Real Estate Quarterly Review

Kindly sponsored by Abrdn

Value to be found in topsy-turvy market

The first three months of 2022 have been full of significant events. Investor caution followed Russia’s invasion of Ukraine and put paid to a London-listed property company with a portfolio of Russian assets (see page 6 for details). The cost-of-living crisis has grown during the quarter, with inflation hitting 30-year highs and fuel and energy prices rocketing.

It is only predicted to get worse as the year goes on, with inflation forecast to hit double figures and another increase in energy prices expected in October. The retail-focused property companies are most at risk as purse strings are tightened. Commercial real estate is historically a good inflation hedge, and investors have taken advantage of the perceived value in the sector.

Merger and acquisitions (M&A) gathered pace, with Yew Grove REIT acquired in a €177.4m deal and both McKay Securities and Hibernia REIT receiving bids during the quarter. M&A may be a theme for the rest of the year, with many companies trading at significant discounts to NAV.

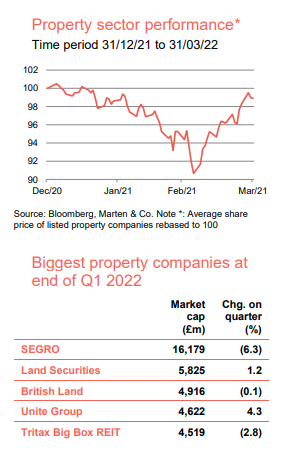

Performance Data

Best performing property companies

South East of England office and industrial owner McKay Securities and Dublin office specialist Hibernia REIT were the outliers in the first quarter having both received bids for the companies at substantial premiums to their prevailing share price. It has been a common theme over the past two years, with investors taking advantage of persistent and unfair wide discounts to NAV that some property stocks trade on.

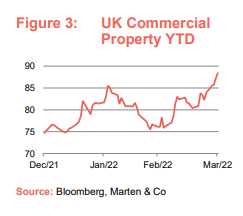

Of the rest, FTSE 250 constituent UK Commercial Property REIT saw the largest share price gain in the quarter, jumping 18.3%. The group is still trading on a double-digit discount, however. Several other diversified REITs also performed well, perhaps due to their perceived value.

BMO Real Estate Investments, BMO Commercial Property Trust, Schroder REIT and Alternative Income REIT all made it into the best performers for the quarter. Again, however, all are still trading on wide discounts.

Circle Property saw its share price rise 9.9% in the quarter following its announcement that it would sell assets and return capital to shareholders after suffering a persistently wide discount.

Worst performing property companies

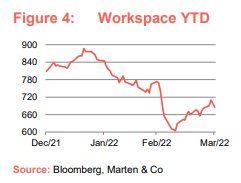

Workspace Group, the bidder for McKay Securities, saw its share price fall 11.4% following the announcement of the offer, perhaps reflecting shareholder appetite for the deal. Due to the structure of the offer, which will be part funded by the issue of new Workspace shares, the bid price for McKay has also fallen.

German business park owner Sirius Real Estate was another company that started the year with a share price fall (of 11.3%). This may be down to profit-taking, as the company had an impressive year of gains in 2021.

European logistics specialist Tritax EuroBox also saw its share price cool in the quarter. The sector has been one of the perennial winners in the property sector over the last few years with significant valuation growth, as demand for space continues to outstrip supply.

Office specialists Helical and CLS Holdings both suffered share price losses during the quarter as the future demand for office space continues to be questioned by working-from-home and hybrid working trends.

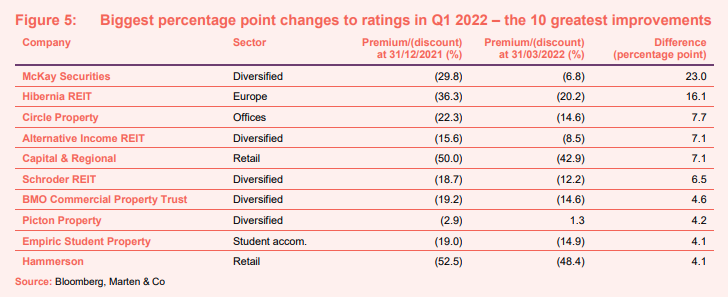

Significant rating changes

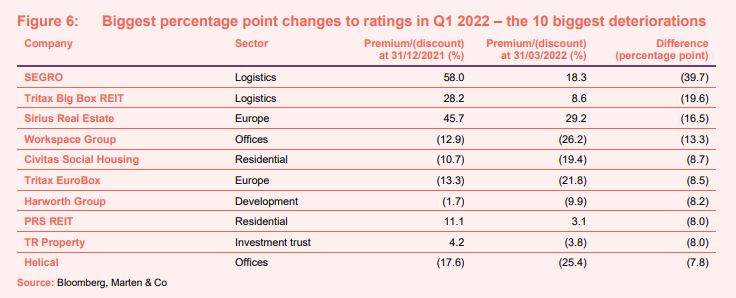

Figures 5 and 6 show how premiums and discounts to NAV have moved over the course of the quarter.

Many of the positive rating changes were discussed in the previous section. Of the others, retail landlords Capital & Regional and Hammerson both posted significant falls in NAV during the quarter, which have impacted their discounts, as the sector continues to struggle. Both are still trading on 40%-plus discounts.

By contrast, logistics specialists SEGRO and Tritax Big Box REIT reported large NAV uplifts during the quarter as values in the sector continue to rise on unprecedented rental growth performance. Their share prices didn’t quite keep pace, resulting in their premium ratings narrowing.

Major corporate activity

Fundraises

The difficult investing environment caused by the ongoing war in Ukraine meant that just £343m was raised by property companies in the first quarter of 2022. The proposed initial public offering of a new REIT – GCP Co-Living REIT – was paused following the events in Ukraine. The company had been looking to raise £300m and invest in the fledgling co-living residential sector.

Before the invasion a handful of companies raised money. By far the highest was LXI REIT, which raised £250m in a substantially oversubscribed issue. The group quickly deployed the proceeds into a pipeline of long-income investments.

Impact Healthcare REIT raised £40m from investors and will use the proceeds to fund a near-term pipeline of assets including forward funding opportunities.

Abrdn European Logistics Income raised £38m (€45.6m) in a placing pursuant to its share issuance programme. The group has a near-term funding requirement totalling €142m.

Residential Secure Income raised £15m from a placing and, together with debt facilities, the group plans to buy £39m of shared ownership housing.

Mergers and acquisitions

Hibernia REIT agreed a deal with Brookfield on the sale of the business for around €1.089bn. Under the terms, shareholders would receive €1.634 per share – made up of €1.60 per Hibernia REIT share and a 3.4 cent dividend. The offer price, excluding the dividend, represented a 35.6% premium to its share price and a 7.6% discount to NAV.

McKay Securities received a bid for the company by Workspace Group valuing it at around £272m. Under the terms of the deal, each McKay shareholder would be entitled to receive 209 pence per share in cash and 0.115 new Workspace shares. Later in the month McKay received an approach from Slate Asset Management L.P. over a possible offer. Slate has until 20 April to either announce a firm intention to make an offer or walk away.

Yew Grove REIT was acquired by Slate Office Ireland Investment Limited, an indirect wholly-owned subsidiary of North American real estate investment trust Slate Office REIT, for €177.4m.

Other major corporate activity

Raven Property Group, the owner of warehouses in Russia, suspended its shares on the London Stock Exchange and proposed a de-listing of its shares after the war in Ukraine and subsequent sanctions on Russia. It will sell its Russian business to Prestino Investments Ltd, which is to be owned and controlled by Raven’s Russian management team. Raven will retain an economic interest in the company via existing unsecured loans of £41m and Rub1.1bn and non-voting preference shares of £678m.

Supermarket Income REIT migrated its shares from the Specialist Fund Segment of the London Stock Exchange to the premium segment. The company’s market capitalisation has grown significantly since IPO from £100m in July 2017 to around £1.2bn. The move would allow its shares to become eligible for inclusion in the FTSE UK and the FTSE EPRA NAREIT Index Series.

Helical converted to a real estate investment trust (REIT) with effect from 1 April 2022. Following conversion, Helical is exempt from UK corporation tax on the profits of its property activities that fall within the REIT regime in the year ending 31 March 2023 and beyond (the rate of UK corporation tax increases from 19% to 25% from April 2023).

SEGRO launched a €1.15bn senior unsecured Green Bond issue. It is split into two tranches: €650m with a fouryear term with an annual coupon of 1.25%; and €500m with an eight-year term with an annual coupon of 1.875%.

Life Science REIT secured its first debt facility, £150m with HSBC UK Bank, comprising a £75m three-year term loan facility and an equally sized revolving credit facility. It has an interest rate of 225 basis points over SONIA, which is currently equivalent to a total cost of 2.9%.

Major news stories

- Urban Logistics REIT acquired four new assets for £72m, including its first central London property, at a blended net initial yield of 4.6%. It has now deployed £140m of capital since its December 2021 £250m fund raise.

- British Land sold 50% of its stake in the Canada Water Masterplan to AustralianSuper for £290m. Following completion of the sale, the two companies will form a joint venture to accelerate the delivery of the 53-acre development, which is one of London’s largest regeneration projects.

- Unite Students has sold a portfolio of 11 properties, comprising 4,488 beds, to an affiliate of Lone Star for £306m (Unite share £236m). The disposals are priced in line with prevailing book value, which reflects a yield of 5.7%.

- LXI REIT deployed the proceeds of its £250m equity raise in less than a month, purchasing 19 assets in total. The group now has a portfolio of 191 properties and 70 tenants, with its largest sector weightings being: foodstores (25%), industrial and logistics (17%) and budget hotels (13%).

- Hammerson sold Victoria Gate and Victoria Quarter shopping centres in Leeds for £120m. The group said the sale was in line with its strategy to dispose of non-core assets to strengthen its balance sheet and re-cycle capital into its core portfolio and development pipeline.

- Great Portland Estates announced it had broken its leasing record for the financial year with two months to spare after signing new lettings worth a combined annual rent of £32.5m, surpassing its previous record leasing high of £31.8m.

- Home REIT fully deployed the £350m it raised in September 2021, with £55.1m of new acquisitions. The company acquired 240 additional properties, providing 880 beds for homeless people, bringing the portfolio total to 7,953.

- BMO Commercial Property Trust bought two logistics assets for £66m and committed to two developments within its existing portfolio at a cost of £10.5m. The group’s portfolio weighting to the industrial and logistics sector has increased to 30.6% (from 19.1% at December 2020).

- Palace Capital completed the sale of an office building in Brighton, bringing the total proceeds from its £30m disposal programme to £31.5m – 20% above the aggregate book value and 12% ahead of the original purchase prices paid plus any capital expenditure. The proceeds will be used to reduce debt and fund new acquisitions.

- Circle Property said it plans to sell more assets and return capital to shareholders after selling its largest asset, Kents Hill Park for £34.5m, as it battles a persistently wide discount to net asset value.

Selected QuotedData views

Real estate research notes

abrdn European Logistics Income – Logistics safe haven with growth on horizon

Tritax EuroBox – Fast-tracked

Urban Logistics REIT – In the sweet spot

Grit Real Estate Income Group – Showing some grit

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.