Post COVID-ready

Standard Life Investments Property Income Trust’s (SLI’s) manager has tweaked its investment criteria, putting a greater emphasis on holding assets with strong ESG credentials. These follow structural trends that have emerged during COVID. In the pursuit of durable income with growth potential, high-yielding investments have made way for newer, quality assets that the manager believes meet future occupier and investor demand in a post-COVID world.

With eyes firmly fixed on the future, the fund invested in a carbon offsetting project that will go a long way to achieving its net carbon zero target. It is set to gain significant early mover advantage, securing a relatively cheap fixed-price solution, with the path to net zero expected to become increasingly expensive. A peer group beating NAV performance further highlights its undeservedly wide discount.

Commercial UK property exposure

SLI aims to generate an attractive level of income, along with the prospect of both income and capital growth, by investing in a diversified portfolio of UK commercial property assets, primarily in three principal commercial property sectors: industrial, office and retail. SLI uses gearing with the aim of enhancing returns, with the current loan-to-value (LTV) ratio at 17.6%.

Fund profile

SLI launched on 19 December 2003. It is domiciled in Guernsey, has a premium main market listing on the London Stock Exchange and, to maintain a tax-efficient structure, migrated its tax residence to the UK on 1 January 2015, when it also became a UK Real Estate Investment Trust (REIT).

SLI aims to provide investors with an attractive level of income, together with the prospect of income and capital growth. It aims to achieve this by investing in a diversified portfolio of UK commercial property. These are principally direct holdings within the three main commercial property sectors: office, industrial and retail, although it can also hold assets in the alternatives sector.

The board’s and manager’s preference is towards properties that are in good, but not necessarily prime, locations, where it is perceived that there will be good continuing tenant demand. The manager also looks for properties where it can add value using asset management initiatives. There is a focus on tenant quality, and as part of SLI’s strategy, tenants are treated as key stakeholders and the manager works closely to understand their needs. The aim is to achieve greater tenant satisfaction and retention, and hence lower voids, higher rental values and stronger returns.

SLI has full use of the wider Aberdeen Standard Investments (ASI) team, which has 270 people globally working on property. This provides access to specialist transactions, ESG, debt and research teams, as well as providing a risk management framework.

The manager

SLI’s portfolio has been managed by Jason Baggaley since September 2006. Jason has 30 years of property management experience. He has previously worked for Legal & General as a portfolio manager and joined Standard Life Investments in 1996. He gained his degree in real estate from the University of Portsmouth in 1990. He is a member of the Royal Institution of Chartered Surveyors (RICS).

Benchmark index

SLI uses the quarterly version of the IPD Balanced Monthly Funds Index to assess the performance of its property portfolio. The trust also uses the FTSE All-Share REIT Index and, to a lesser extent, the FTSE All-Share Index as means of comparison in its own literature. For the purpose of this report, we have used the Morningstar UK REIT Index and the MSCI UK Index as comparators. However, we have also included comparisons against peer group averages as well as a range of cash measures.

Market outlook

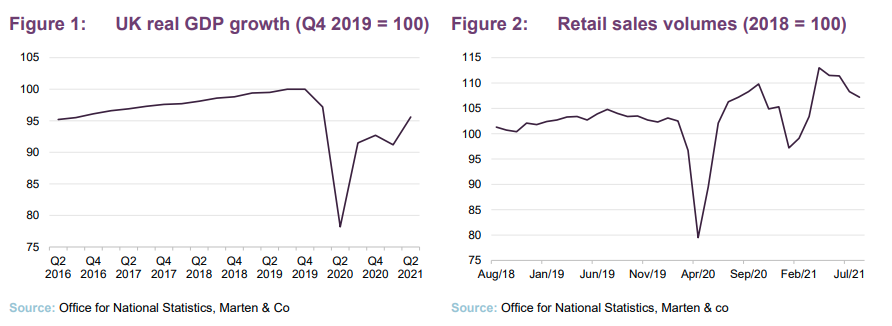

The UK commercial property market’s recovery from the depths of the COVID-19 pandemic is gaining momentum, with almost all restrictions lifted. The success of the vaccine programme has enabled the reopening of the economy and confidence to return to businesses.

UK gross domestic product (GDP) was estimated to have increased by 4.8% in the second quarter of the year following the easing of restrictions. The largest contributors to this increase were from wholesale and retail trade, accommodation and food service activities. The level of GDP is now 4.4% below where it was pre-pandemic. Retail sales fell in August but were 4.6% higher than pre-pandemic levels in February 2020.

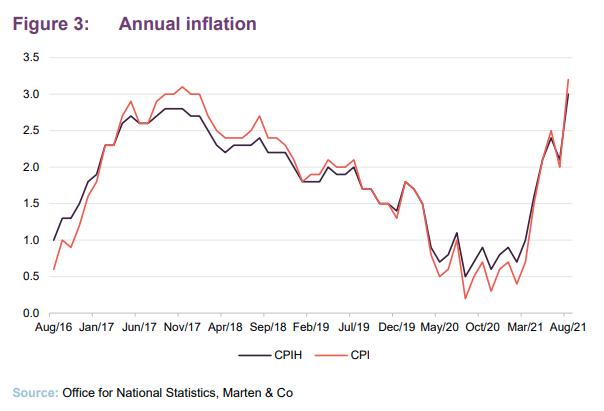

The re-opening of the economy was accompanied by a marked increase in inflation. The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.0% in the 12 months to August 2021, up from 2.1% in the 12 months to July, the largest since records began in 2006. Base effects largely drove inflation, with the discounted restaurant and café prices in August 2020 resulting from the government’s Eat Out to Help Out scheme and reductions in VAT across the same sector. Fuel prices also dropped sharply last spring and are now significantly higher.

The prospect of higher transport costs, due to the shortage of HGV drivers, pushing up the price of food has led to forecasts of inflation reaching 4% by the end of the year – double the Bank of England’s target. If high inflation was sustained, a rise in interest rates next year becomes more likely.

Commercial property valuation uplifts

The UK’s economic recovery has been mirrored in a recovery of commercial property values. According to the MSCI UK Monthly Property index, which measures the unlevered total returns of 2,065 property investments with a total capital value of £36.8bn, property returns increased 1.4% in August 2021 versus July. Over a six-month period, returns rose 7.9% and in 12 months, 11.8%.

All sectors saw positive returns in August, but the polarisation across the three core sectors (retail, office and industrial) continues, as illustrated in Figure 4. The industrial sector, benefitting from structural changes in retail consumption, saw the largest return (we go into more detail on the structural trends driving performance in the different sectors in the next section).

Despite the economic recovery, the prospect of a spike in cases, hospitalisations and deaths from COVID this winter looms large. A return to lockdown – as witnessed in March–June 2020, November 2020 and the first few months of 2021 – would likely see businesses in the retail, leisure and hospitality sectors struggle to pay rent again and valuations decline.

Structural trends to drive performance

During the pandemic structural trends have developed or accelerated that are likely to have a profound effect on the future of commercial real estate and a continued polarisation of the sectors, at least in the medium term. Most prominent is the continuation of the structural shift to online retailing, which has been accelerated during the pandemic. This has driven demand for logistics space and, in turn, rental growth.

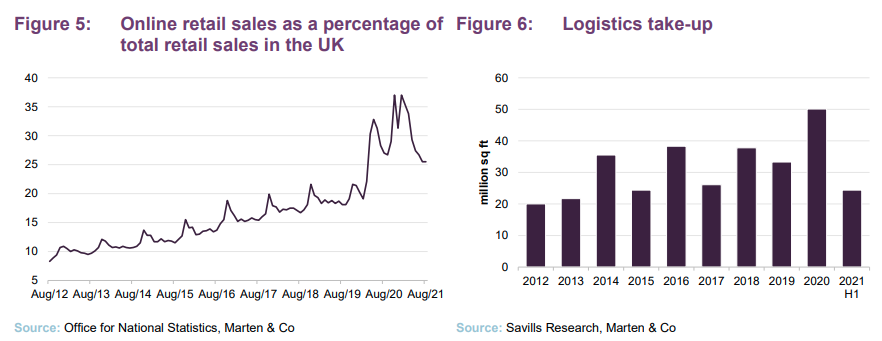

Figures 5 and 6 show the correlation between the growth in online retailing and take-up of logistics space over the past decade. Since February 2020, online sales as a percentage of total sales in the UK have grown from 19.1% to 25.5% in August, having been as high as 36.3% in January 2021. Online sales seem to have plateaued since the reopening of the economy at around 25% of total retail sales, with both July and August 2021 at the same level.

In response, record-breaking take-up of logistics space was recorded in 2020, with 50.1m sq ft of warehouse space let (12.7m sq ft ahead of the previous record set in 2016). The first half of 2021 has continued in the same way, with 24.41m sq ft of warehouse space transacted, according to Savills, setting a new half-year take-up record, 82% above the long-term half-year average. Demand for logistics space has not all been down to online retailing. Supply chains have been tested during the pandemic like never before, with shortages and issues across the UK. Weaknesses in global supply chains were exposed and found to be lacking in sufficient levels of stock and has resulted in a near-shoring or re-shoring of manufacturing facilities closer to the end consumer. The Suez Canal incident in March 2021 further emphasised the need for supply chain resilience.

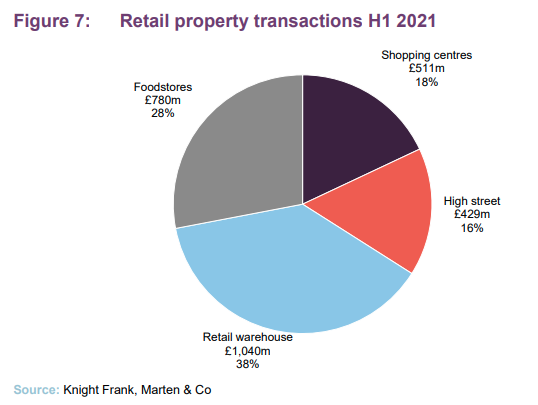

The trend to online retailing is the key reason behind the retail sector’s challenges, especially in the high street and shopping centre sub-sectors, which are expected to have another year of negative returns. The retail warehouse sub-sector has been in favour with investors, as illustrated in Figure 7, due to the fact it plays a key role in retailer’s omnichannel offerings through click-and-collect. They tend to be located on the edge of town/city centres, offer free parking and have large footprints. Those that are let at affordable rents and anchored by grocery, discount retailers and/or DIY occupiers are particularly sought-after.

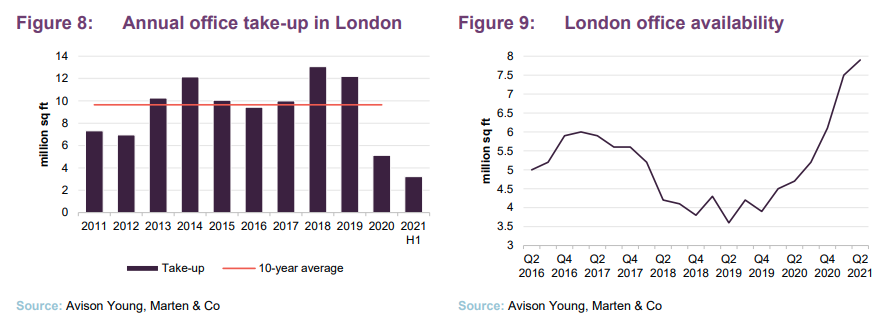

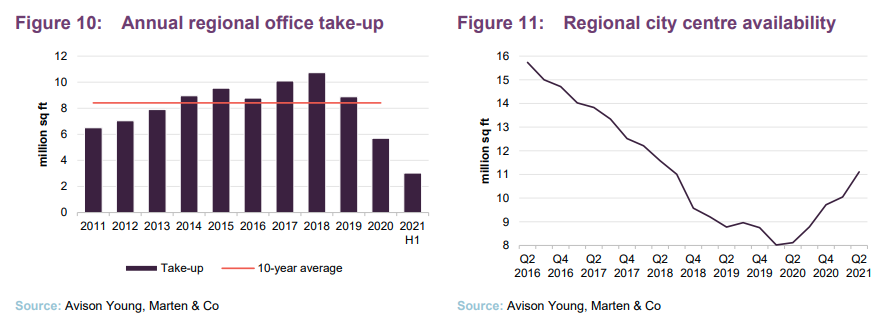

The structural trends at play in the office sector are expected to have a huge bearing on the future of the sector. The trend for remote and hybrid working, which was forced on many businesses during lockdowns, is expected to endure after the pandemic – causing much uncertainty for the office sector. The impact on office space requirements is not yet known, and in truth will probably not be known for many more months as businesses assess what works for them. Accordingly, take-up of office space was well below the 10-year average across the UK as companies put office moves on hold.

Availability of office space has also risen in all major office markets, but most steeply in London. The net effect of depressed take-up and increased availability is likely to be a stagnation in rental growth for the medium term. Smaller, secondary offices have been hardest hit and are expected to see a fall in rental levels.

Manager’s view

Given the evolving real estate trends highlighted during the pandemic and the increasing importance and relevance of ESG in property, SLI’s manager – Jason Baggaley – has reviewed its portfolio and tweaked its investment strategy to put a greater degree of emphasis on sustainability and post-COVID trends.

For the best part of a decade, SLI has invested in good secondary properties at higher-than-average yields, with the benefit of capturing yield compression between prime and secondary. The manager believes that over the next five years there will be a reversal of this theme, and that the yield spread for secondary assets will widen. At the core of this thinking is sustainability. The manager believes investors and occupiers will shy away from assets with poor ESG credentials, and pricing will fall as new investors build in significant refurbishment costs. Sustainable and growing income will come from better-quality assets, and yields will remain keen for those, he argues.

Change driven by COVID-19 means that an active approach to managing the portfolio is required, he states. In the office sector, SLI had undertaken a thorough review of the portfolio to ensure that the assets are “future fit”, meaning they will meet the needs of occupiers and investors in a post-COVID world. The manager expects a divergence in fortunes across the office sector, with total occupier demand under downward pressure from hybrid working. Offices that do not offer amenities and connectivity and fail on sustainability measures face a hugely challenging future that is not, in his view, reflected in current values. Assets that are future-fit, however, will remain attractive and could start to attract a rental premium if supply of the highest quality buildings is constrained, he says. For this reason, secondary offices will become increasingly distressed, with high vacancy rates and very weak occupier demand resulting in significant falls in rents and values.

SLI has disposed of assets that it doesn’t believe fit these criteria (more detail on page 12) and will recycle the proceeds into a pipeline of assets that do (more detail on page 14). Of course, this will come with a different yield profile than SLI’s investors have become accustomed to, but the manager states that investors will be rewarded with durable and growing income.

Investment process

The majority of the portfolio is invested in direct holdings within the three main commercial property sectors of retail, office, and industrial, although SLI may also invest in other commercial property such as hotels, nursing homes and student housing. Investment in property development and in co-investment vehicles where there is more than one investor is permitted up to a maximum of 10% of the property portfolio.

Risk limits and controls

SLI must abide by the following restrictions to the portfolio:

- No property will be greater by value than 15% of total assets;

- No tenant (with the exception of the government) shall be responsible for more than 20% rent roll; and

- Gearing, calculated as borrowings as a percentage of the group’s gross assets, may not exceed 65%. The board’s current intention is that the company’s LTV will not exceed 45%. The current LTV is 17.6%, below the manager’s intended range of 25–35%.

Research-based approach to investments

A research-based approach is taken to buying and selling property, looking at where markets are likely to change in the short term, with changes in infrastructure seen as a key driver of market developments. Following the COVID-19 pandemic, the manager has changed his approach to investments, with an absolute focus on the long-term durability of income. This means owning property that fits with macroeconomic trends that have developed or it believes will develop because of the pandemic (such as offices with amenity space and retail that supports an omnichannel strategy) and that it believes will appeal to occupiers in the future. The sustainability credentials of an investment are a major facet of long-term durability of income, as well as a priority for the fund (more information on SLI’s ESG credentials is detailed on page 15). SLI cannot complete investment deals without prior consent of ASI’s ESG team.

When it comes to sourcing deals, SLI’s size and reputation see it receive numerous leads from the market; these are then passed through a centralised acquisitions team. SLI minimises the use of agents when dealing with its tenants, preferring a principal-to-principal approach to reduce fees, improve outcomes and increase its understanding of tenant needs. This is possible because of SLI’s existing relationships and the ASI network.

The manager considers no property to be ‘sacrosanct’ and makes the point that SLI’s asset base has been turned over three times since he took over in 2006. Realising profit at key times has been just as important as making new investments.

Asset allocation

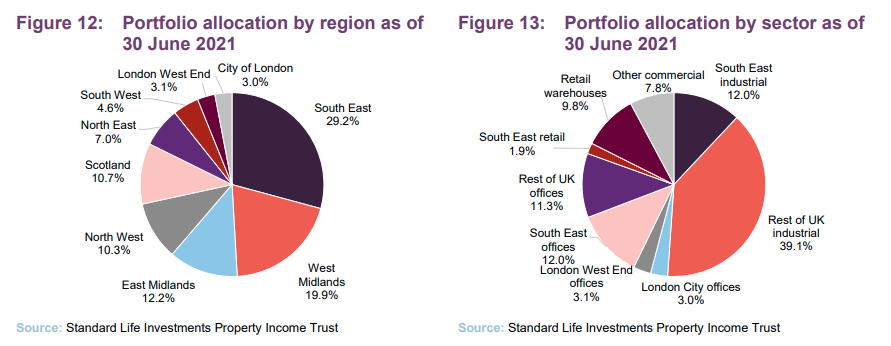

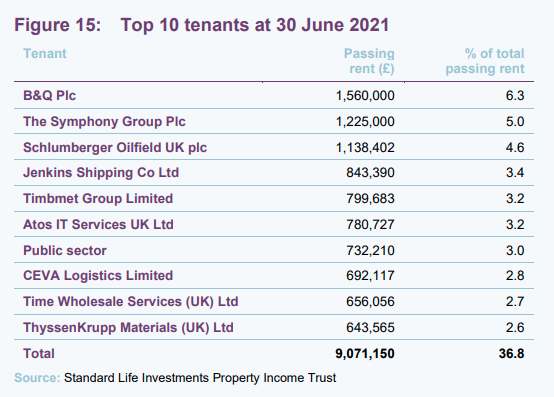

SLI’s portfolio was valued at £433.8m on 30 June 2021 (March 2021: £438.6m) and consists of 46 assets, primarily allocated across three sectors: industrials 50.7%, offices 31.0% and retail 11.0%. The ‘other commercial’ sectors make up 7.3% of the portfolio and consists of a data centre and a leisure complex in north London with redevelopment potential. The three largest properties are covered in more detail below.

The portfolio has a net initial yield at 30 June 2021 of 5.3% and an equivalent yield of 6.3%. The portfolio has a WAULT of 6.1 years and an occupancy rate of 87.8%.

The group has collected 95% of the rent due for the whole of 2020, and for the first half of 2021 it has so far received 91% of rent billed. As at 31 August 2021, the third quarter figure (rents are paid in advance) stood at 94%.

Top 10 holdings

The main change in SLI’s top 10 holdings came with the sale of its out-of-town office building in Farnborough let to BAE Systems Plc in May 2021. BAE had been the second-largest tenant in the portfolio (accounting for 4.5% of the income at 31 December 2020), but following a detailed review of the offices in the portfolio the manager decided the asset would not meet future occupier requirements, even with significant capital expenditure. BAE was not in occupation of the office (but had sublet some of the space) and the manager says the asset was over-rented. For similar reasons, the manager also sold an office on a business park in Dartford. The combined sales price for the two offices was £12.4m and was 5.5% below the December 2020 valuations (driven by the Farnborough asset). In September, the group sold a small office asset – Anglia House, in Bishop’s Stortford – for £3.75m.

A small retail warehouse in Bradford let to Halfords and Cubico, which was deemed over-rented by the manager, was also sold in May 2021 for £2.65m – in line with the December 2020 valuation. In June, the group completed the sale of an industrial asset in Kettering for £9.05m. The manager said that the property was dated and didn’t match its ESG criteria. The proceeds of these sales will be reinvested into higher quality assets (more detail on page 14).

Hagley Road

The acquisition of 54 Hagley, Birmingham, in late 2018 was SLI’s largest to date. It paid £23.75m for this multi-let office complex, comprising 141,436 sq ft. The manager says the building is located in an area where rents are generally cheaper than in other parts of Birmingham, at £12–18 per sq ft compared with £25 per sq ft in much of the city. The building is equipped with shared amenities that include conferencing facilities, a yoga studio and parking docks for cyclists.

Five floors in the building, including the reception area, have undergone a £2m refurbishment following the administration of a tenant. The ground floor refurbishment includes new conference facilities, which double up as a fitness studio, bike storage, lockers and changing facilities. SLI has completed several lettings in the refurbished space – including at its flexible fitted office suites – and agreed terms on further lettings.

A new tram stop right outside the building is due to open in December 2021, increasing connectivity. Meanwhile, 54 Hagley is located just outside of Birmingham’s new Clean Air Zone congestion charge, which launched in June 2021.

Why does the manager like it? The manager believes the building to be well-situated and to offer good prospects for rental growth. The location on the edge of the congestion charge zone, a new tram stop outside, ample car parking, and shared services has resulted in strong demand for space at the building.

B&Q retail warehouse, Halesowen

SLI purchased the B&Q retail warehouse in Halesowen, West Midlands, for £19.5m in September 2020. The purchase, at a net initial yield of 7.5%, was financed through its revolving credit facility.

The property is let to B&Q for a further 11 years and is a top quartile trader for B&Q. It is let on a reasonably low rent in the mid-teens per square foot, equating to £1.56m per annum, making B&Q the fund’s largest tenant.

Why does the manager like it? The manager says the asset fits its strategy exceptionally well, providing secure long-term income on an asset that not only works for the existing tenant, but also has future potential for urban logistics.

Symphony

The Symphony acquisition in October 2014, for £14.6m, included three storage units in Rotherham, covering 360,000 sq ft. The units were acquired with a 20-year letting agreement in place with Symphony Group, a kitchenware and bathroom furniture manufacturer. The passing rent is £1.225m per annum, making Symphony the second-largest tenant behind B&Q.

Symphony Group is the UK’s largest privately-owned manufacturer in the sector, turning over more than £220m per annum, with a headcount of over 1,500 staff. It supplies private developers, social housing providers, retailers and hotel operators across the UK and internationally. The 20-year lease includes a tenant break clause after 15 years, as well as a provision for fixed uplifts every five years.

Why does the manager like it? The three units are located in an established manufacturing region and were acquired with a long-term lease in place with a leading firm in its sector. The lease contract also includes an inflation adjustment.

Asset management initiatives

So far in 2021 SLI has agreed six lease restructures or renewals across its portfolio, securing an additional £877,830 per annum, the most significant of which was a renewal on a logistics unit at a new rent 23% above the previous level and a rent review on its data centre 10.3% ahead of the previous rent. Across its office portfolio, the group made three new lettings and a renewal securing £444,575 per annum. The manager says that conversion of office interest into lettings will increase as COVID restrictions are eased.

Acquisition pipeline

As mentioned earlier, SLI is working on deploying the proceeds from several sales into a pipeline of assets that fit its renewed investment criteria. Terms for the acquisition of several purchases have been agreed including: a B&Q retail warehouse for £14m at a yield of 6.5%; a logistics unit in Washington for £7m at a yield of 5.75% recently let on a new 15-year lease; and the funding of an industrial development pre-let to a council for 15 years at a total cost of £15m, reflecting a yield of 4.25%.

The manager states that all new purchases will focus on good-quality assets that can provide a sustainable income. ESG will play an important part in the assessment of suitable new investments in terms of energy efficiency, carbon footprint, tenant use, and social factors.

Carbon offsetting investment

In line with its ESG and sustainability strategy, SLI made a significant purchase in September 2021 in its aim to be carbon net zero. It acquired 1,447 hectares of upland rough grazing and open moorland in the Cairngorm national park, in Scotland, for £7.5m, that will see around 1.5m trees planted. The site is expected to offset around 195,630 tonnes of carbon up until 2060, representing 73% of the company’s residual embedded and operational carbon.

The manager says that the fund’s net carbon zero strategy is primarily based on reducing operational carbon at the individual property level, with offsets for residual carbon that cannot be eliminated.

It is anticipated that the costs of planting the 1.5m trees will be met through grant funding. SLI’s manager says that it will likely make further similar acquisitions, on a smaller scale, to complete this element of the carbon strategy.

QuotedData believes that SLI will benefit from early mover advantage, with the cost of carbon offsetting expected to rise dramatically in the future. By paying a fixed price of £7.5m (or £38 per tonne over the period) now, it is hedging against a hike in carbon offsetting prices. Real estate companies are grappling with the issue of carbon offsetting, as with all the will in the world, buildings will always have residual carbon that cannot be eliminated. The cost of offsetting this residual carbon is set to rise dramatically over the next few years. One form of carbon offsetting is through the purchase of carbon credits from certified climate projects. Research by the Grantham Research Institute on Climate Change and the Environment and the Centre for Climate Change Economics and Policy suggests that by 2030 carbon credits could cost between £60 and £140 per tonne, and by 2050, as much as £300 per tonne.

Through this investment, SLI is taking carbon offsetting into its own hands, and evading any potential future increases in carbon credits by paying a fixed price today.

ESG initiatives at portfolio level

As mentioned, reducing operational carbon at the individual property level is the manager’s main priority, which is being achieved through the recycling of older assets with newer, greener properties. On its existing portfolio, SLI has undertaken a major Photo Voltaic (PV) installation across its industrial portfolio, the largest undertaken by Aberdeen Standard Investments in the UK. It currently has six operational PV schemes providing 1.2MWp and a further 13 projects that are advanced (offering up to 2.8MWp). It is also in discussions on another seven. The existing PV output of 1.2MWp is the equivalent to the yearly electrical use of 239 average UK households.

SLI has an ESG charter that includes:

- all members of the team being able to demonstrate that ESG is considered in every decision;

- a team member given overarching responsibility to drive PV and electric vehicle (EV) roll out;

- new lettings to have enhanced lease provision for collection of utility consumption data;

- net zero assessment being made from fund level to asset action plans;

- all assets to be assessed under the ASI Impact Dial proprietary tool (an internally developed tool to measure all aspects of an asset’s performance in terms of ESG, as well as to identify the asset’s potential performance);

- all office maintenance plans to incorporate additional capex required to meet future energy standards through to 2030; and

- a future carbon offset plan in place to give fixed cost solutions.

Performance

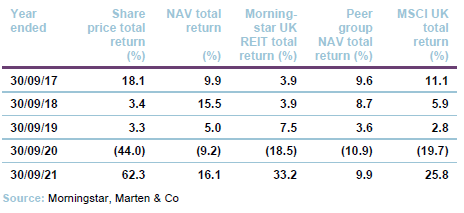

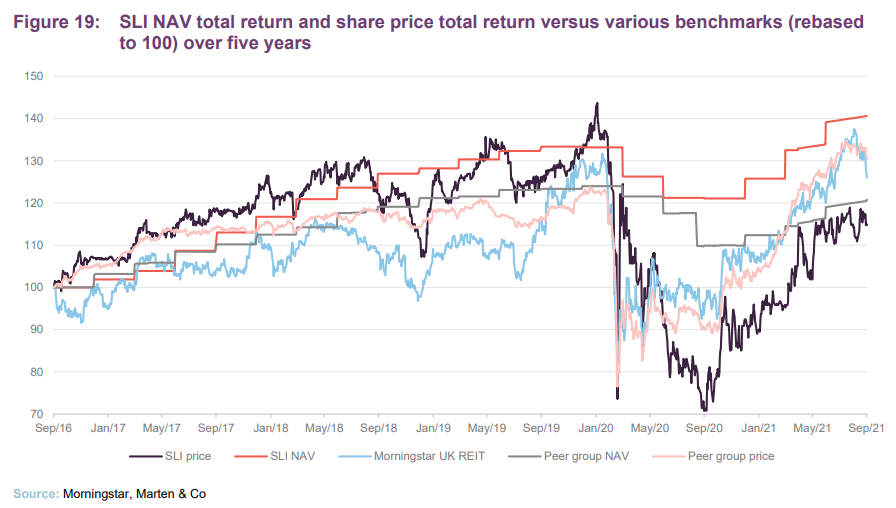

SLI’s NAV total return has recovered from its pandemic lows, with portfolio valuations increasing as confidence returned to the commercial property sector. As Figure 19 shows, SLI’s NAV total return has markedly outperformed that of its Property – UK Commercial peer group over the five-year period. Despite SLI’s superior NAV performance, its share price recovery has lagged that of its peer group and the Morningstar UK REIT index, which seems perverse.

Peer group analysis

SLI’s NAV total return has, for all periods from six months to 10 years, beaten that of the Property – UK Commercial peer group average, as illustrated in Figure 20. For a strategy such as SLI’s, where assets tend to be held for the long term, we consider that the longer-term periods are the most relevant when assessing the effectiveness of the strategy. In this regard, SLI has clearly outperformed the peer group averages. Over a 10-year period it has outperformed the peer group by more than 50% in NAV terms.

We have used the Morningstar UK REIT Index and the MSCI UK Index as comparators to SLI’s short- and long-term performance. From an inflation comparison, SLI’s NAV total return has been significantly ahead of inflation (as measured by both RPI and CPI) over five- and 10-year periods. In Figure 20, we have used RPI, RPI + 2%, CPI + 3% and Libor + 5%.

NAV and portfolio valuations

SLI publishes NAVs on a quarterly basis, based on portfolio valuations, which are approved by the board prior to publication.

Independent international real estate consulting firm Knight Frank performs the valuation, in accordance with the then-current RICS guidance. The fair value of properties is determined using the income capitalisation method, which begins by capitalising a property’s net income over its lease period; the valuer then assumes the property will be re-let at a pre-determined estimated open market rental value; allowances for voids are made where applicable. The yield used by the valuer to capitalise a property’s income stream reflects views on factors that include (not an exhaustive list): a property’s location, its perceived quality, the credit quality of its tenants and its lease term profile.

SLI’s manager meets with the valuers on a quarterly basis to ensure the valuers are aware of all relevant information for the valuation and any change in the investment over the quarter. The manager then reviews and discusses the draft valuations with the valuers to ensure correct factual assumptions are made. The valuers report a final valuation that is then reported to the board.

Dividend

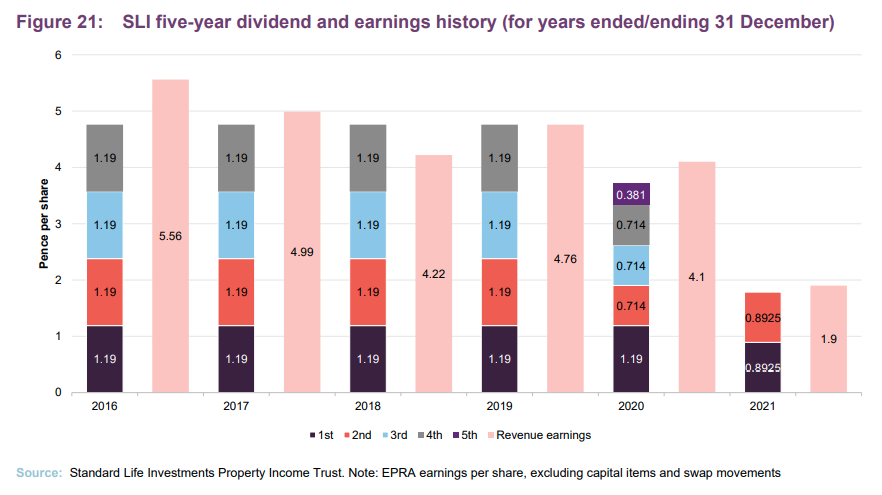

SLI reduced its quarterly dividend by 40% at the height of the pandemic (from 1.19p to 0.714p) as it reviewed the impact of COVID-19 on its rent collection levels. It declared and paid a fifth ‘top-up’ dividend for 2020 of 0.381p as rent collection levels improved over the course of the year (as mentioned earlier) and in order to comply with the REIT rules to distribute at least 90% of its annual property income. In total, the group distributed 3.713p in 2020, which was 22% down on previous years, but comfortably covered by earnings of 4.1p per share. Reflecting strong rent collection levels, the group increased the quarterly dividend by 25% for 2021 to 0.8925p (but still 25% lower than its pre-pandemic level). Earnings in the first half of the year were 1.9p per share, giving a dividend cover of 106%.

The board has kept the dividend policy under review and will monitor the impact of the lifting of lockdown restrictions on rent receipts and recurring earnings in addition to the contribution from new acquisitions. If required, a fifth dividend will again be paid, to ensure at least 90% of net rental income is distributed, as required by the REIT rules.

SLI’s EPRA earnings per share were less than its total dividend payment only once in the last five financial years (in 2018). In this instance, SLI was able to draw on its retained earnings to fund any deficit. As at 30 June 2021, SLI had retained earnings of £7.04m (equivalent to 1.77p per share).

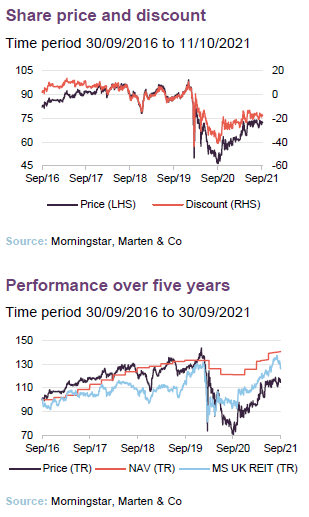

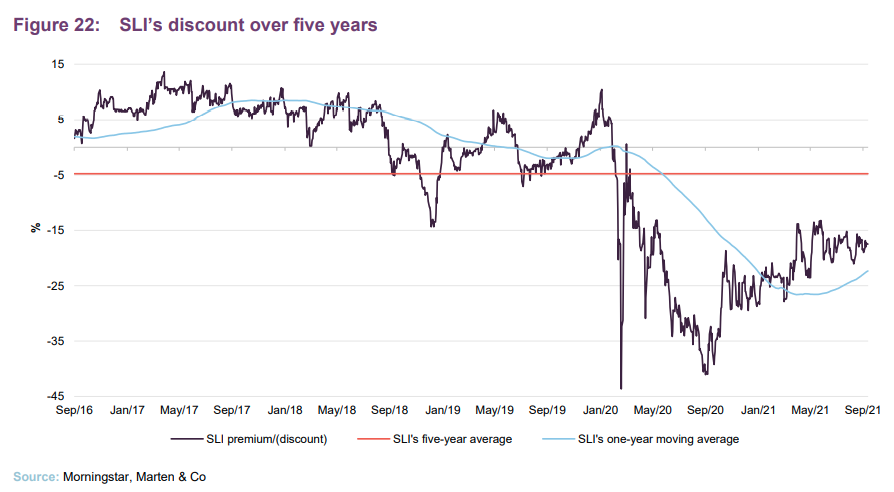

Premium/(discount)

Having traded at a premium for much of the time pre-pandemic, SLI is currently trading at a discount of 17.5% (as at 11 October 2021). The outbreak of COVID-19 saw SLI’s rating fall from a 9.8% premium to a 43.6% discount in a matter of days, with a mass stock market sell-off. After recovering somewhat, the discount widened again as the fund cut its dividend. Positive news on the rent collection rate and increased quarterly dividends has seen the discount narrow over recent months.

SLI is authorised to repurchase up to 14.99% and issue up to 10% of its issued share capital (renewal of these authorities is sought annually at the company’s AGM). Purchase of shares will only be made at prices below the prevailing NAV to enhance shareholder value.

Since November 2020, SLI has repurchased 9.9m shares for just under £6m at an average price of 60.1p in a share buyback programme. These shares are held in treasury.

Fees and costs

SLI’s management fees are charged according to the following structure: 0.7% of total asset up to £500m and 0.6% of total assets above £500m. SLI does not pay a performance fee. The investment management agreement can be terminated at one year’s notice by either side.

Administrative, secretarial and registrar services

Administrative, company secretarial and registrar services are provided by Northern Trust International Fund Administration Services (Guernsey) Limited. For these services, Northern Trust is entitled to a fee of £65,000 per annum, payable quarterly in arrears. Northern Trust is also entitled to reimbursement of reasonable out-of-pocket expenses. Total fees and expenses charged for the year ended 31 December 2020 amounted to £81,250 (2019: £81,250).

Portfolio valuation services

Portfolio valuation services are provided by Knight Frank LLP, which values SLI’s property portfolio on a quarterly basis. For these services, Knight Frank is entitled to an annual fee that is equal to 0.017% of the aggregate value of property portfolio paid quarterly.

The total valuation fees charged for the year ended 31 December 2020 were £84,638 (2019: £97,668). Knight Frank charges a minimum fee of £2,500 per property for new properties that are added to SLI’s portfolio.

Allocation of fees and costs

In SLI’s accounts, investment management fees, administrative expenses, finance costs and all other revenue expenses are charged to the revenue account. The costs of property purchases and disposal are allocated to the capital reserve, as are capital expenditure on properties and the capital expenditure that results in a movement in the capital value of a property (e.g. refurbishing an asset).

Capital structure and life

SLI has a simple capital structure with a single class of ordinary shares in issue and trades on the main market of the London Stock Exchange. As at 12 October 2021, there were 396,922,386 ordinary shares in issue and 9,943,033 shares in treasury. SLI does not have a fixed winding-up date and there is no specific measure, such as a regular continuation vote, to wind up the company.

Gearing

SLI is permitted to borrow and its articles of association mandate that its gearing, defined as total borrowing divided by gross assets, cannot exceed 65%. The board’s current intention is that SLI’s loan-to-value ratio (LTV – total borrowings less cash divided by portfolio value) shall not exceed 45%. At 30 June 2021, SLI’s LTV ratio was 17.6%. The manager says an LTV in the range of 25% to 35% was desirable, and once investments (mentioned above) have been made the LTV should move into this bracket.

The company has two facilities with RBS, both of which expire in April 2023. The main facility is a fully drawn fixed-term loan of £110m, which is subject to an interest rate swap. The second part of the facility is a revolving credit facility (RCF) of £55m. At 30 June 2021 no sum was drawn from the RCF, as the proceeds of sales at the end of 2020 and into 2021 were used to repay it. It is anticipated that the RCF will be utilised again later in 2021 as further investments are made. The fixed term loan has an interest rate of 2.725%, while the RCF has a margin of LIBOR plus 1.45% on £35m of it and LIBOR plus 1.6% on £20m.

Loan covenants for the quarter ended 30 June 2021 were comfortably met. SLI’s interest cover of 517% was significantly greater than the limit of 175% and its LTV of 24.7% (loan value less cash held in RBS accounts only divided by pledged portfolio) is well below the 55% covenant limit.

SLI entered into an interest rate swap when the term loan was taken out. As at 30 June 2021, the interest rate swap had a liability of £2.45m (December 2020 – £3.7m). This liability will reduce to zero on maturity in 2023.

Financial calendar

The trust’s year-end is 31 December. The annual results are usually released in April (interims in September) and its AGMs are usually held in June of each year. SLI pays quarterly dividends in May, August, November and March.

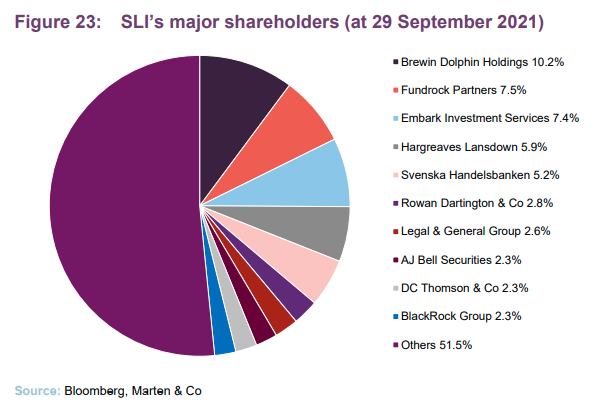

Major shareholders

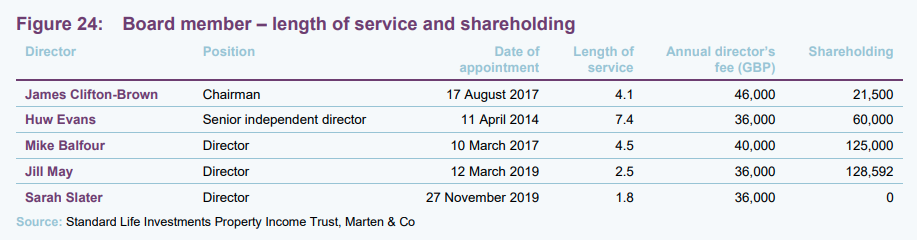

Board

SLI’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. All directors stand for re-election on an annual basis.

James Clifton-Brown (chairman)

James heads the board as non-executive chairman. He has extensive experience in the real estate sector, and joined CBRE Global Investors in 1984 as a fund manager on the Courtaulds Pension Scheme Account (now Akzo Nobel Pension Scheme) becoming the firm’s UK chief investment officer in 1996, where he had responsibility for the firm’s UK house strategy and risk management as well as client and investor relationship management. Since 2004, he has been a director on a number of boards relating to CBRE Global Investors Limited. James is a voting member on the USA and European Investment Committees of CBRE Global Investors.

Huw Evans (senior independent director)

Huw assumed the role of senior independent director on 13 June 2019. He is based in Guernsey and qualified as a chartered accountant with KPMG before building a career in financial advisory, focused on mergers and acquisitions and more general corporate strategy. Huw advised a wide range of companies in financial services and other industries. He is currently also a director of Third Point Offshore International Limited and of VinaCapital Vietnam Opportunity Fund Limited.

Mike Balfour (director)

A chartered accountant by training, Mike has more than 30 years of experience in investment management. He has held a number of executive leadership roles, including seven years as the chief executive of Thomas Miller Investment, before which he was the chief executive at Glasgow Investment Managers. He has also held the role of chief investment officer at Edinburgh Fund Managers. Mike was appointed to SLI’s board in March 2017. He also holds non-executive directorships with Perpetual Income and Growth Investment Trust, Fidelity China Special Situations and chairs the Investment Committee of TPT Retirement Solutions.

Jill May (director)

Jill assumed her role as non-executive director with effect from 12 March 2019. She has spent most of her career in investment banking, where she held roles with SG Warburg & Co for 13 years (in mergers and acquisitions) and UBS for 12 years. Jill is currently an external member of the Prudential regulation committee of the Bank of England. She is also a non-executive director of Sirius Real Estate, JPMorgan Claverhouse Investment Trust, Ruffer Investment Company, and the Institute of Chartered Accountants in England & Wales (ICAEW).

Sarah Slater (director)

Sarah joined the board on 27 November 2019. She is the chief executive of The Eyre Estate, a private family trust, a trustee of Dulwich Estate, and was a board member of GRIP REIT Plc, one of the UK’s largest residential REITs. During her career, Sarah has held senior positions at The Canada Pension Plan Investment Board (CPPIB), ING Real Estate Investment Management (now CBRE GI) and Henderson Global Investors (now Nuveen) with responsibility for the delivery of major real estate programmes.

Previous publications

QuotedData has published four previous notes on SLI. You can read these by clicking the links.

KYT (know your tenant) – initiation, published July 2019

Adding value in cautious times – update, February 2020

Building for a new normal – annual overview, September 2020

Focus on tomorrow’s world – update, April 2021

The legal bit

This marketing communication has been prepared for Standard Life Investments Property Income Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the

period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.