Property’s alternative theory

Property’s alternative theory

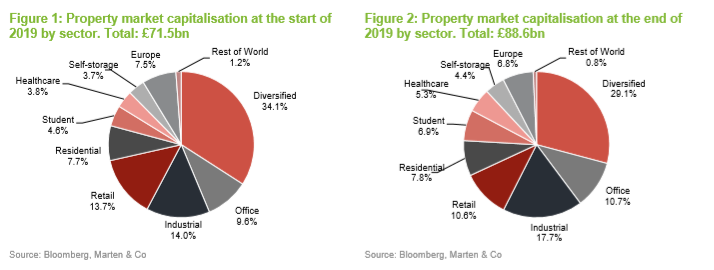

The year was dominated by political and economic uncertainty, with Brexit negotiations casting a shadow over the market and the general election adding a further layer of doubt for much of the year. For a market that is staunchly aligned with political and economic sentiment, listed property companies and REITs performed well, all things considered. The total market capitalisation of property companies reached £88.6bn at the end of the year, an increase of 24% over the course of 2019.

The year ended on a positive footing for the property sector as the Conservatives’ big general election win brought much-needed political certainty. Off the back of the result, pent up overseas investment into direct UK property was released. For listed property companies, a post-election bounce saw share prices rise almost 5% on average.

Alternative property sectors – self-storage, student accommodation and healthcare – were the standout performers as the specialist nature of the sectors and positive market dynamics were recognised.

Of the traditional property sectors, industrial continued its dominance at the expense of retail, reflected by the fact that SEGRO’s market cap at the end of the year was bigger than the eight retail-focused companies combined. Meanwhile, the office sector trundled along nicely – in the face of Brexit fears. For 2020, caution will continue to be the watchword as Brexit negotiations rumble on.

Biggest property companies at end of 2019

The property sector in 2019

The property sector in 2019

The market capitalisation of property companies and REITs at the start of the year and the end of the year paint very different pictures. Overall the sector grew in size by 24%, or £17.1bn, over the course of 2019 to £88.6bn.

The sector breakdown at the start and end of the year, illustrated in Figures 1 and 2, show some interesting moves and reflects wider investor sentiment to the different property sectors. It is no surprise that retail slipped in its overall status, given the numerous retailer failings during the year and the catastrophic drop off in retail property valuations. The market capitalisation of the eight retail-focused companies fell from £9.8bn to £9.4bn with some big losses, namely shopping centre owner Intu Properties, which went from a market cap of £1.5bn at the start of the year to £460m (a fall of 70%).

The seven companies that make up the industrial sector made huge gains during the year of more than 55% overall, as the shift in consumer spend to online continues to reap rewards and attract investors to the companies benefitting from it.

The alternative property sectors – that incorporates student accommodation, healthcare and self-storage – all had great years and, with industrial, led the pack in terms of market capitalisation change over 2019, as can be seen in Figure 4. The specialist nature of these sectors means the companies operating in them have to have the skill and expertise to grow income. All three sectors are also benefitting from positive supply/demand dynamics.

The office sector, which is predominantly made up of central London developers and landlords, had a good year, rising by 37% to a market capitalisation of £9.4bn. Central London offices was the main property sector threatened by a no-deal Brexit, but despite this lingering threat the share price of the four companies dedicated to London offices – Derwent London, Great Portland Estates, Helical and Workspace – performed well.

Residential was heavily impacted by estate agency group Countrywide, which carried out a 50 to 1 share consolidation right at the end of 2019 after a terrible year. Even so, the sector posted a 25.5% increase in market capitalisation as companies including Countryside Properties, Grainger and Inland Homes posted stellar years.

Only two sectors lost market capitalisation in 2019 – UK-listed companies with property in countries outside of Europe (Rest of World), which lost 20%, and retail. Given the structural changes effecting the retail market, it was no surprise that the sector lost market capitalisation. There were retail focused companies that did increased their market caps – Supermarket Income REIT, Shaftesbury and Capital & Counties.

Performance data

Performance data

Performance by sector and fund

Performance by sector and fund

In price terms, the three alternative sectors performed well over the course of 2019 as demonstrated in Figure 5, which also lists the best and worst performers in each sector. Whilst almost all sectors made money, retail and the rest of world sectors were the laggards.

The three self-storage specialists – Lok’n Store, Safestore and Big Yellow – all had a strong 2019, as robust demand for storage space in the UK encouraged investors to push their share prices up. Lok’n Store led the way with the biggest price rise among all property companies and Safestore was third overall with a 59.1% rise.

In the office sector, serviced office specialist Workspace’s differentiated and successful business model, which combines property ownership with a flexible workspace operation, was reflected in the share price. Circle Property, which is focused on offices in regional locations, had a steady year.

UNITE Group’s £1.4bn acquisition of a rival student accommodation platform got the approval of shareholders, with its share price up more than 56% over the year. Empiric Student Property, on the other hand, had a steadier year, which was matched by its share price performance. GCP Student Living’s acquisition programme, which helped grow its NAV by 14% over the year (see Figure 7), was well received by investors with its share price rising 33.4%.

SEGRO had another huge year operationally – making progress in its core London and big box development markets and consolidated its position as the biggest UK listed property company, with a market cap of £9.8bn at the end of 2019 (more than the whole of the retail sector).

Tritax Big Box REIT had a transformational year with a switch in focus to development and its position on the right-hand side of the table reflects the strong performance of the industrial sector in general. Highlighting this further, Urban Logistics REIT, which focuses on the ‘last mile’ delivery hubs, grew its NAV by 12.4% in 2019.

Assura’s development push and ESG credentials are proving popular with investors. The healthcare sector was another in which all the constituents had a positive year in price terms.

CLS Holdings’ active portfolio management proved popular with investors and topped the diversified sector, which is made up of 30 companies – by far the biggest. Drum Income Plus REIT, the £30m market cap trust, failed to appeal to wider investors.

As mentioned previously, Inland Homes had an excellent year. The brownfield developer’s focus on the south and south east of England and the receipt of two huge planning consents during the year – as well as the big election win for the prohousebuilding Conservative party – saw its share price rise 61.5%. Fellow housebuilder Countryside Properties had an impressive price rise, too, of almost 50%.

Grainger, the private rented sector (PRS) specialist, is growing quickly in the nascent sector and is benefiting from a surge in demand from the millennial generation being priced out of buying homes. PRS is becoming a huge part of the residential sector in the UK but is still some way behind that of the US or German private rented markets.

By far the best performing of the European property-focused companies was Sirius Real Estate, which has grown its NAV by 13% with the acquisition of several German business parks during 2019. Its share price rose by 47.5%

The much-publicised woes of the retail sector has hit shopping centre owner Intu Properties the hardest. A host of retailer failings has impacted rental income and seen the values of its malls plummet, with its NAV falling 35.6%. The huge mountain of debt the company is sitting on has further alienated investors, with its share price falling 70% during the year. Plummeting retail values were behind big drop-offs in NAVs for Capital & Regional, NewRiver REIT, RDI REIT, Hammerson and British Land.

All five of the London-listed companies focused on property markets elsewhere in the world – Aseana Properties (Vietnam and Malaysia), GRIT Real Estate (Africa), Dolphin Capital, Ceiba Investments (Cuba) and Macau Property Opportunities (China) – saw big price falls as investors were put off by negative political or economic sentiment and/or poor underlying performance.

Significant rating changes

Significant rating changes

The tables below show how discounts and premiums moved over the course of 2019. The share prices of UK property companies rallied from August, as investors sought value stocks, and closed the year strongly following the general election result. Once again, it was companies in the alternative property sectors that flourished.

The top five biggest rating improvements during 2019 were all from companies in the three alternative sectors, with four of them going from relatively small premiums to significant premiums.

It is interesting to note that four companies focused on central London offices – Workspace, Helical, Derwent London and Great Portland Estates – all saw significant discounts, of between 32% and 22%, narrow or even move to a premium rating over the year. All four companies reported positive leasing figures during the year, helped by record low supply of offices and contrary to fears that there would be a hiatus in leasing activity or even a mass exodus of companies due to Brexit.

It’s remarkable to think that SEGRO was at a discount at the start of the year, given the strength of its portfolio, but it soon moved to a premium and finished the year with a 33.3% premium. LondonMetric’s acquisition of fellow industrial-focused company, A&J Mucklow, was well received by investors and its premium soared to 35.3%.

Most of the names on the list of biggest rating deteriorations have been impacted by government policy or structural changes in the market. The biggest deterioration in rating over the year was Ceiba Investments, the company focused on Cuban real estate. The rating fall is no surprise, given the severe sanctions US president Donald Trump has imposed on Cuba.

Intu Properties, as discussed before, is facing up to increased retailer failings, plummeting shopping centre values and a huge pile of debt. From an already wide discount of 68.7% at the start of the year, its discount widened further to 85.4%.

Phoenix Spree Deutschland, which owns a portfolio of residential property in Berlin, was heavily impacted by the announcement of proposed rent controls in Berlin. AEW UK Long Lease REIT had a tumultuous year – losing a large tenant to administration, deciding to put the company up for sale, serving notice on its manager, getting bids for the company, re-letting the space vacated by the large tenant, rejecting the offers and deciding to carry on but with a focus on cost cutting. The upshot was a widening of its discount to 22.7% at the end of the year from 6.3% at the start.

Major corporate activity in 2019

Major corporate activity in 2019

Fund raises

Fund raises

Property companies raised more than £1.7bn during the course of the year. Globalworth Real Estate Investments, which invests in office space across Central and Eastern Europe, topped the list with €764.8m (£708.5m) raised in two placings during 2019. Tritax Big Box REIT raised £250m in a placing that was used to acquire developer DB Symmetry in February.

LXi REIT raised £200m in June and quickly set about spending the cash on index-linked long income property. Supermarket Income REIT raised £145m during the year in two oversubscribed placings, which it has used to buy more supermarkets. Impact Healthcare REIT raised £135m – also in two separate placings – as it continues to grow its care home portfolio.

Primary Health Properties raised £100m in September following its merger with MedicX earlier in the year, while GCP Student Living raised £77m from an over-subscribed placing in December. It had already raised £5m earlier in the year to fund the acquisition of a new scheme close to Queen Mary University of London.

Regional REIT raised £62.5m in an oversubscribed placing in July to acquire a pipeline of assets. Yew Grove REIT, which owns Irish commercial property, announced a 12 month share issuance programme in June and during the second half of the year raised €10m and €25.8m in two placings. Picton Property Income failed to hit its £15m fundraising target in June, raising just £7.1m.

Mergers and acquisitions

Mergers and acquisitions

Conversions to REITs

Conversions to REITs

De-listings

De-listings

Major news stories

Major news stories

• RDI REIT rejected a takeover bid by Cromwell Property stating it undervalued the company and its prospects. Earlier in the year RDI breached a debt covenant held against a portfolio of its shopping centres

• WeWork cancelled its much anticipated multi-billion-dollar IPO after failing to attract enough support from investors. Huge losses and governance issues put paid to the flexible workspace provider’s listing

• SEGRO cashed in on the clamour for big box warehouses with the £241m sale of a non-core portfolio

• LondonMetric also sold a portfolio of big box warehouses, for £145.3m, as it continued to reduce its big box exposure in favour of urban logistics assets

• AEW Long Lease REIT rejected several takeover approaches, after putting itself up for sale following the loss of a large tenant, and decided to continue

• Intu Properties continued its disposal programme with several sales during the year, the largest of which recouped €237.7m from a Spanish mall, in a bid to shore up its balance sheet

• Secure Income REIT sold a portfolio of eight private hospitals for £347m at a premium of 19% to book value

• Stenprop continued its transition to a fully-focused UK industrial owner with the €160m sale of a German office, its largest asset

• Ground Rents Income Fund moved its management contract from Brooks MacDonald to Schroder Real Estate Investment Management. The move followed the loss of a high court judgement in respect of repair costs at Beetham Tower in Manchester

• AXA Property moved away from property when it changed its investment policy to become an investor in undervalued British listed securities

Outlook for 2020

Outlook for 2020

Here are a few recent comments from managers and directors on how events may unfold in 2020, drawn from our latest real estate roundup.

On Brexit

On Brexit

Duncan Owen, chairman of Schroder REIT: “The outlook for UK real estate markets in 2020 may be negatively impacted by macroeconomic factors. A risk of the UK leaving the EU without a deal could lead to a recessionary environment as companies delay investment decisions. An orderly Brexit transition should lead to continued growth with real assets benefiting from a low interest rate environment.”

Richard Grainger, chairman of McKay Securities: “The protracted uncertainty over Brexit across our markets has held back occupier demand and resulted in lower levels of office occupier take up. Despite this, the highly restricted supply of modern business space, especially across our South East office markets, has helped maintain rental values and is set to support future rental growth, especially with a recovery in business confidence.”

Nicholas Thompson, chairman of Picton Property: “There is much economic uncertainty at present and a perception that we are in an environment where interest rates are likely to remain low for the foreseeable future, alongside a period of lower returns generally. Against this backdrop we believe that investing in real assets remains attractive, in particular where there is a strong income stream with further potential for growth through active management. Investing in the right assets where there is good occupational demand will continue to deliver positive results for shareholders.”

On retail

On retail

Allan Lockhart, chief executive of NewRiver REIT: “Despite a relatively resilient consumer backdrop, which has seen modest wage growth and employment at a 40-year high, the retail sector continues to face significant challenges, and there remains a clear divergence in retailer performance as a result. Retailers focused on providing convenience, value or services have shown resilience due to their focus on essential spending and the barriers to replicating their business models online. In contrast, retailer underperformance in these market conditions has generally been a result of operating in structurally challenged sub-sectors, mismanagement, or a combination of both factors. It remains our belief that the UK has too much retail space. This excess of space has led to increased vacancy in town centres, a lack of investment by landlords and lower business rates income for councils, with significant implications for the vitality of town centres.”

Richard Shepherd-Cross, investment manager of Custodian REIT: “While Custodian REIT is not immune from falling values in retail, this is a cloud with a silver lining. Market conditions through late 2018 and 2019 have made it very difficult to source investment property with the appropriate risk profile. Properties that are modern, fit for purpose; capable of delivering long-term secure income; not in need of significant capital expenditure and likely to show limited voids have been scarce. A downward adjustment in market values could create the sort of opportunities that will allow Custodian REIT’s strategy to continue to thrive.”

William Hill, chairman of Ediston Property Investment Company: “The sector has been changing for a long time in how it is carried out as an activity, and in terms of what consumers want to buy and from where. Investors and retailers on the wrong side of this substantial shift are paying a big price. However, retail is not dying, it is changing. The board believes the company is on the right side of the retail change given its assets are largely in convenience led retail warehousing, and this will increasingly be evident going forward.”

Brian Bickell, chief executive of Shaftesbury: “The structural changes facing national retail are unlikely to abate, tempering retailer demand for space other than in the busiest locations. By their nature, qualities and international appeal, London and the West End are much less affected by current national concerns, and their prospects for long-term growth and investment remain strongly positive.”

On Europe

On Europe

Schroder European REIT’s investment manager: “The eurozone is currently a two-speed economy. The slowdown in world trade and investment has hit manufacturers and output has fallen by 1% since late 2018. Conversely, the services sector continues to grow, supported by solid labour markets, rising consumption and government spending. The risk is that the downturn in manufacturing deepens, possibly because of a disruptive Brexit or a further escalation of the trade dispute and then spreads to the services sector. The ECB has begun to loosen policy, but its room to manoeuvre is limited, given that the main financing rate is already at zero. However, low borrowing costs for governments provide some room for government stimulus. Schroders forecasts that eurozone GDP will grow by 1% per annum through 2019/20. Sweden, France and Spain will probably see faster growth, while Germany, which has a relatively large manufacturing sector, is likely to lag behind.”

Property sector publications in 2019

Property sector publications in 2019

- Industrial property market – Real estate sector note on the industrial market. Published December 2019

- Retail property market – sector note on the retail market. Published October 2019

- Aberdeen Standard European Logistics Income – On the crest of a wave. Update note, published October 2019

- Civitas Social Housing – Targeting full dividend cover. Annual overview, published September 2019

- Standard Life Investments Property Income Trust – Know your tenant. Annual overview, published July 2019

- Aberdeen Standard European Logistics Income – Poised to expand. Annual overview, published March 2019

- Civitas Social Housing – Regulatory action is positive. Update note, published February 2019

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.