Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Research published over March

Aberdeen Emerging Markets Investment Company – Cautiously optimistic

“Aberdeen Emerging Markets Investment Company’s (AEMC’s) managers, Andrew Lister and Bernard Moody, note investors’ new-found enthusiasm for emerging markets, now that they have been outperforming for a while. Their long experience of investing in the space tells them that now is a good time to be cautious. They have been taking profits on some positions and reallocating funds to areas that are yet to feel the full benefit of the change in sentiment toward the sector.”

Aberdeen New Dawn – An ESG leader in Asian equities

“Despite the difficulties of COVID-19, Aberdeen New Dawn (ABD) has provided very strong absolute and relative returns during the last 12 months. These are markedly ahead of its benchmark, the wider Asia ex Japan region and global equity markets more generally. Asia is emerging from the pandemic in a position of relative strength and ABD’s manager thinks valuations are at attractive levels relative to global equities.”

Vietnam Holding – Leveraging Asia’s rising star

“Vietnam’s response to the COVID-19 pandemic has been very effective and, reflecting this, the International Monetary FUND (IMF) has predicted that it will post positive GDP growth of 1.6% for 2020, increasing to 6.7% this year and averaging 7.0% for 2021 to 2025. Indeed, Dynam Capital, Vietnam Holding’s (VNH’s) manager, believes that Vietnam will be one the 20 largest economies in the world by 2050.”

Jupiter US Smaller Companies – Over the pond

“From the beginning of April, Brown Advisory (Brown) is set to take over the management of Jupiter US Smaller Companies (JUS), following the retirement of the trust’s long-standing manager, Robert Siddles. Back in December, when JUS’s board announced its intention to appoint Brown, it said that the long and impressive track record of the new manager’s US small-cap growth strategy, with annualised returns of 14.5% over 10 years, stood out in a highly competitive field. It also said that it believed that the appointment of Brown should lead to strong performance, a narrower discount and ultimately the ability to grow the company over time.”

The North American Income Trust – Well-positioned as rotation gathers pace

“North American Income Trust (NAIT) stands apart amongst the AIC North America sector funds in combining an income focus with at least 90% of its portfolio invested in the US. NAIT’s manager, Fran Radano, believes that this should work in its favour, as there is a good chance that the market rotation back into sectors with attractive valuations, like financials, will continue over the rest of 2021.”

Weiss Korea Opportunity Fund – A remarkable success story

“Weiss Korea Opportunity Fund (WKOF) was one of the best-performing of all London-listed investment companies last year, and since its 2013 launch, it has delivered more than twice the return of its performance benchmark index, the MSCI Korea 25/50 Index. WKOF has a unique investment approach within the investment company sector. Not only is it the only UK-listed fund offering investors dedicated access to South Korean stocks, it has also adopted a differentiated investment approach that seeks to profit from the valuation gap between the non-voting Korean preference shares that make up substantially all of its portfolio and the common shares issued by the same companies.”

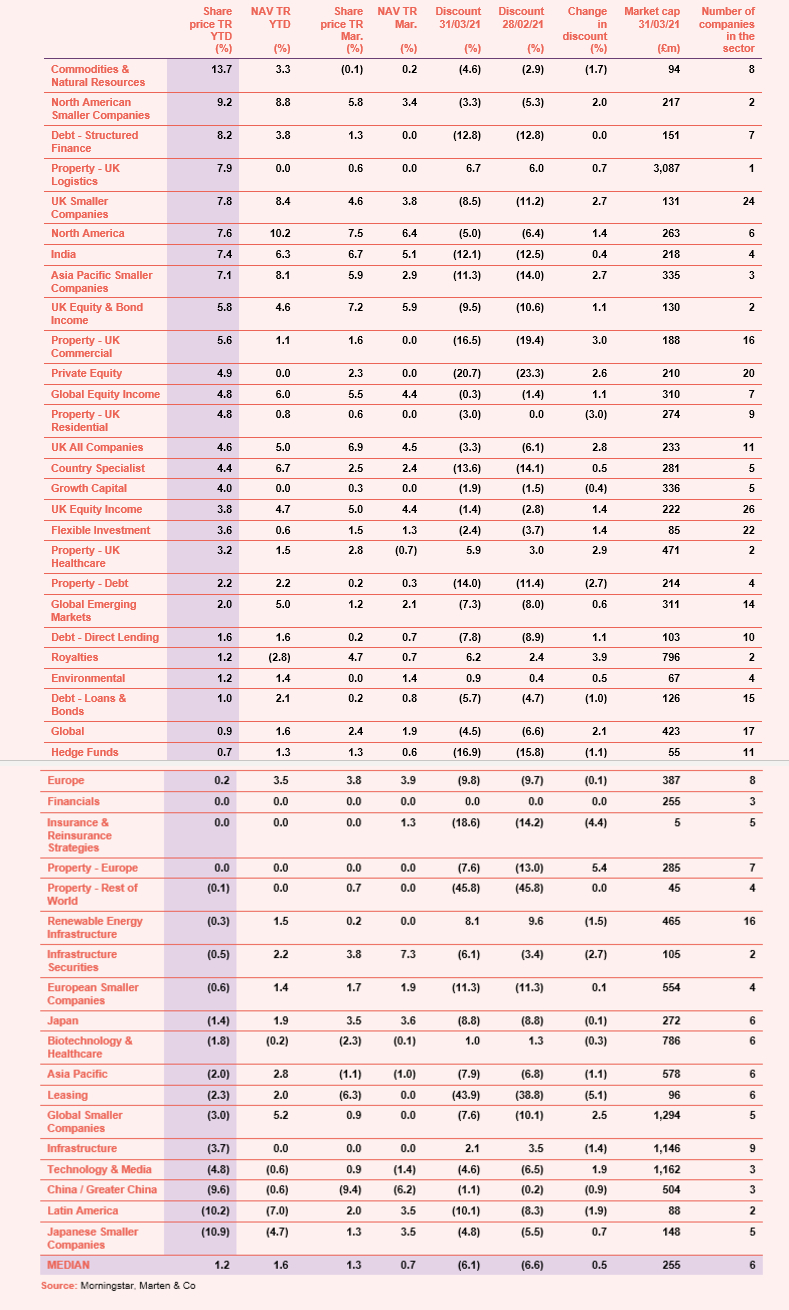

Performance

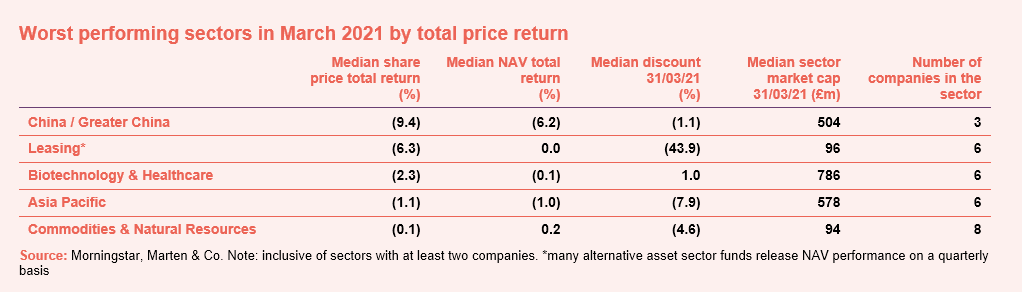

It feels as though the rotation from ‘growth’ to ‘value’ that began last November regained some momentum in March. Having been amongst the best performers over 2020, sentiment towards Chinese funds has deteriorated, China appears to be withdrawing stimulus, clamping down on lending and is targeting many of its leading companies with anti-monopoly probes. We note that the Association of Investment Companies (AIC) has made some changes to its sector classifications, headlined by the introduction of China/Greater China, India and Property – UK Logistics as separate sectors (see Appendix 1 for a breakdown of how all the sectors have performed this year).

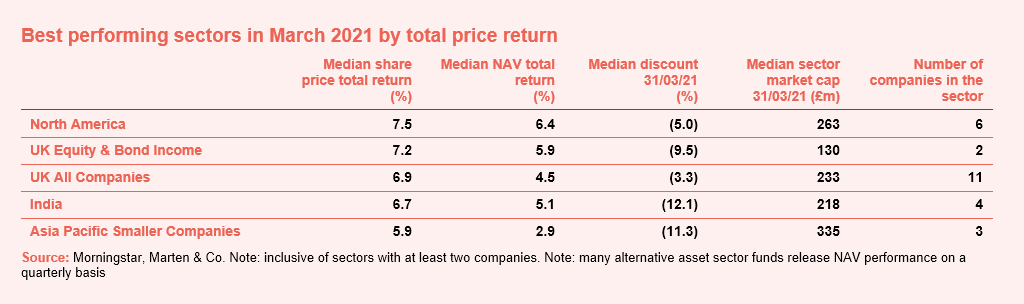

On balance, it was a good month for investment companies, March’s median total share price return was 1.5% (the average was 2.4%) which compares with an increase of 0.7% in February. UK equity and property assets continued to rally while improved sentiment towards US cyclical sectors benefitted the North America sector, which includes a number of equity income strategies.

Readers interested in the most recent briefings from the industry can click here to access our economic and political roundup.

Best performing sectors over March

Worst performing sectors over March

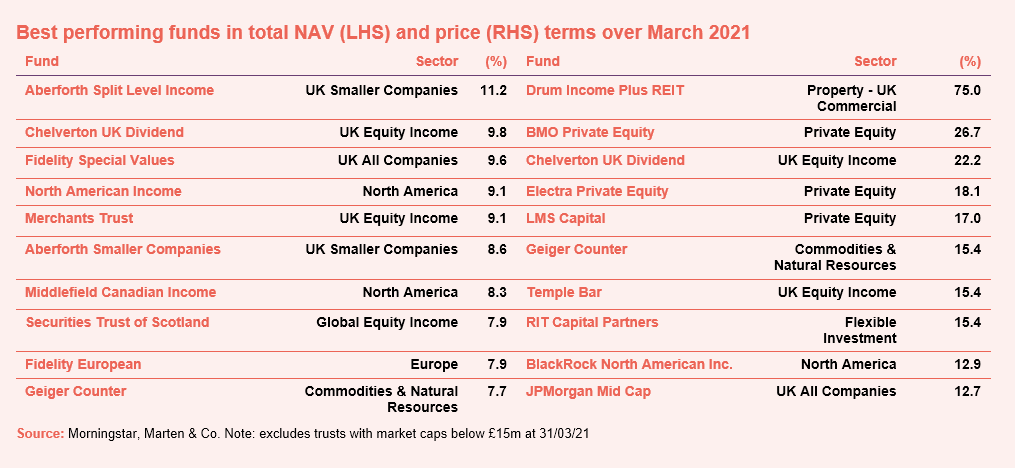

On the positive side

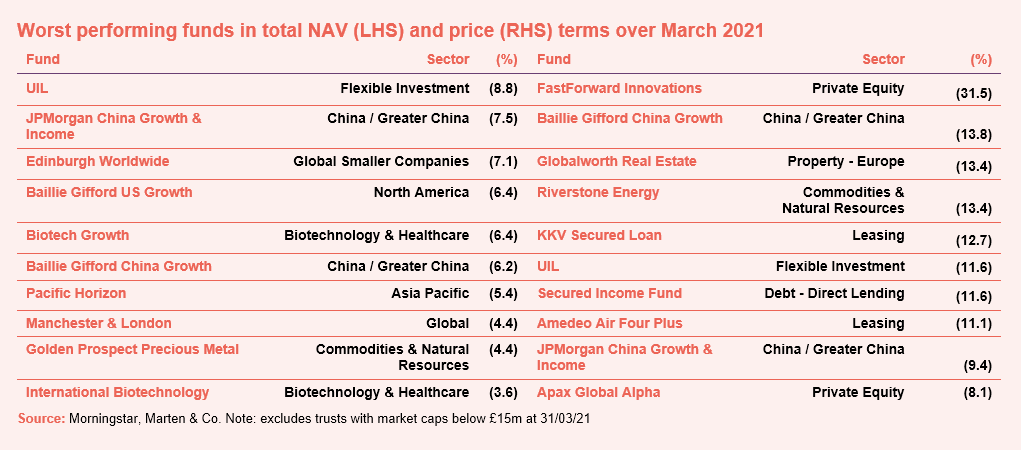

The split capital structures operated by Aberforth Split Level Income and Chelverton UK Dividend has made them particularly strong beneficiaries of the ongoing rally in UK equities. We note that, as of 31 March, only Geiger Counter had a higher NAV return (minimum market cap of £15m) over the year-to-date. In fact, five of the 10 best performers, in NAV terms, were UK equity strategies. With the outlooks for many of their underlying cyclical sectors improving, North American income strategies, led by North American Income, performed well over March. Discounts have been narrowing across much of the private equity sector (arguably belatedly), with the majority of the underlying funds held by the fund of funds structures generating distributions well ahead of forecasts. BMO Private Equity and LMS Capital began March trading at discounts of close to and over 40% of their most recently published NAVs, but these have narrowed since. Drum Income Plus REIT’s shares shot up after announcing a strategic review that could result in it selling off all its assets. It has traded at a persistent discount since launching in 2015. After faring so well over 2020, sentiment towards Chinese stocks has deteriorated over recent weeks. Baillie Gifford China Growth led share price declines in the newly segregated China/Greater China sector classification. As shown in the Appendix section, in share price terms, China/Greater China has been the third-worst performing sector this year. This is primarily being driven by profit taking as the Chinese government withdraws stimulus. Investors also seem to be withdrawing money from growth sectors such as tech and biotech, hitting Baillie Gifford US Growth and Manchester & London. Biotech Growth and International Biotechnology have returned (9.5%) and (9.7%) over the year-to-date in share price terms, after a strong 2020. While UK property funds have been staging a comeback, this has not extended to Continental and Eastern Europe, where the vaccine rollout has been uneven. This was reflected in the share performance of Globalworth Real Estate. It is a major office-space investor in Poland and Romania.

On the negative side

Discounts and premiums

More expensive and cheaper relative to NAV

Schroder European Real Estate was the best performing European property fund in price terms over March, as investors saw value in the discount of (34.1%) and a yield above 7%, at the start of the month. Rent collection of 89% in the final quarter of 2020 was received positively and progress towards bringing the dividend back to its pre-COVID level has been encouraging, helped by the ability to dip into its capital following the timely sale of a Paris office block for a profit of around €70m. Chelverton UK Dividend was covered above while Gresham House Strategic has similarly benefitted from the marked improvement in sentiment. As of 31 March, only Drum Income Plus REIT has performed better than Geiger Counter over the year-to-date in share price terms. Uranium miners have been rallying considerably with Uranium supply constrained and demand benefitting from the increase in nuclear capacity across China especially, as part of its clean energy policy. It is also believed that the US and EU want nuclear to play an important part in the evolvement of the energy composition mix. Gore Street Energy Storage’s premium widened following its update on the National Grid’s new Dynamic Containment Service, which may have made battery storage a lot more lucrative.

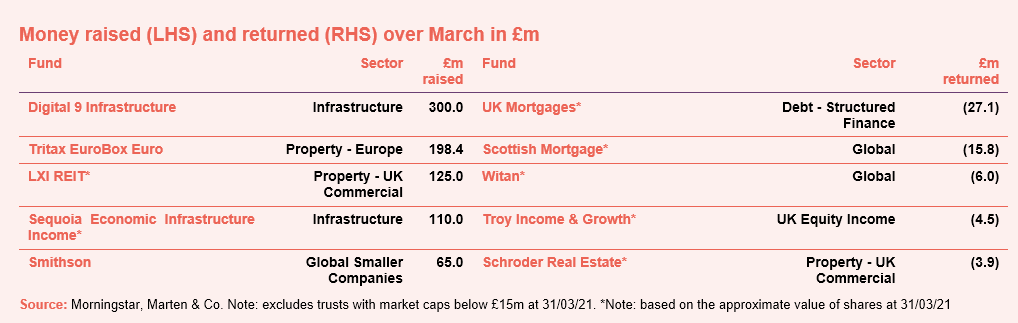

Money in and out

Money coming in and going out

Following on from Cordiant Digital Infrastructure’s £370m IPO last month, Triple Point’s Digital 9 Infrastructure got off the ground, raising £300m. While this was below their £400m target, the issue size is still a very good result. It will invest in a range of digital infrastructure assets, which deliver a reliable internet including (but not limited to) subsea fibre, data centres, terrestrial fibre, tower infrastructure and small cell networks (including 5G). Elsewhere, Tritax EuroBox led capital raising amongst the existing funds, bringing in £198.4m in an oversubscribed issue. The logistics sector has taken off since the pandemic with online retailing growing exponentially and businesses responding by shoring up their distribution networks. EuroBox’s key developer relationships allow it access to investment opportunities that would never come to the market. Sequoia Economic Infrastructure Income’s £110m of new capital will be used to pay down debt and expand the portfolio.

Returns of capital were led by UK Mortgages, Scottish Mortgage, Witan, Troy Income & Growth, and Schroder Real Estate.

Major news stories over March

Portfolio developments

- SDCL Energy Efficiency Income sealed a deal with the UK’s largest operator of public electric vehicle charging points

- HgCapital Trust had a bumper year

- RTW Venture participated in financing rounds held by Ventyx Biosciences and Visus Therapeutics

- BlackRock World Mining had a great 2020

- Mercantile reflected on a difficult year and its optimism around the UK for 2021

- India Capital Growth began to reap the rewards of an improved process

- BioPharma Credit is to invest $150m in senior secured loan agreement with LumiraDx

- We had inaugural results from Octopus Renewables Infrastructure

- It was a tough year for BlackRock Latin American

- Apax Global Alpha had a great year

- JLEN Environmental Assets made its third investment into battery storage systems

- Aberdeen Smaller Cos Income held its nerve through pandemic

- Syncona acted as a cornerstone investor in a US$148m financing round for Gyroscope Therapeutics

Corporate news

- Digital 9 Infrastructure’s IPO raised £300m

- Strategic Equity Capital scored a comfortable win in its continuation vote

- Drum Income Plus REIT is undertaking a strategic review

- Fundsmith Emerging Equities proposed an amendment to its investment objective and policy

- Fair Oaks Income published a prospectus on its reorganisation and placing programme proposals

- There was a shakeup at JPMorgan Multi Asset. It is changing its name to JPMorgan Multi-Asset Growth & Income

- Chrysalis Investments is looking to grow to fund its active pipeline of around £1bn

Managers and fees

Property news

- Civitas Social Housing achieved an investment-grade credit rating

- We also had a response from Civitas and Triple Point Social Housing to a regulator update

- CEIBA raised €25m in a convertible bond issue

- Tritax EuroBox was assigned investment grade credit rating by Fitch. It also raised €230m in oversubscribed placing

- LXI REIT bought seven foodstores for £85m

QuotedData views

- There’s more to emerging markets than China – 26 March

- Will Rishi’s call for return to office impact sector? – 26 March

- Retiring gracefully – 19 March

- Property one year on from lockdown – 19 March

- Keeping the dividends flowing – 12 March

- Too late to save property’s problem child? – 12 March

- Inflation fears making waves – 5 March Student digs top of the class for COVID rebound? – 5 March

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Murray International Trust PLC online shareholder presentation,

13 April - Herald AGM 2021, 20 April

- CVC Credit Partners European Opportunities AGM 2021, 22 April

- The London Investor Show, 23 April

- JPMorgan US Smaller AGM 2021, 26 April

- Fidelity Japan presentation 2021, 26 April

- Aberdeen Asian Income manager presentation 2021, 27 April

- JPMorgan American manager presentation 2021, 28 April

- Aberdeen Smaller Companies Income AGM 2021, 28 April

- Pershing Square AGM 2021, 28 April

- Greencoat UK Wind AGM 2021, 28 April

- Witan AGM 2021, 28 April

- BBGI Global Infrastructure AGM 2021, 30 April

- Apax Global Alpha AGM 2021, 4 May

- The Renewables Infrastructure Group AGM 2021,

5 May - Schroder Asian Total Return AGM 2021, 7 May

- Aberdeen Asian Income AGM 2021, 12 May

- Nippon Active Value Fund AGM 2021, 12 May

- Temple Bar AGM 2021, 13 May

- JPMorgan American AGM 2021, 14 May

- Baillie Gifford Shin Nippon AGM 2021, 14 May

- Fidelity Japan AGM 2021, 18 May

- Riverstone Credit Opportunities Income AGM 2021,

19 May - Henderson High Income AGM 2021, 24 May

- Sustainable & Social Investing Conference,

21 May - Axiom European Financial Debt AGM 2021, 19 July

- Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

And here is what is coming up:

| Friday | Special Guest | Topic | |

| 16 April | Hugo Ure | Troy Income & Growth |

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – March median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.