Real estate quarterly report

Kindly sponsored by abrdn

Choppy waters ahead

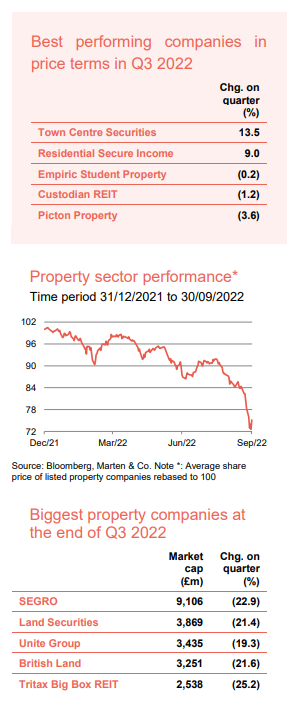

High interest rates is a killer for real estate, and so the chancellor’s disastrous ‘mini budget’ at the end of September – which spooked gilt markets and saw interest rate forecasts for next year top 6% – had a catastrophic impact on the listed property sector, as shown in the property sector performance graph to the right. The market is pricing in large valuation declines as investment into real estate is choked off by rising debt costs.

A softening of investment yields and capital values are inevitable and lower yielding real estate sub-sectors such as industrial and logistics are most susceptible. Meanwhile, high inflation and the cost-of-living crisis threatens the discretionary retail sector, and a recession would have a negative impact on demand for office space. All-in-all, the near-term future looks rocky for commercial real estate. Sectors with strong supply-demand characteristics, however, should be able negotiate this period with some earnings growth, making the wide discounts to NAV they have moved out to quite appealing.

Meanwhile, the £2.8bn merger of LXI REIT and Secure Income REIT completed during the quarter and Capital & Counties and Shaftesbury’s £3.5bn tie-up is being looked over by the Competition and Markets Authority.

In this issue

- Performance data – Discounts to NAV widened across the sector as share prices plummet

- Corporate activity – The planned launch of a new social housing fund was pulled due to market volatility

- Major news stories – Large London office sales dominated the headlines

Performance data

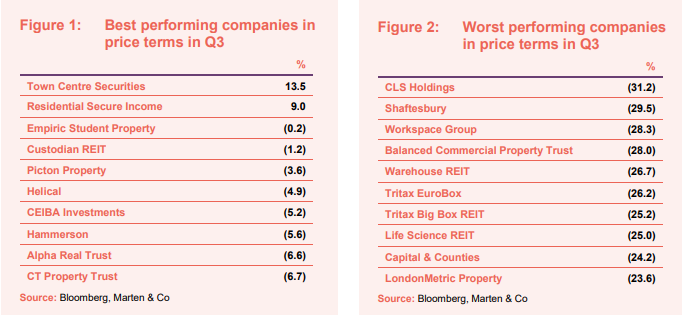

Best performing property companies

There were just two share price risers in the third quarter of 2022 as economic woes hit sentiment towards the real estate sector. Town Centre Securities, which completed a tender offer of £7.4m worth of shares at a significant premium to its share price, was the biggest riser.

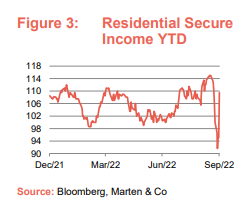

The retirement and affordable housing focused trust Residential Secure Income had an impressive quarter of share price gains as the defensive nature of its portfolio starts to look more attractive as we approach a recession. It also announced extended debt facilities and a £50m acquisition partnership (see page 9 for more details).

Having reported positive half-year results during the period, in which occupancy was up on pre-COVID levels, Empiric Student Property’s share price was flat over the quarter. With the student accommodation sector returning to normality following the COVID disruption, the company’s sizable 27.2% discount to NAV seems appealing.

After several months of heavy losses, retail landlord Hammerson stemmed the flow somewhat in the quarter. However, as the cost-of-living crisis deepens the retail sector could be in for more pain.

Worst performing property companies

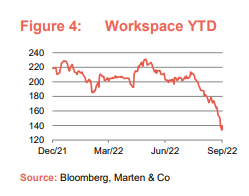

Concerns over the impact of a recession on leasing demand in the office sector, on top of uncertainty over future demand in a hybrid working environment, may have been behind the large share price declines of CLS Holdings and Workspace Group.

Shareholder apathy towards the merger of Capital & Counties and Shaftesbury, which is awaiting Competition and Markets Authority approval, continues to hit both share prices.

With interest rates predicted to rise rapidly, a softening of investment yields and capital values are inevitable and lower yielding real estate sub-sectors, such as industrial and logistics, are most susceptible. Logistics heavyweights Tritax Big Box REIT and LondonMetric, and European specialist Tritax EuroBox saw substantial falls during the quarter. All three are now down 45.5%, 38.4% and 45.9% respectively for the year.

Warehouse REIT owns a portfolio of multi-let industrial properties, which are more exposed to small and medium-sized enterprise (SME) businesses that could be hit hardest in a recession.

Significant rating changes

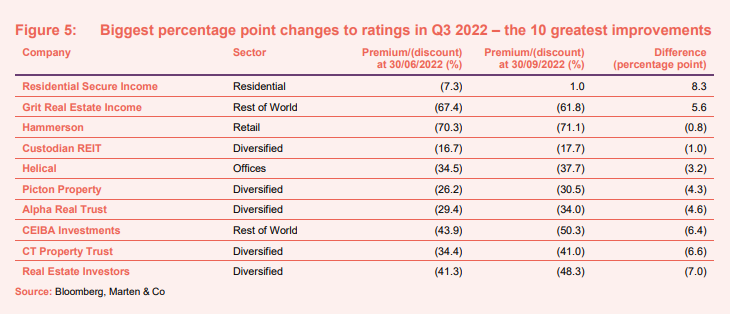

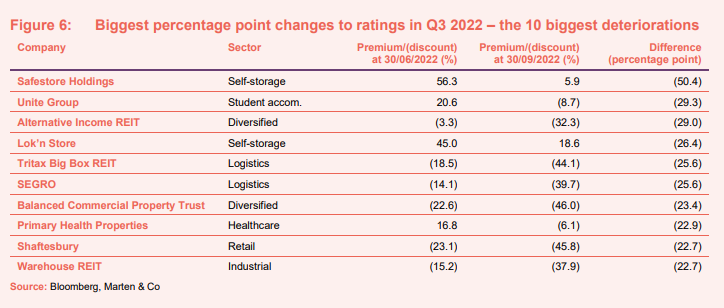

Discounts to NAV in the property sector are now some of the widest in the investment trust world. Figures 5 and 6 show how premiums and discounts to NAV have moved over the course of the quarter.

Many of the positive rating changes were discussed in the previous section, with Residential Secure Income moving to a premium rating. Of the others, Grit Real Estate Income saw its wide discount narrow slightly – mainly due to a negative re-rating of its NAV due to the dilutive impacts of the company’s equity issuance in December 2021 (note that the NAV used is the company’s upper estimate of NAV to 30 June 2022. Results are due to be announced on 28 October).

Some of the diversified trusts saw relatively minor impacts on their share prices during the quarter compared to the rest of the sector. Custodian REIT fared best among its peers, with its discount moving out by one percentage point to 17.7%. Although share price performance relative to the market was good, Picton Property and CT Property Trust are now trading on wide discounts of 30.5% and 41.0% respectively.

London office landlord and developer Helical’s discount widened slightly to 37.7% but was spared the large share price falls of some of its peers. The company was buoyed by the sale of one of its developments for a slight premium towards the end of the quarter (see page 9 for more detail).

Micro-cap Alpha Real Trust, which has a portfolio of property and property loans, completed a tender offer for 9.5% of its share capital in a bid to combat its significant discount to NAV, but still saw it move out 4.6 percentage points to 34.0%.

Again, some of the funds mentioned in the biggest discount deteriorations during the quarter were covered earlier. Self-storage operators Safestore Holdings and Lok’n Store suffered two of the biggest discount declines. A large increase in interest rates and the affordability of mortgages, coupled with a recession, may impact on demand for self-storage space, with less people moving home and requiring self-storage units. In Safestore’s case, its share price fell 20.9% while its NAV increased 16.8%.

Student accommodation giant Unite Group also saw its NAV increase, while its share price drop, wiping out the large premium it traded on at the start of the quarter.

Primary Health Properties also saw its healthy premium turn into a discount during the quarter, with its share price falling 16.8% despite a 3.5% uplift in NAV.

Major corporate activity

Fundraises

Not surprisingly, there was no fundraising activity in the quarter as the traditionally quiet summer period was interspersed with rising inflation and interest rate hikes, which tempered markets, followed by the UK’s mini-budget towards the end of the quarter, which has spooked financial markets with gilts yields rising sharply.

There was an intention to float that was announced in September but it failed to get away. The planned initial public offering (IPO) of a new supported living real estate investment trust (REIT) was shelved due to the market turmoil. Independent Living REIT had sought to raise £150m, which it would have used to acquire social housing properties.

Mergers and acquisitions

The merger of LXI REIT and Secure Income REIT completed in July, creating a combined company with a property portfolio of long index-linked income worth £3.9bn and net assets of £2.8bn.

The merger of Shaftesbury and Capital & Counties Properties rumbles on, with the £3.5bn all-share deal awaiting Competition and Markets Authority approval. The merger would create a REIT, which would be called Shaftesbury Capital Plc, focused on the West End of London with a £5bn portfolio across Covent Garden, Carnaby, Chinatown and Soho.

Other major corporate activity

CLS Holdings announced the results of the tender offer for one in every 40 shares in the company. A total of 10,184,894 shares were tendered, scaled back from 154,132,053 shares that were validly offered, at an aggregate price of £25.5m. This represented around 2.5% of the share capital of the company.

Alpha Real Trust purchased just over 5.4m shares in the company through a tender offer, representing 8.7% of the share capital, for a total of £9.5m.

Town Centre Securities also completed a tender offer, purchasing 4m shares (7.6% of the company) for a total cost of £7.4m (at 185p per share, a 19.4% premium to the prevailing share price).

Grit Real Estate Income Group concluded the second phase of its acquisition of a controlling interest in Gateway Real Estate Africa (GREA) – the leading development company in Africa – increasing its stake to 35.01% from 26.29%. The acquisition provides GRIT with control of its own accretive development pipeline.

LXI REIT fully hedged the cost of the £385m acquisition debt facility, used to complete the merger with Secure Income REIT, with an interest rate cap. As a result, it says that 100% of the enlarged group’s debt is either fixed or capped, with the same maximum all-in rate of 4.1% per annum.

Supermarket Income REIT secured a new £412.1m unsecured credit facility with a bank syndicate comprising Barclays, Royal Bank of Canada, Wells Fargo and Royal Bank of Scotland International. The facility consists of three tranches and has a margin of 1.5% over SONIA and a weighted average term of 6 years. It will be used in part to refinance £255m of existing secured commitments in addition to providing further debt capital for acquisitions.

Warehouse REIT updated its debt facilities to hedge against rising interest rates, taking out two interest rate caps of £100m each for three and five years respectively, which serve to cap the SONIA rate in the company’s debt facilities at 1.5%. Following the amendments, the company has total debt facilities in place of £345m, with a loan to value ratio of 30.1%, which mature in January 2025. Around 75% of this debt is now hedged against interest rate volatility.

Three members of Palace Capital’s board resigned from the company after shareholders revolted against the company’s planned change in strategy. Mickola Wilson, Kim Taylor-Smith and Paula Dillon all stepped down. The company has since appointed former NewRiver REIT director Mark Davies as senior independent director.

Home REIT and Warehouse REIT were added as constituents of the FTSE 250 Index.

Major news stories

- Land Securities sold its 21 Moorfields office development in the City of London, which is pre-let to Deutsche Bank, for £809m and a 4.7% net initial yield. The price represents a 9% discount to the March 2022 value, but crystallises a development profit of £145m, representing 25% profit on cost.

- LXI REIT pulled out of its planned £500m acquisition of a portfolio of Sainsbury’s supermarkets. The deal was conditional on LXI raising equity from investors, which it wasn’t able to do due to the market turmoil.

- LXI REIT sold a 65-year “income strip” on its Thorpe Park and Alton Towers assets to an institutional investor for £257m. As part of the deal, the company sold the freehold in the properties, with 999-year leases granted back to the company, with LXI paying the buyer an annual aggregate rent of £8.2m. The company can acquire the freehold back from the buyer for a nominal price of £1 in year 65. The deal reflects a net initial yield of 2.96%.

- Helical sold its TikTok-let Farringdon office building Kaleidoscope to Chinachem Group for £158.5m, at a 4.8% yield. It let the 88,580 sq ft office to TikTok in March 2021 on a 15-year lease at £7.6m a year.

- Supermarket Income REIT acquired several supermarket stores over the quarter worth more than £243m, this included the purchase of a Tesco store, an Iceland Food Warehouse and complementary non-grocery units in Bradley Stoke, Bristol, for £84.0m, reflecting a net initial yield of 5.6%.

- Home REIT was also on the expansion drive having acquired almost £235m of homeless accommodation in the quarter, adding 540 properties to its portfolio. It has now deployed 88% of the proceeds from its £263m equity issue in May.

- Residential Secure Income agreed a £50m partnership with social impact real estate firm HSPG, giving it the exclusive option to acquire HSPG’s entire pipeline of shared ownership properties. The company expects to acquire at least £50m of properties as part of the deal over the next three years.

- Urban Logistics REIT acquired five assets with significant potential for value creation, for a total of £90m and a blended net initial yield of 4.5%. Four of the properties are income-producing and one is vacant.

- CLS Holdings completed on the sale of two UK properties – Great West House, Brentford and 62 London Road, Staines – and one French property – 96 Rue Nationale, Lille – for a total of £39.8m. The three properties sold for an average 3.7% above the 31 December 2021 valuations. The proceeds were used to fund its tender offer.

- Derwent London exchanged contracts to sell Bush House in London WC2 for £85m, reflecting a premium to December 2021 book value. The building is being sold with vacant possession and the proceeds of the sale will be used to invest in the group’s development pipeline.

Selected QuotedData views

Real estate research notes

An annual overview on Urban Logistics REIT (SHED). The company has seen its discount to NAV widen considerably on weakened investor sentiment towards the logistics sector. The long-term market dynamics driving growth in the sector remain, however.

An update note on Grit Real Estate Income Group (GR1T). After its capital raise, the company has cleared a path for an increased, sustainable dividend and NAV growth following the acquisition of a developer.

An update note on Civitas Social Housing (CSH). The fundamentals of the social housing sector remain strong and the wide discount to NAV that the group’s share price trades at may make it attractive.

An update note on Standard Life Investments Property Income Trust (SLI – now known as abrdn Property Income Trust – API). The trust has proved resilient during the pandemic and is capturing capital value growth as the economy bounces back.

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number