Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

December’s biggest movers in price terms are shown in the chart below.

The boost of coming out of the second national lockdown in early December was short lived as Christmas was cancelled for most of the UK with COVID-19 cases spiking. It did little to dampen investor appetite for real estate stocks, however, with the vaccination programme in the UK getting underway. For the second month running, shopping centre owner Capital & Regional saw its share price soar – this month by 21%.

In the final quarter of 2020, the company saw its share price bounce 86.7%, albeit from a low base after a prolonged period of falls. Fellow retail landlords NewRiver REIT, which also owns a portfolio of pubs, and Hammerson likewise had strong ends to 2020 with 20% and 14.9% share price increases in December, respectively, and 71.4% and 52.5% in the fourth quarter. Meanwhile, two office specialists – Workspace and Regional REIT – saw significant gains as the vaccine news spurred hopes of a return to the office. Buoyed by a positive trading statement in which it revealed it was ramping up its industrial and logistics business, St Modwen Properties saw double-digit growth in its share price.

Coming off big gains in November following the positive vaccine news, there were several funds that saw their share price fall in December. Top of the list was small-cap company Drum Income Plus REIT, where its small shareholder base magnifies the impact of dealings. Palace Capital, which saw its share price jump more than 20% in November, lost some of that momentum in December with a 10.2% fall.

Alternative Income REIT, whose new investment strategy had been well received by investors, saw its share price fall 7%, sullying an otherwise positive end to 2020 in which its share price gained 17.1% in the final quarter. Despite a strong year of growth, in which it raised more than £220m, Urban Logistics REIT saw its share price fall 3.7% in December, and ending the year with a share price fall of 1.4%. U and I Group have been perennial members of the worst performing real estate funds in share price terms throughout 2020, having been hit with falling values of city centre schemes, and in December lost a further 2.7% in value, bringing its decline over the year to 65.1%.

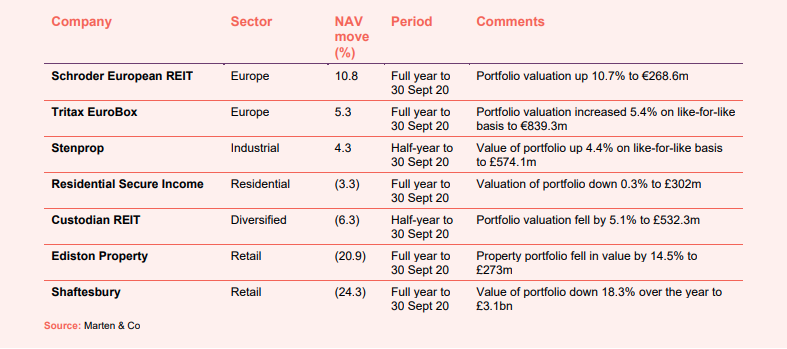

Valuation moves

Corporate activity in December

Aberdeen Standard Investments (ASI) announced it was acquiring a 60% interest in Tritax Management, the fund manager behind Tritax Big Box REIT and Tritax EuroBox. The move by ASI comes as it looks to strengthen its offering in the growing logistics real estate market, where it already has a listed fund in Aberdeen Standard European Logistics Income.

Primary Health Properties internalised its management with the acquisition of its manager Nexus Tradeco for £33.1m. It said it would save £4m a year in fees.

SEGRO acquired a controlling stake in Sofibus Patrimoine, a Euronext Paris-listed company that owns a portfolio of urban logistics assets in Paris. SEGRO already owned a 19.5% stake in the company and bought a further 74.9% for €178.6m – valuing the company at €238.5m. SEGRO intends to file a tender offer for the shares it does not own before delisting the company.

Home REIT secured a £120m debt facility with Scottish Widows. It has a 12-year term and a fixed interest rate of under 2.1%. Having launched in October in a £240.5m IPO, the company has spent £115m and is in advanced negotiations on deploying the remaining capital and debt.

Stenprop secured a new seven-year, £66.5m fixed rate senior debt facility with ReAssure, which refinances an existing £61.5m loan that was due to expire in June 2022. The new loan is fixed at an annual rate of 1.66%, compared to 3.2% on the previous arrangement, reduces the cost of debt on its multi-let industrial portfolio from 3% to 2.2% and extends the weighted average maturity from 2.8 years to 5.6 years.

Triple Point Social Housing increased its existing revolving credit facility (RCF) from £130m to £160m and extended its term by a year to December 2023.

Grit Real Estate Income is to transfer the listing category of its ordinary shares from a standard listing to a premium listing. This would qualify it for inclusion in the FTSE indices and increase protections for shareholders under the listing rules. The target date for this is 22 January 2021. The company is also looking to redomicile from Mauritius to Guernsey.

Hammerson now has a secondary listing on the Euronext Dublin stock exchange, guaranteeing it an EU equivalent trading venue.

December’s major news stories

British Land sold a 75% stake in a portfolio of three offices in London’s West End (10 Portman Square, Marble Arch House and York House) for £401m, reflecting a blended net initial yield of 4.32%.

Standard Life Inv. Property Income sold a portfolio of four multi-let industrial estates for £37.75m, a retail warehouse in North Shields for £3.3m and an office in Derby for £4.3m. Proceeds will be used to repay debt and fund share buy backs.

- Stenprop steps up portfolio transformation with UK multi-let industrial buys and Berlin retail sales

Stenprop acquired three multi-let industrial estates – in Edinburgh, Cardiff and Wigan – for £11.82m. It also sold the Hermann Quartier shopping centre and the Victoria Centre, both in Berlin, for €30.8m and €37.45m respectively. On completion of the deals, UK multi-let industrial assets are expected to make up 72% of Stenprop’s total portfolio.

UK Commercial Property REIT bought an Asda supermarket in Torquay, Devon, for £16.6m and a net initial yield of 4.7%, and agreed to forward fund the development of a purpose built student accommodation asset in Edinburgh for £29.1m.

Schroder REIT completed the acquisition of Langley Park in Chippenham and Stanley Green Trading Estate in Manchester, with an adjoining development plot, and for £19.25m and £17.25m respectively.

Urban Logistics REIT bought three logistics assets in Huntingdon, Northampton and Fareham for £22.9m as it continues to deploy the proceeds from its recent equity raise.

Aberdeen Standard European Logistics was awarded four Green Stars out of five in the Global Real Estate Sustainability Benchmark (GRESB) survey.

Land Securities sold 1 & 2 New Ludgate, located next to the Old Bailey, for £552m, ahead of valuation, and bought an office development opportunity at 55 Old Broad Street for £87m.

Tritax EuroBox refined its acquisition strategy to a more value-add approach, acquiring assets earlier in the development process or with leasing events and vacant land.

Regeneration company Harworth sold 12.5-acres at its South East Coalville development in the Midlands to Bellway Homes and in the final quarter of 2020 sold 51.73-acres of land to housebuilders for just over £33m.

QuotedData views

- Is a European logistics powerhouse on the cards? – 11 December 2020

- What next for Debenhams and Arcadia landlords – 4 December 2020

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Retail

Brian Bickell, chief executive:

In the year ahead, the widespread distribution of effective vaccines will bring a gradual return of confidence and activity across the West End and, a recovery in domestic footfall and spending to our villages. At the present time, it is not possible to predict at what point conditions will improve but it is likely social distancing and other restrictions, with the risk of further lockdowns, will continue into the spring and possibly early summer, putting further financial strain on many of our occupiers. The overhang of unusually high vacancy across the West End will take time to be absorbed.

The direct and immediate impact of restrictions to control the pandemic are being seen in cities across the country and much of the world. However, the economies of London and the West End have a long history of structural resilience, having weathered many episodes of challenges and uncertainties. Their unique features, which come from a culture of constant evolution across a broad-based economy, attracting talent, creativity, innovation and investment from across the world, will hasten their recovery and reinforce their enduring appeal to businesses, visitors and residents alike.

William Hill, chairman:

COVID-19 is making us rethink how we live, work, shop and play. Irrespective of whether the economy gets back to where it was, we will be using real estate in a different way to that pre-crisis. Some of the change was already in the pipeline. Mega trends relating to the climate crisis, demographics, digitalisation, disruption from new technologies (such as robotics), the emphasis on health and well-being and the circular economy were all there before. The post COVID-19 ‘reset’ will accelerate the pace of many of these changes. Other changes will be new and reflect risk management against future pandemics. As owners of real estate we want to be on the right side of these changes by holding assets that are likely to both show resilience to short term economic volatility and the ability to generate attractive long term performance from current valuations.

The board remains positive about the company’s exposure to its retail warehouse focussed portfolio. It has a high proportion of essential retail tenants, a defensive convenience led bias, rents at affordable levels and it fits well into the new retail economy, including retailers’ omnichannel strategies.

Industrial

Paul Arenson, chief executive:

The current low interest rate environment is likely to remain for some considerable time, which will favour high yielding assets with sustainable and growing rental flows. Notwithstanding the recent positive news regarding a vaccine, we are very aware of the continued threat from the pandemic and the additional uncertainty regarding Brexit. The multi-let industrial (MLI) sector has displayed its strength over the last six months and we have seen a material increase in demand from a new and ever diversifying occupier base. The pandemic has accelerated the adoption of e-commerce and the importance of regional distribution channels, which are served well by businesses operating within MLI property.

Europe

Sir Julian Berney Bt., chairman:

Faced with a global pandemic such as COVID-19 and ongoing political risk such as Brexit, it is impossible to accurately forecast with any degree of confidence how European economies and real estate markets will perform this year. In the face of uncertainty, we believe there will continue to be caution amongst occupiers, investors and banks, which will put downward pressure on rents and values in the short-term, particularly in certain sectors such as retail. We expect the consequences of COVID-19 to continue to present a challenging market backdrop for the foreseeable future and lead to long-term and permanent structural changes affecting how we live, work and play, particularly for leisure and shopping centres.

Robert Orr, chairman:

Occupier demand is set to remain strong, while the supply of new logistics space will be constrained for some time to come, which is positive for market rental growth. While each European country is different, there are common themes of rising occupational demand, constrained supply, increasing rents and improving lease terms. There is a growing body of evidence that the COVID-19 pandemic is leading to an acceleration in many of these trends, intensifying occupational demand and increasing investment returns. Logistics property occupiers are responding to profound structural and operational changes in their markets. To ensure these occupiers have sustainable business models, they must focus on meeting the needs and changing demands of modern consumers; optimising their supply chains to reduce costs; and ensuring they occupy sustainable assets that will be fit for purpose for years to come.

Diversified

Richard Shepherd-Cross, investment manager:

As we see increasing confidence in the collection of contractually deferred rents and once landlords can formally pursue non-payers, positive sentiment towards the income credentials of commercial real estate investment is likely to return. In a low return environment, where dividends are under pressure across all investment markets, we believe that property returns will look attractive and the search for income and long-term capital security will bring many investors back to real estate. We expect further tenant failures as government support packages are withdrawn, the lockdown and subsequent restrictions bite and while CVAs remain legal, if questionable, practice, but this is likely to be heavily weighted towards the retail sector and should not diminish the overall appeal of real estate.

Residential

Rob Whiteman, chairman:

Regardless of the implications of the COVID-19 outbreak, the country will still have a significant shortfall of housing and even more so affordable housing. The past 12 months has highlighted the need for new investment by long-term investors into this sector, particularly given the need of housing associations to invest huge sums into ensuring their existing stock is both safe and energy efficient reducing their ability to provide new affordable homes. Last year brought to everyone’s attention the importance of good quality, fit for purpose, affordable housing. All of our homes have highlighted their social value for residents; be it the ability for retirees to live with peers and avoid loneliness, provide accommodation for those otherwise homeless; or to provide spacious high quality affordable home ownership to lower- and middle-income households through shared ownership.

Real estate research notes

Aberdeen Standard European Logistics Income – Expansion on the radar

Lar Espana Real Estate – Built to last

Tritax EuroBox – Boxing clever

Civitas Social Housing – Solid foundations for future growth

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.