Real Estate Roundup

Kindly sponsored by abrdn

Performance data

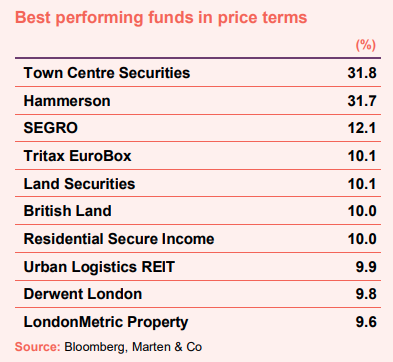

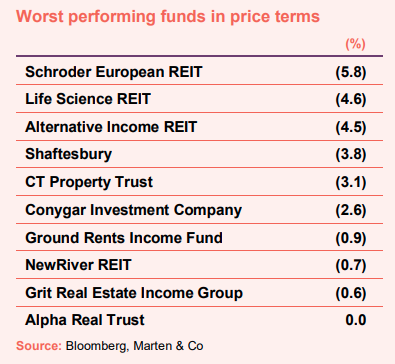

July’s biggest movers in price terms are shown in the charts below.

Many of the logistics and office focused companies that have suffered in the past few months saw somewhat of a recovery in July, as the substantial discounts that their share prices trade at relative to net asset value (NAV) narrowed. Leading the pack, however, was Town Centre Securities, which announced a tender offer of up to £7.4m at a significant premium to its share price (see page 3 for details). The tender is funded by the sale of its equity stake in a technology company at a substantial premium to its balance sheet value (see page 4). After months of heavy losses, retail landlord Hammerson saw its share price bounce 31.7% in July, as evidence that retail rents and values may have hit the bottom. The company’s share price is down 23.8% in the year to date. After last month’s fears that demand for logistics space would subside following a bleak statement from Amazon, the share prices of market leaders SEGRO and LondonMetric, European specialist Tritax EuroBox and ‘last-mile’ specialist Urban Logistics REIT all rebounded somewhat. The retirement and affordable housing focused Residential Secure Income was buoyed by another month of share price gains as the economic woes make the defensive nature of its portfolio more attractive.

On the flip side, Schroder European REIT saw the largest share price fall among property companies after announcing that the value of its portfolio had dropped marginally in the quarter to the end of June. After another monthly decline in share price, Life Science REIT has now seen its share price fall 8.4% since launching in November 2021. Bucking the trend of share price gains among generalist REITs in July are Alternative Income REIT and CT Property Trust (formerly BMO Real Estate Investments), with the latter seemingly out of favour with investors having fallen 15.9% in value over three months. Alternative Income REIT gave up some of its gains, having performed strongly in the year to date – up 8.6%. Shaftesbury continues to see its share price suffer as the possible merger with fellow central London retail and hospitality landlord Capital & Counties progresses. In the past three months its share price has fallen 16.1%. Micro-cap fund Alpha Real Trust, which has a portfolio of property and property loans, completed its tender offer in July (more detail on page 3) in an attempt to combat its wide discount to NAV. Its share price was flat during July, but up 0.7% over three months. It still trades on a 29.4% discount to NAV.

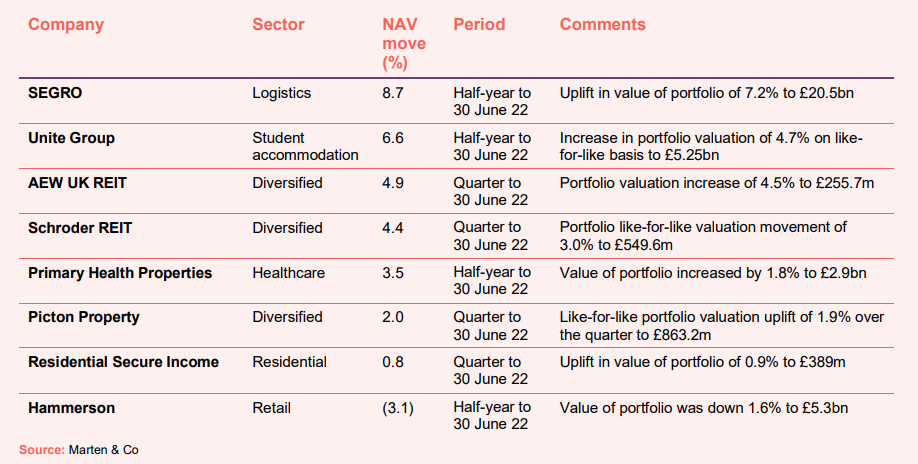

Valuation moves

Corporate activity

The merger of LXI REIT and Secure Income REIT completed in July, creating a combined company with a property portfolio of long index-linked income worth £3.9bn and net assets of £2.8bn.

LXI REIT fully hedged the cost of the £385m acquisition debt facility used to complete the merger with Secure Income REIT using an interest rate cap. As a result, it says that 100% of the enlarged group’s debt is either fixed or capped, with the same maximum all-in rate of 4.1% per annum.

Supermarket Income REIT secured a new £412.1m unsecured credit facility with a bank syndicate comprising Barclays, Royal Bank of Canada, Wells Fargo and Royal Bank of Scotland International. The facility consists of three tranches and has a margin of 1.5% over SONIA and a weighted average term of 6 years. It will be used in part to refinance £255m of existing secured commitments in addition to providing further debt capital for acquisitions.

Warehouse REIT updated its debt facilities to hedge against rising interest rates, taking out two interest rate caps of £100m each for three and five years respectively, which serve to cap the SONIA rate in the company’s debt facilities at 1.5%. Following the amendments, the company has total debt facilities in place of £345m, with a loan to value ratio of 30.1%, which mature in January 2025. Around 75% of this debt is now hedged against interest rate volatility.

Alpha Real Trust purchased just over 5.4m shares in the company through a tender offer, representing 8.7% of the share capital, for a total of £9.5m.

Town Centre Securities announced a proposal to return up to £7.4m to shareholders through a tender offer. It said that up to 4,000,000 ordinary shares would be purchased, representing 7.61% of the company, at a price of 185p per share. This is a 19.4% premium to prevailing share price of 155p.

Three members of Palace Capital’s board resigned from the company after shareholders revolted against the company’s planned change in strategy. Mickola Wilson, Kim Taylor-Smith and Paula Dillon all stepped down. The company has since appointed former NewRiver REIT director Mark Davies as senior independent director.

Chairman of Land Securities Cressida Hogg announced that she intends to retire in 2023, after nine years on the board – five as chairman.

Home REIT has been added as a constituent of the FTSE 250 Index.

Major news stories

- Home REIT splashes £92.3m on double portfolio buy

Home REIT acquired two portfolios of homeless accommodation properties for a total of £92.3m as it deploys the £263m raised in an equity issue in May 2022. The company acquired 183 properties located across England for £84.9m, and in a separate transaction bought 33 properties for £7.4m. In total, these have added a further 998 beds to the portfolio.

- Supermarket Income REIT checks out £83m purchase

Supermarket Income REIT acquired two supermarket assets for a total of £82.9m, reflecting a combined net initial yield of 4.9%. It purchased a Tesco superstore, M&S Foodhall and an Iceland in Chineham, Basingstoke, and an Asda supermarket in Carcroft, Doncaster.

- Derwent London swells development coffers with West End sale

Derwent London exchanged contracts to sell Bush House, South West Wing, in London WC2 – a 103,700 sq ft freehold office building – for £85m, reflecting a premium to December 2021 book value. The building is being sold with vacant possession and the proceeds of the sale will be used to invest in the group’s development pipeline.

- Capital & Regional sells resi development at London mall for £21.65m

Capital & Regional completed the sale of the residential development project at its 17&Central community shopping centre in Walthamstow, London, to specialist residential developer Long Harbour for £21.65m.

- Custodian REIT acquires two DFS retail park units

Custodian REIT acquired two DFS-let retail warehouses – in Measham, Leicestershire, and Droitwich, Worcestershire – for £8.9m. The units combined total 40,077 sq ft and are let at an aggregate passing rent of £894,103 per annum, reflecting a net initial yield of 9.4%.

- Warehouse REIT gets green light for 1m sq ft scheme

Warehouse REIT secured planning permission for 1m sq ft of warehousing at its flagship logistics park development at Radway Green. The final phase of the scheme will see the company develop five units ranging from 90,000 sq ft to 400,000 sq ft. The 102-acre site also has planning consent for a further 803,000 sq ft of warehouse space across six units.

- Sirius Real Estate disposes of London business park

Sirius Real Estate sold BizSpace Camberwell in London for £16m, representing a net initial yield of 2.0% and a 94% premium to the value of the asset at the time of the company’s acquisition of the BizSpace business in November 2021.

- Primary Health Properties sells medical centre portfolio

Primary Health Properties exchanged contracts to sell a portfolio of 13 smaller medical centres, located across England and Wales, for a price of £27.7m. The sale price is 13% above the 31 December 2021 book value.

- Industrials REIT disposes of vacant property

Industrials REIT completed the sale of Rose Kiln Court, Reading for £5.88m, representing a 2.2% discount to the 31 March 2022 valuation. The property, which comprises 31,687 sq ft of hybrid office/industrial accommodation on a 1.88-acre site, is currently vacant following the expiry of a lease across the entire building to Thames Water.

- Town Centre Securities sells stake in tech app for huge profit

Town Centre Securities sold its equity investment in parking app YourParkingSpace (YPS) Limited to Flowbird SAS for £20.7m – a huge uplift on the book value of the stake of £1.47m.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

David Sleath, chief executive:

Occupier demand for warehouse space is strong, broad and deep and continues to be driven by long-term structural tailwinds particularly in those urban markets where our space is used to provide a wide range of often essential goods and services to consumers and businesses. We are mindful that the coming months will be impacted by heightened macroeconomic risk but, against this backdrop, our portfolio offers considerable inflation protection: almost half of our rents are index-linked and the majority of the remaining leases are exposed to UK upwards-only rent reviews, where we have significant reversionary potential and continue to see strong demand led market rental growth.

Our sizeable, mostly pre-let, current development programme and well-located land bank provide us with both significant potential to grow our rent roll, and optionality due to the short construction periods of our assets. We will continue to be led by customer demand as we make decisions regarding the execution of future projects. The long-standing and strong relationship between our development teams and key construction partners is helping us to de-risk our pipeline by securing materials on a timely basis, whilst the tight occupier supply-demand situation has meant that we have been able to offset increased building costs with higher rents, which is in turn helping to drive further rental growth from our £20 billion portfolio. We will continue to take a disciplined approach to allocating capital to development and investment activity, ensuring that our portfolio should continue to outperform, and expect to invest at least £700 million on development capex in 2022.

Finally, in recent years we have significantly strengthened our balance sheet alongside our property portfolio. We benefit from low leverage and one of the longest debt maturities in the sector with no significant refinancing requirements in SEGRO before 2026. We have demonstrated again this year that we have access to diverse sources of debt finance. 94 per cent of our debt is either fixed rate or capped so we are well protected against interest rate rises and have plenty of capacity to continue to invest capital in the profitable opportunities available to us.

These factors combined mean that we are heading into the second half of the year with confidence in the outlook for our business. Whilst we remain watchful of the world around us and will respond accordingly to any changes in market conditions, we intend to continue to deliver the much-needed modern, sustainable warehouse space in the right locations to enable our customers to make their businesses fit for the future, and at the same time ensure that we continue to create value for all of our stakeholders.

Retail

Rita-Rose Gagné, chief executive:

Physical retail is a critical part of the omnichannel fulfilment and brand experience for our occupiers and to the consumer. Our strategy is focused on best-in-class city centre destinations which play a central role for our occupiers and the communities in which we operate, and which can continue to grow and thrive.

Notwithstanding the macroeconomic events unfolding at the beginning of the year and the ensuing economic and political turbulence, the recovery in footfall, sales, collections, and leasing at our destinations has strengthened year-on-year.

Footfall recovered steadily through the period with Q2 stronger than Q1, with the latter slightly dampened by the impact of the omnicron variant on consumer appetite. Having started the year with footfall at around 77% of 2019 levels, June levels were around 90% of 2019 for the Group as a whole. Certain core destinations have continued to exhibit footfall at or above 2019 levels.

We continued to see resilient sales, with customers spending with confidence. As with footfall, Q2 showed an improving trend over Q1. For the half, sales were 2% over 2019 levels in the UK, 3% in Ireland, and around 5% below in France, although we saw sales 2% above 2019 levels in France in Q2 ahead of the key summer sales period. Strong categories included leisure, sports & outdoors, men’s fashion, jewellery, food & beverage and services.

Healthcare

Steven Owen, chairman:

PHP’s mission is to support the NHS, HSE and other healthcare providers, by being a leading investor in modern, primary care premises. Never has this been more important as the NHS seeks to work through the backlog of procedures created by the COVID-19 pandemic and the Government delivers its Levelling Up agenda. In the longer term, the ageing demographic of western populations means that health services will also be called upon to address more ongoing, complex, chronic co-morbidities. PHP stands ready to play its part in delivering the real estate infrastructure required to meet this need in the community.

We will continue to actively engage with government bodies, the NHS, HSE in Ireland and other key stakeholders to establish, enact (where we can), support and help alleviate increased pressures and burdens currently being placed on healthcare networks.

In July 2021, the UK Government published a draft Health and Social Care Bill setting out a number of reforms in order to implement the commitments of the NHS England Long Term Plan. This included the introduction of regional Integrated Care Boards and Partnerships tasked with co-ordinating NHS partners with local government services and budgets, such as social care and mental health, in a geographic area, for the first time; the idea being that services are then pushed to the most efficient, cost-effective part of the system (whether primary care, hospital or care home) for the best patient outcomes. We welcome these reforms and are hopeful they will lead to better outcomes for patients and to further development opportunities in primary care in the medium to long-term.

Despite the recent and rapid interest rate increases we have not seen any change in investor sentiment in our sector and the UK and Irish investment markets for primary healthcare property, with its strong fundamental characteristics and government-backed income, continues to be robust. However, we do not expect any further significant yield compression in the second half of the year as the market digests the outlook for longer-dated interest rates.

We believe that our activities benefit not only our shareholders but also our wider stakeholders, including our occupiers, patients, the NHS and HSE, suppliers, lenders and the wider communities in both the UK and Ireland.

Student accommodation

Richard Smith, chief executive:

We are anticipating strong student numbers for the 2022/23 academic year, with UCAS data showing a 7% increase in the number of applicants as at the 30 June deadline compared to pre-pandemic levels in 2019/20. A record 44.1% of UK 18-year-olds have applied to university this year, reflecting growing awareness of the opportunities and life experience it provides. Applications from non-EU students are up 9%, including notable growth from China and India, which has helped to substantially offset the expected decline in EU applications (-18%) as a result of Brexit.

We expect the share of international students to increase to around 35% of total reservations for 2022/23, up from 30% for 2021/22, with particularly strong growth from India (5% of direct-let reservations), but still modestly below the pre-pandemic level of 40%. This reflects a return to face-to-face teaching by universities and fewer travel restrictions than experienced over the past two years.

We are confident of a strong sales performance for the 2022/23 academic year, reflecting the depth of student demand, reduced disruption from grade inflation and fewer travel restrictions for international students. This underpins our guidance for 97% occupancy and rental growth of 3.5-4.0% for 2022/23.

Our business model has inflationary protection through annual repricing of our income and cost hedging but, like others, we are not immune from the impact of rising costs and interest rates. We will seek to offset higher operating costs through our pricing, while ensuring we continue to offer value-for-money accommodation to students.

The outlook for the business remains strong, reflecting growing student demand, our alignment and partnership with the strongest universities and the capabilities of our best-in-class operating platform. We are well positioned to benefit from the strength of HE, which has historically become more attractive during economic downturns.

Real estate research notes

Grit Real Estate Income Group – Transition underway

Civitas Social Housing – Fundamentals remain strong

Standard Life Investments Property Income Trust – Resilient income in uncertain times

abrdn European Logistics Income – Logistics safe haven with growth on horizon

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.