Real Estate Roundup

Kindly sponsored by abrdn

Performance data

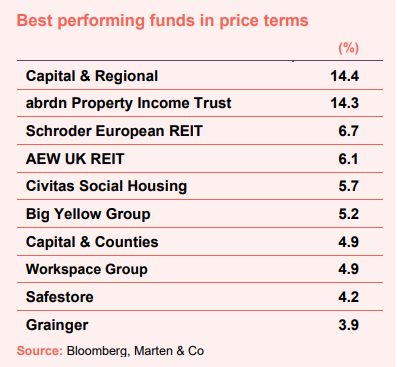

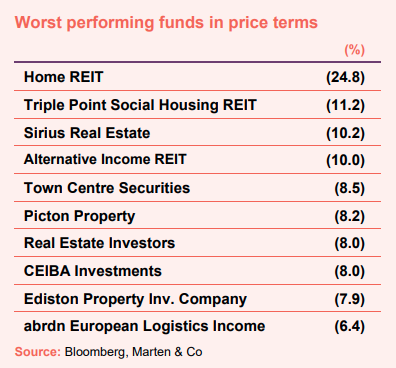

December’s biggest movers in price terms are shown in the charts below.

2022 ended with another difficult month for property companies as the sector continues to get to grips with the impact of higher interest rates. There were several funds that performed well during December, however. Top of the pile was secondary shopping centre landlord Capital & Regional, which finished the year strongly with a 28.9% share price growth in the fourth quarter and 6.0% uplift over the whole of 2022. Retail assets have been less prone to the impact of rising interest rates after many years of yield expansion (and valuation declines) on their assets. abrdn Property Income Trust, whose share price discount to net asset value (NAV) widened to almost 50% in November after a less than favourable refinance of its debt, bounced back in December following another refinancing on superior terms (see page 3 for more details). AEW UK REIT announced the acquisition of two properties in December that will boost its earnings and bring it closer to covering its high dividend. The market also responded positively to Civitas Social Housing’s interim results, which demonstrated the resilience of the social housing sector. The company’s share price has yet to recover from a short-seller attack in 2021 and was down 34.9% in 2022.

For a second month on the trot Home REIT, the provider of homeless accommodation, saw its share price tank after it came under attack from a short seller in November. It has refuted the allegations but has since faced calls for the board to quit and is subject to a class action lawsuit from shareholders. Elsewhere, contrary to the share price gains made by Civitas, the other social housing real estate investment trust (REIT) Triple Point saw a double-digit decline. A housing association tenant of both companies, My Space Housing Solutions, was downgraded by the regulator to the lowest level on governance and viability. The company accounts for 7.5% of Triple Point’s income and 1.3% for Civitas. Despite reporting healthy annual results in December, retail park specialist Ediston Property Investment Company saw its share price fall 7.9% in the month. The company warned that valuations may decline further (having fallen in the final quarter of its financial year), but the fundamentals of the retail park sector (which is somewhat shielded from the woes of the high street) mean that its 36% discount to NAV seems unjustified. abrdn European Logistics Income continued its run of share price falls ending the year with a 6.4% monthly and a 22.5% quarterly drop.

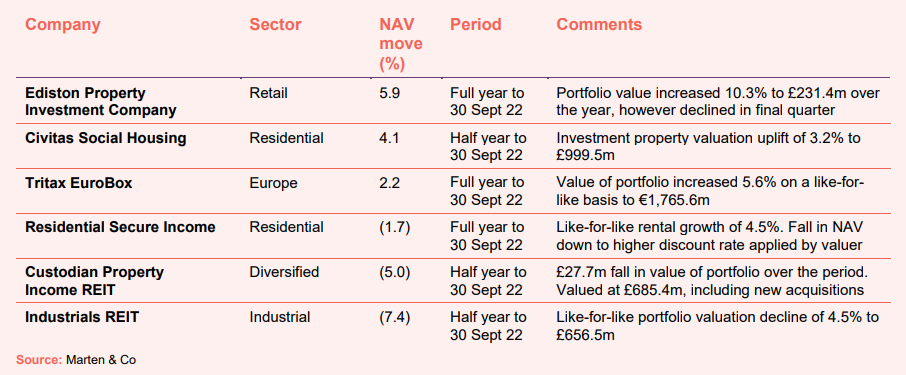

Valuation moves

Corporate activity

The board of Ground Rents Income Fund is considering the future of the company after several legacy issues and continuing headwinds relating to building safety and leasehold reform impacts performance. The board is required to table a proposal for shareholders to vote on a resolution for a voluntary wind-up and subsequent liquidation of the company at a general meeting to be held no later than 13 August 2023. The vote is structured in such a way that if any single shareholder votes for a wind-up, the vote passes. If the wind-up resolution is not passed, then the process is to be repeated every five years.

Home REIT said that it would strengthen its management team and bring in independent pre-purchase valuers as part of several changes to “maintain and enhance shareholder confidence” following a number of short-seller allegations. The company said it would also beef up its board with the appointment of a new non-executive director and hire a national Property Management firm to carry out property management services on its portfolio.

abrdn Property Income Trust refinanced its debt again, on better terms. The company announced in October 2022 (at the height of bond market volatility following the mini-budget) an extension of its debt facilities that were due to expire in April 2023 on a newly agreed term loan of £85m for three years, subject to a margin of 150 basis points (150bps or 1.5%) over SONIA and an interest rate swap that gave an all-in cost of 6.97%. The company has broken the swap at a cost of £3.56m and replaced it with an interest rate cap at a rate of 3.96%, retaining the margin of 150bps previously agreed. The interest rate cap enables the company to benefit from lower interest costs as SONIA falls, whilst providing protection in a rising rate environment such that, should SONIA increase, the maximum all-in financing rate of the term loan is capped at 5.46%.

Impact Healthcare REIT agreed an increase in the size (from £25m to £50m), an extension to the term (to December 2029 from March 2024) and a reduction in the margin (from 225bp or 2.25% over SONIA to 200bp) of its existing revolving credit facility (RCF) with Clydesdale Bank, trading as Virgin Money. This increases its weighted average term of debt from 6.2 to 6.9 years. Debt expiring in the next three years amounts to just £15m. Overall, this increases debt facilities from £216m to £241m, of which £142.3m is currently drawn (70% of which is hedged). The company also announced chairman Rupert Barclay will step down from the board at the end of the first quarter of 2023 to be replaced by Simon Laffin, who joined the board as a non-executive director and chairman designate on 1 January 2023.

PRS REIT secured a short-term extension to its £150m revolving credit facility with Lloyds/RBS, which matured in February 2023. The extension has been secured for the period to 14 July 2023 at the same margin above the three-month SONIA rate as the existing arrangements. The board hopes that this will provide additional time for market conditions to stabilise and offers the company further flexibility to fully explore its funding options.

Schroder European Real Estate completed the refinancing of its largest debt expiry in 2023, a €14m loan with VR Bank Westerwald. The refinancing is for 4.75 years and based on a margin of 0.85%, in line with the existing margin. It also extended the facility by a further €4m. The facility will be drawn on 1 April 2023 with expiry 30 December 2027. The total interest cost has been fixed at the time of signing at 3.80% being the 5-year euro swap rate (2.95%) plus the 0.85% margin.

Primary Health Properties announced that chief executive Harry Hyman will retire at its annual general meeting in 2024. The company said that it expects to be in a position to appoint his successor during 2023.

Custodian REIT changed its name to Custodian Property Income REIT Plc. The board said that it believed the new name better reflects the company’s primary focus on and track record of generating income returns for shareholders and expects the change to make the company’s shares more prominent to retail investors, particularly those accessing via online platforms. The group’s ticker (CREI), ISIN and SEDOL numbers and website (custodianreit.com) remain unchanged.

Major news stories

- LXI REIT renegotiates Travelodge leases

LXI REIT renegotiated the leases of 122 Travelodge hotels, extending the weighted average lease length by a further nine years (from 19.5 years to 28.5 years). In return for the nine-year extensions the company has inserted caps and collars on the annual rent reviews. Previously the rent increased annually at RPI, but has been converted to CPI+0.5% with a cap (maximum uplift) of 4% and a collar (minimum uplift) of 1%.

- Warehouse REIT secures lettings at enhanced rents

Warehouse REIT completed four lettings totalling 121,400 sq ft, 7.9% ahead of estimated rental values (ERVs). The deals increase the portfolio occupancy to 93.3% from 92.7% and the portfolio’s WAULT to 5.7 years from 5.4 years.

- LondonMetric acquires London retail park with future scope for residential development

LondonMetric Property acquired a retail park in Old Kent Road in South East London from an open ended property fund for £38.0m through one of its joint ventures. The acquisition price reflects a net initial yield of 5.4%, rising to 5.7% upon completion of short-term asset management initiatives. The 68,000 sq ft property is let to B&Q, Pets at Home and Halfords and has planning in place for 1,100 new residential apartments.

- Regional REIT lets Brum office space

Regional REIT completed the 44,245 sq ft letting of previously vacant office space to Global Banking School at Norfolk House, Birmingham. The 15-year lease has been signed at an annual rent of £840,991.

- AEW UK REIT secures double buy

AEW UK REIT acquired two assets for a combined £18.3m – a 67,020 sq ft mixed-use block located in Bath city centre for £13m, reflecting a net initial yield of 8.5%, and a retail asset in Bromley for £5.3m, reflecting a net initial yield of 8.7%.

- Empiric Student Property sells Soton digs for £13.9m

Empiric Student Property sold Emily Davies House, Southampton to Far East Orchard Limited for £13.9m, reflecting a net initial yield of 5.7%, with pricing ahead of 30 June 2022 book value. On completion, the company would have generated £71.5m from its disposal programme of non-core assets.

- abrdn Property Income agrees new lettings

abrdn Property Income Trust has two new office lettings under offer at Explorer 1 & 2, in Crawley, potentially securing an annual rent of £299,000 per annum. At 54 Hagley Road, Birmingham, terms have also been agreed on a new lease, securing a further £408,000 per annum. This, combined with other contracted lettings, is expected to bring the vacancy rate of the portfolio down from 9.3% as at end September 2022 to under 5%.

- Town Centre Securities sells car park asset

Town Centre Securities completed the sale of its surface level car park at Port Street, Manchester to Select Property Group for £12.95m, slightly above book value. The proceeds from the sale were used to repay bank borrowings.

- Palace Capital disposes trio of assets

Palace Capital sold £7.6m of property across three assets (a leisure asset in Southampton, an office in Winchester and a residential unit in Banbury) at an aggregate 3% premium to the 31 March 2022 book valuation. Proceeds were used to reduce debt, bringing its loan to value ratio down to 29.6%.

- Circle Property continues sell off

Circle Property sold two more assets – 36 Great Charles Street, Birmingham and 710 Aztec West, Bristol – as part of its strategy to sell the portfolio and return money to shareholders. The offices were sold for a combined £5.96m and were both at large discounts to 31 March 2022 valuations.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Custodian Property Income REIT

David Hunter, chairman:

The investment market reached record highs in certain sectors earlier this year as positive market sentiment pushed valuation increases. That sentiment has recently reversed due primarily to inflation, the rising cost of debt as well as global economic and market uncertainty, with associated valuation decreases commencing in August 2022. Certain sectors, particularly prime logistics, have seen the most significant valuation increases over the last 12-18 months but pricing of Custodian Property Income REIT’s smaller regional properties never hit the heights of super-prime logistics, so we expect to see a more correspondingly muted pricing correction as the market reacts to current circumstances.

We expect to see medium term acquisition opportunities as increasing debt costs drive market pricing for new investments closer to our income return requirements. We continue to view income as the key stable component of property returns. In these circumstances we expect investment market sentiment to transition from the relative volatility of single sector investing to a more defensive, diversified, income focused strategy.

Retail

Ediston Property Investment Company

Calum Bruce, investment manager:

Rising inflation, interest rates and energy costs, coupled with political instability, have reduced consumer confidence and put a squeeze on household incomes. Reductions in disposable income could affect the retail market, including retail warehousing. Discretionary spending and the purchasing of ‘big-ticket’ items will be particularly affected. The fact that the company’s portfolio is underpinned by convenience-led tenants, has low average rents and a reduced vacancy rate is important and should help make the portfolio more defensive to these reductions in consumer spending.

If retailers are impacted, there is an increased likelihood of them using Company Voluntary Arrangements (CVAs) and other insolvency processes to reduce costs. The company is in a better position to deal with these challenges than it was during the COVID-19 crisis, which it weathered well in terms of sustaining income.

However, the increase in gilt yields has put all property valuations under downward pressure. The company’s property portfolio reduced in value by 2.5%, on a like-for-like basis, in the quarter to 30 September 2022. Further, larger declines are likely as the property market reprices due to the rise in gilt yields. The expectation is that the property portfolio will fall in value as at 31 December 2022, with the potential for further volatility thereafter.

Despite the more measured short-term outlook, the fundamentals of the retail warehouse sector remain robust. Supply of available space is low, tenant demand is holding up, occupiers are still doing deals and we continue to identify and complete asset management transactions that secure income.

We expect the retail warehouse sector to be the most resilient and flexible part of the retail market, which can adapt to the changing needs of tenants and the integration of their omnichannel strategies. Having sold assets and with cash in the bank, the Company is well placed to capitalise on any investment opportunities that are identified in a re-priced market, but only at the right time and price for the company.

Europe

Robert Orr, chairman:

Following a strong first half for European logistics markets in 2022, the macroeconomic backdrop changed significantly in the second half with the ECB responding to the elevated levels of inflation with a series of aggressive interest rate hikes. The knock-on impact of rising bond yields and debt costs, together with the increased likelihood of European economies experiencing a period of slower growth, has not yet been fully transmitted into real estate markets, with the scale and duration of adjustments to pricing and growth still uncertain.

We believe the structural tailwinds positively impacting the European logistics sector, particularly the growth of internet retail, remain in place and other demand drivers such as the need for supply-chain resilience and buildings that support ESG objectives, will continue to create additional sources of demand. Low vacancy rates and constrained supply of land also serve to underpin occupational market fundamentals.

However, we are cognisant of the recent declines in investment transaction volumes and evidence of a softening in asset pricing and we remain attentive to the potential risk of weaker occupational markets.

In these more uncertain times, the quality of our portfolio together with the strength of our balance sheet combine to provide the company with the resilience and resources to navigate more volatile market conditions. In addition, the embedded indexation, reversion and asset management opportunities in the portfolio provide the ability to grow income and create value throughout the market cycle.

Residential

Michael Wrobel, chairman:

The past six months have seen many economic challenges in the UK and across the world, including the rapid growth in inflation and the Russia/Ukraine conflict. Within our sector of Specialist Supported Housing, I am pleased to note that our rental income has benefited from some positive inflation linkage. At the same time, we note that inflation is causing significant cost increases for both housing associations and care providers to which local authorities and central Government is being asked to respond. We continue to monitor the position closely, working with our counterparties to help them operate as efficiently and effectively as possible. Our sector is exempt from rent caps, due in large part to the essential nature of the services that are delivered in the properties owned by the Company.

Our sector continues to experience strong demand for quality properties that can provide a long-term stable home for the delivery of community-based care. This is evidenced from our direct engagement with local authorities, care providers and housing associations who are seeking additional provision.

Rob Whiteman, chairman:

The current high inflationary environment is raising the cost of living for citizens across the country at the same time the UK is entering into a recession. Now, more than ever, the Company’s investment thesis is supported by a growing need for affordable housing in the UK, across the age spectrum. The country’s structural housing shortfall continues and most of the population lives in areas where home purchase is unaffordable.

The British Property Federation estimates a need for an extra £34bn per annum of investment into affordable housing over the next decade to start to tackle the shortfall. Housing associations, who have historically been the primary investors in affordable housing, are now dealing with rent caps on their social and affordable rent portfolios in addition to allocating c.£10bn for fire safety and c.£25bn to upgrade the energy efficiency of their stock 2030. These financial pressures reduce their ability to provide new affordable homes, and further support for new long-term investment in the sector.

The government continues to encourage new investment, particularly through its Homes England’s Affordable Homes Programme, which provides total funding of £12.2bn to help subsidise 180,000 new affordable homes by 2026. We remain excited by the opportunity to help housing associations recycle their capital with developers to deliver new affordable homes, helping to meet the critical shortage of affordable homes for independent retirement living and homeownership and in turn delivering inflation-linked income to our investors.

Industrial

Paul Arenson, chief executive:

The six-month period has seen further significant changes in the macro-economic environment with increasing interest rates, high inflation, and economic and political uncertainty. Against this backdrop, the occupational market in the industrial sector has remained resilient, but the investment market has come under pressure with yields beginning to move out. Accordingly, we took an active decision to pause investment activity.

Asset pricing has not yet found its projected level, which, combined with high interest costs, means that debt does not enhance returns as it has done previously. Investment valuation yields are expected to continue to rise resulting in further reductions in valuations. However, we carry confidence into the second half of the year due to the quality of our estates, continued rental growth driven by a strong occupier market, a low group LTV of 26.5%, and unrestricted cash balances at 30 September 2022 of £21.7m.

This hiatus in investment activity also provides an unexpected period in which we can focus on consolidating operational efficiencies in the platform. Accordingly, when we do re-enter the investment market, we expect that we will have greater operational strength to capitalise on opportunities.

Real estate research notes

Grit Real Estate Income Group – Going for growth

abrdn Property Income Trust – Laser focus on the basics

Tritax EuroBox – Opportunity knocks

Urban Logistics REIT – Long-term dynamics remain strong

Legal

This report has been prepared by Marten & Co and is for information purposes only. It is not intended to encourage the reader to deal in any of the securities mentioned in this report. Please read the important information at the back of this note. QuotedData is a trading name of Marten & Co Limited which is authorised and regulated by the Financial Conduct Authority. Marten & Co is not permitted to provide investment advice to individual investors categorised as Retail Clients under the rules of the Financial Conduct Authority.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.