Real Estate Roundup

Kindly sponsored by Aberdeen Standard Investments

Performance data

September’s biggest movers in price terms are shown in the chart below.

There was an eclectic mix of property companies to feature in the top price movers for September. Top of the tree was private rented sector and residential development specialist Sigma Capital Group, with a 34.2% rise. The group launched a £1bn joint venture with EQT Real Estate, the real estate platform of global investment firm EQT, to deliver 3,000 private rental homes in Greater London.

Micro-cap investor Panther Securities also hit double-digit gains, while Macau Property Opportunities saw an uplift in its share price after announcing debt refinancing and a disposal. CLS Holdings, the investor in offices in Germany, France and the UK, continued to see a recovery in its share price – which has risen 15.1% in the last three months. Off the back of solid results, Berlin residential landlord Phoenix Spree Deutschland saw its share price gain 7.2%. Schroder REIT’s share price rose 6.6% in the month as it embarked on a share buyback programme, while Irish commercial property investor Yew Grove REIT also saw positive shareholder reaction to amending its investment strategy to increase its target loan to value ratio to 40%.

It is no surprise that once again it was shopping centre owners Capital & Regional and Hammerson that topped the chart of worst performing property companies in September. Capital & Regional published results at the beginning of the month in which it posted a 36.6% fall in net asset value (NAV) in just six months.

Meanwhile, Hammerson completed a rights issue and share consolidation plan during September, as well as announcing a new chief executive. BMO Real Estate Investments continued to see its share price fall, which in the year to date has dropped almost 40%. U and I Group’s share price reached an all time low during the month as it continues to battle against declining land and development values across its portfolio. NewRiver REIT has been another perennial member of the worst monthly property share price performers and has year to date lost 75% in value. Regional REIT reported a 9% fall in its NAV in half-year results, while Capital & Counties’ portfolio in London’s West End has continued to be hit by muted tourist numbers and COVID-19 restrictions.

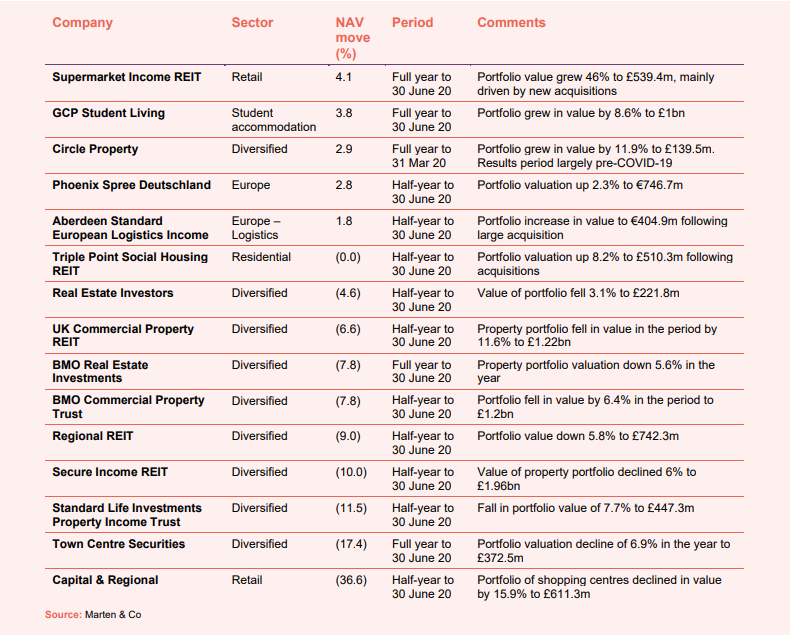

Valuation moves

Corporate activity in September

Urban Logistics REIT raised £89.2m in a placing, that it will use to acquire a pipeline of assets. The group also declared a special dividend of 3.25 pence per share for the six months ending 30 September 2020.

Supermarket Income REIT and Triple Point Social Housing REIT both announced intentions to raise money. Supermarket Income REIT aim is to issue £200m worth of shares, while Triple Point aims to raise £70m.

There were several high-profile appointments during the months. British Land announced current chief financial officer Simon Carter will succeed Chris Grigg as chief executive on 18 November 2020. Retail landlord Hammerson appointed Rita-Rose Gagné as new chief executive replacing David Atkins at the end of the year. St Modwen hired Centrica Consumer chief executive Sarwjit Sambhi as its new chief executive, effective from 2 November 2020. Lastly, Duncan Garrood took up the position of chief executive at Empiric Student Property on 28 September.

Schroder REIT commenced a share buyback programme, taking advantage of its wide discount (of around 50%). It has authority to repurchase a maximum of 77,725,160 of its ordinary shares.

CLS Holdings completed a £154m “green” loan with Aviva Investors secured against a portfolio of 12 UK properties. The loan, which replaces three existing loans that were due to expire in 2020 and 2021, expires after 10 years and 12 years and has an average fixed interest rate of 2.62%. A 10-basis point reduction in the margin will occur depending on specific sustainability targets being met.

BMO Real Estate Investments has removed performance fees from the investment management fee with affect from 1 July 2020. The group produced a total return of -0.6% in the year to June 2020, beating the benchmark meaning the manager was eligible for the maximum performance fee. Conscious of paying performance fees in a market of negative returns, the board has reduced the performance fee by 50% this year and ditched it permanently thereafter.

September’s major news stories

After Urban Logistics REIT announced another equity raise, having invested all the proceeds of its £136m placing from March, QuotedData looks at the polarisation in the property market.

• Tritax Big Box REIT sells £134m of assets

Tritax Big Box REIT disposed of four assets during the month for a combined £134m. It said the assets (Baker Business Park in Ripon; Langley Mill in Nottingham; Warth Park in Raunds and an Amazon-let property in Chesterfield) had reached their full value following completion of asset management initiatives.

• LondonMetric Property sells six warehouses for £57.3m

LondonMetric Property sold a portfolio of six distribution warehouses for £57.3m, reflecting a blended net initial yield of 5.3%. The disposal of the assets (located in Worcester, Leamington Spa, Royston, Castle Donnington, Milton Keynes and Huyton) crystallise an £8.8m profit on cost and deliver an internal rate of return of 11% per annum.

• CLS Holdings acquires commuter-belt office portfolio for £60m

CLS Holdings exchanged contracts to acquire a portfolio of offices in Greater London and the South East (in Richmond, Chelmsford and Leatherhead) for £59.71m, in a major vote of confidence for the UK office market.

• A new launch Home-ing in on social benefit

QuotedData took a closer look at Home REIT after it announced intentions to raise £250m from an initial public offering (IPO). The company is looking to acquire a portfolio of homeless accommodation in the UK.

• Ediston begins construction of retail park

Ediston Property Investment Company announced it had started construction of a 48,000 sq ft retail park in Haddington, East Lothian, which is 97% pre-let to tenants including Aldi and Home Bargains. The decision is a fillip for the retail sub-sector that has proved resilient during COVID-19.

• McKay Securities lets speculative warehouse and disposes of City office

McKay Securities let the 135 Theale Logistics Park, which increased its contracted rental income by 5.3% to £29.8m. During the month it also completed the sale of City of London office 30 Lombard Street for £76.5m.

• NewRiver REIT makes £34.7m retail park sale

NewRiver REIT sold a 90% stake in Sprucefield Retail Park, in Lisburn, for £34.7m. The sale was part of the group’s strategy to dispose of £80m to £100m of assets and brought sales proceeds (including deals exchanged or under offer) to £65.7m.

• Grit Real Estate reduces retail exposure with significant disposal

Pan-African investor Grit Real Estate sold a 39.5% stake in the AnfaPlace Mall, in Morocco, that reduced its exposure to the retail sector to 24.9%.

• Bleak winter ahead for real estate

West End landlord Shaftesbury laid bare the full impact of COVID-19 on the property sector with a trading update that 50% of rent billed in the March and June quarters had been waived or was still outstanding.

Managers’ view

A collation of recent insights on real estate sectors taken from the comments made by chairmen and investment managers of real estate companies – have a read and make your own minds up. Please remember that nothing in this note is designed to encourage you to buy or sell any of the companies mentioned.

Diversified

Standard Life Investments Property Income Trust

James Clifton-Brown, chairman:

From a real estate perspective, our investment manager forecasts that valuations will remain weak, although they are unlikely to experience the declines we have seen in the first six months of this year. In terms of rent collection, some tenants, depending on what sector they are in, will continue to have difficulty in meeting rental obligations over the remainder of this year, and quite possibly for the first half of 2021. However, indicative evidence from our own portfolio is that most tenants are willing to work with their landlords to come to a mutually acceptable outcome for rents due and hence it is hoped there will be a fairly rapid pick-up in activity in 2021. This recovery will not be uniform across the main real estate sectors with the accelerating move away from high street retail to online retail. The resultant requirement for industrial space means the industrial sector is likely to continue to be the best performing sector.

UK Commercial Property REIT

Ken McCullagh, chairman:

The key questions are how much and how quickly the economy can recover and if and when a COVID-19 vaccine might be developed which would allow a return to full economic activity. The effect of the ongoing Brexit negotiations and the uncertainty around whether a trade deal will be agreed between the UK and the EU also cannot be ignored in assessing the future prospects for the UK economy. Our investment manager is forecasting a 12.9% fall in GDP for 2020, a figure which testifies to the damage done to the economy, but encouragingly also forecasts 11.8% GDP growth in 2021, on the basis there are no further setbacks.

Taking this in the context of UK commercial real estate, it is forecast that valuations, which were already under pressure pre COVID-19, will continue to decline for the remainder of the year. The ability of tenants to continue trading and to pay rent will be key in preserving values and revenues. Any recovery in real estate will not be felt to the same extent across all sectors. COVID-19 resulted in most consumer goods only being available online for a period of time, with the consequence that all generations have become more “computer savvy” and increasingly comfortable with online transactions during lockdown. This is widely forecast to further accelerate the move towards online retail with an increasing demand for logistics units at the expense of traditional high street retail and shopping centres.

BMO Commercial Property Trust

Martin Moore, chairman:

Emerging household behaviours such as the acceleration of growth in on-line retailing, changed travel preferences and greater home working are all likely to have lasting impacts on the property market with Brexit adding further unhelpful uncertainties. The removal of the ‘material uncertainty’ clause from property valuations in September is, on one hand, a positive for the sector as it marks the return of more normal levels of trading activity. But on the other, it introduces the potential for further short-term pricing volatility as investors respond to the reopening of open-ended funds.

It has been an extraordinary period and many of the changes brought into sharp focus by the pandemic may lead us to refine our longer-term strategy. As part of this, we are already working with our managers to look at future areas that should be considered to further strengthen the diversification and resilience of the portfolio. Many challenges undoubtedly lie ahead but, in this fast-changing world, the quality of our existing portfolio with its many accretive opportunities remains in the company’s favour.

BMO Real Estate Investments

Vikram Lall, chairman:

There is likely to be increased unemployment as the furlough scheme ends, which could delay recovery, and further waves of infection and lockdowns cannot be ruled out. It looks probable that there will be a permanent shift in the property market, particularly in retail where online shopping has accelerated and in the office sector where there are and will be increasing numbers working from home. Although the lockdown measures began to be eased towards the end of our financial year, the economic outlook remains highly uncertain and the trading position of many occupiers is extremely challenged. It will take time for output to return to pre COVID-19 levels and for many businesses the new economic reality will look very different to that prior to the outbreak.

Real Estate Investors

John Crabtree, chairman:

Assuming no further drastic COVID-19 related events, we see scope for a renewed level of occupier and investor demand, with particular improvement in occupier demand and rental growth for the office sector. This is due to the lack of supply and greater demand for offices closer to employee residential areas and away from city centres, to avoid the need to travel and use public transport. We expect the stability in convenience and neighbourhood retail to continue with improved demand from investors for these assets and government tenanted assets. Overall, we remain optimistic that we will see a gradual return to positive levels of economic activity over the next 12 months.

Logistics

Aberdeen Standard European Logistics Income

Tony Roper, chairman:

Notwithstanding the unprecedented economic environment we are now operating within, the board and investment manager continue to believe that logistics will remain one of the most favoured sectors for real estate investors in the coming years. The logistics industry has and is experiencing unprecedented disruption as a result of systemic changes to the way global economies are functioning and these challenges are manifesting themselves in different ways across different sectors. So far, logistics assets have benefited from additional occupier demand arising from necessary supply chain restructuring.

New technology is creating challenges for supply chains as clients demand frequency and more complexity whilst the nature of e-commerce, where Europe has lagged the UK, has increasingly required operators to adapt faster to future shifts in consumption, particularly so since the European lockdowns. Leasing ‘tension’ has been robust and land values under pressure from competing uses with income growth prospects potentially stronger than for ‘ultra big-boxes’ where risk is higher at maturity of the lease as the number of potential occupiers are limited. The European logistics sector continues to grow with the increasing demand from market participants for newer, quality warehousing driven by their demand for increased space, both for re-shoring of operations and to address the rise in e-commerce demands.

Retail

Supermarket Income REIT

Nick Hewson, chairman:

The COVID-19 pandemic looks as if it is going to be around for some time, meaning that the retail sector will be required continually to adapt to the changing operating environment. However, the food retailers have demonstrated that they can act speedily and efficiently to deliver groceries to customers. The next challenge facing the grocery sector is Brexit. We believe that our tenants are well positioned to deal with any disruption that may occur. They have strong balance sheets and have demonstrated their ability to adapt their business models and supply chains through the COVID-19 crisis. As a result, we believe any adverse impact for the group would be short lived.

Residential

Triple Point Social Housing REIT

Chris Phillips, chairman:

For all the disruption caused by COVID-19, the fundamentals of this sector remain as strong as ever – perhaps stronger than ever before. Despite some short-term delays in deployment and construction, the damage caused by COVID-19 appears to be elevating the relevance of our socially-focused investments, while the fundamental need for this type of housing continues to grow. Commissioners continue to call for new schemes, and our existing schemes continue to operate well. For all the challenges that lie ahead – both for our economy and our business – our performance in the first half of this year allows us to look to the future with optimism.

Student accommodation

GCP Student Living

Gravis Capital Management, investment manager:

The COVID-19 pandemic has presented unprecedented challenges for the higher education sector, including the company. Social distancing will necessitate a hybrid teaching approach until such time that an enduring solution to the COVID-19 pandemic is found by governments globally. This will combine smaller lecture and/or group sizes with online learning. In such a scenario, it is the investment manager’s expectation that students will attend some classes in person whilst making use of online offerings from their accommodation. In doing so, students will seek to attend campuses where possible given the role university plays as a rite-of-passage in the lives of undergraduate students in particular.

Europe

Phoenix Spree Deutschland

Robert Hingley, chairman:

Mietendeckel has already created significant disruption in the Berlin rental market. Predictably, the effect of rent controls which seek to limit rent levels to below those set by the market, has been to reduce the supply and quality of rental property rather than grow it. At a time when the need for sustainable, environmentally friendly housing has become ever more apparent, levels of investment in the fabric of existing properties are declining. This will likely result in an overall deterioration of the standard of Berlin housing stock which had benefited significantly from high levels of investment during the past decade.

These effects could be reversed if and when the Mietendeckel is overturned. A positive ruling on the Mietendeckel has the potential to positively impact the current valuation discount of the company. We hope for further clarity on the legality of the Mietendeckel in the months ahead.

Real estate research notes

Standard Life Investments Property Income Trust – Building for a new normal

Grit Real Estate Income Group – Africa, substantially de-risked

Aberdeen Standard European Logistics Income – Resilient to Covid-19

Civitas Social Housing – Proved its mettle

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority). This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access. No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.