Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

Performance

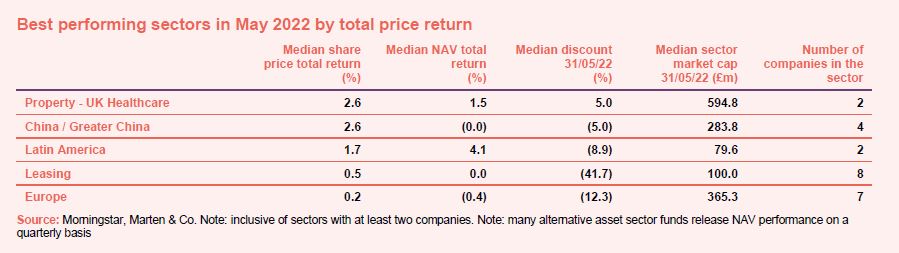

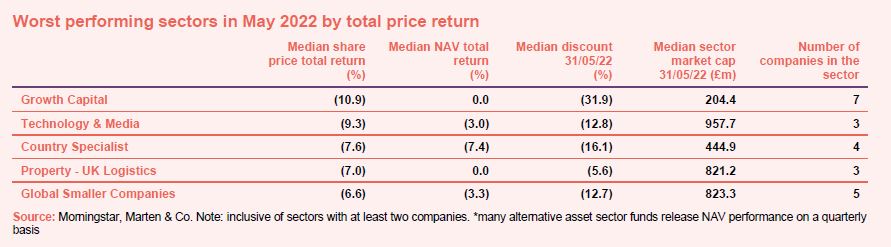

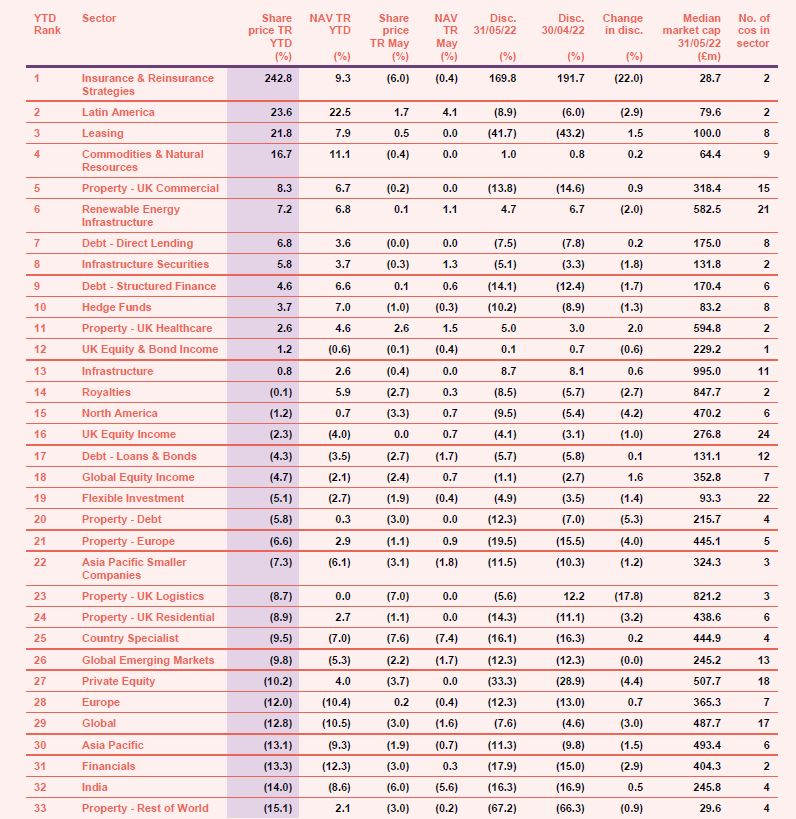

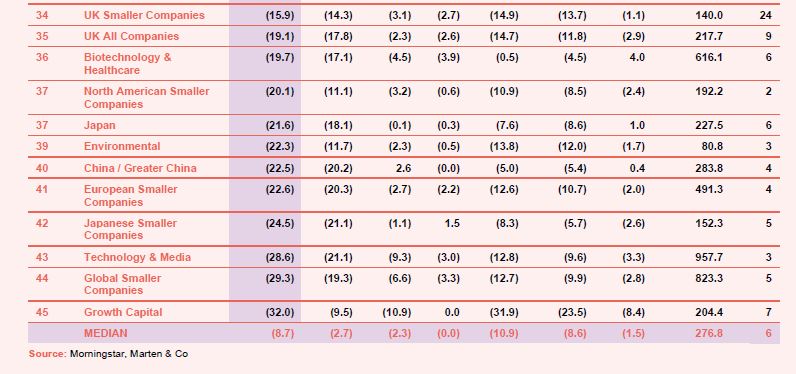

Any hopes for a more positive 2022 were shattered by the ongoing conflict in Ukraine. Economies are feeling inflationary pressures not seen in decades, commodity prices are rising and there is supply-chain disruption. The best performing sector for May was property – UK healthcare, boosted by strong performance from Target Healthcare REIT. Meanwhile, after months of poor performance not helped by new lockdowns across the country, Chinese funds finally got some respite. The Latin America sector revealed positive figures for the month, as it continues to benefit from rising oil and food prices. On the negative side, growth capital and technology & media trusts were once again the biggest losers as growth stocks continue to be out of favour. Meanwhile, the country specialist sector, which is dominated by Vietnamese funds, also suffered. The country’s deputy PM said in May that it faces a big challenge to deliver on its economic growth target of 6% to 6.5% due to inflation concerns and a slower-than-expected global recovery, but the market has rallied in June. Global smaller companies trusts were also hit by worldwide headwinds already discussed. It is worth noting that only 13 of the 45 AIC sectors reported positive share price returns in May (see Appendix 1 for a breakdown of how all the sectors have performed so far this year).

May’s median total share price return was -2.3% (the average was also -2.3%) which compares with a median of -0.4% in April. Readers interested in recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over May

Worst performing sectors over May

On the positive side

Unsurprisingly, BlackRock Energy & Resources Income took the top spot in NAV terms in May as commodity prices have continued to rise (motoring groups have warned the cost of petrol could rise to more than £2 per litre very soon). It was joined by abrdn Latin American Income for similar reasons while the higher oil price was also good news for oil producing economies outside Russia, which helped Middlefield Canadian Income. Income-producing names such as North American Income, Temple Bar and Shires Income also performed well. Reporting strong results which highlighted that dividend payments are finally getting back on track while JZ Capital Partners is set to benefit from the sale of a portfolio holding from the JZHL Secondary Fund, in which it has an interest. Meanwhile, property funds Target Healthcare REIT and Alternative Income REIT made share price gains. Both companies recently saw a valuation uplift. Syncona invested $54m of a total $56m raised by SwanBio in its series B funding round and Foresight Sustainable Forestry completed the acquisition of an afforestation project in Scotland.

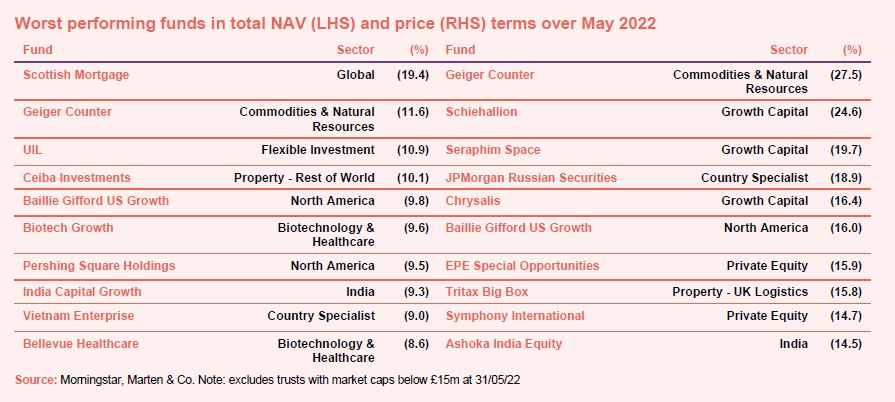

On the negative side

Looking at the laggards, Scottish Mortgage was the worst performing fund in NAV terms after reporting its worst annual results for some years. Many are questioning whether the once most-loved investment company has peaked. Geiger Counter’s NAV (and share price) also fell after an incredibly strong run though this is not as worrying as it looks. Rather it is linked to the exercise of its embedded subscription rights. Meanwhile, growth capital names such as Schiehallion, Seraphim Space and Chrysalis are still suffering from negative sentiment towards growth stocks. This also impacted those with a growth focus such as Baillie Gifford US Growth and biotechnology and healthcare names including Biotech Growth and Belluevue Healthcare. After months of yo-yo-ing between the top and bottom performers, JPMorgan Russian Securities was once again a loser in May in share price terms.

Discounts and premiums

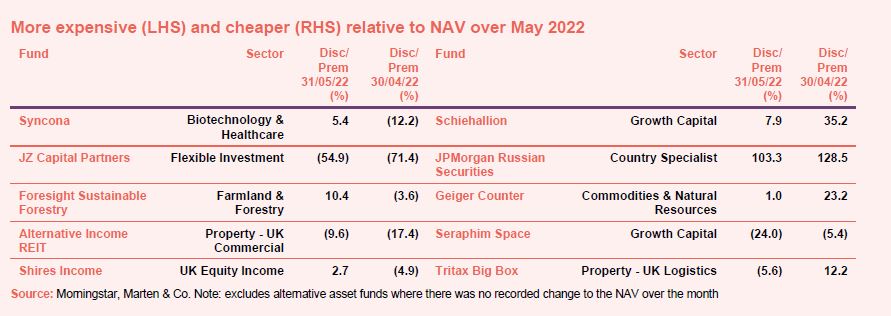

More expensive and cheaper relative to NAV

Syncona became more expensive over May, seeing its double-digit discount swing to a 5% premium. Half-way through the month it announced it had invested $54m of a total $56m raised by SwanBio in its series B funding round. JZ Capital Partners saw its huge 71% discount narrow to a 55% discount after it revealed it was set to benefit from the sale of a portfolio holding from the JZHL Secondary Fund, in which it has an interest. At the start of the month, Foresight Sustainable Forestry completed the acquisition of Dove Hill, an afforestation project near Dalry, Scotland while Shires Income announced a narrower discount and good equity returns in its annual results.

As for trusts getting cheaper, Schiehallion, whose premium swung out to double-digits in April, appeared to come back down to reality in May. The trust’s growth focus has hurt it in recent months, and the same can be said for Seraphim Space, whose 5.4% discount widened to 24%. Having increased to ludicrous levels at the start of the year, JPMorgan Russian Securities’ premium fell sharply in April and again in May, though it remains at a triple-digit 103%. Geiger Counter’s NAV and share price have also been quite volatile recently for reasons already explained and its double-digit premium at the end of April has since evaporated.

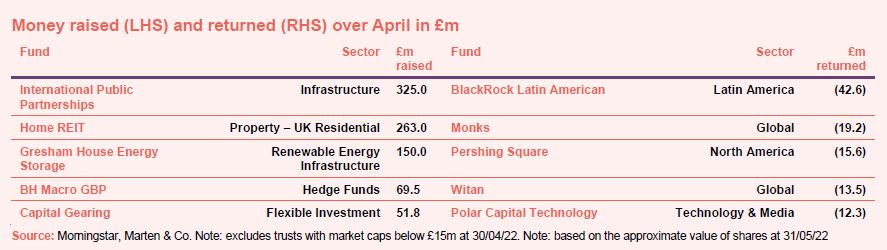

Money in and out

Money coming in and going out

Just over £1.6bn of net new money was raised in May, led by a £325m fundraise from International Public Partnerships. Home REIT also completed a £263m fundraise which will be used to acquire and create homeless accommodation across the UK. The placing was significantly oversubscribed, smashing its initial target of £150m. Meanwhile, Gresham House Energy Storage raised £150m in a placing, which will allow it to fund the majority of its pipeline. The company said that the placing was significantly oversubscribed, and a scaling back exercise was undertaken.

BlackRock Latin American completed a tender offer in May which saw the purchase of 9,810,979 tendered shares with proceeds paid to shareholders whose tendered shares are held through CREST accounts. Share buybacks were led by Monks, Pershing Square, Witan and Polar Capital Technology.

Major news stories over May

Portfolio developments

- Growth sell-off hits BlackRock Smaller Companies

- Inflation hedge works to Aurora’s benefit

- Weiss Korea holds up relatively well in falling market

- Oakley Capital chips in for Vice Golf

- HydrogenOne Capital Growth buys minority stake in fuel cell and electrolyser Elcogen

- Downing Strategic Micro-Cap on journey to grow as it publishes good results

- JLEN Environmental Assets flags big NAV jump

- BB Biotech remains resilient as biotech markets worsen

- Bluefield Solar Income buys UK-based solar and wind portfolio and announces proposed issue

- NextEnergy Solar reports positive performance for Q1 2022

- Aquila European Renewables Income acquires solar asset

- BBGI Global Infrastructure buys German motorway

- Schroder British Opportunities backs Mintec

- JPMorgan Multi Asset to match CPI inflation on dividend

- HICL Infrastructure makes first broadband investment

- Growth sell-off dents Scottish Mortgage

- Securities Trust of Scotland buoyed by consumer staples and IT exposures

- JPMorgan Japanese relative performance hit by growth focus

- Renewable energy funds hit by windfall tax rumour

- Strong performance and a special dividend from Caledonia

Corporate news

- Shaftesbury and Capital & Counties confirm £3.6bn merger talks

- Ecofin US Renewables launches fundraise

- LXI REIT and Secure Income REIT to merge

- ScotGems calls continuation vote

- AVI calls for shakeup at NS Solutions

- …and AVI targets SK Kaken

- JZ Capital Partners to benefit from portfolio holding sale in JZHL Secondary Fund

- Bluefield Solar Income pushes issue timetable back in response to windfall tax rumours

- Foresight Solar proposes policy change to allow investment in development stage assets

- Gresham House Energy Storage rakes in £150m

- Downing Renewables & Infrastructure’s hydro debt facility classified as a green loan

- Home REIT raises £263m to tackle homeless crisis

- abrdn Japan underperforms in challenging year but avoids continuation vote

- BMO UK High Income pleads case for continuation

Managers and fees

- Schroder Oriental Income cuts performance fee

- Capital Gearing reveals ‘satisfactory’ results as trust celebrates 40 years under Peter Spiller’s management

Property news

- Home REIT buys 156 properties

- Derwent buys Moorfields Eye Hospital

- Life Science REIT buys in London

- CLS frustrated by discount and proposes tender offer

- Land Securities sells Strand office for £195m

- UK Commercial Property REIT buys £62.7m hotel development

- Regional REIT splashes £48.2m on trio of offices

- Warehouse REIT posts 33.2% NAV total return as it gears up for main market move

QuotedData views

- Is logistics a house of cards? – 6 May 2022

- Delhi’s dilemma – navigating the region’s geopolitics – 13 May

- What’s the craic, Scottish Mortgage? – 20 May

- Unloved quality – 27 May

Recently published research notes

It has been another tough six months for abrdn New Dawn (ABD) as the Asia Pacific region has had to face new challenges from the Russo-Ukrainian conflict to China’s deadliest COVID-19 wave yet (the economic impacts of which have been made worse by Xi Jinping’s zero-COVID policy). This has only exacerbated headwinds already in place such as rising inflation. Manager James Thom believes the worst is behind us, but uncertainty and volatility remain. The trust itself has underperformed in the short-term but still boasts strong long-term numbers and, if a new dawn is indeed rising over the region, with India finally enjoying its reformation and the vaccine rollout (mostly) underway, now could be an attractive entry point. The trust is also trading on a 12.4% discount.

Civitas Social Housing’s (CSH’s) discount to net asset value (NAV) has yet to recover from an activist short seller attack last year, with its share price almost as low as it has ever been in over five years since it launched. Although CSH’s manager made a strong rebuttal to the allegations made by the short seller, regulatory concerns around the financial strength of some of its housing association tenants has persisted throughout its existence. To aid regulatory compliance, CSH plans to add a new clause to leases that would enable greater risk-sharing with the housing associations and allow them to temporarily stop paying rent in certain circumstances.

The fundamentals that support growth in the sector remain strong and aren’t going away, namely increased demand from individuals and a lack of supply. The high dividend yield/large discount to NAV that CSH’s shares are trading on seem appealing.

Downing Renewables and Infrastructure

With a solid first set of results published, revenue and dividends running ahead of IPO forecasts, a diverse and differentiated portfolio of attractive renewable energy assets, and a growing NAV supported by investments that are helping to build NAV and profits, Downing Renewables and Infrastructure (DORE) is attracting the support of new investors.

On 11 May 2022, the trust announced an NAV as at end March 2022 of 110.1p – up from 103.5p per share as at 31 December 2021; we discuss what drove this uplift on page 15 of this note. The share price is yet to fully reflect the good news, however; currently DORE’s shares are trading at asset value, compared to a median premium of over 7% for its peer group.

Following its latest acquisition, DORE has drawn down 69% of its £25m revolving credit facility (RCF). The manager has a strong pipeline of investment opportunities, and to access that and repay the drawings on the RCF, the directors are considering a fundraise.

Russia’s war on Ukraine and the associated spike in energy prices have underscored the need for Europe to rid itself of its fossil fuel dependence and accelerate the switch to renewables. The compelling associated cost-saving (renewable-powered energy tends to be cheaper than gas-powered energy) is an added bonus. DORE deserves to be playing an active part in this.

After a strong run of both absolute and relative performance, AVI Global Trust (AGT) faces twin headwinds of widening discounts within its underlying portfolio – as holdings’ share prices move further below their underlying net asset value – and a widening discount on its own shares.

The manager has been cautious on markets, eliminating the trust’s gearing (borrowing) at the end of 2021. That gives it the firepower to take advantage of some of the bargains being thrown up by current events. The manager believes that when markets settle, discounts will start to narrow again to AGT’s benefit. Our note describes AGT’s investment process, how it is invested currently, and goes into more detail on some of the larger holdings within the portfolio.

Standard Life Investments Property Income

Standard Life Investments Property Income Trust’s (SLI’s) portfolio has performed strongly over the past year, posting a net asset value (NAV) total return of 30.7%. It is reaping the rewards of its manager pivoting the portfolio’s focus onto the well-performing industrial and logistics sector many years ago (it now makes up 55% of the portfolio). This has allowed the manager to sell assets for substantial profits in a buoyant investment market for industrial assets; focusing on properties that it believes do not fit future occupier needs – specifically, on sustainability features.

The company has around £45m available for new investments and the manager has set its sights on lower-yielding (more expensive relative to rental income), quality assets that have strong environmental, social and governance (ESG) credentials, which it believes will provide it with resilient long-term income with superior growth potential. Despite recent valuation gains, the company’s share price has not kept pace, and it currently trades on an attractive discount to NAV of 23.7%.

Ian Francis, the manager of CQS New City High Yield Fund (NCYF), has observed the marked shifts in central banks’ policy towards raising interest rates this year. He feels that, while recent rises are a move in the right direction, central banks’ caution – driven by concerns regarding the fragility of the global economy and the risk of repeating previous policy mistakes of tightening monetary policy into a slowdown – is leading to a very serious risk of inflation taking hold.

He thinks inflation could become embedded at a potentially unsustainable level and that the UK economy is more vulnerable than those of Europe and the US. Reflecting this, financials and real assets account for a large part of NCYF’s portfolio. Ian has also been adding to NCYF’s overseas exposure at the margin and has been gradually edging up the portfolio’s exposure to equities.

Heightened downside risk and disappointing earnings updates have seen the technology sector give back some of its considerable long-term outperformance of the wider market. As investors retreated to the sector titans (stocks such as Microsoft and Apple), Polar Capital Technology’s (PCT’s) underweight position in these companies has seen it underperform its benchmark over the 12 months to the end of April. PCT’s manager, Ben Rogoff, is undeterred by this, stating that technology stocks are in a better place than last year, and comparable performance will be more favourable going forward.

The manager has taken advantage of valuation compression in the sector to upgrade PCT’s portfolio, rotating away from stocks (such as those in e-commerce), which are more sensitive to the economic cycle, and into secular growth stocks (such as software companies), where earnings are more constant even during downturns. Ben believes that, despite depressed economic growth, the long-term fundamental growth drivers for the sector remain.

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Round Hill Music Royalty Fund AGM 2022, 9 June

- Invesco Perpetual UK Smaller Cos AGM 2022, 9 June

- BlackRock Smaller Companies AGM 2022, 9 June

- Nippon Active Value AGM 2022, 10 June

- Jupiter Emerging liquidation EGM, 13 June

- Fair Oaks Income AGM 2022, 14 June

- Foresight Solar AGM 2022, 15 June

- Baillie Gifford China Growth AGM 2022, 16 June

- Octopus Renewables Infrastructure AGM 2022, 17 June

- RTW Venture Fund AGM 2022, 21 June

- Ecofin US Renewables AGM 2022, 22 June

- Menhaden Resource Efficiency AGM 2022, 22 June

- Cordiant Digital Infrastructure AGM 2022, 23 June

- Invesco Bond Income Plus AGM 2022, 24 June

- Aurora Investment Trust AGM 2022, 28 June

- Pacific Assets AGM 2022, 28 June

- Scottish Mortgage AGM 2022, 30 June

- abrdn Japan AGM 2022, 1 July

- Shires Income AGM, 6 July

- QuotedData’s Property Conference 2022, 7 July

- JPMorgan Multi Asset Growth and Income AGM 2022, 8 July

- Downing Strategic Micro-Cap AGM 2022, 11 July

- Biotech Growth AGM 2022, 19 July

- BMO UK High Income AGM 2022, 20 July

- Fidelity China Special Situations AGM 2022, 20 July

- Odyssean Investment Trust AGM 2022, 21 September

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – May 2022 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.