Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

April’s biggest movers in price terms are shown in the chart below.

Diversified property companies were the winners in April as progress in the UK’s vaccination programme and roadmap out of lockdown continued unabated. Six of the top 10 best performing companies in price terms were generalist REITs that had been trading on wide discounts. Top of the pile, however, was Globalworth Real Estate. The Central and Eastern European office landlord was the subject of a takeover offer by two of its largest shareholders in April. Standard Life Investments Property Income Trust headed the list of generalist property companies with a 19.3% share price rise. Strong rent collection rates, a growing dividend and portfolio valuation rises characterise most of the property generalists as they move on from the depths of the pandemic.

Shopping centre owner Hammerson had another good month, announcing the sale of a retail park portfolio for £330m, and has now seen its share price recover 72% in the past three months. Tritax EuroBox deployed the proceeds of its €230m equity raise last month with the acquisition of two German assets.

There was only a handful of property companies to see their share price fall in April, with Russian logistics landlord Raven Property Group heading the list. Both Circle Property, the small-cap real estate company, and Town Centre Securities saw their share price fall off slightly in April following double-digit gains in March. Both are still up in the year to date – 6.8% and 15.9% respectively. West End of London landlord Shaftesbury also suffered a slight drop in its share price in April, although the group is up 10.5% in the year-to-date as it gears up for a reopening of retail and leisure assets.

Care home owner Impact Healthcare REIT saw its share price fall 1.5% following a £35m capital raise at a discount to its 1 April share price. The share price of specialist homeless accommodation owner Home REIT fell slightly despite reporting positive maiden interim results for the period from launch to the end of February in which NAV rose 4.9%. RDI REIT, meanwhile, has since de-listed from the stock market following the buyout by existing shareholder Starwood.

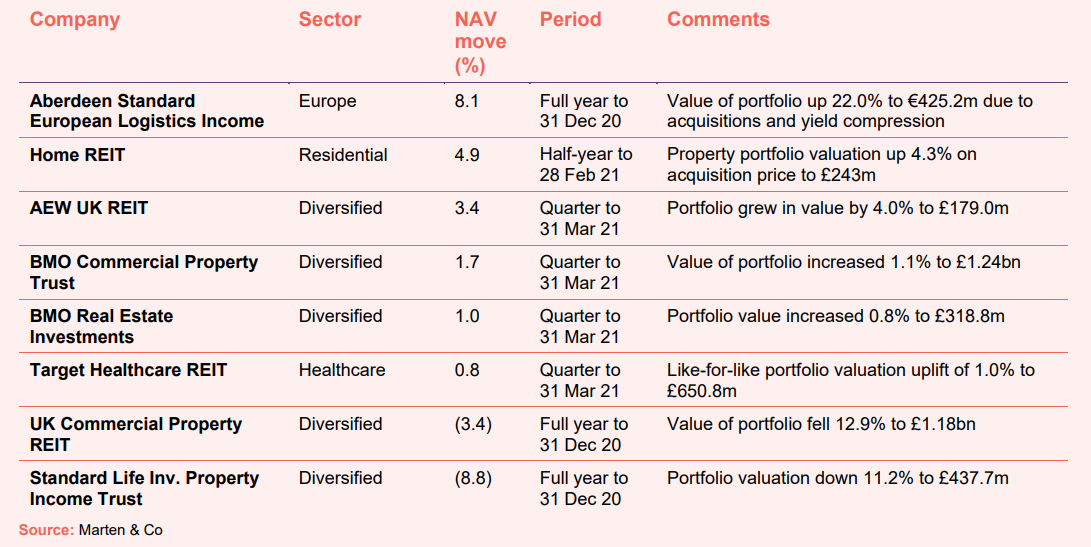

Valuation Moves

Corporate activity in April

Globalworth Real Estate was the subject of a takeover bid by largest shareholders CPI Property Group and Aroundtown, valuing the company at just over €1.5bn. The board said it undervalued the company and holders of 39.8% of its shares – Growthpoint Properties, The European Bank for Reconstruction and Development and Oak Hill Advisors – rejected the offer. These holders represent 82.0% of the Globalworth shareholders to whom the offer would be made.

Shareholders of RDI REIT approved the £467.9m cash offer for the company from its largest shareholder Starwood Capital. Starwood made a cash offer for the 70% of shares it doesn’t own at 121.35p, representing a discount of 19.9% to the group’s most recent EPRA NAV but a 38.2% premium to its six-month average share price.

Impact Healthcare REIT raised £35m through a placing of new shares, below its £50m target. The issue price was 111.5p – a 2.5% discount to its closing price on 1 April 2021 and a 1.8% premium to its most recently reported NAV of 31 December 2020. The proceeds will be used to repay debt and fund new acquisitions.

Yew Grove REIT raised €12.7m with the issue of 13,350,000 new shares at 95 cents per share. It has an acquisition pipeline of approximately €72m, comprising seven properties with short-term reversionary yields of between 7.51% – 9.20%.

CLS completed a £61.7m, 12-year loan with Scottish Widows, secured on a portfolio of five UK office properties. The loan has a fixed 2.65% interest rate and replaces two existing loans of £27.4m, which were due to expire before the end of 2021, as well as financing three recent unencumbered acquisitions. Overall, the transaction results in net additional cash to CLS of £33.7m, after costs. The loan incorporates a 10-basis point margin reduction dependent on the delivery of specific sustainability targets.

Major news stories

AEW UK REIT won a High Court battle against two of its “well-funded” national tenants – Sports Direct and Mecca Bingo – to recover rent that they had refused to pay during the pandemic.

The German Federal Court ruled against the legality of the Mietendeckel rent freeze in Berlin. Phoenix Spree Deutschland had previously estimated a 20% hit on annual rents in 2021, but it is now expected that this will be reversed.

NewRiver REIT is considering an initial public offering (IPO) of its pubs business Hawthorn, as part of a wider strategic overhaul. The group said one of its priorities was to divest the community pub business and focus on “resilient retail”.

British Land announced plans for 1m sq ft of urban logistics development at two of its retail sites. It is the first foray into the burgeoning logistics sector for the REIT, which has traditionally had a portfolio focused on offices and retail.

British Land pre-let 134,000 sq ft of office space at its 1 Broadgate development in the City of London with real estate consultancy firm JLL on a 15-year term.

Hammerson sold seven retail park assets to Brookfield for £330m, representing an 8% discount to the December 2020 book value. Disposals in 2021 now total £403m as the group looks to reduce debt.

Tritax EuroBox acquired two assets in Germany – a 70,000 sqm logistics facility let to a leading German sportswear manufacturer and a 94,800 sqm property let to Wayfair – for €290.9m.

Tritax Big Box REIT acquired the largest wine production warehouse in Europe in a £90m deal. The 872,000 sq ft facility in Avonmouth, in the South West of England, is let to Accolade Wines and was acquired at a net initial yield of 5.1%.

Supermarket Income REIT bought a Tesco supermarket in Colchester, Essex for £63m, representing a yield of 4.5%.

LondonMetric sold five non-core assets – three retail assets and two offices – for £38.5m.

QuotedData views

- Rent Wild West needs a solution? – 30 April 2021

- Rent judgment good news for REITs – 23 April 2021

- British Land’s bold move too late? – 16 April 2021

- Shackles to come off in battle for unpaid rent – 9 April 2021

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Standard Life Investments Property Income Trust

Jason Baggaley, investment manager:

2021 is expected to be a year of two halves. The national lockdown and restrictions on travel along with the impact of the final Brexit deal will have a negative impact on the economy and real estate market in the first half of the year. However, the second half is expected to be significantly different as the economy reopens with strong growth albeit from a low base. The economic shocks from COVID-19, as well as the aftereffects of Brexit are going to create a challenging macroeconomic environment and after the strong bounce back, we are likely to be in a new period of low growth and low interest rates.

The low interest rate environment is likely to support continued demand for real estate as an income producing real asset. The weight of money available to invest in real estate is going to be supportive of values, however we expect a strong differential in performance both across sectors, and within sectors.

The theme of industrial performing well and retail poorly is expected to continue but become more nuanced. Shopping centres and fashion-led retail is likely to continue to see falling capital and rental values, whilst food and budget retail should hold up well. Logistics remains a strong sub-sector with continued demand pushing rents and values up, but we suggest greater caution is required around smaller multi-let units generally rented to poorer covenants more likely to struggle in a weaker economic environment. The office market is in a period of change and is likely to see rental value falls and reduced demand: however, it is a sector that is likely also to see the best properties do better and the weaker ones worse as users and buyers become more selective.

Income will be the main driver of returns over the next few years. Long let secure income is trading at ever lower yields, and those seeking a greater yield are going to have to take an active approach of investing in assets with shorter leases but more sustainable income through diversification and good quality assets that meet occupier needs.

Peter Lowe, fund manager:

The property market was buoyed by encouraging news on the vaccine rollout and a timetable to the reopening of parts of the economy that have remained closed for much of the pandemic. Performance was largely driven by a strong showing from the industrial and distribution sector where occupational fundamentals remain attractive and investment demand has driven sharp yield compression. There was some improved stability in retail markets, particularly retail warehousing, although shopping centres and high street yields continued to soften. Sentiment has improved over the period, however investors outside of the industrial and foodstore markets remain cautious and transaction levels are subdued by historic standards.

Ken McCullagh, chairman:

As the vaccine rollout continues, and in the expectation restrictions are gradually eased, then the key question is how fast and to what extent the economy can rebound from the seismic impact of the pandemic which resulted in a 9.9% fall in UK GDP in 2020. Another factor that may impact the strength of the economy is the Brexit trade deal between the UK and Europe and whether this will result in significant disruption between the two trading blocs. Our investment manager is forecasting 6.2% GDP growth in 2021, on the basis there are no further setbacks.

It remains to be seen whether valuations of UK commercial real estate, which were already under pressure pre COVID-19, will recover to the same extent as the wider UK economy with valuation movements and hence total returns likely to be polarised between the sectors and within sectors. COVID-19 accelerated the structural retail trend away from the high street and shopping centres to online retail and while this trend may flatten out, or indeed partially recede, as people are allowed back to the shops, it is unlikely to completely reverse. There is much speculation over the future of the office sector as businesses adjust to hybrid working practices. However, there is no doubt that some offices will act more as collaboration hubs, reducing the requirement for office space, and that there will be an even more distinct polarisation between well located prime modern offices that fulfil the modern occupiers’ exacting requirements and older, more secondary stock which will fall out of favour. Leisure should recover to an extent but this will be very much linked to the easing of lockdown and the public being both able and confident enough to visit places like cinemas and restaurants.

Richard Kirby and Matthew Howard, fund managers:

As the vaccination rollout becomes more widespread and restrictions are finally eased or lifted, we will see greater certainty returning to the market, lifting confidence and valuations alike. Brexit has been somewhat overshadowed by the pandemic but, now triggered, it is causing some disruption which may be more than frictional. As an asset class, real estate will continue to be supported by a low interest rates environment, providing it with a yield advantage over most other domestic and overseas asset classes.

While the adjustment in retail may have further to go, it is important to distinguish between pandemic-related change and permanent structural change. The company’s portfolio of retail assets is of high quality, with significant potential for further development as we re-position them to grocery and convenience led retail propositions. The office sector outlook is heavily dependent on the balance struck between home-working and the need for office-based collaborative working and social interaction. The way offices are used will change to a more agile model and to have more collaborative space. There has been much commentary over future demand for offices, but we are now seeing many companies restating the future need of offices to support the wellbeing of staff. The polarisation seen between prime and secondary office stock is likely to become more pronounced. The need for flexibility either in the lease structure, whether manifested as shorter lease lengths or turnover rents, or indeed as re-purposing, is expected to persist. Most importantly, is to acknowledge the variation in performance at the asset as well as sector level. Stock selection and a forensic attention to detail in asset management will be key to delivering performance.

Europe

Aberdeen Standard European Logistics Income

Tony Roper, chairman:

The level of activity seen in the logistics market in 2020 provided the latest endorsement of our strategy when launched in 2017. 2020 was a record year of occupier demand; according to Savills, European logistics take-up reached 26 million sqm during 2020, up 12% on the level observed during 2019 and 19% above the five-year average.

Logistics remains one of the most favoured real estate sectors for investors. The logistics industry has been a standout performer benefitting from the unprecedented disruption caused by systemic changes to the way global economies function. Logistics assets have benefited from additional occupier demand arising from necessary supply chain restructuring and the rapid increase in demand for home deliveries.

Clients demand frequency and increasing complexity whilst the nature of e-commerce, where Europe lagged the UK, has required operators to adapt faster to future shifts in consumption, particularly so since the start of the pandemic. E-commerce and the move to online shopping and delivery continues unabated. As Europe’s economy starts to open up once again and the mass vaccination programmes allow for a return to some sort of ‘normal’, I am confident the fundamentals underpinning investment in logistics real estate should continue to drive further rental and capital growth which will translate into attractive returns for shareholders.

Publications

Standard Life Investments Property Income Trust – Focus on tomorrow’s world

Grit Real Estate Income Group – On the path to recovery

Aberdeen Standard European Logistics Income – Expansion on the radar

Tritax EuroBox – Boxing clever

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.