Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

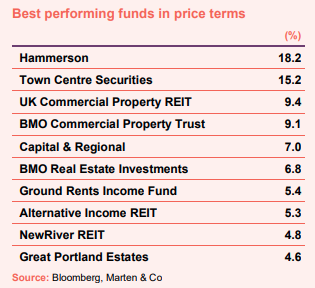

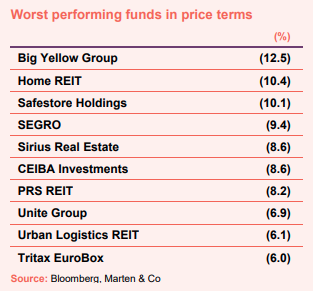

January’s biggest movers in price terms are shown in the charts below.

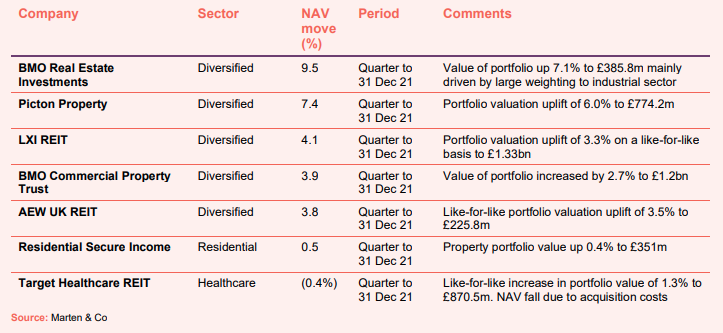

Perhaps reflecting optimism around the strength of the economy coming out of COVID restrictions, a shift to value stocks was triggered in January, with property generalists and retail-focused companies the beneficiaries. Hammerson topped the list after reporting that earnings for the year were on track to be well ahead of expectations. Town Centre Securities, which invests in high street retail and car parks, saw its share price rise by double-digits after announcing it would embark on a £5m share buyback programme to address its wide discount to NAV. Following the uplift in share price, the group’s discount was still 43.3%. Shopping centre owner Capital & Regional and retail park specialist NewRiver REIT were the other retail-focused companies to make the top 10 share price performers. Property generalists, which own diversified property portfolios, dominated the rest of the list of top performers. Most of the generalist property companies have reported strong uplifts in NAV for the quarter to the end of December 2021, on the back of industrial valuation gains, and are in good shape to grow further. UK Commercial Property REIT and BMO Commercial Property Trust saw rises of 9.4% and 9.1% in January.

On the flip side, a lot of the companies that performed well during 2021 saw their share price come off slightly at the start of 2022. The self-storage specialists Big Yellow Group and Safestore Holdings saw their share prices fall 12.5% and 10.1% respectively. During 2021, both companies’ share price rose 55.6% and 80.6% respectively. Industrial and logistics specialists SEGRO, Urban Logistics REIT and Tritax EuroBox also saw their share prices cool in January. The sector has been one of the perennial winners in the property sector over the last few years with significant valuation growth, as demand for space continues to outstrip supply. Having announced that it had fully invested the proceeds of its £350m equity raise (see page 4 for more detail), Home REIT saw its share price fall 10.4%. German business park owner Sirius Real Estate was another company that started the year with a share price fall (by 8.6%), having had an impressive year of gains in 2021 (of 51.4%). Cuban real estate investor CEIBA Investments started 2022 with another month of share price falls. The impact of the pandemic on the Cuban tourist sector has affected the value of CEIBA’s hotel assets and last year its share price fell 24.3%.

Valuation moves

Corporate activity

Yew Grove REIT received approval from the High Court for its scheme that will see it acquired by Slate Office Ireland Investment Limited, an indirect wholly-owned subsidiary of Slate Office REIT. It is expected that trading of Yew Grove Shares on the Euronext Dublin Market and AIM will be cancelled on 9 February 2022.

LXI REIT announced intentions to raise £125m in a proposed issue of new ordinary shares through a placing, open offer, offer for subscription and intermediaries offer under its share issuance programme. The group will target the issue of 88,261,608 new shares at an issue price of 142 pence, representing a premium of 2.9% to the estimated NAV at 31 December 2021. LXI has an investment pipeline worth £272m.

Abrdn European Logistics Income launched a placing under its share issuance programme to fund its near-term €142m pipeline of investments. The group, which has recently deployed the £125m it raised in September 2021 on the acquisition of a logistics portfolio in Madrid, said the placing price will be 110 pence per share, a premium of 4.0% to its 30 September 2021 sterling NAV per share.

Impact Healthcare REIT announced its intention to raise £50m through an issue of new ordinary shares. The open offer, initial placing, offer for subscription and intermediaries offer is priced at 114 pence per share, which represents a premium of 2.0% to the company’s estimated NAV at 30 November 2021. The company will initially use proceeds to pay down debt and secure assets in its immediate investment pipeline, worth £69m.

Supermarket Income REIT submitted an application to the FCA for a migration of listing of its shares from the Specialist Fund Segment of the London Stock Exchange to the premium segment. The company’s market capitalisation has grown significantly since IPO from £100m in July 2017 to around £1.2bn. The move would allow its shares to become eligible for inclusion in the FTSE UK and the FTSE EPRA NAREIT Index Series.

Helical announced its intention to convert to a real estate investment trust (REIT) with effect from 1 April 2022. Following conversion, Helical will be exempt from UK corporation tax on the profits of its property activities that fall within the REIT regime in the year ending 31 March 2023 and beyond (the rate of UK corporation tax increases from 19% to 25% from April 2023).

Phoenix Spree Deutschland completed a new €60m loan facility and refinancing of existing debt on improved terms. The new facility is with Natixis Pfandbriefbank AG and comprises two components: a €45m acquisition facility and a €15m capex facility. The facility matures in September 2026 and carries an interest rate of 1.15% over 3-month Euribor. Additionally, the company has refinanced existing debt provided by Berliner Sparkasse. The refinancing leverages the increase in valuation of certain underlying assets within the portfolio, releasing a further €14.9m of equity.

Major news stories

- BMO Commercial Property Trust increases logistics exposure with £66m double buy

BMO Commercial Property Trust bought two logistics assets for £66m and committed to two developments within its existing portfolio at a cost of £10.5m. The group’s portfolio weighting to the industrial and logistics sector has increased to 30.6% (from 19.1% at December 2020).

- LondonMetric buys cold storage logistics scheme for £53m

LondonMetric acquired a long-let cold storage and logistics warehouse development for £53.4m, reflecting a net initial yield of 3.7%. The 300,000 sq ft building is pre-let on a 25-year lease to AM FRESH GROUP, an international agri-tech company that supplies the majority of UK supermarkets with a range of items including plant-based fresh goods.

- Supermarket Income REIT continues acquisition push

Supermarket Income REIT has continued its acquisition push following its recent equity raise with the purchase of two supermarkets – a Sainsbury’s in Washington, Tyne and Wear, and an Asda in Cwmbran, South Wales – for £55.1m, reflecting a combined net initial yield of 5.3%.

- Home REIT completes £350m acquisition spree

Home REIT fully deployed the £350m it raised in September 2021, with £55.1m of new acquisitions. The company acquired 240 additional properties, providing 880 beds for homeless people, bringing the portfolio total to 7,953.

- Tritax EuroBox acquires third Swedish asset

Tritax EuroBox completed the acquisition of the land and agreed to fund the development of a 17,832 sqm prime logistics asset in Sweden for €39.4m, reflecting a net initial yield of 4.0% (based on the 12-month rental guarantee).

- Unite acquires Nottingham digs project

Unite acquired a 270-bed student development site in Nottingham city centre. Total development costs for the scheme, which will open for the 2024/25 academic year, are estimated to be £34m and is expected to deliver a yield on cost of 7%.

- Derwent London sells London office

Derwent London exchanged contracts to sell New River Yard, London EC1, for £67.5m, representing a 4.5% net initial yield and a marginal discount to June 2021 book value. New River Yard consists of four office buildings and is multi-let to 13 tenants with a total passing rent of £3.3m per annum with an average of 2.6 years to lease break/expiry.

- Irish Residential Properties REIT acquires 152 Dublin apartments

Irish Residential Properties REIT acquired 152 residential units in Dublin, which include completed apartments as well as a forward commitment to purchase a new development currently under construction, for €66m.

- Industrials REIT secures two estates for £17m

Industrials REIT completed two multi-let industrial acquisitions for a total of £17m, reflecting a blended net initial yield of 5.8%. The two properties, Beacon Business Park in Caldicot, South Wales and Belmont Industrial Estate, in Durham, total 173,000 sq ft and generate £1.06m of annualised rent.

- Grit Real Estate sells Mauritius office

Grit Real Estate Income Group sold the holding company of the Absa House office building in Mauritius for MUR 533m ($12.2m), which equates to a 7.75% yield and just below book value. Grit will use the proceeds to reduce debt.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Peter Lowe, manager:

The final quarter of 2021 saw continued positive momentum in the UK real estate market, with the sector delivering further strong returns driven by capital growth and with investment volumes eclipsing the pre-pandemic levels seen in 2019. While much of the focus has rightfully been on the industrial, logistics and distribution markets, which posted a total return in excess of 38% for the year ended 31 December 2021 (MSCI Monthly Index), market dynamics improved more widely across those sectors that had suffered through the early periods of the pandemic. Retail warehousing continues to perform, with robust occupational demand and income resilience leading to yield compression. The office, high street retail and leisure sectors saw improving occupier and investor sentiment across selected sub-sectors. Business confidence linked to improving economic growth forecasts, a robust labour market and the apparent dominance of a milder Omicron variant gives reason for optimism heading into 2022 despite some economic headwinds, most notably in the form of further Brexit disruption, inflationary and cost of living pressures, and the potential for rising interest rates.

Alex Short, manager:

Strong capital growth this quarter was largely driven by the performance of the industrial assets. It continues to be a challenging period for the high street retail sector, but with valuations stable again this quarter, we are starting to see cause for selective optimism. We are often seeing divergence between high street retail and retail warehousing assets, in terms of both tenant and investor demand, with this being evident in retail warehousing valuations.

Michael Morris, chief executive:

Continued strong investment and occupational demand in the industrial sector again led to very positive during the quarter. There remains a supply/demand imbalance, especially in the South East multi-let market, which is continuing to drive rental and capital growth.

Residential

Ben Fry, manager:

The secular tailwinds remain strong. As the nation continues to adapt to post-pandemic working and living patterns, the ageing population and rising house prices continue to drive demand for high quality retirement property and affordable homes. Our portfolio of inflation-linked rental housing continuing to deliver both inflation-protected income and meet homeowners’ needs for affordable rents.

Healthcare

Kenneth MacKenzie, manager:

The [care home] sector’s long-term fundamentals remain highly compelling, and we are well placed to capitalise on these through our broadening occupier mix and balance sheet strength. In our role as an engaged landlord, we have worked closely with all our tenants as they have dealt with challenges of the latest COVID outbreak. We are tentatively confident that we are through the worst and that the portfolio is well-placed to perform through 2022, albeit the pandemic’s residual effects may result in some limited asset management initiatives being required in the short-term to protect income and value.

Real estate research

Tritax EuroBox – Fast-tracked

Urban Logistics REIT – In the sweet spot

Grit Real Estate Income Group – Showing some grit

Civitas Social Housing – Short shrift to short seller

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.