Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

Performance data

April’s biggest movers in price terms are shown in the chart below.

Following two months of heavy falls as the covid-19 pandemic took hold and the UK was put on lockdown, many property companies saw a bounce in their share price in April, although not enough to recover the losses since the crisis hit. Topping the bill in April was housebuilder Countryside Properties, which saw a 42.2% gain. The group’s share price took a dive at the end of February and into March as construction sites were shut down due to the lockdown and social distancing rules. However, as many housebuilders revealed plans to get back on site, share prices recovered somewhat. Two other residential-focused companies – Sigma Capital Group and Inland Homes – also feature in the top 10.

There were positive signs for commercial real estate companies too, with the two behemoths of the listed property sector – British Land and Land Securities – both seeing a recovery in their share price of 20.3% and 18.9% respectively. Both are still a third down in the year-todate, however. Struggling shopping centre landlord Intu Properties saw its share price rise by a quarter during April, albeit from an extremely low base. U and I Group, which has seen dramatic falls in its share price during the crisis, also saw a rebound in April.

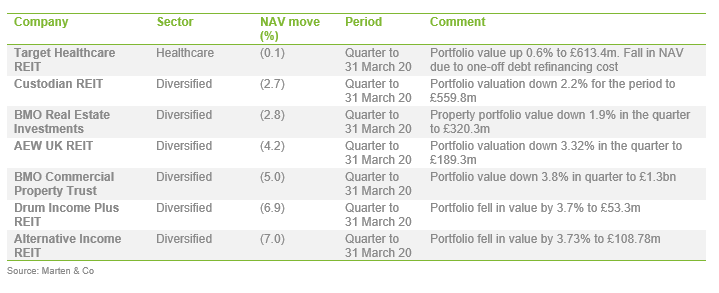

Not every company saw a bounce back in their share price, however, and plenty continued to see big falls in April. Topping the list of fallers was pan-African real estate company GRIT Real Estate. The risks posed to the continent by covid-19 could be behind the fall. The company’s tenant base, however, is largely made up of multi-national businesses, such as PwC, that are well capitalised. Also high on the list of share price fallers was BMO Real Estate Investments. At the end of March, the company announced results for 2019 in which its net asset value (NAV) fell 2.1% and its property portfolio lost 1.8% in value. This was before the effects of covid-19 on its portfolio, with its NAV falling another 2.8% in the first quarter of 2020.

Secure Income REIT, the long lease income trust, has been dogged by the saga with Travelodge – one of its biggest tenants. Travelodge, which is owned by multinational investment businesses including Goldman Sachs, had demanded huge rent cuts from landlords until December 2021 due to the impact of covid-19. Landlords, including Secure Income REIT, rejected the proposals and are in discussions with Travelodge on new terms. Meanwhile, Drum Income Plus REIT reported a huge NAV decline in the first quarter.

Valuation moves

Valuation moves

Corporate activity in April

Corporate activity in April

Despite the uncertainty caused by the covid-19 pandemic, four property companies raised money during the month, totalling £416.6m.

Assura Group, which owns a portfolio of GP surgeries, raised the largest sum at £185m. Most of the proceeds, it said, would finance investments. It had a £165m pipeline of projects ahead of the covid-19 pandemic.

Supermarket Income REIT almost doubled its original target of £75m to raise £139.8m in a heavily oversubscribed issue of 135,748,028 new ordinary shares at 103p. The company has an identified pipeline of acquisitions worth almost £300m.

Self-storage specialist Big Yellow Group raised £81.9m and will use the proceeds to fund the acquisition of land to grow its development pipeline.

Housebuilder Inland Homes raised £9.9m to strengthen its balance sheet amid disruption caused by covid-19. It said the proceeds would help enable an early resumption of its housebuilding programme once the covid-19 restrictions were lifted.

Student accommodation operator Empiric Student Property refinanced £32.8m of existing debt that was due to expire in October 2020. It extended the facility by four years, to 31 October 2024, with existing lender AIB Group. The facility is on more favourable terms with a reduced interest cost of 1.7% per annum above three-month LIBOR (previously 2.25% above three-month LIBOR).

Schroder REIT drew down its revolving credit facility with Royal Bank of Scotland in full, totalling £52.5m, to provide it with firepower to capitalise on investment opportunities.

Impact Healthcare REIT signed a new £50m revolving credit facility with HSBC UK Bank for an initial term of three years with an option to extend by a further two years. The facility has a margin of 195 basis points per annum over three-month LIBOR.

Big Yellow Group completed a seven-year debt facility with Aviva of £35m at an all-in cost of 1.96%, secured over a pool of 15 assets. The all-in cost reduces to 1.91% following the installation of 50 kWh capacity solar panels at three of the assets.

April’s major news stories

April’s major news stories

• Value to be found in property

Covid-19 has severely impacted the property market with tenants across all sectors struggling with cash flow problems as various measures to restrict the spread of the disease have been stepped up. There are one or two property sub-sectors that are performing well during the crisis, however.

• Urban Logistics REIT splashes £103m on acquisitions

Urban Logistics REIT bought 17 assets for a total of £103m as it went about spending the proceeds of its £136.1m equity capital raise that completed in March. The company also confirmed that all its rents have been collected for the quarter.

• Retail landlords call for rental support scheme

Retail property landlords have called on the government to implement a rental support scheme as the covid-19 induced lockdown continues to hit income. Groups including British Land and Land Securities have teamed up with some of the biggest UK retailers to write to chancellor Rishi Sunak with their concerns.

• Helical sells London office at sub-4% yield

Helical sold 90 Bartholomew Close, Barts Square, EC1, for £48.5m and a net initial yield of 3.92%. The sale was a fillip for the property market during a period of few investment transactions due to the covid-19 pandemic.

• Property valuations take a dive

We got the first real insight into the impact covid-19 is having on property valuations, with Picton Property and BMO Commercial Property Trust among companies to announce portfolio values for the quarter to 31 March 2020. Values changes have ranged between +0.6% and -3.9% at companies to have reported.

• GCP Student Living drops acquisition

GCP Student Living says its agreement to buy Scape Canalside Mile End, a new 412-bed student accommodation property, has lapsed. It might still buy the asset but not under the terms agreed back in October 2017.

• U and I Group sells stake in Harwell Campus

U and I Group, the specialist regeneration developer and investor, exchanged contracts to sell its stake in Harwell Campus for £41.74m.

• Will lenders be sympathetic to plight of property companies?

As the cash flow issues are passed from tenants to the landlord, there have been calls for the government to step in and provide guidance to lenders to grant flexibility. Property companies will certainly be hoping it is the approach of the banks, especially as pressure is put on values and LTV covenants come closer and closer to being breached.

• Hammerson’s credit rating under review

Rating agency Moodys has placed Hammerson’s credit rating under review. Currently it rates it as Baa1 (the equivalent of BBB+). If the rating falls below Baa3/BBB-, Hammerson’s debt will no longer be classed as investment grade and it could find it more expensive and harder to borrow and to refinance its existing debt.

After Barclays chief executive Jes Staley said the coronavirus pandemic could permanently change the way it uses the office space, it led to many headlines predicting the end of the office. The London office market is in strong position to withstand a likely drop-off in demand, however.

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Diversified

Custodian REIT

Richard Shepherd-Cross, investment manager:

It is too early to assess the long-term impact of covid-19 on the commercial property market, but we believe it may accelerate pre-existing trends in the use of, and investment in, commercial property. We expect to see a further deterioration in secondary retail, an increase in demand for flexible office space (both traditional offices, fitted out and leased flexibly, as well as serviced offices) and a continuation of the growth of logistics and distribution. As always, we would expect location to be a key determinant of the future success of commercial property assets.

In the near-term, of even more importance than the NAV derived from current valuations is the absolute focus on rent collection, future cash flow, ongoing asset management and the affordability of future dividends which are all underpinned by the company’s low ongoing charges ratio of 1.12% and low cost of debt of 3.0% (circa £4.7m interest per annum in aggregate).

BMO Commercial Property Trust

Martin Moore, chairman:

It will take time for the markets to re-balance following such a major shock. Changes to lifestyles and working patterns may persist beyond the crisis period, which for property may present opportunity as well as challenges. However, the economic outlook will still be affected by Brexit and this represents another area of uncertainty. Given this backdrop, we expect capital values to remain under pressure and rental growth, especially in retail, to be by exception. Optimising and protecting income will be paramount in the difficult period ahead.

AEW UK REIT

Alex Short, portfolio manager:

We are currently seeing an unprecedented period of uncertainty within UK and global markets and understandably, this is having an impact on real estate markets. This is demonstrated within our property valuation this quarter and also by the fact that the property valuation, in line with guidance given by the RICS to the UK real estate market as a whole, is issued with material uncertainty.

Features inherent in the company give us comfort however, that it is as well-positioned as possible in the current time. Firstly, the high and very stable level of earnings generated from the portfolio represent a strong starting point in times of increased volatility. Looking at UK real estate return components since the inception of the MSCI index, income is by far the least volatile providing a much more resilient profile even in times of large capital declines. The company’s ability to generate both high and stable earnings is demonstrated by its dividend of 2p per share per quarter which has been reliably paid each quarter for four years now and was most recently covered to 106%.

Furthermore, the company’s strong focus towards industrial property at over 48% is expected to provide a robust base, both during the crisis and also for recovery once normal life resumes. We can already see that the restrictions that have been placed on all of our lives have led to a significant drop off in trade for retail and leisure operators. In the industrial sector however, we see supermarkets and online retailers looking to take on additional space in order to deal with increased capacity and UK manufacturers rising to new production challenges with an entrepreneurial spirit.

Another area which provides us with some optimism is in connection with ongoing asset management transactions. AEW’s very active approach to asset management is a major feature of its investment strategy and proven by the portfolio’s outperformance of the MSCI UK Balanced Index at property level over various time periods. Since restrictions have been sanctioned in the UK, we have seen some of the portfolio’s potentially most accretive value plays continue to progress and, in addition, some new opportunities have come to light during this time. We continue to work assets hard in order to maximise value. This can be demonstrated by the portfolio’s very low vacancy level, which has now remained below 4% for seven consecutive quarters.

BMO Real Estate Investments

Peter Lowe, investment manager:

Given the uncertainty surrounding the current trading position of some of the company’s tenants, the recovery of income due under existing lease contacts remains the immediate focus. The company’s low void rate of circa 3% and relatively high and diversified weighting to the office and industrial sectors should provide some protection against these challenges but very few areas of the market will offer immunity to the wider downturn induced by the pandemic and associated global lockdown. We therefore continue to expect to see significant disruption to revenues over the near term, including the next quarter’s rent collection, even when the timetable for relaxation of lockdown measures becomes clearer.

Healthcare

Healthcare

Target Healthcare REIT

Kenneth MacKenzie, chief executive:

Given the fast-moving nature of the covid-19 pandemic, it is impossible to predict with any certainty what sort of impact we may see across our portfolio. Whilst we expect to see a small number of care homes disproportionately affected, our investment strategy has always focused on the quality and design facilities of the properties, underpinned by a forensic approach to understanding local market dynamics. Nothing has changed our conviction that this approach, coupled with the underlying demographic trends supporting strong demand for care home beds, will underpin the delivery of reliable and sustainable income over the long term.

Logistics

Logistics

Tritax Big Box REIT

Colin Godfrey, fund manager:

The crisis is bringing into sharp focus the need for occupiers to have a robust, flexible supply chain and the importance of operating in prime, well-located buildings. This pandemic may act as a catalyst for change, accelerating the adoption of ecommerce platforms as consumers increasingly shop online. This will continue to drive demand for logistics space as occupiers build in resilience and capacity to limit future potential disruptions.

Student accommodation

Student accommodation

Unite Group

Richard Smith, chief executive:

The government’s central planning scenario is for the 2020/21 academic year to start in September, broadly in line with the usual admissions cycle. This follows confirmation that students will receive their A-level results on 13 August 2020 as originally planned. However, there is still some uncertainty over start dates for the academic year, which could result in both a later start and finish to the autumn semester.

Universities UK recently proposed a package of support measures for universities to counter the risk of a reduced intake of first-year students from non-EU countries. The proposal includes increased research funding and one-year student number controls to ensure the financial viability of all universities. The government is expected to publish its response in the coming weeks. We will continue to work closely with our university partners to adapt to any changes in admissions for the coming academic year.

There are 1.5 million full-time students in the UK seeking accommodation, of which 1.2 million are domestic students living away from home and international students studying multi-year courses. We expect universities to offset a potential reduction in first-year international student intake by recruiting additional UK students from surplus applications, which totalled 101,000 in the 2019/20 academic year.

We also expect demand for purpose-built accommodation to be supported by market share gains from the 865,000 students currently living in HMOs. We have already shifted the focus of our marketing activity to target students living in HMOs, where we believe that our offer of purpose-built, affordable accommodation with a range of value-added features such as 24-hour security, all-inclusive bills and on-site support will be considered an attractive alternative. Even a small shift of students from HMOs to purpose-built student accommodation would help to substantially offset potential reductions in international student numbers.

Europe

Europe

Aberdeen Standard European Logistics Income

Evert Castelein, investment manager:

Notwithstanding the covid-19 pandemic which has impacted the world greatly during the initial phases of government imposed lock downs, the board and the investment manager believe that the European market will continue to offer attractive opportunities as the logistics segment grows. There will clearly be a period of time where many businesses will be severely impacted through the effective halting of trade and the shutdown of economies as governments attempt to tackle the pandemic. During this difficult period, however, we see that businesses involved in essential services and supplies like food production and supply, pharmaceuticals and parcel deliveries to homes and businesses are faring well and are often requiring additional logistics facilities or space. This crisis will likely see businesses speeding up their adoption of ecommerce use with a resultant increase in take-up of warehouse capacity. We believe that the size segment that we are invested into is the most attractive and liquid part of the logistics sector with the urbanisation trend across Europe driving demand and growth.

With previously close to 10% of retail sales on average in the EU resulting from online transactions and with a double digit growth rate, the economic pressures on the demand side of the logistics sector prior to the crisis were evident, particularly on urban freight infrastructure. Despite what will no doubt be some short-term headwinds, we expect the current environment to accelerate this demand led growth and this gives confidence that we are well positioned in an expanding area of the real estate market.

Tritax EuroBox

Nick Preston, fund manager:

Despite the unprecedented nature of this crisis, we believe that the fundamentals driving demand for continental European logistics assets remain strong. Supply chains have been severely tested, and this has highlighted occupiers’ growing need for modern, well specified, strategically located buildings close to major population centres and infrastructure.

Structural tailwinds driving demand in the big box logistics sector may be accelerated as a result of the impact of the covid-19 pandemic. We anticipate that the recent marked increase in online retail usage in Europe will lead to retailers having an even greater focus on growing their ecommerce platforms. Other emerging themes include manufacturing moving closer to Europe from the Far East in order to shorten supply chains and also companies holding higher inventory levels to protect against potential supply chain disruption. All of these effects are likely to lead to companies growing their logistics functions. Meanwhile, the supply of logistics facilities remains constrained due to low land availability and little speculative development. We believe these supply and demand factors will help to underpin future valuations in the continental European logistics space, and notwithstanding any short-term issues arising from the current crisis, create further upward pressure on rental values.

Upcoming events

Upcoming events

• Empiric Student Property AGM 2020, 7 May 2020

• Secure Income REIT AGM 2020, 21 May 2020

• UK Investor Show, 26 September 2020

• Master Investor, 5 December 2020

Recent publications

Recent publications

Civitas Social Housing – Proved its mettle

Standard Life Investments Property Income Trust – Adding value in cautious times

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.