Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

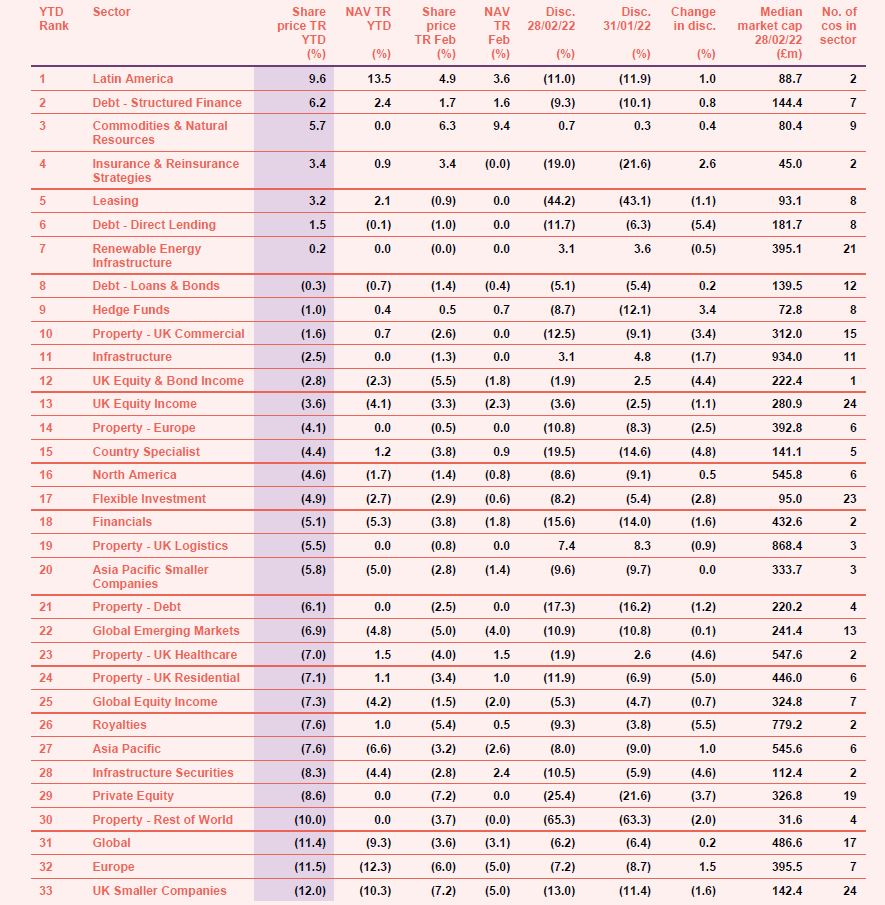

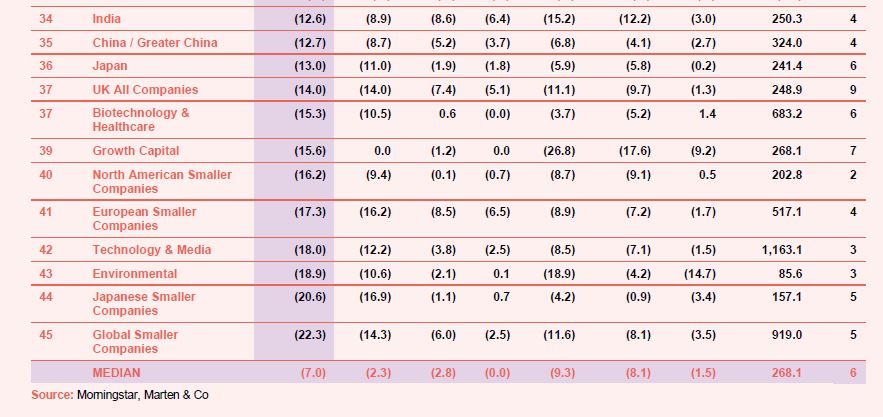

Performance

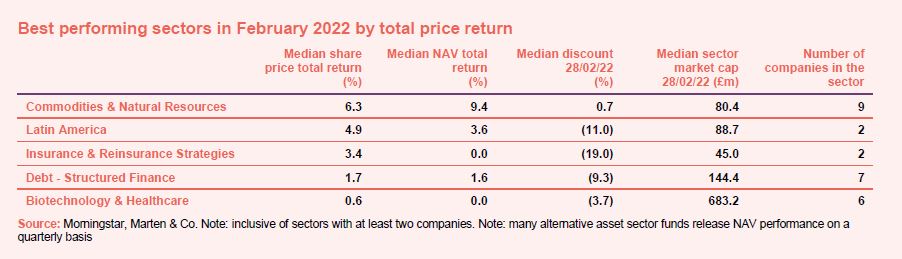

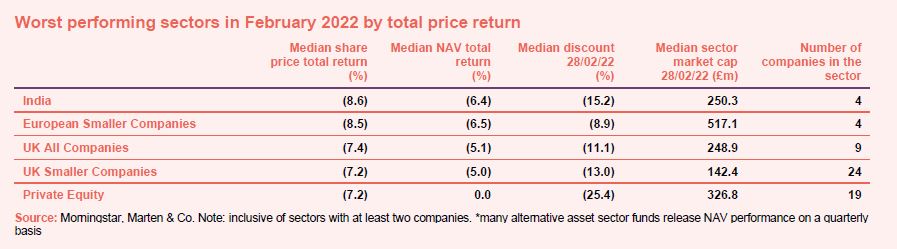

Commodities & natural resources was the top-performing sector for a second month in a row, as energy prices soared even further following Russia’s invasion of Ukraine. The ongoing crisis has resulted in extreme volatility for the commodities market with Brent hitting almost $140-a-barrel, gold $2,000 per ounce and European natural gas €345 per megawatt hour. The rally has also helped commodity-heavy economies such as Latin America, which was another top performer for a second month. After a weak 2021, biotechnology & healthcare funds saw a rebound in February. Some commentators say fundamentals supporting healthcare’s secular growth story remain compelling and so generally look favourable on recent price weakness in the context of a longer-term view. On the negative side, weak investor sentiment due to the crisis has hit global markets in general but India took it at full force thanks to rising energy prices as a net importer. Mining, healthcare and oil sectors in the UK performed well in February but this was overshadowed by small and mid-cap equities suffering severe losses – which placed the UK all companies and UK smaller companies sectors among the worst performers. After a strong 2021, private equity trusts fell in February (see Appendix 1 for a breakdown of how all the sectors have performed this year).

February’s median total share price return was -2.8% (the average was -2.6%) which compares with a median of -3.1% in January. Readers interested in recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over February

Worst performing sectors over February

On the positive side

Commodities & natural resources trusts were the clear winners in February with five members (Geiger Counter, BlackRock World Mining, CQS Natural Resources Growth & Income, Golden Prospect Precious Metals and BlackRock Energy & Resources Income) filling the top five spaces in NAV terms and dotted among the top ten in share price terms. Geiger Counter, which was one of the best performers in 2021, delivered an impressive 30% in share price terms over the month as investors reasoned that in Europe nuclear power would be favoured over natural gas. A higher oil price is good news for oil producers outside Russia, benefiting Gulf Investment and Middlefield Canadian. Latin American funds abrdn Latin American Income and BlackRock Latin America were also among the best performers in NAV terms, likely a result of the commodity market boost. UK Mortgages was one of the month’s winners in share price terms following the announcement of its merger with TwentyFour Income while Seraphim Space posted strong results for the period from its launch in July 2021 to 31 December 2021.

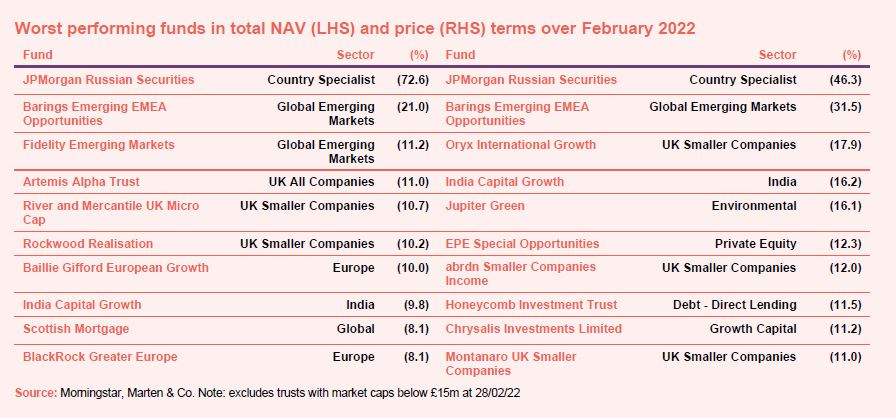

On the negative side

Unsurprisingly, JPMorgan Russian Securities took the biggest hit in February, down by a huge 72% in NAV terms in light of the Russian invasion of Ukraine and sanctions that have seen been placed on the country. Barings Emerging EMEA Opportunities also took a hit from the events as its NAV was adjusted to reflect the board’s assessment of fair value. Investments listed on the Moscow Exchange have been valued at zero and will be if and when the market begins to function in a way deemed appropriate. Fidelity Emerging Markets, which had 16% of the portfolio in Russian securities as at 31 January 2022 offset by a short position on an index, also saw its NAV fall. Meanwhile, UK smaller companies underperformed in February which had a knock-on effect on such funds including River and Mercantile UK Micro Cap and Rockwood Realisation, which were both down in NAV terms, and Montanaro UK Smaller Companies which saw its share price fall by 11%.

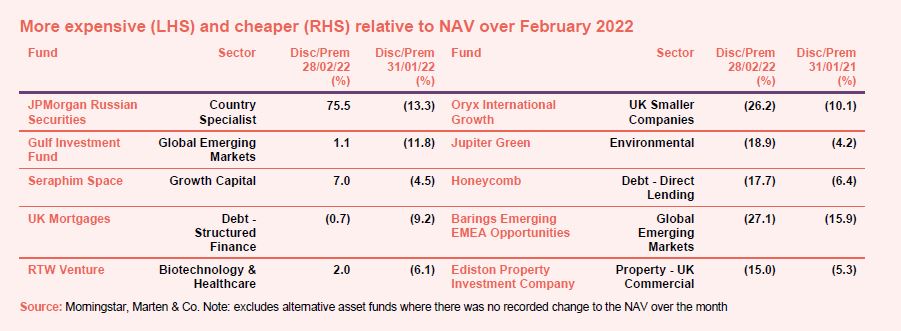

Discounts and premiums

More expensive and cheaper relative to NAV

JPMorgan Russian Securities’ share price lost touch with reality in February, failing to keep pace with a savage fall in its NAV. Its double-digit discount swung to a 75% premium as Russian stocks were suspended from trading. Gulf Investment Fund saw a rerating on the back of the oil price. Seraphim Space posted strong results for its first six months since launch. UK Mortgages saw a significant narrowing of its discount following news of its merger with TwentyFour Income and RTW Venture recovered. It made supported funding rounds for Magnolia Medical Technologies and Third Harmonic Bio during the month.

The hit to UK small caps saw Oryx International Growth become cheaper in February, with its 10% discount widening to a 26% discount. Honeycomb also saw its single digital discount widen by more than 10% following news of its merger with Pollen Street, with an associated planned dividend cut. Barings Emerging EMEA Opportunities became cheaper as its discount almost doubled due to a readjustment of its NAV in light of events in Ukraine. Russian depositary receipts traded on the London Stock Exchange, holdings in US-listed Russian stocks and holdings listed on the Moscow Stock Exchange have all been valued at zero.

Money in and out

Money coming in and going out

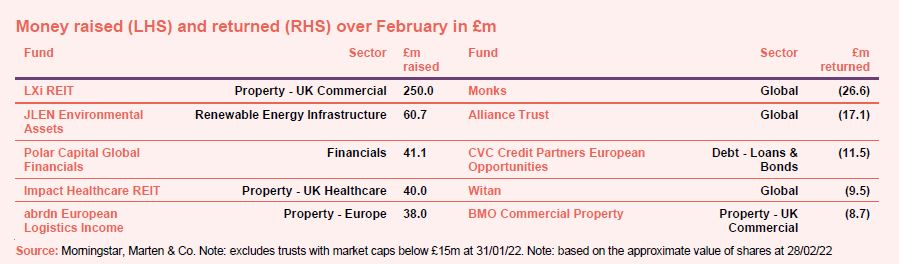

Only £569m of net new money was raised in February, though higher than January. LXi REIT raised £250m in an oversubscribed fundraise, having initially targeted £125m as announced in January. JLEN Environmental Assets also enjoyed an oversubscribed issue of £60m through a placing and offer for subscription at the end of January, though the new shares only started trading in February.

Polar Capital Global Financials completed a fundraise shortly after it reported strong outperformance and an increase in demand for financials. You can read more about why in our latest research note on the trust. Impact Healthcare REIT raised £40m from investors which the chair said will ‘assist in funding a significant proportion of near-term attractive investment pipeline of standing assets, forward fundings, and asset management capex commitments.’

Share buybacks were led by Monks, Alliance Trust, CVC Credit Partners European Opportunities, Witan and BMO Commercial Property.

Major news stories over February

Portfolio developments

- Riverstone Energy backed SaaS provider T-Rex

- Triple Point Energy Efficiency bought a battery portfolio

- BlackRock Energy & Resources Income benefited from its traditional energy holdings

- BlackRock Throgmorton shares strong results

- BBGI Global Infrastructure bought a Canadian hydro refurb

- SDCL bought a Portuguese biomass plant

- Round Hill Music Royalty bought the Alice in Chains catalogue

- Riverstone sold its position in Pipestone Energy

- HydrogenOne Capital Growth invested in Bramble Energy

- Apax Global Alpha made a double acquisition

- Brunner reached 50 years of consecutive dividend increases

- RTW made two new investments

- Mobius enjoyed strong performance despite EM volatility

- CQS New City High Yield’s manager warned on inflation

- BB Healthcare looked back on a year that saw two key debates in the healthcare space

- Greencoat Renewables’ power output was 16% below budget

- The recent National Grid auctions gave Gresham House Energy Storage’s NAV a boost

- Herald proved resilient through a tough second year of Covid

Corporate news

- Twenty Four Income and UK Mortgages announced plans to merge

- Strategic Equity Capital shared a corporate update as it declined Odyssean’s combination offer

- Alternative Liquidity announced plans to target £50m

- Circle Property announced plans to return sales proceeds to shareholders to counter its persistent discount

- Honeycomb and Pollen Street revealed merger plans

- Crystal Amber set out its wind-down plans

- Polar Capital Global Financials announced a placing

- …before raising £16.6m

- Jupiter Emerging and Frontier Income’s continuation was brought into question

- GCP Co-Living REIT paused its IPO process

Managers and fees

Macau Property Opportunities agreed a new investment management agreement

Property news

- British Land bought a £157m urban logistics business

- Great Portland Estate broke its leasing record

- LXI REIT splashed £87m on nine assets

- Empiric Student Property bought a £19m asset in Bristol

- Tritax EuroBox made a €144m Dutch purchase

- Capital & Counties reported on strong leasing momentum

QuotedData views

- Co-living la vida loca – 4 February

- CQS New City High Yield – inflation premium – 11 February

- The real dividend heroes – 18 February

- Russia and Ukraine – can we really continue to turn the other cheek? – 24 February

Recently published research notes

AVI Japan Opportunity – The tortoise triumphs

Within the AIC’s Japanese smaller company sector, the period since AVI Japan Opportunity Trust (AJOT) was launched in October 2018 has resembled the fable of the tortoise and the hare. The majority of competing funds are invested in high growth stocks whose valuation multiples had been soaring. However, these have tumbled in recent weeks as investors fret about the prospect of interest rate rises. Meanwhile, AJOT has been steadily chalking up successes in unlocking value from a range of Japanese companies. It is now the best-performing Japanese smaller company trust over the period since it was launched. The manager points to the considerable latent value within AJOT’s portfolio; it is confident of further uplifts to come.

NextEnergy Solar Fund – Climbing inflation and power prices driving NAV uplift

NextEnergy Solar Fund (NESF) is a leading investor in the UK solar power market. In addition, since investors approved a broadening of its investment policy in 2020, it has added exposure to battery storage and to solar assets in other OECD countries, leveraging the global expertise of its manager which is active across eight countries. At end September 2021, NESF had 99 operational solar assets. The revenue from these comes from sales of power and government subsidies designed to encourage the growth of the renewable energy industry. The subsidy income – around 60% of the total – is inflation-linked (to RPI).

Herald Investment Trust – The future is bright

Whilst Herald Investment Trust’s (HRI’s) results for the year ended 31 December 2021 will not be published for some time, it looks as though it had another impressive year, with particularly strong performances from its semiconductor and UK media holdings. Rising inflation and the potential for interest rises has taken some of the steam out of growth stocks recently, but HRI’s longstanding manager, Katie Potts, believes there’s more to go for. She feels that the sector’s growth will provide a considerable defence against the effects of higher inflation, and remains enthused about the prospects for the stocks in HRI’s portfolio and their ability to have pricing power in an inflationary environment. HRI’s share price discount to net asset value (NAV) has widened recently, but we think this could narrow, potentially making this a good entry point.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Aberforth Smaller Companies AGM 2022, 3 March

- JPMorgan Russian AGM 2022, 4 March

- BlackRock Income & Growth AGM 2022, 8 March

- Henderson Opportunities AGM 2022, 10 March

- BMO Capital and Income AGM 2022, 10 March

- QuotedData’s Round the World webinar – Asia, 10 March

- Murray International AGM 2022, 16 March

- QuotedData’s Round the World webinar – UK, 17 March

- Master Investor Show 2022, 19 March

- Standard Life Private Equity AGM 2022, 22 March

- BlackRock Sustainable American Income AGM 2022, 22 March

- BlackRock Throgmorton AGM 2022, 24 March

- Jupiter Emerging & Frontier Income AGM 2022, 28 March

- Brunner AGM 2022, 30 March

- Herald AGM 2022, 19 April

- Greencoat UK Wind AGM 2022, 29 April

- RIT Capital AGM 2022, 4 May

- Apax Global Alpha AGM 2022, 5 May

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – February 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.