Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

Performance data

June’s biggest movers in price terms are shown in the chart below.

Uncertainty caused by the covid-19 pandemic continued to weigh on property stocks in June and we had the first real casualty in Intu Properties, which collapsed into administration. A number of companies did see their share prices rise during the month, however, with RDI REIT top of the list. The company’s share price rose sharply after majority investor Redefine sold its near 30% stake to private equity group Starwood Capital.

Pan-African real estate company Grit Real Estate saw its share price increase almost 20% off the back of news that it plans to delist from the Johannesburg Stock Exchange and make London its primary listing. Stenprop posted strong results, supported by progress in its portfolio reconstruction efforts to become a fully-focused industrial landlord. Two retail focused companies also make the list, NewRiver REIT and Ediston Property Investment Company, perhaps in recognition that their portfolios are heavily aligned with the favourable retail park sub-sector. European logistics owner Tritax EuroBox continued its impressive growth, with its share price now above pre-covid levels.

Once again, the list of share price fallers was dominated by retail-focused companies. Shopping centre owner Capital & Regional saw the biggest fall, almost 30%, and in the year to date it has lost 66.5% of its value.

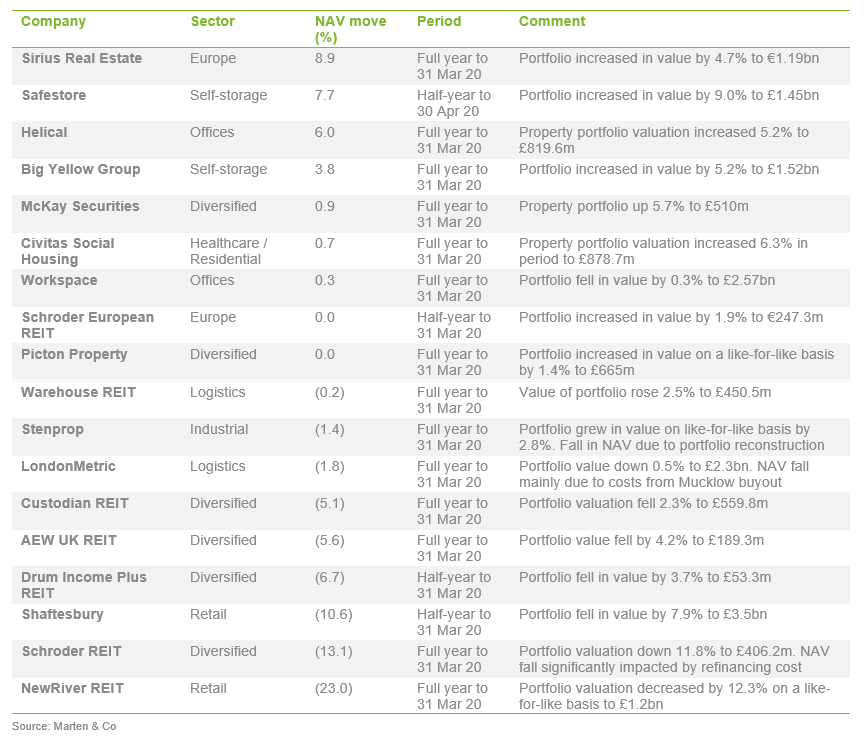

Central London landlords Shaftesbury and Capital & Counties both saw double-digit falls in their share price after the latter bought a 26% stake in the former. Town Centre Securities, which owns retail, leisure and car parks, also suffered a significant fall in its share price during the month. Meanwhile, diverse property owners BMO Commercial Property Trust and Schroder REIT were high on the list, the latter of which reported annual results that included a 13.1% fall in NAV and a 11.8% drop in property values. Workspace Group also reported results in the month, with NAV increasing slightly. The fall in share price could be due to negative sentiment around serviced offices with demand falling due to covid-19. Uncertainty surrounding the future of the student accommodation sector could also be behind the fall in GCP Student Living’s share price, although its London-centric portfolio should stand it in good stead.

Valuation moves

Valuation moves

Corporate activity in June

Corporate activity in June

Logistics landlord SEGRO raised £680m in a share placing “to take advantage of ecommerce trends that are accelerating as a result of the covid-19 pandemic”. A total of almost 83 million shares were placed at a price of 820 pence, representing a discount of 4.5% to the closing price on 9 June 2020 and a 15.8% premium to NAV.

Student accommodation specialist Unite raised £300m in a placing. A total of 34,482,759 new ordinary shares were placed at a price of 870 pence per share, representing a discount of 3.1% to the closing price on 24 June 2020 of 897.5 pence and a 2% premium to NAV.

Warehouse REIT raised £153m in a placing of 139,090,908 new shares at a price of 110 pence. The company has an acquisition pipeline of logistics assets lined up.

Redefine Properties sold its 29.42% stake in RDI REIT to affiliates controlled by Starwood Capital Group. RDI REIT’s shares rose strongly on the back of the news.

Empiric Student Property appointed Ten Entertainment Group’s current chief executive Duncan Garrood as its new chief executive.

The managers of Ediston Property Investment Company bought 276,971 shares at 50p per share on 23 June, to take their holding to 1.5m shares. The price was a 47.1% discount to the last published NAV.

Former Land Securities chief executive Robert Noel will succeed David Tyler as non-executive chair of Hammerson. Noel retired as Land Securities’ CEO in March 2020 after eight years. Hammerson is also adding Desmond de Beer to its board as a non-executive director. De Beer is a non-executive director of Lighthouse Capital, a property company which invests in direct property and listed real estate securities and which has a 15.1% shareholding in Hammerson.

Grit Real Estate announced plans to delist from the Johannesburg Stock Exchange, making London its primary listing and Mauritius its secondary.

June’s major news stories

June’s major news stories

• Intu collapses into administration

Shopping centre owner Intu Properties called in administrators after last gasp rescue talks with creditors collapsed. The company was in dire straits even before the covid-19 lockdown having built up £4.5bn of debt. It was also facing rent reduction demands from struggling retailers. The coronavirus crisis exacerbated the situation and hastened its demise.

After Intu Properties, the biggest shopping centre owner in the UK, plunged into administration what does it mean for the wider property sector and will other companies follow suit?

• LondonMetric splashes £73m with Waitrose store buy

LondonMetric Property acquired five Waitrose supermarkets and an urban logistics facility let to Ocado for a total of £72.9m. It purchased the supermarkets from Waitrose in a sale-and-leaseback deal for £62m and bought the urban logistics unit in Walthamstow for £10.9m.

• Warehouse REIT makes series of lettings

Warehouse REIT secured a series of lettings across its portfolio worth £1.9m in annual rent, reflecting the continued strength of the logistics sector. Highlights included a 10-year lease renewal, with NYSE-listed Iron Mountain at a 26% uplift to the previous rent paid.

• Tritax Big Box pre-lets 2.3m sq ft scheme to Amazon

Tritax Big Box REIT secured a deal with Amazon to pre-let 2.3m sq ft of logistics space at its Littlebrook development in Dartford, east London. The company had just received planning consent for the scheme at the former power station.

• New retail rental solution on the horizon

High street fashion chain New Look was reportedly in crunch talks with landlords about restructuring its leases to turnover-based rents. The proposals reflect a fast-growing trend in the retail sector, but how do they work and what does it mean for landlords?

• LondonMetric acquires Kwik-Fit centres as part of £11.6m of deals

LondonMetric bought five roadside service centres in a sale-and-leaseback deal with Kwik Fit. The assets were bought for £9.6m and are located in Barnet, Whetstone, Hounslow, Hammersmith and Slough. It also purchased, via a forward funding contract, a new build roadside asset in Rushden for £2m let to Euro Garages.

• SEGRO acquires urban logistics site for £202.5m

SEGRO bought a 34-acre urban logistics estate in Perivale, west London for £202.5m. The estate provides 590,000 sq ft of lettable space across 23 units as well as eight-acres of medium-term development land.

• Harworth acquires Midlands industrial estate for £10.1m

Harworth has bought a 20.5-acre industrial estate near Birmingham for £10.1m, reflecting a net initial yield of 10.2%. It said the acquisition was in line with its strategy to grow its recurring income base.

• Regional REIT sells Coventry offices

Regional REIT completed sales of Buildings 2 and 3 The Oaks, Westwood Business Park, Coventry for £6.3m, reflecting a net initial yield of 6.5% and an uplift of 8.6% to latest valuations. The proceeds from the sale will be used to invest in a new opportunity.

Managers’ views

Managers’ views

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Logistics

Logistics

Warehouse REIT

Neil Kirton, chairman:

We do not believe the pandemic will materially alter the structural changes that are driving demand for warehouse space. Indeed, with many more people discovering the convenience of buying online, covid-19 may accelerate the shift from high street retail to the internet. In addition, businesses who have previously relied on just-in-time deliveries may look to increase their resilience by holding more stock or switching to UK-based suppliers, with a corresponding requirement for warehouse space. The continued imbalance of demand and supply of warehouse space means we see the potential for further rental growth.

LondonMetric

Patrick Vaughan, chairman:

Covid-19 is serving to further accelerate structural trends that were already underway. This is having a profound impact on commercial property, with the outlook for certain sectors that were already facing disruption continuing to deteriorate and the polarisation of performances widening further.

It had been apparent to us for a long while that changes in consumer behaviour were going to significantly impact traditional retail property and, over the last year and particularly over recent months with ‘forced adoption’ of new living and shopping habits, this sub sector has seen materially adverse valuation movements and rental declines. Conversely, the supportive tailwinds for logistics and long income property have strengthened further.

Industrial

Industrial

Stenprop

Paul Arenson, chief executive:

Whilst covid-19 is causing immense disruption to the economy and to our customers, we believe that the response is also paving the way for greater future demand for multi-let industrial (MLI) units. The internet sales and distribution channel for all businesses will have taken another big step forward as the whole population has been forced into isolation and have had no choice but to embrace the new technologies and supply and distribution channels. Home working and the explosion of communication technologies will also foster greater ability to work in a decentralised way, which feeds demand for MLI space.

We believe companies will reassess their globalised ‘just-in-time’ supply chains. It is becoming clear to many businesses that it is not viable to rely on geographically distant supply chains from single undiversified sources. We sense a desire for companies to have greater control over supplies and easier access, even if it means more cost. As a result, we expect to see more demand for MLI units as the trend for ever increasing globalisation falters and more is made, sourced or stored locally.

Healthcare / Residential

Healthcare / Residential

Civitas Social Housing

Paul Bridge, chief executive:

Today there is a structural shortage of properties that are capable of hosting mid-to-higher acuity care within local community settings. Such properties are not always available and so are typically highly regarded by both care providers and local authority health commissioners. The drivers of demand for the company’s portfolio are very much settled within the healthcare sector in the UK and result from long standing government policy to seek closure of remote hospitals in favour of community provision.

The trend for community provision has become established in the UK over the past 25 years and reflects much broader societal change in the manner that care is delivered for people of working age with lifelong care needs. What has developed more recently over the past 10 to 15 years has been the emergence of specialist housing associations that deliver the augmented property services and who, in turn, enter into leases to secure available properties for their underlying tenants without any form of public funding.

Whilst this is an important development, the time is now right to broaden the nature of the company’s lease counterparties to include entities such as the NHS and other care providers that are in receipt of government funding as well as leading charities and other not-for-profit entities such as community interest companies.

This initiative is likely, over time, to better reflect the increasingly mid-to-higher acuity focus of the company’s property portfolio and also move the dialogue forward with greater focus on the underlying care. It will also offer alternatives to entering into leases with housing associations where that is felt appropriate or it is required.

Diversified

Diversified

Custodian REIT

Richard Shepherd-Cross, investment manager:

A simple return to pre-COVID-19 pandemic normality by early 2021 appears unlikely. Nevertheless, we still regard commercial real estate as an important and necessary asset for occupiers. Over the course of the next 12 months there may be opportunities in retail warehousing if market sentiment continues to weaken and pricing over-compensates. Strong locations should still see demand from retailers and retail warehouse parks could yet make for a compelling investment, benefiting from large sites close to town centres with free car parking for customers and easy loading and servicing for retailers. These factors should make the stores complementary to online shopping and suitable for use as urban logistics hubs for the retailers.

Good quality offices in regional markets that can offer flexible accommodation, especially on flexible lease terms, are likely to be attractive to occupiers. The covid-19 pandemic lockdown has shown a real benefit to employees, both commercially and socially, of an office providing collaborative space and a hub for doing business. However, the increased ability to work from home, with enhanced connectivity from video conferencing and document sharing, has opened up the possibility of more remote working. It is too early to tell which of these trends will have more impact but going forward we expect in-demand offices to fall into two categories, much the same as retail: prime, town centre offices offering meeting rooms, collaborative spaces and flexible hot desking combined with widespread remote working; or out of town, conveniently located, well-connected, lower cost space. We are conscious that obsolescence can be a real cost of office ownership, which can negatively impact cash flow and be at odds with the company’s relatively high target dividend. The need to provide either good value out of town space or flexible town centre space could be a cost to landlords and this will need to be reflected in either price or rent.

Industrial and logistics properties have been the best performers in real estate markets and the company’s weighting of 46%, by value, to the sector has supported returns during the year. We expect this sector to remain in sharp focus and believe there is still some rental growth potential and refurbishment opportunities.

The covid-19 pandemic has shone a light on the everyday rent collection and asset management of the Custodian REIT property portfolio. Once rent collections return to normal and the free cash and undrawn debt of the company can be deployed, we expect to take advantage of the re-pricing that is likely to be a feature of the market and deliver positive returns to shareholders.

Picton Property

Nicholas Thompson, chairman:

Whilst our focus remains very much around short-term issues and mitigating the impact of covid-19, we recognise that we must also be thinking strategically about the changing long-term trends and demand for commercial property. We think these recent events have accelerated embedded trends in several areas, including online retail, flexible working, digital and technological disruption to name but a few. In addition, a growing sense of environmental impact and the need for change has been self-evident in lockdown. We had already been considering disruptive trends and whilst we believe the portfolio is well positioned, this situation is evolving and continues to be kept under constant review.

AEW UK REIT

Alex Short, investment manager:

It is expected that UK commercial property investment volumes will fall to levels last seen during the 2008 financial crisis during Q2 and Q3 of 2020. The full impact of the current crisis is yet to become clear; but the recovery in the UK commercial property investment market will likely mirror that of the UK economy. Thereafter we expect certain characteristics of the market to return, potentially more forcefully than before. These include a polarisation of the market between the best and worst performing sectors, with occupier demand being driven by structural forces as much as by the health of the economy in general. A clear example of this has been the growth of online retail at the expense of physical stores, which has seen a divergence in the capital values of the retail and industrial warehousing sectors.

McKay Securities

Richard Grainger, chairman:

The longer-term implications of covid-19 on the commercial property market will be determined by its impact on the UK and global economy, and the extent of structural change that the virus necessitates for working practices.

The industrial and logistics sector has proved resilient and our assets may indeed benefit from increased demand generated by an acceleration of the shift to online retail. The inadequacies of global supply chains have been exposed, which may also lead to operating reviews and further support demand.

Office occupiers are likely to be faced with more challenging decisions regarding future operations and requirements, having to take into account factors including culture, cost, transportation and staff retention. Despite the ability of many businesses to work remotely, we do not see this as the end of the office as a place of collaboration and cohesive business.

There will inevitably be shifts in office working practices, and we expect this to lead to an acceleration of many of the trends we have positioned the portfolio to respond to over recent years, such as a flexible lease structure, competitive operating costs, smart technology and high standards of customer service. Occupational costs in the South East are significantly lower than central London. Travel to work options are also more varied, with generous car parking and local transport networks that avoid reliance on the most congested public transport networks. These factors are widely speculated to result in further decentralisation.

Schroder REIT

Duncan Owen, investment manager:

The immediate outlook for the real estate market and economy is highly uncertain due to the covid-19 pandemic. We are assuming the UK economy enters a recessionary period with an increase in unemployment and reduced occupational demand, leading to falling capital and rental values. The extent of the downturn, and shape of the recovery, should become more clear as the lockdown eases over the coming months. Whilst we are expecting the sharp economic slowdown to be followed by a slow recovery, the current situation has accelerated the already identified structural changes and mega themes which have been central to our strategy.

Retail

Retail

Shaftesbury

Brian Bickell, chief executive:

The economies of London and the West End have a long history of structural resilience, having weathered many episodes of near-term challenges and uncertainties. Their unique features come from a culture of constant evolution across a broad-based economy, attracting talent, creativity, innovation and investment from across the world and reinforcing their enduring appeal to businesses, visitors and as great places to live. In the post-pandemic recovery, these fundamental advantages will underpin their return to prosperity and growth.

Whilst the rate of progress out of current pandemic-related restrictions is presently unclear, we believe the qualities of our portfolio and strategy will position us to embrace and adapt to wider societal trends, which were evident in the pre-covid-19 era, and may accelerate as recovery takes hold and business conditions begin to improve.

Offices

Offices

Helical

Gerald Kaye, chief executive:

For the office sector, questions are being asked about the desire to return to previous working practices. It is our view that a large majority of businesses will continue to seek space for their employees to gather in a centralised working environment and that the draw of London, as a pre-eminent global city, will remain. We believe they will continue to seek well located and accessible buildings near large and modern transport hubs, served with the latest technology but with an increased focus on health and well-being within sustainable buildings. We anticipate there will be a growing divergence in the office sector between Grade A buildings and the rest. The response from both occupiers and investors following covid-19 is likely to accelerate this process and we are confident that the successful delivery of our strategy in recent years means we are positioned on the right side of this gap, with our Grade A buildings offering an appealing environment for businesses seeking high quality space.

Europe

Europe

Schroder European REIT

Jeff O’Dwyer, fund manager:

While high-frequency indicators show that activity is returning, it seems somewhat slower than anticipated. Consumers remain cautious and the ongoing uncertainty weighs on business investment. Latest data for China and the US is also suggesting a sharper decline in economic output than previously anticipated. As such, the investment manager’s house view is turning from a V-shaped recovery scenario to a U-shaped forecast with activity to increase again in the second half of the year, but at a slower pace than originally anticipated. The full impact of the crisis will depend on whether the huge package of tax breaks, loan guarantees and compensation for short-time working announced by the EU and by national governments succeed in keeping businesses afloat. If they fail and there is a wave of insolvencies, then unemployment will be permanently higher and the recession will be deeper and longer.

The outlook for real estate markets remains uncertain. The impacts of covid-19 have yet to fully play out and the depth and recovery of global GDP cannot be predicted with any confidence.

Upcoming events

Upcoming events

• QuotedData’s Property Summer Conference, 8 July 2020

• Land Securities 2020 AGM, 9 July 2020

• Workspace 2020 AGM, 9 July 2020

• QuotedData’s Property Summer Conference, 15 July 2020

• QuotedData’s Property Summer Conference, 22 July 2020

• LondonMetric 2020 AGM, 22 July 2020

• Helical 2020 AGM, 23 July 2020

• Great Portland Estates 2020 AGM, 24 July 2020

• British Land 2020 AGM, 29 July 2020

Publications

Publications

Aberdeen Standard European Logistics Income – Resilient to Covid-19

Civitas Social Housing – Proved its mettle

The legal bit

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.