Real estate quarterly report

Kindly sponsored by abrdn

Discounted indiscriminately

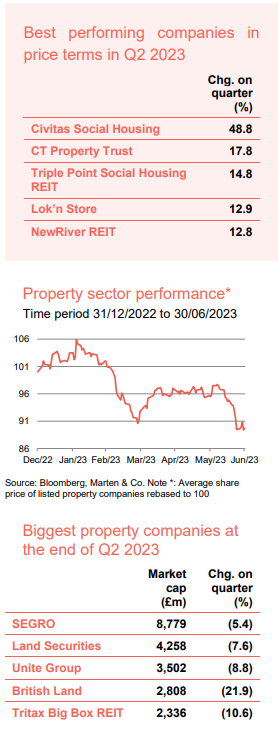

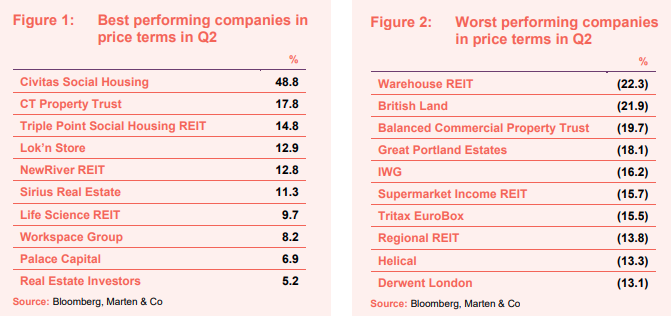

Stubbornly high inflation in the UK has raised the prospect of higher for longer interest rates, with the base rate hitting 5.0% in the UK dashing any hopes of a recovery in commercial property values for the foreseeable future. This negative outlook was reflected in the share price performance of real estate investment trusts (REITs) and listed property companies, as shown in the chart to the right.

Having bounced somewhat at the start of the second quarter (following an 8.9% fall in the first three months of the year) average share prices across the sector plummeted 6.0% in June and by 3.5% in the second quarter. In the first half of the year average share prices are down 10.3%. Investor sentiment towards the property sector has seen discounts to net asset value (NAV) widen indiscriminately across the sector, to levels not seen since the start of the pandemic. This was despite NAVs stabilising in the first quarter and asset sales backing up the legitimacy of book values. Sales were most evident in the industrial and logistics sector, where investors have been attracted by the re-rated assets.

As a result of the wide discounts, merger and acquisition (M&A) activity has intensified. During the quarter, Industrials REIT and Civitas Social Housing were taken private, while LondonMetric acquired CT Property Trust.

Performance data

Best performing property companies

Civitas Social Housing’s share price jumped almost 50% in the quarter after receiving a bid to take it private in May (more details on page 7), at a large premium to its prevailing share price. The bid was also a 26.7% discount to Civitas’s NAV, reflecting the sector’s wide discounts. The share price of the company’s peer Triple Point Social Housing REIT also rose substantially off the back of the bid.

Civitas was not the only subject of M&A activity in the quarter. CT Property Trust was the subject of an all-share bid from LondonMetric, at a decent premium, which resulted in its share price jumping almost 20%.

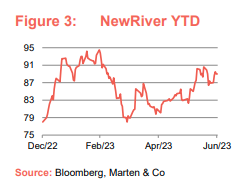

NewRiver REIT published annual results during the period that showed its strategy to focus on resilient retail was paying off with strong operational performance. Meanwhile, the company continues to lower its debt through the proceeds of asset sales, with its LTV now standing at 30%.

Of the rest, Life Science REIT continued its decent share price performance this year as it makes headway with its letting strategy, while flexible office provider Workspace announced favourable annual results compared to the rest of the market and continued to beef up its balance sheet with non-core disposals.

Worst performing property companies

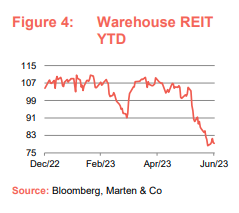

Warehouse REIT saw its share price fall by more than 22% in the quarter after it reported an almost 30% drop in NAV in the year to the end of March. The industrial and logistics sector has been hardest hit in terms of valuation declines following the rapid rise in interest rates over the past nine months, reflecting the extremely low property yields that they were trading on.

Another logistics-focused trust, Tritax EuroBox, also featured in the list of worst performers and has seen its share price fall 40.4% over 12 months. This is despite reporting strong rental growth and having extremely low cost, long-term, fixed debt.

Property stalwart British Land saw its share price fall by more than 20% after reporting another write down in the value of its portfolio in annual results. The recent share price performance, down 32.3% over 12 months, saw it drop out of the FTSE 100 for the first time in 20 years.

Central London office developers Great Portland Estates, Helical and Derwent London all suffered as investors continue to display caution towards the sector in the face of various potential headwinds including potential demand erosion from new ways of working and impending refinancing events that could potentially force fire-sales across the market and impact further on valuations.

Significant rating changes

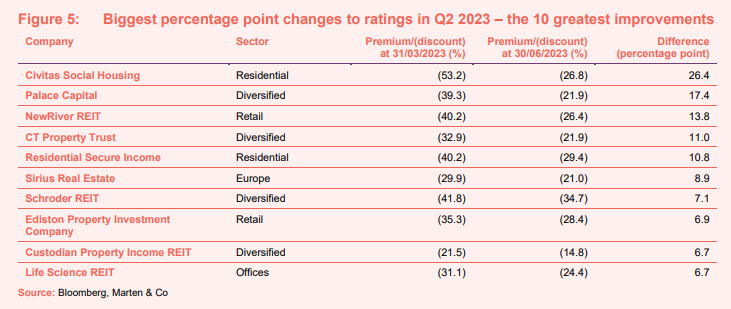

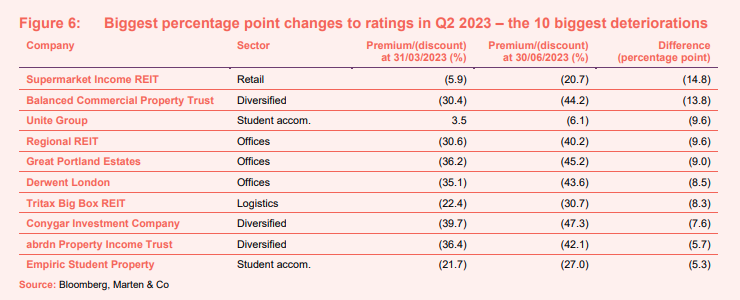

Discounts to NAV in the property sector remain some of the widest in the investment trust world. Figures 5 and 6 show how premiums and discounts to NAV have moved over the course of the quarter.

We discussed some of the names on this list in the previous section. Civitas’s share price bounce brought its discount in line with that of the bid price.

Palace Capital reported a fall in NAV during the period, while its share price increased. The company has sold a number of assets at or above book value and is returning money to shareholders through buybacks (although the pace of future sales is likely to slow due to market conditions).

Residential Secure Income posted a 16% fall in NAV in the six months to 31 March 2023, which resulted in its discount narrowing to 29.4%. Its share price held up in the quarter but has fallen 25.2% so far this year. At the end of September 2022, the company was trading at a small premium of 1.0%, before the market turmoil.

German and UK business park owner Sirius Real Estate reported an uplift in NAV in annual results – one of only a small handful of property companies to have done so in this high interest rate environment – which was reciprocated by a double-digit rise in its share price, closing the discount to 21%.

Diversified funds Schroder REIT and Custodian Property Income REIT and retail-focused trust Ediston Property Investment Company all reported sharp falls in their NAVs, narrowing discounts.

Supermarket Income REIT’s discount widened to 20.7% over the quarter as its share price fell 15.7%. This followed a large portfolio valuation write down (announced at the end of the previous quarter) due to the impact of higher interest rates.

Balanced Commercial Property Trust’s share price fell almost 20% over the quarter, despite the company reporting that portfolio values and its NAV had stabilised. At the end of June 2023, it was trading on an extremely wide discount of 44.2%. Its smaller peer, abrdn Property Income Trust, trades on a similarly wide discount having seen its share price fall 37.4% over 12 months.

The two student accommodation specialists – Unite Group and Empiric Student Property – also suffered share price drops during the quarter that saw the former’s rating swing to a discount and the latter’s discount widen. This was despite both reporting strong occupancy numbers and rental growth forecasts for the upcoming academic year amid a large supply-demand imbalance in the sector.

Major corporate activity

Fundraises

For the fourth quarter in a row, there was no fundraising activity as market conditions continue to dictate sentiment.

Mergers and acquisitions

A bid for Civitas Social Housing, by CK Assets, was declared unconditional having received enough support from shareholders. The company’s shares are expected to be cancelled on 4 August 2023 with almost 90% of shareholders (including CK Assets’ 17% holding) accepting the 80p per share bid (which was made on 9 May at a 27% discount to NAV but at a hefty premium to its share price).

LondonMetric and CT Property Trust (CTPT) reached agreement on the terms of a recommended all-share offer that will see LondonMetric acquire the entire share capital of CTPT. CTPT shareholders will receive 0.455 new LondonMetric shares per share, valuing the company at £198.6m. This represented a premium of 34.3% to the closing price of CTPT on 23 May and a discount of 6.3% on a NAV basis.

Industrials REIT shareholders voted overwhelmingly in favour of the £511m cash offer for the company made by US private equity giant Blackstone. Under the terms of the offer, each shareholder would receive 168p per share, a hefty premium to its prevailing share price.

Other corporate activity

Embattled Home REIT appointed AEW UK Investment Management LLP as its new manager. The manager will prioritise rent collection, which fell to 13% for the five months to the end of April 2023, and will also market a portfolio of properties for sale.

LXI REIT secured a new £565m interest-only debt facility with a syndicate of banks, comprising a £200m five-year revolving credit facility, a £115m five-year term loan and a £250m three-year term loan. The blended margin on the facility is 2.23% per annum over SONIA. The company has purchased interest rate caps representing £400m to cap the SONIA cost of the facility at a rate of 2.0%, resulting in an all-in rate of 4.23% per annum for the first three-years of the facility.

Urban Logistics REIT changed its management agreement that saw Logistics Asset Management LLP, which previously undertook the day-to-day running of the company through asset management services, take over from PCP2 (which is part of the Pacific Investments Group) as investment adviser. Pacific transferred its interests in the investment adviser to Richard Moffitt and Christopher Turner – part of the existing management team. The investment adviser’s appointment was extended for a further three years from 12 May 2024 and may be terminated on one year’s notice from 12 May 2026 onwards. Under the terms of the agreement, the annual advisory fee was also reduced from May 2024.

Ceiba Investments agreed to internalise the investment management contract away from abrdn plc. Sebastiaan Berger, the lead fund manager of Ceiba and a current employee of abrdn, will move to Ceiba as chief executive together with the existing management team. 4K Keys Limited, a company owned by the management team that currently provides consulting services to abrdn in connection with the management of Ceiba, will be appointed to provide strategic consulting services focused on generating cash flows from the real estate assets of the company’s subsidiaries. There will be no change to the board of directors of the company as a result of the internalisation.

Life Science REIT refinanced its existing £150m term loan and revolving credit facility (RCF) with HSBC and Bank of Ireland. The facilities include a £100m fully drawn term loan, increased from £75m, and a £50m RCF facility, both of which have had their terms extended to March 2026, with two further one-year extensions available. Additionally, the company has a £35m accordion facility available on the RCF, if required. Both facilities now carry a cost of SONIA plus a 2.5% margin. The SONIA reference rate on both facilities has been capped at 2.00% per annum until March 2025. The facility also includes a ratchet clause that reduces the margin rate to 2.35% if the gross loan to value ratio decreases to 30%. Following this refinancing £48.7m remains available in the RCF to be utilised in funding the ongoing development at Oxford Technology Park.

Sirius Real Estate completed the early refinancing of its next major debt expiry, a €58.3m facility with Deutsche Pfandbriefbank. A new seven-year, €58.3m facility with an all-in fixed interest rate of 4.25% will replace and redeem the existing facility upon its expiry on 31 December 2023 and will run until December 2030. The refinancing extends the group’s total weighted average debt expiry from 3.3 years to 5.0 years, while the weighted average cost of debt will increase from 1.4% to 2.1%. The group has a total of €975.1m of outstanding debt, €735.0m of which is unsecured.

Impact Healthcare REIT increased the size and extended the maturity of its revolving credit facility (RCF) with NatWest and extended its RCF with HSBC by a year. The NatWest RCF has been increased by £24m, making the total facility £50m. It has also been extended by four years, to June 2028, with a further two one-year extension options. The margin will be 200 bps above SONIA (up from 190 bps) and the interest cover covenant has been reduced from 250% to 175% in the first two years, increasing to 200% for the remainder of the term. The group has also agreed a one-year extension option to its HSBC RCF to April 2026. The interest cover covenant is being reduced from 250% to 200%, with the margin remaining at 200 bps above SONIA.

Triple Point Social Housing REIT completed its initial share buyback programme of £5m. In aggregate, between 20 April 2023 and 12 June 2023, the company repurchased 9,322,512 ordinary shares at an average purchase price of 52.61 pence per share. The share buyback programme may be extended following receipt of proceeds from a proposed portfolio property sale.

Major news stories

- SEGRO completed the acquisition of 419 hectares of land at the former Radlett Aerodrome in Hertfordshire for £120m, where it plans to develop a rail freight terminal with 3.6m sq ft of logistics warehousing.

- Supermarket Income REIT acquired a Tesco omnichannel supermarket in Worcester, for £38.3m, reflecting a net initial yield of 6.0%. The store was acquired from British Steel Pension Fund, with an unexpired lease term of 12 years.

- UK Commercial Property REIT sold its 186,455 sq ft Wembley180 logistics asset in London for £74m, reflecting a net initial yield of 3.49%, to The Church of Jesus Christ of Latter-day Saints. It will use the proceeds to enhance earnings by paying down a substantial amount of its £93m floating rate Revolving Credit Facility (RCF), currently costing 6.3% per annum in interest.

- NewRiver REIT sold the final two assets in its joint venture with Pimco, selling the Kittybrewster Retail Park in Aberdeen and Glendoe and Telford Retail Parks in Inverness for £62.6m (NewRiver share £31.3m), slightly below book value. The proceeds will be used to reduce its LTV to 30.3%.

- Tritax EuroBox let its recently completed development in Dormagen, Germany, to a leading logistics company on a 10- year green lease. The 36,000 sqm letting was 17.8% ahead of the rental guarantee it was receiving and benefits from 100% CPI annual indexation.

- abrdn European Logistics Income completed the sale of a 32,645 sqm warehouse, in Leon, Northern Spain, to SCPI Iroko Zen, for €18.5m. The disposal price reflects a 3% premium to the 31 December 2022 valuation and crystalises 20% profit.

- abrdn Property Income Trust completed a trio of lettings within its office portfolio. A lease to The Birmingham Chamber of Commerce and Industry and an agreement for lease to FCN Group completed at 54 Hagley Road in Birmingham, whilst a letting to OneStream Software completed at 15 Basinghall Street in London. Overall fund occupancy rate now exceeds 95%.

- The leases on 12 sites owned by Urban Logistics REIT, accounting for 3.3% of group income, will be transferred to London-listed logistics company DX Group Plc after previous tenant, Tuffnells, fell into administration in June.

- Hammerson completed the disposal of its 25% stake in Italie Deux, a 62,000 sqm shopping centre in central Paris, and 100% of the 6,500 sqm Italik extension, for €164m to Ingka Centres. This represented a 4% discount to book value and a net equivalent yield of 5.0%.

- Great Portland Estates recorded a record year for leasing, signing 105 new leases and renewals covering 861,200 sq ft and generating annual rent of £55.5m in the year to 31 March 2023. These were at an average 3.3% above the March 2022 estimated rental value (ERV).

Selected QD views

Real estate research notes

Tritax EuroBox – Optimism returns

abrdn European Logistics Income – Riding out the storm

Urban Logistics REIT – Fundamentals strong as market stabilises

Lar España Real Estate – Dominant assets make a resilient business

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.