Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

January’s biggest movers in price terms are shown in the chart below.

The UK’s vaccination programme has lifted optimism for a speedier opening of the economy than first feared at the start of the year. Property companies that reported positive valuation figures for the final quarter of 2020 performed well in January in share price terms. Top of the list, however, was perennial 2020 underperformer U and I Group, which saw its share price rise an astonishing 41% in the month. This followed news that it had replaced its chief executive and was undertaking a review of the business that will likely see it focus on fewer, more valuable development schemes.

BMO Real Estate Investments, AEW UK REIT and Picton Property all announced net asset value increases over the quarter (see page 2 for detail), helped by each company’s portfolio exposure to the industrial and logistics sector. PRS REIT revealed a significant uptick in the delivery of private rented homes in its portfolio in the final quarter of 2020, and its share price responded with a 10% rise. Meanwhile, both Tritax funds – Big Box and EuroBox – saw share price gains off the back of news their manager had been acquired by Aberdeen Standard Investments.

There were no real surprises at the top of the worst performing property companies in January table. Shopping centre owner Capital & Regional’s share price has been on the slide for a while now and this month lost a further 13.7%. In the past 12 months it has lost 73.8% in market cap. Ground Rent Income Fund’s share price tumbled 12.6% in the month after the government published leasehold reform proposals that would reduce future residential ground rents to zero and offer leasehold consumers extension rights.

Both Land Securities and British Land published rent collection figures for the current quarter that revealed rates of 50% and 71% respectively. Retail continues to weigh heavy on both companies, with rent collection rates of 29% and 46% respectively for the first quarter of 2021. Student accommodation specialist Unite announced it was offering its students a 50% discount on rent for an initial four-week period (now been extended to seven weeks) at a cost of £15m in rent. Workspace Group said tenant enquiries across its London flexible office portfolio were down 33% in the final quarter of 2020, with rent roll down 9.1%.

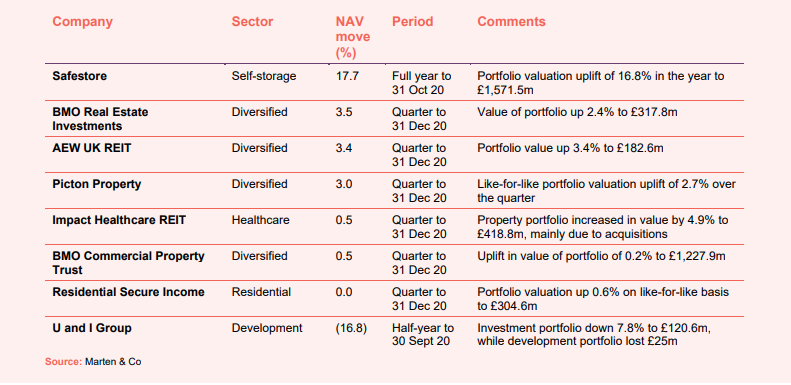

Valuation moves

Corporate activity

Supermarket Income REIT secured a new revolving credit facility (RCF) of £80m with Barclays and Royal Bank of Canada. The interest only RCF has a five-year term and a total cost of 1.55%. A £70m accordion option is exercisable over the term of the facility.

Tritax Big Box REIT chairman Sir Richard Jewson announced his intention to retire at the next AGM in May 2021. Aubrey Adams OBE, the current senior independent director, will take his place.

London office developer Derwent London appointed former JP Morgan vice chairman of mergers and acquisitions Mark Breuer as its new chairman. He will initially join the board as a non-executive director before taking over from John Burns as chairman following the conclusion of the company’s 2021 AGM.

LondonMetric appointed Kitty Patmore as an independent non-executive director. Patmore is current chief financial officer at Harworth Group and has 15 years of finance, banking and real estate lending experience.

St Modwen Properties appointed Dame Alison Nimmo DBE as a non-executive director. The former Crown Estate chief executive joined the board on 1 February 2021.

British Land appointed Bhavesh Mistry as chief financial officer. Mistry is currently deputy chief financial officer at Tesco and was previously finance director at Whitbread’s hotels & restaurants division. He will become an executive director and join the main board at British Land when he makes the move no later than 1 August 2021.

Hammerson chief financial officer James Lenton resigned from the role after just over a year in the job. He will stay in the role until a successor is appointed.

Major news stories

- Supermarket Income REIT buys trio of stores for £95m

Supermarket Income REIT bought a Morrisons, Sainsbury’s and Waitrose supermarket during January for a combined £94.8m. The Morrisons store, in Wisbech, Cambridgeshire, was acquired for £30m, while the Sainsbury’s, in Melksham, and the Waitrose, in Winchester, were acquired together for £64.8m.

- Home REIT builds portfolio with £70m acquisition spree

Home REIT, which is focused on providing accommodation for the homeless, acquired a further 171 properties for £69.5m. The acquisitions mean the company has now deployed £184m (or78%) of the money raised at IPO in October 2020.

- LondonMetric increases urban logistics exposure

LondonMetric acquired four urban logistics assets during January – in London, Redditch, Manchester and Birmingham – for a combined £52.2m.

- CLS acquires trio of German offices for €89.7m

CLS exchanged contracts to acquire three offices in Germany – in Dusseldorf, Berlin and Hamburg – for a combined €89.7m, reflecting a net initial yield of 4.8%.

- Sirius Real Estate returns to acquisitive growth

German business parks owner Sirius Real Estate acquired three assets for €26m plus an €80m acquisition with joint venture partner AXA IM Alts, signalling a return to acquisitive growth after assessing the impact of COVID-19.

- U and I Group appoints new chief executive and launches business review

Regeneration specialist U and I Group replaced chief executive Matthew Weiner with chief development officer Richard Upton after a prolonged period of underperformance. Upton will undertake a review of the group’s investment strategy.

- Urban Logistics REIT acquires site in Wirral for £16.3m

Urban Logistics REIT acquired a 169,963 sq ft logistics unit in the Wirral, let to Great Bear Distribution, for £16.3m, as it continues to deploy the proceeds of its recent fundraise.

- Unite offers students 50% rent discount

Unite announced a 50% rent discount for students following the latest lockdown in the UK at a cost of £15m in rent.

- Grainger completes £63m forward funding

Grainger completed the forward funding acquisition of a 231-home build-to-rent development in Bristol for £63.1m.

- Harworth sells business park

Regeneration company Harworth sold its 283-acre Bilsthorpe Business Park, in Nottingham, for £4.6m in two transactions.

QuotedData views

- Timing just right for Big Box – 29 January 2021

- Can Upton regenerate U and I Group’s future? – 22 January 2021

- Don’t discount the property generalists – 15 January 2021

- Watch property go in 2021 – 8 January 2021

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Peter Lowe, fund manager:

Despite a strong end to the year for parts of the market, buoyed by positive developments on vaccines and the resolution of Brexit, overall sentiment is cautious, with the re-imposition of lockdown restrictions increasing uncertainty around the path to recovery. Overall, the property market delivered positive total returns over the quarter [to the end of December 2020], largely driven by a strong performance from industrials and distribution. Performance was polarised, with town centre retail and leisure remaining under considerable pressure and offices faltering. Total return performance turned positive for retail warehousing.

Development

Richard Upton, chief executive:

The macro environment has changed significantly, exacerbated most recently by a structural shift in behaviours resulting from the COVID-19 pandemic. Delays in completing transactions; reduced market confidence leading to a more cautious approach to decision-making; and a backlog in the planning system, have all impacted our financial performance and made it more difficult to provide clear short-term guidance on the performance of our projects. With this in mind, we are undertaking a 100-day portfolio review, starting immediately, which will critically examine all our projects so that we can refocus and reshape, strengthening our position for the future. It will assess the financial optimisation potential for existing assets; financing arrangements; a new framework to deliver more predictable income streams; focused ESG delivery and review the dividend policy. The plan produced from the review will deliver improved short- and long-term liquidity and a more efficient approach, together with revealing the potential within U+I’s business to deliver compelling and sustainable socio-economic change from our core regeneration projects.

Self-storage

Frederic Vecchioli, chief executive:

There are numerous drivers of self-storage growth. Most private and business customers need storage either temporarily or permanently for different reasons at any point in the economic cycle, resulting in a market depth that is, in our view, the reason for its exceptional resilience. The self-storage market in the UK and France remains relatively immature compared to geographies such as the USA and Australia. Self-storage capacity stands at 0.73 sq ft per head of population in the UK and 0.20 sq ft per capita in France [according to the Self Storage Association]. Whilst the Paris market density is greater than France, we estimate it to be significantly lower than the UK at around 0.36 sq ft per inhabitant. This compares with 9.44 sq ft per inhabitant in the USA and 1.89 sq ft in Australia. In the UK, in order to reach the US density of supply, it would require the addition of around another 17,000 stores as compared to around 1,400 currently. In the Paris region, it would require around 2,400 new facilities versus around 95 currently opened.

Recent real estate research

Aberdeen Standard European Logistics Income – Expansion on the radar

Lar Espana Real Estate – Built to last

Tritax EuroBox – Boxing clever

Civitas Social Housing – Solid foundations for future growth

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.