Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

Performance data

February’s biggest movers in price terms are shown in the chart below.

Property stocks tumbled in February as fears over the spread of Covid-19 spooked financial markets around the world and resulted in the largest sell-off since the 2008 financial crisis. There were just four UK-listed property companies that saw their share prices rise in February, however Daejan Holdings’ 53.5% jump was purely due to the fact it agreed a deal with its majority shareholder to take the company private. Small-cap regional office owner Circle Property led the pack, Daejan aside, with a share price rise of 3.9%. Alpha Real Trust, which invests in high-yielding property and asset-back debt, and private rented residential owner and developer Grainger were the other two property companies that saw share price gains in February, by 0.5% and 0.1% respectively.

During the month Grainger raised £186.7m in an oversubscribed placing that was at a slight discount to the previous day’s share price. Three companies, including Cuban real estate focused Ceiba Investments, saw no move in their share price. Stenprop, which is working through its portfolio to become a purely industrial-focused company, saw a slight drop off in its price, as did Safestore and pan-African investor GRIT Real Estate.

While the sell-off has been indiscriminate, companies focused on the retail market took a bigger hit than most. Fears that people would avoid public places, such as shopping centres, during the coronavirus pandemic was perhaps behind some of the falls. Intu Properties was also affected by news that it needed £1bn in emergency equity and that a Hong Kong REIT had pulled out of talks to be the cornerstone investor. Capital & Regional, which owns a portfolio of regional shopping centres, was second on the list of worst performing companies with a near 20% fall during the month.

Capital & Counties, which owns property in and around Covent Garden in London’s West End, reported full year results during the month that saw its net asset value (NAV) fall by 10.1%, largely attributable to the sale of its Earls Court holdings. Another retail-focused company, NewRiver REIT, also saw a big fall in its share price, by 17.2%. It was a busy month for Countrywide, which announced that the sale of its commercial property arm had hit a snag and then confirmed rumours it was in talks with fellow listed estate agency group LSL Property Services regarding a possible allshare merger. Its share price hit the buffers on the news.

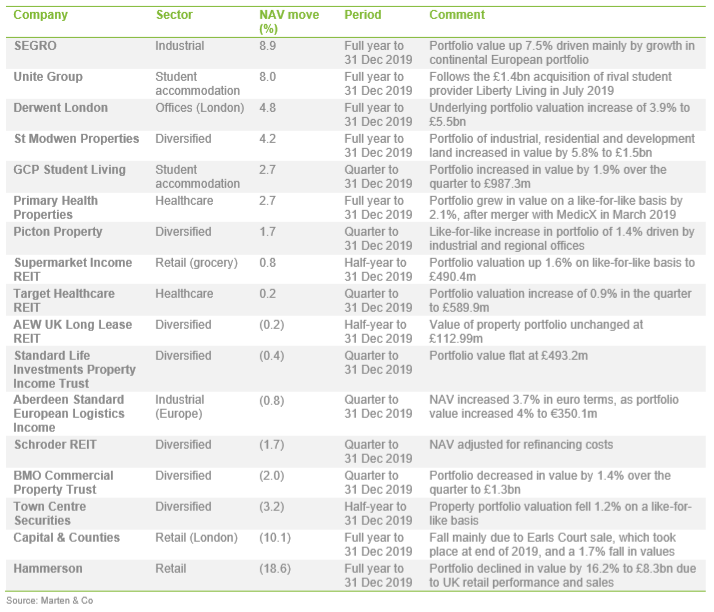

Valuation moves

Valuation moves

Corporate activity in February

Corporate activity in February

Grainger raised £186.7m through a placing. Including debt, the company will use the funds to buy £246m of new property and spend £59m on progressing new developments.

Urban Logistics REIT raised £130m through an oversubscribed placing, smashing its £100m target. The group said it would scale up its portfolio of urban logistics properties.

AEW UK REIT raised £7m through a placing, falling short of its £20m target. It has a pipeline of potential investments in the industrial sector worth £100m.

Warehouse REIT and Regional REIT both announced they were weighing up equity raises in order to expand their portfolios.

Intu Properties agreed terms to amend and extend one of its loans, conditional on it raising £1.3bn in an emergency cash call. The four-year £440m revolving credit facility would replace its £600m facility that expires in October 2021.

AEW UK Long Lease REIT appointed a new investment adviser following a strategic review. AEW UK Investment Management will be replaced by Mason Owen and Partners on 9 April 2020. The company has also changed its name to Alternative Income REIT.

Daejan Holdings announced its majority shareholder, Freshwater Group, had agreed to buy the 20.5% of shares in the company it doesn’t already control for £269.5m. Once completed, the deal will lead to the delisting of the company.

Summit Properties announced it was cancelling the trading of its shares on AIM, which is expected to take place on 17 March 2020, and was holding a tender offer for a third of its shares at €1.45 per share – a discount of 13.7% to its NAV.

Capital & Regional appointed David Hunter as non-executive chairman. He will take up the post on 20 May 2020 at the conclusion of the group’s AGM.

February’s major news stories

February’s major news stories

• Countrywide and LSL Property Services in talks over merger

Estate agents Countrywide and LSL Property Services are in talks over a possible all-share merger. The tie-up would bring together two of the UK’s biggest listed estate agents.

• Hammerson offloads retail park portfolio for £400m

Hammerson exchanged contracts to sell a portfolio of seven retail parks for £400m, as it continues to strengthen its balance sheet. The sale, along with two separate retail parks transactions totalling £55m, represented a discount to book value of 22.2%. Hammerson has now fully exited the retail park sub-sector, generating proceeds of £764m.

• Workspace hires new chief financial officer from Whitbread

Flexible office space provider Workspace Group poached Whitbread’s finance director, David Benson, for the role of chief financial officer. He will join the board of the company and become a member of the executive committee when he joins on 1 April 2020.

• Supermarket Income REIT in talks to buy 26-strong Sainsbury’s portfolio

Supermarket Income REIT is in discussions to acquire a minority stake in a portfolio of 26 Sainsbury’s-let supermarkets. The 26% stake is worth around £105m. It also bought a Sainsbury’s store in Hessle, East Riding of Yorkshire, for £34m, reflecting a net initial yield of 5.5%.

• GRIT Real Estate acquired stake in Moroccan REIT

GRIT Real Estate Income Group, the pan-African property investor, entered into an agreement to buy a stake in a newly formed Moroccan REIT. GRIT intends to inject further equity into the vehicle and grow the asset base with a number of identified acquisitions.

• Tritax EuroBox bought logistics site in Poland for €66.8m

Tritax EuroBox acquired two recently developed logistics properties and development land in Strykow, near Lodz in central Poland, for €66.8m and a net initial yield of 6.1%.

• Helical sold London office campus for £41.6m

London developer Helical sold the Power Road Studios in Chiswick for £41.6m, reflecting a net initial yield of 4.8%, as part of its strategy to dispose of non-core assets.

• Tritax Big Box REIT to seek sales to fund development pipeline

Tritax Big Box REIT said it was looking to recycle capital from the sale of specific assets in order to fund its near-term development pipeline consisting of 11.5 million square foot. The group is targeting yield on cost of between 6% and 8% across developments compared to the group’s current portfolio valuation yield of 4.5%.

• Palace Capital sets record office rent in York

Palace Capital set a record office rent in York city with the completion of a pre-let agreement at its Hudson Quarter mixeduse development. Solicitors Knights took a 10-year lease that will rise to £25 per square foot.

• Local Shopping REIT to regrow business

The new board of Local Shopping REIT said it would look to grow the business after years of a gradual winding up of the trust by its predecessors. Thalassa did not reveal details of the strategy but said it would “regrow the asset base”.

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Student accommodation

Student accommodation

Unite Group

Richard Smith, chief executive:

Building on the foundations of the sector’s strong fundamentals and our best-in-class operating platform, the group is well placed to deliver sustainable earnings growth in the years ahead. Higher Education (HE) policy is likely to evolve during the current parliament, but we expect increased participation in post-18 education to remain a key part of the government’s education strategy. Our alignment to and relationships with the best universities, as well as our focus on delivering affordable, value-for-money homes for our customers, positions us well to navigate any changes.

There are significant growth opportunities available to the group, created by increasing student numbers and the growing awareness of the benefits of purpose-built student accommodation among non-1st year students. We continue to see opportunities for new developments and university partnerships, building on the strength of our brand in the sector and the need of universities to deliver on exceptional student experience in a competitive HE environment. We are one of the largest operators of rented residential accommodation in the UK and our operating capabilities provide us with a real opportunity. We see the potential to segment our existing customer proposition to better meet student needs and extend our offer to new customer groups.

Despite some uncertainty created by Brexit, the review of HE funding and the Coronavirus outbreak, the outlook for demand remains strong. The early strength of applications data and reservations for the 2020/21 academic year are supportive of rental growth of 3.0-3.5% through a combination of value-driven price increases and improved utilisation. We are also confident in the medium-term outlook for earnings growth. Rental growth, together with cost synergies from the Liberty Living acquisition and new openings net of planned disposals, could add 16p to 20p to EPS on completion of our secured pipeline. This supports attractive total returns, through a balance of growing recurring income and NAV growth.

Diversified

Diversified

Standard Life Investments Property Income Trust

Jason Baggaley, fund manager:

Lagging indicators continue to show slowing momentum in the UK economy, despite the initial positive reaction to the election of a Conservative government with a large majority. We expect fiscal stimulus to come through and steadily feed into growth, with a boost to consumer spending. However, as the UK looks set to drift further from EU economic and regulatory alignment, we do not envisage a material pick-up in investment. With Conservatives representing some constituencies for the first time in many years – or, in some cases, ever – the focus of increased fiscal spending and capital could be tilted more towards the regions.

The political clarity derived from the election result has prompted a noticeable increase in the level of optimism from agents in the market, particularly towards Central London offices. However, as we enter a critical period for Brexit negotiations, we see very little justification to be taking on unnecessary risk at this stage of the UK real estate cycle. The focus remains on assetlevel risk and income prospects to identify attractive long-term investment opportunities in the UK real estate market.

Town Centre Securities

Edward Ziff, chairman and chief executive:

We continue to invest in our assets, with significant redevelopment and refurbishment schemes underway in both Leeds and Manchester. Progress with our development pipeline continues and following the successful completion of our first dedicated PRS building – Burlington House, in Manchester, our next development, a joint venture with Leeds City Council to build a 136-room aparthotel, is progressing well.

The active management of our portfolio has ensured delivery of resilient earnings and a stable valuation. Of particular note, is the increase in value of the Merrion Estate. The ongoing diversification of our portfolio, with our retail assets representing only 35% of the portfolio, will continue as we actively look to sell further retail assets, but as a strategic seller will only do so for the right deal.

AEW UK Long Lease REIT / Alternative Income REIT

Steve Smith, chairman:

The UK property market continues to deliver healthy spreads over 10-year government bond yields, both in absolute terms and relative to other markets. Amid the global economic slowdown for the past 12 months, central banks have kept interest rates low and are now expected to do so for at least the short term and as a result, we expect to see yield stability for property sectors as well.

The long income property sector continues to benefit from strong competition amongst investors looking to buy long, inflationlinked income and gain exposure to assets that either create a bond proxy income stream or are akin to social infrastructure.

St Modwen Properties

Mark Allan, chief executive:

Positively, the general election in December reduced political uncertainty in the UK for the time being and the new government appears supportive to stimulating growth across the regions. Nevertheless, uncertainties around the general economic outlook remain and even though the UK formally left the EU at the end of January, the shape of our future trading relationships with the rest of the world is unclear. As such, we remain mindful of the uncertainty this could cause in the near term and the potential effects in the long term. While we will therefore maintain a conservative level of borrowings and we have the flexibility to adjust our activity quickly in case of any unexpected changes in demand due to the short-cycle nature of our developments, the positive structural growth characteristics in our key sectors provide us with confidence to continue to invest.

Retail

Retail

Hammerson

David Atkins, chief executive:

We have taken decisive action over the past 12 months to reduce debt and significantly reshape the portfolio. Against a challenged retail and investment backdrop, we have exceeded our 2019 disposal target, exited the retail parks sector as we said we would and reduced debt by a third. This delivered nearly £1bn of transactions in the process. With the outlook for the UK retail market remaining uncertain, we believe we should maintain our focus on reducing debt during 2020. In strengthening our balance sheet further, we will create a more resilient business and also generate significant liquidity which could, at the appropriate time, be deployed to create enhanced returns for shareholders.

The magnitude of the challenge facing UK retail is significant. However, as brands look to optimise their store estates and strike the right balance between online and physical retail, the best destinations continue to be highly relevant – this is highlighted by the rise in visitor numbers across all our regions. We remain committed to creating a portfolio of exceptional venues and, as we drive a faster pace of change in shifting our brand line-up and repurposing space, we expect to see improved results in the UK. We will build a stronger business for the future with our focus on this, alongside improved performances in France and Ireland, the extensive opportunity offered by City Quarters and the outstanding contribution from premium outlets.

Retail (grocery)

Retail (grocery)

Supermarket Income REIT

Nick Hewson, chairman:

We invest in omnichannel stores which we believe are the future model of grocery in the UK. Omnichannel supermarkets operate both as physical supermarkets and as online fulfilment centres. We target stores which perform a critical role in the business strategies of our tenants. The big four grocers continue leveraging their existing store networks to support last mile logistics for online grocery. As a result, growth in e-commerce sales is driving value creation in these locations that is not yet fully reflected by the investment market. This stable, inflation-linked income stream enabled us to increase our quarterly dividend in line with RPI for the second year in a row.

Retail (London)

Retail (London)

Capital & Counties

Henry Staunton, chairman:

2019 was a year of significant positive change. Capital & Counties ended the year in a strong position having achieved its strategic objective of separation of its two London estates. The company is now positioned as a central London focused REIT with significant financial flexibility to capitalise on growth opportunities.

Covent Garden demonstrated resilient performance in a challenging environment. Whilst we can expect continued market uncertainty over the year ahead, we are confident about the long-term fundamentals of the Covent Garden estate, our market position and the prospects for central London. Our ambition is to build on the success of Covent Garden, to generate superior total returns for our shareholders over the long-term through creative asset management, investment and specialisation in central London real estate.

With our clear and focused strategy, world-class estate, experienced management team and creative approach, supported by strong financial resources, Capital & Counties is well-positioned to deliver income and dividend growth for our shareholders.

Offices (London)

Offices (London)

Derwent London

Paul Williams, chief executive:

We begin 2020 with a more confident outlook following the decisive 2019 general election result. Uncertainties remain with the global economic outlook subdued by the increasing impact of the Coronavirus and the UK’s future relationship with the EU and the rest of the world yet to be determined. Despite these risks, the central London office market is well-positioned, with occupiers struggling to find the space they want and there is increased investment appetite. In relation to our own portfolio in 2020 we expect to see higher ERV growth of 1% to 4% and property investment yields tighten. This is a stronger forecast than in the past three years which, together with our development pre-lets, is encouraging us to bring forward further projects. This pipeline is well-supported by our financial base and puts Derwent London in a good position to benefit from potential further market upside.

Healthcare

Healthcare

Primary Health Properties

Steven Owen, chairman:

The primary health centres we invest in perform a vital role in the provision of healthcare across the UK and Ireland, and are unlikely to be directly impacted by the final outcome and consequences of Brexit for the UK. Demand for our properties is driven by demographics and in particular populations in our markets that are growing, ageing and suffering from more instances of chronic illness.

Despite the continued volatility in the economic environment and the prolonged era of low interest rates, there continues to be an unrelenting search for income yield across most sectors. Primary healthcare, with its strong fundamental characteristics and government-backed income, has been a significant beneficiary. The UK market for primary healthcare property investment continues to be highly competitive with attractive yields and prices being paid by investors for assets in the sector and we have continued to see yields compress during 2019 although at a much slower rate than that witnessed in both 2018 and 2017.

We believe that our activities benefit not only our shareholders but also our wider stakeholders, including our occupiers, patients, the NHS and HSE, suppliers, lenders and the wider communities in both the UK and Ireland. Following completion of the merger with MedicX, the group is now in a strong position to continue to deliver further dividend growth, fully covered by earnings, together with long term value to shareholders and wider stakeholders.

Industrial

Industrial

SEGRO

David Sleath, chief executive:

The momentum that we have seen across our markets during the final months of the year means that we have started 2020 with confidence. We are proud owners of one of the highest quality logistics and industrial portfolios in Europe and we are well positioned to benefit from the structural drivers that are currently at play in our sector.

We expect to see further rental growth across our geographies, with an increasing contribution from Continental Europe, and the potential for further upside in the UK as our future relationship with the European Union becomes clearer.

Our development pipeline for 2020 is very healthy, allowing us to both modernise our portfolio and generate additional rental income, compounded by the rental growth from the active asset management of our existing estate. Whilst the trends of ecommerce and urbanisation continue to drive occupier demand we expect to be able to develop at this elevated level, de-risking the majority of it by pre-letting.

Looking beyond the immediate future, we recognise that the society in which we operate continues to face unprecedented levels of change as technological advances continue to impact our customers and wider society. In order to position our business to embrace this, we announced in January the creation of a new Strategy, Investment and Innovation team. This will ensure that we are able to navigate and benefit from these structural changes and will help us to become more agile in supporting the evolving needs of our customers and other stakeholders.

Our core strategy and pure focus on warehouse and industrial property will remain unchanged, but by keeping one eye on the horizon we expect to be able to position SEGRO for sustainable, long-term success.

Upcoming events

Upcoming events

• Master Investor, 28 March 2020

• Primary Health Properties AGM 2020, 1 April 2020

• UK Investor Show, 25 April 2020

Recent publications

Recent publications

Standard Life Investments Property Income Trust – Adding value in cautious times

An update note on Standard Life Investments Property Income Trust (SLI). The company has been focused on good portfolio management during an uncertain market by disposing of more risky assets and buying high yielding property with rental growth potential.

Industrial property market – The gift that keeps on giving

The second in our series of real estate sector notes, focusing on the industrial market. It looks at the future growth opportunities that exist and profiles all the industrial focused property companies.

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.