Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Performance

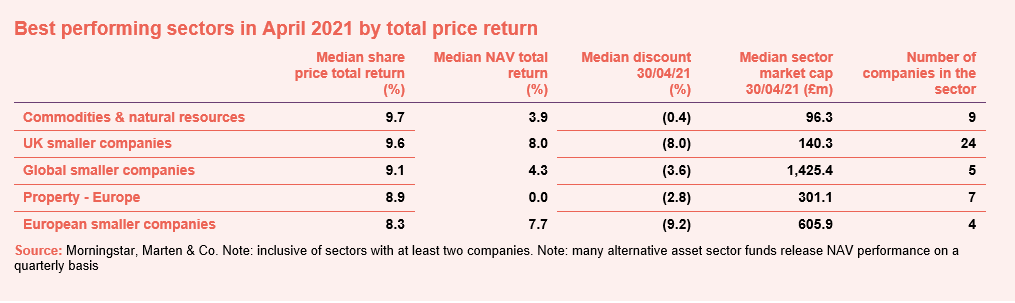

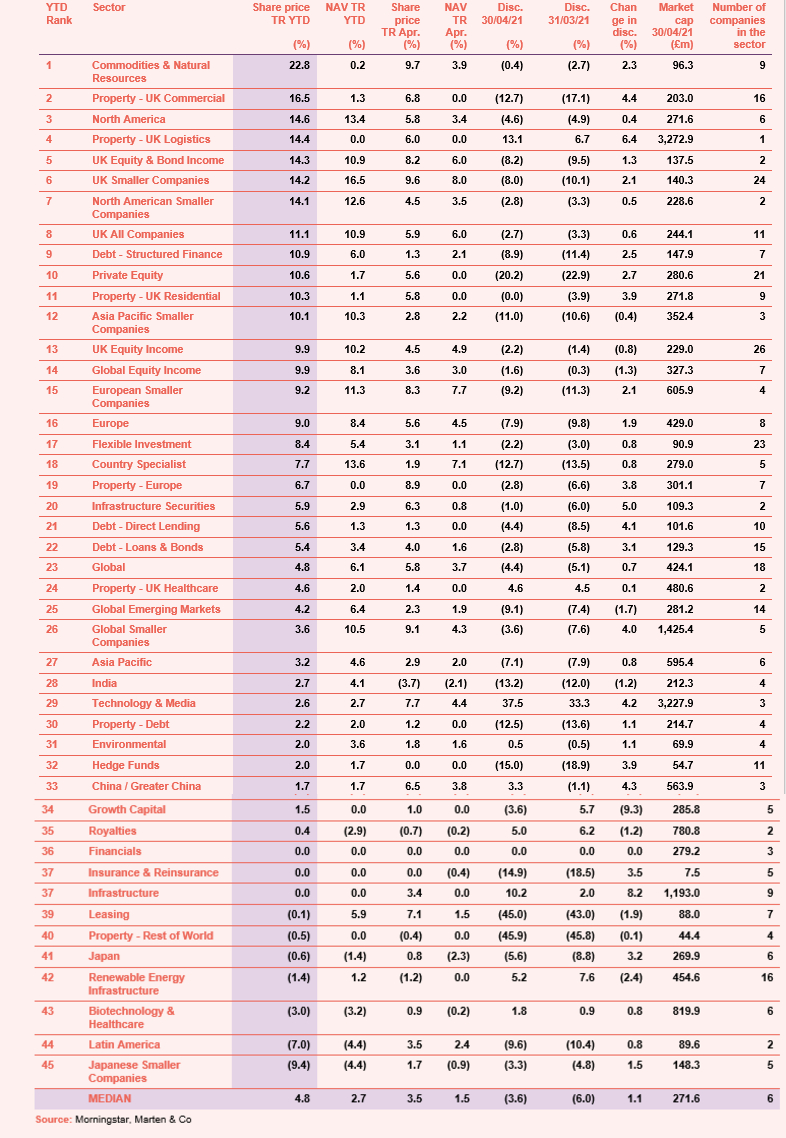

It was another strong month for commodity funds, which have led the way in market return terms so far this year (see the appendix section for a breakdown of how all the sectors have performed this year). Gold had a strong month, following a relatively subdued few months. UK smaller company funds remained very popular, with the ongoing success of the vaccine rollout emphasised by no apparent ill-effects, to date, from the re-opening measures carried out. Elsewhere, the very unfortunate spiralling in cases across India saw capital removed from that country.

April’s median total share price return was 4.4% (the average was 4.7%) which compares with an increase of 1.5% in March.

Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup

Best performing sectors over April

Worst performing sectors over April

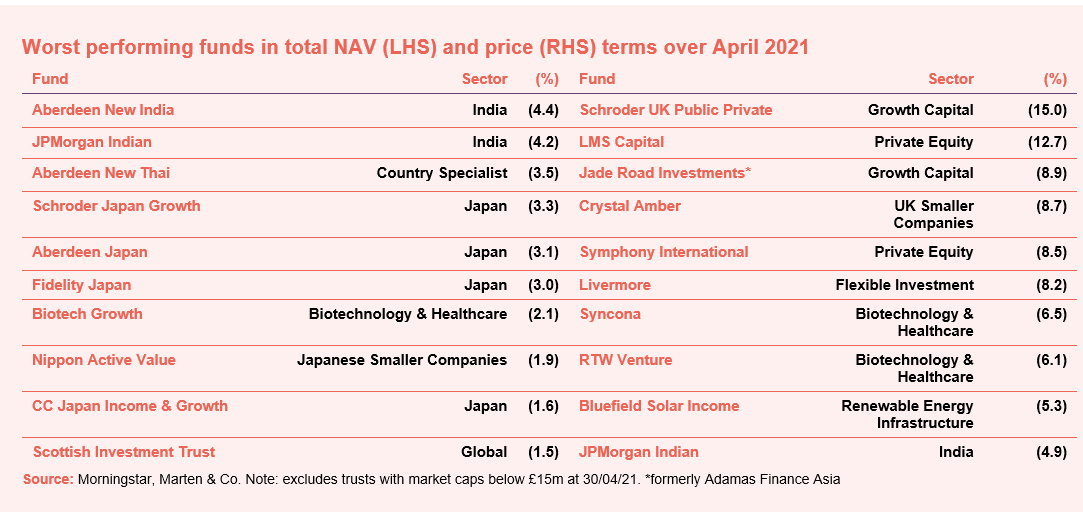

On the positive side

Golden Prospect Precious Metals benefitted as gold sprung back to life over April, following a quiet few months. CQS Natural Resources Growth and Income also saw a higher NAV return as OPEC+ decided to maintain its plans to ease oil output cuts for the next three months due to increasing demand. But UK Smaller Companies trusts dominated the table in April with JPMorgan Smaller Companies, Gresham House Strategic and BlackRock Throgmorton each returning more than 10% for the month.

Six of the 10 best NAV performers were UK strategies, continuing what has been one of the year’s main trends to date. In many cases, prices did not keep pace with the NAV moves, leading to some discount widening. US real estate and micro-cap-focused JZ Capital Partners is selling down its portfolio and paying down debt. Its end February NAV (announced on 13 April) was up 13.6% and this seems to have stimulated some buying interest. Electra Private Equity’s shares ended the monthly sharply up and are now above their pre-pandemic level. The fact that the premium jumped to 40.8% signals that a large uplift in NAV is anticipated. Electra’s core assets include TGI Fridays and Hotter Shoes. The former is benefiting from a relaxation in COVID-19 restrictions and the latter is continuing to build on its direct-to-consumer shift. Electra also profited from the sale of its holding in UK manufacturer Sentinel, which it first invested in ten years ago, that sale adds about 30p to the NAV.

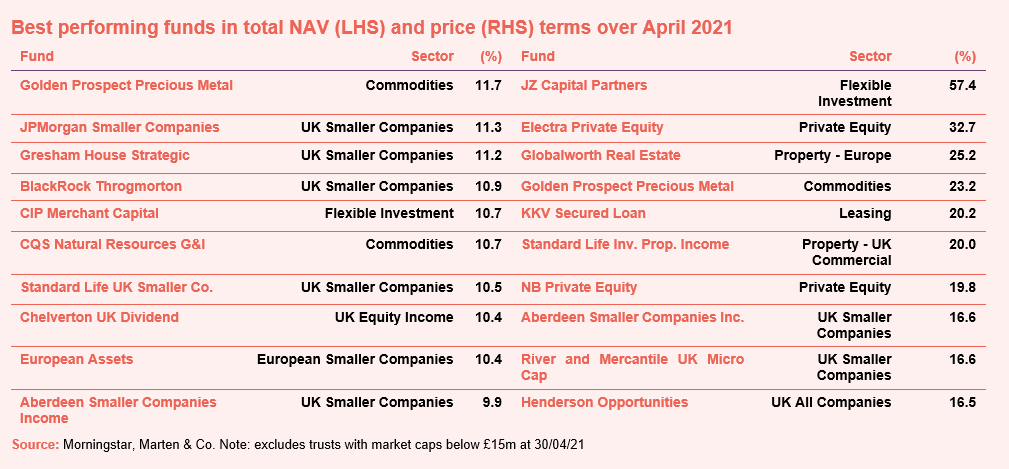

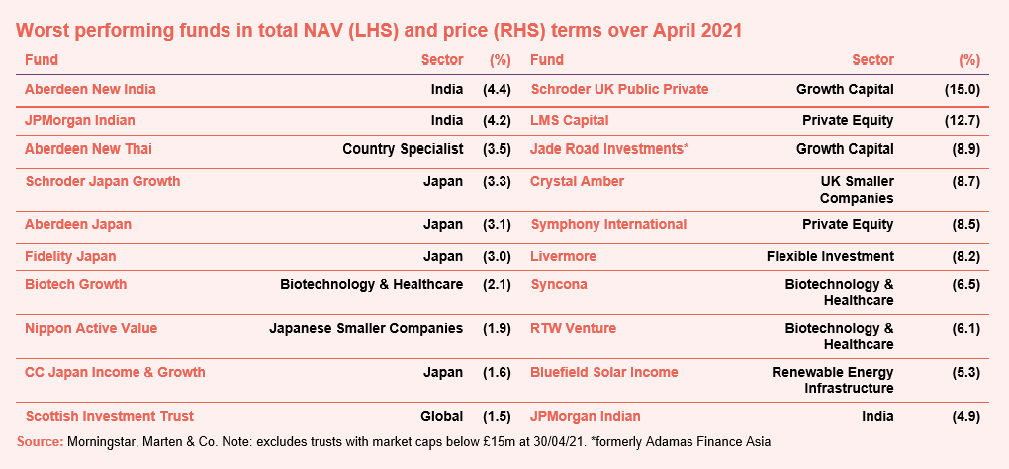

On the negative side

Aberdeen New India and JPMorgan Indian were the worst performers in April, in NAV terms, as the country struggles to manage the spread of the coronavirus. However, five of the 10 biggest losers for the month were Japanese trusts, including Schroder Japan Growth and Aberdeen Japan. While not as severe as the number of cases in India, investors are cautious amid the continuing concerns about the spike in daily infections.

Schroder UK Public Private was hit by the write-down of the value of its Rutherford Health investment. It has had some better news since, however. Symphony International‘s restaurant and hotel investments have struggled in the face of the pandemic. Major shareholder AVI (managers of AVI Global) have vocalised their frustration with the company. Bluefield Solar was affected by further reductions in long term power price forecasts as well as the planned increase in corporation tax.

Discounts and premiums

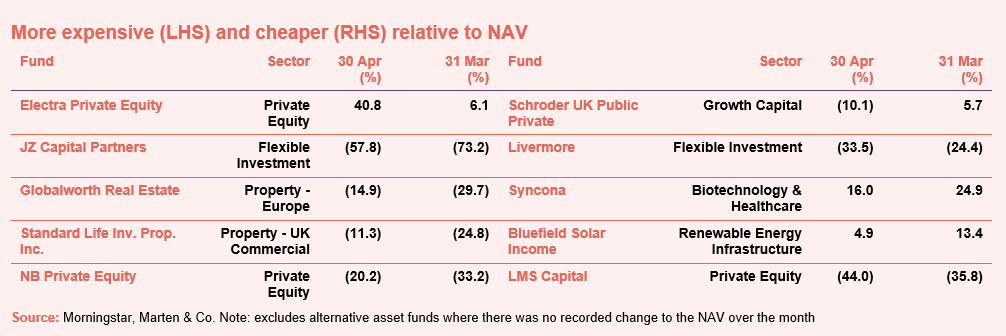

More expensive and cheaper relative to NAV

We discussed Electra Private Equity, JZ Capital Partners and Schroder UK Public Private in the ‘winners and losers’ section above. Shares in Globalworth Real Estate, a major office-space investor in Poland and Romania, reacted favourably following the announcement that two of its major shareholders, CPI and Aroundtown, who own over 50% of the company, were planning a bid for it. Standard Life Investments Property Income continues to benefit from the economic re-opening. It reported a 2.5% like-for-like increase in the value of its portfolio over the first quarter of the year. NB Private Equity announced a decent set of results in the month and that seems to have benefited its rating.

Syncona’s premium narrowed, sentiment has not been helped by the recent announcement that one of its holdings, Gyroscope Therapeutics, was putting its planned IPO on hold. It was a rare bad month for the renewables sector, with market declines led by Bluefield Solar Income following its NAV fall.

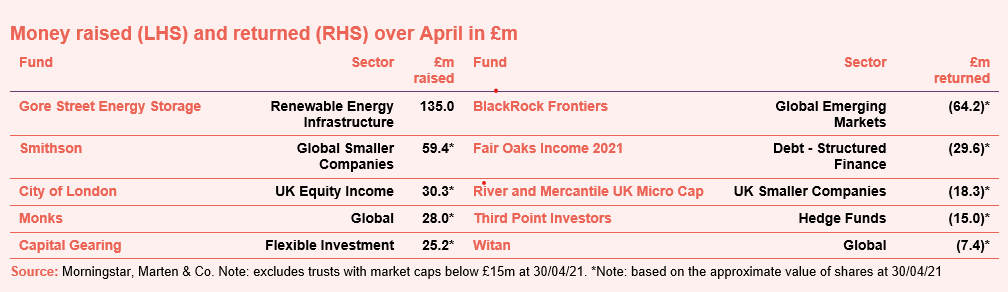

Money in and out

Money coming in and going out

Approximately £502m of net new money was raised by existing funds (excluding those with market caps below £15m at 30/04/21) over April. Gore Street Energy Storage brought in £135m – this has been seen as a game-changer for the company as it almost doubles the size of its market cap. The proceeds are to be deployed principally towards its 1.3GW development pipeline, including the near-term potential acquisition of a 80MW project. The raise moved the fund much closer in size to its most obvious peer – Gresham House Energy Storage. Elsewhere, Smithson, City of London, Monks, and Capital Gearing each raised more than £20m through day-to-day issuance in response to demand.

Returns of capital were led by BlackRock Frontiers, as it completed its tender offer, Fair Oaks Income, as holders of 13.4% of the fund elected to go into a realisation pool rather than rollover into an ongoing fund, River and Mercantile UK Micro Cap, which once again returned the assets that had built up in the fund over £100m, and Witan.

Research published over April

Bluefield Solar Income Fund – On the offensive

“Bluefield Solar Income Fund (BSIF) is growing actively, supported by a wider mandate. Shareholders voted overwhelmingly in July 2020 in favour of proposals to expand the fund’s remit beyond solar. BSIF will apply what has been a very successful model since its launch in 2013 to the complementary technologies of wind and hydroelectric power. The expanded mandate also includes battery storage. A focus on optimising its portfolio over recent years, excellent conditions for solar generation and prolonging the benefit of 2018’s higher power prices through power purchase agreements.”

Temple Bar Investment Trust – Just getting started

“RWC Partners took on responsibility for Temple Bar Investment Trust (TMPL) on 1 November 2020, and its appointment has coincided with a remarkable improvement in the fortunes of this UK equity income trust. Dramatic outperformance, a narrowing of the discount and a buzz around the resurgence of value-style investing mean that RWC has got off to a great start. However, the managers think that this is just the beginning of TMPL’s turnaround. They note that value-style investing often outperforms for an extended period following a shock to markets such as the one inflicted by COVID-19.”

CQS New City High Yield Fund – A short-term opportunity?

“Reflecting sustained strong demand for its strategy, CQS New City High Yield Fund (NCYF) has traded at an average premium to net asset value of 4.9% over the last five years. Whilst the discount to net asset value spiked out in the depths of last year’s market trough, it quickly bounced back and NCYF was until very recently trading at premiums in excess of 5%. However, it has drifted out to trade around par since February’s modest steepening of the yield curve (where the yield curve steepens, longer term interest rates rise relative to shorter-term interest rates).”

CQS Natural Resources Growth and Income – Burnished copper

“CQS Natural Resources Growth and Income (CYN) has provided exceptionally strong absolute and relative performance during the last 12 months, and has markedly outperformed its commodities and natural resources peer group. A key driver of this has been the managers’ preference for base metals, with significant exposure to copper being a major contributor.”

Montanaro UK Smaller Companies – Long COVID effect requires a focus on corporate health

“In absolute terms, Montanaro UK Smaller Companies Trust (MTU) has been generating healthy returns for its shareholders; both the share price and the NAV are close to all-time highs. However, recently MTU has given up some of its earlier outperformance. As vaccines are rolled out, the end of lockdowns is finally in sight and we are all eager to get back to ‘normal’. Last November, the news that a number of vaccines were effective triggered a surge in stock markets and a sharp rotation from high quality and growth stocks into riskier and/or ‘value-style’ stocks. This did not suit MTU’s investment approach.”

Standard Life Investments Property Income Trust – Focus on tomorrow’s world

“With the roadmap out of lockdown and into economic recovery in place, Standard Life Investments Property Income Trust (SLI) has turned its attention to future-proofing its portfolio. This has put environmental, social and governance (ESG) at the forefront of its decision-making process for asset disposals and acquisitions, with longevity of income considered critical to the process. Identifying lasting trends that have developed and accelerated during the pandemic, such as the growth in online retailing and how the office will be used, and its impact on future tenant demand for space, has become mission critical.”

Major news stories over April

Portfolio developments

- VH Global made its first investment

- Menhaden was let down by its wide discount

- Electra sold Sentinel

- Schroder British Opportunities invested in Cera Care

- Hg Capital invested in Auvesy

- BBGI Global Infrastructure invested in Tower Hamlets

- Aquila bought a Portuguese solar plant

- Henderson High Income was held back by gearing

- North American Income delivered a healthy revenue despite Covid

- Invesco Perpetual UK Smaller Companies was hit by dividend expectations

- BB Biotech shared its portfolio changes in Q1

- Dunedin Income Growth considered a new sustainable objective

Corporate news

- AVI said it was looking to unseat Symphony International’s board

- Investec proposed that BH Global and BH Macro combine

- US Solar launched a fundraise

- Hipgnosis became an investment trust

- New Invesco merger proposals were announced

- Polar Capital Global Financials planned a C share issue

- Gore Street Energy Storage completed a game-changing capital raise of £135m

- M&G Credit Income introduced a zero discount policy

- Third Point looked at ways to tackle its discount

- Merchants grew its dividend for a 39th year

- A new shipping trust may float – Taylor Maritime

Managers and fees

- Alliance Trust announced stock picker changes

- Irish Residential Properties REIT highlighted plans to internalise its management team

Property news

- Helical collected 92.9% of rent during COVID

- NewRiver REIT mulled listing pubs business

- Phoenix Spree Deutschland was boosted by the Berlin rent freeze ruling

- Tritax Big Box celebrated a £90m acquisition

- AEW UK REIT won its legal battle over unpaid rent

- British Land moved into logistics development

- Impact Healthcare REIT acquired two care homes

- BMO Real Estate reported positive rent collection rates

QuotedData views

- British Land’s bold move too late? – 16 April

- Shackles to come off in battle for unpaid rent – 9 April

- Go Green? – 9 April

- Go West! – 1 April

- Indian funds take stock – 30 April

- Rent Wild West needs a solution – 30 April

- Backing the future – 23 April

- Rent judgment good news for REITs – 23 April

- Money worries – 16 April

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Aberdeen Asian Income AGM 2021, 12 May

- Nippon Active Value Fund AGM 2021, 12 May

- Temple Bar AGM 2021, 13 May

- JPMorgan American AGM 2021, 14 May

- Baillie Gifford Shin Nippon AGM 2021, 14 May

- Fidelity Japan AGM 2021, 18 May

- Riverstone Credit Opportunities Income AGM 2021, 19 May

- Henderson High Income AGM 2021, 24 May

- Sustainable & Social Investing Conference, 21 May

- North American Income AGM 2021, 1 June

- Fidelity Japan AGM 2021, 18 May

- Menhaden AGM 2021, 3 June

- Martin Currie Portfolio AGM 2021, 9 June

- Aquila European Renewables AGM 2021, 9 June

- Dunedin Income Growth AGM 2021, 10 June

- Aberdeen New Thai AGM 2021, 17 June

- Axiom European Financial Debt AGM 2021, 19 July

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – April median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.