Review 2023

Annual roundup | Investment companies | January 2024

Over the worst, and the bulls are loose

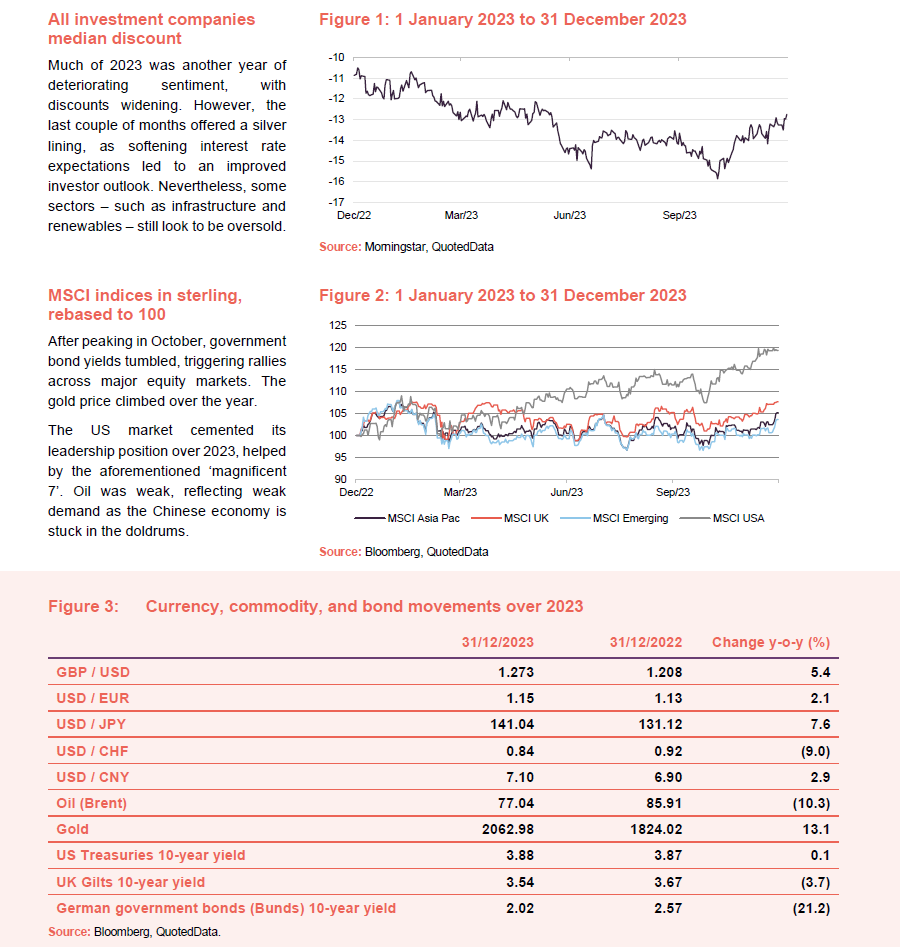

While there were plenty of financial headlines over 2023, inflation was still the main influence on markets. Rates of inflation are well below their 2022 peaks, but it was only towards the end of October 2023 that it became clear that interest rates had peaked. Markets reacted accordingly, with November being one of the best months for bond markets for decades.

Despite the uncertainty that prevailed for much of 2023, it was a strong year for the global equity market, with the MSCI All Countries World index ending up 20% higher than it started. The big driver of this was AI, the catalyst for the rise of the ‘magnificent 7’ – the seven largest US tech companies which drove the broader US market over the year. Elsewhere, China’s predicted post-COVID rebound failed to materialise, with India ending up as the emerging market champion instead.

Going into 2024, there are questions as to whether the hype around AI will be sustained, will economies tip into recession, and what impact will elections have. However, investors in many parts of the market that have been out of favour in recent years – such as growth stocks, small caps, alternative income funds, and emerging markets – can afford to be more optimistic.

At QuotedData, we:

- Celebrated our tenth anniversary;

- added several new members to the QuotedData team;

- Hosted our property and investment trust investor conferences, while expanding our presence at the Master Investor Show (2024’s will be bigger still!); and

- continued our prolific output of news, notes, articles, and industry roundups, expressed our views in our weekly QD view articles, and upped our output of video content.

At a glance

State of play at the end of 2023

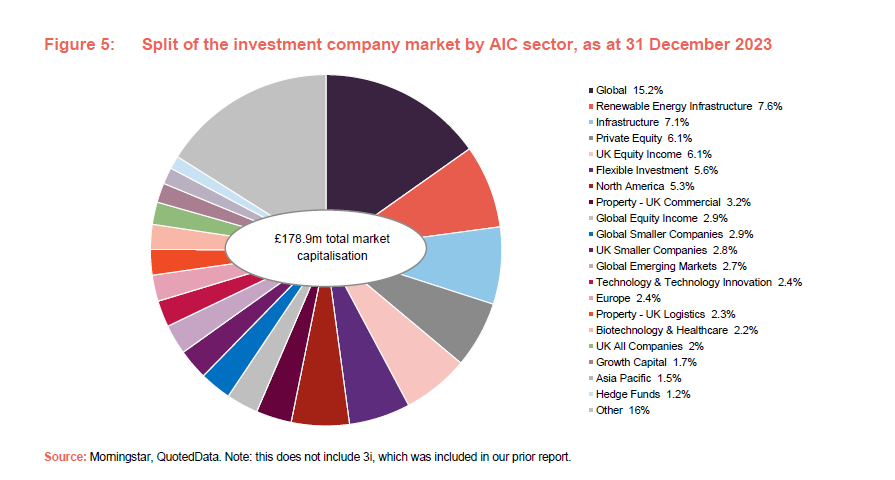

The investment companies sector shrank from £186.2bn to £178.9bn over 2023 in market capitalisation terms, driven by market by widening discounts and the loss of several trusts. Figure 5 displays the relative composition of the industry by sector.

As we list on page 18, 16 funds were lost in 2023 and two new funds entered the sector, Ashoka WhiteOak Emerging Markets and Onward Opportunities.

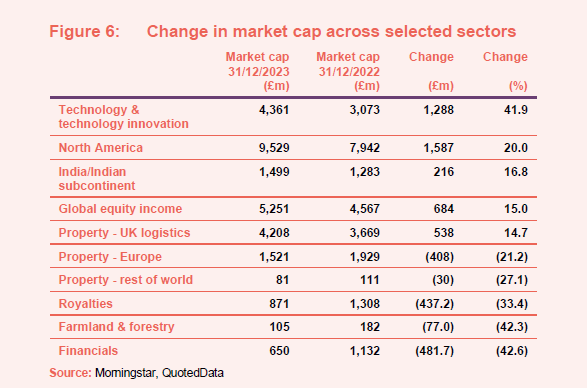

Absolutely and relative to 2022, the technology & technology innovation and North American sectors grew the most, increasing by 42% and 20% respectively (see Figure 6). The growth of these sectors came largely from performance, as their constituents remained static over the year.

Proportionately, on the negative side, financials & financial innovation saw the largest fall, thanks to the loss of Trian Investors. However, in absolute terms it was renewable energy infrastructure that was hit hardest, shrinking by £2.4bn.

Performance data

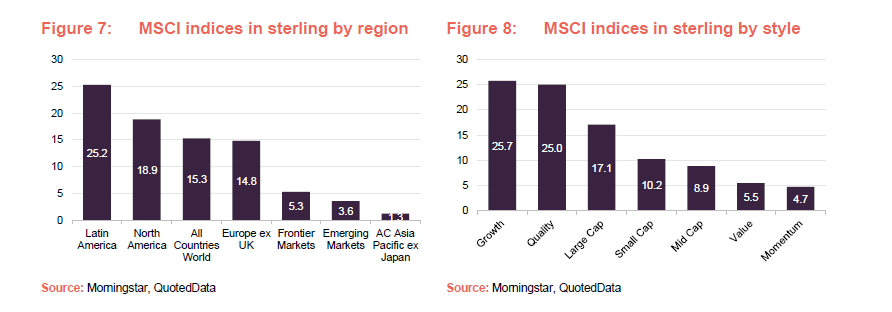

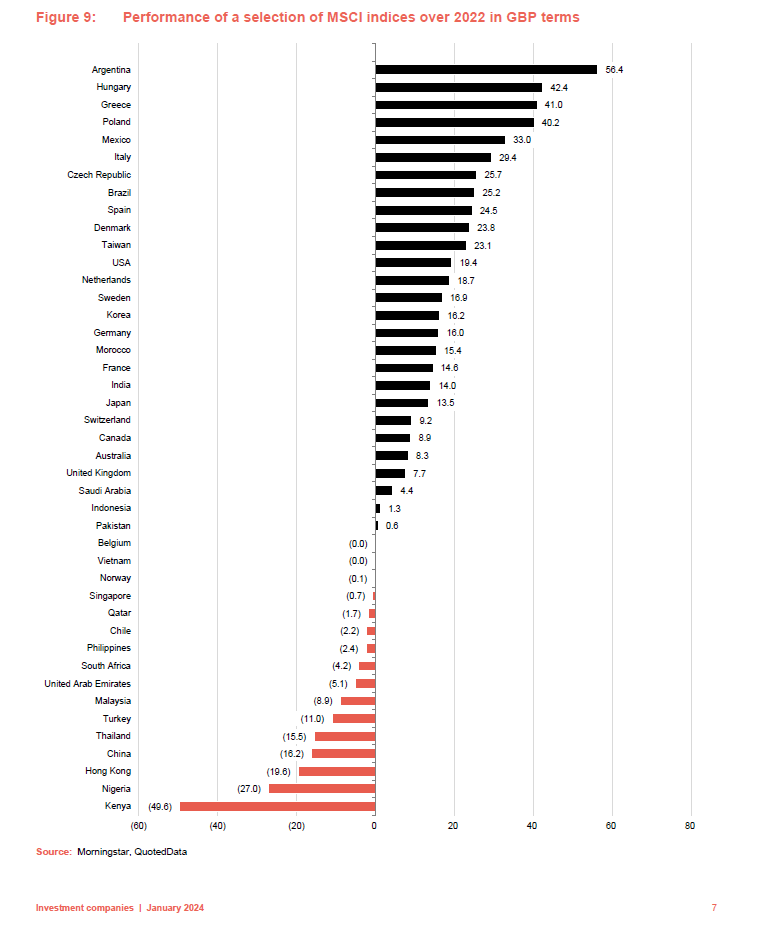

For a UK-based investor, while there was a fairly large dispersion of returns between regions and investment styles over 2023, for the most part equities made gains.

Latin America led the pack in performance terms. As Figure 8 shows on the next page, Argentina was the best-performing market, helped by the outcome of its election. However, Mexico and Brazil both did well too. The increasing expectation of US interest rate cuts and a weaker US dollar was factor in this. Not only did it reduce the opportunity cost associated with risk assets (with EM equities being one of the riskiest) but it also reduced the debt burden for dollar denominated debt.

Other frontier markets did not benefit from the dollar weakness in the same way as Latin America did, and Kenya and Nigeria were amongst the worst-performing markets in sterling terms.

China’s lacklustre economy (the reported 5.2% GDP growth for 2023 reflects a modest rebound from pandemic-related lockdowns) weighed on the emerging markets and Asia Pacific indices. Not only did the rebound disappoint, there were wider concerns around its heavily indebted property sector. Nevertheless, the Emerging Market and pan-Asian indices were buoyed by the stronger performance of the Indian market.

The style indices are heavily distorted by the ‘magnificent 7’, as a quick glance at the returns of most growth- and quality-focused investment companies outside of those exposed to large cap technology reveals.

The market rally was heavily concentrated in only a few months, which limited the benefit of the momentum trade.

Performance by sector and fund

Positives

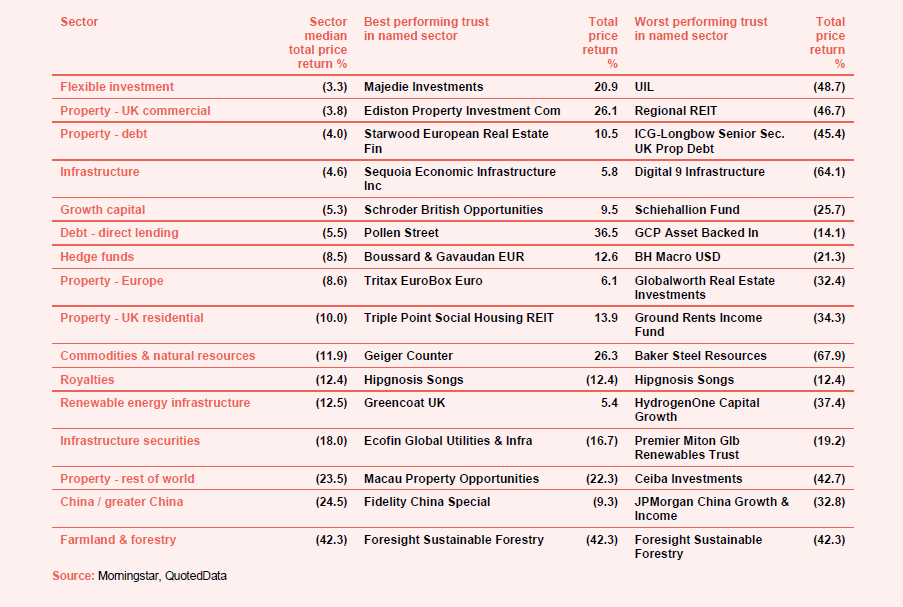

Looking at Figure 10, the best-performing sector was once again the insurance and reinsurance. This was this was driven by the ongoing recovery in the share price of CatCo Reinsurance Opportunities which remains in wind up mode. However, with a market cap of only £13m (the combination of its ordinary and C share classes) its impact is hugely outsized and warping the figures, ahead of the jump in the share price, the company redeemed 99% of its ordinary and C shares. The remaining NAV in the fund related to funds locked-up in side-pockets – money set aside to meet certain reinsurance claims.

Technology is well thanks to the powerful tailwinds supporting the sector over 2023, as we discussed earlier, with both trusts in the sector, Polar Capital Technology and Allianz Global Technology, returning impressive results.

Leasing funds once again benefited from the recovery in air travel, and in particular, Emirates’ decision to retain its fleet of Airbus A380 aircraft, which accounts for the entirety of Doric Nimrod 2 and 3 portfolios. Doric Nimrod 2 sold a couple of aircraft to Emirates and is returning the proceeds. The shipping industry was hit by the slowdown in Chinese demand.

We discussed the regional winners, Latin America, and the developed markets earlier. In the case of India, it was supported by its own improving economic outlook and increased domestic activity, with 150 IPOs in the first 9 months of 2023 alone, as well as benefiting from investors’ aversion to China. Small caps beat large caps in this market.

Negatives

On the negative end of the table, farmland and forestry’s poor performance reflected the widening discount of its sole constituent, the Foresight Sustainable Forestry trust.

China’s poor performance reflected the weak performance of its economy, and the concerns surrounding its property sector, as well as the fallout from increased regulation, which affected several of its large consumer software companies. China’s economic woes were also reflected in the property – rest of the world sector, as it only has two constituents, one of which being Macau Property Opportunities, which solely invests in China.

Infrastructure and renewable energy securities saw a general selloff across virtually all of their numerous constituents. Rising interest rates were the main culprit, putting downward pressure on NAVs and diverting investors into other income producing assets. However, the structural issues facing the sector had a big influence too.

Royalties saw a severe selloff as Round Hill got taken over and the remaining fund Hipgnosis disappointed on performance and governance grounds.

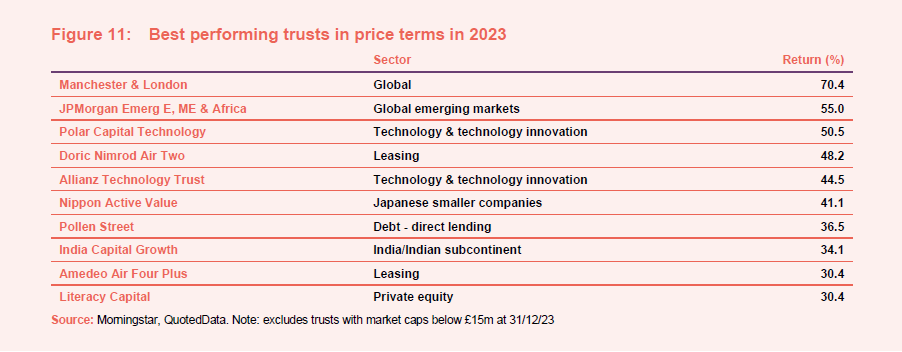

Best performing trusts

Manchester and London, with its mega-cap, AI-focused technology portfolio, was the best performing trust in share price terms, and the biggest beneficiary of the tech rally. Its high allocation to the likes of Microsoft and Nvidia put it front and centre of the AI-frenzy, as well as the wider rally in growth stocks over Q4. Its impressive returns were compounded by increased demand for its shares in the latter months of 2023. For similar reasons, Polar Capital Technology and Allianz Technology Trust saw strong share price performance, compounding both their NAV returns with a narrowing discount. However, they lacked the high concentration of Manchester and London’s portfolio and thus benefited less from the rally.

The performance of JPMorgan Emerging Europe, Middle East, and Africa was less a reflection of its NAV returns, as it generated a mere 5.1% over the period, but a quirk of its previous life as a Russian equity strategy. With its previous portfolio having been effectively written down to zero, its share price rally reflects investors speculating on the potential value that they may one day be able to realise from the stranded Russian assets.

The rally in the airline leasing trusts was evidenced by the returns of Doric Nimrod Air Two and Amedeo Air Four Plus. However, DNA2, which has more exposure to the previous unloved A380, generated stronger NAV returns, at 32% versus 6%.

Nippon Active Value benefited from the double whammy of the broader rally in Japanese equities and within that the impact of further corporate governance reforms. Trust-specific factors included mergers with abrdn Japan and Atlantis Japan, its migration to a premium listing, and several of its activist campaigns bearing fruit over the year.

Pollen Street proposed to leave the investment trust sector and re-list as a commercial company. Its discount narrowed on the back of the proposal being passed in its October AGM.

India Capital Growth was the standout performer in a buoyant Indian market. It generated both the highest NAV and share price returns in the period in this market thanks to some good stock picking.

Literacy Capital was once again the winner within the private equity sector and was the only constituent to achieve double-digit NAV returns. Its performance can be placed at the feet of its management team, who made several profitable disposals over the year, often at impressive premiums to carrying value.

Moving on to Figure 12, we covered many of the best NAV returning trusts previously, including the reasons behind the performance of aircraft leasing, technology, Latin America, India, and North America in previous sections. We note that in the case of JPMorgan America, a new mention in this note, it is a ‘core’ style of investing, intentionally capturing multiple styles of investing, and is arguably the best reflection of its broader US market performance.

Geiger Counter’s performance reflected the rally in the price of uranium over 2023, which almost doubled over the year, with its price moving from 48 USD to 91 USD.

Aurora’s performance came on the back of the takeover Hotel Chocolat and the recovery in airline travel, having a large exposure to low-cost airlines.

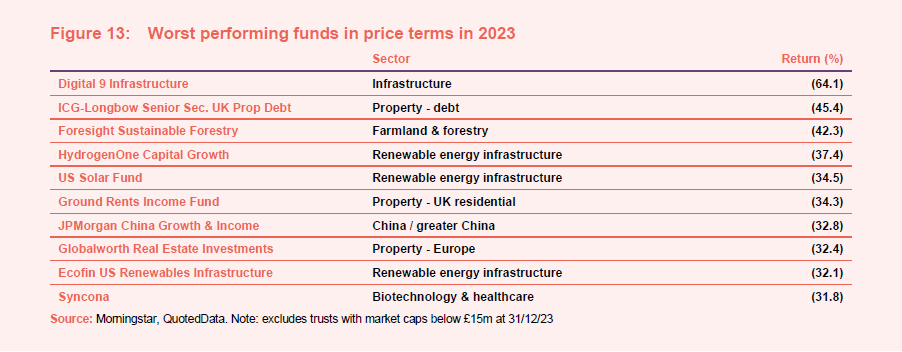

Worst performing trusts

Share price moves

On the negative side, Digital 9 Infrastructure led the pack. It was impacted by issues surrounding its debt, having been too aggressive with its leverage and exposure to cash-hungry companies in prior years. Its debt burden had become so high that the board was required to cut to its dividend, widening its discount in the process. It was also impacted by the delay to the sale of its prize asset Verne Global. The terms of this sale then disappointed investors. Digital 9 now trades on a roughly 70% discount, having traded on a premium in 2022. Its board has announced a strategic review.

Second on the list is ICG-Longbow Senior Secured UK Property Debt, which is in wind-up mode, and this distorts its returns.

In a world of 6% cash deposits, the returns from forestry assets seem pale in comparison. This has certainly been true for Foresight Sustainable Forestry, which returned -6.3% in NAV terms. Rather than there being any trust specific announcement, it seems that the return profile of the trust is no longer attractive in the current market environment, especially when one considers that it pays no dividend.

HydrogenOne is invested in cash consumptive growth stocks and like other funds with similar exposures has suffered since interest rates began to climb. The portfolio is still quite new and will take time to mature. Nevertheless, encouraging progress is being made within many portfolio companies.

Hydrogen is a beneficiary of the Inflation Reduction Act, which also supports the development of renewable energy generation in the US. However, sentiment towards US Solar (USF) and Ecofin US Renewables (RNEW) have been hit hard by higher interest rates. USF underwent a management change during the year and tried and failed to sell its portfolio. RNEW was forced to suspend its dividend following a tornado strike on the grid link to its wind farm investment.

Ground Rents Income Fund will wind-up in light of a more challenging market environment, specifically the likely reforms from the Leasehold and Freehold Bill introduced by the government. Its independent valuer took the opinion that there was material uncertainty around the value of the trust’s assets because of the bill.

Globalworth Real Estate Investments invests in central and eastern European properties and continues to trade. Though given the economic weakness of Europe and large portfolio of corporate properties, investors may have become concerned around the return potential of these assets.

We have covered the reasons behind the decline in demand for Chinese equities, and JPMorgan China Growth & Income, previously.

Despite an active 2023 for Syncona, its discount has still widened, reflecting the general lacklustre returns of the biotech and healthcare sector over the year, increasing costs of capital, and stock specific issues. Syncona was forced to write off a £54.5m earn out from the sale of its Gyroscope experimental eye treatment after the buyer Novartis elected to stop its development.

NAV moves

Moving on to Figure 14, which shows the worst performing trusts in NAV terms, we can see several common trends that have been presented previously in this article. The dire Chinese market is evident once again, with three Chinese strategies present in the top 10 worst performers, and JPMorgan China Growth & Income taking the crown as the worst performing trust. The impact of the decline in Chinese trade also be seen in the NAV returns of Taylor Maritime.

Symphony International Holding’s Asian private equity focus was affected by COVID and China. It has failed to deliver attractive NAV returns and the board has elected to call time on the trust after activist pressure. It will run off its portfolio over time.

While the worst of their share price falls was concentrated in the fourth quarter of 2022, several property trusts continued to feel the pinch over 2023, reflecting the rising rate environment. This pushed up property yields/drove down valuations. Fears of declining economic activity also weighed on sentiment. Europe and the UK both posted weak GDP figures over 2023, barely dodging recession. Tritax EuroBox was hit by rising yields, but tight supply is helping drive up rents in the European logistics market. Phoenix Spree Deutschland, the worst performer of the three property funds on the list, was forced to adopt a more conservative approach in light of higher interest rates weighing on condominium sales, reducing its debt levels and cutting its dividend.

Miton UK Microcap was a casualty of the general aversion to UK equities and smaller, less liquid stocks. Money has been flowing out of funds invested in UK small caps but micro-cap stocks are often too small to attract the attention of corporate buyers.

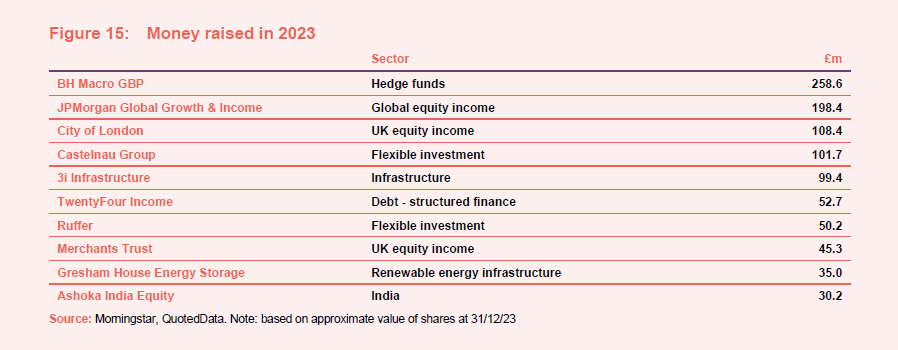

Money in and out

2023 was another difficult year for fundraising within the investment trust sector, with the majority of trusts trading on discounts throughout the year. This limited their ability to raise new capital. However, there was a handful bright spots, with select strategies raising capital at the start of the year, as we highlight in the next section. Nevertheless, more money left the market than was added over the year, with about a net £4.4bn leaving the sector.

Just two tiny trusts launched in the year, Ashoka WhiteOak Emerging Markets, which was able to raise £30.5m at IPO, and Onward Opportunities, which has a market cap of just £16m.

Money coming into existing funds

Early in the year, taking advantage of strong performance, BH Macro was able to issue £315m worth of shares. The investors might have been seeking a safe haven, as those putting money in Ruffer were, but both sets of investors were disappointed.

For another year, JPMorgan Global Growth and Income topped the tables for regular share issuance in response to demand (the £198m in the table reflects this). However, other equity income funds saw sizeable influxes too, including City of London, and Merchants Trust. TwentyFour Income was able to take advantage of rising interest rates to attract more capital. A buoyant Indian market helped Ashoka India Equity expand.

Castlenau grew as it placed stock to help finance its purchase of funerals group, Dignity.

3i Infrastructure raised £100m in January but it was Gresham House Energy Storage, raising £50m to fund a battery project in May, that was the last to get across the line before widening discounts shut off fundraises in the alternative income sectors

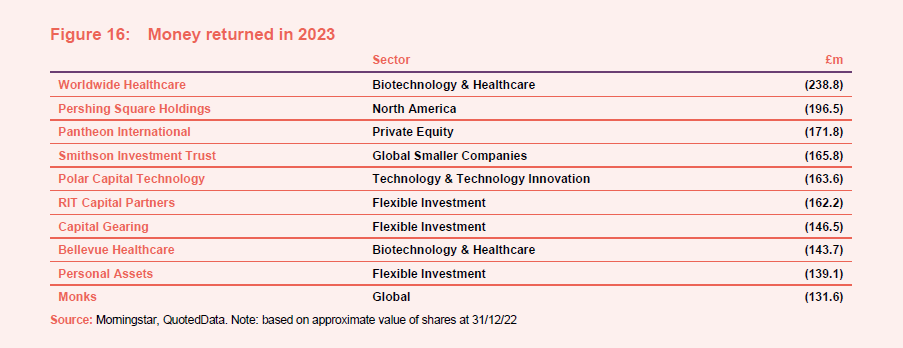

Money going out of existing funds

In an effort to reduce discount volatility and provide some liquidity to investors, a number of large funds bought back stock in 2023, led by Worldwide Healthcare (on the back of another poor year for biotech) and Pershing Square (despite decent returns). Pantheon International’s £200m buyback programme was big news. So too was RIT Capital Partners decision to repurchase stock.

The real surprise on here, given it ranked as one of the best-performing trusts for the year, is Polar Capital Technology Trust

Liquidations, de-listings and trading cancellations

This was probably one of the most active years for corporate actions since the wake of financial crisis of 2008. In 2023, we said goodbye to Civitas Social Housing (bid for at too low a price), Reconstruction Capital II, Cheverton Growth Trust, Highbridge Tactical Credit Fund, Trian Investors 1, Axiom European Financial Debt, CT Property Trust (bid for by LondonMetric Property), Secured Income Fund, SME Credit Realisation, Momentum Multi-Asset Value, Atlantis Japan Growth (merged with Nippon Active Value), abrdn Latin American Income Fund (very poor timing – just before South America had its best year in ages), abrdn New Dawn (merged with Asia Dragon), abrdn Smaller Companies Income (merged with Shires Income), and Round Hill Music Royalty (bid for).

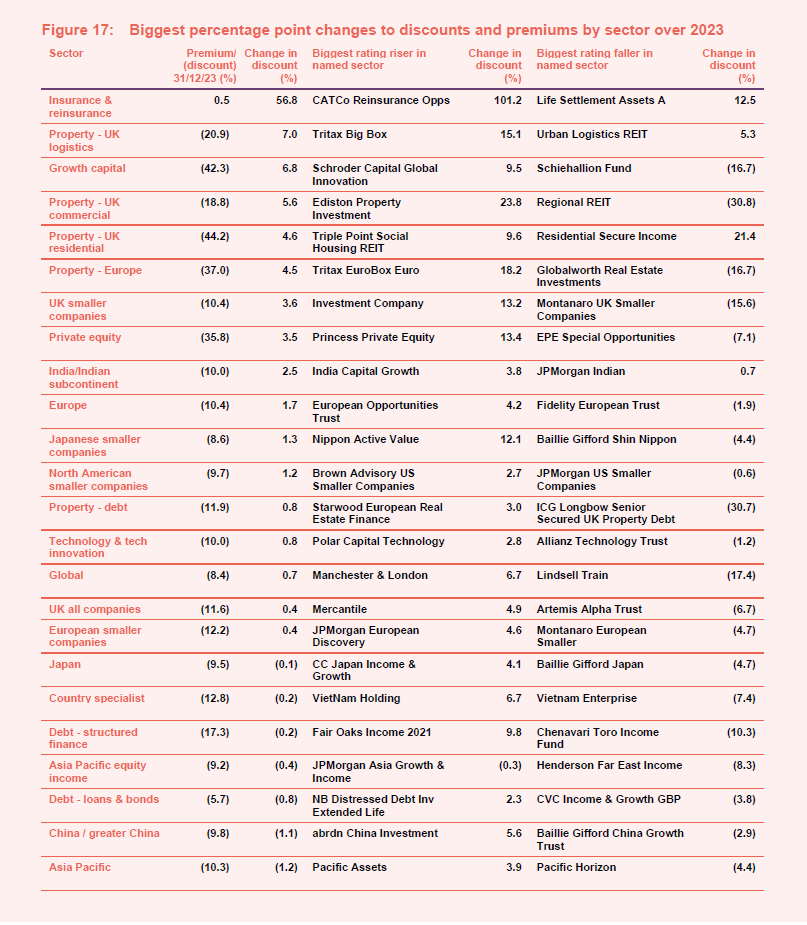

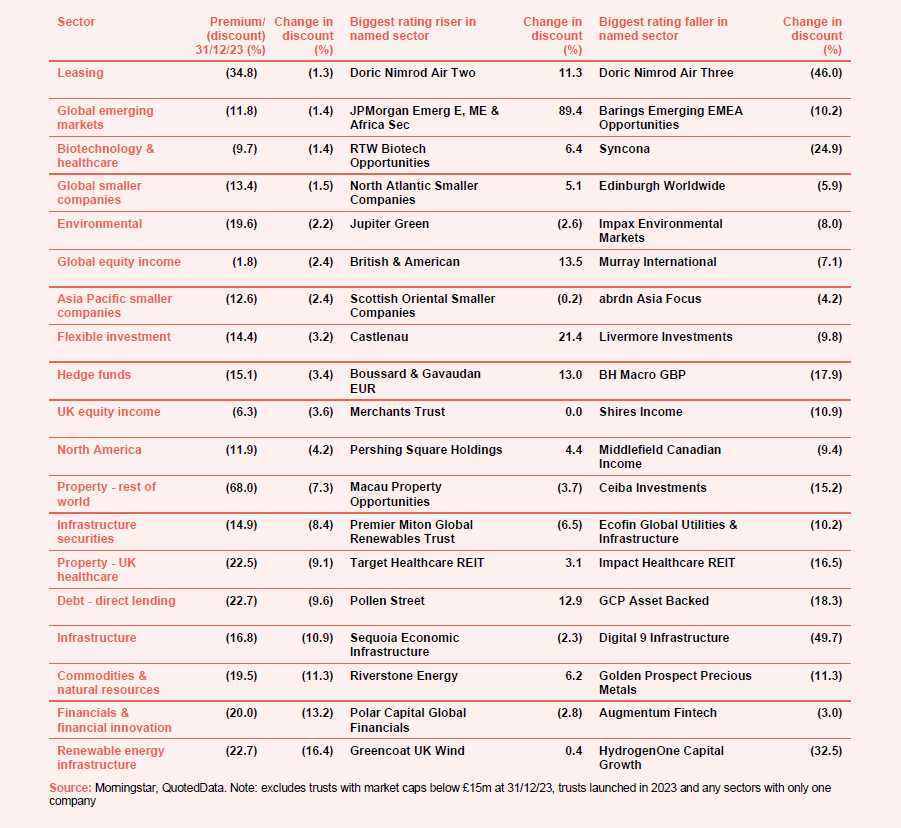

Significant ratings changes

Figure 17 breaks the investment companies universe down by sector and looks at the biggest rating improvements and deteriorations over the course of 2023 within each sector. The overall trend was of discount widening, with just 17 of 43 sectors in a better position at end December 2023 than at the start of the year.

As we have mentioned, CatCo’s winddown process is distorting its returns.

There is a large presence of property sectors within the largest positive movers. This is a reflection of the improving outlook for interest rates, as falling rate expectations improves the valuation outlook for the property sector.

For similar reasons the growth capital sector also saw a positive re-rating. Although the re-rating of growth-focused strategies has some way to go yet as discounts are still very wide on these funds.

The private equity sector’s considerable efforts to attract new investments, pantheon’s £200m buyback and the sector’s great track record nudged discounts tighter, but again there is a long way to go.

The Indian/Indian subcontinent sector is one of only four peer groups to see all of its members positively re-rate over the period. The small cap/large cap divide is evident here – working to India Capital Growth’s advantage.

Given the general aversion to small caps in the UK, it was perhaps surprising to see discounts narrow here. There has been a fair bit of share buyback activity in the sector that might account for it.

On the other end of the table, the discount widening in the renewable energy infrastructure and infrastructure sectors hit almost every fund. Interest rates are the principal culprit, but the cost disclosure issue that we have discussed in recent QD views has had a big impact too.

Financials funds were knocked in March’s banking crisis. Commodities and natural resources trusts wilted in the face of weak Chinese demand. Riverstone Energy has been active in reorientating its portfolio.

QD views from 2023

| Our weekly opinion pieces | |

| REIT consolidation on the cards in 2023 – 6 Jan

Unloved Japan worth a look – 13 Jan Chinese new year in review – 20 Jan And now for something completely different – 3 Feb Bonds will return… but when?’ – 10 Feb Nadir point close for property values – 17 Feb In search of storage solutions – 24 Feb Discounts – time to get serious? – 3 Mar Global voyage in search of income – 10 Mar A Silicon Valley bust? -17 Mar Beyond dividend heroes – 24 Mar Discount opportunity on digital disruptor, DGI9 – 31 Mar Unpicking Dolphin Capital’s chequered past – 4 Apr Jury out on latest IPO – 21 Apr Finding courage in uncertain times – 28 Apr Spreading your bets – asset allocating for uncertain times – 5 May Growth capital – fast growing companies at compelling prices? – 12 May Time to buy Scottish Mortgage? – 19 May REIT mergers could combat vicious discount circle – 26 May Can we just stop oil? Contrasting the fortunes of two UK equity income trusts – 2 Jun AI mania driving tech recovery – 9 Jun |

Divining higher income in an inflationary environment – 7 July

Infrastructure sits on solid foundations – 14 July Where there’s smoke is there fire? – 21 July The new reality for renewables – 28 July The future of growth Investing – 4 Aug Renewables – an inevitable part of our future? – 11 Aug Diversity rules for The Renewables Infrastructure Group – 11 Aug Time is right for this European logistics specialist – 18 Aug What if the tide goes out further? – 25 Sug The right fund in the right structure – 8 Sep Opportunities in commodities? – 15 Sep The retail REIT defying the doom and gloom – 29 Sep Are some investment trust discounts now detached from reality? – 6 Oct Are cracks appearing in US markets – 13 Oct Is there an easy fix to the sector’s discount problem? – 27 Oct The curious case of abrdn Diversified Income and Growth – 3 Nov Japan: more to play for? – 10 Nov Positive inflation data to reignite real estate sector – 17 Nov AI euphoria gone too far? – 24 Nov Your vote will count in Arb fight – 8 Dec An early Christmas present – 15 Dec An update on charges disclosure problem – 22 Dec

|

Manager interviews from 2023

| 13 January | Thao Ngo | Vietnam Enterprise |

| 20 January | Stephanie Sirota | RTW Venture Fund |

| 27 January | Eileen Fargis | Ecofin US Renewables |

| 3 February | Will Fulton | UK Commercial Property REIT |

| 10 February | Colm Walsh | ICG Enterprise |

| 17 February | James Dow | The Scottish American Investment Company |

| 24 February | Jean Hugues de Lamaze | Ecofin Global Utilities and Infrastructure |

| 03 March | David Bird | Octopus Renewables Infrastructure Trust |

| 10 March | Anthony Catachanas | VH Global Sustainable Energy Opportunities |

| 17 March | James Hart | Witan Investment Trust |

| 24 March | Richard Staveley | Rockwood Strategic |

| 31 March | Alex O’Cinneide | Gore Street Energy Storage Fund |

| 14 April | Stephen Inglis | Regional REIT |

| 21 April | Jean Roche | Schroder UK Mid Cap Fund |

| 28 April | Craig Baker | Alliance Trust |

| 5 May | Nicholas Weindling | JP Morgan Japanese Investment Trust |

| 12 May | Kamal Warraich | Canaccord Genuity Wealth Management |

| 19 May | Michael Anderson | Aquila Capital European Renewables |

| 26 May | Andy Ho & Khanh Vu | VinaCapital Vietnam Opportunity Fund |

| 2 June | Iain McCombie | Baillie Giff UK Growth |

| 9 June | James Thom | abrdn New Dawn |

| 16 June | Matthias Siller | Barings Emerging EMEA Opportunities |

| 23 June | Jonathan Hick | Triple Point Energy Transition |

| 30 June | Gervais Williams | Milton UK Microcap |

| 7 July | Steve Marshall | Cordiant Digital Infrastructure |

| 14 July | David Smith | Henderson High Income |

| 21 July | Ian Lance | Temple Bar |

| 28 July | Uzo Ekwue & Pav Sriharan | Schroders British Opportunity Trust |

| 4 August | Fotis Chatzimichalakis | Impax Asset Management |

| 11 August | Helen Steers | Pantheon International |

| 18 August | Richard Moffit | Urban Logistics |

| 25 August | Iain Pyle | Shires Income |

| 1 September | Ed Simpson | GCP Infrastructure |

| 8 September | Prashant Khemka | Ashoka WhiteOak |

| 15 September | Dean Orrico | Middlefield Canadian Income |

| 22 September | Andrew Jones | LondonMetric Property |

| 29 September | Carlos Hardenberg | Mobius Investment Trust |

| 6 October | Alan Gauld | abrdn Private Equity |

| 13 October | James de Uphaugh | Edinburgh Investment Trust |

| 20 October | Tom Williams | Downing Renewables and infrastructure |

| 27 October | Richard Sem | Pantheon Infrastructure |

| 10 November | Craig Martin | Vietnam Holding |

| 17 November | Joe Bauernfreund | AVI Global Trust |

| 24 November | Ben Green | Supermarket Income REIT |

| 1 December | Charles Luke | Murray Income |

| 8 December | Joe Bauernfreund | AVI Japan Opportunity Trust. |

Source: Visit www.quoteddata.com or more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Outlook for 2024

Here are some recent comments from managers and directors drawn from our latest economic and political summary that you may find interesting.

On the investment companies sector

Nick Greenwood, MIGO Opportunities Trust: “We have heard the death knell sounded for investment trusts many times before. The sector has always evolved and progressed. There are self help measures which can be adopted. Oversupply can be dealt with via buy backs. The law of natural selection is alive and well in the world of closed end funds and we expect to see the recent trend of mergers and wind downs to continue. There are new audiences to focus on, such as self-directed investors and newer wealth management businesses often staffed by individuals who have departed the vast chains. Despite experimental capital structures being mooted, the closed end fund is the best structure for accessing illiquid asset classes. The travails of open ended property funds sum up the challenges and explain why investment trusts will continue to exist.”

On the global economy

David Higgins, Majedie Investments: “Markets have largely completed a transition to a new regime that will be characterised by higher interest rates, variable liquidity, and more geopolitical and cyclical volatility. Many of the tailwinds upon which the fortunes of conventional investment strategies rode have turned into headwinds. Against a backdrop that is likely to be more challenging, an investor’s ability to identify – and capitalise upon – idiosyncratic, bottom-up situations will be critical to success.

Our January 2024 economic and political roundup has much more detail and many more comments on sectors including Europe, Japan, private equity, biotechnology & healthcare and renewable energy infrastructure.

The global economic outlook is uncertain and is likely to remain so. When framing our decisions, we do not dismiss the possibility of a recession over the next 12-24 months. We can identify numerous possible threats to the equilibrium of markets, which include a sharper-than-expected economic slowdown, geopolitical instability, a possible resurgence of inflation (which would most likely be caused by rising commodity prices), or some other extraneous variable. The ‘equity risk premium’ is low by historic standards, i.e. the projected earnings yield on equities is very close to the yield on long-dated government bonds, which suggests that stocks are expensive at an aggregate level.”

On the UK

Graeme Proudfoot, chair, BlackRock Income and Growth Investment Trust: “Despite the negative sentiment around the outlook, the UK economy has displayed notable resilience, with household balance sheets and corporate earnings in better shape than many anticipated. In fact, the UK managed to avoid a much feared recession in 2023 and although the economic data indicates our economy shrank in October 2023, it is forecast to return to modest growth in 2024. As a result, the likelihood of a ‘soft landing’ – a slowdown in economic growth that avoids a recession – may well have increased, although this remains to be seen. In any case, the current cycle of monetary policy tightening appears to have peaked, and markets are now focused on if and when interest rates will be cut; an event that may be the catalyst for a broader change in market sentiment towards UK equities.”

On Asia

Ayaz Ebrahim and Robert Lloyd, portfolio managers, JPMorgan Asia Growth & Income: “Asia is set to fare better. The Chinese economy is expected to continue slowing, realising growth of around 4% next year, but this is still an enviable pace compared to western economies. And the Chinese government’s more pro-growth stance may see further efforts to reinvigorate the property market and support household incomes. India looks set to maintain its current pace of growth above 6% pa, consistent with the government’s long-term target, and the region as a whole, which accounts for 40% of the world’s GDP, is projected to grow at around 5% both this year and next.

The region’s longer-term outlook is also very positive. Asian nations are undergoing major structural and social changes such as rising incomes, urbanisation, infrastructure investment and digitalisation, which will ensure the region continues to grow rapidly, with domestic demand supported by the increasing prosperity of Asia’s burgeoning middle class. Furthermore, Asia is home to many innovative and dynamic companies that are leading the world in a wide range of industries, including semiconductor manufacturing, healthcare, renewable energy, next generation automotive production and financials. This provides us with many attractive long-term investment opportunities.”

On Japan

Nicholas Weindling and Miyako Urabe, managers, JPMorgan Japanese: “The reforms underway in Japan’s corporate sector are not the only positive recent development in the Japanese market. The economy has been on an improving trend since the government lifted its strict border controls in October 2022 and removed the last pandemic related restrictions earlier this year. Since then, tourist numbers have risen very sharply. This activity is benefiting a broad array of tourism and hospitality businesses.

There are also signs of a very welcome shift in Japan’s labour market. The country has labour shortages in many fields due to its aging population. Yet historically, companies have been resistant to raising wages to attract and retain workers, and Japanese wages barely increased for 30 years. However, this is beginning to change. Recent wage increases have been significant and broad-based.

Although Japanese inflation remains relatively low in absolute terms and relative to other countries, it is noteworthy that inflation is the highest for decades at around 3%. The Bank of Japan (BoJ) response has been muted so far and it continues to pursue a negative interest rate policy although there have been some recent tweaks to yield curve control. It is possible that we see further shifts in policy and this may, in turn, have implications for the Japanese yen which has been weak against major currencies over the last year.

After a long period during which Japanese equities have been unloved and under-owned by global investors, Japan’s improving fundamentals have begun to attract attention. The stock market has reached multi-decade highs and outperformed global markets over the year ended 30th September 2023 – the MSCI ACWI and the S&P 500 both rose by c 11.0% over the period in GBP terms, compared to the TOPIX index’s 14.7% rise. One of the most welcome aspects of this market rebound is that it has been driven in part by foreign investors.”

On technology

Ben Rogoff, manager, Polar Capital Technology Trust: “AI continues to dominate technology performance at both headline and stock level. While it is still early days, we are seeing encouraging signs for the adoption of AI and the impact of the AI transformation on companies up and down the supply chain. AI services accounted for 3pts of Microsoft Azure’s y/y growth, compared to just 1pt last quarter, indicating a $1.5bn revenue run-rate. Microsoft Azure-OpenAI customers increased to 18,000 from 11,000 last quarter, and 40% of the Fortune 100 are trialling the M365 Copilot product (which launched on 1 November). Meta Platforms spoke to a mid-single digit increase in time spent on their main platforms due to AI-powered recommendation improvements. Meanwhile Alphabet said generative AI projects on its AI Vertex platform were up 7x from last quarter.

This is unsurprising to us given early productivity gains across a range of tasks and applications (estimated at between 30-50%) and broad GenAI applicability since a majority of jobs in advanced economies are knowledge workers. Despite this, there has been a healthy tempering of expectations for some of the leading suppliers into the AI infrastructure buildout after earlier exuberance. While tighter US export restrictions may have played a part in this, we anticipate continued strong demand and as such see this as a buying opportunity given the build out of the new AI computing stack remains in its infancy. According to Gartner, 73% of CIOs plan to increase AI investments in 2024.”

IMPORTANT INFORMATON

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.