Investment Companies Quarterly Roundup

Kindly sponsored by Baillie Gifford and Aberdeen Standard Investments

Finally on the mend

Global equity markets finally appear to be recovering after almost 18 months of extreme volatility and uncertainty. On average, even the losses on those funds in negative territory this quarter were muted by comparison with last year. UK assets are improving and many emerging market economies are proving more resilient against the pandemic than expected.

Discounts were fairly stable over the quarter, having recovered from last-year’s COVID-related jitters.

Increasing enthusiasm for European property has helped narrow discounts in the sector over the past year. During Q2, some trusts benefited even further from specific events such as the end of Berlin’s rent freeze, which boosted Phoenix Spree Deutschland’s share price.

In this issue

Performance data – Commodity funds ended the quarter wiping out almost all the gains made during the start of the year while growth stocks seem to be back in vogue after temporary concerns over inflation and rising interest rates. Investors fled India in April as it was hit by a second COVID-19 wave, though the country bounced back swiftly.

Major news stories – New leasing fund Taylor Maritime completed deployment of its IPO proceeds while Schroder UK Public Private made its first new investment since changing manager. Gresham House Strategic announced a strategic review, Lindsell Train updated its benchmark and performance fee, and Pacific Horizon‘s Ewan Markson-moved onto pastures new. In property news, St Modwen Properties was the subject of a £1.2bn cash offer.

Money in and out – The sector raised £1.8bn of net new capital over the second quarter of 2021, with notable fundraisings from Cordiant Digital Infrastructure and Digital 9 Infrastructure and new listings by Aquila Energy Efficiency and Literacy Capital.

Research published over Q2 2021

Over the quarter, we published notes on Jupiter Emerging & Frontier Income, India Capital Growth, Tritax EuroBox, JPMorgan Japanese, Ecofin US Renewables Infrastructure, Civitas Social Housing, Temple Bar, Bluefield Solar Income Fund, (plus a flash note), CQS New City High Yield Fund, CQS Natural Resources Growth and Income, Montanaro UK Smaller Companies and Standard Life Investments Property Income.

Winners and losers

Out of a total of 331 investment companies (we excluded funds with market caps below £15m), the median total NAV return over the second quarter of 2021 was 3.8% (the median total share price return was 6.2%).

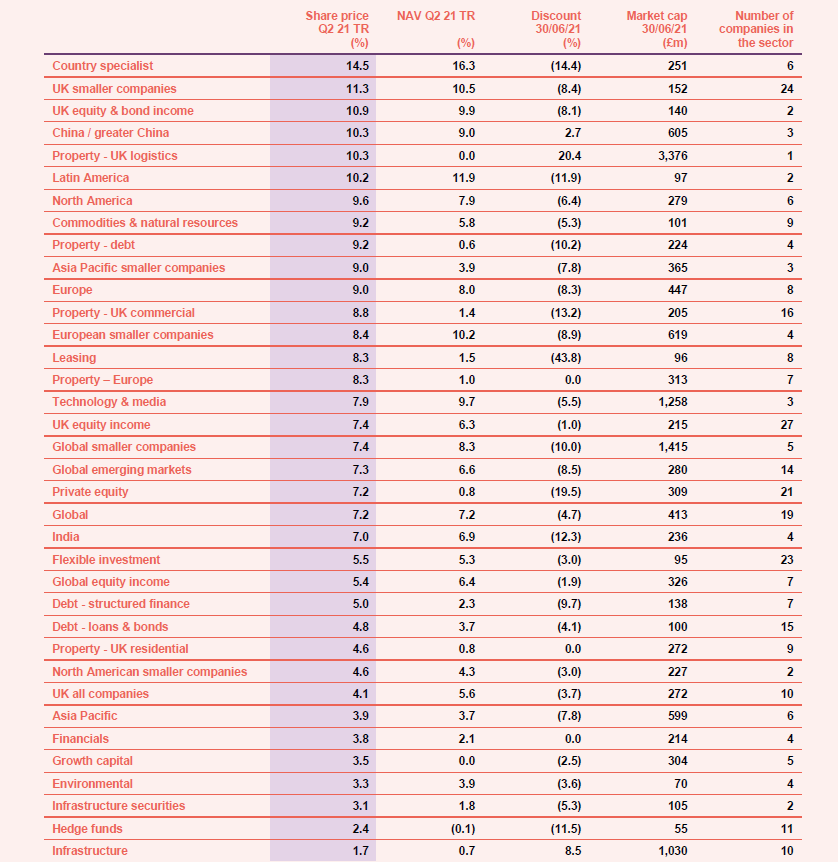

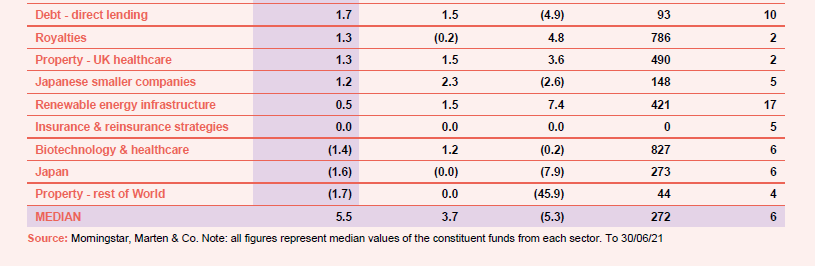

By sector

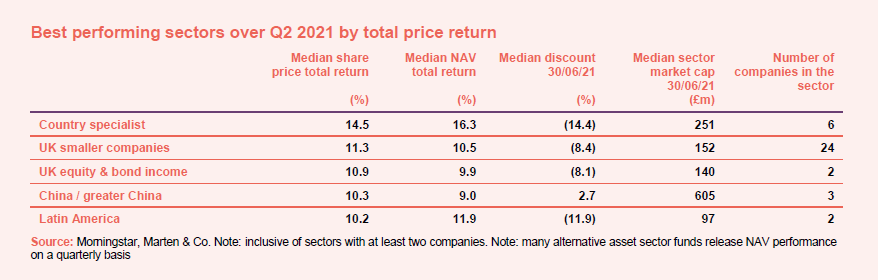

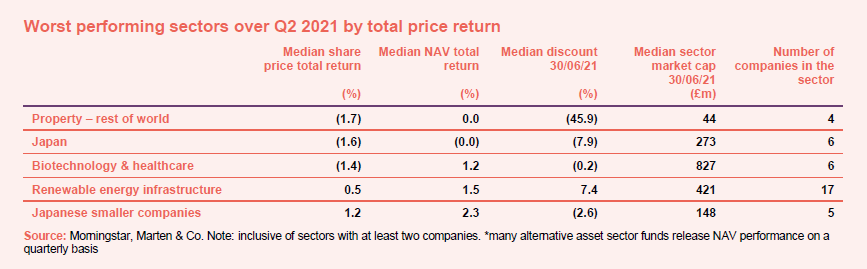

UK assets continued to benefit from the vaccine rollout over Q2 along with what is promised to be a permanent full reopening of the economy. There has been a greater onus on supporting smaller businesses through the pandemic which may be reflected in the share price return of the UK smaller companies sector. The top performing sector however was Country specialist, largely thanks to strong performance from Vietnamese funds, which appeared to shrug off concerns over rising COVID-19 cases.

Japanese funds suffered as the country has fallen behind on its vaccine rollout programme, despite the incentive to get the virus under control as it prepares to finally host the Olympic Games. But Property – rest of world funds (a number of which are fairly low-quality) led declines, though these were minimal at a median share price loss of just 1.7%. By comparison, last quarter, the worst performing sector (Japanese Smaller Companies) was down 10.9%. On the whole, equity markets performed well having dropped so far over the past year.

By fund

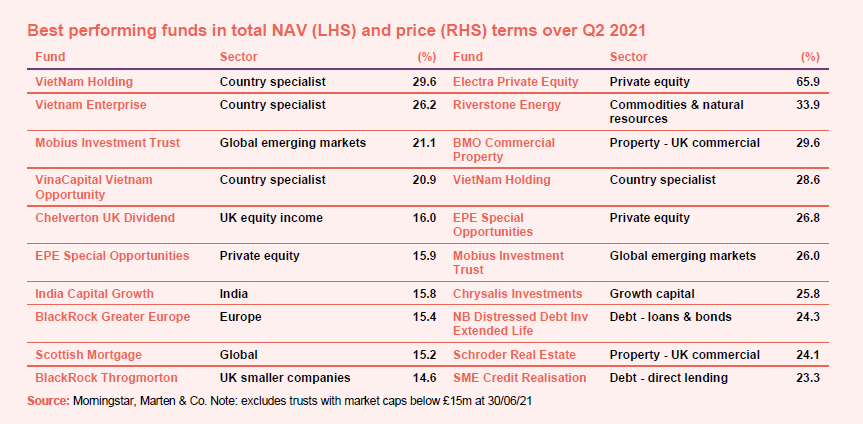

As the sector performance section highlighted, country specialist funds led the way in NAV terms during Q2, with Vietnam mandates VietNam Holding, Vietnam Enterprise and VinaCapital Vietnam Opportunity, at the top of the charts. Domestic investors drove that market higher, encouraged by good earnings data for the first quarter of 2021. Despite the volatility in April, foreign direct investment swiftly returned to India in May and India Capital Growth did particularly well from the shift in sentiment towards small and mid-cap companies. More growth-focused funds such as Scottish Mortgage and BlackRock Throgmorton benefited from renewed worries about new virus variants which led investors back towards companies that could grow regardless of the strength of the economy.

In share price terms, Electra Private Equity continued to climb after a strong showing in April as the company approaches the final stage of its winding up. Meanwhile, Riverstone Energy made an impressive comeback despite annual results, released in February, that depicted a particularly tumultuous 2020 with poor returns. Chrysalis Investments has been busy raising further funds for its ‘active pipeline of £1bn’, and making the most of a ‘buoyant tech IPO market’ – having most recently invested £75m into leading retirement tech platform Smart Pension. A couple of commercial property funds also feature on the list. These were perhaps oversold and are rising in anticipation of an end to lockdowns.

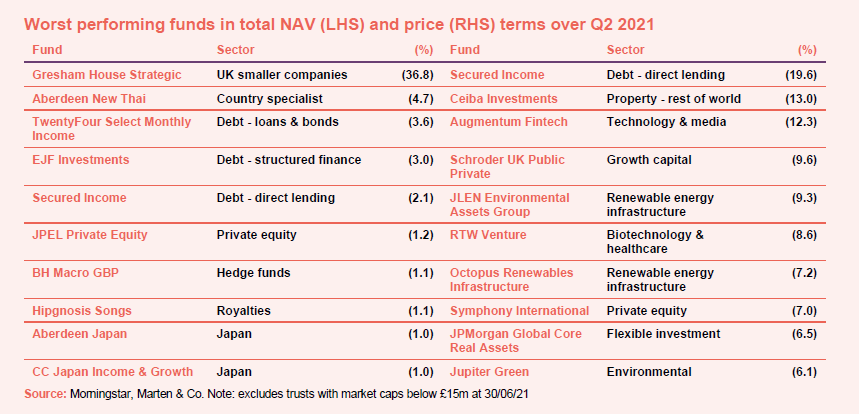

Gresham House Strategic was the worst performing trust in NAV terms during Q2 by a long stretch, as the only one making double digit losses. The company has had a challenging few months after announcing a strategic review in May and calls for its chairman to retire, which was followed by the dramatic resignation of one of its managers, Richard Stavely. Aberdeen New Thai continued to lag its benchmark after revealing lacklustre results in April, while BH Macro’s NAV return has fallen ahead of its merger with BH Global (which also saw its NAV fall during Q2 by 0.4%).

In addition to being one of the ten worst performing funds in NAV terms during the second quarter of 2021, debt fund Secured Income was the worst performing in share price terms, having fallen by 20% in June after taking a knife to the valuations of its film financing portfolio. Cuban property fund, Ceiba slid as protests rocked the country. Meanwhile Augmentum Fintech’s share price fell after it announced a significant fundraise in June, and Symphony International‘s restaurant and hotel investments continue to struggle in the face of the pandemic. Major shareholder AVI (managers of AVI Global) has vocalised its frustration with the company.

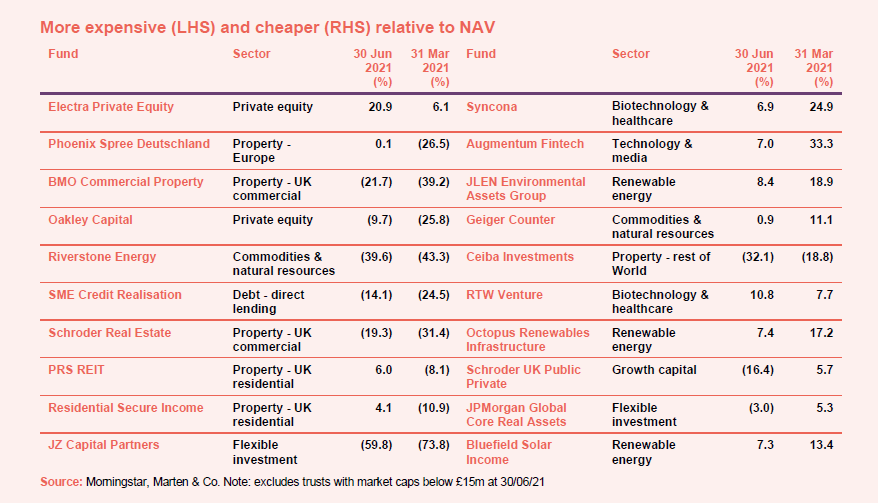

Significant rating changes by fund

Getting more expensive

Discounts narrowed across much of the private equity sector in Q1 and this continued into Q2, as we continued to drive the message that we thought these funds were too cheap. Electra Private Equity and Oakley Capital led the narrowing in discounts. Property funds in the UK commercial and residential sectors also saw their discounts narrow. These included BMO Commercial Property, Schroder Real Estate, PRS REIT and Residential Secure Income, all of which have benefited from the economic re-opening.

Getting cheaper

Syncona’s premium narrowed at the start of Q2 as sentiment moved against it following the announcement that one of its holdings, Gyroscope Therapeutics, was putting its planned IPO on hold. It is notable that RTW Venture, which has a similar approach also features on this side of the table. It was a tough quarter for the renewable energy infrastructure sector, with market declines led by JLEN Environmental Assets Group after it issued more shares, Bluefield Solar Income following its NAV fall and Octopus Renewables Infrastructure.

Money raised and returned

The 331 investment companies we follow raised £1.8bn of net new capital over the second quarter of 2021. There were three IPOs, starting with ship leasing trust Taylor Maritime Investments, which raised $254m in May. In June, renewable energy infrastructure mandate, Aquila Energy Efficiency raised £95m and Literacy Capital listed. It didn’t raise any fresh capital at launch but currently has a market cap of about £116m

Money coming in

The biggest fundraising came from Cordiant Digital Infrastructure and Digital 9 Infrastructure, both of which only launched in Q1, but brought in a combined £420m during Q2 – making £1bn in total raised for these trusts this year. Both companies have substantial pipelines of new assets and we could easily see them come back again for more money later in the year. Polar Capital Global Financials capped a remarkable turnaround in its fortunes since last year’s cash exit opportunity with a sizeable issue of C shares. Investors are backing banks once again and the sector is outperforming.

Money going out

Share buybacks were led by Fair Oaks Income, as holders of 13.4% of the fund elected to go into a realisation pool rather than rollover into an ongoing fund, River and Mercantile UK Micro Cap, which has a policy of handing back cash once its net assets exceed £100m, Scottish Mortgage and Witan.

Major news stories over Q2 2021

Portfolio developments:

- Bluefield Solar bought a new UK based wind portfolio

- HgCapital’s manager agreed the sale of its Allocate holding

- Chrysalis bought a leading retirement tech platform provider

- Taylor Maritime completed the deployment of its IPO proceeds

- Caledonia sold long-term holding Deep Sea Electronics

- VH Global Sustainable Energy Opportunities bought Brazilian solar

- Downing Renewables & Infrastructure announced plans to acquire Swedish hydropower company Elektra

- Schroder UK Public Private made its first new investment since the new manager’s December 2019 appointment

- US Solar refinanced legacy loans in its Heelstone Portfolio

- Apax Global Alpha gained ‘ultra-premium’ pet food exposure

- Gore Street Energy Storage acquired a new project in Milton Keynes

- Menhaden was let down by its wide discount

- Henderson High Income was held back by gearing

- North American Income delivered a healthy revenue despite COVID

- Invesco Perpetual UK Smaller Companies was hit by dividend expectations

Corporate news:

- BlackRock North American Income revealed a revised objective and name change to BlackRock Sustainable American Income

- An activist Investor publicised plans to block the continuation of Crystal Amber

- Round Hill Music Royalty announced a new C share placing

- Literacy Capital announced its intention to float

- FastForward Innovations proposed a name change

- New space fund Seraphim Space issued an intention to float and published its prospectus

- JPMorgan European Smaller Companies officially relaunched as JPMorgan European Discovery

- Augmentum Fintech revealed plans to amend its investment policy

- JZ Capital Partners called an EGM to issue loan notes to managers

- Gresham House Strategic announced a strategic review

- Aquila Energy Efficiency targeted an £150m IPO

- M&G Credit Income introduced a zero discount policy

- Third Point looked at ways to tackle its discount

- Merchants grew its dividend for a 39th year

Managers and fees:

- Ewan Markson-Brown, co-manager of top-performing Pacific Horizon trust left Baillie Gifford

- Lindsell Train updated its benchmark and performance fee

- Richard Staveley left Gresham House Strategic

- Acorn Income announced plans to appoint BMO as manager following strategic review

- Alliance Trust announced stock picker changes

- Irish Residential Properties REIT highlighted plans to internalise its management team

Property news:

- Tritax EuroBox acquired its first asset in the Nordics

- UK Residential REIT published its prospectus

- Sigma Capital Group reached an agreement on its takeover

- Home REIT invested the remainder of its IPO proceeds

- St Modwen Properties was subject of a £1.2bn cash offer

- UK Commercial Property REIT upped its dividend by 40%

- Helical collected 92.9% of rent during COVID

- AEW UK REIT won its legal battle over unpaid rent

- British Land moved into logistics development

- Impact Healthcare REIT acquired two care homes

QuotedData views:

- Chinese private equity – 25 June

- Office needs to Flex muscles – 25 June

- Is property still a good hedge against inflation? – 18 June

- Step off the train? – 18 June

- Space! – the not so final frontier – 11 June

- Not all industrial is equal – 11 June

- REIT IPO to get excited about – 4 June

- On drugs – 4 June

- Got gas? – 28 May

- Warm fuzzy feelings? – 21 May

- Property funds to fall like dominoes? – 21 May

- Timid start for real estate stock exchange – 14 May

- Spotlight on logistics development – 7 May

- How the top 10 trusts have changed – 7 May

- Indian funds take stock – 30 April

- Rent Wild West needs a solution – 30 April

- Backing the future – 23 April

- Rent judgment good news for REITs – 23 April

- Money worries – 16 April

- British Land’s bold move too late? – 16 April

- Shackles to come off in battle for unpaid rent – 9 April

- Go Green? – 9 April

- Go West! – 1 April

Events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Blackstone Loan Financing AGM 2021, 23 July

- Gresham House Strategic AGM 2021, 26 July

- TR Property AGM 2021, 27 July

- BlackRock North American EGM 2021, 29 July

- Syncona AGM 2021, 3 August

- JPMorgan Global Core Real Assets AGM 2021, 3 August

- Sequoia Economic Infrastructure Income AGM 2021, 4 August

- NextEnergy Solar Fund AGM 2021, 9 August

- SDCL Energy Efficiency Income AGM 2021, 10 August

- Montanaro UK Smaller Cos AGM 2021, 12 August

- Aberdeen New Dawn AGM 2021, 1 September

- JLEN Environmental Assets Group AGM 2021, 2 September

- Hipgnosis Songs AGM 2021, 15 September

- Henderson Diversified Income AGM 2021, 16 September

- Civitas Social Housing AGM 2021, 22 September

- Miton Global Opportunities AGM 2021, 6 October

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

Guide

Our Independent Guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector.

Appendix – Q2 2021 median performance by sector

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in any of the securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.