Real Estate Quarterly Roundup

Kindly sponsored by Aberdeen Standard Investments

Covid chaos

Covid chaos

The covid-19 pandemic has had a devastating effect on the share price of property companies, with 31% wiped off the value of their total market capitalisation during the first quarter of 2020.

Companies focused on the retail, leisure and hospitality property sectors were particularly badly affected as the country was put on lockdown in an effort to halt the spread of the disease. Later in the quarter, the extent of the problem for property companies was revealed with rent collection announcements. Some retail-focused companies had collected below 50% of rent and service charge during the quarter.

It wasn’t just the retail, leisure and hospitality sectors that were affected. Office landlords saw their rental income fall as tenants moved business operations remotely. The industrial sector was also impacted, but to a lesser degree due to the spike in demand from ecommerce tenants.

The huge hit on rent collection saw companies rush to shore up their balance sheets and many have suspended dividends.

There were a handful of companies that did emerge from the quarter unscathed. Healthcare property companies, whose income is backed by the government, all saw a slight increase in their share prices over the period.

Performance data

Performance data

There are no real surprises in both the best and worst performing property companies in the first quarter of 2020. Those companies with a stable income stream or that operate in property sectors that are set to be less impacted by the coronavirus have made it into the top 10, although only five companies have actually seen their share price rise in the three months. Conversely, those companies that are more exposed to the pandemic, such as retail landlords and development companies, have seen huge share price falls.

Best performing property companies

Best performing property companies

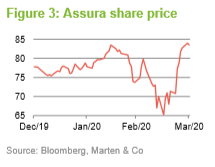

Four of the five companies to have seen share price rises over the quarter have a large majority of their income either directly or indirectly paid by the government. Assura, which tops the group, and Primary Health Properties, which saw a marginal gain of 0.4%, both own portfolios of GP surgeries and their income is predominantly paid by the government through the NHS.

That is the case for the two social housing companies, Civitas Social Housing and Triple Point Social Housing REIT, whose rents are indirectly paid by the government through housing benefit.

Two European logistics companies were also among the best performing companies in the quarter, with the logistics sector witnessing an increase in demand for space from ecommerce companies as online orders surged. Aberdeen Standard European Logistics Income (ASLI) saw its share price rise marginally, while Tritax EuroBox saw its share price fall slightly.

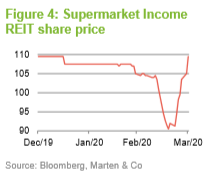

Supermarket Income REIT, which owns a portfolio of supermarkets let on long leases to the likes of Sainsbury’s Tesco and Morrisons, ended the quarter in the same position as it started it. No mean feat given that its share price fell 14% in early March during the wider stock market sell-off as the covid-19 pandemic escalated. Its share price recovered all its losses as the grocers saw a spike in demand as people stockpiled goods.

Standard Life Investments Property Income Trust also has a heavy focus on logistics assets and has a strong balance sheet following some profitable sales at the end of 2019.

Worst performing property companies

Worst performing property companies

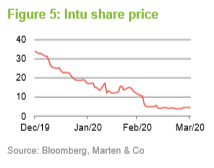

Unsurprisingly, companies that have a large exposure to retail saw heavy falls in their share price as all but essential retail outlets were forced to shut. Retailers have been unable to pay rent as it fell due, leaving retail-focused property companies with significant holes in their income. For retail-focused companies, it was the latest in a long run of bad news. Intu Properties was the worst affected, announcing it had received just 29% of rent due at the end of the first quarter. This followed disastrous results, in which the value of its property portfolio plummeted by £2bn, as well as a failed £1.5bn emergency cash call.

Fellow shopping centre owner Hammerson didn’t fare much better, losing almost 75% of its value in the quarter having faced similar troubles collecting rent.

NewRiver REIT also suffered heavy losses in the quarter, being one of the first property companies to announce it was suspending its dividend distribution. Although it does own a portfolio of pubs, its retail portfolio is less exposed than its peers, with 36% of its retail tenants by income still trading. Nevertheless, its share price plunged 70% in the three months. Capital & Regional also owns a portfolio of shopping centres that have predominantly been closed and it expects to collect just 50% of rent for the quarter.

Estate agency group Countrywide has been on the ropes for a while now and its performance wasn’t helped by an all-share takeover of the company falling out of bed during the period. Now the housing market has all but stalled, the group lost 86.1% of its value during the quarter.

Significant rating changes

Significant rating changes

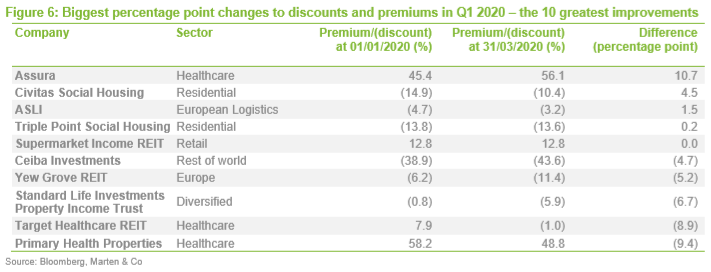

The top of the table has a similar feel to it as the share price moves. Again, there was only a handful of companies that saw their ratings increase. Assura’s premium widened from an already large 45.4% at the start of the year to 56.1% at the end of the first quarter.

We touched on Civitas Social Housing and Triple Point Social Housing REIT in the performance section. Likewise, ASLI and Supermarket Income REIT have performed well for similar reasons.

Elsewhere, Ceiba Investments, the real estate company focused on Cuba, has seen its discount widen slightly over the period by 4.7 percentage points. Ceiba is used to operating in difficult conditions, with the Cuban economy being hit by sanctions imposed by US president Donald Trump, and is well placed to ride out the covid-19 pandemic having zero debt on its balance sheet.

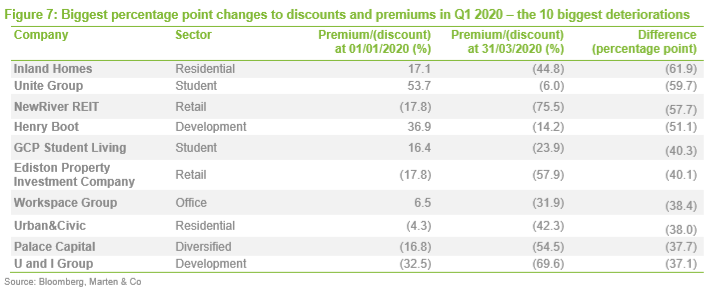

Inland Homes has seen its share price collapse since the global pandemic escalated as its developments were halted and fears for the impact of a recession on the housing market grew.

Development specialist Henry Boot saw its healthy premium turn to a large discount during the quarter as its development sites were shut down. Fellow development specialist U and I Group saw its already large discount widen to almost 70%.

Student accommodation operators Unite Group and GCP Student Living also saw their premiums turn to discounts as universities were locked down and fears grew for international student numbers in the 2020/21 academic year.

Major corporate activity

Major corporate activity

Fundraises

Fundraises

The covid-19 pandemic put paid to a number of planned fundraises in the first quarter of 2020. There was, however, more than £330m raised by property companies during the period.

In February, private-rent residential specialist Grainger raised £186.7m through a placing. Including debt, the company said it would use the funds to buy £246m of new property and spend £59m on progressing new developments.

Also in February, Urban Logistics REIT raised £130m through an over-subscribed placing, smashing its £100m target. The group said it would scale up its portfolio of urban logistics properties.

AEW UK REIT raised £7m through a placing, falling short of its £20m target. It has a pipeline of potential investments in the industrial sector worth £100m. Custodian REIT issued equity worth just over £9m during the quarter.

As the coronavirus pandemic escalated during the quarter, two high profile equity raises were shelved. Warehouse REIT called off plans for a £100m equity raise, while Regional REIT also canned its plans.

Mergers and acquisitions

Mergers and acquisitions

Gresham House bought the manager of Residential Secure Income REIT, TradeRisks Limited. Gresham paid £7m upfront and up to £4m more, subject to the achievement of certain performance targets.

AEW UK Long Lease REIT changed its name to Alternative Income REIT after appointing a new investment adviser following a strategic review. AEW UK Investment Management was replaced by Mason Owen and Partners.

De-listings

De-listings

Summit Properties cancelled the trading of its shares on AIM in March 2020. Following a recommended final cash offer, Daejan Holdings also announced plans to de-list.

Major news stories

Major news stories

• Coronavirus – the long-term impact on property

QuotedData assessed the long-term effects of the covid-19 pandemic on the property industry, including on the office sector, which could see the working from home trend accelerate.

• Intu collects just 29% of quarterly rent

Intu Properties said it would seek covenant waivers from lenders as covid-19 hit its rental income. The shopping centre owner received just 29% of rent for the quarter.

• Hammerson suspends dividend after receiving just 37% of quarterly rent

Retail landlord Hammerson collected just 37% of its rent in the latest quarter but vowed to help retailers during the covid-19 pandemic through rent deferrals, waivers and offering monthly payments.

• British Land offers retail tenants rent holidays

British Land suspended its dividend payments and said it was offering smaller retail tenants a three-month rental holiday. The group said larger retailers and leisure tenants would be able to spread payments over the six quarters from September 2020.

• GRIT Real Estate acquires stake in Moroccan REIT

GRIT Real Estate Income Group, the pan-African property investor, entered into an agreement to buy a stake in a newly formed Moroccan REIT. GRIT intends to inject further equity into the vehicle and grow the asset base.

• Supermarket Income REIT in talks to buy 26-strong Sainsbury’s portfolio

Supermarket Income REIT is in discussions to acquire a minority stake in a portfolio of 26 Sainsbury’s-let supermarkets. The 26% stake is worth around £105m. It also bought a Sainsbury’s store in Hessle, East Riding of Yorkshire, for £34m.

• Merger talks between Countrywide and LSL Property Services called off

Estate agency group LSL Property Services pulled out of negotiations to buy fellow estate agent Countrywide. The tie-up would have brought together two of the UK’s biggest listed estate agents.

• Helical fully-lets Old Street office scheme

London office developer Helical let the final floor of The Tower office scheme, near Old Street, taking the building to 100% let. Brilliant Basics, an Infosys Company and existing occupier, let the 15th floor on a five-year lease. The building has an average rent per square foot of £73.55.

• ASLI completes €49.9m Netherlands logistics warehouse buy

Aberdeen Standard European Logistics Income acquired a 43,000 sqm logistics warehouse in Den Hoorn, in the Netherlands, for €49.9m. The newly built facility, which is located within the Randstad region – one of the most densely populated areas in the country, is let to a logistics operator on a 10-year CPI indexed lease.

• Workspace hires new chief financial officer from Whitbread

Flexible office space provider Workspace Group poached Whitbread’s finance director, David Benson, for the role of chief financial officer. He will join the board of the company and become a member of the executive committee when he joins on 1 April 2020.

Recent publications

Recent publications

Standard Life Investments Property Income Trust – Adding value in cautious times. Published 13 February 2020.

Civitas Social Housing – Proved its mettle. Published 15 April 2020.

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.