Real Estate Roundup

Kindly sponsored by abrdn

Performance data

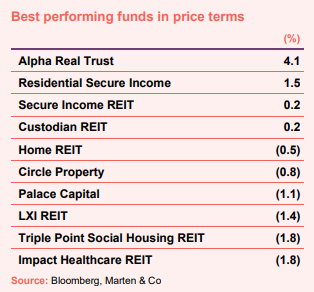

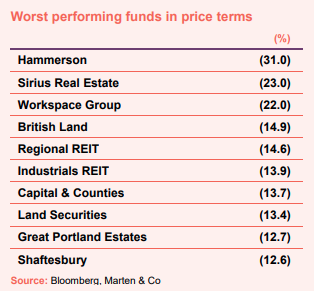

June’s biggest movers in price terms are shown in the charts below.

There were only a handful of property companies that saw share price growth in the month of June as interest rate rises and concerns of an impending recession took hold. Top of the list was micro-cap Alpha Real Trust, which has a portfolio of property and property loans, after it announced a tender offer for up to 10% of its share capital. The group’s shares are trading at a significant discount to NAV. The defensive characteristics of Residential Secure Income’s portfolio of affordable housing and retirement homes may have been behind its share price rise of 1.5%. It shares still trade on a 7.7% discount to NAV, however. Both Secure Income REIT (up 0.2%) and LXI REIT (down 1.4%) make the top 10 best performing funds, having received approval from both sets of shareholders for the merger of the trusts (see page 3 for more details). Custodian REIT was the only other positive mover in the month after it reported a substantial rise in NAV for the year to March 2022 (see page 2) and continued its portfolio recycling with the acquisition of a retail park (see page 4). The defensive nature of Home REIT (homeless accommodation), Triple Point Social Housing REIT (social housing) and Impact Healthcare REIT (care homes) saw their share prices fare better than most.

In a damaging month for property stocks, retail focused Hammerson was the most impacted, with 31% wiped off its market cap. The company has now lost 42.2% in value in 2022 alone, after years of decline. Six of the top 10 worst performing property companies were office specialists. A Bank of America analyst note predicted a “perfect storm” of factors weighing on the outlook for the sector, including working from home and hybrid trends depressing demand and halting rental growth, and rising interest rates curbing investors’ appetite for real estate. Sirius Real Estate, which owns business parks in Germany and the UK, was the most affected, with a 23.0% fall in its share price. London office landlords were also heavily impacted, with Workspace Group (down 22.0%), British Land (down 14.9%), Land Securities (down 13.4%) and Great Portland Estates (down 12.7%) all suffering heavy losses. Regional REIT, which owns offices across the UK, also saw its share price take a hit, with a decline of 14.6% in June. Away from offices, shareholder revolt over the possible merger of central London retail and hospitality landlords Capital & Counties and Shaftesbury (more detail on page 3) saw the share price of both fall by double-digits.

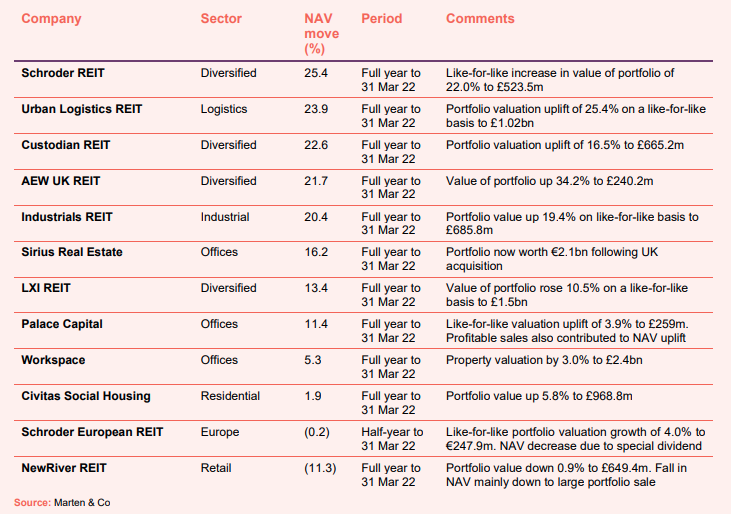

Valuation moves

Corporate activity

Shaftesbury and Capital & Counties Properties reached an agreement on a £3.5bn all-share merger. The merger would create a REIT, which would be call Shaftesbury Capital Plc, focused on the West End of London with a £5bn portfolio across Covent Garden, Carnaby, Chinatown and Soho.

Shareholders of both LXI REIT and Secure Income REIT voted in favour of a merger of the two trusts. Under the terms of the merger, each Secure Income shareholder received 3.32 new LXI shares per one Secure Income share. The merger became effective on 6 July. The combined company has a portfolio worth £3.9bn and net assets of £2.8bn.

Impact Healthcare REIT raised £22.3m in a placing and offer for subscription. The new ordinary shares were issued at 117.0p, representing a premium of 1.8% to the company’s unaudited NAV of 114.93p as at 31 March 2022. The group has a pipeline of care home assets worth £169m.

SEGRO issued €225m of senior unsecured notes with a group of institutional investors in a US private placement. The issue consists of two tranches, both of which will be drawn down in September 2022. The first is €50m at a fixed coupon of 3.87% and matures in 2037 and the second is €175m at a fixed coupon of 4.14%, which matures in 2042. This translates to a weighted average coupon of 4.08% and a weighted average maturity of 18.9 years.

Palace Capital’s chief executive Neil Sinclair stepped down from the board. Sinclair co-founded Palace Capital in 2010 and helped grow the business through a combination of corporate and property acquisitions, with the company moving up from AIM to the Main Market in 2018 and converting to a REIT in 2019. Steven Owen, currently non-executive chairman, has assumed the role of interim executive chairman.

Target Healthcare REIT and Supermarket Income REIT both moved up into the FTSE 250 Index.

Major news stories

- Tritax Big Box REIT completes 1m sq ft letting

Tritax Big Box REIT let 1m sq ft across four buildings at its Symmetry Park Rugby development site to a global leader in storage and information management services. Two of the buildings are from the company’s speculative development programme, and the other two are being pre-let and will be constructed on a built-to-suit basis.

- Impact Healthcare REIT buys trio of care homes

Impact Healthcare REIT completed acquisition of three care home properties for £25m. The portfolio includes a 61-bedroom specialist dementia nursing home in Devon, and two part-converted and extended nursing and residential homes in Devon and Somerset. Initial rent under the new 30-year leases is set at £1.7m, reflecting a gross initial yield of 6.8%.

- Big Yellow buys Slough site for self-storage development

Big Yellow Group exchanged contracts to acquire a site on Farnham Road in Slough from SEGRO. It will develop a 62,000 sq ft store on the site at a cost of £19m. As part of the transaction, Big Yellow has also agreed to the surrender of the lease on its existing Slough store on Whitby Road, which is leased from SEGRO.

- Grainger forward funds Bristol BTR scheme

Grainger exchanged conditional contracts to forward fund and acquire a build-to-rent development at ‘Redcliff Quarter’ in Bristol, which comprises 374 private rental (PRS) homes as well as 94 affordable homes and six commercial units. Construction is expected to complete in early 2025, and the scheme is anticipated to return a gross yield on cost of 6%.

- Regional REIT continues on acquisition trail

Regional REIT acquired three offices for a total of £26.5m, reflecting an overall blended net initial yield of 8.0%. It has bought 1 North Bank, in Sheffield for £8.5m, Thorpe Park, in Leeds for £8.6m, and Albion Street, also in Leeds for £9.4m.

- Custodian REIT buys £15m retail park

Custodian REIT acquired a 70,160 sq ft retail park in Nottingham consisting of four units occupied by Wickes, Matalan, Poundland and KFC, for £15m. The units have a weighted average unexpired term (WAULT) of nine years with an aggregate passing rent of £994,050 per annum, reflecting a net initial yield of 6.2%.

- Schroder REIT sells industrial property at 3.2% yield

Schroder REIT sold Southlink, a 26,975 sq ft single-let industrial asset in Portsmouth, for £6.5m. The price is a premium to the March 2022 valuation of £4.9m and reflects a net initial yield of 3.2%.

- AEW UK REIT buys retail park

AEW UK REIT acquired the Railway Station Retail Park in Dewsbury for £4.7m, reflecting a net initial yield of 9.4%. The park is fully let with an average passing rent of £8.28 per sq ft. Tenants include Sports Direct, Mecca Bingo and KFC.

- BMO property funds change name after manager buyout

BMO Commercial Property Trust and BMO Real Estate Investments have both changed their name, to Balanced Commercial Property Trust and CT Property Trust respectively, following the acquisition of BMO by Columbia Threadneedle. CT Property Trust’s new ticker is CTPT, while Balanced Commercial Property Trust remains BCPT.

- New name for abrdn property trust

Standard Life Investments Property Income Trust has also changed its name – to abrdn Property Income Trust Limited, with a new ticker of API.

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Cyrus Ardalan, chairman:

The prospect of higher inflation in the UK for the longer term is now a key concern to many, with RPI exceeding 9% and CPI exceeding 7% (as at May 2022). Forecasts for 2022 showing RPI averaging 9.1% and CPI averaging 7.5% (The HM Treasury Forecasts for the Economy Medium-term forecasts, May 2022).

The inflation outlook for the Group is positive insofar as our portfolio is well placed to deliver superior returns given the portfolio’s rent review linkage to UK inflation (58% RPI, 17% CPI), but we are also cognisant of the potential impact that current levels of inflation could have both on the economy and to the prospects of our tenant operators.

At current levels of inflation, the majority of the Group’s rent reviews are being capped at the maximum uplift given that 67% of the portfolio contains a capped rent review averaging 3.6%. These caps offer important protection for the long-term sustainability of rental levels across our portfolio for tenant operators. Caps can also avoid rents moving materially out of kilter with market rents that might cause a significant softening of yields where a portfolio becomes overrented.

Our tenants are well capitalised and generally operate with the ability to pass on a good deal of inflationary cost increases to their own customers given the nature of their business operations.

As interest rates continue to rise as a measure to counter higher inflation, yields may begin to soften across property assets in general, but index-linked real estate, and in particular those with very long leases, have tended to more stable in such times, as the anticipation of future rental growth counteracts a higher cost of debt for investors.

Geopolitical uncertainty, as well as the cost of living crisis and inflation, have meant that global markets remain volatile but I am comforted by the defensive and robust platform that the Group enjoys through its diversified long-let assets and high quality tenant operators.

David Hunter, chairman:

Thematic investment continues to dominate fund raising and is polarising property investment demand and pricing. The weight of capital chasing the industrial and logistics sector and more recently retail warehousing has led to some significant yield compression and has boosted capital value returns for investors in logistics specialists. While this yield compression has led to NAV growth for existing investors, the counterbalance is that income yields are being materially squeezed. Custodian REIT’s regional smaller property specialism, targeting the marginal income advantage from smaller lots which offer a higher rental yield for the same level of property and tenant risk, has never been of greater relative importance than in current market conditions.

With logistics property yields now by some distance at historical lows, investors are acutely sensitive to any hint of slowdown from operators such as Amazon. At a time of rising interest rates we simply do not believe that yield compression driven growth will continue in logistics property over the next two years. Without further yield compression, investors are relying on continuing high levels of rental growth to deliver returns, which again points to the fortunes of the operators. A reversal of returns from logistics property will quickly highlight the risks inherent in a single sector property strategy, and we believe would generate a re-focus on diversified strategies where managers can exploit mispricing in sub-sectors of the office and retail markets, while still enjoying rental growth from industrial, logistics and retail warehousing.

Lorraine Baldry, chairman:

The strong, post-pandemic recovery in real estate values is likely to slow, given concerns regarding rising inflation and interest rates. In the short term, whilst there is a risk of more persistent inflation, unlike the period prior to the Global Financial Crisis in the early 2000s, average real estate yields continue to offer a healthy premium above fixed income investments. This should mitigate the negative impact of rising rates on the real estate sector, albeit with very low yielding assets potentially at risk of capital value declines due to rising borrowing costs.

The company’s portfolio is well positioned for these risks, with an above-average income yield, a pipeline of asset management initiatives that should support returns and long-term, fixed-rate debt. The diversified nature of the strategy enables the Investment Manager to act opportunistically and reinvest in sectors offering more attractive returns.

AEW UK Investment Management:

Despite COVID-19 restrictions finally being lifted, the anticipated post-pandemic rebound appears to have slowed as UK GDP fell by a disappointing 0.1% month-on-month in March 2022. It is likely this is primarily due to a significant increase in the rate of inflation with a 30-year high of 9.0% recorded for April 2022. Russia’s invasion of Ukraine, and the consequential sanctions imposed by the international community, continues to drive up energy and commodity prices. There is a risk that, as well as affecting manufacturing industries, this may further damage consumer and investor sentiment as real income and wealth levels are reduced. Economic growth is now forecast to slow to 3.8% by 2022 year-end.

With higher-than-expected inflation, the Bank of England has increased interest rates from 0.50% in February 2022 to 1.25% in June 2022. Despite this backdrop of rising inflation and rising interest rates, over a five-year period, we consider that bond yields are likely to remain low with central banks reluctant to push economies into recession, particularly in times of war.

Retail

Allan Lockhart, chief executive:

Within the capital markets, we have seen an increase in liquidity. In particular, the retail park sector benefited from a significant increase in demand from a wider investor pool which has led to a year of strong capital growth with year on year volumes doubling in 2021. The shopping centre market saw an improvement in liquidity but less pronounced than retail parks. Nevertheless, shopping centre valuations stabilised in the latter part of the year after a prolonged period of material valuation decline.

With retail stores being open for the majority of the financial year, UK in-store retail sales have recovered overall to pre Covid-19 levels according to ONS. By contrast, online sales reported by ONS have fallen during the year due to the reopening of physical stores.

The recovery in retail sales has been supported by a UK consumer who, for the majority of the year, has been in reasonable financial shape. Low levels of unemployment with just 3.8% of people searching for jobs in the three months to February 2022, record job vacancies, wage growth, elevated savings ratios and a good year for house prices, having increased by 14.3% in the year to March 2022, have all supported increased consumer spending. With retail sales broadly back to pre COVID-19 levels, we have seen active demand for space in the market and in the UK overall, vacancy rates have fallen. In addition, there has been a significant decline in CVAs and tenant administrations.

More recently, the tragic war in Ukraine has led to significant inflationary pressure as a result of higher energy and commodity costs with inflation in the UK rising to a 30-year high with prices rising 7% in the 12 months to March 2022. This, coupled with the Bank of England implementing monetary tightening at the same time that the UK Government has adopted fiscal tightening, is clearly resulting in a contraction of economic growth. On top of that, the continuing large-scale lockdowns in China resulting in supply chain disruption, are only adding to the economic challenges.

It is therefore likely that consumer disposable income will be impacted in the year ahead. For retailers that means margins will be lower as not all of their increased costs will be passed on to the consumer. It is interesting to note that the pure-play online retailers are, in particular, challenged by a high inflation environment given their lower margins in the first place. In contrast, multi-channel retailers are better placed to deal with rising costs by using their physical store distribution network for click and collect.

For NewRiver, our portfolio, which is more focused on essential goods and services, is the right place to be when consumers prioritise necessity-based retail spend over discretionary spend and so will provide us with insulation. Our assets are located in the heart of their local communities, easily accessible to our shoppers with low travel times which means they spend less on fuel travelling to our assets compared to more destination-led, discretionary spend assets. With our occupiers facing rising costs, having affordable rents, which we do, is key to sustaining rental cashflows particularly in periods of high inflation and contracting economic growth. Moreover, next April our occupiers should receive a significant reduction in their rateable values which we currently estimate to be circa 30% on average across our portfolio.

Offices

Graham Clemett, chief executive:

The changes to working practices that we have been seeing for some time have accelerated in the post-Covid environment and I believe are here to stay. We benefit hugely from these changes; flexibility has become mainstream; businesses have realised that the office must be a place for collaboration and creativity and demand is broadening out to a wider range of locations in and around London. Employers are also aware of the growing importance of creating a culture and environment their employees want to be a part of and want to commute to, helping ensure they attract and retain the best talent. With all of this in mind we are very much in growth mode, both organically from our extensive project pipeline and from acquisitions.

While all our projects have different characteristics and asset plans, there is a common thread tying them together; the sustainability lens through which we operate our business. Our focus is on future proofing our properties for generations to come, often breathing new life into older character buildings, ensuring they are climate resilient and will have a positive impact on their local community and environment. By generating hubs of economic activity we aim to create a flatter, fairer, more sustainable London.

This focus on sustainability extends to our engagement with people across all aspects of our business. We prioritise the satisfaction and wellbeing of our employees and our customers and work in partnership with them to drive more sustainable behaviours across our sites. Over the coming year, we will be rolling out a programme of engagement with local schools and youth organisations to offer workshops and work experience placements for disadvantaged young people with our customers’ businesses to support the next generation of entrepreneurs.

Looking ahead we are of course conscious of the challenging economic environment in the UK, with inflationary pressures to the fore and concerns over a potential recession. That said, we have proved many times over the enduring appeal of our flexible offer and our ability to manage through these more challenging times. We have a distinctive flexible offer that chimes with the market, a scalable operating platform, a great portfolio of properties with a rich pipeline of project activity and the opportunity to add to this from selective acquisitions. With our like-for-like occupancy now back at its target level, customer demand strong and pricing improving we are well-positioned to deliver superior returns to shareholders over the coming years.

Industrial

Paul Arenson, chief executive:

Demand for multi-let industrial (MLI) space remains strong and is increasingly diverse. More importantly, the demand is coming from a large variety of non-industrial businesses which have never previously occupied MLI space. This is as a direct result of the advances in communications technology and the resulting e-commerce revolution, which has enabled many businesses to operate from MLI units and use the internet to access suppliers and customers in a way that could not be done before. Traditional industrial occupiers are simultaneously experiencing a revival, with less inclination for businesses to outsource manufacturing offshore due to increased transport costs and less reliable security of supply resulting in more local production and increased stock levels. We believe the trends of e-commerce and deglobalisation are both likely to continue for the foreseeable future.

Supply of new MLI units remains constrained. MLI units need to be situated in and around densely populated towns and cities and what little land is currently available in those locations tends to be developed for residential. Furthermore, even where industrial is the most viable use, it tends to be for single-let distribution units leased to strong tenants on long leases. An additional supply constraint is the fact that in all but very few locations, were a developer minded to build small MLI units speculatively, the level of current MLI rents and yields achievable relative to build costs would likely result in development losses. We estimate MLI build costs (excluding land) to be around £120 per sq ft compared to the current independent valuation of our portfolio of £90 per sq ft. For the foreseeable future, we continue to be able to buy MLI estates at around 70% of replacement cost.

Despite the positive long-term trends we are seeing in MLI, as we move into the financial year ending 31 March 2023 we are cognisant of several challenges that are emerging which will require us to be vigilant.

The first of these is the cost inflation being seen across the entire economy, to which we are not immune. From our perspective, operating costs are increasing primarily because of wage inflation, which is significant across all disciplines but especially within the industrial property and technology skillsets. As an internally managed entity, this can impact overall EPRA cost ratios. Similarly, the cost of maintaining or building MLI units is also going up. We have very limited development exposure but estimate that the cost of building a new MLI unit has increased by over 20% in the last 18 months. This further reduces the likelihood of any new supply coming on stream and should therefore be positive for future rental growth, which over time we also expect to occur in any case as a result of inflation.

The second challenge is central banks’ response to these inflationary pressures through increasing interest rates and withdrawing quantitative easing. This is having a material impact on borrowing costs. Eighteen months ago, we were able to borrow at an all-in fixed rate for seven years at 1.66%. Now, five-year all-in fixed rate borrowings are costing approximately 3.75%. This means interest costs are now getting close to net initial yields (after operating leakage) and are no longer enhancing cash flow at the time of acquisition. Leveraged returns are becoming dependent on future rental growth and/or yield compression to provide enhanced returns. In this environment, we need to be more prudent on debt and LTV levels and are likely to target lower overall debt levels of around 30% rather than 40%. We would also seek lower levels of leverage on new acquisitions.

If top line revenue growth is unable to keep up, these increases in operating costs are likely to dampen earnings. However, we believe the potential for revenue growth remains strong due to the demand/supply imbalances and other factors in the MLI market referred to above. These give us the potential of passing on increased costs through higher rents and mitigating cost increases through future scale savings from our platform.

In this changing economic environment, there is a risk of a fall in GDP and a possible recessionary environment for a period. Under such conditions, we do not anticipate that vacancy levels will rise to levels experienced in previous severe economic downturns such as in 2008 and in the early 90s. Our thesis is that the structural change in the nature of demand from e-commerce related businesses has created a whole new class of businesses, who now need MLI space compared to the past where it was only the industrial manufacturing and service businesses. This growth in the universe and type of occupiers has taken place at a time of no new supply due to cost and land availability constraints. In our view, the existence of this additional new group of occupiers will go a significant way to offsetting the impact of vacancies due to a downturn. We saw this in the downturn caused by the pandemic, although we appreciate that the specifics of that downturn caused an acceleration of the growth in demand for online solutions.

Logistics

Richard Moffitt, chief executive:

The supply chain issues associated with the pandemic, and the rise and rise of e-commerce, need no further elaboration, but as we have learned to “live with COVID-19”, pent-up demand has met those continuing supply chain issues, resulting in inflation. It is in this environment that our focus on strong tenant covenants becomes important, as demonstrated by our 99.9% rent collection rate in the year.

Towards the end of our financial year Russia attracted the attention and condemnation of the world through its invasion of Ukraine. Aside from dreadful human cost to the citizens of Ukraine, the war and subsequent sanctions have led to the effective decoupling of Russia from the western economy. Thanks to Russia’s role as a major supplier of oil, gas and grain to the European markets, this has quickly fed through into higher energy and food prices, throwing further fuel on the inflationary fires.

At Urban Logistics we feel we are well positioned for an inflationary world. As an active asset manager, with strong tenant engagement, we are able to capture inflationary uplifts in rental incomes quickly. With our focus on strong covenants, and occupiers delivering essential goods, we believe our tenants will be in a good position to pass along inflationary price increases. In terms of our exposure to interest rate increases, we are 74% hedged with a 3.7-year weighted average maturity date, and post year end entered into a ten-year fixed rate term loan with Aviva Investors, further extending our debt to 5.1 years and increasing our overall fixed or hedged position to 95%. Towards the end of the year we took a decision to slow the pace of investment to allow us to take advantage of opportunities in the market in a time of economic turbulence.

Europe

Sir Julian Berney, chairman:

The global economy is in a fragile state. Although sentiment around the pandemic is improving, and economies are opening up, we are witnessing mounting concerns around supply chains, inflation, low growth and the increasing of interest rates. On top of this, the war in Ukraine is delivering further pressures on the European economy. These collective headwinds are making it difficult to have a clear view on forecasts and associated underwriting of investments.

The outlook is for European real estate returns to be muted over the short term. Performance will benefit from inflation, given underlying indexation clauses. We are however mindful of geopolitical risks and its ramifications to sentiment, surging energy costs, inflation and contractions in household spending. These are all having an impact on fiscal and monetary government policies and ultimately economic growth. Notwithstanding, real estate continues to remain attractive relative to other asset classes. We remain confident in the diversified qualities of the portfolio, particularly given the exposure to high growth locations and local management expertise.

Real estate research notes

Grit Real Estate Income Group – Transition underway

Civitas Social Housing – Fundamentals remain strong

Standard Life Investments Property Income Trust – Resilient income in uncertain times

abrdn European Logistics Income – Logistics safe haven with growth on horizon

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.