Investment Companies Quarterly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

False hope?

The global recovery continued over the third quarter of 2021 with many countries catching up on their respective vaccination programmes, such as Japan, and others rebuilding their economies after deadly outbreaks as seen in India. The pace of the rebound triggered supply chain problems, energy price rises and shortages of some components. In the UK, this has been compounded by Brexit-related labour shortages and import/export disruption. These bottlenecks are feeding through into inflation, which hopefully will not become entrenched.

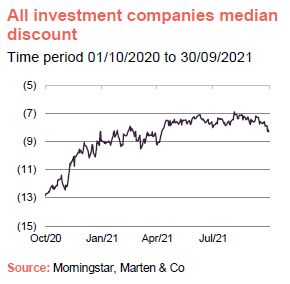

Discounts were fairly stable over the quarter, having recovered from last-year’s COVID-related jitters.

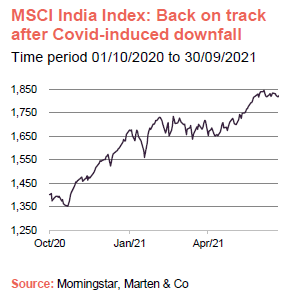

India made back all its second wave of Covid induced losses from Q2 in Q3, and then some. Despite the big hit, many believe the country has plenty more to offer as one of the up-and-coming global superpowers. Some India-focused funds such as India Capital Growth saw record returns.

In this issue

Performance data – China funds plummeted as the government tightened regulation in many sectors and a major developer looked likely to default on its debt. This has had a knock-on effect on some commodities and even Latin American trusts. Meanwhile, India enjoyed a significant bounce and private equity funds are making further gains.

Major news stories – Acorn Income announced its ‘scheme of reconstruction’ while Electra’s demerger plans also progressed. The AIC appointed a new CEO and sadly, industry veteran Simon Fraser passed away. In property news, Civitas Social Housing came under attack from a short seller.

Money in and out – A huge £3.0bn of net new money was raised in Q3, made up of three IPOs – including Seraphim Space which launched with over £170m – and a significant number of fundraises from property and renewable energy infrastructure funds including Home REIT which raised an impressive £350m, and SDCL Energy Efficiency Income which enjoyed an oversubscribed issue, raising £250m.

Research published over Q3 2021

Over the quarter, we published notes on Strategic Equity Capital, Standard Life Private Equity, Aberdeen Standard European Logistics Income, BlackRock Throgmorton, Henderson High Income, Baillie Gifford UK Growth, Henderson Diversified Income, Urban Logistics REIT, AVI Global, JLEN Environmental Assets, Alliance Trust, Downing Renewables and Infrastructure, AVI Japan Opportunity and Polar Capital Technology.

Winners and losers

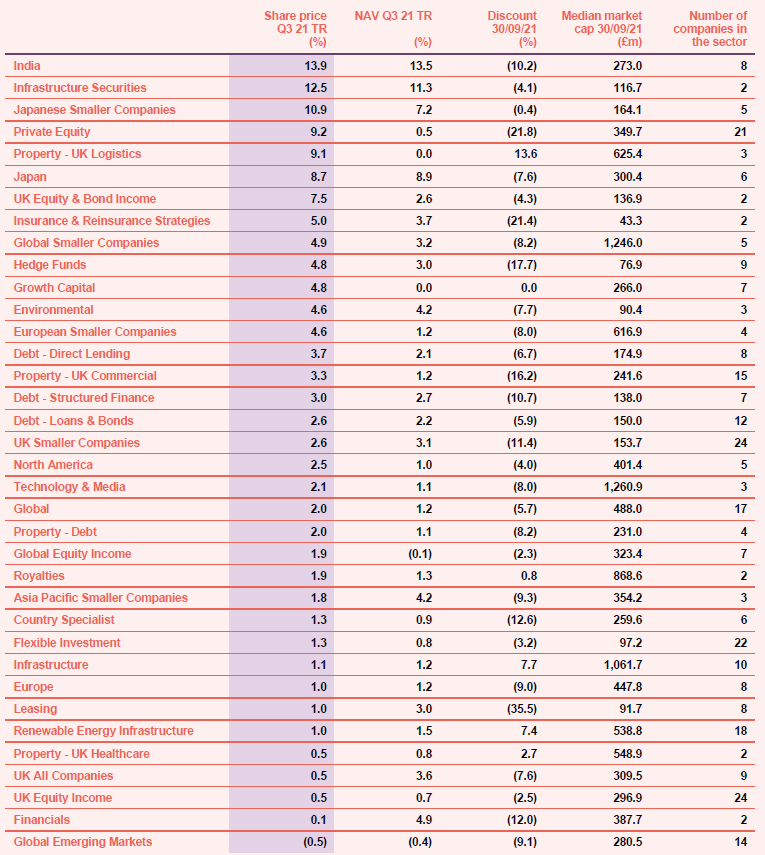

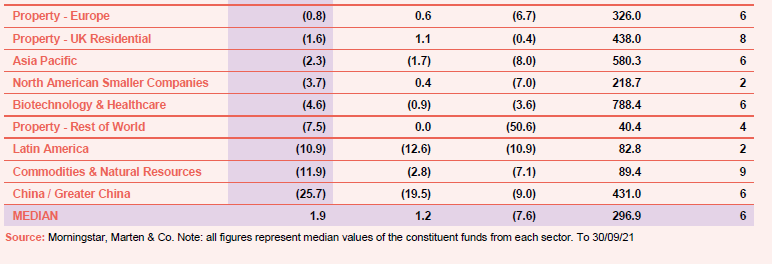

Out of a total of 351 investment companies that we follow, the median total NAV return over the third quarter of 2021 was 1.2% (the median total share price return was 1.9%).

By sector

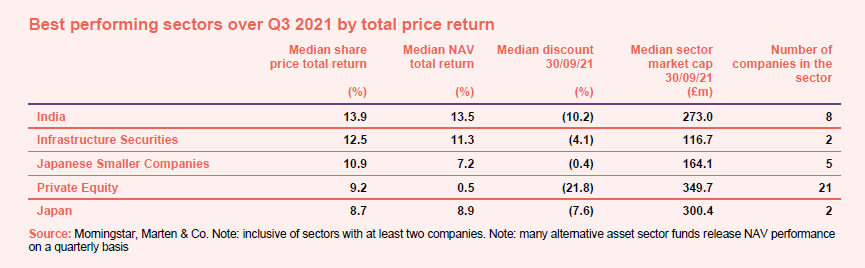

India was the best-performing sector in the third quarter of 2021, largely a reversal from being one of the worst in Q2 due to its deadly second wave of coronavirus. However, many say the country’s bounce-back is also a product of its resilient economy, growing companies with strengthening balance sheets and a wider investment opportunity set. Infrastructure securities funds benefited from higher energy prices. Japanese funds got back on track in Q3 – both Japan and Japanese Smaller Companies had featured in the worst performing sectors last quarter. Japan has finally caught up with its global peers regarding its vaccination programme.

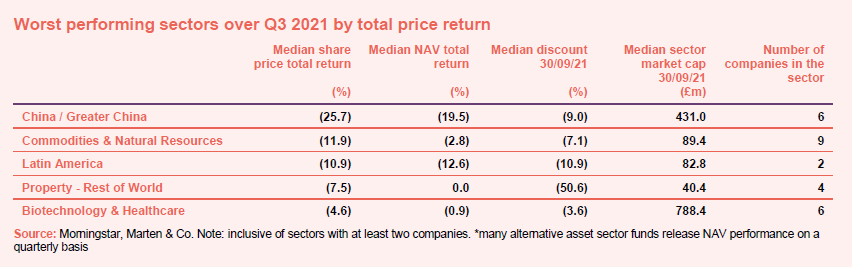

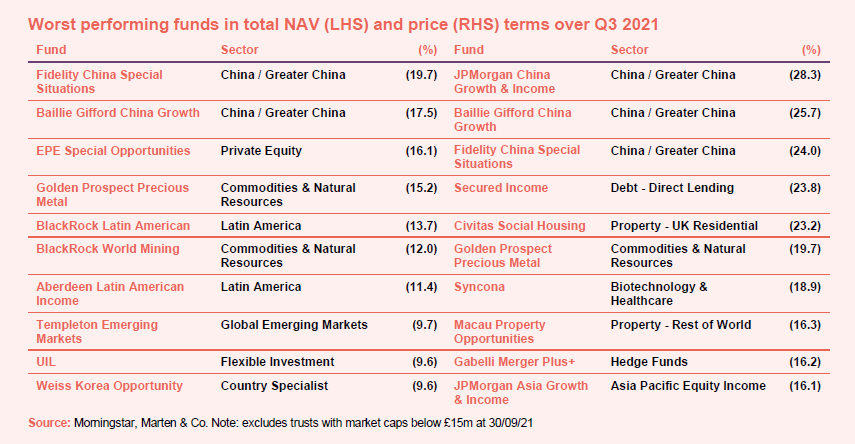

China funds were battered in Q3, with most of their losses suffered in September, following lacklustre sales, a weaker stock market and worsening business confidence. As the state takes greater control of key sectors, fears are growing about the country’s regulatory environment. Commodities & Natural Resources trusts were also among the worst performers despite shooting the lights out earlier in the year, likely on fears of slowing Chinese demand. The domino effect also hit Latin America, whose markets are heavily reliant on commodity exports.

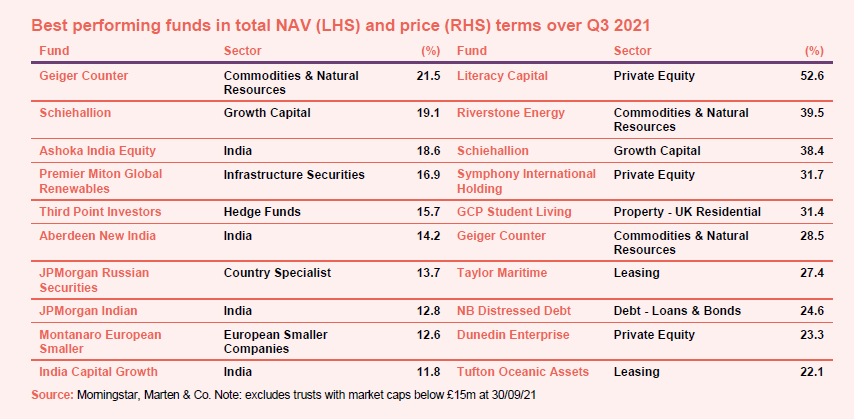

By fund

Q3 saw a mix of trusts among the top performers, with both macro and individual events affecting share prices and NAV figures. India funds Ashoka India Equity, Aberdeen New India, JPMorgan Indian and India Capital Growth were all winners in NAV terms as the country recuperated losses it made during Q2 while suffering from its deadly second wave of the coronavirus. Energy price increases benefited Geiger Counter, as the uranium mining sector rose and the trust’s small-cap focus also helped. Premier Miton Global Renewables made most of its gains towards the end of the quarter, with gains amplified by being around 40% geared by its split capital structure. Over 40% of JPMorgan Russian’s portfolio is in energy stocks.

In share price terms, leasing names Taylor Maritime and Tufton Oceanic Assets performed well as shipping rates rose sharply. Schiehallion, Symphony, Dunedin Enterprise and Literacy Capital also performed well during the quarter. The private equity industry has substantial liquidity to deploy which has led to high levels of investment and takeover activity. Literacy Capital made a number of announcements that suggest its NAV will rise significantly when it is next published. GCP Student Living was bid for.

As already discussed, China was the worst performing sector by a long way in Q3, reflected in the share prices and NAVs of a number of trusts such as Fidelity China Special Situations, Baillie Gifford China Growth and JPMorgan China Growth & Income. In addition to the government/regulatory clampdowns, the country’s economic recovery also appeared to have lost steam as production fell over the summer and a fresh bout of Covid-19 outbreaks took hold. Some feel that policymakers may need to do more to aid the recovery. This may have also had an impact on global emerging markets and Asia names such as Templeton Emerging Markets and JPMorgan Asia Growth & Income while the downfall also had a knock-on effect on Latin America trusts BlackRock Latin American and Aberdeen Latin American Income. Golden Prospect Precious Metals has been hit by a falling gold price, which seems at odds with rising inflation fears.

In share price terms, Civitas Social Housing was one of the worst performers after being targeted by ShadowFall, a short seller, who made a variety of accusations (after it shorted the stock) which the company has since rebutted. It also suffered as it fell out of the 250 Index. Secured Income uncovered more problems with its loan portfolio. Syncona was another laggard in share price terms as biotech stocks have been weak, but we sense that investors are also frustrated by the pace of progress within its portfolio.

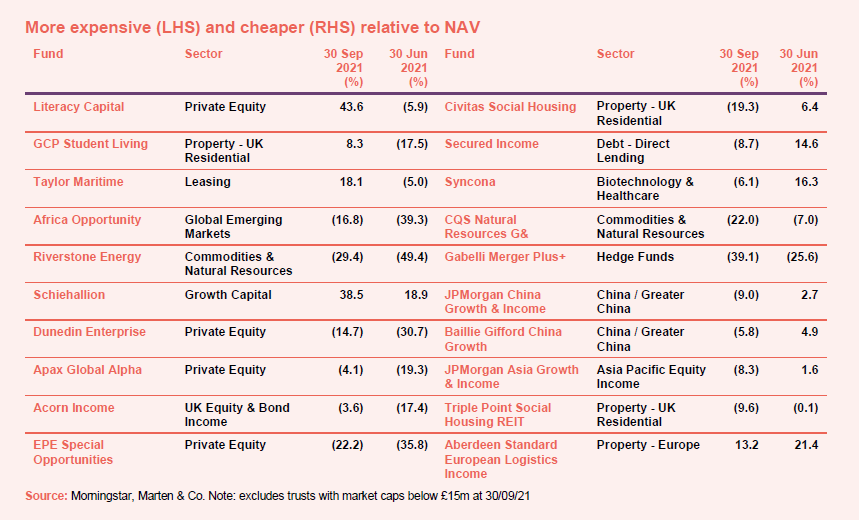

Significant rating changes by fund

Getting more expensive

For a third quarter in a row, discounts narrowed across much of the private equity sector in Q3. Literacy Capital shot from a 5.9% discount to a premium of more than 40%. Its NAV is out of date, the trust has already gained much success in its short life so far, with many of its holdings completing funding rounds including Butternut Box and Hometree. Meanwhile, Acorn Income’s double-digit discount narrowed following the announcement of its ‘scheme of reconstruction’ which will see shareholders’ money either returned or rolled into the open-ended Unicorn UK Income fund and the trust officially wind up. The news helped narrow its double-digit discount to just 3.6% in September. Riverstone Energy has been boosted by the higher oil price. Aoax Global Alpha has benefited from the IPO of its largest investment, Thoughtworks.

Getting cheaper

As already covered, Civitas Social Housing came under attack from ShadowFall while investors are becoming disillusioned with Syncona’s falling NAV. Secured Income became significantly cheaper over the quarter as its 14.6% premium (which was as high as 31% in August) plummeted to a 9% discount following a return of capital. The company agreed to amend its investment management agreement with KKV Investment Management, confirming a monthly management fee of £20,500 until the end of the year. CQS Natural Resources Growth & Income became cheaper during the quarter, with its discount widening into double digits. Gabelli Merger Plus+ also saw its discount widen. The stock is quite illiquid.

Money raised and returned

Out of the 351 investment companies we follow, a huge £3bn of net new capital was raised over the third quarter of 2021. There were two successful IPOs – Seraphim Space and renewable energy infrastructure mandate, HydrogenOne Capital Growth. A couple of other proposed IPOs fell through but plenty of trusts raised new money.

Money coming in

The biggest fundraising came from Home REIT, which raised £350m in a hugely oversubscribed issue, far exceeding its original target of £262m. Similarly Tritax EuroBox decided to increase the size of its placing to £213m after demand flew past its £170m target and Target Healthcare REIT also raised £125m, having initially targeted £100m. It will invest in more care homes. Meanwhile SDCL Energy Efficiency Income also enjoyed an oversubscribed issue, raising £250m against a target of £175m, while Renewables Infrastructure raised gross proceeds of £200m to repay debt it had run up, in part as it made its first investments in Spain, buying four solar plants. New name Seraphim Space was oversubscribed and exceeded its IPO target of £150m but HydrogenOne Capital Growth failed to hit its £250m target, raising just £108m. The digital infrastructure sub-sector expanded again and is now about £1bn in size.

Money going out

Share buybacks were led by JPEL Private Equity, having made a mandatory redemption of shares after its sale of its largest holding and VietNam Holding which held a tender offer.

Major news stories over Q3 2021

Portfolio developments:

- Downing Renewables & Infrastructure posted strong numbers for its first set of results

- Schroder UK Public Private got excited about Oxford Nanopore’s IPO plans

- CQS New City High Yield made a good recovery

- JPMorgan Mid Cap reported a bumper year of outperformance

- India Capital Growth posted strong results ahead of its redemption vote

- JPMorgan Emerging Markets achieved record outperformance

- Unlisted name was Fidelity Japan’s ‘standout contributor to performance’

- RIT Capital Partners enjoyed new all-time high NAV numbers

- Another year of outperformance for Henderson Smaller Companies

- Another legendary acquisition for Hipgnosis boosted its Fleetwood Mac exposure

- Atlantis Japan Growth significantly outperformed the TOPIX

- Hg Capital invested in insight software

- Polar Capital Technology was held back by its widening discount

- Ecofin US Renewables and Infrastructure bought 12 new solar projects

Corporate news:

- Acorn Income revealed its ‘scheme of reconstruction’

- Digital 9 Infrastructure announced another equity raise

- Foresight Sustainable Forestry shared IPO plans

- Petershill Partners announced its intention to float

- SDCL Energy Efficiency raised £250m

- Gresham House Energy Storage agreed a five-year debt facility

- Gore Street Energy Storage planned a placing and retail offer

- AVI requisitioned Third Point Investors to address its ‘entrenched trading discount’

- Greencoat Renewables called for an EGM to consider a new investment policy

- Blackfinch Renewable European Income announced it was targeting a £300m IPO

- BBGI Global Infrastructure announced a new dividend target

- Electra’s demerger plans progressed

- A lawsuit was filed against Pershing Square Tontine Holdings

- Blue Planet appeared to be in dispute with a big shareholder

- HydrogenOne Capital Growth launched but missed its £250m target

- Gabelli Value Plus officially wound up

- Augmentum Fintech fundraise hit its £55m target

- Seraphim Space launched with £178.4m

Managers and fees:

- Gresham House agreed terms to purchase VCT business Mobeus Equity Partners

- Schroder UK Public Private’s Ben Wicks stepped down

- City of London appointed David Smith as deputy manager

- Industry veteran and former F&C chair Simon Fraser passed away

- Genesis Emerging Markets announced its appointment of Fidelity as its new manager

- The Association of Investment Companies appointed ex Share Centre boss Richard Stone to replace Ian Sayers as CEO

- Aberdeen Emerging Markets and Aberdeen New Thai announced plans to combine and focus on China as one trust

Property news:

- SLI Property Income shared carbon offsetting plans

- Aberdeen Standard European Logistics raised £125m in an oversubscribed issue

- Tritax EuroBox announced a £170m equity raise

- Civitas Social Housing was targeted by a short-seller

- Social Housing REIT announced its intention to float

- Home REIT eyed a £262m fund raise

- Regional REIT acquired a £236m portfolio

- Urban Logistics REIT raised £108.3m

- ASLI bought in Barcelona

- UK Resident REIT failed to hit its IPO target

- Custodian REIT was in talks to buy Drum Income Plus REIT

QuotedData views:

- Ranking UK equity income trusts – 24 September

- HOME run and a strike-out? – 24 September

- Private equity – silly cheap – 17 September

- Harworth-y plan – 17 September

- Carbon kings – 10 September

- Tree time – 10 September

- Something in the water – 3 September

- Contrarian view worth backing? – 3 September

- UK glass half-full? – 27 August

- Growth works, value works, cash not so good – 20 August

- Urban vibes – 20 August

- Reading is fundamental – 13 August

- More property companies in crosshairs of private equity – 13 August

- Do we love tech or not? – 6 August

- Who’s looking good for property bounceback? – 6 August

- China poses a puzzle – 30 July

- Eyes on Tokyo – 23 July

- Levelling up – 23 July

- Is India back on track? – 16 July

- Define future fit offices – 16 July

- Is football coming home? – 9 July

- Another property takeover? – 9 July

- Volatility remains hallmark of biotech in first half – 5 July

- Told you so! – 2 July

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Tufton Oceanic Assets AGM, 20 October

- Master Investor – Small Cap Chat, 21 October

- Standard Life UK Smaller Companies AGM, 21 October

- The Investment Company AGM, 27 October

- Aberforth Split Level Income AGM, 28 October

- Greencoat Renewables EGM, 28 October

- City of London AGM, 28 October

- ICUK – London Investor Show, 29 October

- Murray Income AGM, 2 November

- JPMorgan Mid Cap AGM, 2 November

- JPMorgan Emerging Markets AGM, 4 November

- Mid Wynd International AGM, 9 November

- European Opportunities AGM, 10 November

- QuotedData’s annual ESG webinar, 16-18 November

- Master Investor – Investing in the Age of Longevity, 17 November

- Schroder British Opportunities AGM, 30 November

- CQS New City High Yield AGM, 2 December

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – Q3 2021 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in any of the securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.