Real Estate Quarterly Roundup

Kindly sponsored by Aberdeen Standard Investments

Toughing it out

It has been another challenging quarter for the real estate sector as the COVID-19 pandemic continues to take its toll.

The economy bounced back in the early part of the quarter after the national lockdown was lifted, while government schemes such as ‘Eat Out to Help Out’ stimulated activity. However, towards the end of the quarter a rise in COVID-19 cases heightened fears of a second lockdown and new restrictions were placed on the hospitality sector.

Tough trading conditions meant the ability of tenants to pay rent in the most affected sectors – retail, leisure and hospitality – continued to be diminished, impacting the rent collection rates of property companies that hold these assets in their portfolios. An uncertain future for offices, with a long-term trend for working from home now prevalent, also took its toll.

The logistics sector, however, continued to benefit from increased online consumer spending, while sectors with resilient income streams, such as social housing, proved popular with investors.

Performance data

On the whole, it was another difficult quarter for the property sector as the impact of the coronavirus pandemic continued to be felt. Retail, leisure and hospitality sectors are still reeling from the initial lockdown and fresh restrictions are now taking their toll on these companies’ ability to pay rent.

Best performing property companies

There was an eclectic mix of property companies to feature in the top price movers for the quarter. Top of the pile was private rented sector and residential development specialist Sigma Capital Group. It launched a £1bn joint venture with EQT Real Estate, the real estate platform of global investment firm EQT, which will see it deliver 3,000 private rental homes in Greater London.

CLS Holdings, the investor in offices in the UK, Germany and France, continued to see a recovery in its share price – which has risen by 15.1% in the quarter.

UK Commercial Property REIT and AEW UK REIT, which own diverse portfolios of property, both saw double-digit gains in their share prices during the quarter. The share price of generalist property companies that hold a portfolio of diverse property assets have taken a big hit during the pandemic and the discount to NAV on these two funds has perhaps proved too great to ignore.

Macau Property Opportunities, which owns property in the Chinese gaming city of Macau, saw an uplift in its share price after announcing debt refinancing and a disposal.

Solid half-year results and a share buyback programme saw Berlin residential landlord Phoenix Spree Deutschland’s share price rise 10.7%. The proposed six-year rent freeze legislation in Berlin, which is currently being challenged in the Federal and State courts, was ruled against by the Bavarian Constitutional Court.

Triple Point Social Housing REIT continued its momentum in 2020 with another quarter of share price growth. The social housing sector has performed strongly during the crisis, with government-backed income proving resilient. In the year to date its share price has risen 19.2%, more than any other listed property company.

Worst performing property companies

It is no surprise that once again it was shopping centre owners Capital & Regional and Hammerson that topped the chart of worst performing property companies in the quarter. Capital & Regional published results at the beginning of the month in which it posted a 36.6% fall in net asset value (NAV) in just six months. Meanwhile, Hammerson completed a rights issue and share consolidation plan during September, as well as announcing a new chief executive.

U and I Group’s share price reached an all-time low during the quarter as it continues to battle against declining land and development values across its portfolio. In July it reported full year results in which its NAV plummeted 19.7%.

The share price of small-cap company Drum Income Plus REIT also continued to fall. After suspending its dividend amid poor rent collection figures, its share price has now fallen 51.6% in the year to date.

Capital & Counties’ portfolio in London’s West End has continued to be hit by muted tourist numbers and COVID-19 restrictions. In August, the company reported a huge fall in NAV of 18% in half-year results.

Standard Life Investments Property Income Trust suffered a 23.3% fall in its share price after announcing a drop in NAV during the quarter. The value of company’s property portfolio has fallen further than its peers during the crisis, despite a large weighting to the favoured industrial and logistics sector.

NewRiver REIT, which owns shopping centres, retail parks and pubs, has been hit hard during the pandemic and has year to date lost 75% in value.

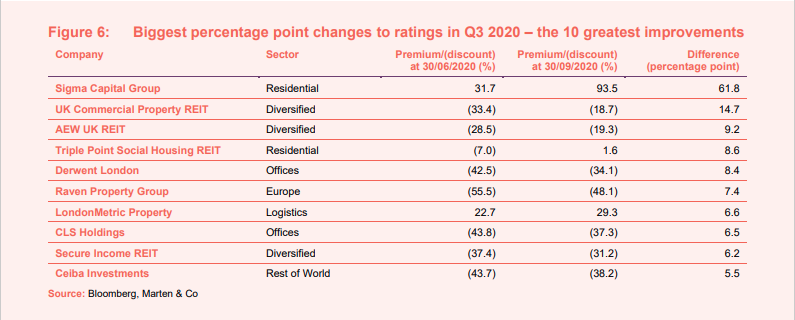

Significant rating changes

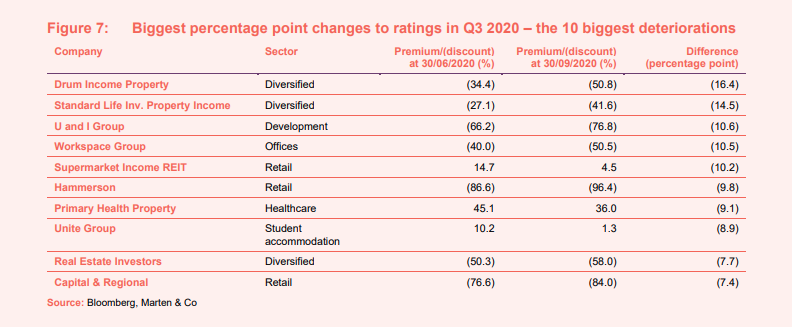

The tables below show how premiums and discounts have moved over the course of the quarter.

Sigma Capital Group’s substantial new contract to develop 3,000 new homes in Greater London has seen its rating move up 61.8 percentage points.

Central London office owner and developer Derwent London saw its significant discount narrow, while LondonMetric, owner of logistics assets, saw its premium widen to almost 30% as it deployed the proceeds of its £120m capital raise in June.

Secure Income REIT’s discount had been widening during the course of the year as one of its largest tenants, Travelodge, entered a company voluntary arrangement (CVA – a form of insolvency), in which £23m of rent will be written off. The group has maintained its dividend and seen its discount narrow 6.2 percentage points.

Most of the companies to feature in Figure 7 have been covered off earlier in the worst performing companies’ section. Additional entrants include Workspace Group, which owns a portfolio of flexible office space in London – a sector that has an uncertain future given the changes to working practices during the pandemic.

Supermarket Income REIT saw its NAV grow during the period, but its share price fell slightly after it announced a capital raise at a discount to its then share price.

Student accommodation specialist Unite Group saw its premium narrow following a chaotic return to university.

Major corporate activity

Fundraises

A total of £237.5m was raised by property companies during the quarter, with a further £200m already raised in October and a new issue that raised £240.5m in an initial public offering (IPO).

Primary Health Properties raised £140m in a share placing “to further accelerate growth by funding near-term portfolio expansion, forward funded developments and asset management projects”.

Urban Logistics REIT raised £92.3m in a placing, falling short of the £130m it had sought. It will use the proceeds to acquire a pipeline of assets in the next three months.

Aberdeen Standard European Logistics Income issued 5 million new shares at a price of 104 pence, raising £5.2m. Following a similar issue in June, the company has raised £10.45m for potential acquisitions.

During the quarter both Supermarket Income REIT and Triple Point Social Housing REIT announced intentions to raise money. Supermarket Income REIT has since announced it has raised £200m in an oversubscribed placing. Triple Point is aiming to raise £70m.

Home REIT, which will invest in a portfolio of homeless accommodation, published a prospectus in September for an IPO and announced it had raised £240.5m in October.

Buybacks

Hibernia REIT, which owns commercial and residential properties in Dublin, announced a €25m share buyback programme that it said would return to shareholders the proceeds from the sale of 77 Sir John Rogerson’s Quay.

Schroder REIT also commenced a share buyback programme, taking advantage of its wide discount (of around 50%). It has authority to repurchase a maximum of 77,725,160 of its ordinary shares.

Meanwhile, Phoenix Spree Deutschland and Stenprop, the UK industrial investor, have also returned money to shareholders through smaller share buybacks.

Major appointments

There were a number of major appointments in the property sector during the quarter.

Standard Life Investments Property Income Trust’s chairman Robert Peto stepped down from the board. He was replaced as chairman by James Clifton-Brown.

Schroder REIT’s fund manager Duncan Owen will step down as global head of real estate at Schroders at the end of the year. From next year he will become a special advisor to the company.

Meanwhile, British Land, Hammerson, St Modwen and Empiric Student Property appointed new chief executives.

British Land announced current chief financial officer Simon Carter will succeed Chris Grigg as chief executive on 18 November 2020. Retail landlord Hammerson appointed Rita-Rose Gagné as new chief executive replacing David Atkins at the end of the year. St Modwen hired Centrica Consumer chief executive Sarwjit Sambhi as its new chief executive, effective from 2 November 2020. Lastly, Duncan Garrood took up the position of chief executive at Empiric Student Property on 28 September.

Other major corporate activity

Hammerson completed a rights issue raising £552m that it will use, along with proceeds of the sale of its 50% stake in VIA Outlets, to pay down debt to around £2.2bn, a loan to value of 41.7%.

Grit Real Estate completed its delisting from the Johannesburg Stock Exchange, making London its primary listing and Mauritius its secondary. It also converted to a sterling quotation on the London Stock Exchange.

Major news stories

• Where are the property bargains?

With so many REIT’s having de-rated heavily, QuotedData looks at the companies that are still languishing on heavy and possibly unjustified discounts.

• New launch Home-ing in on social benefit

QuotedData took a closer look at Home REIT after it announced intentions to raise £250m from an IPO. The company is looking to acquire a portfolio of homeless accommodation in the UK.

• Tritax Big Box REIT sells £134m of assets

Tritax Big Box REIT disposed of four assets for a combined £134m. It said the assets (Baker Business Park in Ripon; Langley Mill in Nottingham; Warth Park in Raunds and an Amazon-let property in Chesterfield) had reached their full value following completion of asset management initiatives.

• Working from home or back to work?

The debate around the future of the office continues to rage with the government on a campaign to get people back to the office. But is there an appetite among employees and even employers to get back to the office, though?

• CLS Holdings acquires commuter-belt office portfolio for £60m

CLS Holdings exchanged contracts to acquire a portfolio of offices in Greater London and the South East (in Richmond, Chelmsford and Leatherhead) for £59.71m, in a major vote of confidence for the UK office market.

• Ediston begins construction of retail park

Ediston Property Investment Company announced it had started construction of a 48,000 sq ft retail park in Haddington, East Lothian, which is 97% pre-let to tenants including Aldi and Home Bargains. The decision is a fillip for the retail sub-sector that has proved resilient during COVID-19.

• LondonMetric Property sells six warehouses for £57.3m

LondonMetric Property sold a portfolio of six distribution warehouses for £57.3m, reflecting a blended net initial yield of 5.3%. The disposal of the assets (located in Worcester, Leamington Spa, Royston, Castle Donnington, Milton Keynes and Huyton) crystallised an £8.8m profit on cost and delivered an internal rate of return of 11% per annum.

• Grit Real Estate reduces retail exposure with significant disposal

Pan-African investor Grit Real Estate sold a 39.5% stake in the AnfaPlace Mall, in Morocco, that reduced its exposure to the retail sector to 24.9%.

• An unlikely saviour of shopping centres

The solution to filling the vast amount of vacant space in shopping centres could come from an unlikely source in logistics. Mall owners in the US have reportedly been in talks with Amazon to convert vacant department store space into distribution hubs. The idea makes perfect sense for both parties.

• Civitas Social Housing confirms cash raise likely

The board of Civitas Social Housing said it was “considering options for raising additional capital” to enable it to fund the acquisition of properties in its pipeline. New debt facilities were also being negotiated to finance some of the pipeline.

Recent publications

Standard Life Investments Property Income Trust – Building for a new normal

Home REIT IPO note – Tackling homelessness

Grit Real Estate Income Group – Africa, substantially de-risked

Aberdeen Standard European Logistics Income – Resilient to covid-19

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.