Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

March’s biggest movers in price terms are shown in the chart below.

Drum Income Plus REIT saw its share price rally 75% in March following the announcement that its board was undertaking a strategic review to consider the future of the company, which it said could include “realising the value in the group’s property portfolio”. The trust has failed to generate any liquidity in the shares, which have traded at a significant discount to their net asset value since it launched in 2015. Despite the uplift in its share price, the group is still trading at a 28% discount to net asset value.

Shopping centre owner Hammerson also saw a jump in its share price in March, albeit from a low base. The company’s share price has been decimated over recent years as its exposure to the struggling retail sector hit the valuation of its portfolio. Schroder European REIT recovered from share price falls in January and February this year, while long income specialist Secure Income REIT continued its share price recovery with another good month. Year to date, its share price has risen almost 20%, although it is still 22% down on its pre-pandemic height.

The two biggest real estate winners last year – Aberdeen Standard European Logistics Income (ASLI – up 20.3% in 2020) and Triple Point Social Housing REIT (up 24.2%) – both saw their share prices fall in March. Share price gains in 2020, off the back of their reliable income from favoured real estate sectors, have stalled, perhaps on profit taking. ASLI’s share price was flat during the first three months of 2021, while Triple Point’s has fallen 9.4%. NewRiver REIT, which had been enjoying a rally in its share price, saw that come to an end in March with a 4.3% fall. The group, which owns retail property as well as a significant pub portfolio, was one of the hardest hit in the pandemic sell-off but since March 2020 its share price has risen 57%.

The share price of Ceiba Investments, which owns real estate in Cuba, was off 3.6% in March. However, the group successfully raised €25m in an oversubscribed convertible bond at the end of the month that will allow it to complete the development of a new hotel on the Caribbean island.

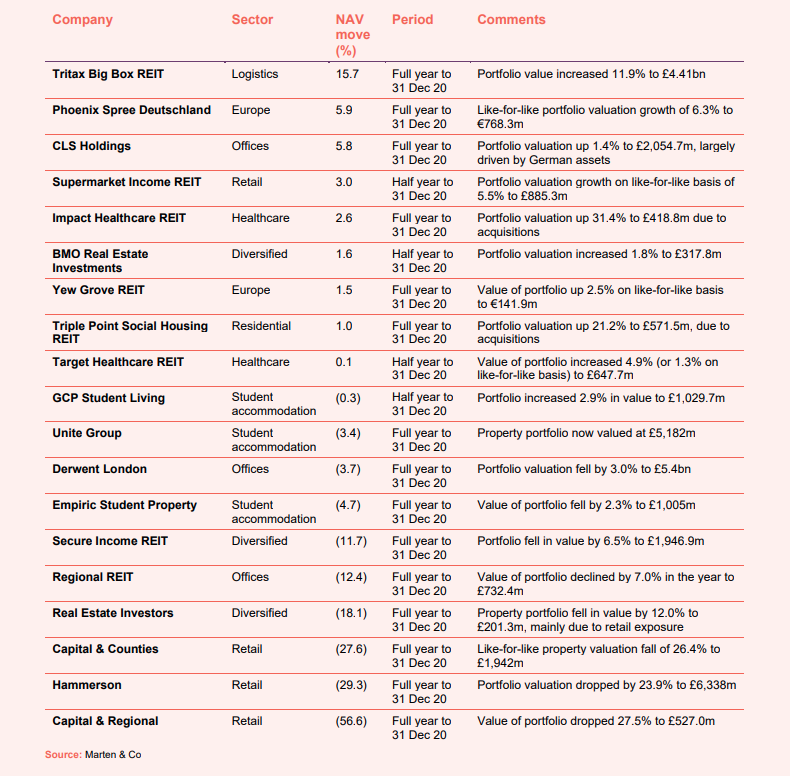

Valuation moves

Corporate activity

Tritax EuroBox raised €230m (£198.4m) in an oversubscribed issue. The proceeds will be used to acquire a near-term pipeline of assets worth €416m. The group was also assigned investment grade credit rating by Fitch, opening up access to a wider pool of financing strategies.

Supermarket Income REIT raised £153m from an oversubscribed issue. The group has identified immediate investment opportunities worth £230m across four deals and has a further nine assets in the pipeline worth £184m.

LXI REIT raised £125m from a significantly oversubscribed share issue. The group has identified an acquisition pipeline worth £140m in sectors including foodstores, industrial, drive-thru coffee and garden centres.

Aberdeen Standard European Logistics Income raised £19.4m after issuing 18.45 million new shares, representing the total remaining authority granted by shareholders at its AGM.

LondonMetric priced a £380m private debt placement with institutional investors in North America and the UK, upsized from an initial £150m. The debt has a blended maturity of 11.1 years and a weighted average coupon of 2.27%.

Urban Logistics REIT secured a new £48m loan facility with Aviva Investors. This new facility provides a seven-year term and comes at a fixed cost of 2.34%.

Ceiba Investments raised €25m in a convertible bond issue. The unsecured, 10%, five-year bond was priced at the unaudited NAV of 104.3p. It will use the capital to finance the construction of the Melia Trinidad hotel.

The board of Drum Income Plus REIT announced a strategic review into the company that it said could result in the company being sold.

Civitas Social Housing secured investment grade credit rating with Fitch, which will allow it to grow its debt funding strategy and gives it access the broader bond market.

Major news stories

Unite Students, the student accommodation owner, sold a portfolio of eight properties, comprising 2,284 beds, for £133m as part of its strategy to exit “subscale” markets.

LXI REIT acquired seven grocery stores for £85m, in the first step in deploying capital from its £125m raise. The acquisitions comprise both pre-let forward fundings and built investments and have an average net initial yield of 5.25%.

Urban Logistics REIT forward funded on a speculative basis the development of five assets in the East Midlands for £23m. It also sold five assets for £30m at a 35.4% uplift to book value.

LondonMetric acquired a TalkTalk-let data centre and an urban logistics warehouse, both in Milton Keynes, for a combined £31.2m and a blended net initial yield of 4.4%. This followed the £40.9m sale of three long income assets.

Stenprop acquired three multi-let industrial (MLI) estates for £18.4m and remains on target to be a fully focused on MLI by 2022. The three assets – in Newcastle, Bromborough and Bradford, have been purchased at a net initial yield of 6.7%.

Home REIT fully invested the proceeds of its £240m initial public offering after the acquisition of 11 portfolios for £48.1m. The group, which launched in October 2020, now has a portfolio of 572 homeless accommodation properties.

Helical let the 88,500 sq ft Kaleidoscope office in Farringdon to TikTok on a 15 year term at an annual rent of £7.6m.

Supermarket Income REIT acquired a Tesco Superstore, which forms part of Prestatyn Shopping Park, from Ediston Property Investment Company for £26.5m, which is equivalent to a net initial yield of 5.3%.

UK Commercial Property REIT sold the single-let office Hartshead House, in Sheffield, for £17m.

Sirius Real Estate acquired a business park in Essen, Germany, for €10.7m through a sale-and-leaseback deal with industrial engineering and technology group Thyssenkrupp.

QuotedData views

- Will Rishi’s call for return to office impact sector?

- Property one year on from lockdown

- Too late to save property’s problem child?

- Student digs top of the class for COVID rebound?

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Martin Moore, chairman:

The government’s road map envisions the reopening of outdoor visitor attractions from mid-April, followed by indoor activity in most hospitality assets permitted from mid-May, with the caveat that these dates are not cast in stone. The expectation that the rollout of vaccinations to the entire UK adult population by the middle of this year provides much stronger foundations for an enduring release from the impact of the pandemic. The capital markets reflect this view, pricing in a strong recovery in both the publicly traded equity and debt of many companies in the leisure and hospitality sectors. While many of our leisure and hospitality assets have been closed for an extended period, 78 of our 123 hotels are already open, serving those unable to work from home. But we expect clear benefits for our leisure, hotels and pubs tenants from the easing of restrictions anticipated in May. In the meantime, our healthcare assets have proved very resilient and remain in strong demand, further underpinned by an NHS tender valued at £10bn over four years to the independent hospital sector to try to clear the backlog of procedures.

The pandemic has created a recession unlike any other with its economic effects felt very unevenly – devastating for a minority but leaving a surprising number financially untroubled. Lockdown restrictions have pushed up household savings ratios to record levels, creating high levels of enforced savings in the UK which provide the means to accompany the natural desire to make the most of leisure and hospitality when it reopens. In tandem, the unprecedented size and nature of government financial support has driven down interest rates to record lows and unleashed a surge of liquidity seeking a suitable investment home – a home that may soon require inflation protection. Highly expansionary monetary policy has seen the Bank of England continue to increase its quantitative easing programme to a level over four times higher than after the Great Financial Crisis. With debt levels hitting unprecedented heights the government has a strong incentive to manage its cost and deflate its value by letting inflation run above interest rates. Unfortunately, the other side of the same coin is the prospect of a protracted period of negative real interest rates which would pose a challenge for savers. This is where REITs with long-dated Inflation linked leases can prove their worth, delivering healthy dividend yields and inflation protection.

John Crabtree, chairman, and Paul Bassi, chief executive:

As the market place normalises, we anticipate a healthy recovery in valuations and sales at pre-COVID-19 levels with a strong investor demand for regional assets that performed well during the global pandemic, supported by high levels of equity and low costs of debt available for real estate. Signs of market recovery are emerging, supported by the recent budget announcement, with many business owners optimistic about future trading. Our regional economy looks set to recover from the pandemic and looks forward to the economic boost from HS2, Coventry City of Culture 2021 and the Commonwealth Games 2022.

Offices

Paul Williams, chief executive:

As restrictions ease, economic activity should start to improve. In the short term, it is the pace of economic recovery that will be the most important determinant of the London office market’s performance. New office supply is anticipated to remain constrained. Larger businesses are likely to focus on good quality space and, as there is less availability for these properties, we expect rents here to hold up. Older and smaller units, where there is greater availability, may prove more vulnerable. As such, we expect overall vacancy levels will continue to rise but will remain lower in the West End than the City.

Stephen Inglis, investment manager:

Although the COVID-19 pandemic has forced the adoption of alternative ways of working, it can be argued that the pandemic merely accelerated changes that were already occurring in terms of both digital transformation and flexible working. However, in accelerating the working from home trend, the pandemic also highlighted its limitations in terms of collaborative working, training and productivity, to name a few. To date, there has been considerable speculation regarding the future of the office. The office has long provided a place for concentrated work and increasingly a place for collaboration, connection, innovation and social interaction, and the desire for these characteristics has not diminished. Research by JLL found that 70% of employees believe the office environment is more conducive to team building and creative collaboration, with 74% of respondents indicating that they were looking forward to the opportunity to return to the office.

The asset manager believes that the office will continue to play a vital role in working life, and that going forward, many occupiers will require more space per employee as greater importance is placed on health and wellbeing. The average office space per employee has reduced drastically since the 1990s, with typical densities of just c.85 sq. ft. per employee. Therefore, de-densification of floorplates will likely take place as offices are transformed to encourage teamworking, innovation and education. Additionally, preferences for increased distance between workstations, more private offices, more defined private space, and a reduction in hot desking, may result in increased demand for space.

Fredrik Widlund, chief executive:

We believe that the debate has moved on such that the need for offices, balanced against working from home, is now accepted. Evidence from economies around the world which have opened up again has highlighted the return to more normal patterns of office use. Whilst there will continue to be much speculation until more normality returns and the debate between de-densification and the settled pattern of work from home can be resolved, it is only by returning to the office that some of the forgotten benefits can be demonstrated. The office market is not going to go the way of retail property, as whilst shopping can be delivered to houses (and returned), there is no substitute for the office-generated atmosphere for collaboration, innovation, mentoring and socialising to name but a few.

Student accommodation

Mark Pain, chairman:

Despite being considered an alternative real estate investment, purpose built student accommodation (PBSA) is cementing itself as a mature real estate asset class, with the potential to generate significant income and be resilient even in periods of economic downturn. As reported by CBRE’s 2020 Student Accommodation Index, PBSA was the best performing real estate asset class in the year to September 2020. Looking forward, Savills’s five-year forecast released in January 2021 had PBSA as the third best performing sector.

These strong returns are also associated with lower volatility, meaning the sector has produced risk-adjusted returns roughly three times as high as the mainstream market. Like all sectors, PBSA has been affected by the COVID-19 pandemic with capital values falling 0.4% in the year to September 2020, its only fall in the past decade. However, PBSA saw one of the smallest declines in capital values when compared with other sectors and still saw rental growth of 1.6% in the year to September 2020, the fifth consecutive year of outperformance against the mainstream real estate market. Only industrial saw higher rental growth in 2020 (at 2.0%) while both office and retail saw rental values fall (2.2% and 8.1% respectively).

David Hunter, chairman:

There is clear evidence of strong application trends for UK universities both from domestic and international students alike, although restrictions have temporarily reduced the benefits for owners of student accommodation. Whilst vaccination programmes in the UK and abroad will improve the prospects of a complete reopening of UK universities for in-person teaching and improve national and global student mobility, with national or localised lockdowns remaining likely over the short term, a return to full attendance at universities and full occupation of student accommodation facilities will take time.

Retail

Atrato Capital, investment adviser:

The continued COVID-19 pandemic has illustrated that supermarket stores in strategic locations, are pivotal to the critical supply of food across the UK. Supermarkets are a regular part of the lives of the UK population and a core part of the UK’s food infrastructure. UK Supermarkets stayed open throughout the periods of lockdown and, at the height of the crisis, employed an additional 45,000 workers to maintain the supply chain and implement social distancing measures. The continued impact of the pandemic has driven record grocery sales volumes with an unprecedented annual growth rate of 11% for the year to December 2020.

The pandemic has also accelerated the move to online grocery shopping propelling the online channel to 13% of the market up from 8% a year earlier and represents 16%-18% of Tesco and Sainsbury’s total sales. Much of this demand is here to stay as online becomes an integrated part of customers grocery shopping habits. A survey from Waitrose indicated that around 75% of the UK population was now doing part of its food shopping online with half of those surveyed believing their shopping habits have been changed permanently.

The substantial capacity growth by the big four to meet demand, adding over 1.9 million slots from 1.8 million per week to 3.7 million per week, has re-emphasised the vital role of omnichannel stores operating as last mile logistics nodes in the food supply network. Omnichannel supermarkets represent the mission critical infrastructure that is integrating online and traditional in-store sales.

Europe

Jonathan Laredo, chief executive:

The Irish economy, driven by the resilient foreign direct investment (FDI) sectors such as life sciences and technology, has been one of the best performing globally even as the domestic economy suffered a worse slow down than most in Europe. As the country emerges from lockdown it is likely that the recovery will be sharp and the continued performance of the key FDI sectors should produce yet another strong year despite the headwinds that will be generated by Brexit.

Even with the complications caused by travel bans and market shutdowns the IDA Ireland still managed to generate almost as many foreign direct investments in 2020 as in 2019 and with the easing of lockdowns, which will begin between spring and late summer 2021, we should expect an acceleration of demand.

I expect the industrial sector to have another excellent year with the principal issue being the availability of quality stock and an increase in build and design across the country. In offices, the market will be slow until a clear and timetabled route out of lockdowns can be mapped. However, that is just a question of time. In my view, there is no doubt that the office has a future, but as employers and employees include the flexibility to work both in an office and from home, it will be different from its past. In our markets I expect a greater stratification of offices into those seen as attractive and deserving of a premium and those which are acceptable but will trade back from the very best. Because the estimated rental values (ERVs) on our offices still sit well below the levels which would trigger new development (and even further below the levels required for premium builds) and because appropriate space is still in short supply, I expect our office rents to keep rising.

Publications

Standard Life Investments Property Income Trust – Focus on tomorrow’s world

Grit Real Estate Income Group – On the path to recovery

Aberdeen Standard European Logistics Income – Expansion on the radar

Tritax EuroBox – Boxing clever

Legal

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.