Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

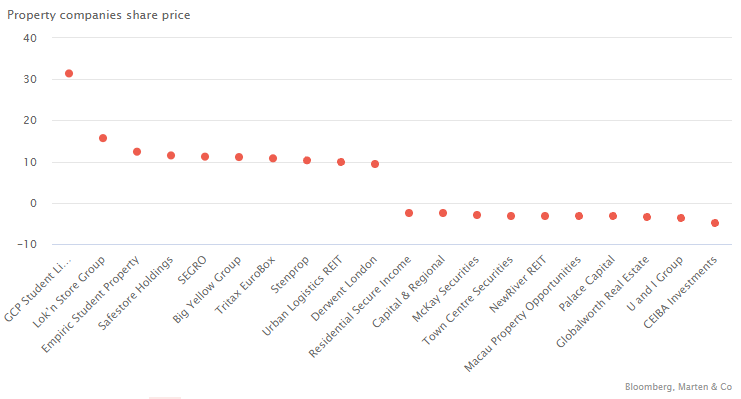

July’s biggest movers in price terms are shown in the chart below.

It was no surprise that GCP Student Living topped the table for best performing property companies in July after it received a takeover bid 30% above its share price during the month.

Fellow listed student accommodation specialist Empiric Student Property saw its share price bounce on the back of the news. The three listed self-storage specialists – Lok’n Store, Safestore and Big Yellow Group – all witnessed double-digit rises in their share prices after reporting impressive operational performances as the sector continues to benefit from structural tailwinds. Logistics giant SEGRO’s share price jumped 11.2% after it reported impressive half-year results in which its portfolio valuation grew 10.2%. A huge surge in demand for logistics space sees no signs of abating and logistics specialists are continuing to benefit. Tritax EuroBox is putting together an impressive portfolio in Europe, while Urban Logistics REIT is operating in one of the most supply-constrained sub-sectors in property. SEGRO is up 28.5% in the year-to-date, while Tritax EuroBox and Urban Logistics REIT are up 21.3% and 20.6% respectively.

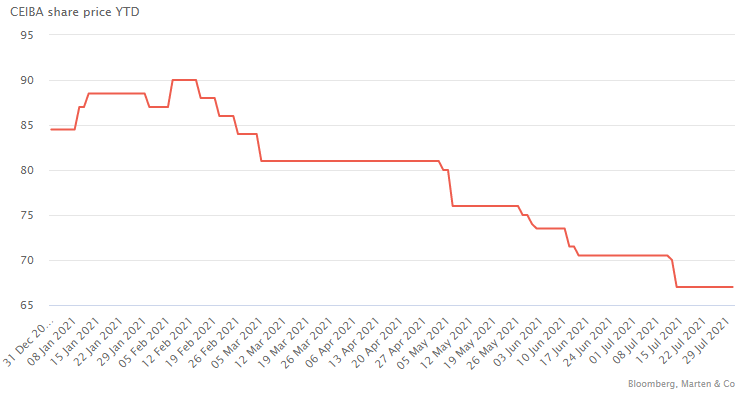

It was a mixed bag in the list of worst performing property companies in July, with CEIBA Investments at the bottom of the pile. The Cuban real estate investor has suffered from harsh US sanctions and the pandemic and has not been helped by recent unrest in the country. Its share price is down 20.7% in the year-to-date.

Central and Eastern Europe office investor Globalworth Real Estate saw its share price come off a further 3.5% in the month after the hostile takeover of the company progressed. NewRiver REIT, which owns shopping centres and retail parks, also saw its share price fall in July, despite selling its pubs business for £222m. Secondary mall owner Capital & Regional was again down on the month, with operational performance not yet at pre-COVID levels. In the past three months its share price is down 18.4%. Rounding off the list was Residential Secure Income, which owns a portfolio of affordable housing, having been the best performer in share price terms in June. In the year-to-date the group has seen its share price rise 15.8%.

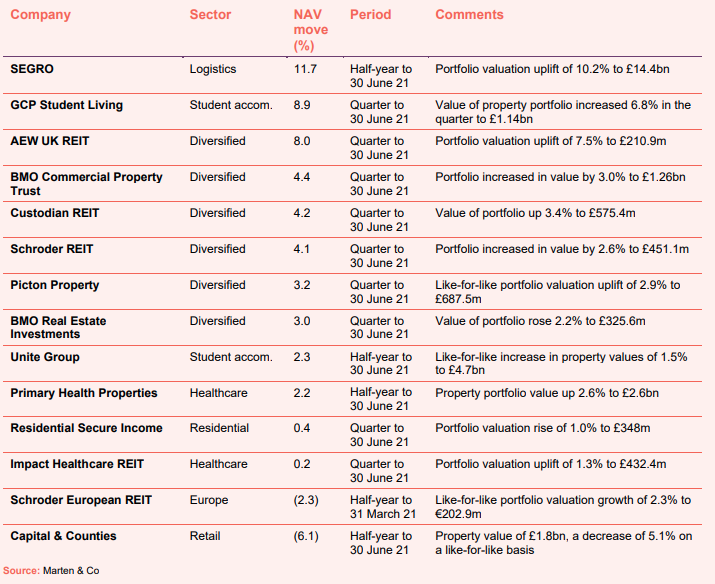

Valuation moves

Corporate activity

GCP Student Living received a takeover bid from Scape Living (funded by APG – a current shareholder) and iQ (funded by Blackstone) valuing the company at £969m. The bid price of 213p per share was a 30.7% premium to its 1 July share price and a 19.1% premium to its 31 March 2021 EPRA net tangible asset value of 179p. The board intends to recommend in favour of the bid.

CPI Property Group and Aroundtown declared their takeover offer for Globalworth Real Estate Investments unconditional. The Frankfurt-listed group’s received acceptances from just 2.7% of Globalworth shareholders, but they already hold 51% of shares between them, meaning they can complete the deal by lowering the acceptance threshold to 50% from 90%. The €7-per-share cash offer values Globalworth at €1.57bn. All remaining conditions for the takeover have been satisfied, after the Romanian competition regulator gave its approval.

The initial public offering (IPO) of UK Residential REIT failed to raise its target £150m. The investment company announced its intention to float at the beginning of June and was hoping to enter the market on 16 July.

Urban Logistics REIT raised £108.3m in an equity raise. A total of 65,870,766 shares (£102.1m) in the company were placed at an issue price of 155 pence. Additionally, a total of 4,000,000 shares (£6.2m) were placed by PrimaryBid.

Home REIT announced it was considering a potential issue of further equity, having fully deployed the equity and committed the debt facility raised on and since its IPO in October 2020. Based on the identified pipeline and discussions already underway, the company said that the net proceeds of any issue of equity would be substantially invested within three to six months.

Assura cut the size of its revolving credit facility from £225m to £125m. Its A-credit rating allows it to borrow at more attractive rates.

Major news stories

NewRiver REIT sold its pub business, Hawthorn Leisure REIT, to Admiral Taverns for £222.3m. It will use the proceeds to strengthen its balance sheet and reduce its loan to value (LTV) to below 40%.

Hibernia REIT pre-let of the majority of its 337,000 sq ft office development at Harcourt Square, Dublin, with KPMG Ireland at an initial net effective rent slightly below €50 per sq ft per annum.

Regional REIT sold an industrial property portfolio for £45m, reflecting a net initial yield of 6.75% and a 7.5% premium to valuation, as it continues to focus its portfolio on higher yielding regional offices.

British Land acquired a retail park in Thurrock for £82m and plans to redevelop it into an urban logistics scheme. The company has turned its hand to logistics development to take advantage of the favourable demand-supply characteristics.

Aberdeen Standard European Logistics Income acquired an urban logistics warehouse in Barcelona, Spain for €18.8m and a net initial yield of 3.7%. The 13,907 sqm asset is let to Mediapost until 2029.

LondonMetric signed two new lettings in its logistics portfolio totalling 260,000 sq ft. Carlton Packaging took 172,000 sq ft at its Bedford Link development, and My 1st Years took 86,000 sq ft at Grange Park, Northampton. Both on 15 year leases.

Stenprop acquired Bradley Hall Trading Estate, Wigan, for £20.6m, reflecting a net initial yield of 6.43% and a capital value of £67.40 per sq ft. The 275,079 sq ft property is 100% let and generates an annual rent of £1.4m.

- Custodian REIT sells industrial portfolio 10% above book value

Custodian REIT sold a portfolio of five industrial assets – in Gateshead, Stockton-on-Tees, Warrington, Stone and Christchurch – for £23.355m, 10% above the June 2021 valuation.

Derwent London sold Angel Square in Islington to Tishman Speyer for £86.5m. The 126,200 sq ft office was let to Expedia and The Office Group but will become vacant following the sale.

- Great Portland Estates lets Regent Street store to UNIQLO

Great Portland Estates has let the entirety of the 56,850 sq ft 103/113 Regent Street to UNIQLO, which will take the space from Superdry and occupy both the retail space and above office space.

QuotedData views

- Levelling up – 23 July 2021

- Defining future fit offices – 16 July 2021

- Another property takeover? – 9 July 2021

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

David Sleath, chief executive:

A significant portion of occupier demand continues to arise from the increased use of digital channels by retailers and consumers which, in turn, is driving increased e-commerce penetration and consumption of data across Europe. Although internet sales penetration levels have understandably fallen from their highs as physical retail has reopened, they remain significantly higher than pre-pandemic levels as cultural barriers have been overcome and habits have changed. We believe that the long-term trend towards increased online shopping has been amplified and accelerated by the pandemic and this has given a new impetus to demand for space.

Coupled with that, many customers and logistics suppliers are placing renewed emphasis on supply chain resilience, near-shoring and local sourcing, improved customer service and cost or inventory efficiency which are fuelling increased demand for modern, well-located warehouses – both urban and big box. We expect these themes to continue for some time. More recently we have also seen demand arising from emerging new sectors including creative industries and q-commerce (including rapid food delivery providers).

Record levels of take-up across Europe have resulted in low vacancy rates and in most of our markets supply currently equates to less than a year of take-up. This is resulting in rental growth in our core markets, most notably in urban areas where the combination of a shortage of modern warehouse space, a shortage of land suitable for development and the diversity of the occupier base is most prevalent. Given these strong market dynamics investor demand for well-located, modern industrial assets is likely to continue to grow, putting further upward pressure on asset values.

Healthcare

Steven Owen, chairman:

The provision of healthcare in the UK and Ireland will need to be transformed over the coming years as the NHS and HSE respond to the long-term requirements of dealing with the COVID-19 pandemic together with the resultant backlog of non-COVID-19 treatments that have been suspended and now need to be addressed. While remote consulting is here to stay, we do not expect it to have a material impact on future space requirements; although useful for an initial triage, it often results in the need for a subsequent physical appointment or is not suitable for all patients, especially the elderly.

In July 2021, the government published a draft Health and Social Care Bill setting out a number of reforms in order to implement the commitments of the NHS England Long Term Plan including the introduction of regional Integrated Care Boards and Partnerships tasked with co-ordinating NHS partners with local government services and budgets such as social care and mental health, in a geographic area, for the first time. The idea being that services are then pushed to the most efficient, cost effective part of the system (whether primary care, hospital or care home) for the best patient outcomes. We welcome these reforms and are hopeful they will lead to further development opportunities in primary care in the medium to long-term.

With many services now expected to move away from hospitals and into primary care facilities together with the NHS’s ambition of being the world’s first carbon net zero healthcare system by 2045; these changes will undoubtedly require substantial investment into other areas, most notably primary care that will be able to take on the non-urgent and periphery procedures and deal with the long-term demographic trends of populations that are growing, ageing and suffering from more instances of chronic illness.

Diversified

Richard Shepherd-Cross, investment manager:

UK commercial property investment activity in the first half of 2021 has been at levels last seen in the first half of 2018, according to a recent report by Carter Jonas, with over £20bn of investment. Market demand has been focused on the industrial and logistics sector where rising prices continue to indicate record low yields, but demand for office investment is resurgent, with Q2 outstripping Q1 and the retail warehouse market is also showing a sharp recovery in investment activity. Colliers reported £1bn of investment into retail warehousing in the first half of the year and, in common with the office sector, Q2 was stronger than Q1.

Investment demand has been matched by occupier activity. In the industrial and logistics sector there is a depth of demand from a range of occupiers which, along with limited supply, restrictive planning and build-cost inflation constraining the pipeline of new development, is leading to sustained rental growth. These factors have resulted in a £20.2m (7.5%) increase in valuation during the Period. In strong regional office locations, where office space is well-matched to occupier demand, rental growth is taking place and many occupiers are starting to plan for post-pandemic working practices. Demand for retail warehousing let off low rents is robust despite, or perhaps due to, pandemic-restricted shopping habits. Challenges remain on the high street, but on prime and good secondary high streets, rents are finding a level which can attract occupiers and maintain occupancy.

Peter Lowe, investment manager:

The property market continued to deliver positive total returns over the second quarter with the continuing success of the vaccine roll-out and further relaxation of restrictions contributing to improving consumer, business, and investor sentiment. A note of caution remains around the rising COVID-19 cases, which is continuing to weigh on the manufacturing, retailing and hospitality sectors, with isolation protocols leading to staffing shortages.

As in previous quarters, performance was driven primarily by the industrial and distribution sectors where the weight of investor demand is continuing to generate yield compression with occupational markets offering further support to pricing through leasing activity and rental growth. Yields across all Industrial sub-sectors are trending down in the context of strong occupational fundamentals driving record low vacancy rates and correspondingly attractive rental growth.

The retail sector is showing signs of some stabilisation, with opportunistic investors beginning to call the bottom of the market. There is caution however and sentiment is fragile given the likelihood of further rental decline and occupier fallout as COVID support measures unwind. While the yields are no longer falling at the same rate, valuations remain under downward pressure.

While the nature of the UK’s return to work and adoption of flexible working practices remains uncertain vacant space in the office markets is increasingly being taken up and large corporate occupiers are beginning to move to acquire new space. However, this recovery will not be spread evenly across geographic regions and asset types, which is continuing to weigh on the offices sector as a whole.

Student accommodation

Richard Smith, chief executive:

We have growing visibility and confidence over our income for the 2021/22 academic year, reflecting record student demand and an enhanced campus experience this autumn. This underpins our guidance for occupancy of 95-98% and rental growth of 2-3% for 2021/22. There remains a higher risk than usual to occupancy due to uncertainty around international student arrivals, although we have minimal exposure to students currently in red list countries.

We are anticipating record student numbers for the 2021/22 academic year, with UCAS data showing a 4% increase in the number of applicants as at the 30 June deadline compared to 2020/21. A record 43% of UK 18-year-olds have applied to university this year, reflecting growing awareness of the opportunities and life experience it provides. Applications from non-EU students are up 14%, including notable growth from China and India, which has helped to substantially offset the expected decline in EU applications (-43%) as a result of Brexit and COVID-19 travel restrictions.

All Higher Education students were allowed to return to in-person teaching from mid-May and the Government has recently confirmed that there will be no restrictions on in-person teaching and learning in universities from 16 August. A recent student survey by HEPI underlined that in-person teaching remains fundamental to student experience and their perception of value from their course. Universities will continue with blended learning in the Autumn term, albeit with a greater emphasis on in-person teaching in smaller groups, tutorials and practical settings. There remains a risk that student numbers and demand for student accommodation could be impacted by a further wave of COVID-19. In particular, there is uncertainty over international student numbers, given ongoing travel restrictions.

Retail

Ian Hawksworth, chief executive:

Elevated level of enquiries, strong transactional activity and improving sentiment indicate that the worst of the pandemic may be behind us. There remain challenges in the near term, however the return of office workers and opening of nightlife and theatres will help the economy move towards more normal levels of activity. Covent Garden vacancy remains low, although wider vacancy issues across the West End may take some time to be absorbed by the market.

Customer sales data is moving in the right direction with positive trajectory to date and it will be important this continues for the rest of the year to build towards the important Christmas trading period. The pace of rental decline has slowed, and yields are stable reflecting the valuers’ view on improving sentiment and the strength of demand for this prime central London estate.

Europe

Jeff O’Dwyer, fund manager:

The initially slow rollout of COVID-19 vaccines in the EU and the new surge in infections during March and April means that many countries are likely to remain in lockdown or under tight measures to control the spread of the virus. Accordingly, Schroders now expects the recovery in eurozone consumer spending once non-essential shops, bars and restaurants re-open to begin in the second half of 2021. Germany is likely to be the first of the big four countries to get back to its pre-virus level of GDP, thanks to the recent strength of its exports trade with Asia and the US. Italy and Spain, which are more reliant on tourism, may not fully recover until 2023. The rebound in energy and commodity prices means that inflation is likely to accelerate to 2% by the end of 2021, before easing to 1.2% next year. We expect the ECB to leave the refinancing rate at zero and continue with quantitative easing through to the end of 2022.

Looking forward, the real estate sector is becoming increasingly operational, with technology arguably increasing a building’s physical life whilst limiting its economic life. This could increase obsolescence and therefore favour buildings in mixed-use, densely populated urban areas that can be adapted to new technologies and changing occupier trends. Occupiers will also require more personalised service levels and increased engagement with landlords so that both can deliver their sustainability objectives.

Real estate research notes

Tritax EuroBox – Full throttle

Civitas Social Housing – On firm footing

Standard Life Investments Property Income Trust – Focus on tomorrow’s world

Grit Real Estate – On the pathway to recovery

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.