Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

August’s biggest movers in price terms are shown in the chart below.

There were some interesting price rises during the month of August as investors’ search for returns took them to property companies that have seen their share prices severely depressed during the Covid-19 pandemic. The biggest share price mover was BMO Real Estate Investments, with a 24.1% rise. Despite this, the company, which owns a diversified property portfolio, has seen its share price fall 19% in the year to date.

Fellow diversified property trust Alternative Income REIT saw its stock rise 22.4% having increased its dividend above pre-Covid levels. BMO Commercial Property Trust and Regional REIT both saw double digit gains in their share price during the month after declaring re-set dividends. Two student accommodation specialists, GCP Student Living and Empiric Student Property, saw strong share price growth as demand for university places from domestic students increased, despite the A-Level results fiasco. Both companies are still trading at significant discounts to net asset value having seen their share prices fall by around 30% in the year to date.

Once again retail landlord Hammerson was the biggest monthly share price faller among listed property companies, having announced a rights issue and share consolidation plan. The share price of small-cap company Drum Income Plus REIT also continued to fall. After suspending its dividend amid poor rent collection figures, its share price has now fallen 51.6% in the year to date. Another long-time constituent of the top 10 price fallers, shopping centre owner Capital & Regional, saw another 14% decline during the month as retail continued to struggle. It has now lost 72.4% in the year to date.

Central London landlord Capital & Counties, which owns huge swathes of Covent Garden, suffered a 7.5% fall as visitor numbers to London continued to be subdued due to coronavirus. The company reported a huge fall in NAV of 18% in half-year results. Standard Life Investments Property Income Trust suffered a 7.6% fall after announcing a drop in net asset value, while both Schroder REIT and Schroder European REIT also saw share price falls.

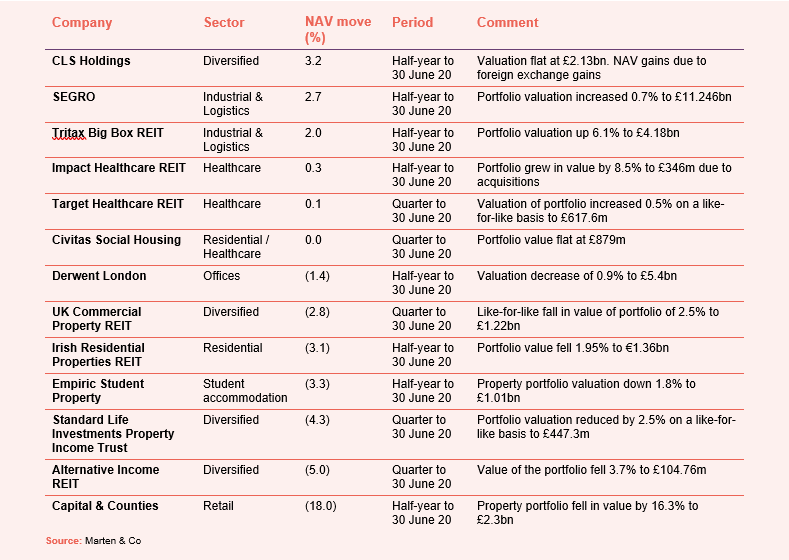

Valuation moves

Corporate activity in August

There were no equity raises among listed property companies in August.

Hibernia REIT, which owns commercial and residential properties in Dublin, announced a €25m share buyback programme that it said would return to shareholders the proceeds from the sale of 77 Sir John Rogerson’s Quay. In August it bought 2,688,183 shares for around €3.1m.

Stenprop, the UK industrial investor, repurchased 1,110,937 shares for around £1.3m during the month to “mitigate the dilutive effect of the scrip dividend election”.

Hammerson announced a proposed rights issue and share consolidation to raise gross proceeds of around £552m. This along with the sale of its 50% stake in VIA Outlets,

would raise gross proceeds of around £825m. The money raised will pay down debt to about £2.2bn, a loan to value (LTV) of 41.7%.

Great Portland Estates announced it is issuing £150m of new unsecured US private placement notes. The sterling denominated notes cover 12-year and 15-year maturities and have a weighted average fixed rate coupon of 2.77%. The company’s weighted average debt maturity will be 7.5 years once drawn on 5 November and it will have £500m of available liquidity.

Standard Life Investments Property Income Trust’s chairman Robert Peto stepped down from the board. He was replaced as chairman by James Clifton-Brown.

August’s major news stories

• Working from home or back to work?

The debate around the future of the office continues to rage with the government on a campaign to get people back to the office. But is there an appetite among employees and even employers to get back to the office, though?

• Civitas Social Housing confirms cash raise likely

The board of Civitas Social Housing said it was “considering options for raising additional capital” to enable it to fund the acquisition of properties in its pipeline. New debt facilities were also being negotiated to finance some of the pipeline.

• Urban Logistics REIT makes trio of purchases

Urban Logistics REIT bought three assets for £36.8m in Colchester, Exeter and Nottingham. At Exeter, the acquisition comprised two development plots pre-let to Amazon and DHL.

• An unlikely saviour of shopping centres

The solution to filling the vast amount of vacant space in shopping centres could come from an unlikely source in logistics. Mall owners in the US have reportedly been in talks with Amazon to let vacant department store space into distribution hubs. The idea makes perfect sense for both parties.

• McKay Securities buys Bracknell logistics property

McKay Securities acquired the fully-let 1-4 Willoughby Road logistics asset in Bracknell for £10m, representing a net initial yield of 5.6%. The combined contracted rent of £594,722 per annum provides scope for future growth based on recent lettings in the town and the leases offer potential vacant possession for redevelopment in 2024.

• University challenge may come good

Listed student accommodation specialists could replace the lost international student cohort with demand from domestic students. With a possible return of international students next year, the large discounts that the student accommodation specialists are trading on could be enticing.

• Triple Point Social Housing REIT completes acquisition of 16 properties

Triple Point Social Housing REIT has completed the acquisition of 16 properties, comprising 70 individual units in total, for £9.6m. CPI-linked, upward only leases of between 20 and 40 years have been entered into with care providers or housing associations, including Blue Square Residential, Inclusion Housing, Keys Group and Sandwell Community Caring Trust.

Stenprop bought St Andrews Industrial Estate a 73,248 sq ft multi-let industrial estate of nine high quality warehouse units near Glasgow city centre. The £5.5m acquisition price reflects a net initial yield of 7.3% and a capital value of £75 per sq ft. Multi-let industrial now constitutes 60% of Stenprop’s portfolio.

• LondonMetric Property hikes dividend 5%

LondonMetric Property demonstrated the resilience of its logistics-focused property portfolio with a 5% hike in its quarterly interim dividend to 2.1p.

• BMO Commercial Property Trust reintroduces monthly dividend

BMO Commercial Property announced it was to reintroduce a monthly dividend from August at 0.25p per share (half the previous rate). It also agreed a new £100m loan facility that matures on 31 July 2022.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Will Fulton, investment manager:

While it is likely that April will prove to be the nadir for the economy, the shape and speed of recovery remain uncertain at present. All told, we are forecasting a 12.9% contraction in GDP for this calendar year and then a strong, but still partial, recovery of 11.8% growth in 2021. Our house view forecast for a theoretical balanced portfolio of “All Property” expects capital values to fall by more than 14% for this calendar year, with a total return of -9.5%. This would be the second weakest nominal return in the 40-year history of MSCI data. We continue to expect retail to drag the market down, with shopping centre returns forecast to be down 31% over the year. With the segment recording a -9.1% return in the first quarter and the occupier outlook deteriorating substantially since, there may be downside risk even still.

Fredrik Widlund, chief executive:

While 2020 will be a challenging year for many businesses and economies, the last six months have both reinforced the merits of focusing upon, and the diversity benefits of being in, the three largest economies in Europe [Germany France and the UK]. At CLS, we will continue to offer our tenants flexibility in both leases and space configuration as part of providing sustainable, modern spaces that help businesses to grow.

The development and response to the pandemic and the underlying structure of the economies in each of our three countries have meant that we are not seeing a unified picture, with Germany showing an impressive resilience while France and the UK are displaying slightly more uncertain economic indicators, the latter also exacerbated by the uncertainty surrounding the Brexit negotiations. However, we are long-term investors and although the countries have different characteristics, we believe strongly in the long-term prospects of all three economies.

With the gradual easing of lockdown restrictions, the priority for the second half of the year is the conversion of our leasing enquiry pipeline to drive occupancy while continuing to maintain a high level of cash collection from the portfolio. Initial indications are that leasing enquiries are picking up in lockstep with general economic activity.

Industrial & logistics

David Sleath, chief executive:

The Covid-19 pandemic and resulting lockdown measures enforced by governments across Europe have had wide-ranging implications for our diverse customer base. Many have seen demand for their products and services rise sharply, whilst some others have suffered short-term cash flow challenges.

It remains to be seen how long these immediate effects will last but it is clear that the structural trends that have been contributing to occupier demand for our space over recent years have strengthened as a result of the pandemic. This is already starting to show in elevated take-up levels: for example, UK logistics take-up hit record highs in the first six months of the year, 44% higher than in the same period last year according to data recently published by CBRE.

E-commerce penetration has accelerated markedly across all our markets, there is a renewed focus on the efficiency and resilience of supply chains, and the demand for data centre space is increasing as a result of the need for additional data storage to support remote working and video streaming services. These themes should drive both occupier and investor demand for high quality warehousing in core logistics and urban locations.

Sir Richard Jewson, chairman:

The outlook for logistics real estate remains strong and increasingly positive. Occupational and investment demand has remained elevated with the Covid-19 pandemic appearing only to accelerate the tailwinds that have benefitted the sector in recent years. Despite these positives, it is prudent to maintain a cautious outlook on the longer-term impacts from Covid-19, particularly in the face of a potentially deep and protracted recession. We are maintaining an appropriately cautious stance in light of potential longer-term effects from Covid-19 on our customers and the wider economy.

Residential

Irish Residential Properties REIT

Margaret Sweeney, chief executive:

We continue to monitor the development of the pandemic and assess how I-RES will respond to the changing economic environment. The various stimulus and income support measures provided by the Irish government have assisted some of our residents during these last few months. We believe that continued government support and policy stability in Ireland will assist both individuals and companies to successfully come through this very uncertain and unpredictable environment.

Despite continued improvement in housing output in Ireland during 2019, a significant shortage of accommodation still remains the most pressing issue within the housing market. Supply remains limited and is further impacted by current regulations due to Covid-19. Demand drivers for quality, well located and professionally managed accommodation remain strong, in addition to continued population growth and strong inward investment in key sectors.

Offices

Paul Williams, chief executive:

Caution persists especially over the pace of the London economic recovery with many businesses delaying their return to work. In the short term, we are still to see the impact of the government withdrawing furlough support and the terms by which the UK leaves the EU at the beginning of 2021.

We expect rising unemployment and business closures will see the London office vacancy rate rise which, in turn, may put pressure on office rents. However, we believe our better-quality lower rise space, located in West End and Tech Belt mixed use locations that attract a broader spread of occupiers, will be relatively resilient.

Against the background of extremely low interest rates, the relatively attractive yields on central London office properties should support values. However, investments are likely to become increasingly differentiated with demand focused on properties that offer secure income with a growing focus on adaptability and climate resilience.

Occupier demand is key to our business so the speed of London’s economic recovery will play an important part in determining our medium-term performance. The current slowdown in momentum means that, in the short term, there will be more focus on the Group retaining existing income. However, we do have significant income growth already built-in from our recently completed or pre-let developments.

Student accommodation

Mark Pain, chairman:

The attractive fundamentals of increasing structural demand from both domestic and international students for premium, responsibly managed student accommodation focused in high demand UK towns and cities remains strong, whilst the supply of such accommodation continues to be restricted. Combined with the company’s robust balance sheet, differentiated well located portfolio focused on premium studio-led and smaller buildings with rooms predominantly direct-let, and the benefits of our operational transformation continuing to strengthen, we see significant opportunities for the group to grow and deliver value to our stakeholders despite the short-term uncertainty.

Real estate research

Grit Real Estate Income Group – Africa, substantially de-risked

Aberdeen Standard European Logistics Income – Resilient to covid-19

Civitas Social Housing – Proved its mettle

Standard Life Investments Property Income Trust – Adding value in cautious times

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.