Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

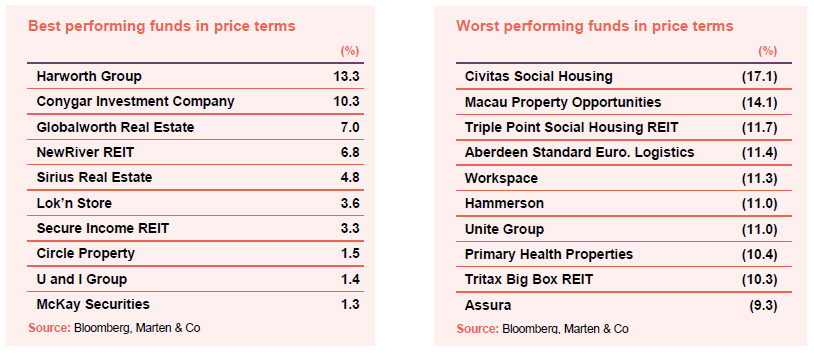

September’s biggest movers in price terms are shown in the chart below.

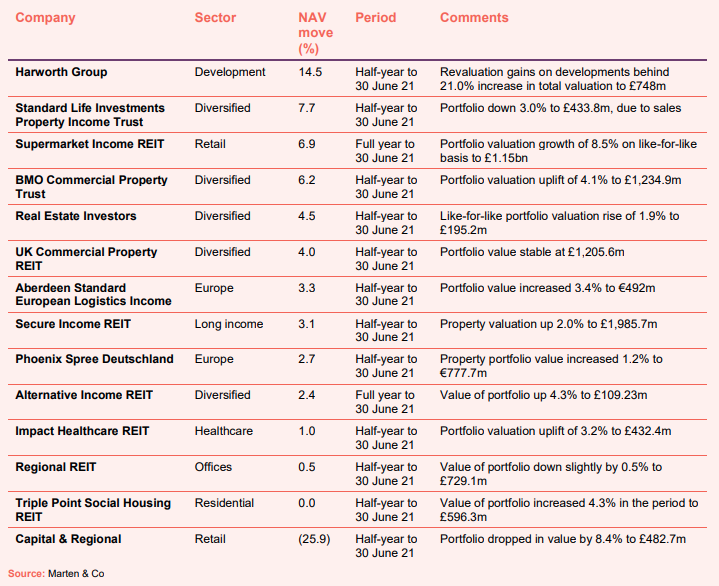

With fears that economic growth will be stunted by supply chain issues, September wasn’t a great month for property stocks. However, development and regeneration specialist Harworth saw its share price rise 13.3% in the month after reporting a 14.5% uplift in EPRA net disposal value (NDV) for the six months to 30 June 2021. This was largely thanks to an increase in the value of its industrial and logistics developments. The group set out plans to double the size of the business over the next five to seven years.

NewRiver REIT is also embarking on a renewed strategy focused on resilient retail and in September saw its share price rise 6.8%. On an annual basis, the company’s share price has risen 68.8%. Secure Income REIT posted impressive half-year results that showed valuations across its long-income portfolio of healthcare, leisure and budget hotels were continuing to recover from the depths of 2020. Its share price rose by 3.3% in line with its net asset value (NAV) growth of 3.1%. The group was also the subject of press speculation around a possible £3bn merger with LXI REIT, but initial talks have now ended. Interestingly, LXI’s share price fell 7.9% during the month.

Civitas Social Housing’s share price took another dive in September, by 17.1%, having fallen 10.8% in August. Short-seller ShadowFall published a report criticising the company for not disclosing possible conflict of interest matters in a small number of property transactions as well as questioning the strength of some of its housing association tenants. The share price fall may have been compounded by the group dropping out of the FTSE 250 index.

Fellow social housing specialist Triple Point found itself in the crossfire of the short-selling drama. Two regular constituents of the best performing property companies – Tritax Big Box REIT and European specialist Aberdeen Standard European Logistics Income (ASLI) – both raised equity in September at discounts to the prevailing share price (but premium to NAV) which could explain the double-digit share price falls both recorded in September. In the year to date, Tritax Big Box is up 26.6%, while ASLI is up a more modest 2.9%. Perhaps reflecting the heightened uncertainty around the economic recovery in the UK, Workspace Group (London flexible offices) and Hammerson (retail) both saw their share price come off.

Valuation moves

Corporate activity

In a huge vote of confidence for real estate, just shy of £1.4bn was raised by property companies in September. Home REIT led the way, raising £350m in a significantly oversubscribed issue, substantially exceeding its target of £262m.

Tritax Big Box REIT raised £300m in a placing of shares, while its European-focused sister fund Tritax EuroBox raised £213m (€250m), far exceeding its £170m target.

Aberdeen Standard European Logistics Income raised £125m, which will be deployed into an identified pipeline of European logistics assets.

Private rented sector (PRS) specialist Grainger will use the proceeds of its £209m raise to grow its portfolio of 10,000 homes, while PRS REIT fell short of its £75m target with a £55.6m placing.

Finally, Target Healthcare REIT raised £125m through an oversubscribed issue. The investment manager has a pipeline of acquisition opportunities worth £230m.

Custodian REIT and Drum Income Plus REIT agreed terms on an all-share acquisition of Drum by Custodian. The offer was at a ratio of 0.530 Custodian shares for each Drum share, valuing the company at £21.4m.

Supermarket Income REIT announced it was looking to raise £100m through a placing of new shares. The issue price of 115p is a 6.5% premium to its last reported EPRA NTA. The group’s investment manager has an immediate acquisition pipeline of four assets worth £180m.

Stenprop changed its name to Industrials REIT, with a new ticker of MLI. Multi-let industrial (MLI) assets now comprise 92% of its total portfolio, and the group is on course to be a 100% MLI business by March 2022.

LXI REIT held what it called “very preliminary discussions” with Secure Income REIT over a possible £3bn merger of the two funds, but said it was “no longer reviewing this opportunity”.

Major news stories

Civitas Social Housing was targeted by short-seller ShadowFall, which criticised the company for conflict-of-interest issues in a small number of transactions. Civitas’s board said the criticism was based on “factual inaccuracies”.

SLIPIT acquired 1,447 hectares of upland rough grazing and open moorland in the Cairngorm national park for £7.5m, where around 1.5 million trees will be planted to offset carbon emissions from its portfolio, in a first for the property sector.

BMO Commercial Property Trust sold its second largest holding – Cassini House, in St. James’, London – for £145.5m, 11% more than the last external valuation of 30 June 2021.

Supermarket Income REIT acquired six supermarkets for a total of £113.1m, reflecting a combined net initial yield of 4.6%. Acquired from different vendors, the purchases consist of a Tesco in Prescot, two Morrisons in Durham and Cumbria, an Aldi in Oldham and an Aldi and M&S Foodhall site in Liverpool.

Urban Logistics REIT deployed £88m of the £109m it raised in July in six off-market transactions. At a blended net initial yield of 5.4%, the assets are made up of a combination of income producing assets and forward funding commitments.

Workspace sold 13-17 Fitzroy Street, London for £92m, at a yield of 4.6%, and bought Stapleton House, also known as ‘The Old Dairy’, in Shoreditch, for £43.38m, a net initial yield of 4.9%.

LondonMetric acquired three urban logistics warehouses for £35.4m, reflecting a blended net initial yield of 4.4%.

Tritax EuroBox entered into the forward funding of a 13,181 sqm logistics facility near Stockholm, Sweden, for €27.9m. The deal marks the company’s second acquisition in Sweden.

UK Commercial Property REIT acquired Trafford Retail Park, near Manchester, from Peel L&P for £33m.

LXI REIT acquired a portfolio of 23 nursery schools in England for £34m, reflecting a 5.5% net initial yield. Acquired from and leased back to KidsFoundation on 30-year leases, the rent increases annually in line with inflation.

QuotedData views

- HOME run and a strike out? – 23 September 2021

- Harworth-y plan – 17 September 2021

- Carbon kings – 10 September 2021

- Contrarian view worth backing? – 3 September 2021

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Retail

Nick Hewson, chairman:

The financial year has been one of continued disruption caused by the COVID-19 pandemic during which supermarkets have continued to show their agility in responding to the increased level of demand and demonstrating their pivotal role as ‘feed the nation’ infrastructure. Omnichannel supermarkets have performed particularly strongly. Omnichannel supermarkets now fulfil 80% of all online grocery orders and have clearly emerged as the winning model for last mile grocery fulfilment.

To understand the trend in grocery sector growth it is important to compare 2021 sales to 2019 which was the last full pre-Covid year. In 2020, prolonged lockdowns caused a one-off temporary boost to sales making it a poor comparator for underlying trends. To illustrate this, in the 12-week period up to 12 July 2021, UK grocery sales fell by 5% vs the same period in 2020. However, when compared to the same 12-week period in 2019, 2021 sales were up £3bn or 11% despite the broad re-opening of the economy. We believe that this shows that we are starting to see more persistent changes in consumer habits and the impact they have on the grocery sector.

Online grocery market share has grown to 13% of total UK grocery sales. This is well above 2019 levels and seems to be both resilient and consistent. This demonstrates that the step change in online utilisation has become ingrained in consumer behaviour.

We have seen growing investor interest in the grocery sector with private equity attracted by the strong cash flows and the property backing. 2021 may see over £14bn invested into the sector with Asda and, most likely, Morrisons being taken into private ownership. We have also seen increased investment volumes into UK supermarket property with close to £2bn invested in 2020 and already 2021 looks on track to exceed this.

This sector growth and record investment interest has resulted in supermarket property yields falling, reflecting our long-term investment thesis.

Lawrence Hutchings, chief executive:

Accepting the further fall in valuations during the period, current market dynamics in the sector as well as the wider economy provide cause for optimism that the investment market may be starting to stabilise. As we emerge from 18 months of unprecedented challenges we are increasingly confident that a shared need from consumers and retailers for well-located, accessible retail and services with affordable occupancy costs, is highly supportive of our community centre strategy and our belief in the 15 minute neighbourhood.

Long income

Martin Moore, chairman:

Whilst the general economy has rebounded strongly, there are obstacles in the path of a complete recovery. Labour shortages are feeding through into supply chain interruptions, inflation is rising and a fourth wave of infections is widely predicted in the autumn, albeit with a predominantly vaccinated adult population and a government eager to avoid the reimposition of restrictions this should temper those headwinds. These elements may hamper the speed of recovery but we do not foresee that they will ultimately knock it off course.

In our long lease property market the combination of low interest rates and rising inflation creates a very supportive environment. Yields for properties let on long inflation protected leases are typically 7% above the gross redemption yield of long dated index linked gilts, providing an attractive blend of income return and inflation protection that is generating strong bidding for these types of assets in the market. However, whilst we have seen a revival in the trading and share prices of many leisure and hospitality businesses and a recovery in their bond prices, the property investment market in this sector remains subdued. We believe that the low number of transactions is primarily due to buyers seeking to obtain a pandemic discount whilst owners feel little compulsion to sell unless they can receive much closer to pre-pandemic pricing.

Diversified

Standard Life Investments Property Income Trust

James Clifton-Brown, chairman:

After withstanding the unprecedented economic shock created by the COVID-19 pandemic, the economy is now in recovery mode as the vaccination programme has reached critical mass and restrictions are relaxed, although uncertainties remain. From a real estate perspective in the UK, structural trends are set to drive performance over the medium term, leading to polarisation both between, and within, sectors.

Industrials are forecast to remain the best-performing sector over the next three years, underpinned by fundamentals supporting further rental growth and investment demand to push yields lower into the second half of 2021.

By contrast, office fundamentals point to falling rental values and rising income risk. With little adjustment to values thus far, weak returns are expected over the medium term along with a widening gap between offices regarded as best quality space and ageing office space that does not offer attractive working conditions for staff. Such a split is also expected in the retail sector, with retail warehouse values now rising rapidly in modern parks, anchored by strong occupiers in the grocery, discount variety and DIY markets; meanwhile, fashion-led offerings and high-street or shopping-centre locations are expected to see ongoing difficulties.

This trend of bifurcation highlights the need to hold the right assets, not just assets in the right sector.

Ken McCullagh, chairman:

While the economy is now in recovery mode as COVID-related restrictions are relaxed, for much of the UK real estate market it is structural trends that are set to drive performance over the medium term. Most notably this will be in the industrials and logistics sector where the fundamentals are supportive of further rental growth. As a consequence, investment demand for industrials is set to push yields lower in the second half of the year, and this sector is forecast to remain the best performer over the next three years.

Meanwhile, office fundamentals point to falling rental values and rising income risk. With little adjustment to values thus far, we are forecasting weak returns for the sector over the course of the next three years. Importantly though, the market is likely to be split, with the best quality space favoured by tenants and investors, and secondary space increasingly distressed.

Divisions are also appearing in the retail sector. For modern retail warehouse parks leased at affordable rents and anchored by grocery, discount retailers and DIY occupiers, values are now rising quite rapidly. Fashion-oriented parks, however, are more vulnerable in-line with the challenges faced by high streets and shopping centres, where we anticipate a further year of negative total returns.

Paul Marcuse, chairman:

The world now is in a fundamentally different place than it was six months ago with large swathes of the population vaccinated and lockdown restrictions generally lifted. We have seen government stimulus for the economy with most support schemes in place until the autumn.

The continued march of e-commerce is likely to continue and the restructuring of supply chains, to allow companies to establish and/or facilitate an omni-channel platform, will determine the survival of some and the demise of others, all the while supporting unrelenting demand for the wider industrial sector. Some haze exists as to exactly what the office sector will look like in the future, but there is more clarity, and a general leaning of companies to adopting a hybrid model with more areas in offices dedicated to creative and social space. But one size does not fit all, and a sensible, tailored approach is needed as each business and its people are different.

Europe

Aberdeen Standard European Logistics Income

Tony Roper, chairman:

The European logistics market is large and continues to develop rapidly; growing tenant demand is fuelled by the strong growth of e-commerce across Europe and the consequent supply chain reconfiguration as operators embrace this technological advancement. Of additional note is the rapid acceleration of interest and demand amongst logistics occupiers to adhere to higher ESG standards and the Investment Manager both recognises and has embraced this fundamental change in occupational demand for suitable buildings.

As a consequence of strong occupier demand, and constrained supply conditions, tenants have been prepared to secure favoured assets by signing long, index-linked or fixed uplift, lease contracts. Such indexed leases typically offer annual CPI uplifts and can provide for a transparent and predictable inflation-proofed cash flow to the Company.

In an increasingly uncertain world, the incontrovertible shift in the way consumers shop and the infrastructure required to service that demand is a source of greater certainty. The Investment Manager believes that logistics assets are primed for further growth, as well as being relatively defensive against any cyclical downturn in economic activity.

Healthcare

Andrew Cowley, investment manager:

On 7 September 2021 the Prime Minister announced major structural reforms of adult social care in England. A 1.25% increase in National Insurance and dividend tax hypothecated to fund health and adult social care is expected to raise £36 billion over the next three years. We will analyse the implications of these reforms with care, but on first reflection expect them to be a step change in repositioning care homes as critical social infrastructure.

Real estate research notes

Aberdeen Standard European Logistics Income – Handbrake off in growth drive

Urban Logistics REIT – Shed load of growth to come

Tritax EuroBox – Full throttle

Civitas Social Housing – On firm footing

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.