Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

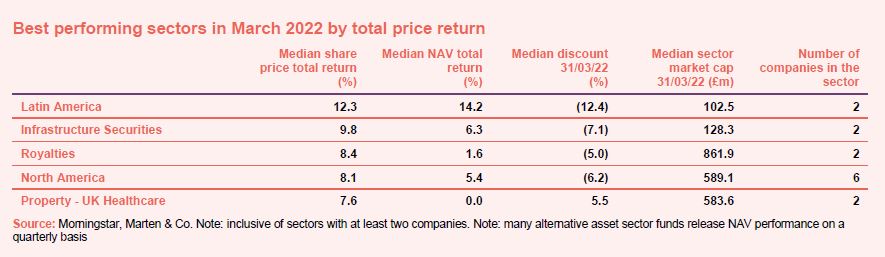

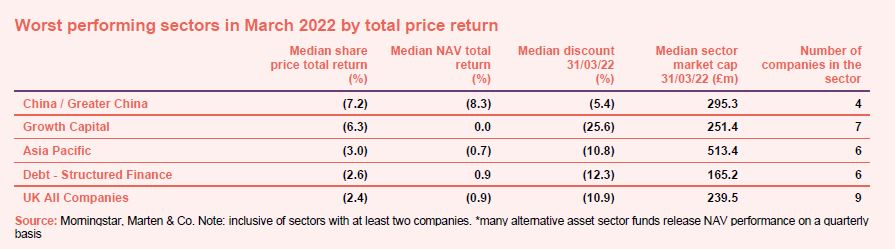

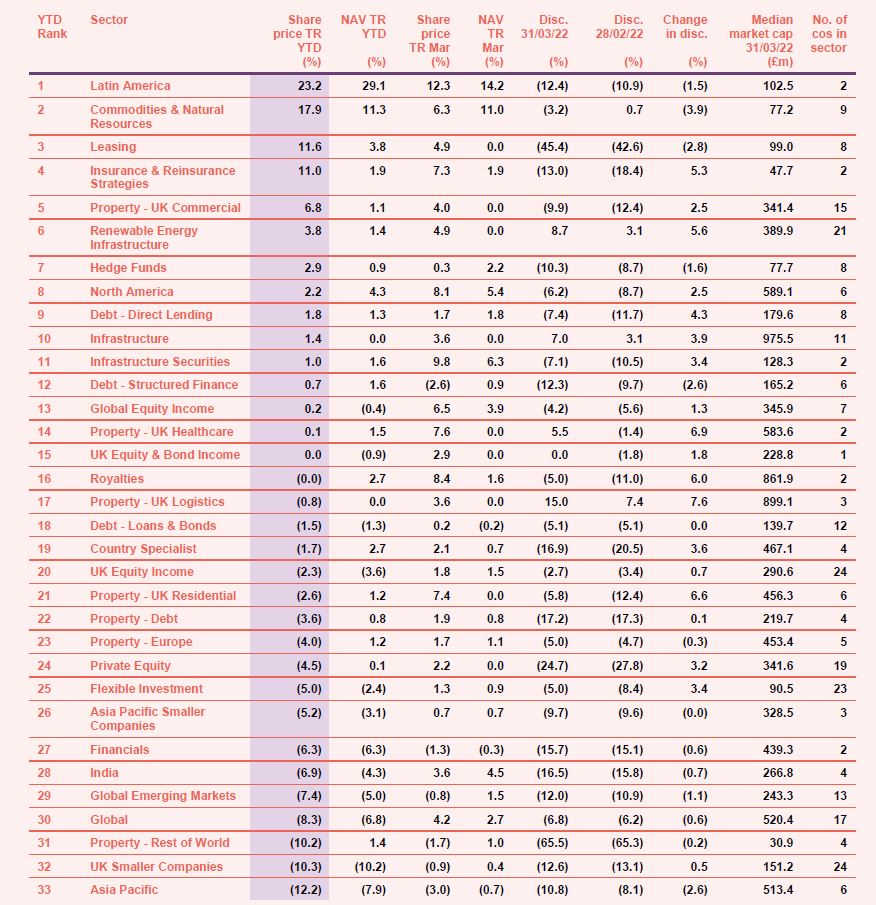

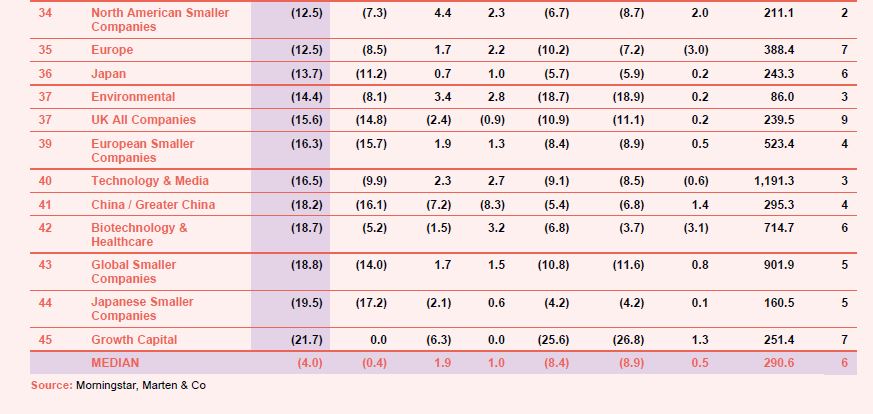

The Russo-Ukrainian conflict, which began at the end of February, worsened over March which, unsurprisingly, caused further volatility in global markets and a significant impact on energy, metals, and wheat prices. That has been good news for commodity exporting regions such as Latin America, which was the best performing sector for the month. Infrastructure securities did well thanks to a good month from Ecofin Global Utilities & Infrastructure, which makes up 50% of the sector. The royalties sector also got a boost from member Hipgnosis Songs. North American trusts did well in March as investors took advantage of steep discounts to pick up bargains. China/Greater China was the worst performing sector over the month as coronavirus cases remain high in parts of the country and restrictions are still well in place. Meanwhile, President Xi Jinping set China’s growth target for 2022 at 5.5% – the lowest in three decades. Asia Pacific funds were also hit, likely impacted by its proximity to Russia as well as some of the region’s countries’ reliance on its exports. Growth capital trusts are still reeling from the rotation out of growth stocks earlier this year, especially with higher inflation and increasing interest rates likely to continue (see Appendix 1 for a breakdown of how all the sectors have performed this year).

March’s median total share price return was 1.9% (the average was 2.3%) which compares with a median of -2.8% in February. Readers interested in recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over March

Worst performing sectors over March

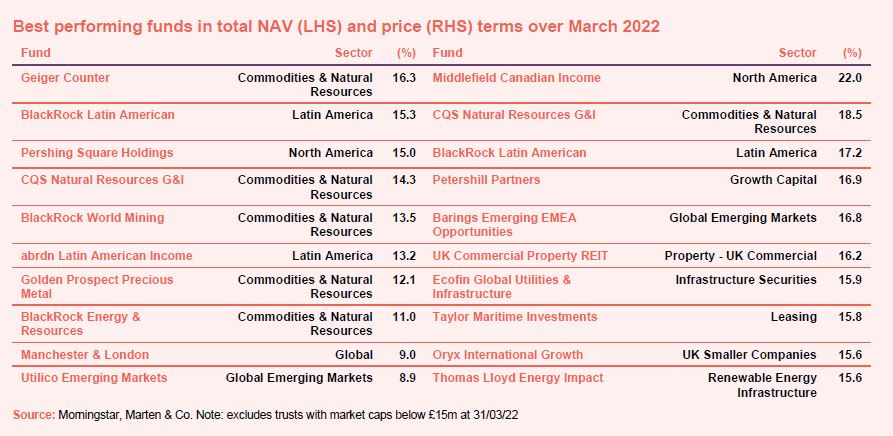

On the positive side

BlackRock Energy & Resources Income) dotted among the top ten. Higher commodities prices are also good news for Latin American funds abrdn Latin American Income and BlackRock Latin American, the latter of which made gains in both NAV and share price terms. Pershing Square Holdings enjoyed some uplift as, once again, it benefited from derivative trades designed to cushion against market falls, while its North American peer Middlefield Canadian Income was the best performer during the month in share price terms, helped by Canada’s resource-rich economy. New renewable energy infrastructure kid on the block, ThomasLloyd Energy Impact also made the top ten after receiving formal approval by the government of India for the purchase of a 43% economic interest in SolarArise India Projects Private Limited.

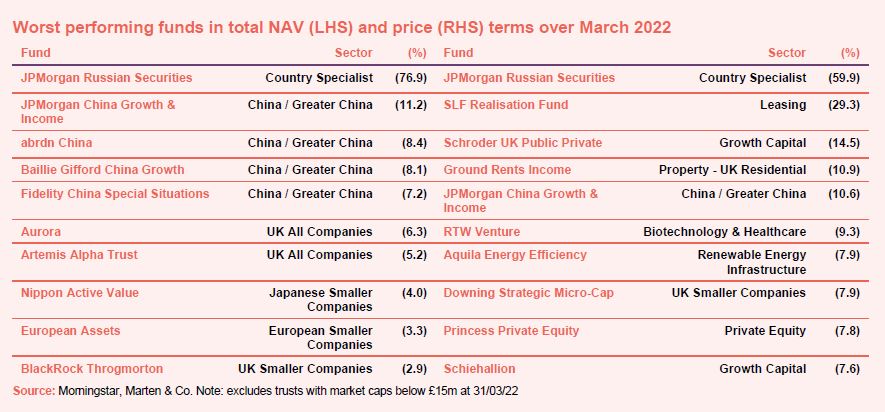

On the negative side

On the negative side, JPMorgan Russian Securities and Barings Emerging EMEA Opportunities continued to suffer in the face of the current conflict while all four members of the China/Greater China sector (JPMorgan China Growth & Income, abrdn China, Baillie Gifford China Growth and Fidelity China Special Situations) saw their NAVs fall over March for reasons already discussed. SLF Realisation fell after making a distribution to shareholders. UK names Aurora, Artemis Alpha Trust and BlackRock Throgmorton also fell in NAV terms. In share price terms, growth capital members Schroder UK Public Private and Schiehallion were down as the sector continues to be out of favour in the uncertain and higher interest rate environment. At the end of the month, RTW Venture reported lacklustre results for 2021, in a very weak market for biotech stocks; its NAV fell by 13% and share price by 5%.

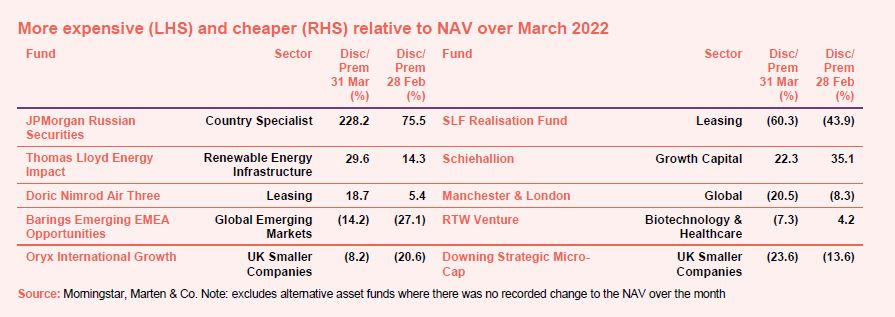

Discounts and premiums

More expensive and cheaper relative to NAV

The premium for JPMorgan Russian Securities soared to a ridiculous 228% by the end of March as, rather distastefully, some investors try to profit from the war in Ukraine, by betting that sanctions will be lifted. The war crimes in Bucha probably make that a distant prospect. Barings Emerging EMEA Opportunities is valuing its Russian investments at zero. However, the Gulf region – which also falls into its remit – is a beneficiary of a much higher oil price. After seeing its discount widen faster than any other trust in February, ThomasLloyd Energy Impact’s premium is starting to look excessive, it hasn’t finished investing its IPO proceeds yet, but when it has, it will likely be issuing more shares. Oryx International Growth bounced in March, though it remains on a single-digit discount.

RTW Venture became cheaper during the month, likely a result of its miserable annual results following a tough year for the biotech space. Schiehallion’s premium also appears to be coming back down to reality (it was trading on a 59.3% premium by the end of 2021) though it remains in double-digits. SLF Realisation Fund saw its discount widen to 60% following a return of capital. The trust is in wind-up mode as it sells its assets. Investors may be thinking that the next capital return is some way off.

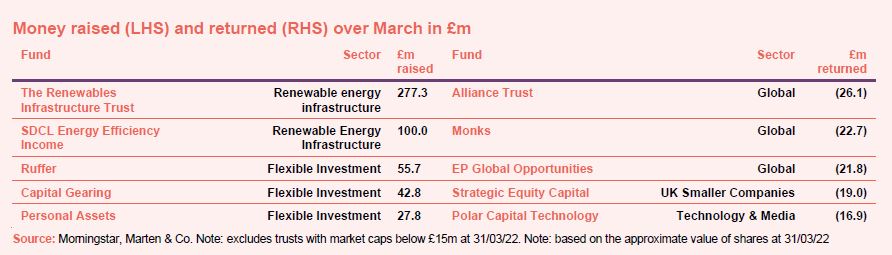

Money in and out

Money coming in and going out

Just over £350m of net new money was raised in March, led by a £277m fundraise from The Renewables Infrastructure Trust. The trust issued shares to professional investors via a bookbuild – where investors bid to buy shares through the company’s brokers at a strike price of no less than 130p. The proceeds were raised to acquire a 7.8% equity interest in the Hornsea One offshore wind farm in the UK from Global Infrastructure Partners. SDCL Energy Efficiency raised £100m in an oversubscribed placing to fund new investment opportunities identified in its wider pipeline worth over £250m. Ruffer, Capital Gearing and Personal Assets also issued new shares.

Share buybacks were led by Alliance Trust, Monks, EP Global Opportunities, Strategic Equity Capital (via a tender) and Polar Capital Technology.

Major news stories over March

Portfolio developments

- 80p dividend for Honeycomb shareholders ahead of merger

- Schroder UK Public Private backs Epsilogen

- HydrogenOne buys Norwegian hydrogen supply project

- Barings Emerging EMEA Opportunities updates on Russia weight

- HgCapital achieves record performance for 2021

- BioPharma Credit backs UroGen Pharma

- Premier Miton Global Renewables soars above new benchmark

- Foresight Solar outperforms following first battery storage holding

- Further disappointment and Russian surprise for ScotGems

- Literacy Capital outperforms in 2021 while growth means more charitable donations

- Witan more than doubles last year’s dividend thanks to reserves

- Tough year for Baillie Gifford Shin Nippon

- Fundsmith Emerging Equities benefits from India exposure

- Fidelity European benefits from continued rebound in 2021

- VH Global Sustainable Energy Opportunities off to a strong start

- More outperformance for JPMorgan US Smaller Companies

- European Assets had a good 50th year

- M&G Credit benefits from narrower discount but tough times await

- Temple Bar sets up share split after good 2021

- International Public Partnerships says COVID woes receding

- Aquila European Renewables Income acquires 100MW solar project in Andalucía

Corporate news

- JPMorgan Russian loses another director

- Cordiant Global Agricultural Income targets $300m in new IPO

- Triple Point Social Housing REIT to amend investment policy

- Jupiter Emerging and Frontier Income considers scheme of reconstruction

- Female and ethnic minority entrepreneurs trust plans IPO

- JPMorgan Claverhouse makes 49th year of increasing annual dividend as chair retires

- Renewables Infrastructure raising cash to invest in Hornsea One

- Raven Property to de-list as Russian sanctions bite

- Dunedin Enterprise makes progress on wind-up

- Greencoat Renewables looking for more money to fund attractive near-term opportunities

- Gresham House sale of Rockwood sparks rethink of future

- Strategic Equity Capital tender taken up in full

- Cordiant Digital seeks debt finance to continue roll-out

- Gore Street plans dividend shake up and fundraise

- CIP Merchant Capital rejects Corporation Financière Européenne’s ‘highly opportunistic’ final takeover offer

- SDCL Energy Efficiency wants £75m

- New conditional tender for Aberdeen New India

- Fidelity Japan to seek shareholder approval to invest in more unlisted companies

- Hidroelectrica IPO going ahead – great news for Fondul

Managers and fees

- Allianz Technology announces results as Walter Price prepares to stand down

- New US investment and revised management agreement at Gore Street

- F&C cuts fees and ups dividend

- Ross Teverson departs Jupiter as fund edges towards oblivion

Property news

- Workspace agrees deal to buy McKay Securities for £272m

- Developments paying dividends for Tritax Big Box REIT

- Hammerson cuts losses as disposals strengthen balance sheet

- Unite sells digs portfolio for £306m

- British Land partners with AustralianSuper to bring forward Canada Water masterplan

- Secure Income REIT to see income boost due to rising inflation

- Co-living loan dents otherwise good year for GCP Asset Backed

QuotedData views

- Feeling resourceful? – 4 March

- Cushion the inflation blow – 11 March

- Why AVI Japan is blooming – 18 March

- Two years since the world changed – 24 March

Recently published research notes

JLEN Environmental Assets – It’s all about renewables

The renewable energy sector has been particularly buoyant over the past 18 months, and JLEN Environmental Assets (JLEN) is well-positioned to benefit. Initiatives such as the United Nations Climate Change Conference (COP26), new regulations on climate related financial disclosure – TCFD – and the Russo-Ukrainian crisis, combined with rising inflation and power prices, have only heightened the attractions of renewable energy.

The managers have identified an exciting pipeline of potential new investments made up of a number of opportunities from electric vehicle charging infrastructure to biomass, an area which JLEN dipped its toe into last year with its acquisition of the Cramlington facility. A recent fundraise means JLEN’s managers can get to work on this pipeline now, while the trust is also on track to achieve its dividend target for 2021/22 of 6.80p.

Ecofin US Renewables Infrastructure Trust – Clear path to growth

Having just had its first birthday in December, Ecofin US Renewables Infrastructure (RNEW) has had plenty of reasons to celebrate. It successfully deployed all its IPO proceeds ahead of target and managed to increase its dividend each quarter, bringing its aggregate total dividends for 2021 to 3.2 cents per ordinary share, a 3.2% dividend yield – again ahead of its 2-3% target for its first financial year (the target is an annual dividend yield of 5.25% to 5.75% for 2022 onwards).

The political and regulatory environment in the US continues to be supportive of substantial and reasonably rapid growth in RNEW’s target markets and as such, performance has been good for the relatively new and small fund. RNEW’s wholly-owned US subsidiary, RNEW Capital, secured a $65m revolving credit facility (RCF) last year with KeyBank (one of the premier lenders to the US renewable energy industry) on attractive terms, which the manager says will help pave the way to growing the company. It is also considering an equity fundraise in the near-term, which we welcome.

Montanaro European Smaller Companies – Unfazed by market turmoil

Montanaro European Smaller Companies (MTE) has built up an enviable track record by backing high-quality growing companies for the long-term. In recent months, fears of interest rate increases (in response to rising inflation) have triggered a sharp reversal of sentiment towards ‘growth’ stocks. The war in Ukraine has made investors more risk averse, and some have sought safety in large cap stocks. MTE’s shares have moved from trading at a small premium relative to net asset value (NAV) to trading on a single-digit discount.

What we will not see in response to this situation is any change in the way in which MTE is managed. MTE has experienced many periods where low-quality stocks outperform or investors retreat to so-called defensive (usually low-growth) stocks. The manager may take advantage of the situation by adding to favoured stocks at attractive prices, but MTE will stick by its portfolio and wait for markets to come back to its way of thinking. The current discount may represent a buying opportunity.

Strategic Equity Capital – Time to look forward

In a vote held on 23 March 2022, Strategic Equity Capital’s (SEC) shareholders have overwhelmingly approved proposals to address the trust’s discount and provide liquidity to those shareholders that need it.

We believe that the focus should now switch to the trust’s much-improved track record under manager Ken Wotton at Gresham House Asset Management (GHAM).

SEC’s investment approach emphasises qualities such as balance sheet strength, free cashflow and structural growth. As we explore in this note, that should ensure that the overall portfolio is relatively resilient in the face of the current market turmoil associated with high inflation, rising interest rates and Russia’s invasion of Ukraine.

Henderson Diversified Income Trust – Ahead of the curve

Henderson Diversified Income (HDIV) is managed with a focus on good quality issuers of debt securities operating in growing industries. Sustainability is an important factor in any assessment of quality. On 25 February 2022, shareholders overwhelmingly approved a new investment objective and policy that seeks to better define and highlight the trust’s approach to environmental, social and governance (ESG) issues.

Recent market jitters triggered by the war in Ukraine have left HDIV trading on a much wider discount to NAV and higher dividend yield than its long-run averages.

Markets were already pricing in a number of interest rate rises this year as central bankers look to choke off inflation. As we explain in this note, the managers have positioned the trust’s conservative and quality-focused portfolio in anticipation of a swift end to this process. That could help trigger the next phase of outperformance by the trust, as bond yields compress and their price rises to reflect lower than expected interest rates.

abrdn European Logistics Income – Logistics safe haven with growth on horizon

As events unfold in Ukraine and inflation rages, the European logistics property sector should prove to be a safe haven for investors. One of the largest investors in the space, abrdn European Logistics Income (ASLI), has a growing portfolio that has significant inflation protection, with all of its rental income linked to inflation indexes and almost two-thirds uncapped (meaning it will rise annually with the rate of inflation).

It has been a busy period of growth for the company, with the manager putting the proceeds from recent capital raises to good use. Its focus has been on urban logistics assets, which now account for 53% of the portfolio and which the manager says display superior rental growth potential. The group acquired an Amazon-anchored portfolio of urban logistics assets in Madrid for €227.3m in December, making the online retail giant its largest tenant. It is again on the acquisition trail following its most recent fund raise, and is in exclusive negotiations on the purchase of four new assets.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Downing Renewables AGM 2022, 6 April

- Murray International Trust PLC Online Presentation, 7 April

- ShareSoc/Yellowstone Webinar with Lloyds Banking Group, 7 April

- Gore Street Energy EGM, 11 April

- HydrogenOne manager presentation April 2022, 12 April

- Herald AGM 2022, 19 April

- Murray International AGM 2022, 22 April

- JPMorgan US Smaller Companies AGM 2022, 25 April

- Annual Investment Fund Conference 2022, 26 April

- VH Global Sustainable Energy Opportunities AGM 2022, 27 April

- EP Global Opportunities AGM 2022, 27 April

- Premier Miton Global Renewables AGM 2022, 28 April

- HICL EGM 2022, 28 April

- Greencoat UK Wind AGM 2022, 28 April

- JPMorgan Claverhouse AGM 2022, 29 April

- AVI Japan Opportunity AGM 2022, 3 May

- Smithson AGM 2022, 3 May

- RIT Capital AGM 2022, 4 May

- Apax Global Alpha AGM 2022, 5 May

- Pershing Square Holdings AGM 2022, 5 May

- abrdn Smaller Companies Income AGM 2022, 5 May

- Witan AGM 2022, 5 May

- BlackRock World Mining AGM 2022, 6 May

- Temple Bar AGM 2022, 10 May

- abrdn Asian Income AGM 2022, 11 May

- Baillie Gifford Shin Nippon AGM 2022, 12 May

- Schiehallion AGM 2022, 12 May

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – March 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.