Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

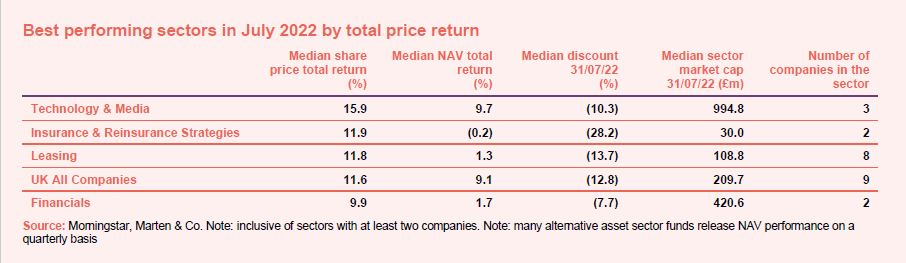

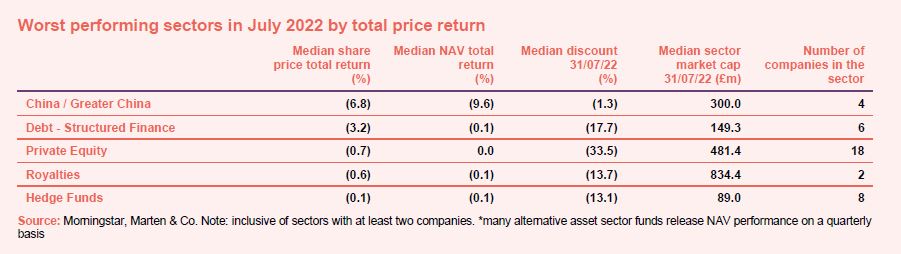

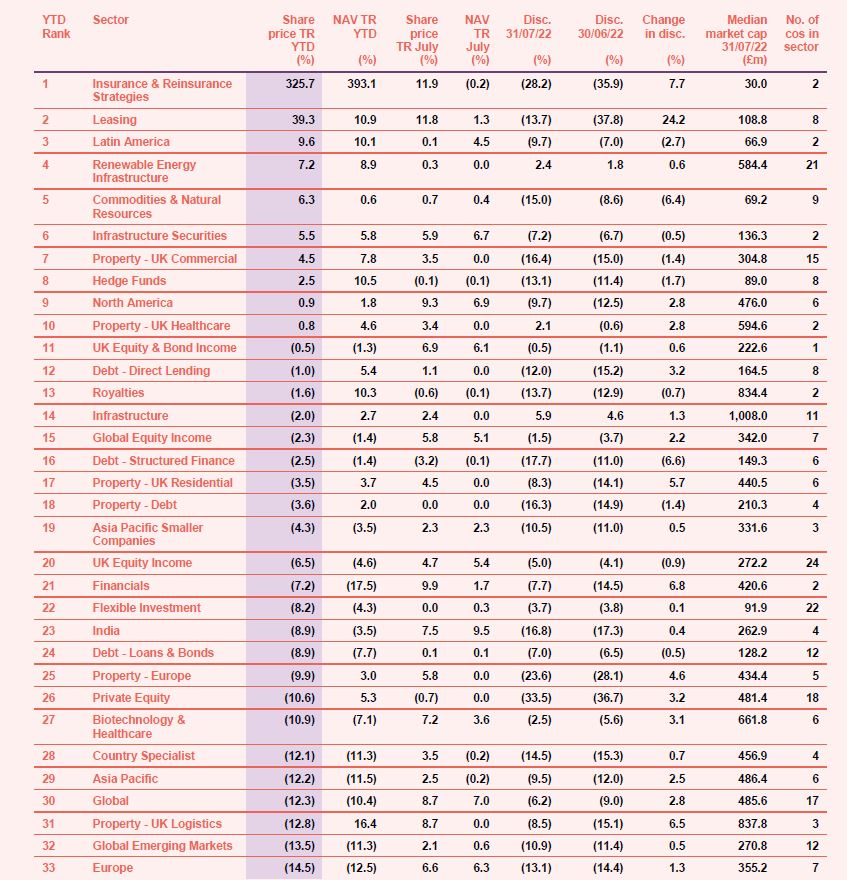

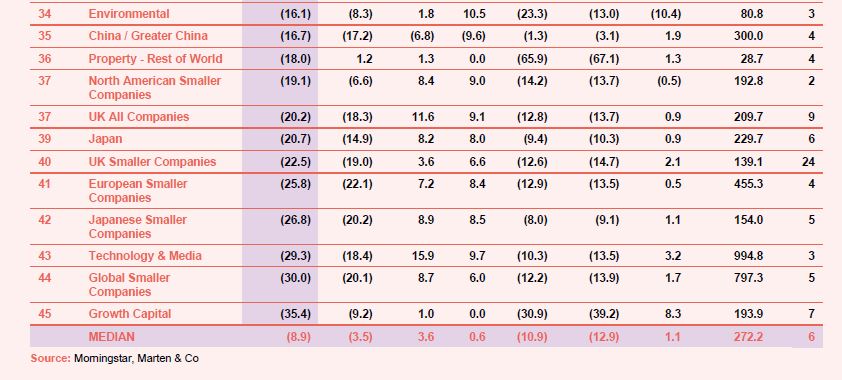

Fears of a recession taking hold later this year have strengthened, while two 0.75% US interest rate rises in quick succession, and a higher-than-expected increase in European interest rates, appear to have convinced investors that inflation will eventually be tamed. After months of misery, the technology & media sector made a comeback during the month (which we highlighted may happen in last month’s roundup). The leasing sector benefited as Emirates agreed to buy a plane from Doric Nimrod Air One, while UK All Companies also did well – a contributing factor may have been the announcement of Prime Minister Boris Johnson’s resignation. Other winners were insurance & reinsurance strategies and the financials sector. On the other hand, China/Greater China’s bounce back in June was short-lived and it was the worst-performing sector. The country reported GDP growth of just 0.4%, falling short of the 1% projected by analysts. Similarly, debt and hedge funds, which were top performers in June, found themselves on the other side of the pendulum in July. The royalties sector was another laggard for the month despite the good news that the US Copyright Royalty Board ruling to increase royalty rates for songwriters and publishers was upheld. Perhaps the impact of this will be reflected later in the year when payments start coming through (see Appendix 1 for a breakdown of how all the sectors have performed so far this year).

July’s median total share price return was 3.6% (the average was 4.5%) which compares with a median of -5.1% in June. Readers interested in recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over July

Worst performing sectors over July

On the positive side

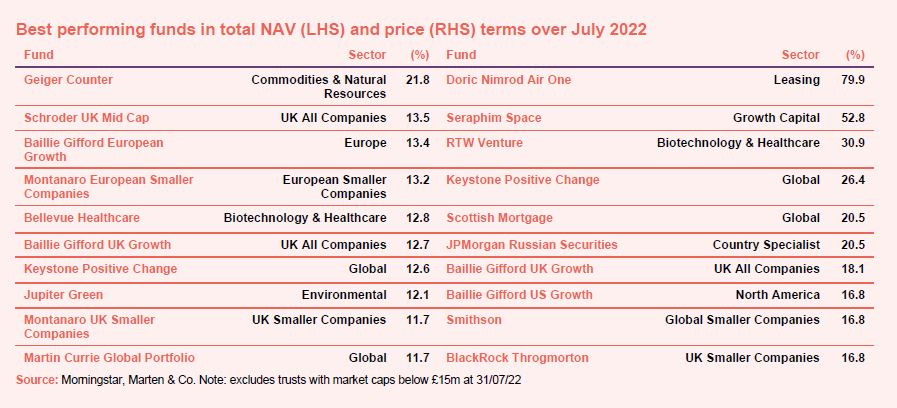

Geiger Counter was the best performing investment trust in NAV terms in July after leading uranium producer Cameco made encouraging noises about the uranium price. ‘Growth’ stocks rallied after July’s US interest rate rise. Names such as Baillie Gifford European Growth, Baillie Gifford UK Growth and Keystone Positive Change performed well in NAV terms while Seraphim Space, Scottish Mortgage and Baillie Gifford US Growth were among the best share price performers. Biotechnology & healthcare names Bellevue Healthcare and RTW Venture also performed well. Technology & media was the best-performing sector, all evidence that suggests the tide may be turning on the appetite towards growth investing. Other strong performers for the month included growth-focused smaller companies mandates such as Montanaro UK Smaller Companies, Montanaro European Smaller Companies, BlackRock Throgmorton and Smithson.

On the negative side

On the negative side, after enjoying a NAV and share price increase in June, every Chinese trust (Baillie Gifford China Growth, Fidelity China Special Situations, abrdn China and JPMorgan China Growth & Income) found themselves back in the laggards list for July in NAV terms and, for some, in share price terms too. The country has suffered its worst GDP growth figures since the first quarter of 2020, when it began battling the pandemic, on the back of increased COVID cases and a real estate slump. Similarly, JZ Capital Partners, which was June’s top share price return performer became July’s worst. Emerging markets names Fidelity Emerging Markets and JPMorgan Global Emerging Markets Income didn’t fare too well either in July, perhaps a knock-on effect from rising interest rates, while microcap funds River and Mercantile UK Micro Cap and Miton UK Microcap were also hit in NAV terms.

Discounts and premiums

More expensive and cheaper relative to NAV

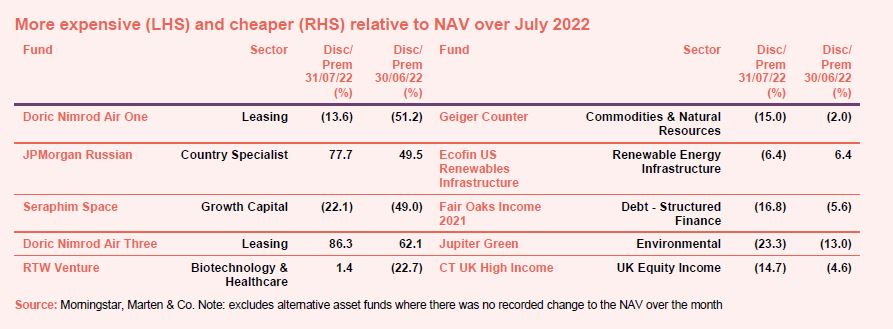

Leasing names Doric Nimrod Air One and Doric Nimrod Air Three became more expensive in July. Emirates, one of the best-placed airlines globally, bought the sole A380 owned by Doric Nimrod Air One for £25m (investors had been fretting that it was worthless). After months of seeing its discount widen, Seraphim Space bounced back in July; a move that some commentators linked to Eutelsat’s interest in acquiring OneWeb, although we do not see the logic in this. It remains on a double-digit discount. RTW Venture which saw its 6% discount almost quadruple to 22% in June, saw a just as significant swing back the other way in July and found itself trading at a premium by the end of the month.

On the other hand, Geiger Counter became cheaper in July, with its 2% discount growing to a double digit 15% as its NAV soared, this may resolve itself in August. Ecofin US Renewables Infrastructure saw its 6.4% premium swing to a 6.4% discount as its management team walked out. We discussed this in our news show on Friday 29 July. Meanwhile, Fair Oaks Income’s discount widened to double digits, perhaps on fears of growing loan defaults. Jupiter Green’s double-digit discount widened further on the back of poor annual results which suggested that it had suffered from ‘scale back ambitions of US climate policy’.

Money in and out

Money coming in and going out

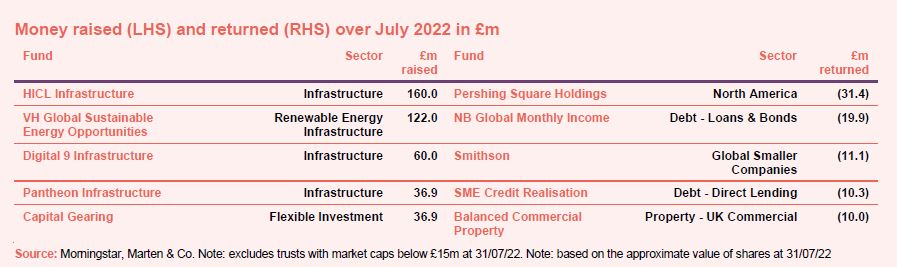

Only £320m of net new money was raised in July, led by a £160m fundraise from HICL Infrastructure. The net proceeds of the issue helped fund its purchase of mobile phone towers in New Zealand. VH Global Sustainable Energy Opportunities raised £122m which it hopes to commit within three to six months, while Digital 9 Infrastructure’s fundraise pulled in £60m. The net proceeds of the issue are to be used to fund expansion opportunities – Finland approved the fund’s purchase of Nordic data centre and cloud services provider, Ficolo Oy, during July. Pantheon Infrastructure expanded as another tranche of its subscription shares were exercised.

Share buybacks were led by Pershing Square (who also announced an additional share buyback programme of $200m), NB Global Monthly Income, Smithson, SME Credit Realisation and Balanced Commercial Property.

Major news stories over July

Portfolio developments

- Polar Capital Global Financials suffers ‘highly volatile year’

- Hipgnosis Songs to receive withheld streaming revenues following US Copyright Royalty Board decision

- JPMorgan Global Core Real Assets boosted by private and liquid strategies

- Round Hill comments on copyright decision

- HgCapital boosts investment in entrepreneurial platform team.blue

- Very poor year for Artemis Alpha

- Oryx International Growth reports on a disappointing year

- Sequoia Economic Infrastructure Income achieves ‘solid performance’

- SDCL Energy Efficiency Income to acquire £100m portfolio from United Utilities Group

- TwentyFour Income dividend benefits from higher base rates

- Taylor Maritime publishes breath taking inaugural results

- Schroder British Opportunities held back by listed holdings

- BB Biotech shares rise as sector sees signs of recovery

- Jupiter Green suffers from scaled back US climate policy ambitions

- Henderson Diversified Income hit by ‘fundamental change in perception of inflation’

- Miton UK Microcap hit as investors favour large caps

- SVM UK Emerging hit by ‘painful period for growth investors’

Corporate news

- Aberdeen New India to introduce conditional tender offer following underperformance

- Octopus Renewables Infrastructure seeks shareholder approval to invest more in offshore wind farms

- Digital 9 Infrastructure fundraise pulls in £60m

- HICL Infrastructure announces fundraise

- Seraphim Space updates on plans for remaining cash

- JPMorgan Russian hopes to shift focus to Emerging Europe, the Middle East and Africa

Managers and fees

- Templeton Emerging Markets reduces management fee

- abrdn New Dawn cuts fees

- Ruffer’s Hamish Baillie to step down after 20 years

Property news

- Home REIT deploys £92m on 216 homeless properties

- Supermarket Income REIT checkouts £83m deals

- Palace Capital to become focused on ESG

- Impact Healthcare REIT raises £22.3m in placing

- Town Centre Securities sells stake in parking app at huge uplift

QuotedData views

- GP struggles may significant – 1 July

- Multi-manager trusts – a safe heaven in current choppy markets? – 8 July

- (Half) year in review – 15 July

- Is the tide finally turning for biotech? – 22 July

- More power to battery growth story – 29 July

Recently published research notes

Montanaro UK Smaller Companies

Shares in the good-quality growing businesses favoured by Montanaro UK Smaller Companies (MTU) have experienced a sharp selloff since the beginning of 2022, when interest rates began to rise in response to rampant inflation. Manager Charles Montanaro is focused on picking stocks for the long term rather than trying to second-guess macroeconomic trends. He and his extensive team have a strong dialogue with the management of these companies. He observes that high-quality, well-managed small businesses with strong market positions and pricing power have been able to pass on additional costs and are better able to cope with supply chain disruptions. Charles believes that following the selloff, valuations are now the most attractive that they have been in many years. This could be a great opportunity for long-term investors.

African property company Grit Real Estate Income Group (Grit) has cleared a path for increased dividend distributions and net asset value (NAV) growth following a decisive piece of corporate action in the form of a heavily NAV dilutive capital raise. It has used the proceeds to bring its loan to value (LTV – borrowings plus cash as a percentage of portfolio valuation) under control and to expand its core business with the acquisition of a developer and asset manager.

The developer – Gateway Real Estate Africa (GREA) – has an attractive pipeline of NAV accretive development projects, most notably diplomatic residences across the continent let to the US government and data centres (see page 5 for an in-depth look at the development pipeline). Meanwhile, within its current portfolio, its hospitality assets are rebounding with the return of international travel, and retail valuations seem to have bottomed out – suggesting valuation growth in these sectors. Grit also has plans to ramp up exposure to the industrial sector, which is chronically undersupplied across Africa.

A sharp selloff in the share prices of the types of high-quality, growing companies favoured by JPMorgan Japanese Investment Trust (JFJ) has meant that the trust has given back much of its recent outperformance. The selloff mimics those of other countries such as the US and UK, but Japan is not afflicted by the high inflation or the threat of rising interest rates that triggered the stock market falls in other countries.

JFJ’s managers are seeing opportunities to buy stocks that they favour on attractive valuations. They are also encouraged by the increasingly shareholder-friendly environment in the country; share buy backs and dividends are at record levels.

GCP Infrastructure Investments Limited (GCP) recently published its half-yearly report covering the six months ended 31 March 2022. It was a period that saw GCP’s net asset value hit a new high, and the end June NAV is higher still. Record electricity prices and stronger than forecast inflation contributed to this, but so too did the actions of the adviser. We look at the drivers of GCP’s returns in this note.

The adviser sees potential for further NAV progression in coming months. The need to decarbonise the UK economy provides a supportive backdrop, and the adviser has identified a substantial pipeline of potential investments that should underpin the continued success of the fund.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- JPMorgan Global Core Real Assets AGM 2022, 5 August

- abrdn New Dawn online manager presentation, 22 August

- JLEN Environmental Assets AGM 2022, 1 September

- Monks AGM 2022, 6 September

- abrdn new Dawn AGM 2022, 6 September

- Lindsell Train AGM 2022, 8 September

- Polar Capital Technology AGM 2022, 8 September

- Augmentum Fintech AGM 2022, 14 September

- Odyssean Investment Trust AGM 2022, 21 September

- India Capital Growth AGM 2022, 21 September

- Miton UK Microcap AGM 2022, 27 September

- Aberdeen New India AGM 2022, 28 September

- MIGO Opportunities AGM 2022, 29 September

- Henderson Diversified Income AGM 2022, 4 October

- Artemis Alpha AGM 2022, 13 October

- QuotedData’s Property Conference 2022, 19 October

- The London Investor Show 2022, 28 October

- QuotedData’s Investment Strategies Conference 2022, 9 November

- QuotedData’s Responsible Investing Conference 2022, 10 November

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – July 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.