Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

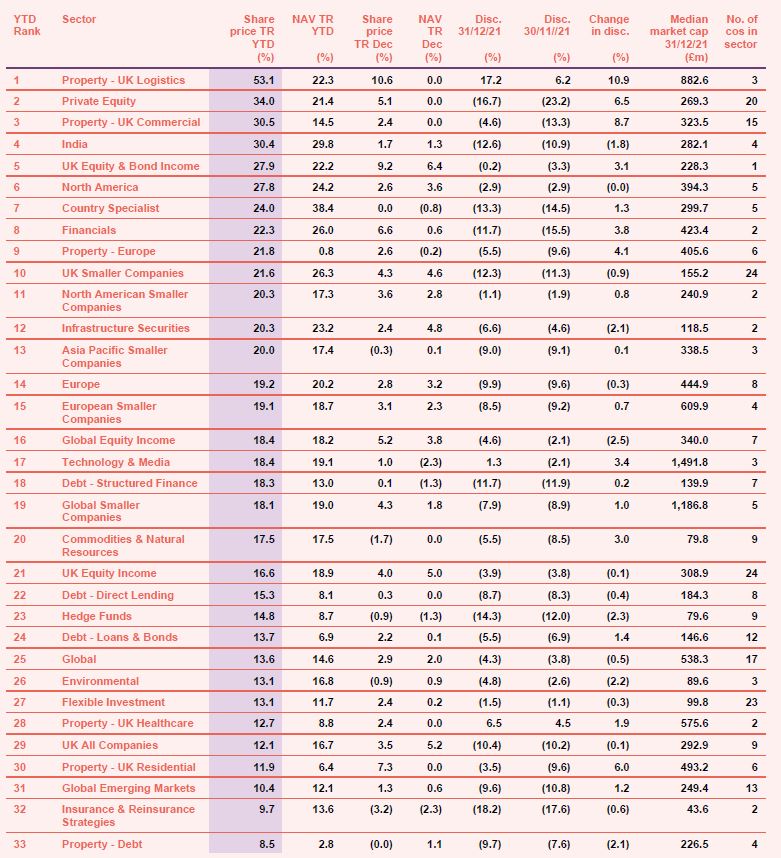

After a second year of navigating the uncertainty and volatility caused by the coronavirus pandemic, 2022 ended with an outbreak of the latest variant, Omicron. Though reportedly a milder version, the virus has proven extremely contagious, and lockdowns and restrictions have once more been imposed in various countries across the world. December’s median total share price return was 2.4% (the average was 2.2%) which compares with a median of 0.7% in November. Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

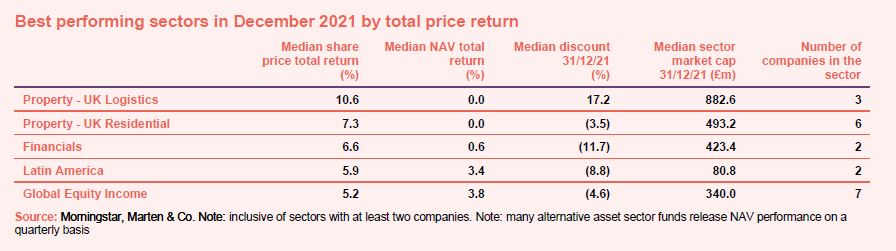

Best performing sectors over December

In terms of top performing investment companies for December, property trusts did well, with those in both logistics and residential sectors making share price gains, though NAVs remained, on average, flat. Latin American trusts made somewhat of a comeback after falling for the bulk of 2021 while global equity income names also performed well.

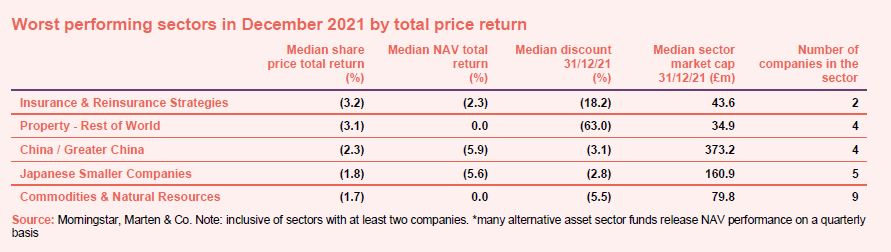

Worst performing sectors over December

On the other hand, China, Japanese smaller companies and commodities & natural resources trusts were weak in December, ending on a low after what had already been a generally tough year for these sectors. The worst sector for the month however was insurance & reinsurance strategies (see Appendix 1, below, for a breakdown of how all the sectors have performed this year).

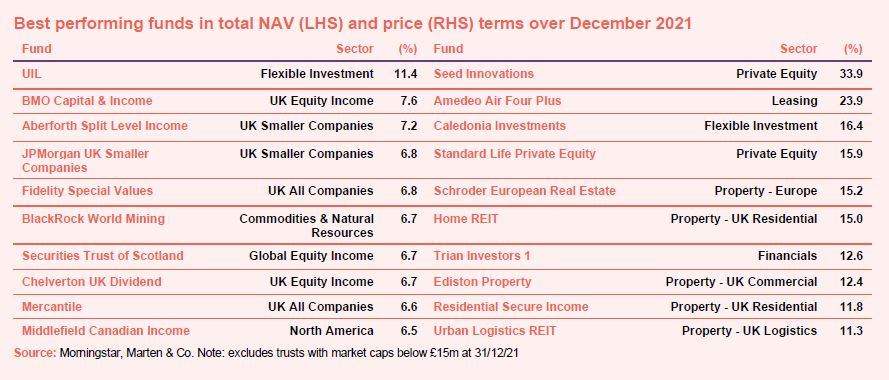

On the positive side

After years of underperformance and being underappreciated, UK trusts dominated the best-performing tables in December in NAV terms, with BMO Capital & Income, Aberforth Split Level Income, JPMorgan UK Smaller Companies, Fidelity Special Values, Chelverton UK Dividend and Mercantile among the top ten. This reflects the UK market in general, which had a good month and which saw the MSCI United Kingdom index up by 3.2% in December. Despite Omicron woes, restrictions were not implemented at the same level as previously seen, and so consumers could get out and about and spend in shops, restaurants and the like, in the run-up to the holiday season. Though its sector was hit in December, BlackRock World Mining navigated the storm and performed strongly, while Securities Trust of Scotland enjoyed a boost following the publication of its good interim results. In share price terms, property trusts led the way, with Schroder European Real Estate, Home REIT, Ediston Property Investment Company, Residential Secure Income and Urban Logistics REIT all enjoying returns of above 10%. Private equity names Standard Life Private Equity and Seed Innovations also performed strongly in December, with the latter at the top of the list after its discount narrowed as its portfolio holding, Yooma Wellness, reported strong growth and operational progress.

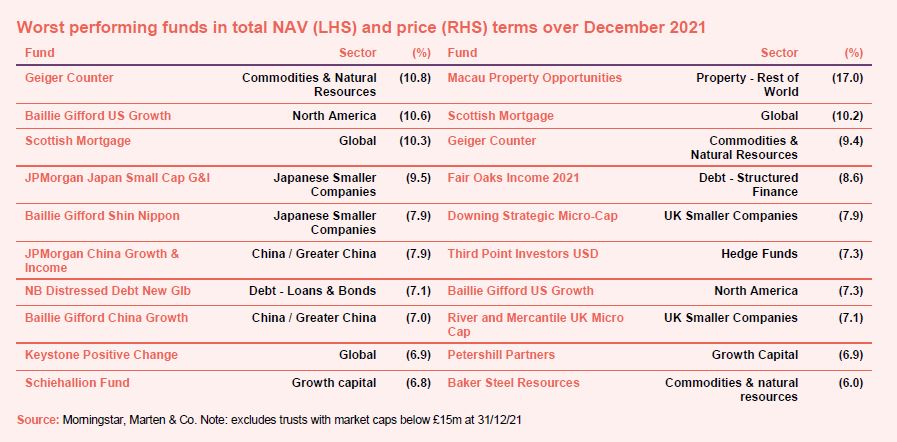

On the negative side

On the negative side, Japanese Smaller Companies and China trusts took a hit, as already highlighted, with names such as JPMorgan Japan Small Cap Growth & Income, Baillie Gifford Shin Nippon, JPMorgan China Growth & Income and Baillie Gifford China Growth all down in NAV terms. Worries over China’s heavily indebted property development sector and new lockdowns as China attempts to control the spread of Omicron generated growth fears. Omicron, rising fuel costs and a decision by the Bank of Japan to reduce its support for the economy all weighed on that market. In share price terms, Macau Property Opportunities was the worst performer as it asked shareholders to extend its life to allow the piecemeal sale of its Waterside apartment complex rather than a quick sale of the whole block. This company has been in wind down mode for many years now. Baillie Gifford managed funds, including market-leader Scottish Mortgage, feature prominently. It has been suggested that the prospect of rising interest rates is denting valuations of high growth companies. Hedge fund Third Point Investors was in the news a lot over the month. Asset Value Investors and others have been trying to encourage it to narrow its discount. However, they were knocked back and the discount has widened once again.

Discounts and premiums

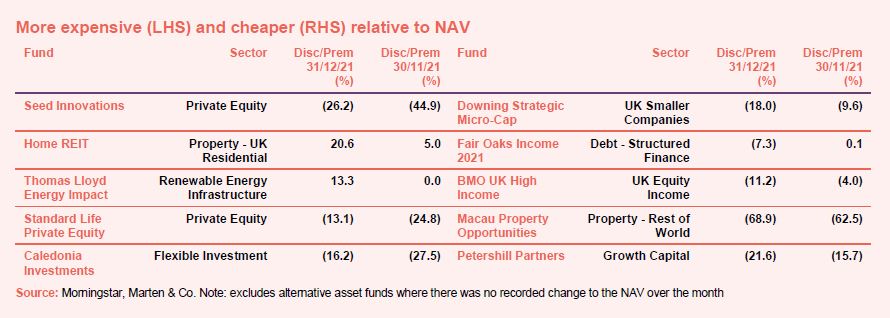

More expensive and cheaper relative to NAV

Seed Innovations become more expensive in December as its overly-wide discount narrowed by almost half to 26.2%. Strong growth prospects from one of its key holdings, Yooma Wellness, gave the trust a boost. Meanwhile Home REIT saw its 5% premium shoot up to 20.6% over the month, while new kid on the block, Thomas Lloyd Energy Impact has kicked off its life on an attractive double-digit premium. Standard Life Private Equity and Caledonia Investments enjoyed their mid-20s discounts narrowing to 13.1% and 16.2% respectively during December, helped by good performance over 2021. Meanwhile, Downing Strategic Micro-Cap became cheaper in December, with its 9.6% discount widening to 18%. The manager reported on a tough period in its interim results while inflation, interest rates and supply chain issues continue to be concerning. BMO UK High Income, whose defensively focused portfolio struggled to make headway in 2021, saw its 4% discount more than double to 11.2% while Petershill Partners, which only launched in October and is not well-understood by investors we think, seems to have taken a hit, now trading on a discount of 21.6%.

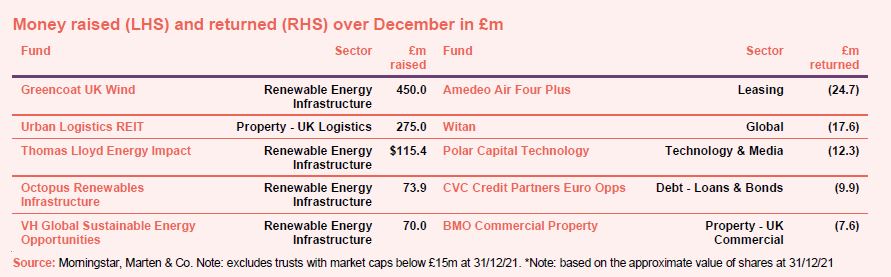

Money in and out

Money coming in and going out

£1.2bn of net new money was raised in December following a combination of IPOs and fundraises. Greencoat UK Wind raised the lion’s share of £450m – an impressive total for a secondary issue, which will be used to fund its recent offshore wind farm investment – while Urban Logistics REIT enjoyed an oversubscribed fundraise of £275m despite targeting gross proceeds of £200m. It ended the year purchasing four new assets with the proceeds. The one IPO during the month was that of new Asia-focused renewable energy infrastructure trust, Thomas Lloyd Energy Impact, which raised $115.4m in cash and also issued about $35m of stock in exchange for assets, while Octopus Renewables Infrastructure and VH Global Sustainable Opportunities also raised around £70m each.

At the start of the month, Amedeo Air Four Plus handed back almost £30m to shareholders which it received following the sale of two planes last September and had been holding on to for financial flexibility but has since decided it is no longer needed. Share buybacks were led by Witan, Polar Capital Technology, CVC Credit Partners European Opportunities and BMO Commercial Property.

Recently published research notes

North American Income Trust – Healthy dividend increases

Unlike its AIC North America peers, North American Income Trust (NAIT) combines an income focus with having at least 90% of its assets invested in the US. After more than a year of uncertainty around dividends, things finally seem to be normalising, with some companies even increasing their dividends. Over the past year NAIT’s manager, Fran Radano, has found good value in stocks with slightly lower dividend yields than would previously have been expected for a NAIT holding, but these companies offer greater opportunities for capital appreciation and often-times double digit dividend growth. These are complemented by high yielders with more modest dividend or earnings growth.

Grit Real Estate Income Group – Showing some grit

Grit Real Estate Income Group (Grit) has taken decisive action to secure its future with the announcement of a proposed capital raise of up to US$215.6m. The group’s portfolio has suffered heavy valuation declines during the COVID-19 pandemic, especially in the retail sector, which has seen its loan to value ratio (LTV – borrowings plus cash as a percentage of portfolio valuation) soar to 53.1%. The proceeds of the equity raise will be used in two parts: firstly to pay down debt and secondly to acquire a controlling stake in a real estate developer, which has an attractive pipeline of projects including diplomatic residences let to the US government. If fully subscribed, the issue will not only result in the LTV dropping to 33.6% but will allow Grit to address its short-dated debt and be a catalyst for a re-rating of the discount to net asset value (NAV).

The turnaround in Temple Bar (TMPL)’s fortunes following the appointment of RWC as manager last November and a surge in ‘value’ stocks on hopes of an end to the COVID-19 pandemic has been dramatic. Frustratingly, the discount that the trust’s shares trade on relative to their net asset value widened from the middle of April 2021, as investors fretted about the impact of new variants of the virus and switched back to buying ‘growth’ companies for their perceived ability to thrive even in a lacklustre economy.

India Capital Growth – The show must go on

India has attracted a lot of attention over 2021 as it has outperformed even the US, despite suffering from one of the deadliest waves of the COVID-19 pandemic earlier this year. Combined with improved stock selection and its new investment policy, India Capital Growth (IGC) has also seen its performance shine through.

The adviser, Gaurav Narain, highlights the start of a new economic cycle and the returning of profitability to Indian corporates, which had previously been at all-time lows. Meanwhile India is also benefiting from extra capital via the China Plus One strategy (a strategy where companies seek to diversify their supply chains beyond China so as to reduce risk) and a government that is now prioritising growth over reform and giving extra support to private companies. These developments are particularly timely as IGC can enjoy increasing traction ahead of its redemption vote at the end of the year.

Vietnam Holding Limited – Asia’s emerging champion

Since we last published on Vietnam Holding (VNH), the Vietnamese economy has gone from strength to strength, lifting the country’s equity markets, which are among the best performing globally year-to-date (YTD). VNH has captured this and more – outperforming local and global indices, and its direct competitors. Despite this impressive performance, there is still much to go for – attractive valuations (despite the strong earnings growth potential); domestic income that has passed US$3,000 per head (which the manager identifies as an inflexion point from which it could accelerate); a boom in exports as multinationals continue to diversify their supply chains; further benefits to come from privatisation; and, over the medium term, the potential for Vietnam’s elevation to the MSCI Emerging Market index. With its decent track record and strong environmental, social and governance (ESG) focus, we see room for VNH’s currently double-digit discount to narrow from here.

Bluefield Solar Income Fund – Executing on revised objective

Since we last published on Bluefield Solar Income Fund (BSIF), the company has raised £105.1m in an oversubscribed share issue, and completed on the purchases of its first wind and battery storage investments. The company’s financial results, covering the 12-month period ended 30 June 2021, were encouraging. BSIF hit its 8p per share dividend target comfortably, maintaining its record of sector-leading distributions that are well-covered by underlying earnings (after paying back debt as it falls due for repayment). A high proportion of government subsidy income (designed to encourage the development of solar power in the UK) means that BSIF’s revenues already have a high degree of predictability and inflation-linkage.

JPMorgan Japanese Investment Trust – Bright long-term future

JPMorgan Japanese Investment Trust (JFJ) had an impressive run of both absolute and relative (to its benchmark index and to competing trusts) performance going into and during the worst of the pandemic. However, once vaccines became a reality, the share prices of businesses that had struggled during lockdowns surged. These were often the types of company that the managers would not consider for JFJ’s growth- and quality-focused portfolio. Consequently, over the past 12 months, JFJ has produced decent returns, surpassing £1bn in assets, but has given up a little of its outperformance of its benchmark.

The management team of Nicholas Weindling and Miyako Urabe is unfazed by this. They make the compelling argument that an investor in JFJ is backing the companies that are set to disrupt and revitalise Japan’s sclerotic economy, which are also capable of compounding their earnings sustainably over the long term. The long-term future is bright.

BlackRock Throgmorton – Powering on

BlackRock Throgmorton Trust (THRG)’s results for the accounting year ended 30 November 2021 will not be published for a while yet, but it looks as though THRG has had another great year, with its net asset value (NAV) and share price returns well above peer group averages and its benchmark.

It might have been reasonable to think that the resurgence in sectors hit badly by COVID (retail, leisure, banks, energy and mining, for example) – areas that THRG tends to have little or no exposure to – would have provided a significant headwind. However, this has not been the case and THRG manager Dan Whitestone says that the trust’s good performance reflects the success of the companies in the portfolio. He remains enthused about their prospects.

Jupiter Emerging & Frontier Income – When the going gets tough

Emerging markets have struggled to make headway over the course of 2021, but Jupiter Emerging & Frontier Income (JEFI), helped by its frontier market exposure, has been one of the winners within its peer group. Manager Ross Teverson’s long-held view that better value is available outside of China has worked in the trust’s favour, while its allocation to frontier markets offers an opportunity otherwise not available in the majority of its peers’ portfolios.

Headwinds in the form of inflation, potential interest rate rises and rising energy prices do exist, but the manager’s bottom-up approach – which combines value and growth elements – offers some resilience from the strength of the underlying portfolio’s balance sheets and earnings growth. We also note that JEFI is the top-yielding trust within the AIC’s Global Emerging Markets sector.

Urban Logistics REIT – In the sweet spot

It has been a whirlwind few months for Urban Logistics REIT (SHED) as it continues to grow rapidly in one of the best-performing real estate sectors in the UK. The group deployed the proceeds of a July capital raise in short order and earlier this month raised a further £250m to plough into a net asset value (NAV) accretive pipeline. The logistics sector is currently in the sweet spot, with high demand for space and a chronic lack of supply resulting in strong and sustained rental growth.

Major news stories over December

Portfolio developments

- 3i Infrastructure makes further investment in ESVAGT

- JPMorgan China produced positive returns

- Barings Emerging EMEA Opportunities outperforms benchmark during recovery year

- Seraphim Space backs ICEYE

- Schroder UK Public Private’s Benevolent AI in SPAC deal

- Henderson European Focus stock picking pays off

- Great year for TwentyFour Select Monthly Income

- Improved picture at Aberdeen Diversified Income & Growth

- Schroder AsiaPacific bet against China pays off

- HgCapital invest in Pirum Systems

- Top performance at Aberdeen Standard Equity Income

- Edinburgh Worldwide looks to increase exposure to unquoteds

- River and Mercantile UK Micro-Cap outperformed

- Henderson Diversified Income embedded ESG

- Sequoia took a hit from the Bulb administration news

- GCP Infrastructure benefitted from its decarbonisation agenda

- Disappointing year for Finsbury Growth and Income

Corporate news

- VH Global Sustainable Energy Opportunities raises further £70m just nine months after launch

- Chrysalis targets £125m in placing and PrimaryBid offer

- AVI claims moral victory in Third Point tussle

- Octopus Renewables Infrastructure placing and REX Retail Offer raise £74m

- Downing Renewables and Infrastructure enters into new loan agreements

- India Capital Growth confirms upcoming redemption facility details and determines exit discount for 2023

- ThomasLloyd Energy Impact Trust IPO raises US$150m

- Lowland mulls share split after strong year of performance

Managers and fees

- Amedeo Air Four plans cash distribution and restores dividends

- JPMorgan Japanese increases dividend for second year running

Property news

- Residential Secure Income posts impressive results

- Life Science REIT makes maiden purchase

- Impressive results for Tritax EuroBox

- Schroder European REIT reports 3.2% NAV total return

- ASLI secures €227m Madrid logistics portfolio

- Hammerson disposes of £92m non-core assets

- LXI REIT swoops for £58.9m Sainsbury’s supermarket

- Grit Real Estate raises $156.7m

- Urban Logistics REIT purchases four assets

QuotedData views

- Pacific Horizon – a premium that’s spicy for a reason? – 17 December

- Opportunities on the forefront(iers) – 10 December

- Living in interesting times – 3 December

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- JPMorgan Japanese AGM 2022, 13 January

- BMO Private Equity presentation, 13 January

- Troy Income & Growth AGM 2022, 19 January

- Aberdeen Standard Asia Focus presentation, 19 January

- Majedie Investments AGM 2022, 19 January

- Henderson Far East Income AGM 2022, 20 January

- Lowland Investment Company AGM 2022, 26 January

- Aberdeen Standard Asia Focus AGM 2022, 27 January

- Henderson European Focus AGM 2022, 27 January

- JPMorgan China Growth & Income AGM 2022, 28 January

- Scottish Investment Trust AGM 2022, 1 February

- Schroder AsiaPacific AGM 2022, 1 February

- Edinburgh Worldwide AGM 2022, 2 February

- JPMorgan Indian AGM 2022, 3 February

- Bailie Gifford European Growth AGM 2022, 3 February

- Aberdeen Standard Equity Income AGM 2022, 4 February

- Schroder UK Mid Cap Fund AGM 2022, 9 February

- JPMorgan Asia Growth & Income AGM 2022, 9 February

- Finsbury Growth & Income AGM 2022, 9 February

- Polar Capital Global Healthcare AGM 2022, 11 February

- Aberdeen Diversified Income & Growth AGM 2022, 22 February

- BMO Capital and Income AGM 2022, 10 March

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 2 July | GSS, PCFT, SHED, BSIF | David Conlon | GCP Asset Backed Income |

| 9 July | AGT, DIGS | Matthias Siller | Baring Emerging EMEA Opportunities |

| 16 July | AGT, ABD, SONG, PRSR, RHM | Nick Wood | Quilter Cheviot |

| 23 July | RNEW, PSH | Gareth Powell | Polar Capital Global Healthcare |

| 6 August | AEMC, ANW, CREI, DRIP | Matthew Howard | BMO Commercial Property |

| 13 August | AIF, SSON | Andrew Bell | Witan |

| 20 August | APAX, ELTA, PSH | Abbie Glennie | Aberdeen Smaller Companies Income |

| 27 August | GRP, SHB | David Smith | Henderson High Income |

| 3 September | AIF, BRET | Ian Lance | Temple Bar |

| 10 September | GSEO, ASLI, SLI | Craig Baker | Alliance Trust |

| 17 September | APAX, GABI, SUPP | Robin Parbrook | Schroder Asia Total Return |

| 24 September | NCYF, RNEW, FEML, USF | Peter Hewitt | BMO Managed Portfolio |

| 1 October | AIE, CAT, IGC, VNH | Tim Creed | Schroder UK Public Private |

| 8 October | FEML, GRP | Steven Tredget | Oakley Capital |

| 15 October | ATS, CGL, GHS | Nicholas Yeo | Aberdeen China |

| 22 October | FEML, SCIN | Claire Shaw | Scottish Mortgage |

| 29 October | EPG, SHED | Richard Pindar | Literacy Capital |

| 5 November | UKW, GHS, ACIC | Rory Bateman | Schroder British Opportunities |

| 12 November | PINT, SMT, GSEO | Helen Steers | Pantheon |

| 19 November | TIGT, ROOF | Iain McCombie | Baillie Gifford UK Growth |

| 26 November | MTU, JLEN, GRIT, CORD | David Cornell | India Capital Growth |

| 3 December | AAS, TEEC | Rob Crayfourd | CQS Natural Resources Growth & Income |

| 10 December | EWI, TLEI | Nicholas Ware | Henderson Diversified Income |

| Coming up | |||

| 7 January | QuotedData | Andrew McHattie | 2021 roundup |

| 14 January | LABS | Simon Farnsworth | Life Sciences REIT |

| 21 January | NCYF | Ian Francis | New City High Yield |

| 28 January | SEIT | Jonathan Maxwell | SDCL Energy Efficiency |

| 4 February | PNL | Sebastian Lyon | Personal Assets |

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – December 2021 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.