupancy is uncertain, ultimately the care they offer is in the best modern real estate which can meet the needs of residents.

Development

Harworth Group

Owen Michaelson, chief executive:

Despite the pandemic, the core strength of the “beds and sheds” markets remains. Our sites persist in their popularity, backed by their strong locations close to principal infrastructure and the quality of the land and property. The stability of the regional markets in which we operate is underpinned by comparatively low prices, a continuing lack of consented and engineered land for housing given the continued chronic under-delivery of new housing stock, and the need for industrial land to support the acceleration of e-tailing post-pandemic.

We strongly welcome government support aimed at rebalancing the UK economy. Significant further financial investments in brownfield land, road and rail infrastructure and regional devolution will ultimately support making our regions more economically competitive and help to realise the significant latent value in our underlying portfolio.

Residential

Sigma PRS Management, investment adviser:

New housing delivery over the course of 2019/20 continued to fall short of annual government targets of between 240,000 and 340,000 new homes per annum. It is estimated that the deficit over the year was a minimum of 70,000 new dwellings. The COVID-19 crisis of 2020, which saw the shutdown of all building sites for at least six weeks and reduced activity levels thereafter, has further dampened unit output.

The supply of rented properties has also reduced following tighter regulation and increased tax burdens, which caused large outflows from the ‘Buy-to-let’ sector. With the average home in the UK now a multiple of 7.7 times gross average salary, the choices available to those who are too economically active to qualify for affordable housing but without sufficient savings to pay for a minimum deposit, are increasingly limited. The Build-to-Rent (BTR) sector can absorb some of this demand, although currently there are only 43,000 operational homes, and just 33,500 under construction.

BTR currently accounts for just 1% of all private rented homes in the UK, which when compared to 45% in the US and 35% in Germany, indicates the sector’s potential growth. Savills estimates that the sector, currently estimated to be worth £10bn, could expand to nearer £550bn at full maturity.

The UK market continues to focus on high-density flatted developments in city centre locations whilst the PRS REIT has maintained its focus on regional family homes. The relevance of the PRS REIT’s housing model has been brought into sharp relief this year with COVID-19 and home-working causing tenants to rethink their space requirements and the need for private outdoor space.

Real estate research notes

Civitas Social Housing – Solid foundations for future growth

Standard Life Inv. Property income Trust – Building for a new normal

Grit Real Estate Income Group – Africa, substantially de-risked

Aberdeen Standard European Logistics Income – Resilient to COVID-19

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.