Real Estate Roundup

Performance data

Performance data

January’s biggest movers in price terms are shown in the chart below.

The sluggish start to the year for listed property companies is hardly surprising given they were coming off a high base after the “Boris-bounce” following the general election in December. Topping the list was Triple Point Social Housing REIT. The group, along with its social housing peer Civitas Social Housing – which had the fifth highest share price gain in January, had a strong end to 2019 and regained some of the share price falls they had suffered earlier in the year. Both have taken the momentum into 2020 and their performance suggests the market has got to grips with their model.

Also high on the list is Secure Income REIT, which holds a diverse portfolio of healthcare and leisure properties, as its large dividend continues to prove popular. Off the back of some savvy portfolio recycling, Standard Life Investments Property Income Trust’s share price rose 8.5%. The company has been disposing of more risky assets and buying high yielding property with rental growth potential. Housebuilder Countryside Properties has now made the top 10 list for best performing companies for five straight months and in a 12-month period has seen its share price rise 58.8%.

The plight of the retail market sees no signs of abating and once again the worst performing funds of the month was dominated by retail-focused companies. Intu Properties’ share price fell a whopping 49.9% in January and in a 12-month period has lost 85.3% in value.

Six of the 10 worst performing companies in the month were companies with big retail portfolios. Fellow shopping centre owner Hammerson witnessed huge losses in January of 24.4%, and over a year has lost 37.2%. British Land, which owns a big retail portfolio as well as central London mixed-use office campuses and developments, also suffered as its near 50% weighting to retail drags on its performance. Capital & Regional, which owns a portfolio of secondary shopping centres, also took a big hit on its share price, as too did NewRiver REIT, whose portfolio is somewhat more diverse than that of Capital & Regional. The final retail-focused company among the worst performers is Capital & Counties. It recently converted to a REIT after selling off its Earls Court residential development site. After a strong final two months of 2019, CLS Holdings, which owns a diverse portfolio of property in the UK, Germany and France, saw its share price come off slightly.

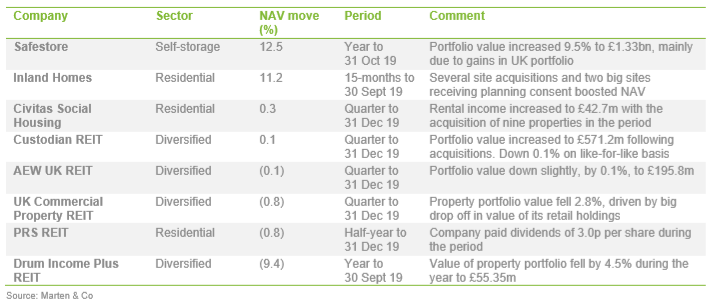

Valuation moves

Valuation moves

Corporate activity in January

Corporate activity in January

Embattled shopping centre owner Intu Properties is planning to raise as much as £1bn in fresh equity in February 2020 in a bid to shore up its balance sheet.

Target Healthcare REIT secured a new £50m borrowing facility with an aggregate fixed rate of interest of 3.28% per annum for its 12-year term. The facility has been used to repay an existing £40m loan with First Commercial Bank, which was due for repayment in August 2022. The average term to maturity of the group’s borrowings has extended from 1.6 years to 4.3 years following the deal.

Shaftesbuty’s dispute with major shareholder Samuel Tak Lee rumbled on with Tak Lee blocking three resolutions at the group’s AGM relating to issuing new shares and holding meetings on 14 days’ notice. Tak Lee is suing Shaftesbury for £10.4m relating to a December 2017 placing.

SEGRO announced a restructuring of board roles after chief investment officer Phil Redding stepped down. Responsibility for capital allocation and portfolio planning will now be integrated with a newly formed ‘strategy, investment and innovation’ function reporting to chief financial officer Soumen Das.

Ground Rents Income Fund refinanced its debt, reducing its overall interest cost from 3.37% to 2.76%, increasing the loan to value covenant on its debt from 40% to 45% (giving it more headroom to borrow if it chooses) and extending the facility’s maturity from November 2021 to January 2025.

Yew Grove REIT has agreed a €9.9m increase to its three-year floating rate loan facility with Allied Irish Banks, bringing the total to €39.0m. The facility is in place until December 2021 and interest is charged on a margin over three-month Euribor.

January’s major news stories

January’s major news stories

• Urban Logistics REIT exploring capital raise to fund acquisition pipeline

Urban Logistics REIT said it was considering an equity fundraising having identified a pipeline of acquisitions worth more than £300m. It was in advanced negotiations on £146m worth of property, it said.

• GRIT Real Estate completed acquisition of Senegal hotel

GRIT Real Estate completed a deal to buy the Club Med Cap Skirring Hotel in Senegal for €16.2m and plans to commence with renovation and development works, which are capped at a cost of €28m, by the end of Q1 2020. On completion of the development work, the lease with Club Med will be renewed in the form of a 12-year lease.

• ASLI completed €49.9m Netherlands logistics warehouse buy

Aberdeen Standard European Logistics Income acquired a 43,000 sq m logistics warehouse in Den Hoorn, in the Netherlands, for €49.9m, reflecting a net initial yield of 4.5%. The newly built facility, which is located within the Randstad region – the most densely populated areas in the country, is let to a logistics operator on a 10-year CPI indexed lease.

• Target Healthcare REIT bought new care home development site

Target Healthcare, the care home investor, completed the acquisition of a new development site in Cheshire for £9.7m as it continued to deploy the proceeds from its £80m oversubscribed capital raise in September 2019.

• Helical fully-lets Old Street office scheme

London office developer Helical let the final floor of The Tower office scheme, near Old Street, taking the building to 100% let. Brilliant Basics, an Infosys Company and existing occupier, let the 11,331 sq ft 15th floor on a five-year lease. The building has an average rent per square foot of £73.55.

• Great Portland Estates sold Kurt Geiger-let office for £64.5m

Great Portland Estates exchanged contracts to sell 24/25 Britton Street, which is located in the City fringe area and let to Kurt Geiger, to an overseas investor for £64.5m. The deal reflects a net initial yield of 4.07% and was sold at a premium of 6.2% to the September 2019 valuation.

• CLS Holdings acquired an office in Staines for £19m

CLS Holdings, the UK, France and Germany focused property company, exchanged contracts to acquire ‘TWENTY’ Kingston Road in Staines for £19m, reflecting a net initial yield of 5.3%. It also sold Quayside Lodge in Fulham for £19m.

• Triple Point Social Housing added four supported living properties to portfolio

Triple Point Social Housing completed the acquisition of four supported housing properties, totalling 41 units, for £6.3m. They are located in Yorkshire and the East of England.

• Sirius Real Estate bought two German business parks for €33.4m

Sirius Real Estate, which owns and operates business parks in Germany, added two more assets to its portfolio for a total of €33.4m. Neuss II, in Düsseldorf, and Neuruppin, in the Brandenburg region, were acquired for a net initial yield of 6.8%.

• Picton Property sold a DHL-let warehouse for £15.9m

Picton completed the disposal of a distribution warehouse in Lutterworth, Leicestershire, for £15.9m. The sale of 3220 Magna Park follows the execution of an asset management initiative that saw Picton restructure the lease with DHL secure an 11% uplift on the rent to £1m a year.

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Diversified

UK Commercial Property REIT

Will Fulton, lead manager:

The political clarity derived from the election result has prompted a noticeable increase in the level of optimism from agents in the market, particularly towards Central London offices. However, as we enter a critical period for Brexit negotiations, we see very little justification to be taking on unnecessary risk at this stage in the UK real estate cycle. The focus remains on asset-level risk and income prospects to identify attractive long-term investment opportunities in the UK real estate market.

Given the macroeconomic environment, the UK commercial property market is holding up well with positive total returns forecast for ‘all commercial property’ over the next three years (from December 2019) primarily driven by income. While investment volumes in 2019 were down compared to previous years, occupancy is generally high (other than for much of the retail sector) and there are signs in the first few weeks of the current year of a general pick-up in sentiment and property market activity. The trends that have negatively impacted the retail sector have benefitted the industrial/logistics sector as retailers move more of their business online, increasing the need for storage and distribution space. Aside from well documented issues in much of the retail sector, the wider property market continues to be underpinned by good fundamentals – limited development, high occupancy rates and controlled leverage with attractive income returns compared to other asset classes.

Drum Income Plus REIT

Hugh Little, chairman:

Real Estate has been hit hard in the last six months due to investor concerns about retail. The sector has been changing for a long time in how it is carried out as an activity, and in terms of what consumers want to buy and from where. Investors and retailers on the wrong side of this substantial shift are paying a big price. However, retail is not dying, it is changing.

The advantages of real estate as an asset class remain compelling both as a source of income and as a diversifier. In addition, pricing does not appear stretched relative to bonds. From an international perspective, yields are competitive against the European markets. Supply levels are in check and development activity subdued. Demand for property investment companies to access the market should rise as the liquidity issues in the daily traded property unit trusts continue to be a cause for concern. This should be a positive for the closed-ended investment company sector and its ability to manage illiquid asset classes.

AEW UK REIT

Alex Short, portfolio manager:

The result of the UK general election on 13 December delivered a significant majority to the UK government for the first time in a decade, removing some of the political uncertainty which has prevailed for some time and leading to improved sentiment across the market. This is encouraging for the sector as a whole and positive for the company. The company’s portfolio is well-positioned as we move into 2020 and we are seeing many exciting opportunities. We are actively working on an exciting pipeline of potential acquisitions with a particular focus on the industrial and office sectors, which we believe will be accretive to the strategy both in terms of income but also in terms of long-term value retention and creation opportunities. To that end, the company intends to raise additional capital under its existing Placing Programme in the near future.

Residential

Residential

Civitas Social Housing

The recent definitive General Election result has brought greater clarity to the political landscape. Whilst specialist supported housing has always received cross-party support it is helpful that the macro environment has gained greater clarity and the new Government has made various commitments supporting the delivery of state funded healthcare and social care.

Demand continues to be very strong for the provision of properties in which higher acuity care is delivered, as this generates the highest cost saving for the state and local authorities and the best personal outcomes for individuals. It is also where the rental cost is at its lowest when compared with the total cost of care and accommodation combined.

More generally we have noted that the importance of providing safe, community based accommodation for vulnerable adults, and the insufficiency and dangers of institutional care, are rising up the public debate agenda, with these issues having been highlighted recently by Parliamentary groups, investigative journalists and activists. We consider that this public focus is likely to generate additional demand for the properties that Civitas and others seek to deliver and to highlight the tangible benefits that result from a well-constructed community placement.

Inland Homes

Terry Roydon, chairman:

The lack of suitable housing in our target markets continues to result in sustained demand for the houses and apartments we build. However, we need focused and positive dialogue between the Government and industry in the face of ongoing political and regulatory uncertainty.

If the Government is to achieve its goal of building 300,000 new homes a year by the mid-2020s, the planning process needs further attention. Housebuilders spend an enormous amount of time and money obtaining consents and on clearing reserved matters within an outline planning consent. An extension or alternative to the existing Help to Buy scheme, due to end in 2023, will also be essential to keep the market moving.

Self-storage

Self-storage

Safestore

Frederic Vecchioli, chief executive:

There are numerous drivers of self-storage growth. Most private and business customers need storage either temporarily or permanently for different reasons at any point in the economic cycle, resulting in a market depth that is, in our view, the reason for its exceptional resilience. The growth of the market is driven both by the fluctuation of economic conditions, which has an impact on the mix of demand, and by growing awareness of the product.

Safestore’s domestic customers’ need for storage is often driven by life events such as births, marriages, bereavements, divorces or by the housing market including house moves and developments and moves between rental properties. Safestore has estimated that UK owner-occupied housing transactions drive around 10-15% of the group’s new lets. The group’s business customer base includes a range of businesses from start-up online retailers through to multi-national corporates utilising our national coverage to store in multiple locations while maintaining flexibility in their cost base.

Upcoming events

Upcoming events

• Tritax EuroBox AGM, 13 February 2020

• Schroder European REIT AGM, 3 March 2020

• Master Investor, 28 March 2020

Recent publications

Recent publications

Retail property market – Ready for a renaissance?

Industrial property market – The gift that keeps on giving

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.