Investment Companies Monthly Roundup

Kindly sponsored by Baillie Gifford and abrdn

November 2022

Monthly | Investment companies

Winners and losers in October 2022

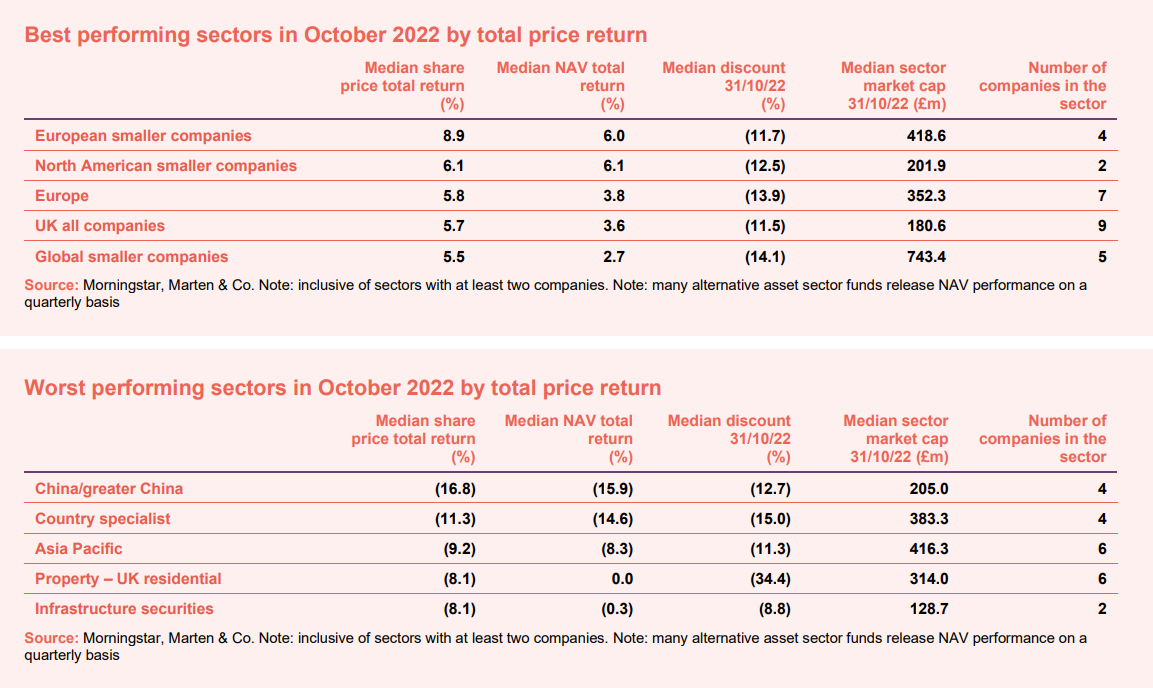

Many equity markets recovered some of the ground lost in September. The swift departure of Liz Truss and her unfunded tax cuts helped the UK stock market and sterling. North America did well, and European markets had a better month in October, and, within the region, small cap outperformed large cap. Signs of easing gas prices may have helped improve sentiment. Hints that the European Central Bank might be less aggressive about raising interest rates may also have helped.

On the negative side, China’s stock market was knocked by renewed COVID lockdowns and Xi Jingping securing backing for a hard-line leadership team. Vietnamese funds, which dominate the country specialist sector, sold off – attributed variously to fears of higher interest rates, slower global growth and domestic scandals at some companies. A weak China also had a knock-on effect on wider Asian indices. Higher mortgage rates are coming in the UK and investors have sold funds in the property – UK residential sector as a result. Energy price caps/windfall taxes are weighing on funds in the infrastructure securities market.

The rebound in US equities, especially smaller companies, over October helped push JPMorgan US Smaller Companies to the top of the performance tables for the month. A couple of other North American focused trusts, North American Income and Pershing Square, also feature. Lula’s victory in Brazil appears to have been taken well by investors, boosting BlackRock Latin American.

Geiger Counter rebounded – its NAV tends to be quite volatile but seems to be on a recovering trend. As OPEC+ agreed a production cut (see our Economic and Political roundup), oil prices bounced which boosted BlackRock Energy and Resources Income and CQS Natural Resources Growth and Income. We mentioned the uplift in European smaller companies stocks earlier, Montanaro European Smaller Companies was the chief beneficiary of this.

CQS Natural Resources Growth and Income also managed to shift to trading on a narrower discount, but still has further to go on that front we think. Dolphin Capital reported a lower NAV in the month but investors were encouraged by its agreement to sell its stake in the One&Only at Kea Island project. SME Credit Realisation was boosted by its latest plan to return capital to investors – £9.1m will be handed back shortly.

It was interesting to see the recovery in Warehouse REIT’s share price. We published a note on the possible overly pessimistic attitude of investors towards the logistics sector, reasoning that a tight market for logistics space would support rental growth. There seems to be some bargain hunting going on elsewhere in the property sectors as Alternative Income REIT and Value and Indexed Property Income both made the list of top-performing funds. Amedeo Air Four Plus remains on a very wide discount but slightly less wide that it was.

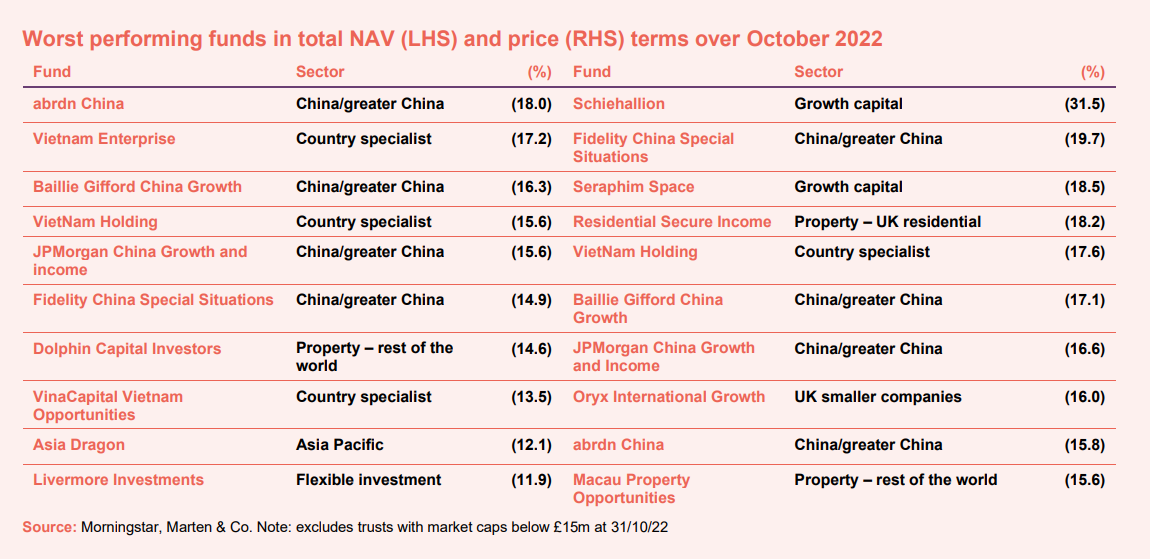

There is a strong pattern to the funds featuring in the lists of worst-performers – China, Vietnam and growth capital funds take most of the slots.

All four China funds and all three Vietnamese funds are amongst the worst-performing funds in NAV terms for the reasons outlined earlier. The general aversion to China seems to have impacted on Macau Property Opportunities and Asia Dragon too.

In the growth capital sector, share prices are falling in anticipation of steep falls in NAVs. Schiehallion held onto a premium rating for far longer than its peers, but sentiment is against these stocks. Seraphim Space announced inaugural results – running from launch to end June 2022 – in which it reported a modest rise in its NAV, reasonable progress in deploying its IPO proceeds, and an expanded management team. Its discount is about 50%, however.

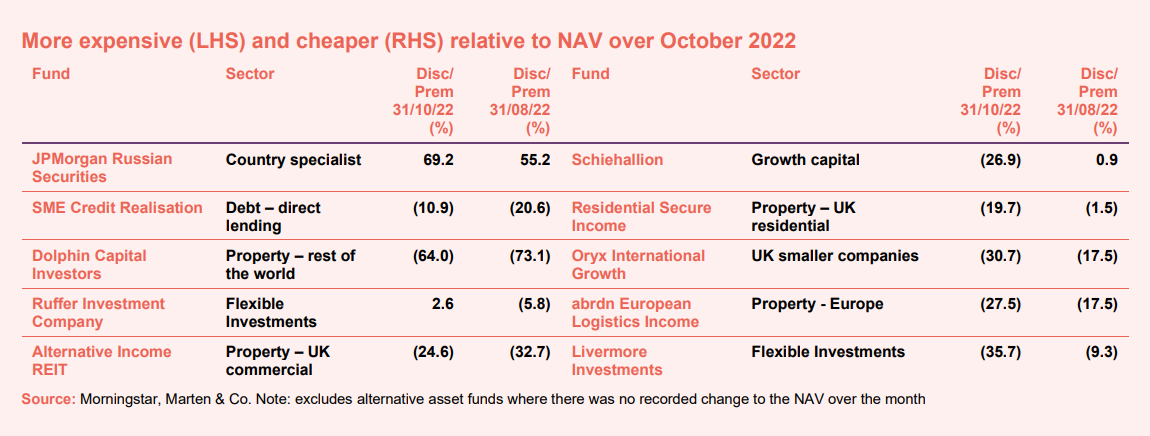

Moves in discounts and premiums

JPMorgan Russian’s shares are a bet on an end to the war and/or the demise of Putin, but investors now need to be mindful of the trust’s plans to change its remit. SME Credit Realisation was bolstered by plans to return some capital to shareholders. The same thought may have occurred to Dolphin Capital investors, but the proceeds of its disposal will be used to pay off debt and the balance kept for working capital requirements. Ruffer’s discount at end September was an aberration and short-lived. Alternative Income REIT investors may have been encouraged by its annual results, which showed an uplift in NAV although that was as at 30 June 2022 before long-term interest rates shot up.

Schiehallion’s wider discount is more in line with peers – we have been puzzled as to how it was holding onto its premium rating for some time. Fears of falling house prices are affecting Residential Secure Income’s share price, we think. Oryx International Growth is thinly traded and it may be that modest selling pressure has triggered the spike in its discount. abrdn European Logistics Income lost its lead fund manager. Livermore Investments announced a sharp drop in its NAV at the end of September and this weighed on its share price during October.

Money raised and returned

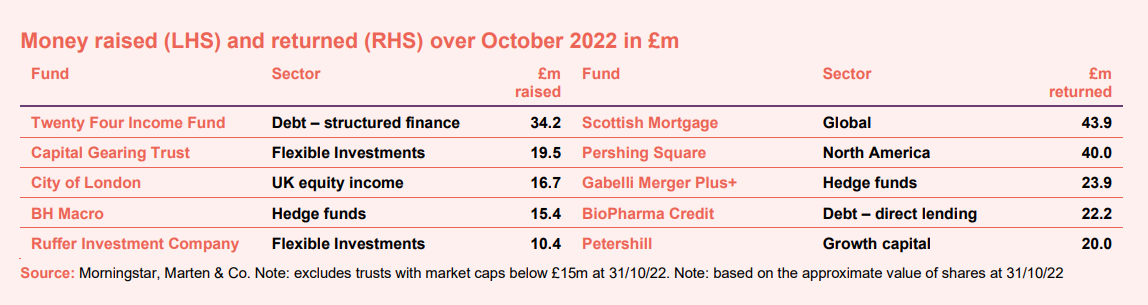

The turmoil in markets has made it hard for investment companies to raise money. One new IPO is on the way we think – a biotech fund is looking to launch – but Welkin China announced that its IPO would be delayed, maybe indefinitely we think.

TwentyFour Income Fund bucked the trend. It offered investors a realisation opportunity and was able to place all the shares tendered with new investors and raise an additional £34m at the same time. The other issuers were the usual suspects.

On the money out side, Gabelli Merger Plus+ held a tender offer. 29.8% of its shares were tendered and will be repurchased. The problem is that its share register is so concentrated after this that it cannot continue to qualify as an investment trust.

BioPharma Credit is performing well and it is not clear why it has been trading on a small discount. Nevertheless, the board stepped up to the plate and are using some of the money freed up by early loan repayments to buy back stock. Petershill has an ongoing share buyback programme.

Major news stories and QuotedData views over October 2022

Portfolio developments

- Schroder UK Public Private Trust-invests antibody drug firm

- NextEnergy-Solar-Fund acquired 250MW battery storage project

- GoreStreet Energy Storage acquire 200MW project

- Relatively good year for JPMorgan Global Emerging Markets Income

- Syncona bids for retinal biotech firm AGTC

- BioPharma makes $140m loan to Insmed

- HICL updates investors on impact of economic turmoil

- Downing Renewables Infrastructure making sense of price caps for renewable generators

- Seraphim Space repurchases not in shareholders’ best interests despite 47% discount

- Oakley Capital sells majority of Wishcard holding

- Fidelity Emerging Markets suffered double-whammy from Russian invasion

- Interest rate swaps give Hipgnosis certainty over debt costs

- BB Biotech enters Q4 with NAV rise on Myovant buyout offer

- Vietnam Holding posts peer beating performance

Corporate news

- JPMorgan Russian to expand remit

- JPMorgan Elect to be absorbed by JPMorgan Global Growth and Income

- US Solar announces strategic review

- Harmony Energy Income C share raises £15m against a very challenging market backdrop

- Taylor Maritime makes cash offer for Grindrod Shipping

Property news

- Strong demand sees Industrials REIT proactively replace non-performing tenancies

- Grit Real Estate Income results show robust underlying performance

- Grit Real Estate secures $306m debt refinance

- Unite Students branches out into residential

- abrdn European Logistics Income buys in France and Netherlands

- Great Portland Estates sells city office at 3.85% yield in fillip for the market

QuotedData views

- Biotech sector is ripe for investment but collectives are the way forward – 28 October 2022

- Has logistics been oversold? – 21 October 2022

- Navigating troubled waters – 14 October 2022

- Sweet Harmony – 7 October 2022

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- JLEN Environmental at UK Investor Magazine’s ‘Investment Trusts & Funds’ Conference – 8 November

- ShareSoc webinar with Central Asia Metals – 8 November

- Baker Steel Resources EGM – 9 November

- Marble Point Loan Financing AGM – 16 November

- abrdn Asia Focus manager presentation – 16 November

- European Opportunities AGM – 16 November

- Asia Dragon manager presentation – 21 November

- Pacific Horizon AGM – 24 November

- JPMorgan Global Emerging Markets Income AGM – 28 November

- Bluefield Solar AGM – 29 November

- abrdn Asia Focus AGM – 30 November

- CQS New City High Yield AGM – 1 December

- VinaCapital Vietnam Opportunity AGM – 5 December

- JPMorgan UK Smaller Companies AGM – 5 December

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 5 August | FEET, JLEN | Kamal Warraich | Canaccord Genuity Wealth Mgmt |

| 12 August | BPCR, IIT, MKNS, TI1 | David Smith | Henderson High Income |

| 19 August | AXI BSIF | Fiona Yang | Invesco Asia |

| 26 August | DGI9, RWK, SHED | Nick Brind | Polar Capital Global Financials |

| 2 September | SDCL, TI1 | Tim Levine | Augmentum Fintech |

| 9 September | UK renewables | Joe Bauernfreund | AVI Japan Opportunity |

| 16 September | FEET | Stuart Gray | Alliance Trust |

| 23 September | CTY, MUT, SUPR, LXI | Matthias Siller | Baring Emerging EMEA Opportunities |

| 30 September | BSIF, discount rates | Masaki Taketsume | Schroder Japan Growth |

| 7 October | VNH, SONG | Simon Farnsworth | Life Science REIT |

| 14 October | TMI, HEIT | Jonathan Maxwell | SDCL Energy Efficiency |

| 21 October | HICL, DORE | Ross Driver | Foresight Solar Fund |

| 28 October | JPE, JRS | Joe Bauernfreund | AVI Japan Opportunity |

|

Coming up |

|||

| 4 November | Jason Baggaley | abrdn Property Income | |

| 11 November | James de Uphaugh | Edinburgh Investment Trust | |

| 18 November | Jeff O’Dwyer | Schroder European Real Estate | |

| 25 November | Bruce Stout | Murray International | |

Research

Recently, Urban Logistics REIT’s (SHED’s) share price has fallen to a wide discount rating to its net asset value (NAV), as the rising cost of debt and concerns over a protracted recession have hit sentiment towards the logistics property sector. However, the long-term trends that have characterised growth in the sector remain and are even more acute in the ‘last mile’ sub-sector that SHED operates. Supply of logistics space is at record lows, while tenant demand is robust, with lettings for the first half of the year at record highs.

AVI Japan Opportunity Trust (AJOT) is delivering returns well ahead of comparable indices and competing funds. Perhaps encouraged by these good returns, AJOT’s shares have been tending to trade close to NAV.

In light of this, the board, following consultation with major shareholders, was able to dispense with the 2022 exit opportunity (a two-yearly exit opportunity at a price close to NAV has been a feature of the fund since launch). That means that AJOT’s managers still have considerable firepower to put behind their efforts to continue unlocking value from mispriced Japanese equities.

The sell-off of real estate investment trusts (REITs) has been breath-taking, with industrial and logistics-focused funds taking their fair share of pain. The major concern is that borrowing costs are now higher than the initial yields on their portfolios, implying an upward re-basing of property yields and a decline in portfolio values.

The average share price discount to net asset value (NAV) among the eight London-listed, industrial and logistics-focused companies has widened to 37.5%. Most were on hefty premiums just six months ago. But what these discount ratings seem to have failed to take into consideration is the off-setting effects of rental growth on valuations and the continued strong occupier market. While demand remains robust, the vacancy rate is the key metric for rental growth and lies at around 3% in the UK and Europe. This suggests substantial rental growth will continue.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

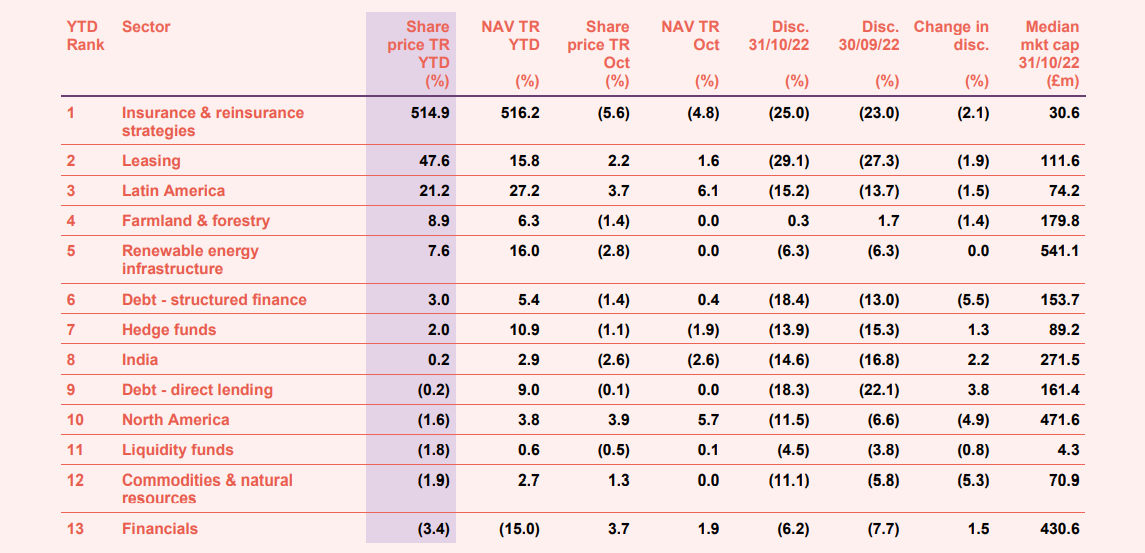

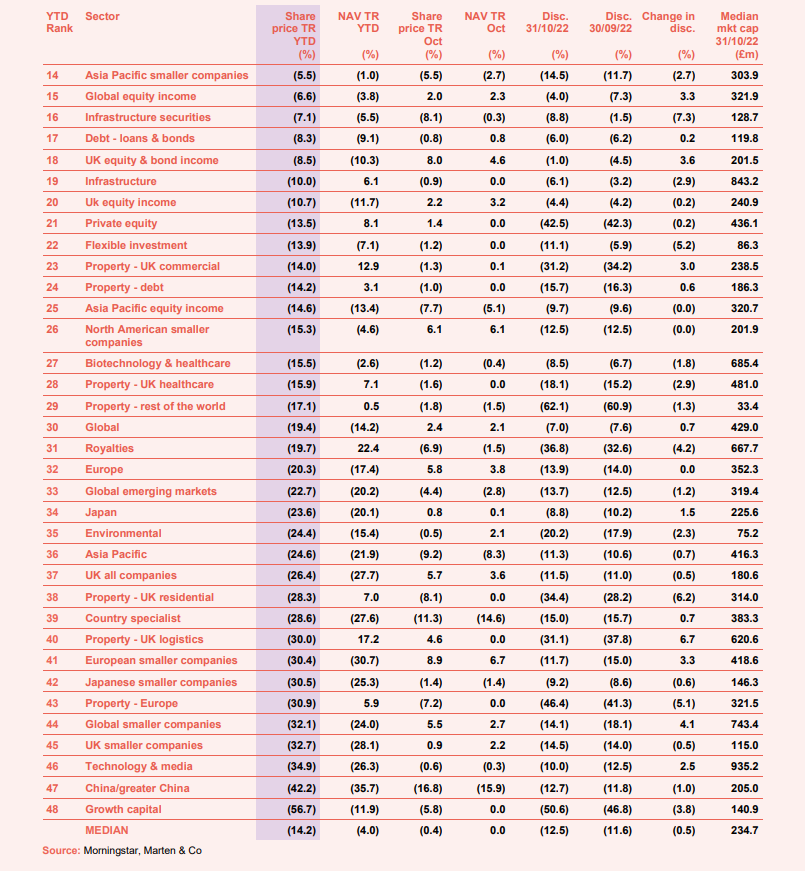

Appendix 1 – median performance by sector, ranked by 2022 year to date price total return

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.