Value hunters boost property

The easing of lockdown restrictions throughout the quarter saw property companies stage somewhat of a comeback from the depths of the pandemic, despite ‘freedom day’ being delayed into July.

The potential for an economic bounce in the second half of the year is growing and generalist real estate investment trusts (REITs), which own diverse portfolios, were popular among value investors. However, the share price of property companies focused on retail, leisure and hospitality fell as the final stage of the roadmap out of lockdown was pushed back by a month.

There is still much uncertainty in the sector, not least with COVID cases increasing and a fourth wave likely in the Autumn. This is reflected in the wide discounts to net asset values (NAVs) that some property companies’ shares are still trading on.

Performance data

The further lifting of COVID restrictions in the UK saw positivity return to the real estate sector in the second quarter of 2021, although rising cases due to the Delta variant held back the returns of those with exposure to retail and hospitality.

Best performing property companies

St Modwen Properties saw a big rise in its share price in the quarter having received a cash offer for the business (which comprises logistics developments and a housebuilding arm) from Blackstone. A subsequent improved offer values it at a big premium to NAV. Its share price was up 37.5% in the quarter.

Generalist real estate investment trusts (REITs) continued their share price recovery from the depths of the pandemic, with the £745m market cap BMO Commercial Property Trust and £245m Schroder REIT making the top 10 best performing property companies in the quarter. Both have seen share price gains in 2021, of 13.3% and 25.1% respectively.

German business parks owner and operator Sirius Real Estate saw its share price rise 24.5% in the three months, during which it reported a big uplift in its portfolio valuation and NAV.

Berlin residential landlord Phoenix Spree Deutschland continued its mini share price resurgence following the federal ruling against the legality of rent controls in the German capital city. Its share price has risen more than 21% in the year-to-date, but it was still trading at a 16% discount to net asset value (NAV) at the end of June.

Warehouse REIT reported a big NAV increase in full-year results during the quarter, as values continue to rise in the industrial sector, while self-storage specialist Safestore made it into the top 10 best-performing property companies in the quarter after reporting significant revenue gains.

Worst performing property companies

Cuban real estate company CEIBA Investments tops the list of worst share price performers, with a share price fall of 13.0% in the quarter. It reported a significant fall in its NAV as the value of its hotels, which have been all-but closed during the pandemic, took a hit. Recent protests against the government have not helped either.

The announcement that the last step in the easing of restrictions in the UK was being pushed back from June to July resulted in share price falls for many of the retail and leisure property landlords. West End of London landlords Shaftesbury and Capital & Counties also suffered share price falls in the quarter, but both are up in 2021 as they gear up for a full reopening of retail and leisure assets.

Secondary mall owner Capital & Regional‘s share price fell 7.4%, while NewRiver REIT, which owns shopping centres and retail parks as well as a pub portfolio, also saw a share price fall in June, but is positive in the year-to-date as it embarks on a renewed strategy focused on resilient retail.

Significant rating changes

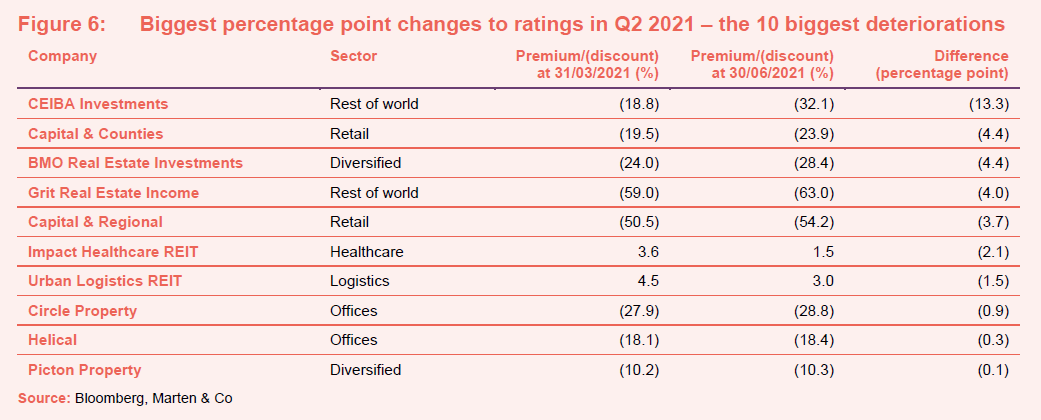

Figures 5 and 6 show how premiums and discounts have moved over the course of the quarter.

Following the two bids to take St Modwen Properties private, the group moved from trading at a discount to net asset value to a huge premium of 27.2% (in line with the bid offer).

Logistics giant SEGRO saw its already healthy premium more than double during the quarter to 34.5% as investors continue to give a vote of confidence to its large development pipeline.

Drum Income Plus REIT’s discount continued to narrow this quarter, following the announcement that its board was considering the future of the company, including realising the value of its portfolio. At the turn of the year the group was trading at a near 60% discount but due to its share price recovery, this has narrowed to 13.7%.

PRS REIT moved from trading at a discount of 9% to a premium of 6% having seen its share price rise 16.6% in the quarter following strong operational performance in which completions of private rented homes increased. The share price was further boosted in June by the announcement that its investment manager’s parent company, Sigma Capital Group, had been the subject of a takeover bid.

Aberdeen Standard European Logistics Income’s rating improvement was as much down to a fall in its sterling NAV (due to the exchange rate with the euro – in euro terms the NAV increased) than a surge in its share price, although this did rise during the quarter by just under 10%.

Most of the companies to feature in Figure 6 have been covered off earlier in the worst performing companies’ section. Additional entrants include care home owner Impact Healthcare REIT, which saw its share price fall slightly during the quarter, and Urban Logistics REIT, which announced in June that it was raising capital at a slight discount to its share price (but at a premium to NAV).

London office developer Helical reported an increase in its NAV during the quarter and despite a 5.2% rise in its share price, its discount widened ever so slightly.

Major corporate activity

Fundraises

A new REIT, UK Residential REIT, announced its intention to float on the London Stock Exchange with the aim of raising £150m to be invested in a portfolio of privately rented residential assets. It is targeting a dividend yield of 5.5% per year once fully invested and a net total shareholder return of 10% per year. An announcement is due to be made on the outcome of the potential float in mid-July.

Meanwhile, around £250m was raised by property companies in the second quarter of 2021, compared to more than £600m in the first quarter.

LXI REIT raised £104m in June through an oversubscribed placing. The proceeds will be used to acquire a pipeline of assets including potential sale-and-leaseback deals and forward funding opportunities.

Big Yellow Group raised £100m from a placing of new ordinary shares, with the proceeds to be used to fund two strategic acquisitions. Along with its existing development pipeline, the acquisitions have the potential to generate more than £40m of net operating income over the short to medium term.

Urban Logistics REIT announced intentions to raise £108m through the placing of new ordinary shares, and in early July announced it had successfully raised £108.3m. The proceeds will be used to acquire a pipeline of assets with an average net initial yield of 6.1%.

In April, Impact Healthcare REIT raised £35m through a placing of new shares, below its £50m target. The issue price was 111.5p – a 2.5% discount to its closing price on 1 April 2021 and a 1.8% premium to its most recently reported NAV of 31 December 2020. The proceeds will be used to repay debt and fund new acquisitions.

Yew Grove REIT raised €12.7m with the issue of 13,350,000 new shares at 95 cents per share. It has an acquisition pipeline of approximately €72m, comprising seven properties with short-term reversionary yields of between 7.51% and 9.20%.

Mergers and acquisitions

Blackstone upped its offer for property company St Modwen Properties to 560p per share (from 542p in May 2021), valuing the company at £1.272bn. The final offer has been recommended by the board and represents a 21.1% premium to its EPRA net tangible asset (NTA) value.

Globalworth Real Estate was the subject of a takeover bid by largest shareholders CPI Property Group and Aroundtown, valuing the company at just over €1.5bn. The board said it undervalued the company and holders of 39.8% of its shares – Growthpoint Properties, The European Bank for Reconstruction and Development and Oak Hill Advisors – rejected the offer. These holders represent 82.0% of the Globalworth shareholders to whom the offer would be made.

Shareholders of RDI REIT approved the £467.9m cash offer for the company from its largest shareholder Starwood Capital. Starwood made a cash offer for the 70% of shares it doesn’t own at 121.35p, representing a discount of 19.9% to the group’s most recent EPRA NAV but a 38.2% premium to its six-month average share price.

Other major corporate activity

Tritax EuroBox announced the pricing of €500m of senior unsecured green bonds maturing on 2 June 2026. The notes will have a tenor of five years and an annual coupon of 0.95%. It will significantly reduce the trust’s cost of debt and will be used to finance and/or refinance, in whole or in part, a portfolio of eligible assets.

Sirius Real Estate raised €400m through the placing of corporate bonds, having attained an investment grade credit rating from Fitch Ratings of BBB in May. The senior bonds have a five-year term with a coupon of 1.125%. Net proceeds are to be used to refinance existing debt, with the remainder deployed on potential acquisitions.

LondonMetric completed a £380m private debt placement, which has a blended maturity of 11.1 years and a blended coupon of 2.27%. Simultaneously with the completion of the placement, the company has also secured two new revolving credit facilities (RCFs) totalling £400m. They comprise a £175m, five-year facility with Wells Fargo and a £225m facility for a three-year term with NatWest, Barclays, HSBC and Santander. The placement and the new debt facilities will replace existing debt facilities. Overall, the refinancings increase the company’s loan maturity by four years to 8.2 years and reduces the average cost of debt to 2.6%.

Hibernia REIT has issued €125m of new unsecured US private placement notes. The issue comprises equal amounts of 10- and 12-year notes with an average fixed coupon of 1.9%. The notes have been placed with five institutional investors, all new lenders to Hibernia.

CLS completed a £61.7m, 12-year loan with Scottish Widows, secured on a portfolio of five UK office properties. The loan has a fixed 2.65% interest rate and replaces two existing loans of £27.4m, which were due to expire before the end of 2021, as well as financing three recent unencumbered acquisitions. Overall, the transaction results in net additional cash to CLS of £33.7m, after costs. The loan incorporates a 10-basis point margin reduction dependent on the delivery of specific sustainability targets.

Major news stories

- AEW UK REIT won a High Court legal battle against two of its “well-funded” national tenants – Sports Direct and Mecca Bingo – to recover £1.2m of rent that they had refused to pay during the pandemic.

- NewRiver REIT announced it was considering an initial public offering (IPO) of its pubs business Hawthorn, as part of a wider strategic overhaul. The group said one of its priorities was to divest the community pub business and focus on “resilient retail”.

- British Land announced plans to move into logistics development. A 1m sq ft urban logistics scheme is planned at two of its retail sites. It is the first foray into the burgeoning logistics sector for the REIT, which has traditionally had a portfolio focused on offices and retail.

- Tritax EuroBox acquired three logistics assets in the quarter, including its first in the Nordics, for a total of €337m.

- Hammerson sold seven retail park assets to Brookfield for £330m, representing an 8% discount to the December 2020 book value. Disposals in 2021 now total £403m as the group looks to reduce debt.

- Phoenix Spree Deutschland was boosted by the German Federal Court’s ruling against the legality of the Mietendeckel rent freeze in Berlin. The group had previously estimated a 20% hit on annual rents in 2021, but it is now expected that this will be reversed.

- Home REIT bought a further 14 property portfolios, totalling 314 beds for homeless people, located across England for £47.1m. Following the deal, it has invested all of its IPO proceeds plus over 40% of its £120m 12-year debt facility.

- LXI REIT forward-funded a portfolio of nine Costa Coffee drive-thrus and an industrial asset for £36m. The nine drive-thru units will be built in the car park of Morrisons supermarkets, while the industrial facility is located in the Midlands.

- LondonMetric upped its exposure to the urban logistics sector with the acquisition of an asset in London for £43.8m in a sale-and-leaseback deal with foodservice business Reynolds. The 115,000 sq ft warehouse in Waltham Cross is let on a new 23-year index-linked lease.

- Mailbox REIT, which owns the Mailbox office block in Birmingham, began trading on the International Property Securities Exchange (IPSX), the debut listing on the world’s first real estate stock exchange.

Selected QuotedData views

- Office needs to flex muscles

- Is property still a good hedge against inflation?

- Not all industrial is equal

- REIT IPO to get excited about

- Property funds to fall like dominoes?

Real estate research

Tritax EuroBox – Full throttle

Civitas Social Housing – On firm footing

Standard Life Investments Property Income Trust – Focus on tomorrow’s world

Grit Real Estate – On the pathway to recovery

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.